|

History > 2007 > USA > Economy (IV)

Andy Singer

NO EXIT

Cagle

31 October 2007

White House Issues

Upbeat Economic Forecast

November 29, 2007

The New York Times

By EDMUND L. ANDREWS

WASHINGTON, Nov. 29 — The White House issued an economic

forecast today that calls for “solid growth” through next year, a prediction

that is more optimistic than that of the Federal Reserve and far more optimistic

than those of many analysts on Wall Street.

The administration predicted that the economy will expand by 2.7 percent in

2008, that unemployment would remain below 5 percent and that the outlook would

be even better in 2009. By contrast, Fed officials are predicting “subpar”

growth through next year, starting with a sharp slowdown over the next six

months. The “central tendency” of forecasts by Fed policy makers is for growth

to slow to between 1.8 percent and 2.5 percent next year.

The White House was closer to the Fed on its estimate about unemployment,

predicting that it would average 4.9 percent next year — up only slightly from

4.7 percent. But many analysts think the Fed’s unemployment forecast is itself

too optimistic, because it is inconsistent with its forecast for slower growth.

“We are forecasting solid growth for 2008 of 2.7 percent, and that is good solid

growth,” said Edward Lazear, chairman of the White House Council of Economic

Advisers, in a conference call with reporters. He said the healthy growth was

“especially significant,” given that the administration expects the housing

market to be a drag on the overall economy throughout next years.

The administration did reduce its forecast for growth next year by about

four-tenths of a percentage point. Mr. Lazear said the downward revision

reflected the unexpectedly steep drop in the housing market as well as earlier

downward revisions of growth in previous years.

“Obviously the housing market has been softer than people expected,” he said.

“We are not the only ones who were surprised by that. For the most part, our

revisions are in line with other revisions.”

White House Issues

Upbeat Economic Forecast, NYT, 29.11.2007,

http://www.nytimes.com/2007/11/29/business/29cnd-forecast.html

U.S. Says China Agrees

to End Some Subsidies

November 29, 2007

The New York Times

By STEVEN R. WEISMAN

WASHINGTON, Nov. 29 — Bowing to American pressure on the eve

of high-level talks to reduce economic tensions, China agreed today to end a

dozen subsidies that promote exports and discourage imports of steel, wood

products, information technology and other manufactured goods.

The Chinese actions affect exports by companies that have foreign investment or

are joint ventures with foreign companies. Nearly 60 percent of Chinese exports

are produced by these companies.

While the intent is to help American companies compete against China, some of

the loss of subsidies would be borne by companies that export goods to the

United States and owned at least in part by Americans.

Susan C. Schwab, the United States trade representative, announced the agreement

by China, signed earlier in the day at the World Trade Organization in Geneva.

She hailed the action as “a victory for U.S. manufacturers, producers and

workers” and a vindication of using negotiations to resolve trade disputes.

Ms. Schwab said she could not identify any names of American or other companies

affected by the new agreement without their permission.

The agreement came only two weeks before Ms. Schwab is to join Treasury

Secretary Henry M. Paulson Jr. and other Cabinet members for a high-level

meeting of the “strategic economic dialogue” with China that Mr. Paulson

launched last year to reduce tensions with China.

The dialogue is aimed at resolving tensions that have mounted along with the

trade deficit, which soared to $232 billion last year and is likely to go

significantly higher this year.

Ms. Schwab said there was no immediate information on how many exports would be

affected, in part because China was eliminating a set of 12 different subsidy

and loan laws on its books, and it was not clear how many companies had actually

taken advantage of them.

The agreement by China left intact other subsidies of exports that the United

States is still challenging in certain kinds of steel products, heavy-duty

tires, paper and chemicals. These challenges are to subsidies and government

assistance that American laws deem unfair and subject to duties imposed on

imports.

Also unresolved are American complaints that China is using regulations and

other practices to favor exports and discourage imports on a broad array of

manufactured goods, as well as separate complaints that China has done little to

crack down on piracy and counterfeit goods of software, videos and consumer

products.

Nor does it affect the principal complaint that the Chinese are keeping the

value of their currency, the yuan, artificially low to promote exports.

The Chinese have been irate over American actions challenging their economic

practices at the World Trade Organization, and this has aggravated efforts to

resolve the disputes through negotiations.

But Ms. Schwab said the agreement on subsidies today vindicated the

administration’s approach of using negotiation to resolve disputes, and to

oppose punitive legislation that is pending in Congress.

U.S. Says China

Agrees to End Some Subsidies, NYT, 29.11.2007,

http://www.nytimes.com/2007/11/29/business/worldbusiness/29cnd-trade.html?hp

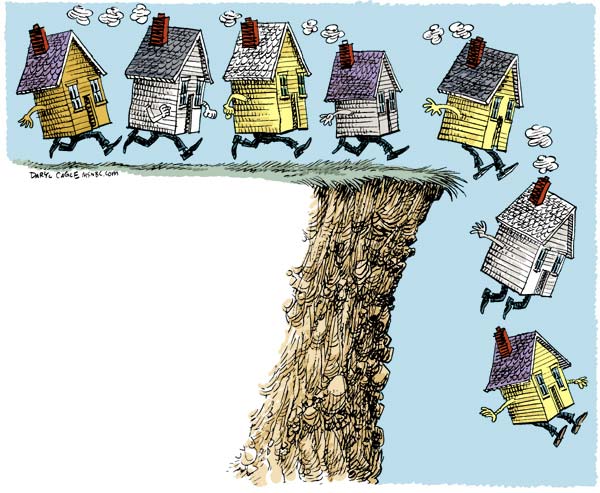

Daryl Cagle MSNBC.com

Cagle 29 November 2007

U.S. says home prices are falling,

first time in 13 years

29 November 2007

By Marcy Gordon, AP Business Writer

USA Today

WASHINGTON — U.S. home prices marked a quarterly decline for

the first time in 13 years in the third quarter, according to government data

released Thursday that provide fresh evidence of the housing market slump.

Home prices dipped 0.4% nationwide in the July-September

period, compared with the previous quarter, the Office of Federal Housing

Enterprise Oversight said.

Compared with the third quarter of 2006, U.S home prices

posted an increase of 1.8%, but it was the smallest year-over-year increase

since 1995, according to the agency, which oversees the big mortgage-finance

companies Fannie Mae and Freddie Mac.

"While select markets still maintain robust rates of appreciation, our newest

data show price weakening in a very significant portion of the country," agency

director James Lockhart said in a statement. Prices declined in more than 20

states, he said.

According to OFHEO's data, many of the cities and states experiencing the

sharpest declines in the quarter were the same areas that had posted the

sharpest increases a couple of years ago during the housing boom.

Price declines were steepest in California (down 3.6%), Massachusetts (2.3%),

Michigan (3.7%), Nevada (2.4%) and Rhode Island (2.2%).

"Rising inventories of for-sale properties are clearly having a material impact

on home prices," said Patrick Lawler, the agency's chief economist.

U.S. says home prices

are falling, first time in 13 years, UT, 29.11.2007,

http://www.usatoday.com/money/economy/housing/2007-11-29-ofheo-q3_N.htm

US Foreclosure Filings Up in October

November 29, 2007

Filed at 11:52 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

LOS ANGELES (AP) -- U.S. foreclosure filings nearly doubled in

October from the same month last year, the latest sign many homeowners are

falling behind on mortgage payments and increasingly losing their homes,

according to a mortgage research company.

A total of 224,451 foreclosure filings were reported in October, up 94 percent

from 115,568 in the same month a year ago, Irvine-based RealtyTrac Inc. said

Thursday.

The number of filings in October rose 2 percent from September's 223,538.

The U.S. had one foreclosure filing for every 555 households in October,

RealtyTrac said.

The filings include default notices, auction sale notices and bank

repossessions. Some properties might have received more than one notice if the

owners have multiple mortgages.

In all, 45 states saw an increase in foreclosure filings over last year.

While the number of filings is still up year-over-year, it has leveled off in

the last two months after hitting a high for the year in August.

