|

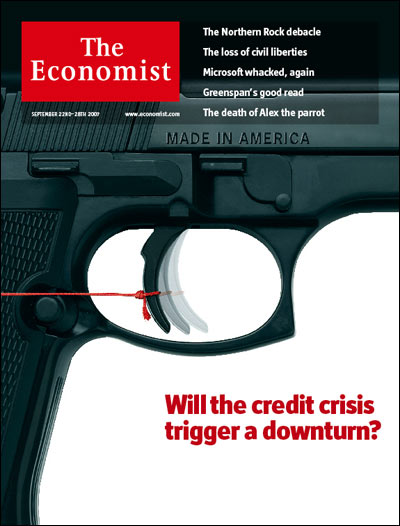

History > 2007 > UK > Economy (III)

The Economist - North America Edition

Sep 22nd 2007

Northern Rock

still lending ‘recklessly’

September

23, 2007

From The Sunday Times

Robert Winnett and Roger Waite

Northern

Rock stands accused of “reckless” lending after it emerged this weekend that the

beleaguered bank is still offering mortgages of six times salary to potential

borrowers.

Despite provoking the worst banking crisis for decades, the bank last week

offered a reporter posing as a first-time buyer a £180,000 mortgage even though

he had a salary of only £30,000.

The loan was at least £30,000 more than other leading lenders were prepared to

offer. Repayments for the loan would have accounted for more than 60% of the

fictional buyer’s take-home salary.

The reporter, posing as another potential customer, was also offered a so-called

“negative equity mortgage” worth 117% of the value of the property he claimed to

be interested in buying. The mortgages offered by other banks to the same

potential borrower were significantly lower.

Financial experts were this weekend stunned that Northern Rock is offering such

loans a week after it was forced to turn to the Bank of England for emergency

funding. Yesterday it emerged that Northern Rock has been forced to borrow about

£3 billion from the Bank in the past week.

Northern Rock is to court further controversy by pushing ahead with a plan to

pay a £59m dividend to shareholders and executives this week. The Financial

Services Authority gave special dispensation to the bank in July to dip into its

assets to pay out the dividend – which is 30% higher than last year’s payout.

Politicians yesterday expressed dismay that the government and its regulators

had not stepped in to supervise Northern Rock’s business practices following the

government bail-out. George Osborne, shadow chancellor, said: “One week Alistair

Darling [the chancellor] is attacking the lending culture in this country, the

next he is issuing emergency guarantees for people’s mortgages and savings.”

George Mudie, a Labour member of the Treasury select committee said: “Of all the

people, have Northern Rock learnt nothing? It is reckless.”

When the Sunday Times reporter posing as a 24-year-old first-time buyer

approached Northern Rock last week he was offered a range of huge mortgages. The

bank’s mortgage adviser provisionally told the reporter after he revealed his

salary was £30,000 that he could borrow £180,000 towards the cost of a £200,000

home. One option offered was for a fixed two-year rate at 6.29% with a “product

fee” of £1,995. The deal offered is not market leading but compares favourably

with competitors.

Of other mortgage providers approached using the same salary figure, Bradford &

Bingley said the maximum it could lend was £127,500, Alliance & Leicester

offered £149,000 and Abbey £138,000.

Northern Rock still lending ‘recklessly’, STs, 23.9.2007,

http://business.timesonline.co.uk/tol/business/

industry_sectors/banking_and_finance/article2512384.ece

The

politics of a bank run

Labour's moment of peril

Sep 20th

2007

From The Economist print edition

Gordon

Brown may still suffer

from a week of financial and political panic

SINCE

Labour swept into power in 1997, there has been only one brief moment when the

government looked really vulnerable. That was when road hauliers blockaded

refineries in the autumn of 2000 and the nation seemed about to grind to a halt.

But this week's run on Northern Rock has been just as perilous.

As so often in modern politics, it was the pictures that shocked. Britain had

not experienced a bank run since Victorian times; it had avoided the bank

failures that blighted the American and German economies in the early 1930s. Yet

that did not stop long lines from forming outside the branches of Northern Rock

once it became known that Britain's fifth-largest mortgage lender, unable to

raise the short-term cash it needed from the gummed-up money markets, had

requested emergency help from the Bank of England.

The bank run was unexpected and perplexing, since by then Northern Rock could

rely on the Bank for support. But the rush to withdraw money was not as

irrational as it looked. Many in the queues knew the limits of Britain's

niggardly deposit-compensation arrangements.

These offer full cover to a depositor with any one bank for the first £2,000

($4,000) and then 90% of the next £33,000. The protection is less generous than

that in America, where deposits are fully protected up to $100,000 under a

federal scheme created in 1933. Furthermore, American depositors get their money

back within days whereas compensation in Britain may take up to six months.

As the run on Northern Rock persisted, there was a growing danger that the

public might lose confidence in other banks. Stopping the run became imperative.

On September 17th Alistair Darling, the chancellor of the exchequer, played the

taxpayers' card: he guaranteed all the existing deposits in the bank for as long

as the financial system remained in turmoil.

That did the trick. The queues disappeared. The financial panic was over. So,

too, was the political panic that had gripped Gordon Brown and his ministers as

the bank run persisted. In a further fillip for Mr Brown, a poll taken by

Populus on September 17th indicated that the public was more inclined to blame

risky mortgage-lending in America than the government in Britain for Northern

Rock's woes. Another survey suggested that Labour's lead over the Conservatives

had widened.

Mr Brown is not yet off the hook, however, for his reputation rests on being

good at running the economy. His much-touted master stroke when he first became

chancellor was giving the Bank of England independence to set interest rates,

which helped keep inflation low and economic growth stable. But part of the deal

was that the Bank stopped supervising banks.

Now Mr Brown will face awkward questions about how a bank run occurred on his

watch, when it was he who designed the regulatory arrangements. And the

government now has the difficult task of trying to limit Mr Darling's guarantee,

which is supposed to apply only during the current exceptional circumstances.

But it is the longer-term economic impact of the bank run that could prove most

damaging to Mr Brown. There have been good solid reasons why the economy has

done well in the past decade, notably a labour market that has remained flexible

and an increasing openness to immigration. But the long expansion has also had a

flakier side. In particular, consumer spending has been sustained by rising

borrowing backed by the long house-price boom.

Now lenders will become more reluctant to lend, another blow for a housing

market that is looking ever more vulnerable. This week Alan Greenspan, a former

chairman of America's central bank, suggested that Britain was more exposed to

the credit crunch than America because a higher proportion of its mortgage

borrowers had taken out loans at variable rates. What's more, British households

are more indebted, in relation to their disposable income, than Americans are.

The damage that a flagging housing market can inflict was made clear in 2005,

when stalling house prices prompted a slowdown in consumer spending and a

slackening in GDP growth. Both have recovered since then, but house prices have

become even more unaffordable and consumers yet more indebted.

While Mr Brown disappeared from sight (an old trick), Conservatives and Liberal

Democrats chastised him for permitting these structural weaknesses to emerge.

David Cameron, the Tory leader, warned that “an economy built on debt puts

economic stability at risk”. Vince Cable, the Lib Dems' Treasury spokesman, said

that he himself had warned of a looming debt crisis four years ago.

So far the public seems to have turned a deaf ear to these warnings. Mr

Cameron's attempt to link the troubles at Northern Rock with Labour's record on

debt may even have backfired by appearing opportunistic. But the message could

get traction if the economy deteriorates or would-be home-buyers find it notably

harder to borrow money.

Lower official interest rates are almost certainly on the way. Encouraging

inflation figures—consumer-price inflation dropped a bit further below the

government's 2.0% target in August—will help make the case for a cut in the base

rate from 5.75% later this year. But it may not be enough to stop a wrenching

slowdown after the financial shocks that have battered the economy. Mr Brown

appears to have escaped this week's events unscathed, though his room for

manoeuvre in calling the next election has been reduced. He is likely to pay a

heavier political price in the months to come.

