|

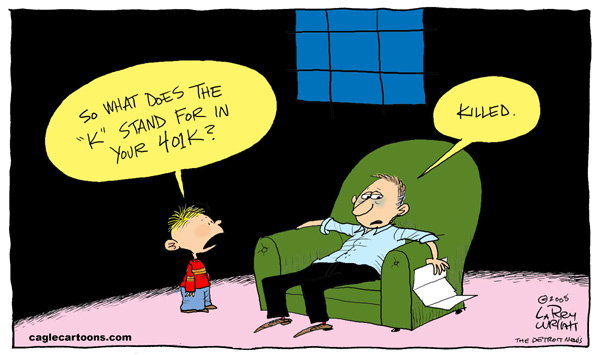

History > 2008 > USA > Economy (Xb)

Larry Wright

cartoon

Detroit, Michigan

The

Detroit News

17.10.2008

One in five homeowners with mortgages

underwater

Fri Oct 31, 2008

1:15pm EDT

Reuters

By Jonathan Stempel

NEW YORK (Reuters) - Nearly one in five U.S. mortgage

borrowers owe more to lenders than their homes are worth, and the rate may soon

approach one in four as housing prices fall and the economy weakens, a report on

Friday shows.

About 7.63 million properties, or 18 percent, had negative equity in September,

and another 2.1 million will follow if home prices fall another 5 percent,

according to a report by First American CoreLogic.

The data, covering 43 states and Washington, D.C., includes borrowers

nationwide, even those who took out mortgages before housing prices began to

soar early this decade.

Seven hard-hit states -- Arizona, California, Florida, Georgia, Michigan, Nevada

and Ohio -- had 64 percent of all "underwater" borrowers, but just 41 percent of

U.S. mortgages.

"This is very much a regional problem, and people tend to forget that," said

David Wyss, chief economist at Standard & Poor's, who expects home prices

nationwide to fall another 10 percent before bottoming late next year.

"Most of the country is not in bad shape," he continued. "Things seem to be

stabilizing in Michigan, but the big bubble states -- Florida, California,

Arizona and Nevada -- are still very overpriced."

About 68 percent of U.S. adults own their own homes, and about two-thirds of

them have mortgages.

JPMorgan Chase & Co, one of the biggest mortgage lenders, on Friday offered to

modify $70 billion of mortgages to keep a potential 400,000 homeowners out of

foreclosure. Bank of America Corp, which bought Countrywide Financial Corp in

July, also has a large loan modification program.

HOME PRICES, ECONOMY UNDER PRESSURE

U.S. home prices fell a record 16.6 percent in August from a year earlier, with

declines in all 20 major metropolitan areas measured by the S&P/Case-Shiller

Home Price Indices.

Foreclosure filings rose 71 percent in the third quarter to a record 765,558,

according to RealtyTrac.

Meanwhile, the Commerce Department said gross domestic product fell at a 0.3

percent rate in the third quarter. Some experts expect the worst U.S. recession

since the early 1980s.

Yet despite a series of expensive government programs to spur lending, mortgage

rates are rising, making it tougher to borrow or refinance. The rate on a

30-year fixed-rate mortgage jumped this week to 6.46 percent from 6.04 percent a

week earlier, Freddie Mac said.

Meanwhile, borrowing costs on hundreds of thousands of adjustable-rate mortgages

are expected to reset higher in the coming months. The problem may be

particularly serious for borrowers with rates tied to the London Interbank

Offered Rate, or Libor, which is abnormally high relative to benchmark U.S.

rates.

Last week, Wachovia Corp said borrowers with its "Pick-a-Pay" ARMs and living in

or near Stockton and Merced, California, owed at least 55 percent more on their

mortgages, on average, than their homes were worth. Wells Fargo & Co is buying

Wachovia.

NEVADA HARD HIT, NEW YORK AT RISK

First American CoreLogic, an affiliate of title insurance and real estate

services company First American Corp, said states with large numbers of homes

with negative equity either had rapid price appreciation, many homes bought with

subprime mortgages or as speculative investments, steep manufacturing declines,

or a combination.

Nevada was hardest hit, where mortgage borrowers on average owed 89 percent of

what their homes were worth, and 48 percent had negative equity. Michigan was

second, with an 85 percent loan-to-value ratio and 39 percent of borrowers

underwater.

New York fared best, with an average 48 percent loan-to-value ratio and just 4.4

percent of mortgage borrowers with negative equity.

But Wyss said this could change as financial market upheaval transforms Wall

Street. This month, New York City Comptroller William Thompson estimated that

the city alone might lose 165,000 jobs over two years.

"We're going to see home prices coming down pretty significantly in New York,"

Wyss said. "A lot of people are losing jobs, and won't be getting their usual

bonuses, and that leaves less money for housing."