Efforts by lenders under pressure to modify loan terms for at-risk borrowers

could explain the slower sequential increase in filings, but the trend is likely

more a result of a lag in filings after interest rate changes on adjustable-rate

mortgages, said Rick Sharga, RealtyTrac's vice president for marketing.

''What we probably did was come out of a reset cycle, but (the filings) have

leveled off at a much higher level than before we got this point,'' Sharga said.

It typically takes two to three months after a rate reset before a borrower who

fails to make payments is considered in default.

Tighter lending standards and the ongoing housing slump are making it harder for

homeowners who can't afford their mortgage payments to sell their homes or

refinance.

Many homeowners with adjustable-rate mortgages are also facing steep monthly

payment hikes. Experts estimate some 2 million of the loans are due to reset at

higher rates in the next eight months, which could lead to more foreclosures.

One alarming trend in October was an increase in the number of homes that were

repossessed by lenders after they failed to sell at trustee auctions.

''About 35 percent of the total filings we collected this month were notices of

bank repossession,'' Sharga said. ''Historically, on average, that number is

more like 20 percent.''

That means more borrowers who entered foreclosure ended up losing their homes.

The trend was particularly evident in Ohio, where 45 percent of all foreclosure

filings during the month were notices of bank repossessions. The repossessions

represented 46 percent of all filings in Missouri and 37 percent in Michigan.

Economic woes and job losses have exacerbated the housing slump in the Midwest.

Nevada, California, Florida and Ohio had the highest foreclosure filing rates in

the country last month, RealtyTrac said.

Nevada reported one foreclosure filing for every 154 households, earning the

state the highest rate in the nation for the 10th month in a row. The state had

6,618 filings in October, up 20 percent from September and nearly triple from

October 2006.

California's rate was one filing for every 258 households. The state reported

the most foreclosure filings of any single state with 50,401, down 2 percent

from September but more than triple the number from October of last year.

The state's foreclosures were primarily driven by adjustable mortgages resetting

to sharply higher monthly payments, RealtyTrac said.

Florida had one foreclosure filing for every 273 households. The state reported

30,190 foreclosure filings last month, down more than 9 percent from September,

but up nearly 165 percent from October 2006's total.

Ohio reported one foreclosure filing for every 290 households. The state had

17,276 filings last month, up nearly 10 percent from September and 136 percent

from October 2006.

Rounding out the states with the top 10 foreclosure filing rates in October were

Georgia, Michigan, Colorado, Arizona, Indiana and Illinois.

------

On the Net:

RealtyTrac Inc.: http://www.realtytrac.com

US Foreclosure

Filings Up in October, NYT, 29.11.2007,

http://www.nytimes.com/aponline/us/AP-Foreclosure-Rates.html

White House Lowers

'08 Economic Forecast

November 29, 2007

Filed at 11:42 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) --The White House on Thursday lowered its

forecast for economic growth for next year and said unemployment will likely

rise as the housing slump and tight credit stunt business expansion.

Under the administration's new forecast, gross domestic product, or GDP, will

grow by 2.7 percent next year. Its old projection called for a stronger, 3.1

percent increase.

''The housing market decline has been more significant that we expected,''

Edward Lazear, chairman of the White House's Council of Economic Advisers, told

reporters in a conference call. That more pronounced housing slump -- along with

the expectation that problems will persist into next year -- was a big factor in

the administration's downgrade of its economic growth forecast for 2008.

With the projection of slowing economic growth, the unemployment rate is

projected to move up to 4.9 percent next year. That's up from a previous

forecast of a 4.7 percent jobless rate but still would be considered fairly low

by historical standards. The unemployment rate last year dipped to 4.6 percent,

a six-year low.

Inflation, however, should improve. The White House expects consumer prices to

increase by 2.1 percent next year, a moderation from a previous forecast of a

2.5 percent rise. That's encouraging news as oil prices have marched past $92 a

barrel.

''While the difficulties in housing and credit markets and the effects of high

energy prices will extract a penalty from growth, the U.S. economy has many

strengths, and I expect the expansion to continue,'' said Treasury Secretary

Henry Paulson.

The odds of a recession have grown this year. But the Bush administration,

Federal Reserve officials and others remain hopeful that one can be avoided.

The big worry for economists is that consumers and businesses will cut back on

spending and investing, sending the economic growth into a tailspin. Spending by

consumers and businesses is the lifeblood of the country's economic activity.

The White House's economic forecasts are issued twice a year. The projections

were developed mainly by a team from the Council of Economic Advisers, the

Treasury Department and the Office of Management and Budget. The

administration's projections are in line with those offered by private analysts.

White House Lowers

'08 Economic Forecast, NYT, 29.11.2007,

http://www.nytimes.com/aponline/us/AP-Bush-Economic-Forecast.html

Op-Ed Contributor

Penny Foolish

November 29, 2007

The New York Times

By ERIC SCHLOSSER

THE migrant farm workers who harvest tomatoes in South Florida

have one of the nation’s most backbreaking jobs. For 10 to 12 hours a day, they

pick tomatoes by hand, earning a piece-rate of about 45 cents for every 32-pound

bucket. During a typical day each migrant picks, carries and unloads two tons of

tomatoes. For their efforts, this holiday season many of them are about to get a

40 percent pay cut.

Florida’s tomato growers have long faced pressure to reduce operating costs; one

way to do that is to keep migrant wages as low as possible. Although some of the

pressure has come from increased competition with Mexican growers, most of it

has been forcefully applied by the largest purchaser of Florida tomatoes:

American fast food chains that want millions of pounds of cheap tomatoes as a

garnish for their hamburgers, tacos and salads.

In 2005, Florida tomato pickers gained their first significant pay raise since

the late 1970s when Taco Bell ended a consumer boycott by agreeing to pay an

extra penny per pound for its tomatoes, with the extra cent going directly to

the farm workers. Last April, McDonald’s agreed to a similar arrangement,

increasing the wages of its tomato pickers to about 77 cents per bucket. But

Burger King, whose headquarters are in Florida, has adamantly refused to pay the

extra penny — and its refusal has encouraged tomato growers to cancel the deals

already struck with Taco Bell and McDonald’s.

This month the Florida Tomato Growers Exchange, representing 90 percent of the

state’s growers, announced that it will not allow any of its members to collect

the extra penny for farm workers. Reggie Brown, the executive vice president of

the group, described the surcharge for poor migrants as “pretty much near

un-American.”

Migrant farm laborers have long been among America’s most impoverished workers.

Perhaps 80 percent of the migrants in Florida are illegal immigrants and thus

especially vulnerable to abuse. During the past decade, the United States

Justice Department has prosecuted half a dozen cases of slavery among farm

workers in Florida. Migrants have been driven into debt, forced to work for

nothing and kept in chained trailers at night. The Coalition of Immokalee

Workers — a farm worker alliance based in Immokalee, Fla. — has done a heroic

job improving the lives of migrants in the state, investigating slavery cases

and negotiating the penny-per-pound surcharge with fast food chains.

Now the Florida Tomato Growers Exchange has threatened a fine of $100,000 for

any grower who accepts an extra penny per pound for migrant wages. The

organization claims that such a surcharge would violate “federal and state laws

related to antitrust, labor and racketeering.” It has not explained how that

extra penny would break those laws; nor has it explained why other surcharges

routinely imposed by the growers (for things like higher fuel costs) are

perfectly legal.

The prominent role that Burger King has played in rescinding the pay raise

offers a spectacle of yuletide greed worthy of Charles Dickens. Burger King has

justified its behavior by claiming that it has no control over the labor

practices of its suppliers. “Florida growers have a right to run their

businesses how they see fit,” a Burger King spokesman told The St. Petersburg

Times.

Yet the company has adopted a far more activist approach when the issue is the

well-being of livestock. In March, Burger King announced strict new rules on how

its meatpacking suppliers should treat chickens and hogs. As for human rights

abuses, Burger King has suggested that if the poor farm workers of southern

Florida need more money, they should apply for jobs at its restaurants.

