|

History > 2005 > USA >

Economy

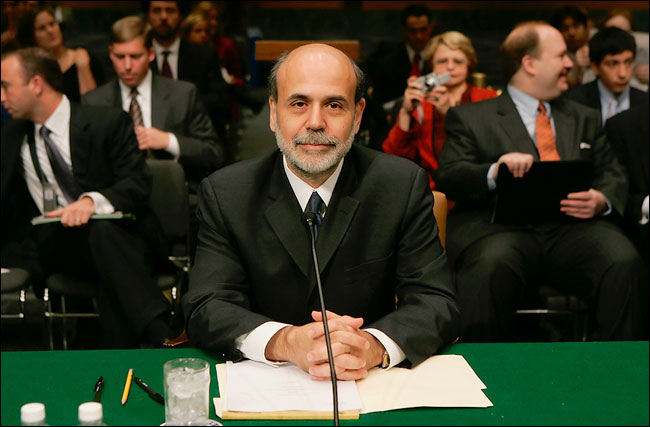

Left:

Federal Reserve Board Chairman Alan

Greenspan

ponders a question during testimony

before the Senate Banking Committee,

on Capitol Hill in Washington, February 16, 2005.

Greenspan said that the U.S. economy entered 2005 in good shape

but warned that fiscal discipline was essential to meet future challenges.

Photo by Jason Reed/Reuters

Greenspan: Rates Low; Discipline Vital

R

Wed Feb 16, 2005 01:34 PM ET

http://www.reuters.com/newsArticle.jhtml;jsessionid=

DFKHH4J4K0JQECRBAE0CFEY?type=businessNews&storyID=7651151

Right:

Chairman of the Federal Reserve Alan

Greenspan listens to a question

while testifying before the U.S. House Financial Services Committee

on Capitol

Hill, February 17, 2005.

Greenspan embraced President Bush's vision of an 'ownership society',

saying private Social Security accounts

could foster feelings of wealth among

poor Americans.

Photo by Larry Downing/Reuters

'Ownership' Key Soc. Sec. Goal -Greenspan

R

Thu Feb 17, 2005 05:56 PM ET

http://www.reuters.com/newsArticle.jhtml;jsessionid=

4FQFLXNJA3BWMCRBAE0CFFA?type=businessNews&storyID=7666852

Wall St. Bets

on Gambling on the Web

December 25, 2005

The New York Times

By MATT RICHTEL

Internet casinos are outlaw operations in the

eyes of the federal government, but they look like solid investments to many of

Wall Street's largest firms.

Blue-chip investment houses like Goldman Sachs, Merrill Lynch and Fidelity now

hold hundreds of millions of dollars in shares of online casinos and betting

parlors, which are publicly traded on the London Stock Exchange and

headquartered in places like Costa Rica or Gibraltar.

The growing participation by American investors underscores a striking gap

between the federal law-enforcement position on online gambling and the

realities behind what has emerged as a booming business.

It also highlights the difficulty of policing cross-border activity in the

Internet age at the same time that electronic commerce and a global economy are

creating fast economic partners across national boundaries.

Legal experts are divided over whether American investors and the investment

houses that operate mutual funds could themselves be seen as criminally liable

for their actions by providing financial backing for offshore casinos. To be

sure, it is not uncommon for Americans to invest in overseas companies whose

operations may be considered illegal or unacceptable here, from sweatshop

manufacturers to European energy producers that do business in Iran.

The difference with Internet gambling is that the activity takes place on

domestic shores - with Americans placing bets online using their home computers

- and the Justice Department has stated clearly that the operators are violating

American law.

Jaclyn Lesch, a spokeswoman for the Justice Department, said that the agency

considered online gambling illegal but declined to "comment on the liability or

hypothetical liability of a company or an individual."

But Internet gambling analysts and company executives said that the investments

highlight how widely the federal policy is, in essence, being ignored.

Millions of Americans use the Internet to play games like poker, blackjack and

roulette, or to place wagers on sporting events. Online casinos advertise in

magazines and on cable television while filling big billboards in Times Square

and other places where crowds congregate. Celebrities like Jesse Ventura, the

former governor of Minnesota, hawk their wares.

Representative Bob Goodlatte, Republican of Virginia, an opponent of gambling,

said that the federal government had essentially given up enforcing laws against

offshore casinos. He noted, for example, that casino operators now travel freely

within the United States, gathering at trade conventions even though, he said,

prosecutors would be within their rights to arrest and bring charges against

them.

He said that the involvement of investment firms could be part of a pattern of

laws being flouted.

"It's very bad, and the Congress ought to investigate it," Mr. Goodlatte said,

adding that it may turn out that the investment houses are knowingly supporting

and promoting illegal enterprises.

For their part, the investment houses have taken the position that they indeed

know there are legal risks involved in investing in offshore casinos, but that

the risks are outweighed by the benefits of owning shares in growing, highly

profitable businesses. Those shares can give a lift to mutual funds and other

types of investments sold by the investment houses, meaning bigger returns for

clients.

"Our analysis shows the gain from these stocks outweighs the very small risk" of

owning them, said a spokesman for one major investment house. The spokesman

would not agree to be identified by name or to have his firm identified, citing

regulatory policy that could restrict the company's ability to buy and sell

individual securities if he commented upon them.

The ownership rolls of offshore casinos read like a Who's Who of America's top

investment firms. For example, public filings show that tens of millions of

shares of SportingBet, a company listed on the London Stock Exchange that allows

people to place bets on sporting events, are owned by Fidelity, Merrill Lynch

and Goldman Sachs.

Fidelity Management holds shares worth about $363 million, or 14.1 percent of

the outstanding shares. Those shares are largely held in mutual funds. Merrill

Lynch Asset Management has $164 million in holdings, and Goldman Sachs Group

Inc. has $137 million.

Similarly, Goldman Sachs and Morgan Stanley Securities hold big positions in

BetOnSports, another publicly traded firm in London that facilitates sports

betting, according to public filings. Morgan Stanley has one of the biggest

stakes - worth around $25.6 million - but the company said that the position is

held on behalf of one large investor, whose identity it withheld.

It is hard to discern how many of the shares are owned by mutual funds available

to American investors. Many of the funds, including some that exclude American

investors, are operated out of London.

For instance, Goldman Sachs's International Growth Opportunities Fund, which is

open to American investors, owns around 175,000 shares of SportingBet, worth

around $960,000, according to a recent public filing by the company.

Goldman Sachs also wrote in a report on Nov. 30 that over the next three months

it "expects to receive or intends to seek compensation" for investment banking

services provided to SportingBet and PartyGaming, two companies that operate

gambling sites.

Goldman Sachs, Merrill Lynch and Fidelity all declined to comment.

George Hudson, a spokesman for SportingBet, said that there had been growing

interest from the investment houses, and not just their European arms.

"It's not just London, it's New York," Mr. Hudson said, noting that the interest

represents a change from two years ago when "the big banks wouldn't touch the

industry with a barge pole."

According to Mr. Hudson and several other industry executives and analysts, a

watershed event took place on June 30 when PartyGaming began trading on the

London Stock Exchange. It was not the first Internet casino to go public in

Britain, but it drew a great deal of attention because of the popularity of the

company's sites. The ensuing demand for its shares put it among the exchange's

top 100 companies in its market capitalization, currently around $9.6 billion.

At the time, I. Nelson Rose, a professor at Whittier Law School in Costa Mesa,

Calif., who has written extensively on gambling law, was flown to London to

advise a number of large investment houses - both American and European - on the

risks involved in owning shares. Mr. Rose declined to specify the companies for

which he consulted, but said that he had told them there was at least some risk

of owning shares in the casinos.

Today, Mr. Rose said he believed there was only a 10 percent chance that the

federal government would take action against the investment houses under the

Wire Act, which covers online gambling, or federal statutes that permit the

government to charge the partners of illegal operations with aiding and abetting

their activities. But he said that if prosecutors did so, they could make a

decent case.