(Reporting by Jonathan Stempel; Additional reporting by Al Yoon; Editing by

Brian Moss)

One in five

homeowners with mortgages underwater, R, 31.10.2008,

http://www.reuters.com/article/newsOne/idUSTRE49S3Q520081031

Oil, down 36% in Oct., heads for worst month ever on Nymex

31 October 2008

USA Today

By Stevenson Jacobs, AP Business Writer

NEW YORK — Oil prices kept falling Friday, heading for their

biggest monthly drop since futures trading began 25 years ago on signs that a

contracting U.S. economy will suppress energy demand well into 2009.

Oil's monumental collapse — prices are down 36% for the month

and 56% from their July record — has stunned oil-producing countries while

giving cash-strapped U.S. consumers a rare dose of relief. Pump prices have

fallen by almost half since their summer peak above $4 a gallon — a huge drop

that's expected to result in more than $100 billion in annual savings for

American households.

"That's a pretty powerful stimulus to consumers," said Adam Sieminski, chief

energy economist at Deutsche Bank Global Markets in Washington.

Friday's oil decline was tied to a significantly stronger U.S. dollar. Oil

market traders often buy oil as a hedge against inflation when the dollar falls

and sell those investors when the greenback rises. The dollar has rallied in

recent weeks as the financial crisis begins hurting economies in Europe and

elsewhere, prompting investors to shift funds into the greenback as a

safe-haven.

Light, sweet crude for December delivery fell $1.35 to $64.61 a barrel on the

New York Mercantile Exchange, after earlier falling as low as $63.12.

Prices closed at $100.64 a barrel on the last trading day in September. That

gives oil the biggest monthly slide since the launch of the Nymex crude futures

contract in 1983. The previous record was a 30% drop set in February 1986.

"We're seeing a huge paradigm shift," said Jim Ritterbusch, president of energy

consultancy Ritterbusch and Associates in Galena, Ill. "We went from $100 at the

beginning of the month to around $65 today. It's quite a decline and shows how

weak the demand picture really is."

Crude hit a record price of $147.27 set on July 11.

At the pump, a gallon of regular gasoline fell 4.3 cents overnight to a national

average of $2.504, according to auto club AAA, the Oil Price Information Service

and Wright Express. Gas prices hit a record $4.114 a gallon on July 17.

Cheaper gas has been a rare bit of good news for consumers rattled by huge drops

in the stock market, rising mortgage payments and difficulty in obtaining

credit. According to Deutsche Bank research, for every dollar that comes off

pump prices, U.S. households save a $100 billion a year — money that can be

spent on other goods and services to help jolt the economy.

Deutsche Bank estimates that the $100 billion would be worth 3 million new jobs.

But even with cheaper energy, Deutsche Bank's Sieminski predicts the weak global

economy will weigh on fuel demand well into 2009 — bringing oil to a quarterly

average of $50 a barrel for that year.

OPEC and international energy agencies earlier this year predicted oil demand

would rise by 800,000 barrels a day next year, driven by growth from developing

economies like China and India.

Given the widening economic downturn, Sieminski said those figures now seem

wildly optimistic.

U.S. gross domestic product, the broadest barometer of a nation's economic

health, shrank at a 0.3% annual rate in the July-September quarter, the Commerce

Department said Thursday. It marked the worst showing for the world's largest

economy since it contracted at a 1.4% pace in the third quarter of 2001.

"We believe there will be no growth in oil demand in 2009, and we may even see a

decline," Sieminski said.

The drop in oil has come despite moves by OPEC to prop up prices. Last week, the

Organization of the Petroleum Exporting Countries announced plans to cut 1.5

million barrels of production per day at an extraordinary meeting in Vienna.

Venezuela's Oil Minister Rafael Ramirez says OPEC, which controls about 40% of

world crude oil production, will need to cut production by at least another 1

million barrels per day to boost falling prices.

Analyst believe oil price hawks like Venezuela and Iran need prices at near $100

a barrel to balance their national budgets, while Saudi Arabia and other members

would like to see prices stabilize at around $80.

Opinion, however, is mixed on whether all members of the cartel will follow

through on the cuts — or keep churning out as much crude as they can on fears

that prices will plummet more.

"A further fall in the oil price cannot be ruled out. It is difficult to predict

where the bottom could be," said David Moore, commodity strategist with

Commonwealth Bank of Australia in Sydney. "An important factor over the next few

months will be whether OPEC can achieve its output cuts. If it can that will

certainly tighten market conditions."

In other Nymex trading, gasoline futures fell 3.95 cents to $1.4275 a gallon,

while heating oil fell 2.22 cents to $1.9774 a gallon. Natural gas for December

delivery was up 5.7 cents at $6.791 per 1,000 cubic feet.

In London, Brent crude fell $2 to $61.71 a barrel on the ICE Futures exchange.

AP writers By Louise Watt in London and Stephen Wright in Bangkok, Thailand

contributed to this report.

Oil, down 36% in

Oct., heads for worst month ever on Nymex, UT, 31.10.2008,

http://www.usatoday.com/money/industries/energy/2008-10-31-oil-oct_N.htm

Beaten Down,

American Consumers Burrow Deeper

October 31, 2008

Filed at 10:02 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) -- Beaten down and watching their wealth

shrink, Americans are cutting back sharply on their spending, trimming it in

September by the largest amount in four years.