Three private equity firms — Bain Capital, the Texas Pacific Group and Goldman

Sachs Capital Partners — control most of Burger King’s stock. Last year, the

chief executive of Goldman Sachs, Lloyd C. Blankfein, earned the largest annual

bonus in Wall Street history, and this year he stands to receive an even larger

one. Goldman Sachs has served its investors well lately, avoiding the subprime

mortgage meltdown and, according to Business Week, doubling the value of its

Burger King investment within three years.

Telling Burger King to pay an extra penny for tomatoes and provide a decent wage

to migrant workers would hardly bankrupt the company. Indeed, it would cost

Burger King only $250,000 a year. At Goldman Sachs, that sort of money shouldn’t

be too hard to find. In 2006, the bonuses of the top 12 Goldman Sachs executives

exceeded $200 million — more than twice as much money as all of the roughly

10,000 tomato pickers in southern Florida earned that year. Now Mr. Blankfein

should find a way to share some of his company’s good fortune with the workers

at the bottom of the food chain.

Eric Schlosser is the author of “Fast Food Nation” and “Reefer Madness.”

Penny Foolish, NYT,

29.11.2007,

http://www.nytimes.com/2007/11/29/opinion/29schlosser.html

Editorial

Spreading the Misery

November 29, 2007

The New York Times

The nation’s foreclosure crisis is metastasizing, and

communities are in harm’s way as property values and tax bases decline and crime

increases.

In the third quarter, there were 635,000 foreclosure filings, a 30 percent

increase from the previous quarter and nearly double from a year ago, according

to RealtyTrac, a national real estate information service. That works out to one

for every 196 households. Michigan and Ohio, which were hit early and hard by a

combination of economic weakness and reckless lending, continue to reel.

Foreclosures rose last year in Colorado, Georgia and Texas and are now surging

in California, Nevada, Arizona and Florida. In those states unsustainable

mortgages are at the root of the problem.

The Bush administration has been far too slow to respond, with some officials

apparently worried that helping today’s troubled borrowers might encourage

future borrowers to take on too much debt. That misses a critical point: much of

this crisis can be traced to lenders’ failure to vet borrowers and the

government’s failure to regulate the industry. And it misses an even bigger

point: unless something is done quickly, whole communities, not just people who

lose their homes, will suffer.

Foreclosed properties damage the value of nearby homes and the tax bases of

municipalities. There is also a strong correlation between foreclosures and

crime. For every one percentage point increase in a neighborhood’s foreclosure

rate, violent crime rises 2.3 percent, according to a recent study by Dan

Immergluck of the Georgia Institute of Technology and Geoff Smith of Woodstock

Institute, a research and advocacy organization in Chicago.

Reports from Cleveland, Atlanta and the sprawl around Los Angeles and Sacramento

— from low-income city neighborhoods to middle-class suburbs — all tell a

similar story: when vacancies appear, so do looters, vagrants, prostitutes and

drug dealers. In Cleveland’s inner city, it takes 72 hours for a vacated house

to be looted, a community activist told CNN recently, with lootings often

followed by violent crime. In the suburbs, the descent may be slower, beginning

with graffiti and vandalism and moving to gang activity and other crime.

Police departments may not be able to keep up, in part because foreclosures are

projected to strain municipal budgets. Neighborhood watch groups are quickly

overwhelmed. The United States Conference of Mayors met this week to discuss the

impact of foreclosures. Based on the mayors’ experience, their estimates of the

number of coming foreclosures, and the damage inflicted on community life, were

grimmer than projections from the federal government and the housing industry.

The question is whether their concerns will be heeded.

As more foreclosures take their toll, the need becomes ever more obvious for a

comprehensive, national effort to avert evictions. Last week, Treasury Secretary

Henry Paulson Jr. wisely shifted his position on loan modifications, endorsing

the idea that some at-risk loans should be modified en masse rather than on an

inefficient one-by-one basis. If Mr. Paulson backs up his new stance with a plan

of action, the socio-economic costs of foreclosures may yet be contained.

Spreading the Misery,

NYT, 29.11.2007,

http://www.nytimes.com/2007/11/29/opinion/29thu1.html

Lenders’ Belt-Tightening

Stifles Growth in Economy

November 29, 2007

The New York Times

By PETER S. GOODMAN

Credit flowing to American companies is drying up at a pace

not seen in decades, threatening the creation of jobs and the expansion of

businesses, while intensifying worries that the economy may be headed for

recession.

The combined value of two leading sources of credit — outstanding commercial and

industrial bank loans, and short-term loans known as commercial paper — peaked

at about $3.3 trillion in August, according to data from the Federal Reserve. By

mid-November, such credit was down to $3 trillion, a drop of nearly 9 percent.

Not once in the years since the Fed began tracking such numbers in 1973 has this

artery of finance constricted so rapidly. Smaller declines preceded three

recessions going back to 1975; at other times such declines tended to occur in

conjunction with an economic downturn.

Policy makers at the Federal Reserve are growing increasingly alarmed about the

problem, which is an outgrowth of the woes of the housing and mortgage

industries. Just yesterday, the Fed’s vice chairman, Donald L. Kohn, said that

the latest market turbulence appeared to be reducing credit to businesses and

consumers, hinting that the central bank, in response, was prepared to cut

interest rates further.

Mr. Kohn’s unexpected pledge that the Fed would pursue “flexible and pragmatic

policy making” that might help counter the trend and shore up the economy

spurred a rally on Wall Street that sent stocks soaring. The Dow Jones

industrial average jumped 331 points, to 13,289.45, while the broader Standard &

Poor’s 500 index climbed 2.86 percent, to 1,469.02.

For now, though, the situation is looking bleaker for many businesses. Already,

companies in everything from furniture manufacturing to Web site design are

tightening their belts, delaying expansion and scrambling for other sources of

cash.

“This is a very big deal,” said Andrew Tilton, a senior economist in the United

States Economic Research Group at Goldman Sachs. “You’re basically crimping the

growth of the more vulnerable companies. If they can’t borrow the money, their

options are much more limited. They’d have to have less ambitious hiring plans,

buy less machinery and cancel projects.”

Two years ago, in what now seems like another era, Carmen Murray easily borrowed

$100,000 from a local bank to finance her company, Rodeo Carpet Mills, which

makes high-end rugs in an industrial stretch near Los Angeles. Getting a check

was as simple as returning a mass-mailed flier.

Today, Ms. Murray is seeking a fresh loan from the bank to finance an expansion

to supply Las Vegas hotels with floor coverings. She needs new machinery and 15

more workers, bringing the total work force to 45. If she manages to get the

money, it will not come easily.

“They want this; they want that,” Ms. Murray sighed. “I got the sense that I

have to start all over again. They need to know who I am and all about my

business.”

A survey of bank loan officers conducted by the Federal Reserve in October found

that about one-fifth of lenders had tightened lending requirements for

commercial and industrial loans for large and midsize businesses over the

previous three months. A slightly smaller proportion reported tightening lending

to small companies.

By themselves, commercial bank loans have actually surged: large companies have

tapped prearranged lines of credit to weather the financial chaos that has

accompanied the unraveling of the American real estate market.

But this source of finance has been nowhere near enough to compensate for the

virtual shutdown of the short-term commercial paper market. Much of this debt

had been pledged against the value of mortgages, making them effectively

radioactive in markets around the globe.

In recent years, a lot of commercial lending was inspired by an upward spiral of

enrichment: banks made new loans, then swiftly sold them off for profit, using

the proceeds to extend still more. But with much of the financial world unnerved

by the mortgage meltdown, buyers for commercial loans are scarce.

“Since the resale market went away, major banks have had much less availability

to make loans,” said Mark A. Sunshine, president of First Capital, a private

commercial lender. “Absolutely, credit is much less available.”

Some of the drop reflects the subsiding in the run of mergers, diminishing the

demand for credit by companies buying other companies. Some can be explained by

what many economists view as a healthy return to the skeptical scrutinizing of

prospective borrowers by banks. But lenders and borrowers from northern Virginia

to southern Arizona confirm that the credit tightening has already begun to cut

money reaching healthy companies as well, affecting their spending and hiring.

What loans are being extended are going primarily to companies with longstanding

relationships with banks. Lenders are reluctant to bet their increasingly scarce

capital on riskier, less-established companies in a time of economic anxiety.