Labour's moment of peril, E, 20.9.2007,

http://www.economist.com/world/britain/displaystory.cfm?story_id=9833550

New Northern Rock savers

left out in the cold

The saver's

shares slide

as Alistair Darling, the Chancellor,

refuses to guarantee

any new

customer accounts

September

20, 2007

From Times Online

Miles Costello

Shares in

Northern Rock slid almost a third as the Government threw an obstacle in the way

of a Northern Rock recovery this morning by refusing to stand behind any new

accounts opened from today.

The move by the Treasury - which at the same time guaranteed the rights of

existing borrowers - left the Tyneside lender isolated and was seen as making a

rescue takeover significantly less likely

The Treasury also ensured that the bulk of Northern Rock's securities issued to

the wholesale markets were ring-fenced from the sovereign's gilt-edged guarantee

on savings.

Northern shares plunged through the 200p barrier to as low as 176p, although

they came back to 198.5p.

The move by

the Treasury, issued in a formal statement to the stock market this morning, is

a massive setback to any hopes Northern Rock might have of building its customer

base and developing a recovery strategy.

Staff union Unite has been busy trying to encourage Newcastle-based savers and

borrowers to set up accounts at Northern Rock to boost the standing of the UK's

ailing mortgage lender. They were not immediately available for comment this

morming.

Banking sources said the limited guarantee will act as a disincentive for new

account-holders. The Treasury was not immediately able to elaborate on the

reasons for its decision.

Northern Rock was this morning preparing a response. A source close to the

lender said: "It's an obstacle; but not an insurmountable one."

The mortgage bank, in freefall since being forced to go to the Bank of England

for emergency funding last week, has been prioritising winning back existing

account-holders.

After panic-stricken savers formed massive queues to withdraw their money, it is

thought that Northern has stemmed the flow of departures. Less than 75,000, or

below 5 per cent of the bank's 1.5 million customers are thought to have shut

down their account over the past week.

Lloyds TSB and Northern were in talks over an agreed takeover before the

facility, although a deal is thought to have been spiked by the Bank of England.

Three days ago, Alistair Darling, the Chancellor, agreed to guarantee deposits

at Northern Rock, and the Treasury confirmed today that all accounts existing as

at midnight last night would be covered.

"This guarantee covers future interest payments, movements of funds between

existing accounts, and new deposits into existing accounts. The guarantee will

also cover accounts re-opened in the future by those who closed them between

Thursday September 13 and Wednesday September 19, inclusive," the Treasury said.

But it added: "Since it would otherwise be unfair to other banks and building

societies, the arrangements would not cover any new accounts set up after

September 19, other than re-opened accounts."

For the wholesale markets, the Treasury said it will stand behind wholesale

borrowing and lending that is not collateralised. This appears to underwrite

liquidity for the Rock in the short-term money markets.

However, the department added that its guarantee will not cover other debt

instruments, including Northern Rock's "Granite" securitisation programme.

Mortgage lenders regularly package up mortgage assets of varying qualities and

issue securities backed by their repayments.

New Northern Rock savers left out in the cold, Ts,

20.9.2007,

http://business.timesonline.co.uk/tol/

business/industry_sectors/banking_and_finance/article2495180.ece

Editorial

comment

U-turn

erodes Bank’s credibility

Last

updated: September 19 2007 18:53

Published: September 19 2007 18:53

The Financial Times

Why, after

weeks of refusing to intervene in the money markets, after declaring again and

again that such action would cause moral hazard, and after the run at Northern

Rock appeared to be stabilised, has the Bank of England done a U-turn? Its

decision to inject funds into the three-month market, against a wider range of

collateral, raises the suspicion that the Bank has been overruled by the

Treasury.

Since the Northern Rock rescue began last Friday, official handling of the

crisis has been marked by muddle, indecision and disunity. Poor communication

when the rescue was launched, the delay in guaranteeing Northern Rock deposits,

and now this belated liquidity operation add up to an incoherent response to the

crisis.

It is not clear what the latest intervention is meant to achieve. The Bank will

offer three-month liquidity at a penalty of at least 1 per cent above its base

rate, an offer that will only appeal to banks in difficulties. Northern Rock

could have used this a week ago, but Northern Rock has now been dealt with. The

move would only make sense to the extent that it protects banks similar to

Northern Rock, but it risks creating the fear that another such case is out

there. Circumstances may have changed fundamentally but the authorities will

need to show that at some point.

Since the credit squeeze began the Bank has insisted that it will only intervene

in the overnight market and will only lend against the collateral of AAA

government and agency bonds. It has held to that position for two reasons.

First, the Bank has argued that to offer longer-term liquidity would be to bail

out those banks that have not financed themselves prudently, and so encourage

them to be equally careless in future.

Second, the Bank has implied that high rates in the money markets represent a

repricing of risk rather than any shortage of central bank money, so liquidity

injections might not have much effect. Sound banks would snap up the funding on

offer, but would not necessarily lend it on to institutions they suspected were

in trouble, such as Northern Rock. The European Central Bank has intervened at

three-month maturities with limited results.

The Bank of England’s principle – a determination to avoid moral hazard – was

right. But its forced capitulation suggests that taking so pure and so aloof an

intellectual position was unwise. Of course central banks must avert moral

hazard, but in a crisis they need to be helpful.

The wider handling of Northern Rock suggests that there has been a breakdown in

the relationship between the Bank, the Financial Services Authority and the

Treasury, which are jointly responsible for financial crises. The principals at

each organisation: Mervyn King of the Bank, Sir Callum McCarthy of the FSA, and

Alistair Darling, chancellor of the exchequer, share responsibility for that

failure.

The entire tripartite system, in which the FSA supervises individual banks, but

the Bank of England has the balance sheet and acts as lender of last resort, is

now in doubt. When the FSA was created in 1997 many said that split would prove

unworkable in a crisis and so it has proved. The Bank is isolated from the

lenders that it may be called upon to rescue. The FSA has no power to intervene

in the markets. And rather than smooth co-operation, the two organisations have

started sniping.

The man who created this system of banking regulation is Gordon Brown, Britain’s

chancellor in 1997 and now its prime minister. His responsibility for the mess,

and that of his government, is considerable.

The tripartite approach will have to be reconsidered as will banking supervision

more generally. If the Bank is to turn illiquid assets and lower grade

collateral into liquid central bank money, regulation will have to be tightened

to reduce the resulting moral hazard.

By far the most serious consequence, however, is the damage done to the Bank of

England. In a statement released last week, Mr King was careful not to rule out

money market intervention or acting as a lender of last resort, but as a whole

that statement implies money market action would be ineffective and wrong.

When Mr King goes before a parliamentary committee on Thursday he will face the

near impossible task of justifying what the Bank has done. He will either have

to concede that he was wrong not to intervene earlier or that he has been forced

to intervene now. Either way the harm to the Bank is immense. The Treasury and

the FSA have also suffered blows to their reputations and have questions to

answer. But because of its public statements, it is the Bank and its governor

that have lost most credibility. The position of Mr King is now very difficult.

U-turn erodes Bank’s credibility, FT, 19.9.2007,

http://www.ft.com/cms/s/0/5812ed6c-66d8-11dc-a218-0000779fd2ac.html

Bank of

England in money market U-turn

Last

updated: September 19 2007 12:30

Published: September 19 2007 12:30

The Financial Times

By Chris Giles, Economics Editor

British

banks will be able to borrow from the Bank of England for three months using

mortgages as collateral, the central bank announced in an extraordinary U-turn.

The humiliating move for Mervyn King, Bank governor was announced on Wednesday

morning when the Bank said that next week, it would be willing to swap £10bn of

cash for a wider range of commercial bank assets “including mortgage

collateral”.

