|

History > 2006 > USA > Internet (V-VI)

Experts say Google

will be No. 1 in

visitors in '07

Updated 12/28/2006

3:12 AM ET

USA Today

By Jefferson Graham

Internet search giant Google, which defied

gravity this year, is set to become the world's most visited Internet site in

2007.

Google's revenue hit $7.2 billion for the first three quarters of 2006. Its

stock topped the $500-a-share mark (now at $468). Most significant, Google in

October acquired highflying video site YouTube

for $1.7 billion. Measurement services ComScore Media Metrix and

Nielsen/NetRatings plan to add YouTube to Google's overall rankings next year.

That "assures that Google will be No. 1 in both worldwide and U.S. visitors,"

says Danny Sullivan, editor of the Search Engine Land blog.

Even without YouTube, in November Google (GOOG) surpassed Yahoo for the first

time as the second-most-visited site worldwide, ComScore says.

Microsoft is the top site in ComScore's worldwide rankings — fueled in part by

downloads of Microsoft software updates. In the USA, ComScore has Yahoo as the

top site, with 130 million visitors, to 108 million for Google.

Yahoo has been the most-visited Internet property in the USA for more than 10

years, thanks to its popular e-mail, instant messaging and directory

applications. But it trails Google in revenue: Yahoo reported revenue of $4.5

billion in the first three quarters of 2006.

Google taking the No. 2 spot in worldwide traffic "is a big deal," Sullivan

says. "Google's critics say the company is a one-trick pony, and is focused too

much on just search. This just shows how powerful search is."

Only 10% of Yahoo's traffic comes from search, according to rival measurement

firm Hitwise. At Google, meanwhile, 87% comes from search. Yahoo's top traffic

generator is e-mail, at 33%.

Yahoo has struggled in the shadow of Google this year. Its revamped search

advertising system was delayed until early 2007. Its stock trades at around $26

a share, from more than $40 in January. And it has announced a restructuring to

get back on track.

Earlier this year, Citigroup analyst Mark Mahaney predicted Google would top

Yahoo and Microsoft in traffic even without YouTube. "It's a matter of math," he

says. "The Internet population is growing at 10% a year, and Google's audience

is growing at 9% to 15%," compared with 6% to 12% for Yahoo, and 4% to 7% for

Microsoft. He also says Google's stock will hit the $600-a-share mark by the end

of 2007. "The rise in traffic shows that the new applications they've been

adding are being widely accepted," he says.

Experts say Google will be No. 1 in visitors in '07, UT, 28.12.2006,

http://www.usatoday.com/tech/news/2006-12-27-webleader_x.htm

Google Passes Yahoo

in Tally of Visitors

December 23, 2006

By BLOOMBERG NEWS

The New York Times

Google, the search engine company, displaced

Yahoo as the world’s second-most-visited Web site in November and closed in on

the leader, Microsoft, a market researcher said yesterday.

Visitors to Google’s sites rose 9.1 percent, to 475.7 million in November from a

year earlier, while those to Yahoo sites rose 5.2 percent, to 475.3 million, the

researcher, ComScore Networks, said. Both sites trail Microsoft, which had 501.7

million visitors, ComScore said.

It was the first time that Google, based in Mountain View, Calif., attracted

more visitors than Yahoo, reflecting Google’s growing popularity outside the

United States. Yahoo, based in Sunnyvale, Calif., is still the most-visited site

within the United States, ComScore said. Microsoft’s visitors increased 3.3

percent from a year earlier.

Visitors to Fox Interactive Media sites, owned by the News Corporation, rose

almost fivefold, to 130.4 million, in November from a year ago, reflecting a

surge from the purchase of MySpace.com.

Visitors at YouTube, bought by Google for $1.65 billion in November, rose more

than 24-fold to 107.9 million, ComScore said.

Google Passes Yahoo in Tally of Visitors, NYT, 23.12.2006,

http://www.nytimes.com/2006/12/23/technology/23google.html

Google Steps More Boldly Into PayPal’s

Territory

December 20, 2006

The New York Times

By MIGUEL HELFT

SAN FRANCISCO, Dec. 19 — Steven Grossberg, who

sells video games online from his home in Wellington, Fla., recently sent an

enticing offer to 20,000 customers: $10 off any purchase over $30 using a new

payment service, Google Checkout.

Traffic on his site more than tripled, and best of all, he said, Google picked

up the tab for the promotion.

“I think it’s fantastic,” he said. “I’m selling the product. Google is getting

tons of customers to sign up for Checkout. Customers are happy because they are

getting a monster deal.”

And Google is not charging merchants any processing fees through the end of

2007.

As a result, getting customers to use Checkout will increase profits, Mr.

Grossberg said.

So starting next year, he plans to take some of the money he spends to list

items on eBay and try a new marketing strategy: placing ads alongside Google’s

search results.

That is exactly what Google wants to hear.

When Google introduced Checkout in June, it was seen as a formidable rival to

PayPal, eBay’s online payment service. And with Google aggressively promoting

Checkout during the holiday season and beyond, its use with some merchants has

already surpassed PayPal’s.

But Google’s plan for Checkout has always been about more than online payments.

The service is a calculated effort to expand Google’s base of advertisers, which

provide the bulk of the company’s revenues.

And Google has made a substantial financial commitment to the service’s success.

Goldman Sachs estimates that Checkout promotions will cost Google about $20

million in the current quarter.

The campaign to promote Checkout also says something else about Google: As

rivals Yahoo and Microsoft are working on getting the basics right in their

search and advertising systems, Google is racing ahead to consolidate its lead.

“I believe that Google’s advantage is widening with time and this is one

example,” said Scott Devitt, an analyst with Stifel Nicolaus & Company.

“Checkout could be a game changer, and the competitors are doing nothing of the

sort.”

Unlike PayPal, a full-fledged payment system that can be used to transfer money

between individuals and can draw funds directly from bank accounts, Checkout

merely offers users an easy way to use their credit cards. Checkout users enter

their credit card information, shipping and billing address into Google’s

system. Then, they can pay with Checkout at participating stores without having

to enter their personal information again and again.

Google says thousands of merchants are using the service. That is dwarfed by

PayPal, which has millions of merchants and 123 million users around the world.

In the most recent quarter, PayPal processed $9.1 billion in transactions, up 37

percent from a year earlier. While most of those were payments between eBay

buyers and sellers, the number of PayPal transactions outside eBay rose 59

percent, to $3.3 billion.

Google has not released figures on the number of Checkout users. Still, there

are signs that with the heavy promotions, the service is making significant

inroads.

GSI Commerce, a company that runs about 60 online stores, including toysrus.com,

levis.com and timberland.com, said that one in five holiday sales at its

partners’ stores through the end of November were completed with payment systems

other than credit cards, which include PayPal, a service called BillMeLater and

Checkout. Of the three, “Google is the biggest by far,” said Michael Rubin,

chief executive of GSI Commerce.

At StarbucksStore.com, Checkout transactions topped PayPal transactions by about

a third, said Tracy Randall, president of Cooking.com, which operates

StarbucksStore.com.

Checkout’s gains have not necessarily heralded a PayPal decline. A Goldman Sachs

report this week said that based on conversations with various merchants,

Checkout appeared to be making gains against traditional payment options and

that PayPal’s share of online transactions was also growing.

Regardless, it is clear that the promotions have played an important role in

Checkout’s quick adoption.

When Google introduced Checkout in June, it charged merchants 20 cents plus 2

percent of the purchase price for every transaction. (PayPal charges 1.9 percent

to 2.9 percent plus 30 cents a transaction, while credit companies typically

charge about 1.95 percent and 30 cents for every purchase.)

Yet, to lure merchants to its advertising system, Google offered them $10 worth

of free transaction processing for every $1 in advertising they spent on Google.

But Google recently got more aggressive. On Nov. 8, it waived transaction fees

for all merchants, regardless of whether or not they were Google advertisers,

through the end of the year. Then, on Nov. 27, it began offering Checkout users

$10 off $30 purchases at many e-commerce sites and, in some cases, $20 off $50

orders. And on Dec. 5, it announced that transaction processing would remain

free to merchants through the end of 2007.