The companies are shareowners "in an illegal enterprise," Mr. Rose said.

"Therefore they are liable." Potential penalties could range from small fines to

prison terms.

But Lawrence G. Walters, a Florida lawyer who specializes in investment law and

who has consulted for some prospective American investors, said that the

government would have difficulty finding a theory of liability given that the

investors do not control the offshore casinos or direct their activities. They

are "passive investors," Mr. Walters said.

"Nobody takes them seriously when they say this is a serious crime," he said of

the government and anti-gambling laws. "But there is stuff still on the books,

and somebody could go down heavily if government decides to turn its attention

to them."

The bottom line, according to casino industry executives and some financial

analysts, is that the opportunity for profit may be too good for the investment

houses to pass up. Over all, Internet gambling is projected to reach almost $12

billion in business this year, up from $8.3 billion in 2004, according to

Sebastian Sinclair, a gambling industry analyst with Christiansen Capital

Advisors.

Individual companies are enjoying strong growth and big profit margins. Morgan

Stanley on Dec. 1 published an analysis of SportingBet that noted that the

company had acquired 700,000 new customers in a recent quarter, almost equal to

the number of people it signed up all of last year. The Morgan Stanley report

said that the company was taking in $530,000 a day just from its poker business.

"There is no other leisure business in the world with the same potential for

growth and shareholder returns as online gaming," said David Carruthers, the

chief executive of BetOnSports, noting that the major casinos each project 20

percent annual sales growth. "We're in our embryonic stages."

Mr. Carruthers said that the investments from American financial institutions

have provided the stability and legitimacy needed to helped the casinos grow.

"It says we're running a business legitimately and responsibly," he said, "and

we're seen as a worldwide leisure product - similar to KFC, Ford, Coca-Cola,

I.B.M. or any other global brand."

Wall

St. Bets on Gambling on the Web, NYT, 25.12.2005,

http://www.nytimes.com/2005/12/25/business/25gamble.html

Government Finds

Seesaw View of Housing

Market

December 23, 2005

The New York Times

By VIKAS BAJAJ

Sales of new homes fell in November from a

record-setting pace, and the number of homes for sale touched a new high, the

government reported today.

Coupled with data from October, the latest report from the Commerce Department

provides a seesaw view of the housing market - a sharp drop after a sharp rise.

The herky-jerky movements indicate that even as home sales remain high by

historical standards, they are starting to level off from what had been

relatively uninterrupted growth in the last four years.

Sales fell 11 percent, to an annual pace of 1.2 million, and the number of homes

for sale jumped 3 percent, to 503,000. At the current pace of sales, that

equates to a 4.9-month supply of homes, the highest that inventory has been

since December 1996 when there was a five-month supply. Median prices for new

homes - half the homes sold for more and half for less - was little changed from

a year ago at $225,200.

New home sales make up just 15 percent of all housing sales. That is one reason

economists caution against reading too much into this report. Another is its

significant margin of error, which was plus or minus 8.9 percent this month,

enough to erase most of the drop in sales.

Separately, the Commerce Department said orders for durable goods jumped 4.4

percent last month with most of the increase because of surging airplane orders.

Excluding the transportation sector, orders for durable goods, which last more

than three years, dropped 0.6 percent last month, compared to analysts'

expectations of a 1 percent increase.

"The important aerospace industry is expanding again and overall manufacturing

activity is growing, but the pace of growth in manufacturing is overstated in

the durable goods report," said Daniel Meckstroth, chief economist at

Manufacturers Alliance/MAPI, a research firm in Washington.

Also today, the University of Michigan revised up its estimate of consumer

confidence in December to 91.5 from 89 percent. That change puts the index

slightly above where it was before Hurricane Katrina smashed into New Orleans in

late August.

Government Finds Seesaw View of Housing Market, NYT, 23.12.2005,

http://www.nytimes.com/2005/12/23/business/23cnd-econ.html

Can America keep it up?

Dec 14th 2005

From The Economist Global Agenda

As the Federal Reserve raises interest rates again and the trade deficit

breaks another record, the American economy continues to confound the sceptics.

Thanks for that go largely to resilient consumers and booming productivity

FOR several years now, economists have been

watching American consumers with the same mixture of astonishment and

anticipation that wide-eyed fans bring to endurance sports: amazing that they’ve

made it so far, but how much longer can they go on like this? Strong consumer

spending has underpinned America’s robust economic expansion, even as most other

industrialised countries have struggled to get their economies back on track.

But consumers have been running down savings to sustain this level of spending;

the personal savings rate has actually been negative since June. Booming house

prices and low interest rates have enabled consumers to take on more debt

without suffering much, but with interest rates now climbing, Americans have

begun to feel the pinch. Data from the Federal Reserve show that the percentage

of household disposable income devoted to servicing debt was a record 16.6% in

the third quarter.

Yet the consumers soldier on. Figures released by the Census Bureau on Tuesday

December 13th show that retail sales in November, when the Christmas shopping

season starts, were up by 0.3% from October, and 6.3% higher than a year

earlier. And on Wednesday, the Department of Commerce announced that imports of

oil, cars and consumer goods caused the already gaping trade deficit to balloon

even further in October, to a record $68.9 billion (see chart). This surprised

economists, who had been expecting the deficit to fall slightly as oil prices

subsided from their September highs.

It seems unlikely that consumers will have the stamina to keep this up much

longer. While petrol prices have fallen back, crude oil is still trading above

$60 a barrel, pinching the pockets of fuel-guzzling Americans. Long-term

interest rates are currently kept low by foreign central banks buying

dollars—and dollar-denominated assets—to keep their currencies cheap. But those

mountains of dollars are creating ever bigger problems for the banks, which may

have to cut back soon. That would bring on a sharp increase in American interest

rates, which in turn would deflate the housing bubble—if it doesn’t shrivel on

its own first. There is growing evidence that this may be happening already.

Economists have long been warning of these risks. But someone plainly forgot to

tell the economy that it was supposed to be in trouble. According to figures

released earlier this month, GDP grew at an annualised rate of 4.3% in the third

quarter, revised upward from a preliminary estimate of 3.8% issued in November.

That is despite the ravages wrought by hurricanes in August and September, which

not only destroyed a major port city but closed down a big chunk of the energy

industry.

Better still, last week the Department of Labour reported that over the same

period, productivity had grown by 4.7%. And payrolls, which barely grew at all

in September and October, finally posted a respectable 215,000 new jobs in

November. Little surprise, then, that George Bush is once again talking up the

economic data, and seeking to claim some of the credit for his policies,

particularly tax cuts.

Sadly for Mr Bush, it appears someone also forgot to tell the voters that the

economy is doing well. Polls show approval ratings for the economy on a par with

the rest of his dismal numbers. Employment has generally lagged behind the

economy. Payroll employment troughed in May 2003, 18 months after the recession

ended. Since then, the economy has added 4.5m jobs—and unemployment currently

hovers around 5%. But wage growth has been sluggish, implying a soft jobs

market.

The economy is also posing some difficult questions for the Fed, whose

monetary-policy committee met on Tuesday. The central bank has steadily raised

short-term interest rates over the past year and a half to fight off inflation.

But where does it want to stop? As expected, the Tuesday meeting delivered

another 25 basis-point increase in the benchmark interest rate, to 4.25%, but

the language of the accompanying statement contained both hawkish and dovish

signals. Unlike previous statements, there was no mention of “accommodation”,

suggesting that the Fed considers monetary policy to be close to neutral, and

will stop tightening soon. But strong wording also indicated that at least one

or two more rate increases can be expected before the cycle turns. Nonetheless,

the dollar dropped on the news, a decline that grew steeper after Wednesday’s

trade figures.

High oil prices may not have translated into slower economic growth yet, but

they are creating inflation, which ran well above 4% in September and October.