Up to now, Mr King has insisted that such action would be tantamount to bailing

out banks that had made risky lending decisions and would sow “the seeds of a

future financial crisis” because it provides after the event insurance for risky

behaviour.

The Bank always insisted it had the option of such action, but was unwilling to

take the plunge because, as Mr King wrote to members of Parliament last week,

“central banks cannot sensibly entertain such operations merely to restore the

status quo” before the market turmoil began.

He added that the only circumstances in which such action would be warranted

would be when failure to act “would lead to economic costs on a scale sufficient

to ignore the moral hazard in the future”.

The move clearly shows that while equity markets have been buoyed by the US

Federal Reserve’s decision to slash interest rates by half a percentage point,

the Bank knows that turmoil still stalks the money and credit markets and that

this painful action, something the Bank was desperate to avoid, has become

necessary.

Schadenfreude – the pleasure in someone else’s misfortune – is guaranteed at the

Financial Services Authority, which has wanted the Bank to take this action for

some time and in other central banks. The latter felt the Bank of England was

free-riding on actions they have taken similar to those launched in the UK on

Wednesday.

The Bank said it took the decision to “to alleviate the strains in

longer-maturity money markets” where interest rates have remained far above the

Bank’s official 5.75 per cent rate. On Wednesday, the London interbank

three-month rate stood at 6.75 per cent and it fell to 6.55 per cent after the

Bank’s action.

Mr King’s position will be very difficult after this announcement, since he has

been so public in criticising similar moves.

To defend the action he will point to some of the conditions underlying the new

loans the Bank is now offering. The interest rate on the loans will be higher

than the 6.75 per cent rate banks can always borrow from the Bank in exchange

for high-grade collateral and they will not receive £100 in cash for every £100

of mortgage assets they deposit at the Bank.

Even so, Northern Rock and other banks and politicians will ask Mr King why the

Bank delayed such action if it is now deemed necessary. Had the Bank taken this

step a week ago, the run on Northern Rock would have been avoided as it could

have swapped mortgages for cash in a normal and confidential operation, but

without the full glare of publicity that greeted it when it went cap in hand to

the bank last Thursday seeking money under the Bank’s lender of last resort

facilities.

The Bank said it would announce details of the terms of the loans on Friday.

Bank of England in money market U-turn, FT, 19.9.2007,

http://www.ft.com/cms/s/0/43a7b3ac-66a2-11dc-a218-0000779fd2ac.html

11.15am

update

Northern

Rock crumbles again

Wednesday

September 19, 2007

Guardian Unlimited

Graeme Wearden

Shares in

Northern Rock slumped this morning as rumours swept through the market that it

could be taken over at a knockdown price.

The bank's

shares suddenly plunged 20% to 246.25p shortly after 10am amid high volumes of

trading. By 11am they had recovered slightly to 280p, an 8.5% drop.

This wiped out the recovery the stock price had seen since the government

stepped in to guarantee that depositors' savings were secure.

There was talk in the market that Lloyds TSB was preparing a bid of 200p a share

for the company.

Martin Slaney, head of spread betting at GFT Global Markets, predicted further

volatility in the stock.

"The longer we go without a bid, the lower that bid is likely to be," he said.

Northern Rock's largest shareholder, Baillie Gifford, confirmed this morning

that it had sold some of its 6% holding. Deutsche Bank later announced that it

had bought over 3% of the stock.

Northern Rock crumbles again, G, 19.9.2007,

http://business.guardian.co.uk/markets/story/0,,2172453,00.html

Brown

defends economic policy

Tue Sep 18,

2007

5:44pm BST

Reuters

LONDON

(Reuters) - Everything is being done to maintain the stability of the British

economy after a bank crisis, Prime Minister Gordon Brown said on Tuesday.

"What I want to assure people of is that everything that can be done will be

done -- and is being done -- to maintain the stability of the economy," Brown

told the BBC after a government promise to guarantee deposits at Northern Rock

bank appeared to ease a run on the bank.

"We are an economy that will continue to grow and continue to create jobs and

continue to have low inflation and low interest rates and everything that has

been put in place ... is designed to ensure that," he said.

Brown argued that Northern Rock's problems were the result of international

events that were "bound to have an effect on every industrial country", but he

said the British economy was strong enough to deal with them.

"This is a set of financial problems that have happened in America, spread to

Germany and Europe and now we're seeing some instances of that in Northern Rock

in the UK," he said.

"But we are an economy that has taken the measures that have been necessary to

keep a stable economy, so inflation is coming down, and at the same time we

could embrace regulatory measures to ensure that when incidents like this happen

they are properly dealt with," said Brown, who was attending a discussion on the

future of the health service in Birmingham.

Brown defends economic policy, R, 18.9.2007,

http://uk.reuters.com/article/businessNews/idUKL1875060920070918

5.30pm

update

Banking

shares rebound

Tuesday

September 18, 2007

Guardian Unlimited

Staff and agencies

Chancellor Alistair Darling was holding talks with representatives from the Bank

of England and the Financial Services Authority today amid relief among

investors after his pledge to guarantee savings at stricken mortgage lender

Northern Rock.

Downing Street today also insisted prime minister Gordon Brown retained "full

confidence" in Bank of England governor Mervyn King, who has been criticised for

his handling of the crisis. He is due to face questions on Thursday from MPs on

the Treasury select committee over his handling of the current financial turmoil

and the Northern Rock crisis.

Gordon Brown later claimed the government's intervention to guarantee savings at

Northern Rock, which could cost the taxpayer up to £28bn, was a sign of

strength.

"It's because of the strength of our economy we've been able to take this

decisive action," he said. "I want to reassure people that everything that can

be done to maintain the stability of the economy [is being done]."

The prime minister added: "With this decision we've shown in Britain we're

strong enough to deal with financial instability."

Although the mood in the market remained nervous, the government's unprecedented

intervention looks to have halted the run on the Britain's fifth-largest

mortgage lender, although some customers still arrived at Northern Rock branches

in the early hours of this morning to withdraw their cash.

Shares rebounded across the banking sector with Northern Rock, whose shares have

halved in value since Friday, climbing 11% in early trading. By the close the

shares were 23.25p or 8.22% higher at 306p. At their peak this year, they were

changing hands at more than £12.

Alliance & Leicester, which plunged more than 30% in late trading yesterday,

rebounded 32.17% to 753p and there were also gains for HBOS.

Bradford & Bingley had a rough ride - its shares initially gained 6% in early

trading, reversed to a 5% loss by lunchtime, then closed up 6% at 297.75p.

In an attempt to stem the panic sweeping through the British banking system, Mr

Darling last night pledged to guarantee savings at Northern Rock.

Amid fears that the bank would collapse, panicked savers have besieged its

branches since last Friday, withdrawing an estimated £3bn.

They were still queueing this morning, with some arriving outside branches as

early as 1.30am, although the numbers were well down on the past few days.

Mr Darling today pledged that the government would "do everything we can" to

return financial markets to normal in the wake of the Northern Rock crisis. "I'm

determined we maintain a stable banking system," he told reporters.

Asked whether he retained confidence in Mr King, the chancellor said: "The

governor of the Bank of England, the chairman of the Financial Services

Authority and I have been meeting very regularly for several weeks now. We keep

in constant touch, we are just about to meet again. We are working closely

together."

He said the same facilities as have been offered to Northern Rock savers would

be made available to any bank which sought help, but stressed that "no other

bank" had yet approached the Bank of England for assistance.

"In the event that another bank were to need assistance from the Bank of England

- and there is no sign of that at the moment - then exactly the same facilities

that Northern Rock has been offered would be offered to that other bank," he

said.

Asked about the experience of his first few months at the Treasury, Mr Darling

said: "Every chancellor should expect to deal with turbulence from time to time.

