|

History

>

2006 > UK > Economy (I)

Work until 68

and save or face a time bomb

Hutton plans

to link basic state pension to

earnings

and rein in means testing

Friday May 26, 2006

Guardian

Phillip Inman

The government yesterday unveiled ambitious plans to overhaul the retirement

system including proposals to make people work until they are 68 and encourage

them to save in an effort to defuse a future pensions time bomb.

In a statement to the Commons, the pensions

secretary John Hutton said he plans to make the basic state pension more

generous by re-establishing the link with earnings within the next parliament.

The means tested pension credit, which has come under attack for excluding an

estimated 1.6m pensioners on low incomes, would be restricted.

Proposals for a low cost savings scheme with automatic enrolment for staff and

compulsory employers' contributions would further encourage private saving.

Mr Hutton said the changes, published in a white paper Security in Retirement:

Towards a New Pensions System, met the challenges posed by increasing life

expectancy, an overly complex state system and a lack of private saving. "I

believe it can lay the foundations for a lasting solution to the pensions

challenge we face."

Government figures show that spending on pensions and pensioner benefits

accounts for 6.3% of national income. By 2050 reforms will take the total to

7.8%.

The white paper is the government's response to Lord Adair Turner's pensions

commission. In three reports the commission examined the pensions system and

made recommendations for reform. Initially Lord Turner was asked to advise on

how to encourage private saving, but he quickly widened the scope of his study

to include the state system, which he said provided disincentives to save

through complex means testing and regulation.

The commission concluded that unless the state pension was overhauled and

private savings boosted, millions were headed for poverty. A recent study showed

that workers on average faced a drop in income of 60% when they retired.

The Treasury initially claimed Lord Turner's proposals were unaffordable. But

pressure from unions, backbench MPs and some sections of the business community

persuaded the chancellor that he needed to side with Lord Turner.

Lord Turner welcomed the government's proposals, saying it planned to implement

95% of his recommendations. The main recommendations are for the state pension

age for men and women to increase to 66 in 2024, to 67 in 2034 and 68 in 2044

and for the basic state pension to be tied to earnings rather than prices;

In addition the government will end contracting out from the earnings related

state second pension for 3m workers in occupational schemes.

The move will provide savings now on contributions the government would

otherwise have given to occupational schemes. Workers will receive the benefit

from the government in the future rather than their employer. Contrary to some

reports, the government said no-one would lose out by this measure

The lifeboat scheme for workers who lose their pensions when their employer goes

bust is also to be expanded. Mr Hutton said the three year limit - which

provides compensation for people three years from retirement - would be extended

to 15 years, giving a boost to an estimated 30,000 workers.

Mr Hutton said the proposals would promote personal responsibility for

retirement savings, be simple, affordable fair and sustainable. But critics said

the plan would be rejected by large numbers of workers.

Ros Altmann, a former pensions adviser to No 10, said the reforms still left an

overly complex system that most people would find difficult to understand.

The basic state pension would continue to rely on accumulating national

insurance contributions rather than switching to a simpler residency test

preferred by most pensioner groups and the Liberal Democrats. She said means

testing would remain a significant factor in calculating whether it was worth

workers on low incomes saving in a private pension.

Tom McPhail of financial adviser Hargreaves Lansdown said the government would

still need to persuade large swaths of middle England that saving more and

working longer was a viable option when many of them had accumulated large debts

and were in danger of bankruptcy. A report this week said 1 million people were

in danger of becoming bankrupt after taking on large mortgages and loans.

Work

until 68 and save or face a time bomb,

G,

26.5.2006,

https://www.theguardian.com/money/2006/may/26/

politics.lifeandhealth

Mortgage lending hits April record

Friday May 19, 2006

Guardian Unlimited

Hilary Osborne

April saw the highest level of mortgage

lending on record for the fourth month of the year, according to figures

released today, suggesting that consumers still have a high level of confidence

in the housing market.

It was the sixth month running that records

had been broken, the Council of Mortgage Lenders (CML) said.

The council said that £25.1bn was advanced to homebuyers and remortgagors during

April, 16% more than in the same month in 2005.

However, the figure did mark a 12% fall from March, when gross lending totalled

£28.4bn.

The CML said the drop was likely to have been caused by the timing of Easter,

which meant that while there were only 23 working days in April, but 27 in

March. When this was taken into account, average daily lending was actually

higher in April than in the previous month.

Michael Coogan, the CML's director-general, said there was evidence that the

value of mortgages paid out would remain around their present level unless the

cost of borrowing increased.

"The record figures we have witnessed over the past six months illustrate that

the market is in robust shape. Even so, the level of new mortgage approvals has

stabilised in recent months, and we do not expect the underlying level of

lending to rise from recent levels," he said.

"In the past couple of months the interest rate picture has changed and

financial markets are expecting the Bank of England to raise rates this summer,"

Mr Coogan said.

"If this happens, housing and mortgage market activity is likely to slow down

from the recent high levels as the year progresses."

However, Adrian Coles, director-general of the Building Societies Association

(BSA), said seasonally adjusted figures for mortgage approvals showed that April

had been the second busiest month in two years, while mortgage advances were

running at higher levels than in any month last year.

"Concerns at the end of last year that the housing market would slow right down

in 2006 now seem misplaced. Instead, it looks like we are in for a busy summer."

The figures support the finding of a BSA survey of building society chief

executives, which showed that the majority expect house price rises to outstrip

inflation this year.

Although most chief executives in January were predicting an annual increase of

2% in 2006, they were now forecasting price inflation of 4 to 5%.

Figures from the British Bankers' Association (BBA) showed a increase in

non-mortgage borrowing in April.

The amount borrowed on personal loans, overdrafts and other forms of consumer

credit rose by £33m over the month, compared with a fall of £239m in March.

Credit card borrowing also picked up, growing by £277m in April and more than

reversing March's £186m fall.

David Dooks, BBA director of statistics, said the increase should be viewed with

some caution.