On the other hand, core inflation, which excludes volatile energy and food

prices, is still relatively modest. With gasoline dropping back to $2.19 a

gallon from nearly $3 in September, fears that high oil prices will feed through

into the broader price index have eased. And the stellar productivity figures

increase the pace at which the economy can grow without fuelling inflation.

Ben Bernanke, the incoming Fed chairman, will want to be tough, to prove to

financial markets that he is serious about keeping prices stable. But if current

trends continue, he will not have to be so tough that he causes serious economic

pain. Those economists may continue to be astonished for quite some time

Can

America keep it up?, E, 14.12.2005,

http://www.economist.com/agenda/displaystory.cfm?story_id=5320706

Consumer Prices

Fell by Largest Amount

Since 1949

December 15, 2005

By THE ASSOCIATED PRESS

Filed at 11:16 a.m. ET

The New York Times

WASHINGTON (AP) -- A record plunge in the cost

of gasoline pushed consumer prices down by the largest amount in 56 years in

November while industrial production posted a solid gain.

The new government reports Thursday provided further evidence that the economy

is shaking off the blows delivered by a string of devastating hurricanes. But

analysts cautioned that the huge drop in consumer prices was overstating the

improvement in inflation.

The Labor Department report showed the Consumer Price Index fell by 0.6 percent

last month, the biggest decline since a 0.9 percent fall in July 1949. It

reflected a record fall in gasoline prices, which have been retreating since

they surged to above $3 per gallon right after Katrina hit.

Meanwhile, the Federal Reserve said output at the nation's factories, mines and

utilities rose a solid 0.7 percent last month following a 1.3 percent rise in

October. Industrial output had plunged by 1.6 percent in September, reflecting

widespread shutdowns of oil refineries, chemical plants and other factories

along the Gulf Coast.

The decline in consumer prices was better than the 0.4 percent drop that

analysts had been expecting. Outside of the volatile food and energy categories,

so-called core prices were up 0.2 percent, matching the October increase. Both

months showed a pickup in core prices from benign readings of 0.1 percent in the

previous five months.

Brian Bethune, senior economist at forecasting firm Global Insight, said that he

expected to see further increases in core inflation in coming months, reflecting

the cumulative effect of higher energy costs.

''Continued pressure on the core index over the next several months will keep

the Federal Reserve vigilant on the inflation watch,'' he said, predicting

further Fed rate hikes in January and March. The Fed raised rates for a 13th

time on Tuesday.

The rise in industrial production reflected a 0.3 percent increase in

manufacturing and a 4.8 percent surge in the category that covers oil and gas

production, which is recovering as Gulf Coast wells and refineries get back on

line. Output at the nation's utilities was up 0.3 percent.

In other economic news, the number of people who have lost jobs because of the

string of devastating Gulf Coast hurricanes climbed to 602,200 last week. That

gain reflected a rise of 1,500 jobless applications linked to Katrina and Rita

and an additional 1,000 claims linked to Wilma, which hit Florida in October.

Overall, the number filing new claims for unemployment benefits totaled 329,000

last week, up slightly from the 328,000 claims filed the week before but still

at a level consistent with an improving labor market.

The huge 0.6 percent fall in consumer prices last month followed a small 0.2

percent October increase which had come after a 1.2 percent surge in September,

which had been the biggest monthly gain in a quarter-century.

In early September, the nationwide price for gasoline briefly hit a record high

above $3 per gallon. But since that time pump prices have been falling,

including an additional decline of around 42 cents in November, as Gulf Coast

production has resumed.

That decline pushed gasoline prices down by a record 16 percent in the CPI

report, a drop that had followed a 4.5 percent decline in October.

Overall, energy prices were down a record 8 percent, reflecting not only the

fall in gasoline but also declines of 6.1 percent for home heating oil and 0.5

percent for natural gas. Those drops still left prices higher than a year ago

and homeowners will feel the pinch when they pay heating bills this winter.

Food costs were up 0.3 percent in November, with the prices of beef, pork and

poultry all up. Fresh fruit prices also rose but the cost of vegetables dropped.

Through the first 11 months of this year, inflation at the consumer level has

been rising at an annual rate of 3.8 percent, compared to an increase for all of

2004 of 3.3 percent. The slight acceleration in overall inflation reflected

faster increases in energy prices, which are up at an annual rate of 21.7

percent so far this year compared to a rise of 16.6 percent for all of 2004.

Excluding food and energy, prices this year are up 2.1 percent, a well-behaved

performance which was a slight improvement over the 2.2 percent rise in

so-called core prices last year.

More than half of the 0.2 percent increase in core inflation last month was

attributed to a 1.3 percent rise in the cost of hotel and motel rooms.

Medical care was up 0.6 percent last month, driven higher by rising drug costs,

while new car prices and airline ticket prices both fell.

Consumer Prices Fell by Largest Amount Since 1949, NYT, 15.12.2005,

http://www.nytimes.com/aponline/business/AP-Economy.html

Trade gap widens unexpectedly,

hits record

Wed Dec 14, 2005 9:10 AM ET

Reuters

By Andrea Hopkins

WASHINGTON (Reuters) - The U.S. trade deficit

widened unexpectedly in October to a record $68.9 billion despite a drop in the

cost of imported oil, as the deficits with China, Canada, the European Union,

Mexico and OPEC all hit records, government data showed on Wednesday.

Economists had expected the trade gap to shrink in October to $63.0 billion, and

its surprising growth suggests fourth-quarter economic growth will likely be

even weaker than first thought.

"The trade deficit certainly came in worse than expected," said Bob Lynch,

currency analyst at HSBC in New York. "It was largely energy influenced but I

don't think that should detract from the overall deterioration of the external

balance. The dollar was already on the defensive this week and this data only

reinforces that bias."

The dollar extended losses against the euro and yen, while U.S. Treasury debt

prices remained higher after the report.

The Commerce Department said the deficit widened 4.4 percent from September

after growing 11.9 percent the previous month.

Imports of goods and services rose 2.7 percent to a record $176.4 billion while

exports increased a smaller 1.7 percent to $107.5 billion, the second-highest on

record.

While oil import prices declined in the month to an average $56.29 per barrel,

the volume of crude imports surged 9.3 percent, driving the value to $17.1

billion, the second-highest on record. Imports of energy-related petroleum

products, a wider category that includes propane and butane, hit a record $26.2

billion.

Imports of industrial supplies and materials and automotive vehicles and parts

rose to records in October. Imports of consumer goods also climbed, while foods,

feeds and beverages and capital goods fell.

Analysts said the strong pace of imports reflect robust business investment and

hurricane rebuilding efforts.

"On the import side, the strength is from a rebuilding of inventories from

companies and a general expansion of the U.S. economy. Petroleum imports

increased, adding to the import bills," said Lynn Reaser, chief economist at

Banc of America Capital Management in Boston.

Trade through hurricane-damaged Gulf ports picked up in October. Imports rose

$3.6 billion while exports climbed $1.3 billion, on a non-seasonally adjusted

basis.

The politically sensitive trade deficit with China widened 2.1 percent to a

record $20.5 billion as imports from that country rose 4.8 percent to $24.4

billion.

The increase in the deficit with China came despite a 10.9 percent drop in

textile imports in October. Washington and Beijing reached a deal last month to

rein in China's surging clothing and textile exports to the United States

through 2008. Textile imports from China are up 47.6 percent so far in 2005

compared to 2004.

The deficit with Canada, Mexico, the European Union and OPEC countries also

widened to record levels.

Ten months into the year, the overall trade deficit reached $598.3 billion, just

$19.3 billion shy of the record $617.6 billion deficit set in 2004.

IMPORT PRICES FALL

More up-to-date information on the economy showed U.S. import prices eased last

month, which could help ease the trade deficit in November. The Labor Department

said import prices fell an unexpectedly large 1.7 percent last month on the back

of the biggest decline in the cost of petroleum imports in almost a year.