There are always going to be difficult decisions to take."

In full-page adverts in the national press today, Northern Rock's embattled

chief executive Adam Applegarth said he wanted to make it "emphatically clear to

Northern Rock customers that we are open for business as usual".

He said the bank remains a safe place for savings, loans and mortgages.

"The simple fact now is that the chancellor has made it clear that all existing

deposits in Northern Rock are fully backed by the Bank of England and are

totally secure during the current instability in the financial markets."

He added: "These have been troubled times but Northern Rock will prevail. We

will not let you down."

Phil Hammond MP, shadow chief secretary to the Treasury, said the chancellor had

played his "last card" with the emergency pledge. Speaking on GMTV this morning

he said the government had "no option" but to act.

"We are talking about real people here, their hopes and futures," he said,

adding: "The chancellor has played his last card with the guarantee he gave

yesterday. People have now been given an absolute government guarantee - if that

doesn't stabilise the situation, nothing will."

Banking shares rebound, G, 18.9.2007,

http://business.guardian.co.uk/markets/story/0,,2171652,00.html

A&L

seeks to ease worries

as shares crash

Mon Sep 17,

2007

6:15pm BST

Reuters

LONDON

(Reuters) - Alliance & Leicester said on Monday it was successfully funding

itself and had not sought any assistance from the Bank of England, after its

shares plunged over 30 percent on fears it could face some of the problems that

have battered rival mortgage lender Northern Rock.

A&L, the country's seventh-largest bank, saw its shares tumble in the last

minutes of trade to close down 31.3 percent at 600 pence, its lowest level in

almost 7 years.

"The market is looking to the potential next victims and in a sense all banks

are more or less exposed," said Felix Lanters, an equities portfolio manager at

Theodoor Gilissen.

But A&L dismissed concerns and said it had no funding trouble and hadn't sought

central bank assistance.

"We are successfully funding the bank and we have not sought assistance from the

Bank of England," an A&L spokesman said. "We know of no reason why the share

price has fallen so sharply."

He added: "We stated on September 4 that current conditions in the funding and

liquidity markets have had no material impact on profit or franchise growth.

That remains the case."

The Bank of England, which routinely declines to comment on market movements,

declined to comment on the share price drop and on speculation of funding

concerns.

The UK Treasury and the Financial Services Authority were not immediately

available for comment.

Shares in Northern Rock, in a tailspin since credit market liquidity dried up

two months ago to hit its main source of funding, ended the day down more than

35 percent, as customers queued outside its branches to withdraw savings.

Other large mortgage lenders also reliant on funding from wholesale markets --

although not to the same extent as Northern Rock -- were hit on Monday,

including Bradford & Bingley , which closed down 15.4 percent, and HBOS down 5.5

percent.

Merrill Lynch said in a note on Monday that A&L's takeover premium could also be

removed as a result of market turbulence.

"We think a takeout is unlikely in the current environment, especially when

there is no shortage of cheaper UK assets for an interested buyer," the bank

said. Merrill cut its earnings forecast for A&L in 2008 by 12 percent, saying

the outlook for wholesale funding costs was very tough.

A&L seeks to ease worries as shares crash, R, 17.9.2007,

http://uk.reuters.com/article/businessNews/idUKL1735699720070917

Government to guarantee

Northern Rock deposits

Last

updated: September 17 2007 18:15

Published: September 16 2007 20:31

The Financial Times

By Jean Eaglesham,

Peter Thal Larsen,

Chris Giles

and Lina Saigol in London

Alistair

Darling, chancellor of the exchequer, has announced that the government will

guarantee all deposits of Northern Rock account holders as ministers sought to

calm savers’ fears.

Mr Darling’s actions came amid signs of the panic that was spreading across the

banking sector with shares of Alliance & Leicester falling 31 per cent on

concerns that the bank would be the next to turn to the Bank of England for

assistance.

Mr Darling said that “should it be necessary, we and the Bank of England will

put in place arrangements that guarantee all the existing deposit arrangements.”

The existing deposit guarantee scheme protects part or all of the first £35,000

of an individual’s savings only.

The chancellor is anxious to prevent the surge of withdrawals from Northern

Rock, which has seen queues outside all of the struggling bank’s branches,

triggering a wider crisis of confidence in the UK’s financial system.

The state guarantee came after savers again beseiged the bank’s branches. About

£2bn has been withdrawn since Thursday, when the bank applied to the Bank of

England for emergency funds.

Northern Rock shares plunged by a further 35 per cent in afternoon trading as

the mortgage lender and its regulators prepared to try again to arrange a sale.

As

depositors continued to withdraw their savings from Northern Rock – with some

reported to have begun queuing as early as 4am on Monday – people familiar with

the matter said the bank and its advisers were planning a new push to find a

“commercial solution” that would allow it to be sold as a going concern.

Northern Rock held talks with Lloyds TSB, the UK’s fifth-biggest bank, as

recently as last Monday. Those discussions were undermined by the turmoil in the

credit markets and the Bank of England’s reluctance to offer financial support

to facilitate a deal, people familiar with the matter said.

However, the central bank on Sunday indicated that the credit line it had

provided to Northern Rock would not be removed in the event of a sale. “We have

agreed that any bidder would be able to take on the facility for any unexpired

term left,” it said.

Any renewed takeover interest will depend on whether Northern Rock’s business

can be stabilised. About £2bn ($4bn) has now been withdrawn by savers. But

people close to the bank say the figure – about 8 per cent of total deposits –

is lower than initially feared.

Sir Callum McCarthy, chairman of UK regulator the Financial Services Authority,

and Mr Darling both stressed over the weekend that the bank was solvent.

If no buyers come forward, it seems likely Northern Rock’s business will be

gradually wound down, effectively leaving it with a shrinking mortgage book as

loans are repaid. Its advisers are thought to have calculated that, in this

situation, it would be worth about 180p a share.

The shares fell 35 per cent to 282.75p on Monday. Other bank shares also fell

sharply, with Alliance & Leicester down 31 per cent, Bradford & Bingley down

nearly 15 per cent and HBOS 5.5 per cent lower.

The Bank of England has been stung by criticism that it is providing a bail-out

to Northern Rock and wants the terms to be published, so it can demonstrate how

tough they are for Northern Rock’s shareholders. The central bank said: “We

expect the terms to be disclosed in due course.”

Northern Rock executives spent the weekend trying to ensure the business was

functioning, and organising the delivery of sufficient cash for customers to

make their withdrawals. They are also seeking to fix the bank’s website, which

has been struggling with the high volume of traffic.

Adam Applegarth, chief executive, again sought to reassure Northern Rock

customers in a statement published on the lender’s website on Sunday.

“Your money is safe with us and if you want some, or all of it back, then you

are perfectly entitled to it,” he said. “Whilst you may have to wait a little

longer than usual to receive it, you will get it. However, your savings are

secure and there is no need for you to withdraw your money based on our recent

announcement, and the widespread media coverage that has ensued.”

His comments were echoed by Mr Darling, who told BBC Radio 4’s Today progamme:

“If people want to get their money out of Northern Rock, they can. The money is

there and it is backed by the Bank of England so they can get it.”

Mr Darling added: “The problem at the moment is not that there isn’t money in

the system, because the banks do have a lot of money. It is the fact that they

have been reluctant to lend to each other whilst they work out what the extent

of their risk is following on the difficulties in the American market.”

Government to guarantee Northern Rock deposits, FT,

17.9.2007,

http://www.ft.com/cms/s/2/39199b78-6489-11dc-90ea-0000779fd2ac.html

Northern

Rock shares plunge

as customers flee

Mon Sep 17,

2007

5:46pm BST

Reuters

By Steve Slater

LONDON

(Reuters) - Thousands of customers queued to withdraw savings from embattled

bank Northern Rock on Monday and its shares plunged again, heightening pressure

for a sale of the business or its assets.