In other words, Google plans to lose money on every Checkout transaction for

more than a year. Yet the company believes it will be worth it.

“It’s a way to incentivize more merchants to join our network,” said Benjamin

Ling, a product manager for Checkout. “We want everyone who sells online to be a

Google advertiser.”

The incentives offered by Google could benefit merchants and the company in

several ways, according to online marketing experts.

Consider first that the ads of stores who accept Checkout are highlighted with

an icon — a Checkout shopping cart. That increases the likelihood that users

will click on those ads, which creates revenue for Google. What’s more, once

users click on an ad, the availability of Checkout makes it more likely that

they’ll complete a transaction.

In other words, Checkout generates more sales leads for online retailers — what

online advertisers call click-through rates — and more of those leads turn into

actual sales.

But the system offers merchants ancillary benefits, said Scot Wingo, the chief

executive of ChannelAdvisor.com, an e-commerce services company that helps

independent store owners sell on multiple online marketplaces, including eBay,

Amazon and their own Web sites.

Google ranks ads based on a secret algorithm that combines factors like the

price advertisers are willing to pay and the click-through rate of a particular

ad. The idea is that ads that are clicked most frequently are those that users

find more relevant.

So by having a Checkout icon that increases click-through rates, over time

advertisers will have to pay less to get the same ranking for their ads. Or,

they could pay the same amount for more ads with better placement, Mr. Wingo

said.

“When you factor all of these together, it can have a pretty significant impact

on your economics as a retailer,” Mr. Wingo said, adding that many merchants are

likely to plow any savings back into Google.

There are other ways in which Google could benefit from Checkout, according to

analysts. Checkout gives Google detailed knowledge of its users’ buying habits,

which the company could use to customize the delivery of ads or search results

to specific users.

And the system could make it easier for Google to develop a new advertising

model in which advertisers pay only when a user completes a transaction, rather

than every time a user clicks on an ad. This model, known as “pay-per-action,”

could bring additional revenue to Google.

Mr. Ling said Google had no plans to tie search results to buying habits or to

use Checkout to move to a cost-per-action ad model. But he added: “If there is a

service that is of value to consumers, we will consider it.”

Not everything has been smooth sailing for Checkout. In the middle of the

holiday shopping season, the electronics merchant J & R suspended the use of

Checkout, telling customers that it was experiencing delays in processing orders

due to the popularity of the system. And Ms. Randall, of Cooking.com, said there

had been some “operational issues” with Checkout at StarbucksStore.com, but that

Google had worked quickly to resolve them.

Google acknowledged the problems. “We have experienced some growing pains,” said

Douglas Merrill, a vice president of engineering at Google who is responsible

for Checkout. “Whenever we find issues, we drop everything else to fix them.”

That is in part why laptopsforless .com, a retailer in Anaheim, Calif., chose to

expand payment options by implementing PayPal first, said Jeff Gardner, vice

president for marketing and e-commerce. “We feel like we want to wait until the

bugs are worked out before jumping into it,” he said about Checkout. But come

next year, he added, “it is our intent to offer our customers both.”

Google Steps More Boldly Into PayPal’s Territory, NYT, 20.12.2006,

http://www.nytimes.com/2006/12/20/technology/20checkout.html

EBay Is Expected to Close Its Auction Site

in China

December 19, 2006

The New York Times

By KATIE HAFNER and BRAD STONE

Acknowledging that the online auction market

in China is enticingly fast-growing but frustratingly tough to crack, eBay will

shut its main Web site in China and enter into a joint venture with a Chinese

company instead, a person briefed on the plans of the companies said yesterday.

EBay will take a 49 percent stake in the venture, he said, with Tom Online Inc.,

an Internet company based in Beijing, taking the majority share and

administering the venture, which has yet to be named.

The plans call for eBay to put $40 million into the venture and Tom Online to

contribute $20 million. Meg Whitman, eBay’s chief executive, is to make the

announcement tomorrow at eBay’s office in Shanghai.

EBay, which has already spent hundreds of millions of dollars trying to

establish its presence in China, declined to comment yesterday.

Analysts said the move was not a surprise. “It’s an admission that they failed

in China, on their own at least,” said Tim Boyd, an analyst with Caris &

Company. “But I think that’s something the market already knew.”

The decision was also seen as a sign of the pressure Chinese government

regulations put on foreign companies to set up joint ventures, even when they

may be reluctant to do so for fear of helping to turn their Chinese partners

into global rivals.

Ina Steiner, the editor of AuctionBytes.com, an online newsletter, said that “a

bailout in China would be a huge concession by eBay.” She noted that last year,

Ms. Whitman touted China as eBay’s biggest long-term opportunity in local

markets.

“The company sold analysts on China as a way to counter slowing growth rates in

its more mature markets like the U.S. and Germany,” Ms. Steiner said.

China has not been easy territory for eBay. The company established itself in

China as early as 2002, when it pulled out of Japan in a concession to Yahoo’s

sizable lead there, and bought a third of Eachnet.com, China’s principal online

auction site.

The next year, eBay acquired the rest of Eachnet, bringing the total price to

$180 million. In 2005, eBay spent another $100 million on marketing in China.

Ms. Whitman predicted in 2002 that within four years, e-commerce revenue from

all sources in China would grow nearly twelvefold, to more than $16 billion.

The projections were on the mark, Mr. Boyd said. “But the problem has not been

the growth in e-commerce in China. The problem has been that eBay is losing

market share.”

EBay has steadily been lagging behind Taobao, the consumer auction arm of

Alibaba.com, China’s largest e-commerce company. The research firm Analysys

International said that in 2005, Taobao’s share of the Chinese online auction

market was 57.7 percent, compared with 31.5 percent for eBay Eachnet.

EBay’s move is similar to a partnership Yahoo struck last year with Alibaba.

With its own Chinese operations failing to gain traction, Yahoo paid $1 billion

to hand over operations to Alibaba in exchange for a 40 percent stake in the

company.

Both deals represent new thinking among Internet companies that what works in

other countries does not necessarily work in China, where strong local managers

are needed.

Last September, Martin Wu, the chief executive of eBay Eachnet, resigned after

just a year, and since then rumors have swirled that the company would quit the

market.

Ms. Steiner also said eBay failed to understand the Chinese marketplace and

culture. For example, she said, in contrast to Taobao, eBay Eachnet provided no

phone support and discouraged buyer-seller contact that could lead to haggling.

Also, she said, eBay failed to react quickly enough when Taobao entered the

market with no user fees. In January, eBay Eachnet stopped charging transaction

fees.

“It has lost market share in China to Taobao and continues to face regulatory

and other challenges,” said Ms. Steiner said. “A partnership with Tom Online

would be an effort to salvage its Chinese investment.”

A senior executive at Alibaba, Porter Erisman, said, that “ any new deal where

eBay changes its model in China would be great for both companies because now we

can work out ways to cooperate.”

EBay has played down its troubles in China. As recently as October, in a

conference call with analysts and the media, Ms. Whitman sought to dispel

speculation that the company might reverse course in China. “We are committed to

China for the long term,” she said on the call.

EBay’s stock has been climbing back after hitting a 52-week low of $22.83 in

August. Shares closed yesterday at $32.42, down 1.5 percent.

Tom Online, with 75 million subscribers, allows users access to television,

music stations and online stores through its Web portal and over wireless

networks. In September 2005, it formed a joint venture with eBay in China to

distribute the popular Internet telephone service Skype, which eBay owns.

Over all, Mr. Boyd said he was encouraged by the news of eBay’s new alliance.

“Now they’re partnering with a strong Chinese presence on the Internet,” he

said, referring to Tom Online. “In hindsight, I think they’d say this is the way

we should have gone about it at the beginning.”

The person briefed on the plan said that eBay was also considering partnerships

and other options for its electronic payments site, PayPal China.