"Although credit card lending was stronger, that has to be viewed against the

rare net repayment seen in March," he said. "Overall, the trends in consumer

lending appear stable."

Mortgage lending hits April record,

G, 19.5.2006,

http://money.guardian.co.uk/news_/story/0,,1778900,00.html

4.30pm

Sterling hits new high against US dollar

Friday May 5, 2006

Guardian Unlimited

Charlotte Moore and agencies

Sterling hit a new high for the year against the US dollar today as

disappointing employment data from America gave traders an excuse to sell.

The pound rose to more than $1.86, the highest level seen since May 2005.

Sterling has strengthened against the greenback over the course of the week as

strong economic data in the UK heightened expectations that the Bank of England

would increase interest rates before the end of the year.

However, the bank's monetary policy committee kept rates unchanged at 4.5%. The

rate has remained the same for the past nine months.

One of the US economic indicators that sparked today's sell-off of the dollar

was a poor result for non-farm payrolls. They rose by 138,000 in April, but

analysts had been forecasting 200,000.

Geraldine Conagh, an economist at AIB Group Treasury in Dublin, told Reuters:

"The payrolls numbers have disappointed and this has helped sterling to bounce

higher."

Earlier in the week, the euro reached its highest levels against the dollar in a

year as comments from the European Central Bank suggested that rates in the

euro-zone might increase once more next month. The rate i presently 2.5%.

Sterling hits new high against US dollar, G, 5.5.2006,

http://business.guardian.co.uk/story/0,,1768709,00.html

Irish spend billions

in UK property spree

Post-ceasefire investors

buy up chunks of

England and Scotland

Sunday April 9, 2006

The Observer

Henry McDonald, Ireland editor

It's the second Irish invasion of Britain. The

descendants of the Irish workers who built the housing estates, the roads, the

airports and the shopping centres of postwar Britain are taking over. In the

last 18 months, billions of pounds have been spent by Irish investors, many of

them from post-ceasefire Northern Ireland, buying up vast quantities of

commercial and residential property in England and Scotland.

According to Irish banks and leading property

consultants on the island, Ireland's entrepreneurs have taken on and beaten

foreign investors like the Saudis and the Germans in the acquisition war across

the Irish Sea.

The properties that have fallen into Irish

hands over the last year and a half include:

· Blackpool and Wolverhampton airports, bought

for £15m.

· Twenty shopping centres throughout England, Scotland and Wales, costing a

total of £1.55bn.

· The high-profile Wolseley restaurant, near the Ritz in central London, for

which a private individual from Northern Ireland paid £11m.

A new report by the property consultants

BTWshiels has found that Northern Irish investors have become 'aggressive' in

buying up properties across mainland Britain.

It discovered that almost one fifth of all

property investors in the UK are now Irish, compared with only three years ago

when the figure was just 10 per cent. Keith Shiels, of BTWshiels, puts the surge

in Northern Irish investment into Britain down to post-ceasefire prosperity.

'The market over here has hit a ceiling. Those

that acquired property in the last six years of boom here don't want to sell it.

There is virtually no turnover any more in Northern Ireland, unlike in Great

Britain. That's why the local investor is looking eastward across the Irish

Sea.'

Among the buyouts BTWshiels has overseen for a

Northern Ireland investor has been the Fosse Retail Park near Leicester. It cost

£360m last year - the largest property deal by an individual in the UK. Another

setpiece sale, Greenlanes Shopping Centre, in Barnstaple, Devon, cost a private

Northern Ireland investor £43m in 2004. Last year he sold it for £57m.

One of those who have invested millions in

commercial property on the other side of the Irish Sea is Belfast property

developer Adam Armstrong. He was back in Britain this weekend attending the

Grand National at Aintree. The horse Armstrong co-owns, Monty's Pass, won the

world famous race in 2003. Armstrong has also gambled and won on the British

commercial property scene.

'My partners and I bought Blackpool and

Wolverhampton airports 15 months ago for around £15m and already the investment

is paying off,' he said.

'Since we bought Blackpool from the local council, Ryanair and Jet2.com have

established a presence at the airport. There are now 17 new routes into Europe

with the airlines operating from there.'

Armstrong also owns 500 acres around Blackpool

airport, which could be the location for the UK's first Super Casino if the

government grants the licence to the Lancashire coastal resort.

The largest lender to Northern Ireland

investors in Britain, the Bank of Ireland, described the eastward investment as

being 'on an exponential curve'. David Service, head of property for the Bank of

Ireland in northern England, said the business has handled up to £2bn pounds in

property deals in Britain.

Across the Irish border in the Republic the new investors into mainland Britain

are not just the millionaire property tycoons, but ordinary homeowners and even

first-time buyers.

A month ago Edinburgh-based Lara MacMillan set

up a website aimed at selling properties in the Scottish capital, including to

Irish people who can't afford to buy a house or an apartment in Dublin.

MacMillan, a former Dublin-based property

journalist, said: 'Since the website was launched we have had enquiries from

around 250 people, which is an incredible response. Many of them cannot afford

to buy in Dublin but can acquire a property in Edinburgh instead, which they

will be able to use for rental income.

'We have also had calls from parents whose

children are looking at going to university in Edinburgh. Their parents often

have untapped equity on their homes in Ireland which they want to release and

help their children as well.'

The BTWshiels report's authors also predict

that the Irish money currently flowing by the billions into the British market

will head further east over the next year.

A poster on the front window of a local mortgage shop on Belfast's Ormeau Road

on Friday appeared to confirm this suggestion. It read: 'Dream Homes and

Investments in Bulgaria.'

Irish

spend billions in UK property spree,

O, 9.4.2006,

http://observer.guardian.co.uk/world/story/0,,1750059,00.html

12.45pm

Dixons

to become internet-only operation

Wednesday April 5, 2006

Guardian Unlimited

Mark Tran

The electrical goods store Dixons is

abandoning the high street for the internet, the company's owner announced

today.