The country's fifth-biggest mortgage lender, which on Friday was rescued by

emergency Bank of England funding, said there was no need for investors or

customers to panic and it remained solvent.

Nevertheless, customers appeared set to continue pulling out savings and by

early on Monday its shares had more than halved in value since Thursday's close.

"I didn't initially panic but the more you watch the news and read you think

maybe we ought to do it as well," said Barbara Williams, retired, as she stood

in line with hundreds of others at the Oxford Circus branch.

"We thought we would do what everyone else is doing. Rightly or wrongly it's a

chance you can't take."

Fears have mounted that a run of withdrawals will exacerbate the lender's

funding problems and force a fire sale of the business. The problems were

triggered by the global credit crunch as banks, worried about exposure to dodgy

U.S. mortgage debt, jacked up the price of lending to each other.

As the fallout threatened to have wider economic and political impact,

Chancellor Alistair Darling said authorities would consider every option to

solve the crisis.

By 11 a.m. shares in the bank were down 32 percent at 296 pence, following a 31

percent tumble on Friday to cut the bank's market value to under 1.3 billion

pounds. The shares fell as low as 290p and have lost 70 percent this year.

"The franchise is broken -- the deposit franchise at least -- the run on the

bank is happening as we speak and could see as much as 12 billion (pounds) of

deposits withdrawn," said Mamoun Tazi, analyst at MF Global. "One way for this

to stop is for the bank to be taken over."

The Newcastle-based bank provides one in 13 home loans. The central bank, as

lender of last resort, stepped in on Friday to offer emergency funding to ease

its funding problems after it struggled to borrow in money markets.

The bank had not drawn on the emergency facility by Sunday, the government said.

News of the emergency funding line sent thousands of Northern Rock's 1.4 million

savings customers rushing to branches and to the Internet for their money.

Customers were estimated to have withdrawn about 1.5 billion pounds on Friday

and Saturday.

Some reports said as much as 2 billion pounds has been withdrawn, which would

represent about 8 percent of its deposits.

Government, banking and regulatory officials are monitoring the situation

closely, trying to halt the run on withdrawals.

But there was an element of panic and frustration across the bank's 76 branches.

"I didn't sleep at all on Friday night. It's a lot of money and I was very

distressed and my husband was as well," said Karen Dawson, 53, a lawyer who was

among hundreds in line at the Oxford Circus branch after failing to access her

account via the Web site and by telephone since the crisis broke.

More significant could be the reaction of postal account holders, however, who

account for 10 billion pounds of the bank's 24 billion pounds of retail

deposits.

"YOUR MONEY

IS SAFE..."

Northern Rock Chief Executive Adam Applegarth sought to reassure customers that

their savings were secure via a message posted on the company's Web site,

www.northernrock.co.uk.

"Your money is safe with us and if you want some, or all of it back, then you

are perfectly entitled to it. Whilst you may have to wait a little longer than

usual to receive it, you will get it," Applegarth said in the message posted on

Sunday.

Northern Rock has hoisted a "for sale" sign up and banks including Lloyds TSB

have considered deals, according to industry sources, but suitors have been put

off by difficult credit markets and uncertainty about the true valuation.

Analysts said the bank, approaching its 10th anniversary as a listed company, is

unlikely to survive in its present form.

Options include an outright sale or the slicing up of its 100 billion pound

mortgage portfolio among the country's other major banks, which industry sources

said could happen but was not imminent.

Other alternatives could include a rundown of the business in which cash is

returned to depositors, branches closed and loans repaid.

Other bank shares were hit in the wake of the turmoil, with shares in Alliance &

Leicester slumping 14 percent and big names such as HBOS, Royal Bank of Scotland

and Barclays all down over 4 percent.

Additional

reporting by Clara Ferreira Marques, Simon Rabinovitch, Gavin Haycock and Matt

Falloon;

Northern Rock shares plunge as customers flee, R,

17.9.2007,

http://uk.reuters.com/article/UKNews1/idUKL171031020070917

4.45pm

update

Thousands of savers

besiege Northern Rock

Monday

September 17, 2007

Guardian Unlimited

Fiona Walsh and agencies

Shares in

Northern Rock went into freefall today as the run on the bank gathered pace with

investors rushing to dump the stock.

The shares nosedived, plummeting 41% to 257p at one stage, valuing the bank at

barely more than £1bn. By the close, the shares had edged back to 282.75p, still

down 35.45% on the day.

This follows Friday's hefty 32% drop and means that the group, Britain's

fifth-largest mortgage lender, has now lost almost 80% of its stock market value

since the start of the year - when it was valued at more than £5bn.

There were heavy losses among other banks, sending the FTSE 100 index of leading

shares down by more than 100 points at one stage.

Alliance & Leicester, which suffered sharp falls on Friday, lost another 31.27%

and Bradford & Bingley was almost 15.39% lower. HBOS lost 5.47%.

By the close of market, the FTSE 100 was down 106.5 points to 6182.8, or 1.69%.

As much as £2bn is believed to have been withdrawn from Northern Rock accounts

on Friday and Saturday, although many online customers were unable to access

their funds. The current share price gives the bank a market capitalisation of

just over £1bn.

Queues started forming outside the bank's branches in the early hours this

morning, with some customers arriving as early as 3am.

In Leeds, around 100 people were queuing outside the Northern Rock on Briggate.

Some had even brought chairs and flasks to make their wait more comfortable.

Pensioner Chris Robertson, 67, said he had a lot of money at stake but did not

want to take a risk.

He said: "Unfortunately I'm doing what everybody else is doing and panicking. I

don't think I'll actually lose anything but I'm joining the herd."

Caroline Clarkson, 39, said she was frustrated by the bank's response to the

crisis.

She said: "When you phone them, you can't get through and when you go to the

website, it just crashes.

"When you read all the reports over the weekend and you think about your money,

I decided it just was not worth the risk. Why risk it when I can take it out

today and put it in another account?"

At a branch in Liverpool, one woman, who left clutching a handbag packed with

around £3,000 with the strap double-wrapped around her shoulders, said: "It is

not much but it's all I have in the world.

"But then, when I think of the staff inside, not knowing how this will turn out

and their whole livelihoods are at stake, I feel rotten."

The bank is also bracing itself for a flood of withdrawal requests in the post

from savers with postal accounts.

Savers have chosen to ignore assurances that their cash remains safe after the

Bank of England stepped in to provide emergency funding. Both the chancellor,

Alistair Darling and under-fire Northern Rock chief executive Adam Applegarth

have repeatedly stressed that the bank remains solvent.

Speaking on BBC Radio this morning, Mr Darling said: "The root of the problem is

in the international markets, in America in particular.

"In the UK our fundamental position is that we have a strong economy, low

interest rates, low inflation, which we haven't had in the past and which will

stand us in good stead."

Mr Darling will discuss the global financial crisis with US treasury secretary

Henry Paulson when they meet later today.

In a message posted on the bank's website, Mr Applegarth made it clear that

anyone who wanted to withdraw cash could do so.

"Your money is safe with us and if you want some, or all of it back, then you

are perfectly entitled to it," he said. "Whilst you may have to wait a little

longer than usual to receive it, you will get it."

However, analysts now believe that a takeover is now the only viable option for

the bank. Frantic attempts to find a "white knight" to rescue the business are

going on behind the scenes and hopes of a rescue have been heightened after the

Bank of England confirmed that its emergency loan would continue to be available

following a sale of the business.

Analysts warned that any buyer would have to move quickly. Nic Clarke of Charles

Stanley said there was now a "gaping wound" in Northern Rock's reputation and

that it has "little future" in its current incarnation.