Petroleum import prices skidded 8 percent in November, the biggest drop since

last December, and nonpetroleum import prices slipped 0.2 percent, the first

fall since July.

The report marked an easing in the inflation pressures stemming from high energy

costs and may also have reflected a rise in the value of the dollar.

It also showed a surprise drop in prices received by U.S. exporters.

U.S. export prices fell 0.9 percent, the largest drop since December 1991, as

nonagricultural export prices posted their biggest decline on records dating to

January 1989 and agricultural export prices decreased for the third time in the

past four months.

Wall Street economists had expected import costs to fall just 0.5 percent in

November, with export prices up 0.2 percent. The department did, however, revise

October's import price figure upward to a gain of 0.3 percent from the

previously reported 0.3 percent fall.

(Additional reporting by Tim Ahmann in Washington)

Trade

gap widens unexpectedly, hits record, R, 14.12.2005,

http://today.reuters.com/business/newsarticle.aspx?type=ousiv&storyID=2005-12-14T141025Z_01_KWA450949_RTRIDST_0_BUSINESSPRO-ECONOMY-DC.XML

Newly Bankrupt

Raking In Piles of Credit

Offers

December 11, 2005

The New York Times

By TIMOTHY EGAN

TACOMA, Wash., Dec. 9 - As one of more than

two million Americans who rushed to a courthouse this year to file for

bankruptcy before a tough new law took effect, Laura Fogle is glad for her

chance at a fresh start. A nurse and single mother of two, she blames her use of

credit cards after cancer surgery for falling into deep debt.

Ms. Fogle is broke, and may not seem to be the kind of person to whom banks

would want to offer credit cards. But she said she had no sooner filed for

bankruptcy, and sworn off plastic, than she was hit with a flurry of

solicitations from major banks.

"Every day, I get at least two or three new credit card offers - Citibank,

MasterCard, you name it - they want to give me a credit card, at pretty high

interest rates," said Ms. Fogle, who is 41 and lives here. "I've got a stack of

these things on my table. It's tempting, but I've sworn them off."

If it seems odd to Ms. Fogle that banks would want to lend money to the newly

bankrupt, it is no mystery to the financial community, which charges some of the

highest interest rates to these newly available customers.

Under the new law, which the banking industry spent more than $100 million

lobbying for, they may be even more attractive because it makes it harder for

them to escape new credit card debt and extends to eight years from six the time

before which they could liquidate their debts through bankruptcy again.

"The theory is that people who have just declared bankruptcy are a good credit

risk because their old debts are clean and now they won't be able to get a new

discharge for eight years," said John D. Penn, president of the American

Bankruptcy Institute, a nonprofit clearinghouse for information on the subject.

Credit card companies have long solicited bankrupt people, on a calculated risk

that income from the higher interest rates and late fees paid by those who are

trying to get their credit back will outweigh the losses from those who fail to

make payments altogether. The companies also directed many of those customers

toward so-called secured cards, which require a cash deposit.

But the new law makes for an even better gamble for lenders, consumer groups

say. It not only makes bankrupt debtors wait eight years to clear their debts

again, but it also requires many of those who do go back into bankruptcy to pay

previous credit card bills that may have been excused under the old law.

Bankers defend the practice of soliciting the newly bankrupt, saying it gives

them a chance to build a new credit history.

"The people coming out of bankruptcy need an opportunity to get back on their

feet," said Laura Fisher, a spokeswoman for the American Bankers Association,

the industry's largest trade group.

"If you take away the opportunity to get credit," Ms. Fisher said, "it's like

taking away the want ads from a job-seeker."

But consumer groups say the new law has put millions of Americans at risk of

being in a continuous debt loop through their credit cards. And while the banks

have taken a short-term financial hit because of the new filings - leaving banks

holding the bills - they will benefit in the long run because the new law makes

it much easier to make money on people who live near the edge every month on

their credit cards, some consumer groups say.

Credit cards are the most profitable part of the banking industry, with late

fees and high interest charges helping make them so. Last year, more than five

billion solicitations for new cards were sent out, nearly double the number from

eight years ago.

"The whole business model of the credit card industry is built around

outstanding debt," said Ellen Schloemer, a researcher at the Center for

Responsible Lending, a nonprofit group that tracks lower-middle-class financial

issues, based in Durham, N.C. "This is the only industry that calls people

deadbeats when they pay all their bills every month."

Among bankers, policies differ in how to approach the newly bankrupt. Bank of

America does not give credit cards to people who have filed for debt protection,

said Betty Riess, a bank spokeswoman.

However, because there is a delay between a bankruptcy petition filing and a

credit report showing the debt consolidation, the bank may still be sending

offers to someone who has filed, Ms. Riess said.

Citigroup, whose credit card offers have piled up in Ms. Fogle's home, has its

own internal credit rating system that does not always rule out the bankrupt.

"We use direct mail to find many of our new customers," said Samuel Wang, a

Citigroup spokesman, in an e-mail message.

As of the end of October, 2,010,567 people had filed for bankruptcy protection

this year, a modern record, federal bankruptcy court officials say. In just over

two weeks of October, more than 600,000 people filed petitions, leading to long

lines outside courthouses across the country, and clerks swamped with petitions.

The debtors were rushing to beat an Oct. 17 deadline when the most sweeping

changes in bankruptcy law in a quarter-century took effect.

Most of the newly bankrupt filed under Chapter 7 of the code, which allows them

to expunge many unsecured debts. The new law makes it much more difficult to

erase debt; it increases the cost of filing and adds requirements like credit

counseling.

The banking industry worked in Congress for nearly 10 years to pass the law, and

critics say it gave them everything they wanted to increase profits from people

prone to debt. Bankers say the law makes it harder for people to abuse the

system.

"The hidden agenda of those who wrote the new law was death by a thousand cuts,"

said Travis B. Plunkett, legislative director of the Consumer Federation of

America, which opposed the law.

Opponents, including a group of bankruptcy law professors, argued that the

changes gave the banking industry too much of an advantage.

"In our view, the fundamental change over the last 10 years has been the way

that credit is marketed to consumers," the bankruptcy professors wrote in a

letter to the Senate this year.

"Credit card lenders have become more aggressive in marketing their products,

and a large, profitable market has emerged in subprime lending. Increased risk

is part of the business model."

Ms. Fogle would seem to be a perfect candidate for long-term debt to credit

cards. Though she works regularly as a nurse at Good Samaritan Hospital here,

earning $16 an hour, and has health insurance, she said a health emergency

pushed her into debt. Last year, she needed surgery for uterine cancer, which

caused her to lose days of work and income. Credit cards made up the difference,

and soon she was $15,000 in debt.

She filed for protection of the courts in late August, and her debts are now

removed. "My plan is to lay off credit cards until I can really afford them,"

she said. "But it's tempting. I would like to have one in case of emergency."

Ms. Fogle said she was trying to stick to a disciplined new pattern with her

finances. "I try to buy only what I need, instead of what I want," she said.

"But there are small things that I want - a latte, every now and then, taking my

kids to the movies."

The credit card offers inform Ms. Fogle that she is pre-approved, but at higher

interest rates - 23 percent or more, which is typical for offers to the newly

bankrupt.

"It's obvious what they're trying to do here - start people off with a fresh

credit card at a much higher rate than before," she said.

Nearly 60 percent of all credit card holders, about 85 million Americans, carry

a balance - that is, they do not pay off the entire debt, according to the

bankers' association.

The average debt among those with a monthly balance is $9,000, said the Consumer

Federation of America in a recent report. Paying just the monthly minimum -

usually 2 percent of the balance - on $9,000, it would take 42 years to pay off

the debt, at a typical 18 percent interest rate, the consumer group calculated.

Since that study, some banks have raised the minimum to 4 percent.