All 190 existing Dixons stores will be rebranded "Currys.digital" to offer a

wider range of products and services, including major and small appliances,

while keeping a strong focus on digital technology.

"The Dixons brand will focus exclusively on e-commerce operations to deliver a

leadership position in specialist electrical e-tailing," a spokesperson said.

DSG, the owner of Dixons, Currys, PC World and the struggling mobile phone chain

The Link, said the makeover is expected to cost around £7m and deliver annual

savings of around £3m.

Experts said Dixons' move was unusual and represented a gamble. "It's a huge

surprise and a very interesting move," said Glenn Drury, managing director of

Kelkoo, a shopping search engine. "They are going away from the conventional

wisdom of creating as many links to your business as possible - online, phone or

shops. The competition online will be even more intense, but they do have a

strong brand, which is still very important in the online world."

The initial conversion of existing Dixons stores to Currys.digital is expected

to start in early May. All staff currently working at Dixons stores are expected

to transfer to Currys as part of the process.

John Clare, the DSG chief executive, said: "Customer buying behaviours are

developing with the growth in broadband usage and, as a group, we constantly

adapt and innovate to support how our customers shop."

Dixons' existing e-commerce operation has recorded on average more than 50%

year-on-year sales growth over the last four years, but its high street store

sales have been slipping.

Dixons closed 106 loss-making shops two years ago, cutting its high street

presence by a third. The company also sought to stem its high street problems by

trying new formats such as stores outside town centres.

DSG insisted that Dixons was making the move online to Dixons.co.uk, which gets

a million visitors a month, from a solid base.

"Our trading statement in January showed 8% sales growth, but we feel this is

the right time to move into the fast-growing online market," said Chris

Matthews, the director of marketing and business development. "We are doing this

from a position of strength."

But DSG believes a high street presence is still critical, so it is converting

the Dixons shops into Currys. Despite the rapid growth of online shopping, half

of electricals purchases still take place on the high street.

Internet retailers such as Amazon have made big in-roads into bricks-and-mortar

retailers, who are also feeling pressure from supermarkets.

Soon after HMV revealed dire Christmas trading figures, Alan Giles, the

chairman, admitted he had underestimated the threat from the internet and

announced plans to step down by the end of the year.

The six Dixons stores in the Republic of Ireland are unaffected by the

rebranding, as are Dixons' 21 tax-free airport stores.

Dixon's total sales for last year were £688m.

Dixons to become internet-only operation, G, 5.4.2006,

http://business.guardian.co.uk/story/0,,1747242,00.html

Amnesty on illegal immigrants

is 'worth

£6bn to UK'

Published: 31 March 2006

The Independent

By Nigel Morris, Home Affairs Correspondent

A vast hidden army of illegal immigrants

ensures that each day thousands of offices and homes are cleaned, streets are

swept and drinks are served in Britain's pubs and clubs.

From London's building sites to farms in East Anglia, and from late-night

takeaways to the treacherous sands of Morecambe Bay, they generally fill the

jobs deemed too menial or too hazardous by UK nationals. If discovered, they

face deportation. But according to a radical new study published today, an

amnesty on their status could be worth up to £6bn to the economy.

By giving the hundreds of thousands of illegal immigrants in Britain a promise

that they will not be deported, at least £1bn a year would be raised in taxes,

the Institute for Public Policy Research (IPPR) has calculated. The left-leaning

think-tank, which has the ear of Downing Street, also warns that government

plans to tighten restrictions on bona fide migrants could have the perverse

effect of driving more "illegals" underground.

The most recent Home Office estimate suggested there could be between 310,000

and 570,000 unauthorised migrants in Britain, with ministers admitting it is

impossible to be more precise.

The IPPR says most are "likely to be doing jobs that could be characterised as

dirty, difficult and dangerous", including work in construction, agriculture,

cleaning and residential care. It concludes that deporting hundreds of thousands

of "irregular migrants", as it describes them, is "simply not feasible".

Citing the success of immigration amnesties in the US and Spain, it urges the

British Government to "regularise their work status". It contrasts the estimated

boost to the public coffers with the potential £4.7bn cost of deporting all of

them.

The IPPR also warns that a new government drive to give priority to skilled

foreign workers "may provide incentives for those ineligible under the proposed

system to migrate without permission". It argues that tighter controls on the

US-Mexico border could have had the unintended effect of keeping in the US

migrants that it wants to shut out.

Nick Pearce, the director of the IPPR, said: "We need proper border controls and

managed legal migration. But immigrants also need to be given a chance to play

by the book. There are thousands of people in Britain who work day in, day out,

in often atrocious conditions for pitiful pay. They would love to pay taxes,

earn the minimum wage and travel in and out of the country legally. London's

economy in particular rests on their labour.

"It is inconceivable that these people will all be deported, even in the wildest

fantasies of the anti-immigration right. The Immigration Service has more than

enough on its hands policing our borders and removing newly arrived failed

asylum-seekers. To go round the country finding, detaining and then deporting up

to half a million people who don't have regular status simply will not happen."

Its report came after Home Office figures suggested racial tension is growing in

several parts of the country. The number of racist incidents recorded by police

in England and Wales jumped by 12 per cent to more than 59,000 last year, with

even sharper rises in shire counties such as Hertfordshire, Hampshire and North

Yorkshire. Many of the attacks take place against a backdrop of relentlessly

negative coverage of migrant workers, portrayed as "spongers" on the British

state.

The Joint Council for the Welfare of Immigrants backed calls for an amnesty for

workers who were making a positive contribution to the nation.

Habib Rahman, its chief executive, said: "As long as migrants' presence and

contribution is not officially recognised, they are without rights and without a

stakehold in society. As events at Morecambe Bay have demonstrated all too

tragically, this leaves them open to exploitation."

Tony Woodley, the general secretary of the T&G union, said: "Workers worried

about their immigration status are among the most exploited in our workplaces.