"The images of customers queuing up in the high street has done irreparable

damage to the franchise and when depositors have a wide range of choice of

institutions that they can place their savings with why would they choose

Northern Rock?", he said.

The takeout price for the bank could something "between 1p and 400p", depending

of the quality of the loan book and how long the sale takes, according to Sandy

Chen at Panmure Gordon.

Thousands of savers besiege Northern Rock, G, 17.9.2007,

http://business.guardian.co.uk/markets/story/0,,2170892,00.html

'Housing

boom over'

as UK bank chaos grows

· Economist

warns of sharp downturn

· Tory leader attacks Brown over crisis

Sunday

September 16, 2007

The Observer

Heather Stewart and Lisa Bachelor

Britain's

house price growth will be halved next year as the global financial crisis

exacerbates the impact of rising mortgage rates, according to Nationwide, the

biggest mortgage lender.

After the

dramatic bail-out of high street bank Northern Rock underlined the impact of the

American 'sub-prime' mortgage crisis on Britain's financial sector, Fionnuala

Earley, Nationwide's group economist, said she expected house price inflation to

slow to around 3 per cent next year.

Thousands of anxious customers queued outside Northern Rock branches for a

second day yesterday, ignoring calls for calm from the Chancellor, Alistair

Darling, and the bank's management, and sparking fears of a full-blown 'run' on

the bank.

Speaking to

Channel 4 News last night, Darling said he had been assured by the Financial

Services Authority that Northern Rock was capable of meeting its financial

obligations to its customers.

In the

first signs of political fallout from the crisis, David Cameron accused Gordon

Brown of failing to rein in public and private borrowing over the last decade,

saying the nation's economic growth is based on a 'mountain of debt'. Writing in

today's Sunday Telegraph, the Tory leader says: 'This government has presided

over a huge expansion of public and private debt without showing awareness of

the risks involved.

'Though the current crisis may have had its trigger in the United States...

under Labour our economic growth has been built on a mountain of debt.'

House price growth was running at just below 10 per cent in August, but

Nationwide believes it will have dropped to 7 per cent by December and continue

slowing throughout next year.

The worldwide credit crunch that pushed Northern Rock to the brink of collapse

could make a housing market slowdown worse, Earley warned. 'I think all it can

do is make it [the market] cooler: that comes through sentiment, and through

expectations.'

With base interest rates at a six-year high of 5.75 per cent, economists said

that the feelgood factor was already evaporating and that the Northern Rock

crisis could deal a fresh blow to confidence.

'This confirms some of the fears that people had, and reinforces the idea that

they need to be more circumspect, and that money is tighter,' said Richard

Hyman, director of retail research firm Verdict.

'It couldn't have come at a worse time: consumer confidence was already heading

south,' said Kevin Hawkins, director general of the British Retail Consortium,

though he added that, as long as Northern Rock was the only casualty, the

effects could be short-lived.

A report from property website Rightmove, released on Friday, showed that

property prices fell in the last month for the first time in three years. It is

expected that, although there will be overall growth in the housing market, some

areas of the UK could suffer significant price decline.

Meanwhile, Northern Rock apologised to customers last night, saying it was

'disappointed to see uncertainty caused'. The apology came amid growing

speculation of a takeover bid, with HSBC and Lloyds TSB both being mooted as

potential suitors. Insiders are predicting that a takeover could occur within

weeks to secure the bank's future. One plan currently being looked at by City

bankers is to divide the company's £100 billion mortgage portfolio between some

of the major banks.

Savers have been rushing to pull out their cash since it emerged last Thursday

that Darling had sanctioned an emergency loan from the Bank of England to

prevent Northern Rock going bust.

One couple had even camped outside Northern Rock's Cheltenham branch in

Gloucestershire overnight, desperate to withdraw the £1m proceeds of a house

sale. 'We were told that because our money was in an online account we wouldn't

be able to withdraw it there and then,' said Fiona Howard. 'That money is our

lifeline, as we are living in rented accommodation at present.'

'Housing boom over' as UK bank chaos grows, O, 16.9.2007,

http://observer.guardian.co.uk/uk_news/story/0,,2170336,00.html

Fears

Spread

Among U.K. Bank's Customers

September

16, 2007

By THE ASSOCIATED PRESS

Filed at 2:21 a.m. ET

The New York Times

LONDON (AP)

-- Hundreds of customers lined up to withdraw their savings from a British

mortgage bank Saturday, ignoring government assurances that their money was safe

despite the bank's request for an emergency loan.

Police were called in some cities to steer panicked crowds away as Northern Rock

bank branches closed for the day.

Fears have spread over the bank's request earlier in the week for an emergency

Bank of England loan amid the global credit crisis. Northern Rock, Britain's

fifth-largest mortgage lender, is the first British bank in 15 years to be

bailed out by regulators.

Customers withdrew $2 billion from the bank Friday, The Financial Times

reported, citing an unidentified person described as close to the situation. The

bank declined to confirm the figure, which represents 4 percent of its deposit

base.

Treasury chief Alistair Darling and the country's Financial Service Authority

tried to assure customers there was no doubt over Northern Rock's solvency.

The authority ''has reiterated yet again tonight that it is satisfied that

Northern Rock is solvent, can carry on doing business and, crucially, paying out

money if people want to withdraw their funds,'' Darling said on Channel 4 TV on

Saturday night.

But The Sunday Telegraph said Northern Rock was preparing itself for a sell-off.

Quoting unidentified sources, the paper said one plan would divide the bank's

mortgage portfolio between other major banks in what would be a private-sector

rescue of the lender.

The bank made the loan request Thursday because it relies heavily on wholesale

money markets for cash, and had been unable to borrow the amounts it required

from other banks since the money markets choked up last month. That was caused

in part by U.S. banks making mortgage loans to Americans with poor credit

histories.

Although Northern Rock requested substantial emergency funds at a penalty rate,

the bank has said it had billions of pounds in cash at its disposal. It has yet

to draw on any emergency funding.

Despite Darling's message, lines stretched around the block Saturday at some of

the bank's 76 branches in Britain and the bank extended opening hours to deal

with the situation.

''Yes, we are making matters worse, but I do think people need some reassurance

from Northern Rock and the government and financial services that their money is

safe,'' account holder Jane Taylor told Sky News while waiting outside a branch

in Kingston-upon-Thames, west of London.

But others said they had faith in the bank and financial authorities and watched

the lines in disbelief.

''It's mostly, in my opinion, ignorance and that's why they're panicking,'' said

another bank customer who gave only his first name, Tom. ''I'm leaving mine

there.''

Under Financial Services Compensation Scheme, deposits of up to $63,900 are

guaranteed should a bank default.

Ron Stout, a spokesman for Northern Rock, told The Associated Press that

reckless comments by some analysts about the bank's solvency prompted customers

to panic and line up outside branches or strain the company's online banking

system.

He said Northern Rock would continue to extend its banking hours, by opening one

hour ahead of schedule on Monday, and to reassure customers that their

investments are safe with the bank.

Fears Spread Among U.K. Bank's Customers, NYT, 16.9.2007,

http://www.nytimes.com/aponline/business/AP-Britain-Mortgage-Bank.html

FSA

reiterates Northern Rock solvent

Sat Sep 15,

2007

10:41pm BST

Reuters

LONDON

(Reuters) - The country's financial watchdog reiterated on Saturday that it

considers mortgage bank Northern Rock to be solvent and that problems customers

are facing in withdrawing money are not linked to its financial health.

Shares in Northern Rock plunged on Friday, and customers clamoured to withdraw

money, after the bank agreed an emergency loan from the Bank to cope with a lack

of liquidity and high interest rates in money markets.

"The FSA reiterates that it judges Northern Rock to be solvent and that savers

can continue to deposit and withdraw funds," the Financial Services Authority

(FSA) said in a statement.