Although eBay’s current site will be shut, he said, a separate site will be

maintained to give Chinese users access to international auctions. And eBay’s

Kijiji China, a Chinese classified ad site similar to Craigslist in the United

States, will continue operations unchanged.

Duncan Clark, the chairman of BDA China Ltd., a technology and media consulting

firm in Beijing, said Chinese regulations requiring domestic control over

companies engaged in many kinds of financial transactions had limited the

ability of eBay’s payment mechanism.

“The end game is who can control online payment,” he said. “They’ve had their

hands tied on that.”

The Chinese authorities are preparing to issue 10 licenses for online payment

systems, and eBay will have a much better chance of winning one, Mr. Clark said,

if its operations are in a joint venture controlled by a Chinese partner.

Keith Bradsher and Howard French contributed reporting.

EBay

Is Expected to Close Its Auction Site in China, NYT, 19.12.2006,

http://www.nytimes.com/2006/12/19/technology/19ebay.html

More shoppers take online plunge; sales hit

$670 million in record day

Posted 12/17/2006 11:07 PM ET

USA Today

By Jayne O'Donnell

Online retail sales from Nov. 1 through Friday

were up 25% over 2005, says Internet market research firm ComScore Networks.

ComScore says last Wednesday was likely the

biggest online shopping day of the year and, with nearly $670 million in sales,

topped last year's No. 1 day by over $100 million. In fact, sales on 12 days

this year have surpassed $600 million.

Last year's single biggest day for Web sales was Dec. 11, when consumers spent

$556 million online.

"It's almost like we're seeing a surging as we come down to the deadline day

somewhere around (today) when free shipping with guaranteed delivery ends," says

ComScore chairman Gian Fulgoni.

"We keep seeing strong growth," says Scott Silverman, executive director of the

National Retail Federation (NRF) online division, shop.org. "It's newsworthy

when it continues, because each year you're growing off a bigger base."

Retail consulting firm Kurt Salmon Associates polled 1,202 consumers between

Nov. 25 and Dec. 5 and found most people planned to spend the same amount as in

2005, but 36% were planning to shop more online.

"We're breaking records in online shopping," says Kurt Salmon interactive

strategies expert Chad Doiron. "That's the big winner."

Through Dec. 3, ComScore says, the number of online buyers was up 17% over a

year ago, and the average amount spent increased 7%. Kurt Peters, editor in

chief of Internet Retailer, says the growth is likely coming from more people

shopping online as well as from experienced online shoppers increasing how much

they spend. Peters says new buyers spend less than experienced buyers.

The good news for online retailers comes with a warning. Because consumers are

trying out many different websites, they get frustrated quickly with the less

satisfying ones, Peters says. Consumers' rising expectations usually outstrip

websites' abilities, he says.

Doiron says online shoppers will put up with slow or hard-to-use websites this

time of year. But they won't forgive being told something is in stock when it's

not: "That's when you've lost a customer."

Some of the biggest retailers aren't going to let shipping deadlines steer

consumers away from their websites. Starting today, the NRF's cybermonday.com

website will be promoting a "buy online, pick up in-store" option for the

holidays. Circuit City, Best Buy, Sears and CompUSA are among retailers offering

the service.

"Picking up items in a store will be a good option for consumers who don't want

to wander around looking for a particular size or color," NRF spokeswoman Ellen

Davis says.

More

shoppers take online plunge; sales hit $670 million in record day, UT,

17.12.2006,

http://www.usatoday.com/money/industries/technology/2006-12-17-online-retail-usat_x.htm

Web Site Hunts Pedophiles, and TV Goes

Along

December 13, 2006

The New York Times

By ALLEN SALKIN

Last month, the Web site Perverted-Justice.com

posted news of the conviction of Sean Young, a Wisconsin man sentenced to 10

years in state prison for soliciting sex online from a 14-year-old girl.

According to a transcript of an online chat posted on the site, at one point Mr.

Young had asked the girl, identified only as Billie, what she was wearing. When

she answered “sweats,” Mr. Young typed back that if she were his daughter, “i’d

make u wear sexy clthes.”

Billie turned out to be an adult volunteer for Perverted Justice, an

anti-pedophile group, and when Mr. Young drove to a house where he expected to

meet the teenager for sex, he was arrested by sheriff’s deputies.

The conviction was logged as the 104th that Perverted Justice says it has been

responsible for since 2003, a tally that as of yesterday had reached 113. What

started as one man’s quest to rid his regional Yahoo chat room of lewd adults

has grown into a nationwide force of cyberspace vigilantes, financed by a

network television program hungry for ratings.

“It’s a kind of blog that has turned into a crime-fighting resource,” said

Robert McCrie, a professor at John Jay College of Criminal Justice in Manhattan.

Perverted Justice is best known for putting its online volunteers at the

disposal of the television newsmagazine “Dateline NBC,” which has broadcast 11

highly rated programs in which would-be pedophiles are lured to “sting houses,”

only to be surprised by a camera crew and, usually, the police.

Despite that publicity, the inner workings of Perverted Justice and its

reclusive founder remain largely a mystery, even as the group has emerged as one

of the most effective unofficial law enforcement groups in the country, a kind

of Neighborhood Watch of the Net. But the group is also criticized by some legal

and law enforcement experts, who accuse it of entrapment, making mistakes that

ruin innocent lives and, paradoxically, disseminating its own brand of child

pornography.

Peter D. Greenspun, a lawyer who defended a rabbi from Rockville, Md., caught in

a “Dateline” sting arranged by Perverted Justice, said that by posting online

transcripts of conversations between would-be child molesters and volunteers

posing as 12- and 13-year-olds, Perverted Justice was encouraging, rather than

deterring, pedophiles.

“They are putting out for unfiltered, unrestricted public consumption the most

graphic sexual material that they themselves say is of a perverted nature,” Mr.

Greenspun said.

Perverted Justice’s founder, Xavier Von Erck, 27, a former tech-support worker,

has a dedication to the cause bordering on obsession, his mother and associates

said. Mr. Von Erck lives in an apartment in Portland, Ore., but rarely gives out

his address, and he would not allow a reporter to visit because he feared

retribution from men exposed by his group. In a telephone interview, he said he

worked for his group seven days a week, mostly from a laptop in his bedroom.

“Every waking minute he’s on that computer,” said his mother, Mary Erck-Heard,

46, who raised her son after they fled his father, whom she described as

alcoholic. Mr. Von Erck legally changed his name from Phillip John Eide, taking

his maternal grandfather’s family name, Erck, and adding the Von.

In many ways, Mr. Von Erck, who said he and his mother moved 13 times when he

was in high school because they were often short of money, continues to live

that messy life of deprivation. His meals often consist of ramen noodles, he

said; his bed is perpetually unmade. For years, he has been trying

unsuccessfully to find his father, who, he says, still owes his mother child

support.

“I have a low opinion of men in general,” he said. “The most heinous crimes in

our society are committed by males.”

Perverted Justice has 41,000 registered users of its online forums dedicated to

the cause of stopping predators, 65 volunteers trained as chat room decoys and

three salaried leaders: Mr. Von Erck, a woman who is a liaison with law

enforcement and a business manager.

Typically, a Perverted Justice volunteer creates a false online profile, posing

as, say, a 13-year-old girl on MySpace. The volunteer will wait to receive

e-mail messages or will enter a chat room. If an adult contacts the volunteer,

the decoy responds and sees if the conversation becomes sexual.

The group’s collaboration with “Dateline” since 2004 has been lucrative. A

person familiar with Perverted Justice’s finances who requested anonymity

because he is not authorized to discuss the matter publicly said NBC was paying

the group roughly $70,000 for each hour of television produced.

“They do a lot a work for us, and they deserve to be reimbursed for that work,”

said David Corvo, the executive producer of “Dateline,” who met with Mr. Von

Erck earlier this year in New York to discuss their collaboration.

Mr. Von Erck said the NBC money had been used in part to buy computer servers

that would not be overwhelmed every time the group was mentioned on television.

Ratings for the “Dateline” broadcasts, a series called “To Catch a Predator”

that has become a network franchise, have averaged 9.1 million viewers, compared

with 7 million viewers for other “Dateline” episodes, according to Nielsen Media

Research.