The Commerce Department reported Friday that consumer spending dropped by 0.3

percent in September, the biggest setback since June 2004. It followed two

months in which spending was flat and left activity for the quarterly falling by

the biggest amount in 28 years.

The weakness in consumer spending, which accounts for two-thirds of total

economic activity, dragged the overall economy down in the third quarter. The

gross domestic product, the broadest measure of economic health, also fell by

0.3 percent in the third quarter, the strongest signal yet that the country has

fallen into a recession.

Many economists believe that economic activity will fall even more sharply in

the current quarter, meeting the classic definition of a recession as at least

two consecutive quarters of declining GDP.

In a separate report, the Labor Department on Friday said the wages and benefits

of U.S. workers rose by a moderate 0.7 percent in the third quarter, the same

increase as in the previous two quarters. The report provided more evidence that

the weak economy is keeping a lid on wage pressures.

One of the biggest problems saddling the country is damage from the housing

market's collapse. Mounting foreclosures, falling home prices and soured

mortgage investments are taking their toll on both individuals and businesses

alike.

Federal Reserve Chairman Ben Bernanke, who is scheduled to speak via satellite

Friday at a Berkeley, Calif., conference on the mortgage meltdown, is likely to

call on government officials and lawmakers to keep working on ways to provide

more relief.

The Bush administration is considering a plan that would help around 3 million

struggling homeowners avoid foreclosure by having the government guarantee

billions of dollars worth of distressed mortgages. The plan also could include

loan modifications that would lower interest rates for a five-year period.

Fallout from the housing meltdown has spurred the worst global credit and

financial crisis in more than a half century. To combat the problems, the

government has taken a number of bold steps. The Treasury Department is pouring

$250 billion into banks in return for partial ownership and the Fed this week

started buying mounds of debt from companies. It also slashed interest rates to

1 percent, a level seen only once before in the last half century.

All the grim news comes just days before the nation picks the next president.

Either Democrat Barack Obama or Republican John McCain will inherit a deeply

troubled economy and a record-high budget deficit that could cramp spending

plans.

''I think it's very, very important not to hold out the prospect of silver

bullets that will correct these crises,'' Lawrence Summers, a Treasury secretary

in the Clinton administration, said in Boston on Thursday.

''One of the difficulties has been there's been a succession of silver bullets

that turned out to be hollow,'' he said. ''So I think one just has to be really

careful and sober about recognizing there are very serious risks in the

situation ... and that the process of improvement will take time.''

--------

Associated Press Writers Martin Crutsinger and Christopher Rugaber in Washington

and Jay Lindsay in Boston contributed to this report.

Beaten Down, American

Consumers Burrow Deeper, NYT, 31.10.2008,

http://www.nytimes.com/aponline/washington/AP-Financial-Meltdown.html

Hope and Fear in Motown

October 31, 2008

The New York Times

By MICHELINE MAYNARD and NICK BUNKLEY

DETROIT — Fall in this city has always felt a bit like spring

elsewhere. It is traditionally the season of fresh starts for the hometown

industry, a time when the auto companies get a jump on the calendar and begin

shipping next year’s models to dealers.

There were some new bright spots this fall, too — or at least brighter ones. The

once-grand Book Cadillac Hotel, long a dilapidated eyesore in the heart of

downtown, reopened after a $200 million renovation.

And the saga of Detroit’s scandal-plagued former mayor, Kwame M. Kilpatrick,

finally ended Tuesday when he went to jail, providing relief to the city from an

embarrassing run of headlines in the national media.

But even in a city that has always, of necessity, been able to cast a favorable

light on the most difficult news, things could not look more bleak.

Detroit’s auto companies are reeling from higher gas prices, a softening economy

and tight credit that has made it harder for dealers to close a sale, even with

eager buyers. Waves of layoffs for white-collar and blue-collar workers have

sent the city’s unemployment rate to a seasonally adjusted 8.9 percent, the

second-highest rate for a United States metropolitan area, behind Riverside,

Calif.

A recent headline in The Detroit Free Press captured the sense of hopelessness

many people feel: “Auto workers fear worst could get worse.”

The dire prospects for the auto companies, as they burn through billions in cash

each month, have prompted General Motors and Chrysler to consider a merger that

would turn Detroit’s Big Three into two, a cultural shift that some people find

hard to swallow.

“I would have never thought — being born and raised here — of one of the Big

Three being gone,” said Tom Carpenter, an electrician, who was attending the

football game Saturday between Michigan State University and the University of

Michigan (U. of M. lost, and is off to its worst start since 1962).

“We’re all hurting,” Mr. Carpenter added. “It’s getting scary.”

The consulting firm Grant Thornton said Thursday that half of Chrysler’s 14

manufacturing plants might close in a merger and that hundreds of parts makers

could go out of business.

The Michigan Economic Development Corporation has invited representatives from

some cities and counties most likely to be affected by a merger to a meeting

Friday near the G.M. technical center north of Detroit.