"Clearly, there have been some operational problems with queues at some branches

and difficulties with the bank's website caused by the unusually high volumes of

customers trying to access their accounts as a result of the publicity

surrounding Northern Rock.

"These problems are entirely logistical and are in no way related to the bank's

solvency or its underlying ability to deliver funds to savers who wish to

withdraw."

FSA Chairman Callum McCarthy added: "To be absolutely clear, if we believed that

Northern Rock was not solvent, we would not have allowed it to remain open for

business."

FSA reiterates Northern Rock solvent, R, 16.9.2007,

http://uk.reuters.com/article/businessNews/idUKL1569711020070915

Customers besiege Northern Rock

Sat Sep 15,

2007

10:34pm BST

Reuters

By Peter Griffiths

LONDON

(Reuters) - Thousands of nervous customers queued for hours outside branches of

Northern Rock on Saturday desperate to withdraw savings after it was forced to

seek emergency funds to weather the global credit crunch.

Queues snaked round the block at branches of Britain's fifth-biggest mortgage

provider for a second day after customers were reported to have withdrawn one

billion pounds on Friday.

Thousands more jammed the bank's phonelines and Web site to try to get their

hands on their money, raising fears that a "run on the bank" could exacerbate

problems.

Despite assurances that their cash was safe, some customers said they had lost

confidence in Northern Rock after it went to Britain's central bank for

emergency funds.

One branch manager was forced to ring the police when a couple barricaded her in

her office after they were unable to withdraw one million pounds of savings,

according to a report in the Sun newspaper.

"Everything we have in our lives is in there," former hotel owner Fiona Howard

told the tabloid. "We would be left with nothing if it is lost."

'CONFIDENCE

IS SHATTERED'

Across the country, scores of customers queued from 6 a.m. to withdraw money

after the story was splashed across front pages under headlines such as "Panic

on the streets of Britain". Staff handed out leaflets saying "savings are safe".

"I just can't take the risk of there suddenly being an announcement that ...

there's been another problem and they've closed the bank," one customer told Sky

News. "I'm erring on the side of caution."

Another customer, Tony Looch, 68, told the BBC: "My confidence is shattered."

The chatrooms of financial Web site were abuzz with people complaining that they

couldn't log on to the bank's web site or get through on the phone.

"I've been trying to take out my savings all night!" one user wrote on

www.moneysupermarket.com.

Northern Rock is Britain's biggest casualty of a global financial crisis sparked

by default on U.S. mortgages.

It has been hit by banks' reluctance to lend as they hoard cash to cope with the

fallout from bad U.S. loans.

On Friday, the government said on Friday it had authorised the Bank of England

to provide an unspecified amount of liquidity to Northern Rock.

A spokesman for the bank refused to comment on the amount of withdrawals made.

The British Bankers' Association said people should "calm down".

"Northern Rock is a sound and safe bank and there is absolutely no reason for

either mortgage customers or savers to worry," it said in a statement.

Customers besiege Northern Rock, R, 15.9.2007,

http://uk.reuters.com/article/businessNews/idUKL154823020070915

Run on the bank

September

15, 2007

From The Times

Patrick Hosking, Christine Seib, Marcus Leroux and Grainne Gilmore

The jitters

plaguing financial markets spread to the high street for the first time

yesterday as thousands of panicking savers queued to withdraw millions of pounds

from Northern Rock, Britain’s eighth-biggest bank.

The rush to pull out savings followed the revelation that Northern Rock had been

forced to ask the Bank of England for a rescue injection of finance.

As crowds of customers demanded their money back, shares in Northern Rock

slumped by 31 per cent after it alerted shareholders to its difficulties, wiping

£900 million from its value. Shares in other financial institutions were also

hit, with Alliance & Leicester down 7 per cent and the specialist lender Paragon

Group down 17 per cent.

The Bank of England pledged to provide unspecified liquidity support to see

Northern Rock through the turbulence while it worked on an orderly resolution to

its problems. The bank is braced for a fresh surge of withdrawals from its 76

branches to-day and last night was planning to extend its opening hours.

Adam Applegarth, the chief executive, told The Times that he had ordered extra

deliveries of cash in expectation of the deluge.

The nerves were exacerbated yesterday when Northern Rock’s computer system

collapsed under the weight of online customers scrambling to transfer money out

of the bank. Savers were blocked from seeing details of their accounts,

including statements, when they tried to log in. A spokesman said accusations

that the bank had shut down its system to prevent a drain on its finances were

ridiculous.

Ministers, regulators and bankers tried to calm the panic by issuing reassuring

statements that customers’ deposits were safe. The Financial Services Authority,

which supervises banks, said that Northern Rock was solvent, exceeded its

regulatory capital requirement and had a good-quality loan book.

Alistair Darling, the Chancellor, who authorised the rescue, said: “At the

moment there is plenty of money in the system, the banks have got money . . .

they are simply not lending in the short-term way that institutions like

Northern Rock need.”

Sentiment soured further amid fresh evidence that house prices were starting to

fall. Rightmove, the online property site, reported that asking prices slumped

by 2.6 per cent last month. That followed a report by the Royal Institution of

Chartered Surveyors showing the first fall in house prices in nearly two years.

Northern Rock customers fearing for their savings filled branches across the

country, with some queues stretching down

the street. At one London branch, customers queued for more than an hour.

Wil-liam Gough, 75, said he did not believe the bank’s assurances that his

savings were safe. “They’re telling us not to worry, but we’ve heard it before,

with Marconi,” he said, referring to the collapse of the telecoms firm in 2002.

Another saver, Gary Diamond, said: “I don’t want to be the mug left without my

savings.”

Another customer, an elderly woman, said that she could not afford to take any

chances. “It’s my life savings we’re talking about, my pension. I’ll have

nothing left if they go under.”

A retired hotelier and his wife barricaded the Cheltenham branch manager in her

office after being told that they could not withdraw £1 million savings without

notice. The situation was resolved only when police officers arrived to calm the

couple down.

The British Bankers’ Association said: “Everyone should calm down and refrain

from making simplistic comments in a very complex area which just causes

unnecessary worry and concern. Northern Rock is a sound and safe bank and there

is absolutely no reason for either mortgage customers or savers to worry.” It is

the first time that the “lender of last resort” facility has been used since the

Bank of England set up the present system in 1998. Other banks, including

Barclays, have called on the Bank of England for overnight funding in recent

weeks, but using the lender-of-last-resort facility is regarded as a much more

serious step.

Sources at the Bank emphasised that Northern Rock would pay a penal rate of

interest on any borrowings and would have to lodge assets as security.

Many financial institutions have been hit by a sudden shortage of cash and other

liquid assets as banks hoard money in anticipation of having to provide finance

to complex investment vehicles. Triggered initally by defaults by poor Americans

struggling to meet increased mortgage bills, the problem has spread.

Northern Rock has been hit particularly badly because it relies much more on

funding from wholesale investors, who have been paralysed by the credit crunch,

rather than ordinary depositors. But it also risks being accused of

overaggressive lending after lifting new loans by 43 per cent in the first eight

months of 2007.

Around 85 per cent, or £24.7 billion, of Northern Rock’s business comes through

mortgage brokers. National Savings & Investments, the govern-ment-backed savings

institution, said that it saw a 20 per cent jump in the number of inquiries

yesterday, the majority from Northern Rock savers.

Northern Rock has around £24 billion of customer deposits, though some of the

money is locked up for months in long-term accounts. It said yesterday that it

still expected to make an underlying profit of £500-540 million this year.

Run on the bank, Ts, 15.9.2007,

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article2457009.ece

Between

Rock and a hard place

- savers besiege bank

· Fears of

property crash as lending squeezed

· Northern Rock shares drop 30% after rescue

· Bank websites down as customers panic

Saturday

September 15, 2007

Guardian

Larry Elliott and Ashley Seager

Branches of Northern Rock were besieged by savers yesterday as fears grew in the

City that the Bank of England rescue package for Britain's fifth-biggest

mortgage lender could herald a slide in house prices and further financial

collapses.

