|

History

> 2007 > UK > Economy (I)

The Guardian

p. 3 30.1.2007

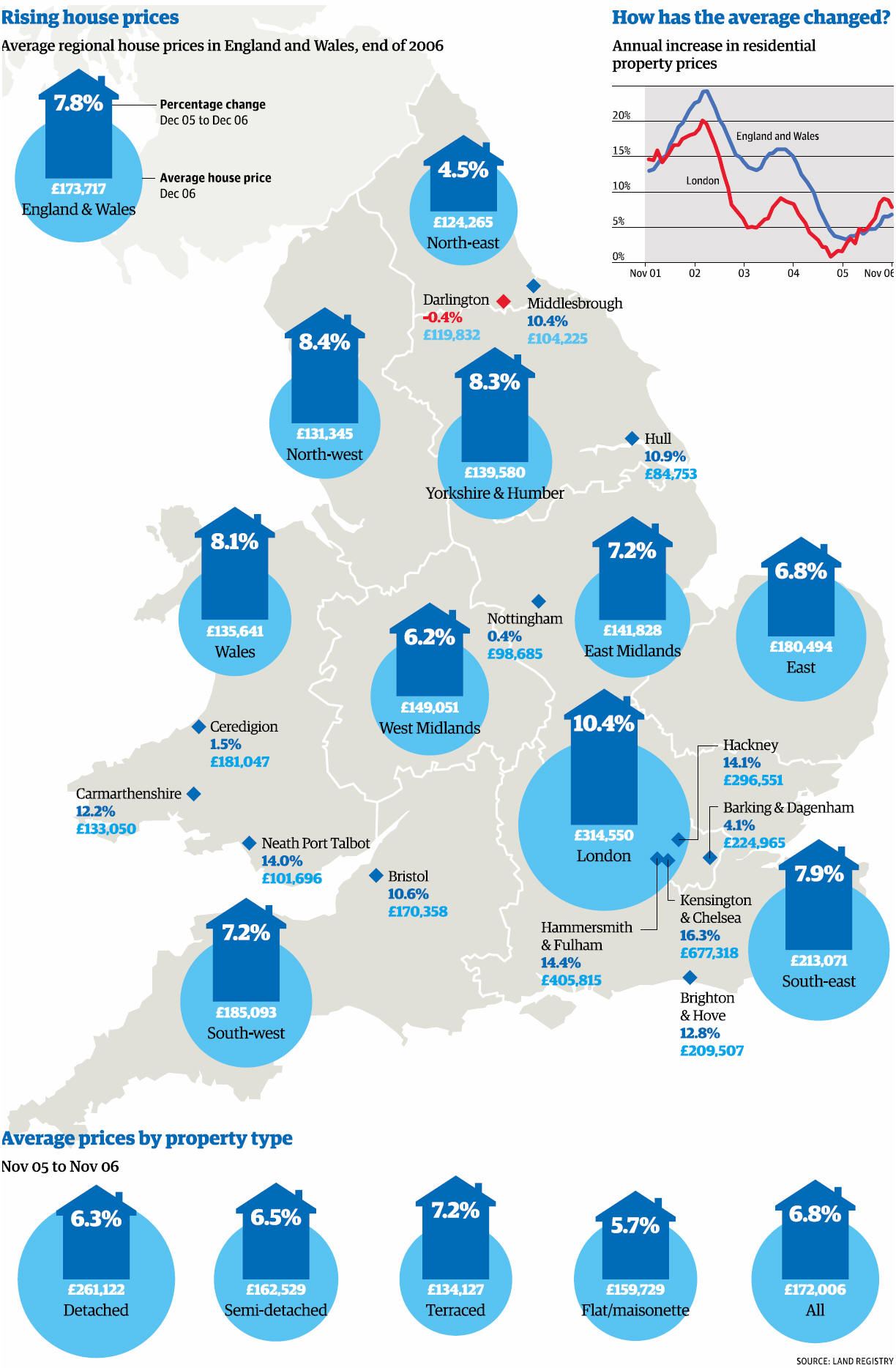

Still going through the roof - the property

boom goes on

Homes are getting ever more expensive,

with the average price now £173,717

G

Tuesday January 30, 2007

https://www.theguardian.com/business/2007/jan/30/

houseprices.money

Spend!

Spend! Spend!

London is the new plutocrats' paradise

Art sales

break records

as wealthy collectors

bid £210m in London auctions

Property boom hits new peak

as buyers queue up

to acquire £84m penthouses

London eclipses New York

as world's financial centre

with £29bn of flotations

Published:

08 February 2007

The Independent

By Cahal Milmo

From

frenzied bidding for art worth £400m to a stampede for fine French wine, London

is in the grip of an unprecedented spending spree fuelled by £9bn of City

bonuses and an influx of super-wealthy foreigners.

The capital has long vied for the title of the world's wealthiest city but it

will this week cement its status as the boom town of a new monied elite with a

seemingly unquenchable thirst for conspicuous consumption.

Britain has become a magnet for a select group of high rollers - international

billionaires who are choosing London above competitors such as New York and

Dubai to make their homes.

Forbes magazine, the bible of the wealthy, revealed that London now has 23

billionaires, including the highest number of non-domiciled tycoons in the

world. Together, they have a combined wealth of more than £45bn.

Nowhere is the flood of affluence more clear than in the auction houses of Bond

Street, which by tomorrow are likely to have enjoyed the most lucrative sales

week in their history.

Works from artists including Francis Bacon, Andy Warhol and David Hockney are

being offered by Sotheby's and Christie's and are expected to push takings from

the traditional February sales week beyond £400m for the first time.

Sotheby's, which set a record on Monday for its single biggest London auction

when one sale took £94.9m, said the results were being fuelled by wealthy

Russian and Chinese buyers.

Melanie Clore, deputy chairman of the auction house, said: "The results provide

clear evidence of the depth of the market - the buyers are informed and

considered private collectors. We are very, very happy, if a little bit tired."