That leaves many of those companies on a limb.

“Small businesses are just inherently more risky, and banks are going to be more

conservative in protecting their assets,” said Jody Keenan, who chairs the board

of the Association of Small Business Development Centers in Burke, Va. “We’re

starting to see a tightening already, particularly for very small companies.

We’re talking about real impacts in local communities.”

A slowdown among smaller companies could be especially costly to the economy in

terms of jobs. More than half of American jobs are at companies with fewer than

100 workers, according to Moody’s Economy.com.

In recent months, smaller companies have been adding jobs even as larger firms

have been shedding workers, according to the ADP National Employment Report,

which tracks changes at companies with payrolls overseen by ADP. From May to

October, 276,000 of the 378,000 jobs added were at companies with fewer than 50

employees, the report found.

To be sure, the strongest companies with property to put up as collateral and

years of profits they can point to are still able to borrow, often at

increasingly favorable terms.

The downturn in the housing market has made banks reluctant to sink money into

anything related to real estate, from title companies to bathroom tile

manufacturers.

But lenders have sought refuge in more vibrant areas — notably agriculture,

which has benefited from the rise in global demand and the sudden boom in

ethanol production.

Richard Brown, president and chief executive of the Krause Corporation, which

makes soil-tilling equipment at its factory in Hutchinson, Kan., relies upon

lines of credit from banks to smooth out the seasonal nature of the business.

Though it sells its products mostly in the spring and fall, the company must

make them year-round.

Mr. Brown said banks had been calling him relentlessly to offer new loans.

“They’re trying to maintain their business and get past the subprime debacle,

and where can they go?” Mr. Brown said. “Agriculture in this country is very

strong.”

But in other parts of the economy, notably the auto industry, access to credit

has tightened considerably, as banks steer their limited capital away from

companies with declining sales.

A year ago, when he needed new machinery, Doyle Hayes, president and chief

executive of Pyper Products, an auto parts maker in Battle Creek, Mich., went

back to the local branch of Comerica bank, where he has been doing business for

years. He borrowed $300,000.

Last week, when Mr. Hayes needed $140,000 for a new robot, he did not even

bother to inquire at the bank. “We knew what the answer was going to be,” he

said, meaning the bank would have turned him down. “When the auto industry goes

down, anything that has four wheels becomes suspect.”

Still, Mr. Hayes did not put off the purchase. “You can’t save yourself into

prosperity,” he said. He managed to borrow the money instead from Battle Creek

Unlimited, a nonprofit economic development arm of the city.

In Arizona, Dennis Long, president of Enterprise Resource Group, which manages

computer networks for businesses in the Phoenix area, is keen to expand,

particularly by picking up work from the federal government. But that requires

hiring a sales representative, and he lacks the capital to go beyond his

$100,000 line of credit from Wells Fargo Bank.

“The bank says we’re maxed out,” Mr. Long complained. “It just seems like before

they were a little more ‘Let me see what I can do,’ where today I just get

‘no.’”

In Los Angeles, Ms. Murray, too, has grown accustomed to a less-than-exuberant

reception from the bank. Having started at the rug factory as a receptionist

some 25 years ago, she now owns the company. A Mexican-American entrepreneur,

she hopes to capture contracts that are set aside for minority-controlled

companies.

She may eventually try an alternative source of finance aimed at small lenders,

with the state guaranteeing her loan. Curiously, at one such institution in Los

Angeles, Pacific Coast Regional Small Business Development Corporation, the

volume of lending has slowed considerably in recent months, said Mark Robertson,

the firm’s president and chief executive.

It may be that the effects of the credit tightening are still unfolding, he

suggested. Eventually, a parade of would-be borrowers may show up at his door.

His business tends to move in the opposite direction of the economy: when times

are bad, more people need help to qualify for a loan. Perhaps things just have

not gotten bad enough.

But Mr. Robertson thinks another factor may be at play. Business prospects are

so uncertain that smaller entrepreneurs have lost their nerve for risk.

“Any business owner that is experiencing less traffic to their establishment is

not willing to take on more debt,” Mr. Robertson said. “Everybody has kind of a

wait-and-see, hold-off sort of attitude.”

Floyd Norris and Eric Dash contributed reporting.

Lenders’

Belt-Tightening Stifles Growth in Economy, NYT, 29.11.2007,

http://www.nytimes.com/2007/11/29/business/29lend.html?hp

Stocks Soar

on Signal of ‘Flexible’ Fed Policy

November 28, 2007

The New York Times

By MICHAEL M. GRYNBAUM

A top Federal Reserve official appeared to open the door this

morning for additional interest rate cuts, pledging to follow “flexible and

pragmatic policy making” as the central bank decides how to cope with the

current financial crisis.

Stock markets soared on investors’ hopes that the unusually candid remarks, made

by the Fed’s vice chairman, Donald L. Kohn, signal serious consideration of a

rate cut at the Fed’s Dec. 11 meeting.

At 11 a.m., the Dow Jones industrials were up 219.08 points, or 1.7 percent, at

13,177.52. The broader Standard & Poor’s 500-stock index was up 2 percent, and

the Nasdaq composite index gained 2.6 percent.

European markets were also up sharply, with the major stock indexes in Paris,

London and Frankfurt all gaining about 2.5 percent.

The Fed has its benchmark interest rate by three-quarters of a point since

September to ease the fallout from the subprime mortgage crisis.

But recent anxiety in the credit markets has made banks and mortgage companies

less eager to lend, leading many investors on Wall Street to call for another

slash in interest rates that would make it easier for banks and consumers to

borrow money.

In his speech this morning, delivered to the Council on Foreign Relations in New

York, Mr. Kohn pledged that the Fed “will act as needed” to address the

volatility of the current economic situation.

“Uncertainties about the economic outlook are unusually high right now,” he

said. “In my view, these uncertainties require flexible and pragmatic policy

making.”

Mr. Kohn noted that “the increased turbulence of recent weeks partly reversed

some of the improvement in market functioning over the late part of September

and in October.” And pointing to “heightened concerns about larger losses at

financial institutions now reflected in various markets,” he said the results

could be “a more defensive posture in granting credit, not only for house

purchases, but for other uses as well.”

Mr. Kohn, who will vote at the bank’s policy meeting on Dec. 11, acknowledged

the “moral hazard” debate that has clouded recent discussions over Fed policy,

referring to the bank’s reluctance to reinforce investors’ poor decisions by

lowering interest rates. Some analysts argue that this approach effectively

rewards banks for poor investments.

But Mr. Kohn said that “when the decisions do go poorly, innocent bystanders

should not have to bear the cost.”

“We should not hold the economy hostage to teach a small segment of the

population a lesson,” he said, suggesting that a rate cut would be justified

Mr. Kohn’s rate-cut remarks were strongly worded, but Fed officials still appear

deeply divided on the issue. The bank issued a statement last month that

suggested it would be reluctant to lower rates again before next year. Less than

two weeks ago, Randall S. Kroszner, the president of the St. Louis Fed, said

that “the current stance of monetary policy should help the economy get through

the rough patch during the next year.”

Ben S. Bernanke, the bank’s chairman, has also hinted in speeches and

Congressional testimony that he is skeptical of an additional rate cut, citing

the threat of inflation and underlying strength in the economy.

But this morning’s economic data suggests that strength may be weakening.

Businesses appear more cautious about spending as they anticipate a drop-off in

demand over the coming months, and new orders of durable goods — major consumer

products like appliances, airplanes and machinery — declined in October by 0.4

percent, the Commerce Department said.

A major indicator of spending — orders of nonmilitary capital goods including

appliances and home computers, but excluding aircraft — fell 2.3 percent,

suggesting slower spending by consumers. It was the first decline in the

category since June, but orders are still down 1.2 percent from last October.

Inventories at businesses ticked up 0.2 percent, following a 0.3 percent uptick

in September. The rise could suggest declining demand and a gloomier outlook for

business activity.

Meanwhile, existing-home sales dropped for the eighth consecutive month as

mortgage availability dries up amid the continuing credit crunch. Sales fell 1.2

percent in October to a 4.97 million annual pace, down from 5.03 million in

September, the National Association of Realtors said today. Inventories of homes

also rose last month, by 1.9 percent.