“No matter which way this goes, it’s going to result in thousands of jobs lost,

and not just in Michigan,” said Richard E. Blouse Jr., president of the Detroit

Regional Chamber. “It does not take long for the ripple effect from the auto

industry to go nationwide.”

Even before its talks with Chrysler became public, G.M. sought help from city

pension funds, suggesting they provide $250 million for half the mortgage on its

downtown headquarters, the Renaissance Center.

Few people can remember when it was this gloomy, even a generation ago when it

looked like Chrysler might go belly up without federal help. At least back then,

Chrysler’s chief executive, Lee Iacocca, was around to provide the firepower

needed to bolster the city’s spirits.

“It’s been a bad 20 years in Detroit, but this has been a very bad year and

there’s not even a light at the end of the tunnel,” said Kevin Boyle, a Detroit

native and professor of history at Ohio State University who has written

extensively about the city.

The evidence is everywhere, from the mailboxes of city residents, where one in

every 66 households has received a foreclosure notice, to restaurants, where

many tables are empty by 9 o’clock on a weekend night.

Detroit’s pro sports teams, long a refuge to distract the city from dreary news,

are hurting, too. The Detroit Lions, winless through Week 7 of the season,

failed to sell out last weekend — a rare occurrence — so their game with the

Washington Redskins was blacked out on local TV.

Eddie Smith, of Canton Township, Mich., who works as a salesman for a printing

company, said his firm was feeling the effects of the downturn, even though it

did not have ties to the automakers. He said he was glad to have followed the

advice of his father, who worked for a parts company. “He told me, ‘Do not get

into the auto industry.’ ”

With analysts predicting that 30,000 more Michigan jobs could be lost in a

G.M.-Chrysler merger, the state’s governor, Jennifer M. Granholm, has been

creating contingency plans aimed at softening the blow.

Steps may include job-training programs for workers laid off by the two

carmakers, as well as home mortgage assistance so jobless residents do not have

to move elsewhere. There also may be help for communities that lose tax revenue

because one of the companies has closed a part of its operations.

“What we can do is look at the worst-case scenario and try to move back from

that,” she said in an interview last week. “It’s so unthinkable, it’s hard to

digest.”

Ms. Granholm joined five other governors Thursday in asking the Treasury

Department and the Federal Reserve to take “immediate action” to aid the

struggling automakers.

Even before the financial crisis, Governor Granholm and state lawmakers had been

on a relentless drive to attract new investment to Michigan.

One new program offers generous incentives to entice film crews to Michigan.

Movies have already started, including projects featuring Drew Barrymore and

Michael Cera, who starred in “Juno.”

But Detroit’s dire straits have not escaped the attention of visiting

celebrities. “I am in detroit michigan/where the recession is already the

depression,” the actress and talk show host Rosie O’Donnell wrote on her blog

last weekend. “Hard 2 believe/unless u see it/we must save this city.”

Michael Smith, director of the Walter P. Reuther Library at Wayne State

University, expressed faint optimism that the city would bounce back, as it has

from numerous past crises. “This town, in a couple years when all the financial

issues get straightened out, is still going to be pretty viable,” he said. “But

tell that to the guy in the streets who lost his job.”

No matter the outcome, said Governor Granholm, “I think we’ll be a different

state.”

Hope and Fear in

Motown, NYT, 31.10.2008,

http://www.nytimes.com/2008/10/31/business/31detroit.html

NYC

We’re All Bankers Now.

So Why’s the A.T.M. Still Charging

Us $2?

October 31, 2008

The New York Times

By CLYDE HABERMAN

According to our math, not the most reliable of guides, each

taxpayer in this country has a $1,785.71 ownership share in the banks of

America.

This figure is based on the $250 billion that the Treasury Department is

investing in banks to prod them to start lending again. We divided $250 billion

by 140 million, which the Internal Revenue Service says is the number of

individual tax returns filed last year. By our count, that gives every taxpayer

a $1,785.71 stake in JPMorgan Chase, Citigroup, Wells Fargo, Bank of America and

the rest.

(In that 140 million, we are not including Charles J. O’Byrne, who resigned

under fire as Gov. David A. Paterson’s top lieutenant. We can’t be sure that Mr.

O’Byrne has fully recovered from what his lawyer calls late-filing syndrome when

it comes to his taxes. Also excluded is Joe the Publicity-Hungry Unlicensed

Plumber. Public records have shown that Joe suffers from Sticky Fingers Syndrome

in paying all that he owes.)

Far be it for us to tell Henry M. Paulson Jr., the treasury secretary, or Ben S.

Bernanke, the Federal Reserve chairman, how to manage $250 billion. They’re the

brains. And they’re doing a heck of a job. Thanks to all that brilliance in

Washington and on Wall Street, the rest of us now know how to make a small

fortune: by investing a large fortune.

But as shareholders, we have thoughts on aspects of banking that seem beyond the

scope of Messrs. Paulson and Bernanke. Call them small-bore issues. But they

affect ordinary people every day.