Such is the fevered nature of the London art market - prices for contemporary

art have quadrupled since 1996 - one dealer said it had reached "the point of

absurdity". The American-based Richard Polsky said: " I would be a seller right

now - especially if I had a blue-chip work."

The emergence of this rarefied world of nine-digit bank balances - far removed

from the daily lives of all but a handful of Britons - has its roots in the

strength of the City and London's unashamed attempt to offer a haven to a new

class of what the cognoscenti call UHNWIs - ultra-high-net-worth individuals.

A welter of takeover activity in the Square Mile, which is eclipsing Wall Street

as the centre of the global financial services industry, and rising share prices

last year produced a record £8.8bn for its workers. Some 4,000 bankers, lawyers

and traders received bonuses of more than £1m, triggering an avalanche of

spending in areas from premium property to lavish dinners in top restaurants.

Their spending power has been coupled with that of super-wealthy individuals who

have opted for what Forbes refers to as London's "ecosystem" of tax breaks,

discreet financial markets and swaths of hyper-expensive real estate.

Alongside high-profile magnates such as the Indian steel tycoon, Lakshmi Mittal

(worth a reputed £14.8bn), and the Chelsea owner Roman Abramovich (£9.1bn), the

capital now hosts 11 foreign billionaires.

Paul Maidment, an analyst for the magazine, said: "London still attracts the

elite of the world's rich and successful. And it can lay claim unchallenged to

one title: it is the magnet for the world's billionaires."

Economists claimed that the "billionaires and bonuses" culture had a

trickle-down benefit for Londoners - sustaining a support system of bankers,

lawyers, gardeners and a rash of elite concierge services providing for every

whim of the rich, such as providing a dozen albino peacocks for a party at three

hours' notice.

But others highlighted the distorting effects of such spending, in particular

sky-high property prices. Yesterday, Britain's most expensive apartments, four

penthouses overlooking Hyde Park, went on the market with a reported asking

price of £84m each.

The high-octane nature of London's economy, which has a greater proportion of

highly-skilled jobs, also means it has a lower employment rate than the rest of

the country - 69 per cent as opposed to 74 per cent.

Dermot Finch, director of the Centre for Cities, part of the IPPR think-tank,

said: "We have got a dual economy in London. On the one hand we have the

über-wealthy who are doing very well but you have almost a third of those of

working age who are not getting jobs.

"The presence of the super rich is a good thing - they are a function of

London's status as a pre-eminent capital for finance. But further efforts are

needed to connect everyone in London to the jobs that are available."

In the meantime, it seems the tills will keep ringing.

Wine merchants in the capital were among those yesterday struggling to keep pace

with demand which has seen prices for prestigious clarets and Burgundies from

the much-hyped 2005 vintage double in a year. Amanda Skinner, chief executive of

the 150-year-old merchant Lay & Wheeler, said: "It's the very rich who want to

buy the best and are not worried about the cost."

Money,

money, money...

Jewellery

Demand for all that glitters - from gem stones to platinum pendants - has risen

dramatically. Theo Fennell, supplier of jewels to clients including Liz Hurley

and Elton John, last year reported a seven-fold increase in pre-tax profits.

Harrods has started stocking a pendant with 5,000 diamonds and 96 rubies. Yours

for £144,000.

Wine

Prestigious clarets and Burgundies, from Petrus to Clos de Vougeot, have long

been a favourite investment in the City but this year demand is far outstripping

supply. Liv-Ex, a wine trade index, rose by 50 per cent in 2006 and Petrus, an

iconic claret, is trading at about £25,000 a case - a level that has been

described as "unprecedented".

Restaurants

Top-end restaurants are buying in foie gras and caviar as fast as they can sell

it. The chef's table at Claridges, run by Gordon Ramsay, is booked up weeks in

advance. A table for two at The Ivy can often only be booked at short notice

with the help of a specialist concierge service.

Yachts

Brokers in Mayfair and Belgravia report record business for the ultimate rich

man's toy to satisfy the 135,000 people in Britain with assets worth an average

£6.4m. Sunseeker, the high-profile British manufacturer, last year had its fleet

of 50 charter yachts fully booked - at up to £55,000 a week.

Jets

Airport security alertshave seen the private air market take off. The cost of

£3,000 an hour is within the budget of the wealthy. One operator, NetJets, which

pioneered the idea of buying shares in a jet, saw its flights increase by a

third.

Spend! Spend! Spend! London is the new plutocrats'

paradise, I, 8.2.2007,

http://news.independent.co.uk/uk/this_britain/article2248775.ece

Divided

by origins,

united by wealth:

the new super-rich

Published:

08 February 2007

The Independent

By Guy Adams

When John

Major moved into Downing Street in 1990, he used a phrase coined by Karl Marx to

describe his ultimate ambition: turning Britain into a "genuinely classless

society".

A glance at today's super-rich would suggest that, in this one regard, both the

Major government and that of his successor, Tony Blair, can go down as a

staggering success. The seriously wealthy are no longer a social class. There

are too many of them. Some were born rich, others self-made. Meet them, and it's

difficult to know if they'll talk in cut-glass vowels, or like a fishwife.

Instead of a single class, then, we should actually divide the wealthy into

tribes. In London today, there are five big ones: Old Money (or OMs), City Boys

(and girls), Celebrities, Entrepreneurs, and the Foreign Invaders.

Each has its favoured habitats. Old Money gravitates towards Chelsea and

Kensington, with a weekend pile in the country; celebrities prefer Belsize Park

or Primrose Hill. Self-made Entrepreneurs such as Sir Richard Branson (Holland

Park) live wherever they can buy a decent mansion.

Meanwhile, Foreign Invaders take over entire areas of town. In Belgravia, it's

the Russians, in Notting Hill, the Americans. The French like South Ken, and

Arabs have always been fond of Mayfair.

The holy grail of wealth is an Eaton Square house, with a mews behind it,

providing both a servants' quarter, and discreet alternative to the front door.

The City's highest-paid trader, Driss Ben-Brahim, lives nearby. He made

headlines at Christmas, after rumours that he had received a £50m bonus.