Opponents of the new bankruptcy law argue that it did not put new restrictions

on credit solicitation and will turn the courts and the government into private

collection agencies for bankers.

While bankruptcy filings increased 17 percent over the last eight years, credit

card profits went up 163 percent to $30.2 billion, according to a report filed

with the House Judiciary Committee by opponents of the new law.

"In the eight years since the credit industry first came to Congress seeking

relief from the rising rate of personal bankruptcy filings, the extent of credit

has not been curtailed, nor have the industry profits been diminished due to

bankruptcy filings," Congressional opponents wrote in their report while the

bill was under consideration.

Americans owe $800 billion in credit card debt, more than triple the amount from

1989, and a 31 percent increase from five years ago, according to a recent

report, "The Plastic Safety Net," by the Center for Responsible Lending, and

Demos, a research group based in New York.

The study found that a third of low- and middle-income American households used

credit cards for basic expenses - rent, groceries and utilities - in any 4 of

the last 12 months.

Those with the worst credit card debt were people ages 50 to 64, who owed $9,124

on average, the study found.

"The people I'm seeing right now, they're mostly middle or lower middle class,"

said Jack Burtch, a bankruptcy lawyer in Washington State. "In a good many of

the cases, credit cards are what got them into trouble. And I don't see how

credit cards will get them out of it."

Newly

Bankrupt Raking In Piles of Credit Offers, NYT, 11.12.2005,

http://www.nytimes.com/2005/12/11/national/11credit.html

Productivity Rise Is Fastest in Two Years

By VIKAS BAJAJ

The New York Times

December 6, 2005

Productivity rose at its fastest pace in two

years in the third quarter, far more quickly than earlier predicted, as output

rose and labor costs fell, the government reported today.

The report eased some economists' fears of rising inflation.

As a measure of how much the economy produced per hour of work, business

productivity rose 4.7 percent outside the farming sector from July to September,

compared with an earlier reading of 4.1 percent, the Labor Department reported.

Real hourly compensation, which adjusts wages and other benefits for inflation,

fell 1.4 percent, unchanged from previous estimates.

Also today, the Commerce Department said factor orders bounced back in October,

rising 2.2 percent, from a decline of 1.4 percent the month before. And the

National Association of Realtors said an index that measures pending home sales

for existing homes fell 3.2 percent after a decrease of 1 percent in September,

providing more evidence of a housing slowdown.

The Labor Department's report indicates that the productivity boom of the last

several years may have more steam left in it than Alan Greenspan, the Federal

Reserve chairman, and other economists believed. Typically, productivity tends

to slow in the latter parts of an economic expansion because businesses have

wrung out most of the efficiencies from their operations and have to compete

more aggressively for a thinning supply of employees.

For workers, however, the report shows that the rise in energy costs wiped away

any advantage they received in the form of higher wages, at least for a time.

Before adjusting for inflation, hourly compensation rose 3.7 percent.

Unit labor costs, which gauge how much compensation it takes to produce one unit

of output, fell 1 percent in the quarter, twice as much as previously expected.

From 2000 to 2004, productivity gains averaged 3.28 percent a year, far higher

than the average of 2.14 percent for the last 45 years. Those gains are one of

the mains reasons cited by Mr. Greenspan and other policy makers for the ability

of the United States economy to achieve long periods of growth in recent years

without causing significant inflation.

Compared with the third quarter of 2004, productivity in the most recent quarter

grew at a rate of 3.1 percent, real hourly compensation rose 1.2 percent and

unit labor costs were up 1.8 percent, much closer to the recent trend.

Some economists noted that the report allays concerns about broader inflation

outside of the recent spike in energy prices, which in the case of gasoline

prices have already fallen back down.

"What this tells us is in terms of the fundamentals the road looks fine," said

Brian Bethune, an economist at Global Insight, a research firm. "It doesn't look

like there are a lot of hazards on the way."

Investors appeared to agree with that assessment; the Standard & Poor's

500-stock index was up 9.60 points, to 1,271.68, around midday.

Mr. Bethune said a tamer inflation outlook should prompt the Federal Reserve to

stop raising short-term interest rates soon after Ben S. Bernanke takes over

from Mr. Greenspan as chairman in February. The benchmark federal funds rate on

overnight bank loans sits at 4 percent today, and analysts expect it will reach

4.75 before the Fed stops.

Productivity Rise Is Fastest in Two Years, NYT, 6.12.2005,

http://www.nytimes.com/2005/12/06/business/06cnd-econ.html

Jobs Surged Last Month

in Rebound From

Storm

December 3, 2005

The New York Times

By LOUIS UCHITELLE

The nation's employers added 215,000 jobs last

month, the government reported yesterday, as the economy rebounded from the

devastating impact of Hurricane Katrina.

The strong November number, the biggest monthly increase since July, suggested

that employers are scrambling for workers in response to a strongly growing

economy. But on the fourth anniversary of the recovery from the 2001 recession,

job growth is still below the levels achieved in previous recoveries, and the

unemployment rate has been stuck at 5 percent nearly every month since June.

"We're back on track after the ill effects of the hurricanes," said Mark Zandi,

chief economist at Economy.com, referring to Wilma, which hit southern Florida

in late October, as well as Katrina in late August. "But it is also fair to

conclude that global competition and corporate layoffs are weighing on job

growth."

In releasing the employment data for November, the Bureau of Labor Statistics

reported that at least 900,000 people age 16 or older - one-third of them black

- evacuated in August because of Hurricane Katrina and that half had returned by

last month. Most apparently came back to jobs.

The unemployment rate among the returnees was 12.5 percent, while 27.8 percent

of those still living elsewhere were unemployed. Hundreds of thousands of other

evacuees simply dropped out of the labor force, not even seeking a job, which is

necessary to be listed as unemployed.

The November surge in hiring was widespread, covering nearly two-thirds of the

nation's industries, the best showing since May of last year. It came after two

months in which only 61,000 new jobs were created, because of the hurricanes,

and it dispelled concerns that hiring would continue to lag despite robust

economic growth.

The White House reacted quickly. "The economy is in good shape," President Bush

said in a Rose Garden appearance shortly after the bureau released the November

numbers. He declared that the future of the economy is "as bright as it's been

in a long time." [Page B4.]

Stock and bond prices barely moved yesterday. That was mainly because "this was

one of those rare occasions when forecasters accurately anticipated the

numbers," said Stuart G. Hoffman, chief economist at the PNC Bank Corporation,

including himself among the accurate forecasters.

The latest employment numbers seemed to track the overall economy. The gross

domestic product grew at a 4.3 percent annual rate in the third quarter, the

government said on Tuesday. Much of that strength was in construction and in

business spending on computers and electronics, and that is where hiring was

strong in November.

"This is very much the type of job report you would expect coming off a strong

quarter," said Jared Bernstein, a senior labor economist at the Economic Policy

Institute, a research organization.

Construction jobs grew by 37,000, on top of 35,000 in October, much of it

related to housing, but also to the rebuilding of roads and utilities after

Hurricane Katrina, Kathleen P. Utgoff, commissioner of the Bureau of Labor

Statistics, said.

Manufacturers added 11,000 jobs in November, on top of 15,000 in October, the

first back-to-back monthly gain in more than a year for a sector that has lost

1.6 million jobs since the start of the recovery in November 2001.

The big manufacturing gains last month were in the production of wood products,

in computers and electronic equipment, and in food processing, reflecting

perhaps a rebound in a sector hurt by Hurricane Katrina.

The stepped-up business investment was evident in job growth in the service

sector, in a category called professional and business services, which added

29,000 white-collar jobs, including 5,000 in computer design as well as 6,000 in

architectural services.

The biggest gain, however - 39,000 jobs - was in food services, mainly

restaurants and bars, which "got whacked by the hurricane and its impact on

tourism," as Nigel Gault, chief domestic economist at Global Insight, put it.