Let’s start with something really easy. Is it too much to ask that all banks

have pens that work on the counters with the deposit and withdrawal slips? In

too many places, the pens are useless. How can people feel confident that their

money is being managed wisely if those in charge can’t even provide a

functioning pen?

As shareholders, we were going to suggest that the top executives of the banks

forgo end-of-year bonuses, but Andrew M. Cuomo, New York’s attorney general, was

ahead of us. He sent a letter on Wednesday to nine big financial institutions

asking for information about their plans in this regard. It doesn’t guarantee

that mega-bonuses are finished. But, really, why should we give a dime to

executives who had to come to us hat in hand? Better to give an extra buck or

two to the guy in the subway with an outstretched plastic cup.

How about a moratorium on new bank branches in New York neighborhoods? The

tanking economy will probably take care of that anyway. But an ironclad

agreement by the banks to halt further expansion would delight New Yorkers. Many

are infuriated as they watch cherished local stores die and give way to

impersonal bank outlets, often located within yards of one another. Enough is

enough.

Why not forbid any bank receiving taxpayer money to purchase naming rights to

sports stadiums and arenas? Citigroup is handing the Mets something like $20

million a year to call their new stadium Citi Field. Surely, the Mets do not

need Citigroup’s money — not to mention yours — to keep failing to make the

playoffs.

Might we end the procedure by which banks stiff you when you deposit a large

check? Often, you are initially credited with only part of the deposit, and must

wait a few days to gain access to the rest. Meanwhile, the bank is using the

withheld portion to pick up a few bucks for itself. Check-clearance times have

been speeded up in recent years. But why shouldn’t depositors be able to get at

their money immediately, all of it?

For that matter, why must bank customers pay several times to retrieve cash at

an A.T.M. (known to some as short for Always Taking Money)? If you use an A.T.M.

at a bank other than your own, that bank usually charges you a fee. Fair enough.

But your own bank also charges you for the same transaction. So you pay twice

for the privilege — no, make that the right — to withdraw your own money. How is

that?

As long as we have $1,785.71 at stake, can’t we ask that banks have recognizable

names?

A few years ago, something called Sovereign Bank began popping up all over town.

We’d never heard of Sovereign. Now, just as we’ve been getting used to the name,

we learn that Sovereign has had it.

A full-page advertisement in Thursday’s paper announced that Sovereign had been

taken over by a company called Santander. What in the name of the Bailey Savings

and Loan is Santander?

Turns out that the full name is Banco Santander, based in Spain. Want to bet

that Santander left out “banco,” except in very small type at the bottom of the

ad, so that few would see right away that another piece of America had been

acquired by a foreign institution.

Sovereign, we hardly knew ye. But at least you didn’t go by a dopey moniker like

WaMu. That’s what Washington Mutual called itself before it, too, flopped. The

name WaMu will soon be gone, whammo!

Here’s hoping the same doesn’t happen to our $1,785.71.

We’re All Bankers

Now. So Why’s the A.T.M. Still Charging Us $2?, NYT, 31.10.2008,

http://www.nytimes.com/2008/10/31/nyregion/31nyc.html

Op-Ed Columnist

When Consumers Capitulate

October 31, 2008

The New York Times

By PAUL KRUGMAN

The long-feared capitulation of American consumers has

arrived. According to Thursday’s G.D.P. report, real consumer spending fell at

an annual rate of 3.1 percent in the third quarter; real spending on durable

goods (stuff like cars and TVs) fell at an annual rate of 14 percent.

To appreciate the significance of these numbers, you need to know that American

consumers almost never cut spending. Consumer demand kept rising right through

the 2001 recession; the last time it fell even for a single quarter was in 1991,

and there hasn’t been a decline this steep since 1980, when the economy was

suffering from a severe recession combined with double-digit inflation.

Also, these numbers are from the third quarter — the months of July, August, and

September. So these data are basically telling us what happened before

confidence collapsed after the fall of Lehman Brothers in mid-September, not to

mention before the Dow plunged below 10,000. Nor do the data show the full

effects of the sharp cutback in the availability of consumer credit, which is

still under way.

So this looks like the beginning of a very big change in consumer behavior. And

it couldn’t have come at a worse time.

It’s true that American consumers have long been living beyond their means. In

the mid-1980s Americans saved about 10 percent of their income. Lately, however,

the savings rate has generally been below 2 percent — sometimes it has even been

negative — and consumer debt has risen to 98 percent of G.D.P., twice its level

a quarter-century ago.

Some economists told us not to worry because Americans were offsetting their

growing debt with the ever-rising values of their homes and stock portfolios.

Somehow, though, we’re not hearing that argument much lately.

Sooner or later, then, consumers were going to have to pull in their belts. But

the timing of the new sobriety is deeply unfortunate. One is tempted to echo St.

Augustine’s plea: “Grant me chastity and continence, but not yet.” For consumers

are cutting back just as the U.S. economy has fallen into a liquidity trap — a

situation in which the Federal Reserve has lost its grip on the economy.