Stocks Soar on Signal

of ‘Flexible’ Fed Policy, NYT, 28.11.2007,

http://www.nytimes.com/2007/11/28/business/28cnd-econ.html?hp

Fed Official Warns About Wall St Turmoil

November 28, 2007

Filed at 10:14 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- If a fresh bout of turmoil on Wall Street

persists, it could further crimp the flow of credit to people and businesses,

raising risks to economic growth, a Federal Reserve official said Wednesday.

Donald Kohn, the No. 2 official at the Fed, said the increased turbulence in

recent weeks ''partly reversed some of the improvement in market functioning''

seen in late September and in October. The credit crunch had taken a turn for

the worse in August, causing stocks to nosedive. Fresh worries about troubles in

the housing and credit market have unnerved Wall Street once again.

''Should the elevated turbulence persist, it would increase the possibility of

further tightening in financial conditions for households and businesses,'' Kohn

said in remarks to the Council on Foreign Relations in New York. A copy of his

speech was made available in Washington. Heightened concerns about larger losses

at financial institutions now reflected in various markets have depressed stock

prices and could induce lenders and other financial companies ''to adopt a more

defensive posture in granting credit, not only for house purchases but for other

uses as well,'' Kohn warned.

The big worry for economists is that consumers and businesses will cut back on

spending and investing, dealing a blow to the economy. The odds of a recession

have grown this year. Still, many economists remain hopeful the country will be

able to weather the financial storm.

Against the backdrop of such uncertainty about how forces will play out with

consumers and businesses, Kohn once again said Federal Reserve policymakers must

remain ''nimble.'' In his view, ''these uncertainties require flexible and

pragmatic policymaking,'' Kohn said.

Wall Street viewed Kohn's comments as hinting that additional rate cuts could be

forthcoming.

The Fed has sliced interest rates twice this year -- in September and late

October -- to prevent the ill effects of the housing collapse and credit crunch

from throwing the economy into a recession. Fed Chairman Ben Bernanke and his

colleagues at the October meeting signaled that further rate reductions may not

be needed to help the economy through its rough spots. Since then, however,

financial markets have suffered through another period of turmoil.

Fed Official Warns

About Wall St Turmoil, NYT, 28.11.2007,

http://www.nytimes.com/aponline/us/AP-Fed-Economy.html

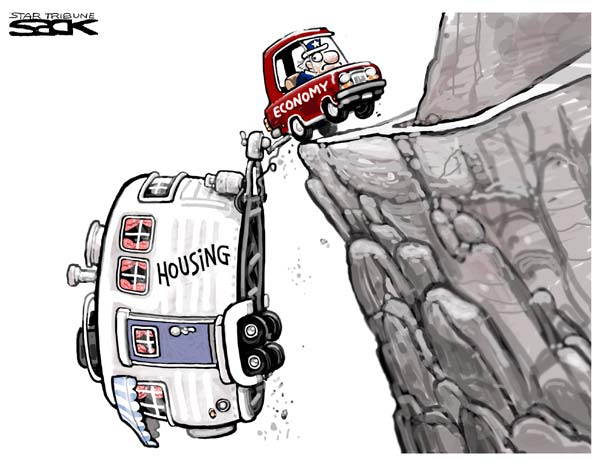

Steve Sack

Minnesota

The Minneapolis Star-Tribune Cagle

28 November 2007

Existing home sales fall again,

biggest price drop ever

28 November 2007

USA Today

By Martin Crutsinger, AP Economics Writer

WASHINGTON — Sales of existing homes fell for the eighth

consecutive month in October, with median home prices falling a record amount.

The National Association of Realtors reported that sales of

existing single-family homes and condominiums dropped 1.2% last month to a

seasonally adjusted annual rate of 4.97 million units.

The sales pace was the lowest since the realty trade group began tracking both

single-family and condo sales jointly in 1999.

The median price of a home sold last month declined to $207,800, a drop of 5.1%

from a year ago, the biggest year-over-year price decline on record.

Analysts blamed the October weakness on the fallout from a serious credit crunch

that roiled financial markets in August. Banks and other lenders have tightened

credit standards in response to a soaring level of defaults, especially on

subprime mortgages, loans provided to borrowers with weak credit histories.

The worry is that the credit crisis and a deepening housing slump could be

enough to push the country into a recession.

By region of the country, sales were unchanged in the Northeast and the South

and down 1.7% in the Midwest and 4.4% in the West.

Lawrence Yun, chief economist for the Realtors, said the big drop in the West

reflected the fact that the market for so-called "jumbo mortgages," loans higher

than $417,000, tightened considerably this summer. California, with its high

home prices, depends heavily on the availability of jumbo loans.

"Temporary mortgage problems were peaking back in August when many of the sales

closed in October were being negotiated," Yun said. "We continue to see the

biggest impact in high-cost markets that rely on jumbo loans."

Yun said he believes the drop in sales, which left activity in October 20.7%

below the level of a year ago, was nearing its end. He said a greater

willingness of lenders to start offering jumbo loans again and the use of

Federal Housing Administration-insured loans in place of subprime mortgages will

help generate a rebound.

However, other economists are predicting housing could remain depressed for many

months to come as sellers face high inventories of unsold homes.

Contributing: Reuters

Existing home sales

fall again, biggest price drop ever, UT, 28.11.2007,

http://www.usatoday.com/money/economy/housing/2007-11-28-existing-homes_N.htm

Existing Home Sales Fall

for 8th Straight Month

November 28, 2007

Filed at 10:12 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- Sales of existing homes fell for the eighth

consecutive month in October, with median home prices falling by a record

amount. Analysts blamed the worsening housing slump on the credit crunch that

hit in August.

The National Association of Realtors reported that sales of existing

single-family homes and condominiums dropped by 1.2 percent last month to a

seasonally adjusted annual rate of 4.97 million units.

The median price of a home sold last month declined to $207,800, a drop of 5.1

percent from a year ago, the biggest year-over-year price decline on record.

Analysts blamed the October weakness on the fallout from a serious credit crunch

that roiled financial markets in August. Banks and other lenders have tightened

credit standards significantly in response to a soaring level of defaults,

especially on subprime mortgages, loans provided to borrowers with weak credit

histories.

The worry is that the credit crisis and a deepening housing slump could be

enough to push the country into a recession.

In another sign of spreading economic weakness, the Commerce Department reported

Wednesday that orders to factories for big-ticket manufactured goods declined by

0.4 percent in October. It was the third straight drop, the longest stretch of

weakness in nearly four years.

Existing Home Sales

Fall for 8th Straight Month, NYT, 28.11.2007,

http://www.nytimes.com/aponline/business/AP-Economy.html

Orders for Durable Goods Fall 0.4%

November 28, 2007

Filed at 8:36 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- Orders to factories for big-ticket

manufactured goods fell in October for a third straight month, the longest

stretch of weakness in nearly four years.

The Commerce Department reported that orders for durable goods declined 0.4

percent last month, a weaker showing than expected. The October decline followed

even bigger decreases of 1.4 percent in September and 5.3 percent in August,

raising worries that the steep plunge in housing is beginning to drag down other

sectors of the economy.

While economic growth roared ahead at a rate approaching 5 percent in the

summer, many economists believe growth has slowed dramatically in the current

quarter from the combined blows of the most severe housing slump in more than

two decades, a serious credit crunch and rising energy prices.

Orders for Durable

Goods Fall 0.4%, NYT, 28.11.2007,

http://www.nytimes.com/aponline/business/AP-Economy.html

Cyber Monday unwraps

online shopping season

26 November 2007

USA Today

NEW YORK — Retailers are hoping last week's strong start to the holiday

shopping season at malls and stores translates into a busy buying season online,

which officially begins Monday.

The Monday after Thanksgiving, tagged "Cyber Monday" by the National Retail

Federation, marks the first big online shopping surge for many merchants as

consumers return to their work computers.

A number of retailers are hosting one-day sales or special offers for the

occasion. Internet research firm comScore Inc. estimated online sales may exceed

$700 million online on Monday.