"We are now at the point where Hurricane Katrina's effects are adding to job

creation rather than detracting from it," Mr. Gault said.

Some economists attributed the hiring rebound to the recent decline in energy

prices, particularly the price of gasoline, which they said freed money for

spending and improved the confidence of both consumers and corporate executives.

Whatever the reasons, job creation is still off the pace of earlier recoveries

going back to the 1960's. Four years into the current one, employment has grown

2.6 percent. That compares with 7.6 percent for the first four years of the

early 1990's recovery, the second weakest, Mr. Bernstein reported.

The increased hiring was reflected in the average hourly wage of production

workers, who constitute 80 percent of the work force. It rose by 3 cents, to

$16.32, on top of a 10-cent rise in October. The latest increase brought the

year-over-year wage gain to 3.2 percent.

That is less than the inflation rate of 4.3 percent, as measured by the Consumer

Price Index through October, but it "suggests that workers are taking advantage

of a tighter labor market to secure wage gains," said Dean Baker, co-director of

the Center for Economic and Policy Research.

The worst news in the November report concerned blacks. Their unemployment rate

jumped to 10.6 percent from 9.1 percent in October. That might reverse itself in

December. But on top of the national setback, unemployment surged among blacks

who evacuated the New Orleans area to escape Hurricane Katrina and have not yet

returned.

That rate was 47 percent in November compared with 13 percent for whites who

have not gone back.

Jobs

Surged Last Month in Rebound From Storm, NYT, 3.12.2005,

http://www.nytimes.com/2005/12/03/business/03econ.html

Greenspan Expressed Concern

Over Worsening

U.S. Budget Deficit

December 2, 2005

By THE ASSOCIATED PRESS

Filed at 1:23 p.m. ET

The New York Times

WASHINGTON (AP) -- Federal Reserve Chairman

Alan Greenspan expressed concerns Friday that America's failure to deal with its

exploding budget defict and worldwide efforts to erect trade barriers could

disrupt the global economy.

Speaking at an economic conference in London, Greenspan said so far the United

States has had no problem financing its current account trade deficit, which

last year hit a record $668 billion, because of the flexibility of the American

economy.

But he said such flexibility would be threatened by rising protectionism, which

would increase barriers to the flow of goods and investments across the U.S.

border. He also worried about the harm that could be done if the United States

and other nations do not get their budget deficits under control.

''If ... the pernicious drift toward fiscal instability in the United States and

elsewhere is not arrested and is compounded by a protectionist reversal of

globalization, the adjustment process could be quite painful for the world

economy,'' Greenspan said in his prepared remarks, which were released in

Washington.

The London speech represented the second warning Greenspan delivered Friday on

the threats posed by rising budget deficits. In an earlier speech, he had said

that there could be severe consequences for the U.S. economy if policy-makers do

not attack a federal budget deficit that is projected to soar with baby boomer

retirements.

In that taped speech to a conference in Philadelphia, Greenspan said that

Congress would likely have to make ''significant adjustments'' in reducing

benefits for future retirees. He said it appears the country has promised more

than it can afford to deliver in Social Security and especially Medicare

payments, given that health care costs have been exploding.

Greenspan, who will step down as Fed chairman after 18 1/2 years on Jan. 31,

used both of the Friday speeches to return to themes he has been emphasizing

over the past two years.

He said that the looming retirement of 78 million baby boomers will put severe

strains on the country's finances and without changes could disrupt the economy

by driving up interest rates from the increased government borrowing.

And he said that the nation's huge trade deficits can be financed as long as the

country does not jeopardize the flexibility of the U.S. economy in such ways as

increasing protectionist barriers.

''If the currently disturbing drift toward protectionism is contained and

markets remain sufficiently flexible,'' Greenspan said, then a rise in

Americans' savings rates and other adjustments needed to reduce the U.S. trade

deficit should proceed without problems.

Greenspan was in London to attend his final meeting of finance ministers and

central bank president of the world's seven largest economies.

In addition to their normal discussions of the global economy, the Group of

Seven finance officials were going to honor Greenspan with a retirement party,

including a dinner Friday night, during the meetings.

In the Philadelphia speech, which had been taped earlier, Greenspan urged

Congress to act quickly so that the baby boomers will have time to adjust to

potential benefit cuts.

Greenspan did not outline what benefit cuts should be considered but in the past

he has endorsed proposals such as raising the age at which retirees can draw

full Social Security benefits.

''The likelihood of growing deficits in the unified budget is of especially

great concern because the deficits would drain a correspondingly growing volume

of real resources from private capital formation and cast an ever-larger shadow

over the growth of living standards,'' Greenspan said.

''In the end,'' he warned, ''the consequences for the U.S. economy of doing

nothing could be severe.''

In a brief mention of current economic conditions, Greenspan said that the

economy had delivered a ''solid performance'' so far in 2005. ''And despite the

disruptions of hurricanes Katrina, Rita and Wilma, economic activity appears to

be expanding at a reasonably good pace as we head into 2006,'' he said.

However, he said the positive short-term outlook for the economy was occurring

against a backdrop of concern about the government's long-term fiscal health.

''Our budget deficit will substantially worsen in the coming years unless major

deficit-reduction actions are taken,'' Greenspan said, echoing comments he made

most recently in an appearance Nov. 3 before Congress' Joint Economic Committee.

He again called for Congress to reinstate budget rules that expired in 2002 that

required any future increases in benefit payments or cuts in taxes to be paid

for by cutting government spending in other areas -- or by increasing taxes.

Greenspan Expressed Concern Over Worsening U.S. Budget Deficit, NYT, 2.12.2005,

http://www.nytimes.com/aponline/business/AP-Greenspan.html

Economy Shows

Some Resilience in Quarter

December 1, 2005

By BLOOMBERG NEWS

The New York Times

The economy grew at a 4.3 percent annual rate

from July through September, the Commerce Department reported yesterday, the

fastest since the first quarter of last year and evidence of resilience in the

face of hurricanes and record energy costs.

The revised figure for third-quarter gross domestic product, the value of all

goods and services produced in the United States, is higher than economists had

forecast and higher than the 3.8 percent initially estimated by the government.

Growth was 3.3 percent in the second quarter.

"The economy is booming," said Mike Englund, chief economist at Action Economics

in Boulder, Colo. "As much as people may have been concerned about gas prices,

consumers took the hit and now gas prices are falling."

The report also showed that the index excluding food and energy, a measure

closely watched by Fed policy makers, rose at a 1.2 percent annual rate - the

slowest pace since the second quarter of 2003. The government reported a

second-quarter increase of 1.7 percent.

In addition, the Federal Reserve said yesterday in its regional survey of

businesses that retailers were optimistic about the holiday shopping season. At

the same time, the report showed that consumer prices "remained stable or

experienced generally modest increases."

A strengthening economy caused wages to rise and made it harder for some

companies to find workers, according to the report known as the beige book, a

regional survey of businesses by the 12 Fed district banks.

The residential real estate market slowed in many areas, while higher energy

costs pushed up prices for construction materials and transportation, the Fed

said.

According to another report, manufacturing in the Chicago area remained robust

for a third consecutive month in November. A survey of executives by the

National Association of Purchasing Management in Chicago fell to 61.7 from 62.9

in October. Readings higher than 50 signal growth and the November figure

exceeded the 60.5 average for this year. A measure of order backlogs was the

highest since July 1994.

According to the Commerce Department, the gross domestic product rose to $11.2

trillion when annualized and adjusted for inflation. Without adjustment, the

economy grew at a 7.4 percent annual pace, to $12.6 trillion, for the quarter.

The government's personal consumption expenditures price index, a measure of

prices tied to consumer spending, rose 3.6 percent, compared with a 3.7 percent

rise reported last month and a 3.3 percent second-quarter gain.