Global criminal operations extort their money, while in the workplace

unscrupulous employers can intimidate them without fear of reproach.

"The only way to end this exploitation is to end the isolation these workers

experience."

Tony McNulty, the Immigration minister, said: "Illegal immigration is not

something the Government is simply going to accept and is taking steps wherever

possible to tackle this issue." He said the Government's points-based approach

would be "robust against those seeking to abuse the system, while welcoming

workers who have the skills needed to benefit the UK economy".

Immigration: The facts we are never told

* There are between 310,000 and 570,000

illegal immigrants in the UK, according to Home Office estimates

* If allowed to live legally, they would pay more than £1bn in tax each year

* Deporting them would cost £4.7bn and leave acute shortages of cleaners, care

workers and hotel staff cIf allowed to stay, the net benefit of nearly £6bn

would pay for 300 new schools, 12 district hospitals or 200,000 new nurses

* Nearly 50% of foreign-born immigrants leave Britain within five years

* Migrants fill 90% of low-paid jobs in London and account for 29% of the

capital's workforce. London is the UK's fastest-growing region

* Legal migrants comprise 8.7% of the population, but contribute 10.2% of all

taxes. Each immigrant pays an average of £7,203 in tax, compared with £6,861 for

non-migrant workers

* There were 25,715 people claiming asylum last year. If allowed to work, they

would generate £123m for the Treasury

'We have been betrayed, cheated and robbed'

* "Charles", a nursing assistant from Brazil,

came to Britain to visit his mother.

Once here, he paid £500 for fake Portuguese identity papers enabling him to

work. He said: "These are made in London very quickly." He travelled to

Leicester, bought a false national insurance certificate for £100, and signed up

with an employment agency with arelaxed attitude to false paperwork. A

gangmaster posing as a supervisor was given another £200 and Charles soon landed

a job producing salad, fruit pies, fruit juice and jellies for high- street

stores. He worked six days a week, getting up at 3.30am to catch the agency bus

which took the "illegals" to work. He was paid £4.50 an hour.

He was picked up in an immigration raid. "Our supervisor had denounced us, and

the agency washed its hands. We were locked in cells. We have been betrayed,

cheated and robbed," he said. He has recently been deported.

* "Alfred" left his family behind in Nigeria five years ago. He arrived on a

student visa but stayed on after it ran out.

Instead of studying for a degree, he took work involving cleaning up after

undergraduates at a well-known London college.

Although Alfred and his fellow workers - many of whom were also in Britain

illegally - were paid the minimum wage, they worked in appalling conditions and

suffered routine verbal abuse.

His patience finally ran out and he started protesting about their treatment.

A friend of Alfred's said: "Everyone was being exploited, whether they were

legal or not.

"When he started to make a fuss, he was told that if he didn't keep quiet he

would be reported to immigration."

Alfred left the job soon afterwards and has since disappeared.

Amnesty on illegal immigrants is 'worth

£6bn to UK' , I, 31.3.2006,

http://news.independent.co.uk/uk/this_britain/article354784.ece

Study reveals

financial crisis of the

18-40s

Tuesday March 28, 2006

Guardian

Patrick Collinson

An official government study into Britain's

personal finances reveals a lost generation of 18- to 40-year-olds unable to

cope with debts and soaring house prices, with alarmingly low levels of savings

and little hope of building a decent pension.

The study, by the Financial Services Authority

(FSA) and Bristol University, published today, is the biggest of its kind

undertaken in Britain. It paints a picture of a generational divide fuelled by

higher education costs and the collapse of company pension schemes - with 42% of

adults now with no pension and 70% with no meaningful savings.

The FSA will call today for a new national strategy to improve Britain's

financial capability, including workplace-based financial seminars targeted at 4

million employees; making personal finance more prominent in the national

curriculum from 2008; and "money doctor" packs which will be sent to 1.5 million

new and prospective parents each year.

FSA chief executive, John Tiner, said: "There is an urgent and serious need to

help the young. They are the first generation to be leaving college with massive

debts, and while housing has always been a challenge, it's become extremely

difficult for young people in parts of the country. Yet at the same time the

young have become serious consumers. It was difficult for an 18-year-old to get

a credit card 20 years ago but today it is relatively easy."

Around one-quarter of adults aged 20 to 39 have fallen into financial

difficulties over the past five years, compared with 5% of over 60-year-olds,

said the report.

It highlights a striking generational gap with regard to credit; 24% of young

adults are currently overdrawn, compared to 11% of over-50s and just 4% of over

60s. The study blamed financial problems among 18- to 40-year-olds not on low

incomes but on rapidly changing economic and social trends presenting young

adults with greater challenges than their parents. "Even after lower incomes and

limited experience are taken into account those in the 18 to 40 age group are

less financially capable than their elders," said Mr Tiner.

In a simple quiz on money matters, young adults scored particularly badly. Over

40% of 18- to 20-year-olds failed a question on interest rates and percentages,

compared with 14% of people aged 50 and above.

The education secretary, Ruth Kelly, said the report highlighted the need to

make personal finance education "more explicit in the national curriculum" and

promised support for teachers "to bring this to life in the classroom". But Help

the Aged criticised the report which, it said, ignored the needs of older

people.

The worsening outlook for pension provision highlighted in the report is likely

to fuel demands for a higher basic state pension, as recommended in the recent

Turner report but fiercely resisted by the chancellor, Gordon Brown. It is also

likely to spark fresh debate about introducing compulsory pension saving.

The report said 81% of people of pre-retirement age think the state pension

would not provide sufficiently for their old age, yet four out of 10 people are

not paying into an occupational or personal pension to top up their state

pension.

Worries over Britain's £1 trillion debt mountain may be overstated. The report

found that only 1% of over 18-year-olds - equal to 500,000 people - have severe

financial problems, although 6% of people (around 2m households) face a

"constant struggle" to keep up with commitments.