Six new episodes are planned for the first half of 2007. Two were shot at a

house in Long Beach, Calif.; two in Flagler Beach, Fla.; and two others in

Murphy, Tex. The Texas sting drew a burst of publicity in early November, months

before the episodes were scheduled to be shown, when a prosecutor implicated as

a would-be predator, Louis W. Conradt Jr., shot himself to death as the police

approached his home.

Supporters of the NBC broadcasts say they have helped increase awareness of

online predators, allowing parents to educate children and spurring law

enforcement to action. One in seven youths ages 10 to 17 who have gone online at

least once a month for six months have received unwanted sexual solicitations,

according to a 2005 study by the Crimes Against Children Research Center at the

University of New Hampshire.

Last month, the “Dateline” correspondent Chris Hansen, who is featured on the

Perverted Justice specials, addressed about 500 students at a school in Rye

Brook, N.Y., about the dangers of Internet predators. One of the first questions

was why the stings filmed by “Dateline” were not entrapment.

The answer, legal experts say, is that it is hard for a defendant to prove

entrapment, in this context or in any other. Some states allow prosecutions as

long as there was a “predisposition” to the conduct. Others require police

misconduct for a defendant to claim entrapment.

One concern about Perverted Justice’s nonprofessional force of vigilantes,

raised by Lt. Joseph Donohue, head of the New York State Internet Crimes Against

Children Task Force, is that decoys impersonating teenagers may be too

aggressive, not understanding the need to let predators initiate the sexual chat

and therefore not gathering chat-log evidence that will stand up in court.

Mr. Von Erck responded that so far prosecutors had not dropped charges against

any man arrested in an investigation begun by Perverted Justice.

Of the 113 convictions Mr. Von Erck’s group claims, some have been for

misdemeanors resulting in no jail time, and others have brought stiff sentences,

like the one of the Maryland rabbi, David A. Kaye, who on Dec. 1 was sentenced

to six and a half years in prison on federal charges of enticement and traveling

to meet a minor for illicit sexual contact.

Mr. Von Erck’s most vociferous critic is Scott Morrow, a retired Canadian Air

Force serviceman who runs a Web site, Corrupted-Justice.com, chronicling what he

says are excesses by Perverted Justice.

“These are anonymous, unaccountable Net junkies doing this work,” Mr. Morrow

said in an interview.

He said that Perverted Justice listed personal information for many men it

accused of being sexual predators and had sometimes mistaken their identities

and humiliated innocent people.

Mr. Von Erck said the criticisms were out-of-date; in its first years the group

did post the phone numbers, employers and photographs of men it accused of being

predators, and anyone could humiliate the individuals by, say, e-mailing

transcripts of a man’s lewd online chats to his friends and colleagues.

But since early this year, Perverted Justice has made a policy of not

immediately posting the information it gathers in most cases; instead it

contacts law enforcement and encourages pursuit of an arrest.

“We are now a conviction machine,” Mr. Von Erck said.

Mr. Von Erck, who said he was not molested as a child, prefers not to analyze

his own motivation for dedicating himself so fully to the effort. Asked to

explain why he did it, he did so with spare emotion.

“It gets tiring,” he said, “but when you find somebody that’s already been

successful doing something harmful to a child and then you get him arrested, you

can’t beat that.”

Happy Blitt contributed research.

Web

Site Hunts Pedophiles, and TV Goes Along, NYT, 13.12.2006,

http://www.nytimes.com/2006/12/13/technology/13justice.html?hp&ex=1166072400&en=1df7a90fb611f093&ei=5094&partner=homepage

Spam Doubles, Finding New Ways to Deliver

Itself

December 6, 2006

The New York Times

By BRAD STONE

Hearing from a lot of new friends lately? You

know, the ones that write “It’s me, Esmeralda,” and tip you off to an obscure

stock that is “poised to explode” or a great deal on prescription drugs.

You’re not the only one. Spam is back — in e-mail in-boxes and on everyone’s

minds. In the last six months, the problem has gotten measurably worse.

Worldwide spam volumes have doubled from last year, according to Ironport, a

spam filtering firm, and unsolicited junk mail now accounts for more than 9 of

every 10 e-mail messages sent over the Internet.

Much of that flood is made up of a nettlesome new breed of junk e-mail called

image spam, in which the words of the advertisement are part of a picture, often

fooling traditional spam detectors that look for telltale phrases. Image spam

increased fourfold from last year and now represents 25 to 45 percent of all

junk e-mail, depending on the day, Ironport says.

The antispam industry is struggling to keep up with the surge. It is adding

computer power and developing new techniques in an effort to avoid losing the

battle with the most sophisticated spammers.

It wasn’t supposed to turn out this way. Three years ago, Bill Gates,

Microsoft’s chairman, made an audacious prediction: the problem of junk e-mail,

he said, “will be solved by 2006.” And for a time, there were signs that he was

going to be proved right.

Antispam software for companies and individuals became increasingly effective,

and many computer users were given hope by the federal Can-Spam Act of 2003,

which required spam senders to allow recipients to opt out of receiving future

messages and prescribed prison terms for violators.

According to the Federal Trade Commission, the volume of spam declined in the

first eight months of last year.

But as many technology administrators will testify, the respite was short-lived.

“At the beginning of the year spam was off our radar,” said Franklin Warlick,

senior messaging systems administrator at Cox Communications in Atlanta.

“Now employees are stopping us in the halls to ask us if we turned off our spam

filter,” Mr. Warlick said.

Mehran Sabbaghian, a network engineer at the Sacramento Web hosting company

Lanset America, said that last month a sudden Internet-wide increase in spam

clogged his firm’s servers so badly that the delivery of regular e-mail to

customers was delayed by hours.

To relieve the pressure, the company took the drastic step of blocking all

messages from several countries in Europe, Latin America and Africa, where much

of the spam was originating.

This week, Lanset America plans to start accepting incoming mail from those

countries again, but Mr. Sabbaghian said the problem of junk e-mail was “now out

of control.”

Antispam companies fought the scourge successfully, for a time, with a blend of

three filtering strategies. Their software scanned each e-mail and looked at

whom the message was coming from, what words it contained and which Web sites it

linked to. The new breed of spam — call it Spam 2.0 — poses a serious challenge

to each of those three approaches.

Spammers have effectively foiled the first strategy — analyzing the reputation

of the sender — by conscripting vast networks of computers belonging to users

who unknowingly downloaded viruses and other rogue programs. The infected

computers begin sending out spam without the knowledge of their owners. Secure

Computing, an antispam company in San Jose, Calif., reports that 250,000 new

computers are captured and added to these spam “botnets” each day.

The sudden appearance of new sources of spam makes it more difficult for

companies to rely on blacklists of known junk e-mail distributors. Also, by

using other people’s computers to scatter their e-mail across the Internet,

spammers vastly increase the number of messages they can send out, without

having to pay for the data traffic they generate.

“Because they are stealing other people’s computers to send out the bad stuff,

their marginal costs are zero,” said Daniel Drucker, a vice president at the

antispam company Postini. “The scary part is that the economics are now tilted

in their favor.”

The use of botnets to send spam would not matter as much if e-mail filters could

still make effective use of the second spam-fighting strategy: analyzing the

content of an incoming message. Traditional antispam software examines the words

in a text message and, using statistical techniques, determines if the words are

more likely to make up a legitimate message or a piece of spam.

The explosion of image spam this year has largely thwarted that approach.

Spammers have used images in their messages for years, in most cases to offer a

peek at a pornographic Web site, or to illustrate the effectiveness of their

miracle drugs. But as more of their text-based messages started being blocked,

spammers searched for new methods and realized that putting their words inside

the image could frustrate text filtering. The use of other people’s computers to

send their bandwidth-hogging e-mail made the tactic practical.

“They moved their message into our blind spot,” said Paul Judge, chief

technology officer of Secure Computing.