Business inventories fell at a $13.4 billion annual rate, compared with the

$16.6 billion downward pace previously reported.

Consumer spending, which accounts for about 70 percent of the economy, expanded

at a 4.2 percent annual pace, compared with the 3.9 percent estimated in October

and the 3.4 percent pace for the second quarter. Economists had expected

consumer spending to set a 3.9 percent annual pace.

Economy Shows Some Resilience in Quarter, NYT, 1.12.2005,

http://www.nytimes.com/2005/12/01/business/01econ.html

Sales Climb at Retailers on Internet

November 30, 2005

The New York Times

By MICHAEL BARBARO

Shoppers, intent on skipping crowded stores

and 6 a.m. squabbles over the last bargain laptop, spent 26 percent more money

online over the Thanksgiving weekend than they did in 2004, according to figures

released yesterday.

Consumers spent $925 million on retail Web sites from Thursday to Sunday,

nudging online purchases since Nov. 1 up 24 percent over 2004, according to

comScore Networks, a market research firm.

And after a long weekend of pointing and clicking, millions kept right on

shopping at work Monday, beginning at 9 a.m., retailers said, validating the

holiday shopping season's latest buzz phrase, Cyber Monday.

VisaUSA said that online buying by its cardholders on Monday rose 26 percent, to

$505 million from the same day last year.

Little was accomplished at the office as the number of workers who shopped

online jumped to 15 million from 11.1 million in 2004.

Cyber Monday "is actually taking place," said Tom Burke, vice president of

BarnesandNoble.com, which, along with Staples, said sales on Monday were the

biggest this holiday season. "We are just finally putting a moniker on it."

Holiday traffic peaked on Monday, reaching 27.7 million visits, compared with

23.9 million on Friday, and 21 million on Saturday and Sunday, Nielsen Net

Ratings, a marketing research firm, found.

The robust start to the online shopping season buoyed retailers, many of which

are still fretting over a lackluster weekend in their brick and mortar stores.

ShopperTrak, which measures purchases at stores in malls but not online, said

sales over the weekend rose a slim 0.4 percent from last year.

It appears the Web snatched at least part of that mall business. Diana Gonzalez,

a 22-year-old legal secretary on Wall Street, said scenes of long lines from the

day after Thanksgiving "made it unappealing to go to the stores."

So Ms. Gonzalez waited until Monday, when she spent "most of the eight-hour work

day" searching for an MP3 player and "dropping hints" to family members by

forwarding links to her favorite products.

The most popular sites were eBay, with 11.7 million visitors Monday; Amazon,

with 5.6 million; and Wal-Mart, with 3 million.

The name Cyber Monday grew out of the observation that millions of otherwise

productive working Americans, fresh off a Thanksgiving weekend of window

shopping, were returning to high-speed Internet connections at work on Monday

and buying what they liked.

This year, retailers said they saw a significant spike in the number of visits

that translated into sales. That shift, they said, indicated that consumers had

researched products and prices at brick and mortar stores before heading into

the office to make their purchase online.

"People knew what they wanted," said Georgianne K. Brown, executive vice

president for marketing at Baby Universe.com That site, which sells gear for

babies like toys, strollers and car seats, had a sales increase of 50 percent

over the same day last year, even as the amount of time customers spent on the

site fell by an average of one minute, she said.

Raul Vazquez, vice president for marketing at Walmart.com, said that "customers

were more decisive in their purchases." Three million shoppers visited

walmart.com on Monday, a strong showing, but not enough to overtake the Friday

after Thanksgiving, when five million clicked onto the site.

To encourage buying, online retailers dangled the same kind of incentives used

in their stores. BabyCenter offered a 10 percent discount on select items;

CompUSA, free shipping, and Godiva, a gift with purchase. Dozens of stores also

sent e-mail messages to customers dangling special deals Monday morning.

Lawrence Cohen, a 32-year-old investment banker from Cedarhurst, N.Y., flipped

on his computer Monday and searched for Amazing Amanda, the popular talking

doll, for his daughter. Toys "R" Us did not have it. Neither did Amazon.

So he called his wife, who drove to a nearby store, where she snapped up the

store's last Amazing Amanda.

So it still pays to shop offline?

"In this situation, yes," Mr. Cohen said.

Ann Farmer contributed reporting for this article.

Sales

Climb at Retailers on Internet, NYT, 30.11.2005,

http://www.nytimes.com/2005/11/30/technology/30cyber.html

November 29, 2005

Upbeat Signs Hold Cautions for the Future

NYT 30.11.2005

http://www.nytimes.com/2005/11/30/business/30econ.html

Economic Memo

Upbeat Signs Hold Cautions for the Future

November 30, 2005

The New York Times

By VIKAS BAJAJ

Gasoline is cheaper than it was before

Hurricane Katrina slammed into New Orleans. Consumer confidence jumped last

month and new- home sales hit a record. The stock market has been rising. Even

the nation's beleaguered factories seem headed for a happy holiday season.

By most measures, the economy appears to be doing fine. No, scratch that, it

appears to be booming.

But as always with the United States economy, it is not quite that simple.

For every encouraging sign, there is an explanation. Consumer confidence is

bouncing back from what were arguably some of its worst readings in years.

Gasoline prices - the national average is now $2.15, according to the Energy

Information Administration - have fallen because higher prices held down demand

and Gulf Coast supplies have been slowly restored.

The latest reading on home sales, released yesterday, contradicts most recent

measures of housing activity, which generally indicate a slowdown. And, yes,

manufacturers' fortunes are on the mend, but few besides airplane makers are

celebrating.

It all means the economy is likely to end the year with a splash. But before you

splurge on a new car, consider this: Many economists do not expect the party to

continue, especially if the Federal Reserve continues taking the punchbowl away

and raises interest rates. That could further slow the housing market, damp

consumer spending and crimp corporate profits.

Indeed, the Organization for Economic Cooperation and Development said yesterday

that 2005 growth would most likely settle at 3.6 percent, down from 4.2 percent

in 2004. The organization also forecast 2006 growth at 3.5 percent, but other

economists think that may be too optimistic.

"The two major concerns are the extent of slowdown in housing and how it can

feed into growth and consumer spending," said Joshua Shapiro, chief United

States economist at Maria Fiorini Ramirez Inc., a research firm in New York.

Many analysts, including Mr. Shapiro, say a housing slowdown is already under

way. Along with rising interest rates and anemic job growth, any such drop-off

could sap the economy next year - by just how much is still subject to debate.

Americans have taken advantage of historically low mortgage rates to buy homes,

refinance existing loans and borrow money for renovations or other household

needs, all of them important and substantial spurs to spending, Mr. Shapiro

said. 00

While neither he nor others expect that activity to dry up, even a modest

tapering off could knock growth down a peg or two. Mr. Shapiro, for one, says

growth could drop from 3.5 percent in 2005 to 3.2 percent in 2006.

The average interest rate on a 30-year, fixed-rate mortgage was 6.28 percent

last week, up from a low of 5.53 percent in June, according to Freddie Mac, the

housing-finance company.

The Commerce Department said yesterday that new-home sales jumped 13 percent in

October, to an annual pace of 1.42 million, a record. But that contradicted

earlier data showing sales of existing homes slowing, construction activity

easing, mortgage applications falling and confidence declining among home

builders.

Two possible explanations for the record pace of new-home sales are that buyers

see a final opportunity to purchase a new house before interest rates go up

again, and they are taking advantage of sales incentives that some home builders

are now offering. But not everyone agrees.

"I basically have a wait-and-see attitude with some healthy suspicion about this

report," said David F. Seiders, chief economist at the National Association of

Home Builders. "Either there is something that all of those other reports are

not telling us, or this will get revised."

In another seemingly upbeat report, the Conference Board, a research group

supported by business, said consumer confidence jumped 16 percent. Still, it is

below the pre-Katrina level. And the Commerce Department said orders for durable

goods - big-ticket items that last more than three years - jumped 3.4 percent,

but most of that increase was concentrated in military and commercial planes.