Bristol University conducted more than 5,000 45-minute long interviews at home

with respondents across the UK as part of the FSA research.

Study

reveals financial crisis of the 18-40s, G, 28.3.2006,

http://money.guardian.co.uk/news_/story/0,,1741079,00.html

Financial Budget report 2006

The Guardian Budget

Report

p. 7 23 March 2006

Brown taunts the Tories:

we invest, you cut

taxes

Education and environment made priorities

but no more for health

Thursday March 23, 2006

Guardian

Patrick Wintour and Larry Elliott

Prime minister in waiting Gordon Brown used

his 10th budget yesterday to sharpen the political battle lines with David

Cameron's Conservatives, by unveiling a package of extra funding for teachers,

school buildings, IT and science, designed to start closing the spending gap

between the state and private sectors.

The chancellor signalled that education would

be given top priority in a tough spending round next year and contrasted

Labour's desire to invest the proceeds of economic growth in public investment

with Tory ambitions for tax cuts.

Reflecting government confidence that education would prove a trump card for

Labour, one cabinet minister said there had been "fear in the eyes" of the

opposition frontbench as the chancellor laid out his plans for education.

Mr Brown revealed, however, that the cost of extra investment in schools would

be a zero real increase in spending for Charles Clarke's Home Office over the

three years from 2007-08, and that spending would be cut by 5% a year at the

Treasury, Revenue and Customs, the Department for Work and Pensions and the

Cabinet Office.

Although the chancellor insisted that both the economy and the public finances

were on the mend, the squeeze on the exchequer was underlined by his

announcement that pay increases in the public sector would average only 2.25%,

with only nurses getting more.

Mr Brown also announced plans to sell off a number of state assets, including

part of British Energy, to raise money for the next spending round.

Labour MPs were cheered by the chancellor's desire to close the gap between

spending on pupils in the state and private sectors. By 2011, he said, capital

spending on buildings and equipment in the state sector would rise by 50% to

£8bn a year, so that spending for each pupil would reach £1,000 - the same as in

private schools.

Mr Brown admitted, however, that he could put no timescale on his long-term aim

of raising overall spending on schools from £5,000 a pupil to the £8,000 in the

private sector, thereby allowing similar pupil-teacher ratios across the board.

"To improve pupil teacher ratios and the quality of our education, we should

agree an objective for our country that stage by stage, adjusting for inflation,

we raise average investment per pupil to today's private school level."

As a down-payment, Mr Brown said each primary school headteacher would receive

£44,000 direct from the government next year, up from this year's £31,000. In

the secondary sector, the average school would see its allocation go up from

£98,000 this year to £150,000 in April and £190,000 next year.

The chancellor said investment in education was vital to meet the challenge of

globalisation; he unveiled plans for 3,000 extra science teachers and free A-

level tuition for those aged under 25 who had left school lacking the right

qualifications for the modern workforce.

The shadow education secretary, David Willetts, derided Mr Brown's promise to

lift spending on state pupils to that of privately educated children: "The

chancellor has offered us an aspiration with absolutely no means of achieving

it."

Mr Brown's £440m for education was part of a £2bn package of extra spending,

which included an additional £800m for Ministry of Defence operations in Iraq

and Afghanistan and £100m to double the number of community support officers to

back up the police.

In an hour-long address, Mr Brown also targeted Mr Cameron's green credentials

by introducing a new top-rate car tax on petrol guzzlers of £210, and raising

the climate change levy for the first time in five years, the one green tax

already ruled out by the Conservative leader.

He claimed that Mr Cameron's promise to share the proceeds of growth already

meant that the Tories were committed to £17bn less in public spending. The

shadow treasury secretary, Theresa Villiers, rejected the figure, but

surprisingly admitted that Tory plans would mean less spending on schools and

hospitals.

Treasury plans to raise pension credit aimed at the poorest pensioners were

fought off by the prime minister and the work and pensions secretary, John

Hutton, who insisted that all big decisions on pensions must await the pensions

white paper in six weeks' time. Mr Brown was allowed, however, to announce £250m

for off-peak free national bus travel for every pensioner and disabled person.

Pensioners' groups attacked him for failing to repeat the £200 council tax

subsidy to those over 65, claiming Labour would pay a heavy price in the May

local elections.

Overall, Mr Brown summed up his thinking: "The budget's choice is to invest

more, not less, in schools and families, to strengthen the new deal, not to

abolish it, to maintain the climate change levy and not remove it, and instead

of cutting investment, to hold firm and not waiver, on the principles that have

given Britain stability."

Mr Cameron called the chancellor the roadblock for reform and "a figure from the

past". He said: "We wondered whether we could get a budget or a leadership bid,

and we did not get much of either. Cut through all the rhetoric, billions

raised, billions spent, no idea where the money has gone. With a record like

that, the chancellor should be running for Labour party treasurer."

The Tories pointed out that taxes overall in the budget were rising by £5.5bn,

and argued that the proportion of the tax-take drawn from green taxes was

falling. "In a carbon-conscious world, we have a fossil fuel chancellor," the

Tory leader said.