As for brick-and-mortar outlets, ShopperTrak RCT Corp., which tracks total sales

at more than 50,000 retail outlets, reported late Sunday that sales on Friday

and Saturday combined rose 7.2% to $16.4 billion from the same two-day period a

year ago.

The biggest draw was electronics, benefiting chains like Best Buy and

discounters such as Wal-Mart Stores and Target Corp. Popular-priced department

stores including J.C. Penney and Kohl's Corp. drew in crowds with good deals.

Toy stores like Toys "R" Us Inc. fared well too. Still, apparel sales appeared

to be mixed at mall-based clothing stores, though a cold weather snap helped

spur sales of outerwear and other winter-related items.

"This was a really good start," said Bill Martin, co-founder of ShopperTrak.

"There seemed to be a lot of pent-up demand."

Now the attention moves online. Toys "R" Us will hold a one-day online sale and

rival eToys.com will launch a two-day sale. Wal-Mart Stores will begin five days

of online-only sales.

Online jeweler Blue Nile will give customers 20% off purchases paid through

PayPal, eBay's electronic payment division. Target Corp., Circuit City Stores,

Sears Holdings Corp., Crate & Barrel, the Discovery Store and Overstock.com are

among dozens of retailers offering free shipping that day.

"The online community is getting more competitive as the amount of new customers

slows," according to Scott Silverman, executive director of Shop.org, an online

arm of the National Retail Federation. "Add to that the concerns about the

economy, and promotions and sales provide a great way to get people excited."

Silverman said the number of retailers offering free shipping with no

conditions, such as a minimum purchase, has jumped to 41.4% from 36% last year.

Nearly one-third of retailers are also having special one-day sales for Cyber

Monday. About 42% plan some kind of promotion, according to the NRF's annual

survey.

In fact, the number of retailers hosting online deals on the Monday after

Thanksgiving has surged to 72% of those polled from 42% just two years ago.

Despite a decent showing, many shoppers interviewed said they planned to curb

their spending. Earl Lee, a mechanic from Live Oak, Fla., who was shopping in

Tallahassee, said that he was planning on spending less this holiday season.

"Gas prices, everything's so high," he added.

John Muller, of Clifton, N.J., who was standing outside Macy's Herald Square in

Manhattan on Sunday, said he plans to spend only about $500 this year, half as

much as a year ago, because of higher expenses and worries about the economy.

This year, "we are mostly buying for the kids," said Muller, who has two

children, ages 3 and 7.

Cyber Monday unwraps

online shopping season, UT, 26.11.2007,

http://www.usatoday.com/tech/products/2007-11-26-cyber-monday_N.htm

Retail Sales Rise,

but Stores Relied on Discounts

November 26, 2007

The New York Times

By MICHAEL BARBARO

Black Friday was big — but with a big caveat.

With stores dangling steep discounts and consumers worried about the economy,

retail sales surged on the day after Thanksgiving, yet the amount of money each

shopper spent fell, according to two reports released yesterday.

The reports suggest that jittery consumers are flocking to rock-bottom prices

and to little else — a boon for discount stores like Wal-Mart and Best Buy and

trouble for higher-end chains, like Nordstrom and Abercrombie & Fitch, which are

averse to discounting.

Sales rose 8.3 percent on Friday compared with last year, the biggest increase

in three years, according to ShopperTrak, a research company. On Friday and

Saturday combined, sales rose 7.2 percent.

But shoppers did not splurge, spending an estimated $348 each over the holiday

weekend, down from $360 last year, a survey conducted for the National Retail

Federation found.

“American consumers are trying to outsmart the stores and wait for desperation

discounts,” said Burt Flickinger, a retail consultant.

Retailers’ performance over the Thanksgiving weekend is closely watched because

it accounts for up to 8 percent, or roughly $40 billion, of all holiday sales,

which are expected to reach $475 billion this year, according to the National

Retail Federation, the industry trade group.

Over all, retail sales growth this season is predicted to be the weakest since

2002, with spending pinched by rising energy costs, falling home prices and a

tight credit market.

As expected, cost-conscious consumers favored discount chains over costlier

stores this weekend, according to the survey, conducted by BIGresearch.

Of those surveyed, 55 percent said they had shopped at bargain chains like

Wal-Mart and Target, up from 50 percent last year. The percentage who made a

purchase at traditional department stores, like Macy’s, fell slightly.

That shift appeared to confirm suspicions that shoppers would “trade down” this

season, largely bypassing full-price stores to save money. That is a reversal

from previous years when shoppers eagerly traded up to luxury outlets like Ralph

Lauren.

Deanna Babikian, 42, had no plans to trade up on Friday, arriving at Target in

Framingham, Mass., by 6:30 a.m. to buy a 42-inch television for $798. “You have

to go then. You can’t get these kinds of deals any other time,” she said.

Higher gas prices, and a reluctance to drive to stores, may be behind the big

rise in the percentage of people who shopped online, 32 percent, up from 23

percent in 2006, the survey found.

Bill Martin, the co-founder of ShopperTrak, said the stronger-than-expected

sales on Friday should leave stores “breathing a sigh of relief.”

But why did individual spending fall, if sales rose? One explanation is that the

most heavily promoted — and discounted — products this holiday season cost less

than those of last year.

In electronics, for example, two best sellers on Friday were Kodak digital photo

frames (for about $100 to $250) and a KitchenAid mixer (for $130), rather than

flat-screen televisions, last year’s must-have gift.

“It takes a lot of $130 stand mixers to add up to a $1,000 high definition TV,”

said Ellen Davis, a spokeswoman for the National Retail Federation.

The retail federation’s survey found that earlier store hours lured more

shoppers. About 2.6 percent of those surveyed shopped at stores with midnight

openings on Black Friday, up from 1.3 percent a year ago.

The discounting in brick-and-mortar stores will spill over onto the Web starting

today.

In a departure from tradition, dozens of Web retailers will offer free shipping,

no matter how small the order, for Cyber Monday, as the Monday after Black

Friday is now called (at least by nickname-adoring marketing executives.)

An estimated 25 percent of online retailers will offer the promotion, like

Joann.com, the Web site of Jo-Ann Fabrics and Crafts; HSN.com, the home shopping

network Web site; and Giftcertificates.com, a site that sells gift cards from

hundreds of stores.

Most retailers provide free shipping only for orders of $50 or higher. But

merchants have observed that, although consumers historically flocked to retail

Web sites today after spending the weekend browsing at stores, they were still

reluctant to buy.

“It’s people coming into browse,” said William Lynch, general manager of

HSN.com, who added that the purchases on Cyber Monday in 2006 “were not as high

as we wanted.”

With free shipping, he said, “we want to convert browsers into buyers.”

ComScore, a research company, predicted that online sales might surpass $700

million today, a record for a single day.

Katie Zezima contributed reporting from Boston.

Retail Sales Rise, but

Stores Relied on Discounts, NYT, 26.11.2007,

http://www.nytimes.com/2007/11/26/business/26retail.html

Retailers Post Robust Start to Holidays

November 25, 2007

Filed at 7:49 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

NEW YORK (AP) -- The nation's retailers had a robust start to the holiday

shopping season, according to results announced Saturday by a national research

group that tracks sales at retail outlets across the country.

According to ShopperTrak RCT Corp., which tracks sales at more than 50,000

retail outlets, total sales rose 8.3 percent to about $10.3 billion on Friday,

the day after Thanksgiving, compared with $9.5 billion on the same day a year

ago. ShopperTrak had expected an increase of no more than 4 percent to 5

percent.

''This is a really strong number. ... You can't have a good season unless it

starts well,'' said Bill Martin, co-founder of ShopperTrak, citing strength

across all regions. ''It's very encouraging. When you look at September and

October, shoppers weren't in the stores.''

In a separate statement released Saturday, J.C. Penney Co. reported ''strong

performance across all merchandise categories,'' including fine jewelry,

outerwear, and young men's and children's assortments.

But the department store chain cautioned, ''while we are encouraged by our

strong start, it is still early in the holiday season, and we are mindful of the

headwinds consumers are facing.''