Once they've bought a home, High Net Worth individuals (known in the trade as

HNWs) love a facelift. Designers such as Kelly Hoppen and Nina Campbell are

employed to sell them £2,000-a-roll wallpaper, or vases filled with pebbles at

£750 a throw.

The surrounding area gets filled with beauty salons, designer boutiques and

other luxury stores.

In parts of Belgravia, it's now more-or-less impossible to purchase white

sliced: instead you must visit Poilane, and fork out £5 for a sourdough

alternative to the baguette.

Schools are a big deal. London's poshest preps, such as The Hall and Hill House

compete with provincial rivals such as Summerfields. Sending children to Eton

represents a coup, but you've got to "put them down" early and many still don't

make it. They have to put up with Harrow or Rugby, or worse still, Radley and

Stowe.

At play, the HNW tribes gravitate towards upmarket restaurants. There's Zuma for

the Eurotrash crowd, Gordon Ramsay for Americans. In the centre of town,

Celebrities eat at the Ivy, Nobu, or the Wolseley. Old Money dines at his club,

or at a push, the Savoy Grill.

Later on, new HNWs enjoy joints such as Aura, Bouji's or Movida. Celebs mooch

around haunts such as Soho House, the Groucho Club, or Annabel's.

If they have any free time HNWs are attracted to the traditional pursuits of the

moneyed classes. Polo is one of Britain's fastest growing sports. Tickets for a

decent enclosure at this summer's major High Goal events, the Cartier and Veuve

Clicquot cups, will go for £500 a head.

For holidays right now, think resorts such as Gstaad, St Moritz and Courchevel;

favourite beach destinations include St Tropez, or the Sandy Lane Hotel in

Barbados. All of which brings up the nasty business of travel. Real wealth

doesn't "do" scheduled flights. Instead they go private; Battersea heliport,

where most choppers arrive in town, is booked from dawn to dusk.

For cars, think Ferrari, Range Rover and Bentley (even new money deems Rollers

too vulgar), or to a lesser extent Porsche. At Stratstones of Mayfair, an Aston

Martin dealership, one salesman recently reported a six-month waiting list. "For

some it's just a whim," he said. "Others just say, 'I haven't got that model in

my collection'. It's a wonderful world." And if you're lucky enough to be part

of one of the HNW tribes, he's probably right.

The 10

richest foreigners in Britain

Lakshmi Mittal - India With a net worth of £14.8bn from the steel industry,

Mittal is the richest Indian in the world. He lives in Kensington.

Roman Abramovich - Russia Oil billionaire and owner of Chelsea FC has been

deemed the world's greatest spender on luxury yachts.

Hans Rausing - Sweden Professor Hans Rausing amassed his £4bn from

co-inheritance of Swedish packing production company Tetra Pak.

Leonard Blavatnik - Russia Billionaire who has interests in Russian and

Kazakhstani mines, property and telecommunications.

Srichand and Gopichand Hinduja - India Now cleared of involvement in a deal to

sell guns to India, the brothers' profits have soared.

John Fredriksen - Norway/Cyprus Most of the shipping tycoon's £2.89bn fortune

was amassed during the Iran-Iraq war.

Charlene and Michel de Carvalho - Netherlands Inherited a 25 per cent stake in

Heineken from Charlene's father, Freddy Heineken.

Kirsten and Jorn Rausing - Sweden Tetra Pak heirs (brother and sister-in-law of

Hans) with a stake in food delivery chain Ocado.

Mahdi al-Tajir - UAE His £2bn wealth was generated by property and finance. He

is known for his extensive collection of antique silver.

Poju Zabludowicz - Finland He owns the investment house Tamares, in London, New

York, Liechtenstein and Tel Aviv.

Source: Sunday Times Magazine

Divided by origins, united by wealth: the new super-rich,

I, 8.2.2007,

http://news.independent.co.uk/uk/this_britain/article2248789.ece

Personal

assistants:

'We furnished a jet in a day'

Published:

08 February 2007

The Independent

By Geneviève Roberts

The pet

chauffeur drives the corgi to the vet while the bodyguard, former SAS, waits by

the school gates. Serving the higher echelons of London society has become a

lucrative industry.

Harrods has an entire department of personal shoppers. Sukeena Rao, head of the

Harrods Personal Shopping Group, says that furnishing the interior of a

Gulfstream jet in 24 hours has been the biggest challenge. "Everything was

thought of - cashmere blankets on every seat, Louis Vuitton bags with Crème de

la Mer toiletries for everyone. And all the beautiful air hostesses were decked

out in Fendi to board the jet to St Petersburg."

The publisher William Cash has launched Spears Wealth Management Survey, a

quarterly magazine that the 50,000 richest residents in the UK have been invited

to subscribe to.

Articles detail the more serious concerns of the billionaire lifestyle, such as

how to avoid kidnapping, alongside advertisements for luxury yachts and banking

services. A team of servants will ensure a billionaire's home and garden in

Mayfair, St James's or Belgravia is in perfect order. Pilots are on call to fly

the private jet to the Maldives.

But perhaps the ultimate symbol of wealth is a "family office" - a full-time

team of lawyers and accountants who dedicate themselves to cultivating and

protecting the wealth of one family.

David Harvey of the Society of Trust and Estate Practitioners has suggested that

a sensible rich family would be advised to think 100 years ahead. He said: "For

a lot of families, the question is: can we take it as far as generation three?"

Personal assistants: 'We furnished a jet in a day', I, 8.2.2007,

http://news.independent.co.uk/uk/this_britain/article2248770.ece

Hamish

McRae:

The challenges of living

in the super-rich playground

Published:

08 February 2007

The Independent

It's trophy

London. The world's most expensive flat, a penthouse overlooking Hyde Park, has

just gone on the market for £84m. Earlier this week Britain's most expensive

office block, the Gherkin (or more correctly 30 St Mary Axe) was sold for £630m.