Antispam firms spotted the skyrocketing amount of image spam this summer. A

technology arms race ensued. The filtering companies adopted an approach called

optical character recognition, which scans the images in an e-mail and tries to

recognize any letters or words. Spammers responded in turn by littering their

images with speckles, polka dots and background bouquets of color, which mean

nothing to human eyes but trip up the computer scanners.

Spammers have also figured out ways to elude another common antispam technique:

identifying and blocking multiple copies of the same message. Pioneering

antispam companies like the San Francisco-based Brightmail, which was bought two

years ago year by the software giant Symantec, achieved early victories against

spam by recognizing unwanted e-mail as soon as it hit the Internet, noting its

“fingerprint” and stopping every subsequent copy. Spammers have defied that

technique by writing software that automatically changes a few pixels in each

image.

“Imagine an archvillain who has a new thumbprint every time he puts his thumb

down,” said Patrick Peterson, vice president for technology at Ironport. “They

have taken away so many of the hooks we can use to look for spam.”

But don’t spammers still have to link to the incriminating Web sites where they

sell their disreputable wares? Well, not anymore. Many of the messages in the

latest spam wave promote penny stocks — part of a scheme that antispam

researchers call the “pump and dump.” Spammers buy the inexpensive stock of an

obscure company and send out messages hyping it. They sell their shares when the

gullible masses respond and snap up the stock. No links to Web sites are needed

in the messages.

Though the scam sounds obvious, a joint study by researchers at Purdue

University and Oxford University this summer found that spam stock cons work.

Enough recipients buy the stock that spammers can make a 5 percent to 6 percent

return in two days, the study concluded.

The Securities and Exchange Commission has brought dozens of cases against such

fraudsters over the years. But as a result of the Can-Spam Act, which forced

domestic e-mail marketers to either give up the practice or risk jail, most

active spammers now operate beyond the reach of American law enforcement.

Antispam researchers say the current spam hot spots are in Russia, Eastern

Europe and Asia.

While spammers are making money, companies are clearly spending more of it to

fight the surge. Postini says that the costs for companies trying to fight spam

on their own have tripled, mostly because of increased bandwidth costs to handle

bulky image spam and lost employee productivity.

The estimates should be taken with a grain of salt, since antispam companies are

eager to hawk their expensive filtering systems, which can cost around $20,000 a

year for a company of 1,000 employees. But the onslaught of junk e-mail does

affect business operations, even if the impact is difficult to quantify.

At the headquarters of the Seattle Mariners this summer, the topic of the

worsening spam problem came up regularly in executive meetings, and the team’s

top brass began pressuring the technology staff to fix the problem. Ben

Nakamura, the Mariners’ network manager, said he tried to tighten spam controls

and inadvertently began blocking the regular incoming press notes from opposing

teams.

Two weeks ago, the situation grew so dire that the team switched from software

provided by Computer Associates, whose suite of security programs sat on the

team’s internal server, to a dedicated antispam server from Barracuda Networks,

which gets regular updates from Barracuda’s offices in Silicon Valley.

Mr. Nakamura said the new system had greatly improved the situation. On a single

day last week, the team received 5,000 e-mail messages and the Barracuda spam

appliance blocked all but 300. Still, some employees continue to see two or

three pieces of spam in their in-boxes each day.

Some antispam veterans are not optimistic about the future of the spam battle.

“As an industry I think we are losing,” Mr. Peterson of Ironport said. “The bad

guys are simply outrunning most of the technology out there today.”

Spam

Doubles, Finding New Ways to Deliver Itself, NYT, 6.12.2006,

http://www.nytimes.com/2006/12/06/technology/06spam.html?hp&ex=1165467600&en=a3f1a74b08d60443&ei=5094&partner=homepage

Bones of contention: Religious crusader battles auction

giant

Posted 11/24/2006 8:21 PM ET

By Brian Murphy, Associated Press

USA Today

Hardly an hour goes by without Thomas Serafin or one of his

cyber-sleuths checking what eBay has to offer.

They're not hunting for bargains and never place a bid.

Their interest is bone shards, bits of wizened flesh and a contemporary twist on

the sacred and the profane: How the ancient trade in the most coveted religious

relics has moved into the global flea market of online bidding.

"You can find bone fragments supposedly from St. Augustine being hawked on the

Internet along with trinkets and antiques. There is something very wrong here,"

said Serafin, a professional photographer and Catholic activist based in Los

Angeles, who has led an expanding campaign since the late 1990s to block the

online sale of objects purported to contain the remains of Christian saints.

Last month, Serafin's group, the International Crusade for Holy Relics, opened a

new front that's truly worthy of a David and Goliath metaphor: a call to boycott

eBay.

It seeks to pressure the world's largest online auction site to close alleged

loopholes used to bypass its ban on allowing bids for human remains.

Hani Durzy, spokesman for eBay, said the San Jose, Calif.-based company is "very

willing to reopen talks" with Serafin's group about its concerns after

discussions broke off about a year ago.

"As far as the boycott, well, we've really seen no impact to speak of," said

Durzy. "We don't know if it's even still in place."

But Serafin said the symbolism is what's important.

"Yes, it's just a blip on the screen," he said. "But we want to make a point.

They are taking the same position as Judas. They are selling out the church."

Interest in religious patrimony of all types — from icons to stained glass — has

soared in recent years, along with the blockbuster novel The Da Vinci Code, the

Christian-themed Left Behind series and major museum exhibits devoted to art and

spirituality. At the same time, a flood of ecclesiastical items has entered

mainstream antiquarian markets from once-flourishing churches that were closed

because of shrinking congregations or population shifts away from older city

neighborhoods.

But the sale of so-called "first-class relics" — bone, flesh, hair, nails and

fragments of other body parts — remains a murky subculture, one that's

increasingly shifting from the back rooms of dealers' shops to the Web's

worldwide mall.

Dozens of religious items are on eBay at any time. Most are ordinary objects

such as icons, medals or prayer cards. But Serafin believes the strongest

interest is for the first-class relics, which he says has accounted for up to

40% of the eBay relic listings at times.

"This is where the real action is," he said. "This is where our fight is."

Serafin describes his motivation as part consciousness raiser and part consumer

crusader.

He calls the sale of such relics deeply offensive to believers in their

sanctity.

Then there is the caveat emptor — or "let the buyer beware" — factor. Clear

documentation on a first-class relic is extremely rare and fraud is as old as

faith — as noted more than 600 years ago in a scene from The Canterbury Tales in

which pigs' bones and a pillow case are part of a cache of dubious religious

relics brought from Rome.

Some recent offerings on eBay include "the air" that Christ breathed, the wing

of the Holy Spirit and "the hand" of St. Stephen.

Serafin also says the rules — both canon and eBay's — are on his side.

Most churches with centuries-old traditions in the display and veneration of

relics, including the Roman Catholic and Orthodox, prohibit the sale of any

objects believed to hold body parts.

The extensive list of eBay's banned items include Nazi paraphernalia, firearms

and ammunition and "human parts and remains."

Durzy said eBay has more than 2,000 people assigned to cull prohibited items,

but noted that blanket enforcement is a challenge with up to 7 million new items

going up for bid every day.

Sellers don't make it any easier.

Many now make a point of saying that the reliquary, or container, is for sale

and the actual relic is a "gift." There are even conflicting linguistic signals.

On Monday, a seller posted a relic of St. Eymard, a 19th century French priest,

that was described as "ex ossibus," Latin for "from the bones." But the fuller

text says the relic "does not contain any human parts."

Attempts by The Associated Press to reach the seller — and several other relic

dealers on eBay — via e-mail contact information were unsuccessful.

"We just want the same rules that apply to guns, Nazi items or the bones of

American Indians," said Serafin, whose group is a loose association of about 200

members around the world ranging from a Russian Orthodox archbishop to Catholic

priests and lay people.

Across the time zones, they try to keep a round-the-clock vigil on eBay for any

suspicious relics. They fire off e-mails to eBay and the seller — who is often

known only by an online nickname and e-mail address — asking for the item to be

withdrawn.

But it's a cumbersome process.