Brown

taunts the Tories: we invest, you cut taxes, G, 23.3.2006,

http://society.guardian.co.uk/publicfinances/story/0,,1737637,00.html

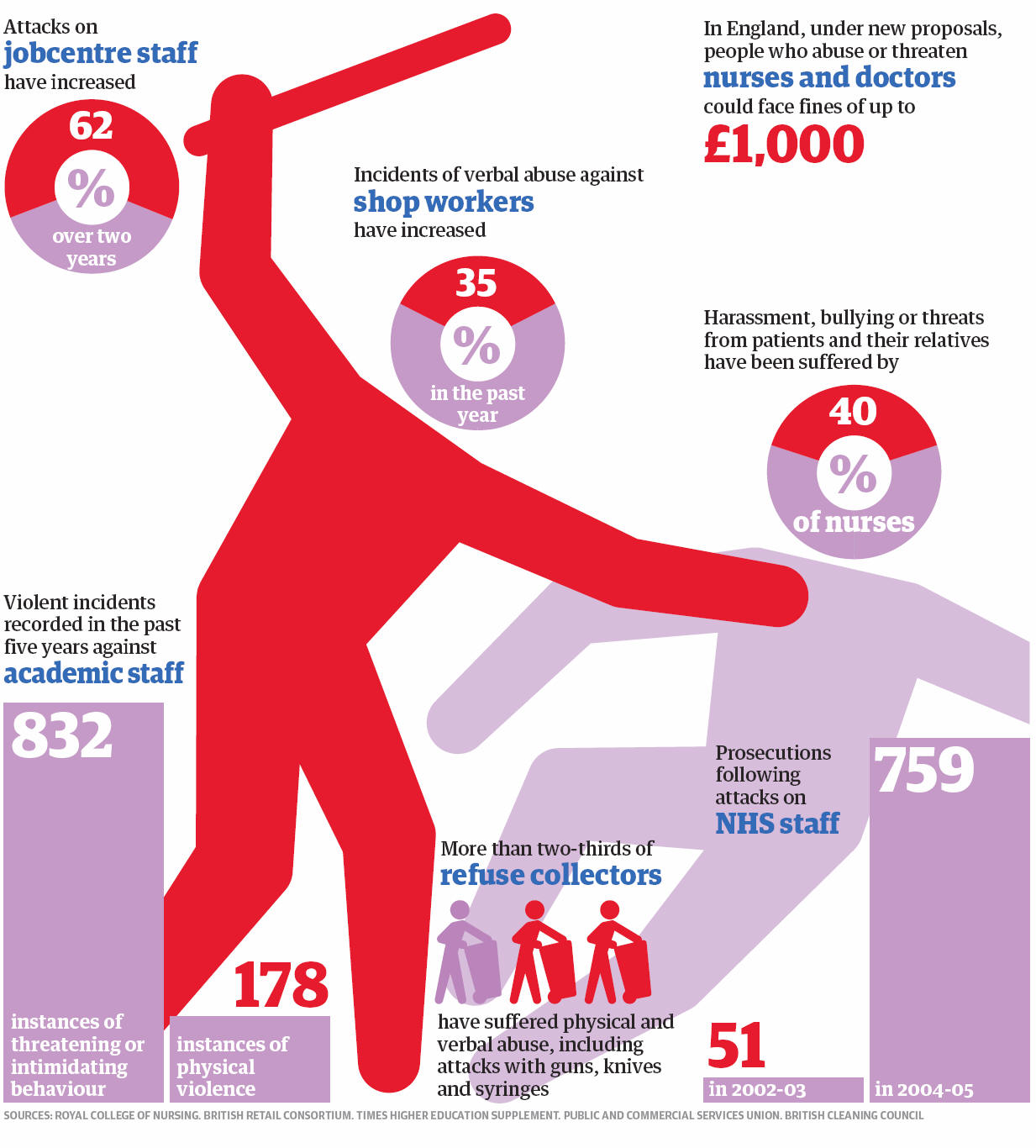

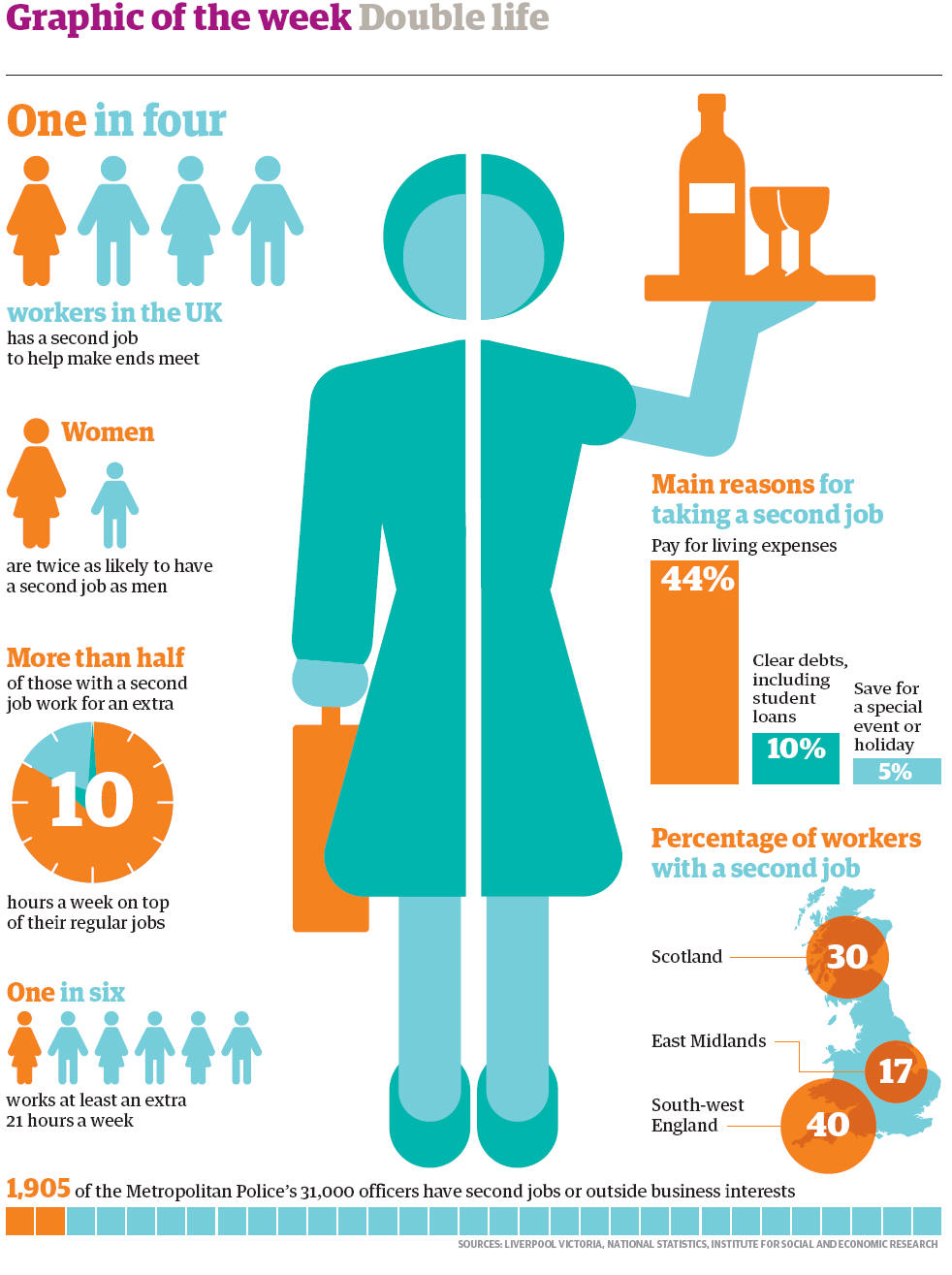

Graphic of the week

Blow by blow The Guardian

Work p. 2

11.3.2006

Unemployment rises

at fastest rate since

1990s

· Claimant count measure rose 14,600 last

month

· Rise in jobless total almost exclusively among women

Thursday March 16, 2006

Guardian

Ashley Seager

The number of people drawing unemployment

benefit has risen at its sharpest rate since the recession of the early 1990s,

figures revealed yesterday.

The figures, which provide the latest indication of a softening labour market,

came a week ahead of Gordon Brown's 10th and possibly final budget. They provide

an uncomfortable backdrop for a chancellor who has made the restoration of full

employment a key plank of policy and follow news that economic growth in 2005

came in at its lowest since 1992.

The Office for National Statistics said the claimant count measure of

unemployment rose by 14,600 in February, more than reversing the 1,100 fall in

January. The claimant count has risen for 12 of the past 13 months and stands

102,000 higher than a year ago at 919,700, although that only gives a jobless

rate of 2.9%, such has been the extent of the falls in unemployment over the

last decade.

The ONS also said the government's preferred labour force survey measure of

joblessness - which picks up those who are unemployed but not claiming

jobseeker's allowance - showed a rise of 37,000 in the three months to January,

taking it to 1.53 million, or 5% of the workforce. Statisticians said the rise

in unemployment was almost exclusively among women, although it gave no reason

for this. Economists said it could show that job losses in the flagging retail

sector are hitting women disproportionately hard.

John Philpott, economist at the Chartered Institute of Personnel and

Development, said: "The number of women in work has fallen as the consumer

slowdown has adversely affected employment in consumer services sectors, notably

the distribution and hotel and restaurant sectors which joined manufacturing in

shedding substantial numbers of jobs last year."

The ONS figures showed that employment fell slightly, by 7,000, to 28.8 million.

But that remained close to its all-time high and was 178,000 higher than a year

ago, mainly due to the increase in the size of the working population.

There was another record high for "economic inactivity" which includes students,

the long-term sick and people looking after their families. This rose to just

under 8 million, although the ONS cautioned that this was mainly due to a rise

in student numbers. Mr Philpott added that the slowdown in the retail sector,

which had pushed up unemployment among women, was probably also contributing to

the rise in inactivity.

Margaret Hodge, employment minister, said the figures showed that the

fundamentals of the labour market remained strong. "Employment is up on the