Add in the mass of foreign companies buying British ones, the art fever that has

erupted at Christie's and Sotheby's, and of course the surge in City bonuses and

you have to ponder quite why such huge wealth seems to be accumulating in

London. You have also to ponder what this might mean for the rest of us.

It is strange, to those of us who have become long-time London residents, to

come to terms with its new iconic status as the playground of the global

super-rich. It has over 15 or 20 years become the most international place on

earth. Forget the stuff about "the capital of cool"; it is the place where, more

than any other, the seismic force we call globalisation is choreographed.

You can measure this in terms of its cost. It has not just the flats and the

offices but also (I was surprised by this) the most expensive industrial

property, which is around Heathrow. But cost is a function of demand. Why the

demand?

The key is globalisation. You can measure London's status on a series of

indicators. More people fly in through its five airports than any other place in

the world. More books are published than anywhere else. On most of the City

indicators of international business London is number one, ahead of New York.

And within the M25 there is the largest non-national professional community on

the planet.

This last point seems to me to be the most interesting of all: the extent to

which London, but also its hinterland, has become a magnet for global talent as

well as for global money. London gets more than its share for a number of

reasons. Russian, Middle East and Hong Kong money more naturally comes to London

than New York. I think the UK is helped by the fact that it is English-speaking

but not American.

But if, as a non-US professional, you want to earn serious money there is really

nowhere else. It is hard to get a visa to work in the US and the job markets in

Europe are segregated by language and other barriers. So the ambitious young

come to London to, I believe, our huge benefit. The tiny number of global

super-rich who buy the penthouses on Hyde Park or the Impressionists at

Christie's are the peak of a mountain of hard-working professionals attracted

from all over the world.

For anyone who remembers the dreary Seventies, when rubbish piled in the streets

and columnists wrote of Britain going into absolute decline, not just relative

decline, this is thrilling. But of course it brings challenges, which we have to

meet.

One is to cope with the "Wimbledon effect", the fact that the UK has created a

global playing field but most of the best players are foreign. Mercifully we

have not quite reached that stage in business and finance. Britain's assets

overseas remain larger than foreign assets in the UK but we have to ask whether

it is safe to have so much of our economy controlled from abroad. A second is

the regional divergence, the extent to which London has become almost an island

state. There are of course other clusters of economic success. But the magnetic

effect of London must remain a concern.

The greatest concern, however, is surely the social pressures that rising

inequality can create. You have to be careful here with the figures.

Statistically, if a rich Russian billionaire moves to London and buys a football

team, that must increase inequality. If he buys a load of foreign players that

increases inequality even more. At the other end of the scale, if a hundred

Somali asylum-seekers land here with the clothes they stand up in, that

increases inequality too.

But it is hard to argue that the rich Russian's arrival increases inequality in

a socially destructive way. Indeed, the arrival of immigrants from new EU states

will have increased inequality but in economic terms this migration has been a

great success.

That said, we do have to acknowledge that the "Trophy London" phenomenon has

resulted in rising inequalities and we need to figure out how best to make sure

that the wealth that is being brought into the country trickles down right

through society. I suspect we are not doing that as well as we should. That,

however, is the challenge of success.

Hamish McRae: The challenges of living in the super-rich

playground, I, 8.2.2007,

http://comment.independent.co.uk/columnists_m_z/hamish_mcrae/article2248756.ece

Leading

article:

Mind the wealth gap

Published:

08 February 2007

The Independent

The fridges

will be big enough to hold a jeroboam of champagne in the four penthouse flats

overlooking Hyde Park, which have just gone on sale for £84m each, a record even

for London. That tells you something. But they will also have bulletproof

windows, eye scanners in the lifts and their own "panic rooms" to retreat into

should intruders break the tight security. That tells you something too.

Who will buy them? The same people who made the modern and Impressionist art

sale at Sotheby's such a gold-plated success, netting nearly $187m (£95m), the

highest amount achieved at an auction in Europe. The buyers came from Russia,

China, India and the Middle East to compete with bonus-bloated high earners from

the City. Half of this year's £8.8bn City bonuses are expected to be spent on

property. Little wonder that London real-estate prices are beginning to outstrip

Manhattan, while even Americans now recognise the capital's dominance as a

financial market. The city has been transformed since Big Bang in 1986 abolished

the restrictive practices of the London Stock Exchange, and finance houses from

across the globe arrived to take advantage of a freedom they were denied at

home, trailed in their wake by multinationals.

Without doubt, this is a special time in the history of London. But amid the

goldrush, there is concern that much of the money is in the hands of a relative

few. Though the City generates one fifth of all corporate-tax revenues in

Britain, it does so with fewer than 350,000 employees. And it does so in a city

where the gap between rich and poor is growing rapidly. Children born in poor

areas have a life expectancy six years shorter than elsewhere. The middle

classes feel the impact too, with house prices trebled over the past decade.

London has, however, driven forward the British economy, which has grown every

quarter since Tony Blair took office in 1997. Some attempts have been made to

address poverty, with strategies such as the minimum wage and efforts to tackle

child poverty, although New Labour has had a rather cavalier attitude to the

growing gulf between top and bottom.

One of the candidates for the party's deputy leadership, the opportunistic Peter

Hain, has called for legislation to limit the size of the gap between the pay of

a company's most senior and junior staff. This foolish suggestion would, if

enacted, endanger gains that have given Britain's fleet-footed service economy

such advantages. But Mr Hain is right to highlight the need for debate. One in

four of the properties bought at the top end of the market is allowed to stand

empty as its new owner counts the increase in value of their investment. That is

a symbol that cannot be ignored

Leading article: Mind the wealth gap, I, 8.2.2007,

http://comment.independent.co.uk/leading_articles/article2248753.ece

Property: Demand 'off the scale'

for £84m Hyde Park penthouse

Published:

08 February 2007

The Independent

By Jonathan Brown

For

decades, wealthy shoppers were forced to avert their eyes from the architectural

carbuncle of Bowater House as they swept in and out of Harvey Nichols. As the

London property market burnt white hot, developers realised that the stunning

views afforded from this unloved 1950s office block, marooned amid some of the

world's most desirable real estate, were wasted on the ordinary mortals who

laboured within.