In late October, Serafin's group protested what they considered an "ex ossibus"

relic of the 19th century St. John Vianney, the patron saint of parish priests.

The sale went ahead, starting at $25. Twenty-seven bids later, an anonymous

buyer picked it up for $565, plus $12 shipping.

Bones of

contention: Religious crusader battles auction giant, UT, 24.11.2006,

http://www.usatoday.com/news/religion/2006-11-24-relics-ebay_x.htm

Point & click holidays: More consumers go

online for holiday shopping

Updated 11/24/2006 2:02 AM ET

USA Today

By Jayne O'Donnell and Mindy Fetterman

Retailers want this to be the best

cyber-Christmas you've ever had.

HomeDepot.com just introduced do-it-yourself

video tips. A week-long sale starts Monday at Walmart.com, where you can get

better deals than in Wal-Mart stores. And Staples.com's experts will take the

answers to five questions about the person you're shopping for and suggest

gifts.

"Consumers are clearly shifting their preferences to online," says Kurt Peters,

editor in chief of Internet Retailer magazine. "Retailers who want to have a

future will have to have a good website."

More than 80% of retailers' websites now offer free shipping, usually with

minimum purchases, to online shoppers. Some let you order online and pick up

merchandise at a store. Many offer more selection, different products and

hard-to-find sizes that aren't available in stores. And still others bring the

best of Web shopping — product comparisons, reviews and easy-to-find products —

to the mall with in-store computers.

It's all part of a push to get your foot in the website door and keep you there.

Sure, they still want you to come into the bricks-and-mortar stores where most

of their sales come from, but they're perfecting how to use the Web to do that.

U.S. online sales, including travel, are predicted to grow by 20% to $211.4

billion this year, including travel, according to Shop.org, a part of the

National Retail Federation. More than one-third of all U.S. households shop

online, and that's expected to increase to 40% by 2009.

Overall, Internet sales make up just 5% of total retail sales, but stores with

catalogs often conduct 50% of their sales online. People who shop both online

and offline spend up to 60% more than those who shop only at stores, according

to research by retail consulting firm Bain & Co. Those are the customers

retailers want to capture.

Today is Black Friday, so-called because retailers depend on the hordes of

day-after-Thanksgiving shoppers to push their bottom lines into the black.

But it's Cyber Monday that's getting a lot of retail attention these days. On

Monday, millions head back to work and log on to their employers' really

high-speed Internet access and start shopping.

Waiting for them: nearly 400 retailers that

will have special deals available only online at CyberMonday.com.

Last year, Cyber Monday was the second-biggest online shopping day after Dec.

12, one of the last days most sites offered standard free shipping for delivery

by Christmas. Now, the entire week after Thanksgiving is "big and getting

bigger," says Carter Cast, CEO of Walmart.com. He expects his site will get more

than 30 million visits during the week.

Online shopping on Cyber Monday is about 40% more than online shopping on Black

Friday, says Susan Phillips, vice president of marketing for Pay Pal, an online

payment company. In 2005, it processed about $61 million in online purchases on

the Friday after Thanksgiving. That jumped 54% to $94 million three days later

on Cyber Monday.

"People still go to the malls, and they still plunk down a lot of money on Black

Friday," Phillips says. "But they go back to work on Monday to find out if they

can get a better price online than they can find at the stores."

Andrea Warren, a programs coordinator for the Houston Bar Association, says she

loves to shop on the Internet because it's so convenient. "Plus, you can get

excited when you buy it and then get excited all over again when it arrives at

your home," she says.

Merging online and offline

Many retailers originally kept their websites and bricks-and-mortar stores

separate, but they've realized that doesn't make sense. websites have invaluable

information about customers' purchasing preferences and can help build brand

loyalty.

Darrell Rigby, head of Bain's global retail practice, says, "Online and offline

retailing are finally converging."

"Retailers are realizing that when they keep the consumer within their brand,

whether it's online or in the store, they win," says Kelly Mooney, president of

Resource Interactive, an Internet marketing agency that specializes in

retailing.

The merging of operations is "easy to see when you buy something online and try

to return it to a physical store," Rigby says.

Mooney says the next step will be an expansion of what consumer electronics

stores already offer: allowing products to be reserved online then picked up at

a store. She says apparel retailers will be the next to offer this, or at least

the ability to have an item held to try on.

Retailers are trying to bring more aspects of the online experience to their

stores because they can influence consumers more once they're inside their

doors, says Chad Doiron, an e-commerce strategist at Kurt Salmon Associates.

For instance, office supplier Staples has computer kiosks in its stores so

customers can do research and check product details before they buy. J.C.

Penney, Doiron notes, has added Internet access to all its cash registers so

sales associates can get more information about its products.

"Retailers want to take the great service they are providing online and provide

it in-store," Doiron says. "It really boils down to treating a customer

one-on-one."

Terry Fike of Midland, Ga., prefers to do her shopping online, especially when

retailers offer her thumbnail photos of similar items and accessories.

"I don't get that kind of service in a store," Fike says.

Internet sales are retailers' fastest-growing outlet. While store sales are

growing by up to 6% a year, online sales are increasing by 25% annually, Peters

says.

Mooney predicts Internet sales will increase from 5% now to 10% of retail sales

by 2010. While that's still much less than what's sold in stores, online sales

can be more profitable. Retailers can sell more types of goods on the Web than

they can within the four walls of a retail building, and they don't have to have

as many employees to handle those sales.

So retail websites are finding new ways to draw more shoppers to their sites:

•Amazon.com is offering one-of-a-kind deals. The site is asking consumers each

week for the next four weeks to pick the products they would most like to see

discounted and will offer below-cost deals for a limited number of customers. An

Xbox 360, which retails for about $299, went on sale Thanksgiving Day for $100.

Amazon will sell 1,000 at that price.

•Bath & Body Works is e-mailing customers to lure them into stores with a gift

with purchase. But it is offering the same deal for online customers who want to

avoid the holiday crowds.

•FAO Schwarzis offering exclusive online merchandise, including Tutu Couture

ballet apparel for children. It offers interactive customization for the tutus,

dollhouses, dolls and train sets on its website.

•Sam's Clubis selling luxury packages on its website, including a Super Bowl

trip and a Tony Bennett concert in London.

•Crate & Barrel, which conducts 22% of its sales online, is offering free

shipping on its heaviest products until Dec. 15. Spokeswoman Bette Kahn says

Crate & Barrel's online sales increase up to 10% each year.

"We are always surprised people buy so much furniture through the Internet,

because we'd want to sit in it and feel it before we bought it," Kahn says.

"It's almost amazing to us and especially to the CEO."

Comparing online

More consumers are comparison shopping online before they show up at a store to

buy in person, says Shira Goodman, Staples' marketing executive vice president.

That's persuaded Staples to integrate its online and offline marketing. TV

commercials can be seen online, and this year's Department of Unexpected Gifts,

which features gift suggestions including shredders and leather chairs, is

featured online and in stores. A panel of experts, including digital camera

aficionado and crooner Engelbert Humperdinck, helps choose gifts for website

users.

"A lot of our attention focuses on trying to make shopping online as easy as

possible," says John Giusti, who heads Staples' website. Sites used to be "very

clunky and not necessarily focused on the user."

"We're more focused on making it easy for customers to learn, easy to shop, easy

to find, easy to compare and easy to purchase online," Walmart.com's Cast says.

Retailers are revamping their websites to keep shoppers online longer. They're

using interactive tricks such as games and video and cartoon avatars to lure

shoppers to linger.

This year, visitors to Home Depot's website can drive Santa's sleigh over a

three-dimensional, snow-covered scene or turn the pages in a Mrs. Santa

home-decorating book to get tips on holiday decor. You can "hang" different

styles of lights on different houses. Or if you have a more-extensive

home-improvement project, such as lining a closet with cedar planks or laying

tile, the retailer has just started offering video tips online through its Home

Depot TV.