J.C. Penney, Wal-Mart Stores Inc. and other major retailers are expected to

report same-store results for November on Dec. 6. Same-store sales are those at

stores opened at least a year and are considered a key indicator of a retailer's

strength.

The upbeat reports were encouraging since merchants have been struggling with

anemic sales in recent months, as shoppers, particularly in the middle and

lower-income brackets, were becoming more frugal amid higher gas and food prices

and an escalating credit crunch.

In an apparent sign of desperation, the nation's stores ushered in the official

start of the holiday shopping season on Friday with expanded hours, including

midnight openings, and a blitz of early morning specials that were more generous

than a year ago. J.C. Penney and Kohl's Corp. opened at 4 a.m., an hour earlier

than a year ago.

The strategy appears to have worked, as shoppers jammed stores in record numbers

for early morning deals on Friday. Martin noted that judging by the strong

figures on Friday, stores were able to sustain strong sales throughout the day.

He said he's counting on strong traffic throughout the weekend as many stores,

including Macy's Inc., are continuing with special deals.

While Black Friday -- so named because it was traditionally when the surge of

shopping made stores profitable -- starts holiday shopping, it is not considered

a bellwether for the season. However, merchants see Black Friday as setting an

important tone to the overall season: What consumers see that day influences

where they will shop for the rest of the year.

Last year, retailers had a good start during the Thanksgiving weekend, but many

stores struggled in December, and a shopping surge just before and after

Christmas wasn't enough to make up for lost sales.

This year, the Washington-based National Retail Federation predicted that total

holiday sales would be up 4 percent for the combined November and December

period, the slowest growth since a 1.3 percent rise in 2002. Holiday sales rose

4.6 percent in 2006 and growth has averaged 4.8 percent over the last decade.

Retailers Post Robust

Start to Holidays, NYT, 25.11.2007,

http://www.nytimes.com/aponline/business/AP-Holiday-Shopping.html

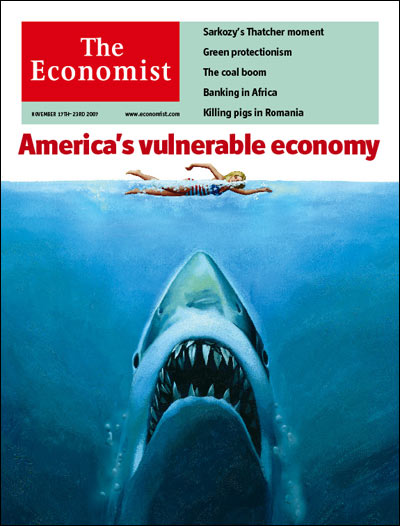

Housing woes have domino effect

25 November 2007

USA Today

If you haven't yet felt the impact of the nation's credit crisis, just wait.

Chances are, you won't have to wait long.

So far, the turmoil may feel a bit remote for average people: Failed mortgage

lenders. Gargantuan write-downs by banks. Foreclosures for people who couldn't

really afford the mortgages they got.

As the credit crisis seeps into farther-flung corners of the economy, more of

us will find it harder — and costlier — to borrow money. The value of the funds

in our retirement accounts could shrink. People with subpar credit will likely

find it more difficult to qualify for auto and home-equity loans. Even consumers

who make the cut may need higher credit scores and more documentation.

With loans harder to get, people will hesitate to buy cars, boats and other

big-ticket items. The gravest fear? That weak consumer spending — along with

surging energy prices, a long housing slump and sluggish job growth — will

plunge the economy into a recession.

Even if a recession doesn't occur, "We're going to be in for a rough ride," says

Robert Kuttner, a senior fellow at Demos, a New York policy organization. "With

job creation slowing down, credit standards being tightened and housing values

not going up anymore, the consumer is under pressure to tighten his or her

belt."

Becki Carr, 28, of Detroit, says she's growing gloomier about the economy. Her

reasons: rising home foreclosures in Detroit, rising heating and gasoline prices

and a cloud of insecurity over the area's job market. As a result, Carr says,

she's watching her money more closely.

"Pretty much everyone around me is unemployed or they are having to travel down

South to do contract work," she says. And "Every other house on our street is

for sale, and they've been for sale for the last year and a half. … It makes me

double-check my costs and things."

Tighter credit and falling home prices top the reasons why the economy could

slip into a recession, according to 50 economists surveyed in late October and

early November by the National Association for Business Economics.

Most economists still don't foresee a recession. But the risk of a downturn is

growing with each bout of bleak news. About 18% of economists who responded to

NABE's survey put the probability of a recession starting within the next 12

months at 50% or greater. That's up sharply from the 11% of economists who said

so in August.

A recession would inflict pain on a majority of Americans as unemployment rose

and the stock market sank further. In a recession, "Investors have to be

prepared to absorb a 20%-plus decline in the value of their portfolios," says Ed

Yardeni, president of Yardeni Research, an investment research firm in Great

Neck, N.Y.

The benchmark Standard & Poor's 500-stock index hit an all-time high of 1565.15

on Oct. 9, but since then, it's fallen nearly 8% to 1440.70. The S&P index,

which tracks large-company stocks and accounts for about 75% of the market's

value, is up 1.6% for the year.

What's managed to help prop up the stock market so far is the sinking dollar,

which has nourished companies that depend on foreign sales, says Gregory Peters,

chief credit strategist at Morgan Stanley.

Peters says the indicator he's watching most closely, to gauge the likelihood of

further economic deterioration, is the labor market. Job growth has clearly

slowed but has still held up "reasonably well," he says. U.S. employers created

an average 118,000 jobs in the three months through October, down from 142,000

during the first three months of 2007, the Labor Department says. The jobless

rate last month was 4.7%, up slightly from the recent low of 4.5% in June but

far below the 6.3% of June 2003.

Still, what began as a housing industry downturn more than a year ago has

widened into a broader financial industry crisis. Too many risky mortgages were

made to people who eventually couldn't afford their payments. Many such

mortgages were bundled into securities that were sold to investors who were

often unaware of the risk they were absorbing.

Every week, more bad news

The initial low rates on adjustable-rate mortgages are resetting to higher

rates. And with housing prices in many markets falling, overextended buyers

can't refinance. Delinquencies and foreclosures are rising. Banks and other

investors holding downgraded securities tied to risky mortgages are writing down

their values billions of dollars at a time.

Each week brings fresh evidence of how the credit crisis is causing damage. Last

week, for example, the stock market fell after Goldman Sachs downgraded the

nation's largest bank, Citigroup, to a sell. Goldman said the bank would likely

have to write down $15 billion over the next two quarters, mainly because of its

exposure to risky mortgage securities.

And darker days probably lie ahead: Mortgage-related losses industrywide are

likely to mount through 2009 and further bruise financial institutions, says

Mark Zandi, chief economist at Moody's Economy.com.

Such losses eat away at banks' capital reserves. That means they can't lend as

much money. Goldman Sachs analysts predict that, overall, banks' exposure to

risky mortgages could reduce the credit available to consumers and businesses by

a staggering $2 trillion.

Even the $2.5 trillion muni bond market hasn't escaped the credit crunch's

damage. Muni bonds are issued by cities and states to raise money for projects

such as schools, highways and airports. Historically, they've been relatively

safe investments because it's rare that governments default on their debts.

But worries about the companies that insure hundreds of billions of dollars in

muni bonds are rippling through to muni bonds and rattling investors. The

insurers, which have exposure to risky mortgages, could see their credit ratings

reduced. If that happened, the muni bonds they guarantee would be downgraded,

too. Cities and states would find it harder to raise money. Projects would be

delayed. Taxpayers could face higher taxes.

Miami-Dade County and Puerto Rico have postponed bond issues totaling $1.5

billion in recent weeks because of credit concerns.

In the housing market, tightening credit has shrunk the pool of potential buyers

for homeowners such as Glynnis Fairbanks, who wants to sell her four-bedroom

home in Broward County, Fla.

Fairbanks had a deal to sell her home in May; she thought the sale would be

finished by August. But the buyers, she says, had to back out because their

lender, Countrywide, tightened its standards on their subprime loan. She's cut

her price to $325,000 from $348,000. But only one other potential buyer has

peeked at the house.