Now demolished and with work on the foundations only just under way, the four

apartment blocks that will replace Bowater House are set to break records for

the most expensive dwellings ever sold in London.

Four penthouses at the new Lord Rogers-designed One Hyde Park are reported to be

on the market for £84m while the cheapest will cost £4m. Each penthouse boasts

20,000sq ft in floor space, panoramic views of the Serpentine and the ultimate

in luxurious interior design. Interest in the building is said to be "off the

scale" with demand for the flats.

Ed Lewis, of Savills, one of the estate agents contracted to sell the

development's 86 flats, declined to discuss details of how many had been sold

off plan or to whom, but he said the company was "very pleased" by the initial

sales. "The London market is sensational," he said. "It is awash with money both

from the City and those who have benefited from the UK's success, but also

international money. As well as strong demand there is a supply shortage which

means exceptional properties like this can expect to achieve good prices."

Much of the excitement surrounding the project has been generated by the

involvement of Nick and Christian Candy, two thirtysomething brothers from

Surrey who mastermind their property empire from tax exile in Monaco. A recent

presentation by the pair noted that property prices in Knightsbridge,

Kensington, Chelsea and Belgravia had comfortably surpassed those of the most

exclusive parts of Manhattan, Hong Kong and Paris.

While apartments around Central Park might be expected to command £1,400 per sq

ft, £1,800 in South Island or just £1,200 in the 6th arrondissement, in

Belgravia they were regularly changing hands for £2,750.

The Candys have been contracted by the project's developers, the Guernsey-based

Project Grande, to act as interior designers and development managers. They

pride themselves on easing the burdens on their clients with gadgets such as the

360-degree video screen/mirror which allows the owner to examine themselves from

the back with the help of a time-delay.

The reaction to One Hyde Park has not been universally positive. The Greater

London Authority raised concerns over the developers' proposals to meet the

Mayor's affordable housing requirements and described the low-rise plan as a

"missed opportunity" to increase the number of central London homes.

But demand for new-build luxury apartments in London has now overtaken that of

other major cities.

Buyers are turning their backs on the mansions of Holland Park and Eaton Square

where parking may be limited and interiors unsuited to the modern tastes for

light and stunning views, according to Mr Lewis.

Property: Demand 'off the scale' for £84m Hyde Park

penthouse, I, 8.2.2007,

http://news.independent.co.uk/uk/this_britain/article2248787.ece

Cultural

Investment:

Record-breaking week of art auctions

in the culture capital

Published:

08 February 2007

The Independent

By Louise Jury, Arts Correspondent

The sense

of anticipation was tangible when the auction house Sotheby's opened its major

sale of contemporary work in London last night, with figures this week already

breaking European records. By the end of a night when more than £45m of art was

auctioned itself a record for any contemporary art sale in Europe more than

£167m worth of art had been sold by the auction house this week.

The top lot in the sale was Peter Doig's White Canoe, which sold to an anonymous

bidder in the room for the record price of £5,732,000; more than five times the

previous record of £1.28m and a record for a work by a living artist.

For the first time a work by 75-year-old artist Frank Auerbach, who has lived

and worked in the same north London studio for almost half a century, sold for

more than £1m. The Camden Theatre in the Rain, painted in 1977, sold for

£1,924,000, almost four times the estimated price. Among the 11 new artist's

records achieved last night was Andreas Gursky's 99 Cent II, Diptych, which sold

for £1.7m a record for any photograph sold at auction.

Add in the £89.7m that Christie's achieved with its Impressionist and modern

auction on Tuesday evening and its high expectations of a world-record price for

a Francis Bacon at its post-war and contemporary sale tonight, and there is

clear evidence that the British art market is booming.

New buyers, such as the Russians who have made London their home, have expanded

the client base. Add in City whizz-kids and their bonuses, and it is clear there

is no shortage of cash. A survey by Barclays Wealth, the wealth-management arm

of Barclays, suggested that one in 10 of those receiving bonuses intended to

invest in art and antiques, with this week's annual sales the first major

opportunity.

In the art world, this excitement becomes self-perpetuating. In the past year or

so, dozens of works have come on to the market for the first time in decades

because it is clear to their owners that they are likely to secure a good price.

The weakness of the dollar has further persuaded many American owners to consign

works to Europe rather than sell on home turf. At least three major American

collections were among the highlights of this week's London art auctions,

including that of the late Charles R Lachman, a founder of Revlon cosmetics.

One of the Lachman-owned works, Les Deux Soeurs by Pierre-Auguste Renoir, was

one of the biggest lots at Sotheby's on Monday night, making £6.8m.

Philip Hook, a Sotheby's specialist, said that London was perceived as an "

absolute centre of the world trade... From a buyer's point of view, prices are a

little bit daunting, but they now have opportunities that they would never

normally have to buy the very best."

Study for a Portrait II, the Bacon that Christie's is selling tonight, for

example, has not even been seen in public since 1963 and is one of only a few in

the series inspired by Velazquez's Portrait of Pope Innocent X not already in a

museum or gallery. It is likely to make about £12m, which would make it the most

expensive painting produced since the Second World War.

Charles Dupplin, an art expert at the specialist insurers Hiscox, said this year

was picking up where 2006 left off, with art looking a good investment. "Our

figures show that prices for contemporary art have risen dramatically by 12 per

cent in the last year alone."

There is some evidence that the greater number of buyers is provoking interest

in a wider range of art. A spokeswoman for Christie's said there was increasing

enthusiasm for German and Austrian art while Sotheby's was surprised this week

by the level of interest in 20th-century sculpture with impressive prices for

work by Gabo, Modigliani, Lipschitz and Arp.

Three works by the graffiti artist Banksy were sold at Sotheby's yesterday for a

total of £170,400, including Bombing Middle England, and another three works are

up today with a high estimate of £62,000.