"It's the most interactive that we've ever been," says Chief Marketing Officer

Roger Adams. "The virtual sleigh ride is like a game, just to have fun while

you're on our site. We want kids to say, 'Hey, Mom, let's go to Home Depot.' "

Blue Shirt tips

Best Buy is emphasizing the expertise of its salespeople, known as Blue Shirts.

It soon will launch online videos with Blue Shirts giving tips on buying

electronics. It also has a new "click to call" button on its website that lets

you talk directly to a Blue Shirt; its 800-number now links you immediately to a

person, and it has a new website, askablueshirt.com, that lets you chat online

with a salesperson.

This month, Walmart.com added more interactivity and third-party experts to its

website. Users can, for instance, "peel back" a cover on a baby's room to see

all the furnishings, then click on the baby bed and find price and order

information.

Online sales won't ever eclipse those of Wal-Mart's retail stores, Cast says.

But Walmart.com has surprised some competitors that didn't expect the retailer's

customers to be online shoppers.

"A lot of people thought our customers wouldn't shop online, but they've been

wrong," says Cast. He says 74% of Wal-Mart customers have access to the

Internet. Walmart.com has "the same shopper. They're just a little higher in

income, a little higher in education and a little more urban than our typical

shopper," he says.

And maybe they're a little less willing to brave the mall crowds this

supercharged holiday season.

They aren't alone.

In an online poll this month by Shop.com, almost a quarter of respondents said

they would "rather eat their arm off" than visit a store on Black Friday.

Point

& click holidays: More consumers go online for holiday shopping, UT, 24.11.2006,

http://www.usatoday.com/money/industries/technology/2006-11-23-online-shopping_x.htm

Armed With Internet Bargains, Travelers

Battle High Airfares

November 23, 2006

The New York Times

By JEFF BAILEY

CHICAGO, Nov. 22 — Air travelers, who have

endured full flights and a 15 percent increase in ticket prices this year, are

exacting revenge with aggressive searches for deals that analysts say are

beginning to force down prices.

Airlines use powerful computers to figure out

just how much passengers are likely to pay for any given flight at various times

of the day. For the last year or so, they have been able to readily increase

fares, in part because of the strong economy. Planes have been packed lately,

too, which gives the industry more power to raise prices.

But a recent drop in fares suggests that many travelers have had enough. They

are balking at paying the higher prices and are scouring the Internet more to

find cheaper fares.

That may be a small comfort to the 25 million people packed into full planes to

join families for Thanksgiving this season. But it is a sign that the cost, if

not the frustration, of flying may be easing.

None of this is good news for the airlines, of course, which always struggle to

turn a profit. Airlines have said for some time that Internet shopping has made

it harder for them to raise fares. Travelers have never had much sympathy for

the industry’s financial plight and they often delight in finding new tricks to

discover low fares.

Acacia Newlon-Yafai, a 20-year-old student at the University of California, Los

Angeles, is one of them. She searches Web sites like cheaptickets.com for low

fares, signs up at airline sites to receive fare-sale alerts by e-mail message

and travels only when the price is right.

A month ago, a Southwest Airlines service called Ding sent her an e-mail message

about a $128 round-trip fare to San Jose, where her family lives, and her

holiday plans were set. “If you look a while, you can figure it out,” Ms.

Newlon-Yafai said. “If you want to fly two weeks in advance, you can’t do that.”

Such hard-nosed shopping is on the rise. About 25 percent of air travelers

consult online newsletters and other sources of special deals before buying, up

from 17 percent last year, according to Henry H. Harteveldt, a travel analyst at

Forrester Research. And 17 percent of travelers use Web sites like kayak.com,

itasoftware.com or sidestep.com, which scour other Internet sites for travel

deals.

“Consumers have access to more and more information,” Mr. Harteveldt said. “It’s

exactly what airlines don’t want consumers to have.”

In the long term, the sharp fare increases this year will probably be an

anomaly. The 15 percent rise in fares, after all, resulted in large part from a

sharp contraction of airline fleets brought on by bankruptcies and a drop in air

travel after the terrorist attacks of Sept. 11, 2001. In coming years, the

growth of Internet fare shopping, and the expansion of low-cost airlines will

most likely help moderate price increases.

Southwest Airlines, for example, acquired 36 additional Boeing 737s this year

and is expected to acquire 37 next year, growing as some traditional airlines

have shrunk.

“We don’t have enough aircraft,” said Gary C. Kelly, chief executive of

Southwest, the biggest low-cost carrier.

Andry Ramandraivonona, an investment banker who lives on the Upper East Side of

Manhattan, booked flights to Boston for himself, his wife and their two small

children two weeks ago, using itasoftware.com. He paid $100 round trip for each.

The family would like to go home to Paris for Christmas, but was put off by the

$1,700-a-person cost. “It’s a bit prohibitive,” Mr. Ramandraivonona said. They

may delay the trip or make the trip sooner.

Leisure fares, those bought far in advance with restrictions, averaged $90

one-way last week on domestic routes, 9 percent lower than a year earlier and

the 10th consecutive week of decline for leisure prices, according to Harrell

Associates, a travel consulting firm in New York.

Business fares, which are typically booked at the last minute and carry few

restrictions, averaged $479 one-way last week on domestic routes, 8 percent

higher than a year earlier. But the rate of increase has slowed markedly from

spring and summer when business fares were rising by 20 percent or more over the

same periods a year ago.

While the tide is shifting toward consumers on prices, they should probably give

up hope of counting on an empty seat next to them when they fly. The number of

planes in the fleets of airlines in the United States is growing slowly. And a

reason consumers are able to find more deals online is that airlines are using

such systems to fill seats that might go vacant. After all, any revenue they can

bring in for a seat is better than nothing.

Industry analysts said that flights could very well average close to 80 percent

full for years to come, which means that those on popular routes at convenient

times are typically 100 percent full.

One thing could, however, send fares back up sharply, at least temporarily. US

Airways offered last week to buy Delta Air Lines, which is operating in

bankruptcy, for about $8 billion. US Airways has said it will reduce the

carrier’s combined fleets by about 10 percent if the deal goes through.

Taking 80 or so big jetliners out of service would allow the combined airline —

and others — to raise fares because there would be less competition in some

markets. Delta is opposing the offer and wants to remain independent.

Higher fares appear to have affected many people’s travel plans this year. Many

more bought tickets to fly on Thanksgiving Day, arriving at family gatherings a

little later but at lower cost, according to Sabre, which operates a vast

computer reservation system. And skipping grandma’s house altogether was also

more popular, as Las Vegas rose to the No. 3 travel destination over the

holiday, from No. 8 last year, Sabre said.

When airlines put their fare information online years ago, their main goal was

to cut out traditional travel agents to save the commissions they paid them. But

many airlines were surprised to learn how much time consumers were willing to

spend shopping for fares.

Dr. Steve Kronick, an emergency room physician in Ann Arbor, Mich., said he

searched Internet sites for weeks this summer to find affordable seats to take

his wife and two children to Seattle to see friends this week. They paid $1,400

for four round-trip tickets on Northwest Airlines after Dr. Kronick consulted

farecast.com, which tries to tell consumers the best time to buy an airfare.

“I don’t know how accurate it is,” Dr. Kronick said, “but it makes you feel

better.”

George W. Evans, a graduate business student at Emory University in Atlanta,

paid $500, about $100 more than last year, for a round-trip flight this week to

visit family in Pelham, N.Y. Earlier this year, he worked on a class project

about Delta Air Lines and was part of a group of students who presented their

work to some Delta executives.

“They told us their strategy this year was going to be to raise fares,” he said.

“I heard it from the horse’s mouth. It was right after I bought my tickets. I

felt used.”

Even with the higher fares, of course, the airline industry remains deeply

troubled after more than $30 billion of losses in recent years. And airfares,

compared with the rising prices of many other goods and services, have remained

quite cheap over time.

Kiki Morris, who works in the entertainment industry in Los Angeles, paid $500 a

month ago for her ticket to New York on JetBlue Airways. She usually pays $100

for a Lincoln Town Car just to get her to the airport in Los Angeles, but this

time took a regular taxi, for $50, instead.