year, vacancies up again this quarter and redundancies at historically low

levels."

She acknowledged that the claimant count was up but said latest Department of

Work and Pensions figures showed falls in numbers of people claiming other

benefits. She pointed in particular to incapacity benefit claimant numbers,

which have fallen 58,000 over the past year.

"But we must do more to tackle worklessness and break the cycle of poverty and

benefit dependency. That is why we set out proposals in January's green paper to

reform the welfare system and give people increased support in return for a

greater responsibility to look for work." Not all was doom and gloom as the

figures revealed that the number of retired people finding work had risen by 10%

over the past year to a record 1.12 million.

The ONS figures also showed little for the Bank of England to worry about in

terms of wage inflation. The Bank has been watching carefully for any upward

pressure caused by the rising price of oil and gas.

Average earnings growth remained at 3.5% in the three months to January compared

with a year earlier. Earnings continued to grow faster in the manufacturing

sector than in the service sector even though manufacturers have shed more than

100,000 jobs over the past year, taking employment in the sector to a record low

of just over three million.

The monthly house price snapshot from the Royal Institution of Chartered

Surveyors powered to its highest level since June 2004. The RICS survey showed a

balance of 28% of surveyors - up from 10% the month before - reported house

price rises rather than falls. The RICS said: "Buyer confidence has returned to

the market with the number of new purchase enquiries rising yet again, despite

diminished hopes that interest rates will fall again."

Unemployment rises at fastest rate since 1990s, G, 16.3.2006,

http://business.guardian.co.uk/story/0,,1731623,00.html

The Guardian

Work p. 2

25 February 2006

The Guardian

Work p. 12

18 February 2006

Boom and Bust Britain, 2006

City bonuses hit a record £7.5bn,

3,000

workers given at least £1m,

Sales of penthouses, fast cars and champagne

at

all-time high, House repossessions up 70%

to highest level since the 1991 crash,

Mortgage arrears up 21%,

Record 70,000 go bankrupt,

a 51% rise

Published: 04 February 2006

The Independent

By Philip Thornton,

Economics Correspondent

and Terry Kirby, Chief Reporter

A stark image of divided Britain was revealed

yesterday as it emerged that a record number of people were made bankrupt, even

as a tiny elite of City of London bankers were looking forward to £1m-plus

bonuses.

The Government's own figures yesterday showed that more than 20,000 people were

forced to file for bankruptcy in the three months running up to Christmas after

being overwhelmed by their debts. The total of 20,461 was a 51 per cent jump on

the previous year and the highest number for a three-month period since records

began in 1960. The total for 2005 was almost 70,000, 57 per cent more than 2004.