Some background: one of the high points of the semester, if you’re a teacher of

introductory macroeconomics, comes when you explain how individual virtue can be

public vice, how attempts by consumers to do the right thing by saving more can

leave everyone worse off. The point is that if consumers cut their spending, and

nothing else takes the place of that spending, the economy will slide into a

recession, reducing everyone’s income.

In fact, consumers’ income may actually fall more than their spending, so that

their attempt to save more backfires — a possibility known as the paradox of

thrift.

At this point, however, the instructor hastens to explain that virtue isn’t

really vice: in practice, if consumers were to cut back, the Fed would respond

by slashing interest rates, which would help the economy avoid recession and

lead to a rise in investment. So virtue is virtue after all, unless for some

reason the Fed can’t offset the fall in consumer spending.

I’ll bet you can guess what’s coming next.

For the fact is that we are in a liquidity trap right now: Fed policy has lost

most of its traction. It’s true that Ben Bernanke hasn’t yet reduced interest

rates all the way to zero, as the Japanese did in the 1990s. But it’s hard to

believe that cutting the federal funds rate from 1 percent to nothing would have

much positive effect on the economy. In particular, the financial crisis has

made Fed policy largely irrelevant for much of the private sector: The Fed has

been steadily cutting away, yet mortgage rates and the interest rates many

businesses pay are higher than they were early this year.

The capitulation of the American consumer, then, is coming at a particularly bad

time. But it’s no use whining. What we need is a policy response.

The ongoing efforts to bail out the financial system, even if they work, won’t

do more than slightly mitigate the problem. Maybe some consumers will be able to

keep their credit cards, but as we’ve seen, Americans were overextended even

before banks started cutting them off.

No, what the economy needs now is something to take the place of retrenching

consumers. That means a major fiscal stimulus. And this time the stimulus should

take the form of actual government spending rather than rebate checks that

consumers probably wouldn’t spend.

Let’s hope, then, that Congress gets to work on a package to rescue the economy

as soon as the election is behind us. And let’s also hope that the lame-duck

Bush administration doesn’t get in the way.

When Consumers

Capitulate, NYT, 31.10.2008,

http://www.nytimes.com/2008/10/31/opinion/31krugman.html

Wall Street Rises After Report on Economy

October 31, 2008

The New York Times

By MICHAEL M. GRYNBAUM

Stocks on Wall Street were higher Thursday, swinging across a

wide range as investors weighed a painful report on the nation’s economy against

signs that the flow of credit had been restored.

The Dow Jones industrial average was about 100 points higher in the early

afternoon, down from a 250-point climb in the opening minutes. The Standard &

Poor’s 500-stock index was up about 1.2 percent, and it has swung across a

nearly 4 percent range over the course of the day.

Investors appeared encouraged by efforts from central banks over the last 24

hours to inject more money into the world’s financial system, offering a buffer

for loans and a backstop for the short-term financing market.

The Federal Reserve lowered its benchmark lending rate by half a point on

Wednesday, and it introduced arrangements to enable several emerging-market

economies to swap their currencies more easily for dollars. The International

Monetary Fund also committed hundreds of billions of dollars in loans.

Borrowing rates among banks fell overnight, a sign of easing in the credit

market. The benchmark Libor rate for overnight loans fell to an all-time low.

Three-month Libor rates also declined sharply.

Buyers also returned to the market for commercial paper, short-term i.o.u.’s

used by businesses to finance daily operations. The amount of outstanding

commercial paper rose by more than $100 billion for the week that ended

Wednesday, rising to $1.55 trillion. That was a major improvement from earlier

in the month, when the market shrank. The Fed’s introduction of a program to buy

short-term corporate debt directly was considered a direct cause for the

improvement.

Investors in the United States were apparently unfazed by a Commerce Department

report that showed the worst consumer spending in nearly three decades. Gross

domestic product declined at a 0.3 percent annual rate from July to September,

the first contraction since 2001.

The report was taken as confirmation that the economy is in recession. But the

decline was slightly better than economists had expected. Investors may have

been pricing in even darker results.

Stocks on Wall Street have not had two consecutive days with gains in more than

a month. A rally on Wednesday fizzled in the final minutes of the session; some

outlets attributed the sudden decline to an erroneous report published about

General Electric that was later retracted. So far, though, stocks are having an

encouraging week, with the Dow up about 690 points since Monday.

Indexes in London and Frankfurt closed slightly more than 1 percent higher after

falling back from earlier gains. Paris stocks showed a modest gain.

The Hang Seng index in Hong Kong led an Asian rally, closing up 12.8 percent,

and the Kospi index in Seoul also soared 12 percent.

In Tokyo, the Nikkei 225 rose 10 percent, giving it a three-day gain of about 25

percent, on speculation that the Bank of Japan would cut its main interest rate

target at its policy meeting on Friday. Prime Minister Taro Aso also was

expected to announce an economic stimulus package worth $50 billion.

The S.& P./ASX 200 index in Sydney closed the day 4 percent higher.

Asian stocks were helped by news that the South Korean government had

established a $30 billion currency swap line with the Fed, a measure expected to

ease pressure on local banks needing to refinance foreign debt.