The price to fly one mile on an airliner, about 12 cents on average

domestically, has changed little over the last 20 years. And, taking inflation

into account, prices have fallen by nearly half.

“Airfares are so cheap,” said Roger King, an analyst at CreditSights. “A brake

job on your car at the dealer is like $500 now. The airlines are just killing

each other on these fares.”

Still, for many, fares are high enough that the ability to travel is limited.

“It made me decide between Thanksgiving and Christmas,” said Tammy Rowe, 30, a

public relations worker in Chicago who flew to Atlanta yesterday to meet family.

“I noticed back in the spring and summer that fares were kind of jacked up.”

Ramona Collins, 33, of Flushing, N.Y., flew to visit her brother in Arkansas

yesterday on Northwest Airlines. Her round-trip ticket cost $402, she said,

purchased in mid-October on kayak.com. “It was probably at least $100 more than

last year,” she said.

“It makes me think about not going anywhere for Christmas,” she said. Normally,

she would go to Arkansas to see her parents.

She is reconsidering, and added, “They don’t know that yet.”

Reporting was contributed by Cindy Chang in Los Angeles, Nick Bunkley in

Detroit, Brenda Goodman in Atlanta and Cassi Feldman in New York.

Armed

With Internet Bargains, Travelers Battle High Airfares, NYT, 23.11.2006,

http://www.nytimes.com/2006/11/23/business/23air.html?hp&ex=1164344400&en=fdb9072cf8a5fd8e&ei=5094&partner=homepage

NYT

November 21, 2006

A $500 Milestone for Google Believers

NYT 22.11.2006

http://www.nytimes.com/2006/11/22/technology/22google.html

A $500 Milestone

for Google

Believers

November 22, 2006

The New York Times

By SAUL HANSELL

When Google’s shares nearly doubled in the

first few months after its initial public offering, Mark Mahaney decided it was

time for his clients to take advantage of the fervor that had built up around

the company. He advised them to sell Google shares and put the money into Yahoo.

“I thought the stock was a little expensive,” said Mr. Mahaney, an analyst then

for American Technology Research and now for Citigroup. “It turns out that was a

terrible call.”

So by the beginning of 2005, Mr. Mahaney jumped on the Google bandwagon. And so

have most of Wall Street’s analysts, along with the portfolio managers who look

after big pension and mutual funds.

Yesterday, Google’s shares closed at $509.65, up $14.60, passing the $500 mark

for the first time. (Mr. Mahaney, who made his sell recommendation at $137, is

now among those predicting that Google shares will rise to $600 within a year.)

Not bad for a company that was forced to reduce its initial offering price to

$85 a little more than two years ago because of lackluster demand. It quickly

confounded the skeptics, rising to $100 on the first day of trading, and

reaching closing prices of $200, $300 and $400 all within the course of 2005.

Google now has a market value of $156 billion, exceeding all but 13 American

companies — icons of commerce like Exxon Mobil, Johnson & Johnson and Wal-Mart.

It is worth more than any media company and all the technology companies except

Microsoft, whose software empire it increasingly threatens, and Cisco Systems.

Google’s success has made its founders, Sergey Brin and Larry Page, the 12th-

and 13th-richest people in the United States, according to Forbes — and, at 33,

the youngest in the top 400. Their shareholdings are worth more than $15 billion

each, on top of the more than $2 billion in cash that each has received for

selling some shares.

Yet Google’s rise in value and corporate maturity is not just about

accomplishment, but about potential. While most companies slow as they grow,

Google so far appears to be accelerating.

Its rising stock price has helped it attract the best engineers, minting an

untold number of Google millionaires. It has also allowed important

acquisitions, most recently a $1.65 billion all-stock deal for the video-sharing

site YouTube. And as Google builds a lucrative franchise in selling advertising

all across the Web, it makes more money, invests more and keeps the cycle going.

Anthony Noto, an analyst with Goldman Sachs, calls this a “flywheel.”

“They can reinvest at a faster rate; they can innovate at a faster rate; they

can create value for advertisers and users at a faster rate,” he said.

The company is spending money as if it doesn’t expect this growth to stop. Since

its offering, Google has quadrupled its staff, to more than 9,000 employees —

many with doctorates from the world’s leading universities — and it is hiring

more than 100 people a week to fill three dozen or so offices in more than 20

countries; its headquarters are in Mountain View, Calif., in Silicon Valley.

Last year, it received more than a million résumés.

Google is pouring billions of dollars a year into research, computers and a

global communications network — as well as investments in solar energy, a new

campus at a decommissioned naval air station, and an army of private chefs

cooking free meals from organic produce and hormone-free meat.

Not everything Google touches has turned to gold. Its homegrown video service,

chat software and financial information section lag behind those of popular

rivals. It has found itself a magnet for legal threats and, in some cases,

lawsuits as it moves aggressively to make a growing body of content searchable

online. And some have expressed concern about the volume of personal data it is

accumulating about its users.

Still, as Google starts to dabble in all sorts of markets, ranging from wireless

Internet access to corporate software, it has become in many ways the center of

gravity for the technology industries.

“It feels in many ways like competing with Microsoft in the ’90s,” said Jim

Breyer, a venture capitalist with Accel Partners. “In a number of investments,

if we are not at the top of our game, we will lose share to Google. Or Google

will buy someone who will compete effectively.”

Hanging over all of this, of course, is the specter of the Internet boom and

then the bust six years ago, and the paper wealth it created and destroyed. Some

see traces of that era’s outsize expectations, if not delusions, in Google’s

ascent.

After all, a company called Amazon.com was once going to change the world. Its

shares split three times in the late 1990s before reaching a high of $113 at the

turn of the millennium — only to fall to single digits within two years. (They

have worked their way back above $40.)

But there are big differences. Google’s rise is not a result of a general

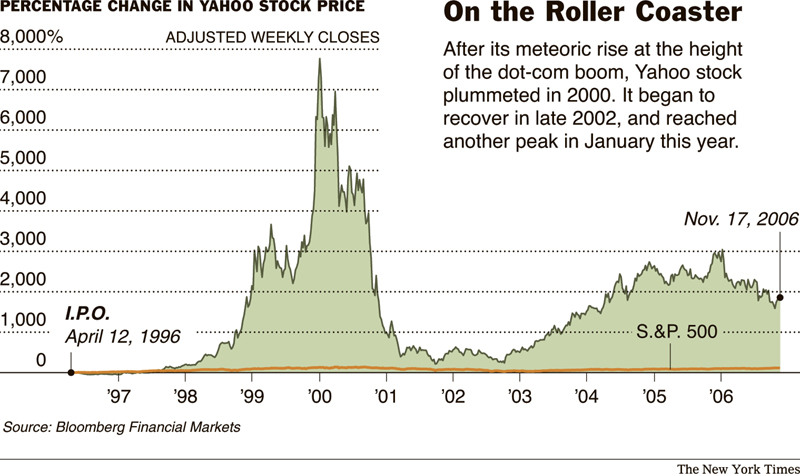

rapture with technology stocks or even the search-engine category. Indeed, while

Google’s stock price has risen almost 50 percent since late March, the shares of

its main competitor, Yahoo, have declined nearly 14 percent.

Yet that does not settle the matter. Geoffrey A. Moore, a Silicon Valley

marketing consultant and author of books on investing in technology stocks,

argues that investors’ fascination with Google will inevitably wear off and its

shares will plummet like so many highfliers before it.

“Google has had a spectacular early run,” he said. “The notion that this is a

different animal is never the right argument.” He suggested that if Google’s

business hit an unexpected slowdown, the company could meet the same fate.

“People will say, How did we ever believe that stuff?” he said. Instead of

admiring Google’s practice of allowing its engineers to spend 20 percent of

their time on personal projects, investors will start complaining that the

company would be “only getting 80 percent productivity out of its work force.”

For now, Mr. Moore is very much in the minority. Many of those analysts who do

not think Google shares will rise further express confidence that the current

value is justified.

“I do not think there is a bubble about to burst — not even close,” said

Benjamin Schachter, an analyst with UBS Securities, who has rated the shares