Cultural Investment: Record-breaking week of art auctions

in the culture capital, I, 8.2.2007,

http://news.independent.co.uk/uk/this_britain/article2248777.ece

The

City:

Global market cornered

in financial services sector

Published:

08 February 2007

The Independent

By James Moore

It is

called the Wimbledon effect - just as Britain lacks a truly world-class tennis

player, so it is with merchant banks.

Yet it does not seem to matter - year in and year out, the champions of racket

and ball are all desperate to play and win at SW19 while the most prestigious

merchant banks all house their top players in the City (or Canary Wharf).

And those players have never had it so good. London's financial centre is in the

midst of a deal bonanza. Merchant banks, lawyers, accountants and PR firms are

generating record fees from the boom, while their employees enjoyrecord bonuses.

Figures from the housing market information company Hometrack show that house

prices are rising twice as fast in the capital as in the rest of the country as

the effect of those bonuses filters into the wider economy.

Jonathan Said, senior economist at the Centre of Economics and Business

Research, said: "London has increased its position as a financial centre in the

last few years, and that has increased the flow of international capital into

Britain.

"There is lots of money in the world economy being generated at the moment as a

result of high commodity prices (such as oil and metals) and the growth of China

and India. London has won an increasing share of that." Mr Said added that the

City enjoyed a number of advantages that have helped it to win against its

international competitors.

First of all the English language, which like it or not is the language of

global commerce. Then there is London's time zone, which allows an overlap with

the US and Asia; and, crucially, its light and flexible regulatory framework.

The latter has been particularly important. Thanks to what are seen as

prescriptive and prejudicial requirements imposed in the US by the

Sarbanes-Oxley Act - brought in following the collapse of Enron - foreign

companies that once chose to list their shares in New York are increasingly

turning to London as an alternative. The London Stock Exchange is odds-on to

notch up its third successful defence against a foreign predator on Saturday,

bringing an end to three months of warfare with America's Nasdaq.

Part of the reason that the American exchange has been desperate to get its

hands on its London rival is because of the LSE's success in attracting foreign

listings. In the past 12 months companies from South Korea, Russia, India,

Georgia, Kazakhstan and even the US, in the form of drug company Napo, have

chosen to float in London.

Figures from the London exchange show that in total 367 companies came to the

London market in the past 12 months, raising £29bn - compared to 270 on the New

York Stock Exchange and Nasdaq combined, which raised $55bn (£28bn). Given the

size of Britain's economy compared with America's, that is a considerable

achievement.

Not only are foreign businesses bringing their shares to the City, they are also

spending huge amounts of money investing in British companies. Last year,

foreign firms spent £97bn buying British companies - the most in Europe, and far

in excess of second-place Spain (£43bn). This is a worry to some, but Mr Said

said the investment benefited Britain's economy.

David Buik, from City company Cantor Index, said: "Britain has always been a

trading nation... It's an island and it doesn't have any natural resources left,

so it has always had to look outwards and that helps to explain why the City has

been so successful."

The City: Global market cornered in financial services

sector, I, 8.2.2007,

http://news.independent.co.uk/business/news/article2248776.ece

Luxury property prices go through roof

as flats in

London set £4,200 sq ft record

February

07, 2007

The Times

James Rossiter

Luxury

apartments in Knightsbridge have been sold off-plan for a record £4,200 per

square foot, turning the development’s penthouses into Britain’s most expensive

residential properties.

The unprecedented sale price achieved for some of the apartments, which have the

exclusive address of One Hyde Park, puts a value of up to £84 million on the

four huge penthouse suites at the top of the new scheme.

The development managers behind the scheme are Candy & Candy, the company run by

Nick Candy, 34, and his brother Christian, 32.

A source involved in the scheme told The Times that “contracts had exchanged on

some of the flats” for the record sum.

Even at the top end of the market for homes worth £10 million or more in

Kensing-ton, Chelsea and Holland Park, residential property rarely sells for

more than £3,000 per square foot.

Yet a wall of money pouring into both London’s commercial and residential

property markets over the past year has pushed up the price of landmark offices

in the City by about 20 per cent. Prices for smart houses in prime Central

London locations are up by 46.5 per cent and even more for homes worth more than

£5 million, according to research by property agency Savills.

Nick Candy said: “We know exactly who has purchased,” but he declined to divulge

details of the buyers or reveal the price. “They have all signed confidentiality

agreements. Demand has been off the scale from all over the world.”

One Hyde Park is still under construction, with cranes and diggers excavating

the foundations over an area that used to be Bowater House, an ugly 1950s

building close to the Royal Albert Hall, with views north over the Serpentine

and Hyde Park.

The site was bought without planning permission from Land Securities for £150

million at the end of 2004 by an offshore-based trust company.

Candy & Candy denies that it owns the site, but were quickly hired as

development managers. Candy & Candy obtained planning permission last year from

Westminster council to build 86 luxury flats on the site, ranging from 1,000 sq

ft to 20,000 sq ft.

The development will not be completed until 2009 and many buyers may not move in

until the following year. Property experts said that buyers on such schemes can

pay deposits of up to 20 per cent of the completion price, but sellers often

make the deposit nonrefundable.

Yolande Barnes, head of residential research at Savills, said: “These prices are

all part of the global explosion in asset prices, but London is playing in a

world market, not the UK. Traditionally, Central London real estate and

Manhattan went hand in hand, but over the next few years you will see London

going ahead mirroring its domination as a financial centre.”

The development company on One Hyde Park is Project Grande (Guernsey) Limited.

Richard Rogers Partnership is the architect, while James Turrell is on board for

exterior lighting.

The site will have underground parking for 115 cars and a link to the Mandarin

Oriental, which will provide concierge service.

Providers

of pads for high rollers

Nick and Christian Candy are linked to some of the most ambitious housing

projects seen in London in recent years. Even before the One Hyde Park plans

were drawn up, the pair hit the headlines touting what was then described as

“London’s most expensive flat”, a £27 million pad that the brothers had created

at a 19th-century building in Chelsea.