Central banks in Hong Kong and Taiwan followed the Fed’s decision on Wednesday

to slash interest rates by half a percentage point. The Hong Kong Monetary

Authority eased its base rate by the same amount to 1.5 percent, and Taiwan cut

its key rate by a quarter of a percent to 3 percent — its third cut in about a

month. Before the Fed decision, the Chinese central bank cut banks’ benchmark

lending and deposit rates by 0.27 percentage point on Wednesday, the third cut

in six weeks.

The Norwegian central bank on Wednesday also cut its main rate by half a percent

to 4.75 percent. The European Central Bank and the Bank of England are both

expected to ease rates next week as well.

The Fed lowered its target rate for federal funds — the interest rate at which

banks lend to each other overnight — to 1 percent, down to the near-record lows

reached in 2003 and 2004, when the Fed was trying to encourage an economic

recovery after the bursting of the Internet bubble. However, the de facto fed

funds market is trading around 0.125 percent, as the central bank continues to

flood the market with cash.

David Jolly, Bettina Wassener and Edmund L. Andrews contributed reporting.

Wall Street Rises

After Report on Economy, NYT, 31.10.2008,

http://www.nytimes.com/2008/10/31/business/31markets.html?hp

U.S. colleges punished by financial crisis

Thu Oct 30, 2008

9:20am EDT

Reuters

By Andrew Stern

CHICAGO (Reuters) - Higher education has been a growth

industry in the United States, evidenced by swelling enrollments, expanding

campuses and growing endowments. But the global economic crisis has caught

colleges and universities in a vice.

With their endowments shrinking along with stock markets, some schools may raise

tuition more than usual, even as students complain it is already too expensive

and struggle to get loans.

"This will definitely test many schools," said Ronald Watts, the finance chief

of Oberlin College, an elite private school in Ohio whose endowment of nearly

$750 million has shrunk by about 15 percent in the past four months.

To be sure, schools have proven resilient in past recessions, helped by rising

student enrollment as people seek a leg-up in a bleak job market.

"It's not going to be as drastic as what corporations are doing," Watts said.

"You don't just eliminate people and lay off faculty and expect not to destroy

your academic program."

Nevertheless, a few schools have already announced fresh tuition hikes, and

school officials said they were keeping a close eye on their finances. And, with

schools under financial pressure, local economies all over the country are

likely to suffer.

Tuition increases have outpaced inflation for years. Tuition and fees at public

universities have risen 175 percent since 1992, while the consumer price index

rose 48 percent.

At the University of Wisconsin in Madison, the school's $1.8 billion endowment

has shrunk by 18 percent since the start of the year, Sandy Wilcox of the

University of Wisconsin Foundation said. Dipping into the endowment to make a

promised contribution to the school's budget only shrinks it further.

Wisconsin, like many schools with substantial endowments -- 400 have endowments

over $100 million and 76 above $1 billion -- use a three-year averaging system

to smooth out how much they pay out from earnings.

RAINY DAY FUND

The wealthiest schools have come to rely on endowments and there has been

growing pressure from Congress to boost payouts, threatening to take away their

nonprofit, tax-free status if they don't comply.

For most other schools, small endowments serve as a "rainy day fund" that can

disappear quickly in tough times, said John Griswold of Commonfund, which

manages money for nonprofits.

"Schools we're most concerned about are smaller, less well-endowed private

colleges," said Roger Goodman, vice president at Moody's Investors Service,

which assigns credit ratings to 500 schools. He said endowment balances have

likely plummeted by 30 percent or more.

"You still need a college degree to be a full participant in the work force," he

said. "What we may see is a shifting (of applicants) from the higher-priced,

small, private colleges, to a lower-priced four-year university, and from the

four-year universities to community colleges for a couple of years."

A survey of 2,500 prospective students by MeritAid.com found 57 percent were now

considering less-expensive colleges due to the economic downturn.

Many prospective students encounter sticker shock when confronted by the $50,000

price tag at schools like Oberlin, Boston University and Bennington College in

Vermont.

But financial aid and federal loans remain available, and families whose assets

have declined qualify for more aid.

Boosting access to college is one plank of Democratic presidential hopeful

Barack Obama's platform. This may add pressure on publicly-funded universities

to boost enrollment, which has already climbed 10 percent since 2002.

Sticker prices at private colleges are usually much higher than pubic schools,

but students rarely pay full price.

"Sometimes a small, liberal arts college will actually be better for a student

and more affordable than in-state (public schools)," said Ken Himmelman,

Bennington's dean of admissions.

Public universities, which educate roughly 75 percent of the 17.5 million U.S.

students, are anticipating cuts in state appropriations, which cover a

substantial chunk of their costs.

State tax receipts have declined due to the economic slowdown and the bursting

of the housing bubble.

"They'll look to the university to cut. They don't want to cut prisons, or

roads," Wisconsin's Wilcox said.

MAKING CUTS

Massachusetts' public universities have cut budgets by 5 percent as their part

in covering a state-wide shortfall.