Amid news

that property prices were already falling sharply before the Bank's first use of

its lender-of-last-resort facility in more than 30 years, the Newcastle-based

Northern Rock was forced to keep branches open late to allow savers access to

their money. By last night it was reported a total of £1bn had been withdrawn.

Customers ignored reassurances from the chancellor, Alistair Darling, the

British Bankers Association and Northern Rock itself that funds were safe.

In the first real test of internet banking, websites at Northern Rock and many

other banks crashed as savers tried to access their accounts. Police had to be

called to a branch in Cheltenham, Gloucestershire, when a couple barricaded the

manager in her office when she refused to let them withdraw their £1m savings.

Shares in Northern Rock fell more than 30% yesterday, dragging the stock market

down. With speculation other mortgage lenders were at risk, the FTSE 100 index

closed down more than 1%. A sharp drop in shares of buy-to-let lender Paragon

Mortgages made it issue a statement that it had no need to resort to the Bank of

England, while Bradford & Bingley and Alliance & Leicester denied they had

problems.

"I'm sure there are more to come. Northern Rock was the biggest in terms of size

but it's not going to be the only one to go. It's not the only one using that

business mode," a City source said, adding that the economy would slow in coming

months as lenders tightened their loan criteria and house prices came under

pressure.

Property website Rightmove reported asking prices across the country had fallen

2.6% since August, and the London market suffered its first drop in asking

prices in three years.

Julian Jessop, an analyst with Capital Economics, said the formal announcement

yesterday that the Bank of England offered Northern Rock unlimited funds at a

penal rate of interest showed that what had been a credit crunch was now "a good

old-fashioned bank run". Senior City sources said questions were being asked

whether the Financial Services Authority, the City's watchdog, should have

detected the bank's problems earlier.

Northern Rock is now seen as a £2bn takeover target after the credit crunch

prompted by the US sub-prime mortgage crisis left it unable to raise funds in

the money markets. Barclays and National Australia Bank, which owns the

Clydesdale Bank and Yorkshire Bank, were last night being tipped as potential

bidders.

Northern Rock was heavily exposed to the turmoil in the global markets because

it borrowed 80% of its funds from wholesale money markets, which have dried up

in recent weeks. It expanded aggressively in the first half of the year, writing

one in four new mortgages, and would lend first-time buyers many times their

salary.

Adam Applegarth, chief executive of Northern Rock, said: "We can't see the end

of this. We don't know how long it will last. We decided we had to move earlier

rather than later. There was no point sitting around like Mr Micawber waiting

for something to turn up."

Mr Darling said Britain's economy and its banking system remained strong.

"Northern Rock is the only institution that has come to the Bank of England,"

the chancellor said. "At the moment there is plenty of money in the system, the

banks have got money...they are simply not lending in the short-term way that

institutions like Northern Rock need."

Between Rock and a hard place - savers besiege bank, G,

15.9.2007,

http://business.guardian.co.uk/markets/story/0,,2169786,00.html

Confidence in Northern Rock collapses

Published:

September 14 2007

08:57

Last updated: September 14 2007

16:25

The Financial Times

By Chris Hughes in London

Fears about

the future of Northern Rock grew on Friday as shares in the Newcastle-based

lender slumped and customers lined up to withdraw funds.

The mortgage lender said in a statement on Friday that the Bank of England had

agreed to provide it with as much funding “as may be necessary” as it warned

that it would otherwise be incapable of refinancing maturing liabilities and

flagged that full-year profits would be 20 per cent below consensus forecasts.

The Newcastle-based bank said that a severe liquidity squeeze in the wholesale

markets had left it able to raise funds only in the short-term wholesale

markets, and in insufficient quantities to refinance maturing liabilities and to

write business at previous levels.

“Northern Rock has agreed with the Bank of England that it can raise such

amounts of liquidity as may be necessary by either borrowing on a secured basis

from the Bank of England or entering into repurchase facilities with the Bank of

England,” it said. “This additional source of funding will enable Northern Rock

to adapt its business model in line with the developing market conditions.”

Confirmation that the Bank had thrown Northern Rock a lifeline unnerved

investors and sent Northern Rock shares tumbling 30 per cent. By late afternoon

the shares were down 201¾p or 31.6 per cent at 437¼p.

Shares in Paragon Group, a specialist buy-to-let lender, slumped nearly 20 per

cent and housebuilders were also caught up in the sell-off worries about a

broader housing market slowdown spread.

The unprecendented move by the Bank of England, which was approved by the

Chancellor of the Exchequer, is the most dramatic illustration to date of how

the British banking sector is being hit by the wave of turmoil that has

paralysed the money markets.

Northern Rock is the first institution to be propped up since the Bank, in 1998,

revised the rules under which it will act as a lender of last resort to banks in

financial difficulty.

The bank said it had not used the facility yet and did not disclose the

financial terms for the loan.

But Adam Applegarth, the chief executive, remained confident the bank, which has

£24.35bn of deposits, would continue to trade.

“The support of the Bank of England through this facility reflects a recognition

that Northern Rock is solvent, exceeds its regulatory capital requirement and

has a good quality loan book,” said Adam Applegarth, the chief executive.

However, the bank said underlying pre-tax profits this year would be £500m to

£540m, down from £588m last year and versus market expectations of £647m. Total

loan growth for the year would be 9 per cent, even though net lending was up 43

per cent in the first 8 months of 2007.

The dire warning sent Northern Rock shares tumbling in opening trade. The shares

fell as low as 491p, 23 per cent below Thursday’s closing price and at levels

not seen since 2001.

The size of the funding was limited by the collateral that Northern Rock could

provide, which was mainly prime residential mortgage assets. The bank likened

the facility to emergency lending available to Eurozone banks from the European

Central Bank.

Mr Applegarth said the company had slowed down its lending in response to the

severe tightening of credit conditions that started on August 9.

The bank had initiated a recruitment freeze and cost growth would be only 3 per

cent this year.

Mr Applegarth declined to outline how the company planned to develop its

business model, saying only that the funding from the Bank was conditional on

demonstrating “a sound business plan” and that the board was aware of its

fiduciary duty to shareholders in respect of any possible takeover approaches.

“We are trying to guess what 2008 will look like. It will be a different

Northern Rock. We will evolve to adapt to market conditions,” he said. “The

market will thaw, the question no one can answer is when.”

Mr Applegarth also moved to calm Northern Rock’s customers saying that with the

backing of the Bank, the company was probably “the safest place to invest”.

“Customers should be greatly reassured,” he said. “These facilities are only

provided to companies with a sound future.”

But he warned that the mortgage market would see higher pricing in future. The

outlook for 2008, however was hard to predict, he said.

The political reaction to the news was led by Alistair Darling, chancellor of

the exchequer, who confirmed that Northern Rock was the only bank that had

sought to use the Bank’s emergency facility.

“”Northern Rock is the only institution that has come to the Bank of England,”

Mr Darling told Radio 4’s Today programme.

He pointed the finger of blame for the current crisis in the credit market at US

lenders.

”Perhaps if someone in America had looked more closely at who they were lending

to... perhaps some of these problems would have been avoided,” he said.

Northern Rock revealed that it had £325m invested in so-called structured

investment vehicles, off-balance sheet schemes that debt investors have baulked

at refinancing over the summer.

Mr Applegarth said the bank had invested in the SIVs as part of a balanced

portfolio investment approach and urged other banks to reveal their exposures.

Northern Rock did not have an off-balance sheet conduit – vehicles similar to

SIVs but run purely for banks – and did not invest in asset-backed commercial

paper.