Their Candy & Candy is the development manager for the Middlesex Hospital after

CPC, an offshore company set up by Christian Candy, bought the site for £175

million last June as part of a consortum including the Icelandic Kaupthing Bank,

through its subsidiary Singer & Friedlander. The site is earmarked for a 500,000

sq ft development covering three acres, The brothers grew up in Banstead,

Surrey, and attended Epsom College. Nick went into advertising while Christian

became a commodities trader before they went into business designing luxury pads

for high-rollers. Both brothers are now tax exiles based in Monaco.

Luxury property prices go through roof as flats in London

set £4,200 sq ft record, Ts, 7.2.2007,

http://business.timesonline.co.uk/tol/business/industry_sectors/

construction_and_property/article1343468.ece

Against all odds:

Manchester hits the jackpot

with the

first supercasino

January 31,

2007

The Times

Philip Webster and Sam Coates

Brown's

view is that one is enough

Controls

will be 'strictest in world'

Gordon

Brown has sent out a warning to the gambling industry that Britain’s first

supercasino — for which Manchester was surprisingly chosen as the site yesterday

— is also likely to be the country’s last.

The Chancellor, overwhelming favourite to be the next prime minister, has told

colleagues that there should be no going back on last year’s agreement to have

one rather than eight supercasinos.

And he has made clear that he does not see Manchester, which went from last to

first to take the country’s biggest gambling prize, as a pilot scheme that will

lead to a network of similar Las Vegas-style casinos around the country.

Mr Brown has also let it be known that he and his successor will continue to

refuse financial concessions or subsidies to encourage foreign investors to set

up casinos in Britain.

The Chancellor’s hard line is in sharp contrast to that taken by Downing Street

and the Culture Department, which were originally opposed to limiting the number

of casinos.

The independent Casino Advisory Panel said that it was “extremely impressed” by

Manchester’s proposal for a supercasino on a 5,000 sq metre site in the

SportCity complex in the east of the city, which, it said, offered “great

promise”. It rejected Blackpool on the ground that most of the social benefits

would be “exported” outside the town.

It also rejected the Millennium Dome, in Greenwich, southeast London, as it was

felt not to be the best place to test the social impact of a big casino.

Tessa Jowell, the Culture Secretary, was reported to be as surprised as everyone

else by the proposal.

Licences were granted for new “large” casinos to Middlesbrough, Great Yarmouth,

Hull, Newham, Solihull, Southampton, Milton Keynes and Leeds. The Casino

Advisory Panel also granted licences for “small” casinos to Bath and North East

Somerset, Dumfries and Galloway, East Lindsey (Lincolnshire), Luton,

Scarborough, Swansea, Torbay and Wolverhampton.

The local authorities in each area will have to hold a competition among

operators to decide which will win the licence. Last night Kerzner

International, the company that did the tie-up with the Dome, was revealed to be

in pole position to run the Manchester operation.

The city council selected Kerzner before the number of supercasinos was limited

to one and the Government will now insist that they must rerun the competition,

but Kerzner, which helped Manchester with its application, is favourite. John

Prescott has admitted meeting its representatives.

Another company in the consortium, Ask Property Developments, gave £5,000 to the

local Labour Party shortly before it was selected. The council denied conflict

of interest, saying the process had been run fairly and was audited by KPMG.

Decisions on future regional casinos will not be taken until 2010, when Mr Brown

still hopes to be prime minister. Mr Blair would have preferred to have had

several located around the country. In the end, Manchester was chosen, a massive

blow to the favourites, the Dome and Blackpool.

Mr Blair is privately dismissive of fears that supercasinos will cause gambling

addiction and debt. But Mr Brown has told colleagues that he does not want to

see an explosion of gambling and believes that it is against the public good.

A senior MP who is close to Mr Brown said: “There is no way we will allow this

to pave the way for a proliferation of casinos. Of course they can bring

economic benefits to individual areas, but that has to be balanced against the

standards and wellbeing of society.”

Ms Jowell said: “Las Vegas is not coming to Britain... British casinos will be

subject to new controls, which will be the strictest in the world.”

Against all odds: Manchester hits the jackpot with the

first supercasino, Ts, 31.1.2007,

http://www.timesonline.co.uk/article/0,,2-2575608,00.html

Still

going through the roof

- the property boom goes on

Homes are

getting ever more expensive,

with the average price now £173,717

Tuesday

January 30, 2007

Guardian

Rupert Jones and Angela Balakrishnan

For

prospective first time-buyers contemplating rising interest rates and the

prospect of a mortgage more than five times their salary, it makes grim reading.

Official house price figures show how 2006 was another year of spiralling values

across most of the UK.

According

to the Land Registry, which collates data for every sale in England and Wales,

it was the super-rich at the absolute pinnacle of the property market who

benefited most last year. In seeming defiance of gravity, the London borough of

Kensington and Chelsea, which was already the most expensive place to buy a

house in Britain, enjoyed the biggest percentage rise in prices in 2006, up

16.3%.

An average home in the royal borough ended December with a price-tag of

£677,318. Twelve months earlier, a typical property there was selling for

£582,235. In other words, Kensington and Chelsea homeowners have, in the space

of a year, seen the value of their property boosted to the tune of £95,000. That

is more than the £84,700 that it costs to buy a house in Hull - though it may be

of some comfort to homeowners in the Yorkshire city to learn that theirs was one

of only six areas outside London to notch up double-digit house price growth

last year.

In its overview of the year published yesterday, the Land Registry said 2006 had

concluded with a "solid" rise in house prices, with property values for England

and Wales as a whole rising 7.8% over the year. That lifted the average

price-tag to £173,717. Once again, London was the engine-room of this growth,

with prices in the capital rising 10.4% last year to hit an average of £314,550.

The region with the lowest annual price growth was the north-east, where

property values ended the year up 4.5%. But both the national and regional

figures disguise wide variations that defy those determined to paint this as

another "north/south house price divide" story.

In Middlesbrough, prices jumped 10.4% in 2006, lifting the average value of a

home to £104,255. And the location with the highest price growth outside London

- 14% - was Neath Port Talbot in south Wales. In Brighton and Hove, the average

price tag jumped from £185,713 to £209,507 in 12 months; Bristol (up 10.6% to

£170,358); and Carmarthenshire (up 12.2% to £133,050).