In addition to housing, the Federal Reserve and businesses will have a big part

in setting the economy's pace next year - the Fed through interest rates and

companies by their hiring decisions.

There is great speculation about how much more the Fed, where Ben S. Bernanke is

expected to succeed Alan Greenspan as chairman in February, will raise its

benchmark short-term rate, now at 4 percent, before Mr. Greenspan leaves.

There is also the question of whether Mr. Bernanke will feel compelled to prove

his inflation-fighting mettle by nudging them higher still. The question may

seem like splitting hairs, especially when the debate is whether the rate will

be 4.5 percent or 4.75 percent, but it certainly has investors' attention.

The recent rally in the bond market, which is considered a haven in periods of

economic stress, indicates that many investors are betting that the Fed "is

likely to overshoot in its tightening," Ethan S. Harris, chief United States

economist at Lehman Brothers, wrote in a note to clients.

A harder question, and one that could greatly influence policy makers, is

whether business will pick up any of the slack if consumers are no longer

spending as much.

So far the evidence is inconclusive.

After adding an average of 202,000 jobs a month for the first seven months of

the year, companies hit a slow patch late in the summer. In August, businesses

created just 148,000 jobs; that was followed by a decline of 8,000 in September

after Katrina. And just when economists expected a big bounce back in October,

the Labor Department reported a net increase of just 56,000 jobs.

Analysts are eagerly awaiting the Labor Department's next jobs report, out

Friday, and hoping the recent weakness will prove temporary. But they worry that

job creation may turn out to be disappointing because of deep-rooted concerns

about thinning profit margins, caused by, among other things, high energy costs.

"This is only a fear that has sprung up recently," said Mr. Shapiro of Maria

Fiorini Ramirez.

Economists expect 220,000 new jobs will be created, according to a survey by

Bloomberg News.

Another hard-to-measure factor that could have a positive bearing on both

businesses and consumers is rebuilding activity in the Gulf Coast and parts of

Florida. The reconstruction that accompanies major disasters has been known to

have a greater economic impact than the initial series of shocks.

Many analysts say a housing-led slowdown is likely to be delayed until the

second half of 2006 because billions of dollars that the federal government and

insurance companies are starting to pump into hurricane-affected regions will

make up for softer consumer spending.

"That is going to push up production activity into the first half of the year,"

said Michael C. Fratantoni, an economist at the Mortgage Bankers Association,

which expects 3.7 percent economic growth in 2006, up from 3.6 percent in 2005.

"The second half of the year, we see somewhat of a drop-off."

Upbeat Signs Hold Cautions for the Future, NYT, 30.11.2005,

http://www.nytimes.com/2005/11/30/business/30econ.html

$430 a Square Foot, for Air?

Only in New

York Real Estate

November 30, 2005

The New York Times

By CHARLES V. BAGLI

The price of air has gone up in Manhattan.

It's now $430 a square foot.

Two New York City developers have agreed to pay a record-setting amount for "air

rights" so they can build a 35-story apartment tower with views of Central Park

from the high floors.

The brothers William L. and Arthur W. Zeckendorf are set to pay $430 per square

foot - more than twice the going rate - for unused air rights over Christ Church

and the Grolier Club at Park Avenue and East 60th Street in Midtown Manhattan.

Christ Church will collect more than $30 million; Grolier will get about $7

million.

Air rights allow developers to build taller by buying the space over low-scale

buildings and transferring it (on paper, if not in reality) to spaces over

adjacent buildings. Although such transfers occur elsewhere in the country, the

prices do not run as high as they do in Manhattan, which generally provides

developers with one option: up.

The rights will be transferred to a site west of the Grolier Club on East 60th

Street, where the Zeckendorfs and their partners own three tenements that are to

be demolished.

If it all goes as planned, the developers will be able to build a taller tower

than the zoning ordinarily allows. In a separate deal with Christ Church, the

tower will also have a coveted Park Avenue address, despite its location on 60th

Street.

The Zeckendorfs are third-generation developers. The brothers disagree with

experts who warn about a bursting housing bubble, at least when it comes to what

the Zeckendorfs call "super prime" areas.

"We want to concentrate on the very high-end market where we see tremendous

strength and a limited inventory," Arthur Zeckendorf said.

M. Meyers Mermel, a real estate broker and a trustee of Christ Church who helped

negotiate the deal, said the money would help sustain the Methodist church's

programs. Carolyn L. Smith, president of the Grolier Club, a storied society of

bibliophiles, confirmed that her club voted on Monday night to approve the deal.

Previously, New York appraisers say that the high end for the price of air

hovered around $200 a square foot.

"Nothing shocks me anymore," said Daniel F. Sciannameo, an appraiser at the

Albert Valuation Group. "This market is absolutely crazy."

$430

a Square Foot, for Air? Only in New York Real Estate, NYT, 30.11.2005,

http://www.nytimes.com/2005/11/30/nyregion/30air.html

Sales of New Homes

Stay Strong in October,

Setting Record

November 29, 2005

The New York Times

By VIKAS BAJAJ

Sales of new homes surged to a record in

October, the government reported today, bucking recent reports of a slowdown in

the roaring housing market.

New home sales jumped 13 percent last month, to an annual pace of 1.42 million,

and selling prices increased modestly, the Commerce Department said. The report

comes a day after the National Association of Realtors said existing home sales

fell 2.7 percent last month and inventories rose to their highest levels in more

than two years.

The positive housing news was accompanied today by two reports that showed a

sharp rise in consumer confidence this month and higher orders for big-ticket

goods like planes in October.

New home sales, which account for about 15 percent of the overall housing

market, tend to increase and decrease more erratically from month to month than

the far bigger base of existing home sales. Also, the Commerce Department

records sales when contracts are signed, rather than when transactions are

closed as the Realtors association does for existing home sales.

Economists had expected new home sales to dip to 1.2 million, according to a

survey by Bloomberg News, and analysts cautioned that last month's surge might

not be an indicator of a larger trend. Experts noted that the median sales price

- half the homes sold for more and half for less - of $231,300 was up just 1.6

percent from September and 0.9 percent from October 2004.

"It's not 100 percent clear where housing really is," said James O'Sullivan, an

economist at UBS. "But the weight of the evidence is that it's not as strong as

this number on new home sales implies."

Mr. O'Sullivan noted that mortgage applications have fallen in recent months as

interest rates have climbed, though they remain close to historic lows. Also,

homebuilders are seeing fewer buyers, according to surveys by the National

Association of Homebuilders.

New home sales were strongest in the West, where they soared by 46.9 percent, to

an annual pace of 457,000, and in the Northeast, where they jumped 43.3 percent,

to 86,000. Sales rose by 1.9 percent in the South and fell 9.5 percent in the

Midwest.

In other economic news, the Conference Board said that its consumer confidence

index surged by 13.7 points, to 98.8, after falling for the previous two months.

It credited an improving job outlook and falling gasoline prices, which at an

average of $2.16 a gallon are below where they were before Hurricane Katrina

struck New Orleans.

"While the index remains below its pre-Katrina levels, the shock of the

hurricanes and subsequent leap in gas prices has begun wearing off just in time

for the holiday season," Lynn Franco, the board's director of consumer research,

said in a statement.

American manufacturers, particularly aircraft makers, also appear to be in

better spirits.

The Commerce Department said today that orders for durable goods - or products

that last for more than three years - surged by 3.4 percent last month after

falling by 2 percent in September. Economists had been expecting an increase of

1.6 percent, according to a survey by Bloomberg News.

Orders for defense aircraft and parts more than doubled to $7 billion in

October, after falling by 2.7 percent in September. Commercial plane orders saw

a dramatic 50.4 percent increase, to $11 billion, after dropping by 41.5 percent