Families struggling to make ends meet will take little comfort from a report by

a leading think tank showing that City traders are set to share a staggering

£7.5bn bonus pool after a bumper year for share prices and company takeovers.

Some 3,000 people are on track for a seven-figure bonus, the Centre for

Economics and Business Research (CEBR) said. Many lenders foreclosing on debts

will be owned by the same financial giants that are paying individual employees

up to £10m.

"The contrast between the financial situations of these groups of people is

shocking," said Vince Cable, the Treasury spokesman for the Liberal Democrats.

"While those in the City worry about whether they have chosen the trendiest

location for their skiing holiday those recently insolvent will be worrying

about how they will put food on the table.

"These figures demonstrate the hollow nature of Gordon Brown's rhetoric on

social justice."

The jump in personal failures was accompanied by a surge in mortgage

repossessions, triggering fresh fears that households were buckling under the

weight of mounting debts and rising interest rates.

The number at least three months behind on their mortgage payments is up by 21

per cent. More than 10,200 people lost their homes last year - a 70 per cent

increase on 2004.

"The underlying theme is the strain from high debt levels and high debt service

payments," said Michael Saunders, a UK economist at Citigroup, the American

banking giant.

Households are currently labouring under a record £1.16 trillion of mortgage and

unsecured debt - credit cards, bank loans and overdrafts and HP deals. Although

there are tentative signs that consumers are reining in their unsecured

borrowing, experts believe that the number of personal failures will increase.

"The bankruptcy bubble is getting bigger but seems unlikely to burst for some

time yet," said Steve Treharne, the head of personal insolvency at the

accountancy firm KPMG. "The levels and availability of credit have been

increasing for some time and recent figures from the Bank show that this trend

is continuing. The more people use credit, it is inevitable this will be

followed by increases in personal insolvencies."

Citizens Advice said its bureaux had seen a 26 per cent surge in the number of

people seeking help over their debts, to 1.23 million last year. The latest

figures, combined with bumper bonuses for top bankers, will fuel calls for a

crackdown on profits made by high-street banks.

A spokeswoman for Citizens Advice said: "Our evidence shows that lenders are

selling products without properly checking whether the borrowers can afford it."

She said that the majority of cases were among the lowest income group. But Mike

Gerrard, a personal insolvency expert at Grant Thornton, said: "We are also

seeing greater numbers of individuals earning good salaries but borrowing

proportionally more than people on lower incomes."

He said the "now culture" - people of all ages expecting things now and no

longer wanting to save to buy them - was generating the highest volumes of

insolvencies.

The figure was distorted by a doubling - 117 per cent - in the number of

individual voluntary arrangements (IVAs), a recently introduced procedure to

take the shame out of bankruptcy.

At the other end of the scale, £7.5bn in bonuses is due to be earned by City

workers this winter, according to the CEBR, a 16 per cent increase over past

year. The rise is due mainly to a 10 per cent rise in stock market trading and a

20 per cent surge in mergers and acquisitions.

At the top end, about 3,000 people, usually at boardroom level at such companies

as Goldman Sachs and Morgan Stanley, will get bonuses of more than a £1m, with a

handful nudging £10m. This includes people such as Michael Spencer, 50, chief

executive of ICAP, the world's biggest money broker, who is said to be getting

£5m this year, and Crispin Odey, 46, a hedge fund manager, said to be due £8.8m.

But there are also 330,000 City workers, usually traders, brokers and dealers,

who are also getting bonuses, ranging from a few hundred pounds right up to the

magic £1m figure; the average is around £23,000. Even relatively lowly workers

on £35,000 might expect to double their salaries in their first year.

The art lover with a £5m bonus to spend

Michael Spencer, chief executive, 50

The British chief executive of the world's

biggest money broker, Intercapital (ICAP), Michael Spencer, isestimated to have

made a £5m bonus this year, which, if he continues his tradition of hospitality,

may be partially spent on a party. Last year, he spent £1m to bring Robbie

Williams over to his pad in St Tropez and sing to the 300 guests who had joined

him for his fiftieth birthday.

"I'm the sad person you see reading the FT on the beach," he says. But it has

paid off - Mr Spencer has homes in Holland Park, St Tropez and New York and is a

collector of modern art with a penchant for Picasso and Jack Vettriano. He

earned around £4.5m last year and has an estimated personal wealth of around

£372m. His company operates from 26 offices across the globe and employs 2,900

staff to handle daily transactions of $1trillion. He lives with his wife

Lorraine and three children. Mr Spencer got a taste for trading when he made a

£300 profit dealing in GKN shares while at Oxford studying physics. He now

controls 22 per cent of Icap.

Geneviève Roberts

The bankrupt forced to give up his home

Robert Power, 26

After the death of his father, Robert Power

went "off the rails". He had a £43,000-a-year sales job, with a £40,000

inheritance. In two years he spent it all. He went bankrupt on 1 April 2004,

having racked up a further £42,000 of debt.

"I used to be very frugal," said Mr Power, 26. "I think dad dying sent me over

the edge. I lost sight of the future and saw it as my own money to spend. I went

out to have fun knowing I had tens of thousands of pounds in my pocket.

"But it got out of control. You get calls and letters every day chasing you. I

used to go and sit in the bus stop for an hour with my head in my hands."

Bankruptcy brought it to an end. He has to pay half of his disposable income -

about £400 a month - to creditors until April 2007. Mr Power says his finances

are back under control.

"There is no longer so much stigma attached to bankruptcy, but it is

humiliating. I used to live on my own in a nice flat in Canary Wharf; now it is

a grotty house with three other people in north London. I have less self-worth.

But the calls have stopped."

Oliver Duff

Boom

and Bust Britain, 2006, I, 4.2.2006,

http://news.independent.co.uk/uk/this_britain/article343102.ece

|