Only one area of the country saw a (small) fall in prices last year: Darlington,

where a typical home saw £458 wiped off its value. At the end of 2006, the

average property value in the town was £119,832.

That finding surprised Simon Bainbridge at local agents Smiths Gore. "I haven't

seen any evidence of a fall in prices - I thought they would have crept up a

little bit overall last year," he said. "Our view would be that the market in

Darlington has stayed pretty level. Transaction levels have been very good,

providing vendors have been realistic about their prices. I think the general

consensus in the area is that the market has been quite bullish." Mr Bainbridge

said one reason why Darlington may have performed poorly was that there was no

shortage of homes for sale.

"Nevertheless, for certain types of properties, around the £500,000 mark, there

has been a lot of competition. Our outlook is good. Despite the recent interest

rate rises, I expect sales to be good into the spring and early summer."

Another poor performer was Nottingham, where average prices rose just 0.4% over

the year to reach £98,685. Nottingham was dubbed "the crime capital of England

and Wales" in a survey last year, which is unlikely to be a coincidence. Estate

agents in Nottingham have also reported a glut of property in the student

market.

Back in Kensington and Chelsea, the extraordinary uplift in property values can

largely be attributed to two words: city bonuses. Many of the traders, fund

managers and others who have enjoyed bumper payouts have been quick to invest

them in bricks and mortar. That upwards trend looks almost certain to continue;

this year's City bonus pot has been estimated at £19bn, with a third of that

total expected to be paid out this month, and it is property in London's most

exclusive areas that is proving a big hit.

Upmarket estate agent Savills said its London West End branches were full of

"bonus boys" splashing out, with many making cash purchases. The number of

£2m-plus properties sold in London jumped 139% between October 2005 and October

2006 - from 31 to 74.

Suzanne Chaffey from agents Bective Leslie Marsh, a member of the Royal

Institution of Chartered Surveyors who has been working in the area for more

than 20 years, said: "We have had an unbelievable number of applicants and we

just have not got the stock. We saw price rises of roughly between 15-20%, but

in some instances, for particular types of houses, it was a 25% increase. We

even sold four homes in December, which is not traditionally a house-selling

month.

"Each was sold to the first person who went through the door and well in excess

of the guide price - up to £250,000 more in some cases. Everyone keeps saying

that it seems as though house prices will tail off, but we have absolutely no

indication of this. As far as we are concerned, the rises will continue. The

city bonuses are coming through in the area, and a lot of housing is being sold

off the market - making the supply problem more difficult and pushing prices up

more."

While there is no shortage of property pundits and indices, the Land Registry's

index is generally regarded as the most authoritative because it is based on all

residential housing transactions, mortgage or cash purchase. Lenders take their

data from approved mortgage applications, while property website Rightmove's

index is based on asking prices. Other London boroughs enjoying double-digit

price rises include Westminster (16%), Hammersmith and Fulham (14.4%), Hackney

(14.1%), Wandsworth (12.6%), Richmond upon Thames (12.5%), Haringey (11.6%),

Merton (11.4%), Islington (11%) and Camden (10.9%). The lowest rate of growth,

4.1%, was seen in Barking and Dagenham.

"London once again represents the main driving force behind the recent house

price growth," said the Land Registry. However, it added: "All regions in

England and Wales experienced average price increases over the last 12 months."

Still going through the roof - the property boom goes on,

G, 30.1.2007,

http://money.guardian.co.uk/houseprices/story/0,,2001801,00.html

Bank of England shocks with rates rise

January 11,

2007

Times Online

Dearbail Jordan and Mark Atherton

The Bank of

England shocked both homeowners and the City today when it raised the base rate

to a five-year high of 5.25 per cent.

The unexpected rate hike means homeowners with a £150,000 variable rate mortgage

will see their monthly repayment leap by £31 a month.

Moneyfacts,

the financial research group, said that a typical homeowner is now paying £148 a

month more on a £150,000 loan compared with July 2003 when the interest rate

bottomed out a 3.5 per cent.

The interest rate increase has been prompted by concern that workers’ demand for

higher wages is outstripping the rate of inflation, adding to inflationary

pressures.

A sharp rise in house prices, which the building society Nationwide states rose

by 10.5 per cent over 2006, is also thought to be behind the Bank’s decision.

It is the third rate rise since August last year, and represents a five-year

high.

Conversely, the European Central Bank today held interest rates steady at 3.5

per cent, which itself is a five-year high for the Euro zone.

It had been widely expected that there would no change in the rate at today’s

meeting of the Bank of England’s Monetary Policy Committee (MPC), ahead of the

publication of inflation figures for December due out next month.

Both the MPC and the Government receive inflation data ahead of the market and

are believed to have been in possession of the figures since Tuesday this week.

It is the first time since January 2000 that the MPC has pre-empted the February

inflation report and raised rates. Typically, increases in employee pay take

place between January and April.

The CBI, the employers' body, today called the surprise interest rate hike

"disappointing". Ian McCafferty, its chief economic adviser, said: "It is

disappointing that, with only tentative indications about the outcome of the

wage round, the bank has already decided to increase interest rates.

"If part of the intention was to dampen wage increases, it is doubtful a rate

rise will have the desired effect."

He added that if wages failed to increase sharply in the next few months,

inflation would fall back to the Bank of England’s medium term target of 2 per

cent from November’s 2.7 per cent.

The MPC

said: "It is likely that inflation will rise further above the target in the

near term, but then fall back as energy and import price inflation abate.

Relative to the November inflation report, the risks to inflation now appear

more to the upside

"Against

that background, the Committee [MPC] judged than an increase in the Bank Rate of

0.25 percentage points to 5.25 percent was necessary to bring CPI inflation back

to target in the medium term."

Bank of England shocks with rates rise, Ts, 11.1.2007,

http://business.timesonline.co.uk/article/0,,16849-2542203,00.html

|