By the end of 2008, more than 1 million homeowners with adjustable-rate

mortgages will see their rates reset higher. Meantime, many people who want to

refinance can't because they lack the credit scores or the home equity to meet

lenders' tighter standards. This is especially true in neighborhoods where

prices are falling. Some people who bought homes with little or no down payment

now owe more than their homes are worth.

Investors, too, have been unnerved by the turmoil. Take Doug Breitenbach, 63,

who pared back on his investments in financial services this month because of

banks' exposure to risky loans.

Since June, "I have lost on paper about $18,000 in my 401(k) fund," says

Breitenbach, a retiree in Silver Spring, Md. Though his portfolio is still up

for the year, "I'm quite concerned about future drops."

As mortgage-related distress spooks the markets, lenders are becoming "more

sensitive" to the risks of other loans, says James Chessen, chief economist of

the American Bankers Association. Banks may require higher credit scores now to

qualify for loans, he notes.

At the moment, though, many businesses say the credit crunch still feels a

little remote. In an October survey of small-business owners, only 6% said loans

had become harder to get, in line with survey results over the past two years,

according to the National Federation of Independent Business. Only 3% said

credit availability and interest rates were their top concerns.

A Federal Reserve survey last month showed little change in banks' lending

standards for small businesses. But the same survey also detected a more ominous

sign: On most consumer loans, 14 of the 50 banks surveyed had tightened their

standards by October. That was up sharply from six out of 50 banks in July.

Banks are starting to do the same with credit cards.

Gary Perlin, Capital One's chief financial officer, said at an analysts'

conference this month that the company has become more selective about granting

credit cards and auto loans. And JPMorgan Chase says it's being more careful

about issuing home-equity credit lines and auto loans, mainly for consumers with

poor credit.

"When there's less credit extended," says Jack Malvey, chief global fixed-income

strategist at Lehman Bros., "it reduces world economic growth and puts the U.S.

at risk of recession. The real damage of that could be measured in hundreds of

billions of dollars and, depending on what happens to the world economy, it

could be $1 trillion."

Discover Financial has jacked up the rate it charges to risky new credit card

customers and has raised late fees for all customers. Some banks are likely to

consider raising fees or rates on credit cards — one of their most profitable

products — because they're under "that much more pressure" in an uncertain

economy to recoup mortgage losses, says Edward Woods, senior analyst at Celent,

a market research firm.

That means that even those with pristine credit aren't likely to escape the

spreading credit crisis. Curtis Arnold, founder of CardRatings.com, says he's

seeing more credit card issuers shrinking consumers' credit lines.

"They try to lower it typically where it's within $100 or $200 of your balance,"

Arnold says. "If you're revolving a balance, you're vulnerable. Just because you

have a good credit score, you're not out of the woods."

Eddie Ward of North Little Rock worries that any change in his credit card terms

would make it harder for him to pay back $20,000 in debt. "I haven't seen much

change yet, but I'm sure there will be over the next few years," says Ward, 31.

Credit bureau TransUnion's TrueCredit.com division has begun recommending that

consumers maintain a credit score of at least 680 to qualify for prime rates.

For years, TransUnion had recommended a score of only 650 or above.

Its rival Equifax has introduced a service to analyze a lender's portfolio to

figure out the probability that existing customers or new applicants have

adjustable-rate mortgages. Based partly on this factor, lenders could decide to

withhold, or to increase, credit to certain consumers.

That service helps lenders "understand where the (potential) problem is," says

Dann Adams, president of Equifax Consumer Information Solutions.

As credit tightens, "The most overextended borrowers are going to be affected

the most, and the hardest, then people on the cusp," says Peters, the Morgan

Stanley credit strategist. But even low-risk borrowers face "tougher times," he

says.

In recent years, consumers have borrowed record-high amounts from credit cards.

Revolving balances on credit cards are at an all-time peak, with U.S. households

owing a monthly average of $6,960 in the year that ended in September 2007, up

41% from four years ago, according to Synovate, a research firm in New York.

The danger is that households that rely heavily on credit "could get into

trouble" as the economy slows, says Andrew Davidson, a vice president at

Synovate. "Their incomes are low on average, and they're more likely to get hit

with late and over-the-limit fees."

'Wages are squeezed'

Consumers who pulled money out of their homes as the market soared in recent

years will also be in for a shock as home prices fall during the worst real

estate recession since the Great Depression.

Kuttner says he believes that consumers' recent "reliance on home equity and

credit card loans isn't because middle-income people are going on shopping

sprees, but because wages are squeezed."

Home-equity withdrawals accounted for up to $324 billion a year in consumer

spending from 2004 to 2006, according to estimates from Federal Reserve

economist James Kennedy, based on a paper he wrote with former Fed chairman Alan

Greenspan. These withdrawals and related consumer spending plunged in the first

half of this year as the housing market weakened, according to updated estimates

from Kennedy.

In many parts of the country, home prices are expected to drop through next

year, with the biggest discounts in Florida, California, Nevada and Arizona.

Those declines will curb consumer spending.

By the time the housing slump bottoms out, $1.7 trillion in housing wealth will

have been lost, economic consulting firm Global Insight estimates. For each

dollar that a home falls in value, consumer spending falls by 4 cents to 9

cents, Fed Chairman Ben Bernanke recently told Congress. That could lead to a

drop in consumer spending of as much as $153 billion over several years. While

that's no pittance, it's only a fraction of the $9.2 trillion that consumers

spent in 2006.

Consumers, in turn, are likely to have difficulty gaining access to money.

Peters, the Morgan Stanley credit strategist, says the "virtuous cycle of

packaging and selling credit has turned vicious."

"The impact on the economy and consumers has yet to fully play out," he says.

"We're still in the early stages."

Housing woes have domino

effect, UT, 25.11.2007,

http://www.usatoday.com/money/economy/2007-11-25-credit-crunch_N.htm

Have We Seen Worst of Mortgage Crisis?

November 24, 2007

Filed at 1:36 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

NEW YORK (AP) -- When Domenico Colombo saw that his monthly mortgage payment

was about to balloon by 30 percent, he had a clear picture of how bad it could

get.

His payment was scheduled to surge by an extra $1,500 in December. With his

daughter headed to college next fall and tuition to be paid, he feared ending up

like so many neighbors in Fort Lauderdale, Fla., who defaulted on their

mortgages and whose homes are now in foreclosure and sporting ''For Sale''

signs.

Colombo did manage to renegotiate a new fixed interest rate loan with his bank,

and now believes he'll be OK -- but the future is less certain for the rest of

us.

In the months ahead, millions of other adjustable-rate mortgages like Colombo's

will reset, giving them a higher interest rate as required by the loan

agreements and leaving many homeowners unable to make their payments. Soaring

mortgage default rates this year already have shaken major financial

institutions and the fallout from more of them, some experts say, could spread

from those already battered banks into the general economy.

The worst-case scenario is anyone's guess, but some believe it could become very

bad.

''We haven't faced a downturn like this since the Depression,'' said Bill Gross,

chief investment officer of PIMCO, the world's biggest bond fund. He's not

suggesting anything like those terrible times -- but, as an expert on the global

credit crisis, he speaks with authority.

''Its effect on consumption, its effect on future lending attitudes, could bring

us close to the zero line in terms of economic growth,'' he said. ''It does keep

me up at night.''

Some 2 million homeowners hold $600 billion of subprime adjustable-rate mortgage

loans, known as ARMs, that are due to reset at higher amounts during the next

eight months. Subprime loans are those made to people with poor credit. Not all

these mortgages are in trouble, but homeowners who default or fall behind on

payments could cause an economic shock of a type never seen before.

Some of the nation's leading economic minds lay out a scenario that is

frightening. Not only would the next wave of the mortgage crisis force people

out of their homes, it might also spiral throughout the economy.

The already severe housing slump would be exacerbated by even more empty homes

on the market, causing prices to plunge by up to 40 percent in once-hot real

estate spots such as California, Nevada and Florida. Builders like Chicago's

Neumann Homes, which filed for bankruptcy protection this month, could go under.

The top 10 global banks, which repackage loans into exotic securities such as