Some public and private schools have declared hiring freezes and made efforts to

reduce expenses because of shrunken endowments, and actual or expected declines

in gifts and government support.

The state of Arizona cut its contribution to the state university system by 4

percent this year and 5 percent next year -- with another mid-year cut possible,

Its more than 118,000 university students may have to absorb a tuition hike next

year of 10 percent or more.

Hawaii lowered its contribution 2 percent, though enrollment rose 6 percent.

Pennsylvania's public universities will raise tuition 4 percent next year ahead

of state cuts.

California sliced 1 percent off its $3 billion contribution to universities but

more cuts are expected as tax revenues lag projections. This spring, New York

reduced its contribution and warned another 30 percent cut may be in the offing.

The bursting of the housing bubble has dried up home equity loans many families

have used to pay tuition. And the stock market drop has shrunk some families'

savings for education.

Often, much of the media's focus is on wealthy private schools with

multibillion-dollar endowments like Harvard and Yale, which have promised to

cover costs for many of those fortunate enough to gain admission.

But at less well-heeled private schools, which make up most of the United

States' unrivaled roster of 4,300 nonprofit institutions of higher learning,

significant tuition increases may be unavoidable.

"If history repeats itself, you're going to have falling state support on a

per-student basis, rising enrollments, and probably rises in tuition," said Paul

Lingenfelter, president of State Higher Education Executive Officers.

Some schools may try to wring more out of their campuses. Professors may have to

teach more courses, schools may rent out underutilized campus buildings, or even

sell dormitories to hoteliers and lease them back, suggested Richard Vedder, who

heads the Center for College Affordability and Productivity.

"Schools normally rely on tuition increases" to offset falls in government and

donor support, Vedder said. "But as economic conditions worsen, students are

going to be resistant, plus there is political pressure not to raise tuition. In

dollar terms, budgets may be equal to last year, and some may be forced into

some sort of austerity mode."

U.S. colleges

punished by financial crisis, R, 30.10.2008,

http://www.reuters.com/article/lifestyleMolt/idUSTRE49T02E20081030

Commercial Paper Rises

for First Time in 7 Weeks

October 30, 2008

Filed at 2:12 p.m. ET

The New York Times

By THE ASSOCIATED PRESS

NEW YORK (AP) -- The Federal Reserve says the amount of

commercial paper in the market increased over the past week for the first time

since the collapse of Lehman Brothers Holdings Inc.

The reversal arrives after the Fed started buying highly rated commercial paper

on Monday.

Commercial paper outstanding rose by $100.5 billion to a seasonally adjusted

$1.55 trillion in the week ended Wednesday. That is still down from $1.82

trillion seven weeks ago, and down from $2.2 trillion when the market peaked in

the summer of 2007.

Commercial paper are short-term, unsecured loans companies get to finance their

day-to-day operations.

Commercial Paper

Rises for First Time in 7 Weeks, NYT, 30.10.2008,

http://www.nytimes.com/aponline/business/AP-Commercial-Paper.html

Families brace for holidays without a home

Thu Oct 30, 2008

7:54am EDT

Reuters

By Lisa Baertlein

THOUSAND OAKS, Calif (Reuters) - A memento with Depression-era

humor helps Kristin Bertrand keep perspective as her family braces for a

Christmas holiday without their home.

The small ceramic dish she keeps from her grandfather reads: "Cheer up, things

could be worse." Then, in smaller type: "So I cheered up and sure enough things

got worse."

Just a few years ago, Kristin and her husband Mike Bertrand, 36, were confident

they owned their own piece of the American dream. They pulled in $140,000 a

year, owned a house, two cars, a telescope and other gadgets, and had season

tickets to Disneyland for their two kids.

But since they lost their home in May, the Bertrands live in a sparsely

furnished rental in Thousand Oaks, California, and have cut expenses to the

bone.

They've sold Kristin's set of wedding rings, given up a car and the Disneyland

passes to get back on their feet. The dish, taken when Kristin's 90-year-old

grandfather moved to a nursing home, sits on the mantel as a reminder.

"It's going to be a lean holiday for us," said Kristin, 36, who said the family

has put plans to visit relatives in Idaho on the back burner. "I think this year

we need to lay low."

Adding to their worries as the holidays approach, Mike just learned that his

consulting contract, the family's main income, will not be renewed at the end of

October.

The Bertrands' story will be played out in many versions across the United

States this holiday season, where several hundred thousand people who lost their

homes to foreclosure try to redefine how they celebrate with their families.

For the Bertrands, and others, past splurges for special occasions have already

been cut out of the household budget.

The Bertrands have kept their 13-year-old daughter McKaylee and 10-year-old son

Taylor in the loop about their financial troubles all along. The kids have long

stopped asking for money for clothes or fund-raisers, they said.

While the family had once taken McKaylee and a friend to Disneyland to celebrate

her birthday, her latest party was held at home with a borrowed karaoke machine

and a jump rope that guests fashioned from glow-in-the-dark necklaces.

NOT JUST A NUMBER

More than one million U.S. homes were lost in foreclosure from the beginning of

2007 through the end of September this year, according to RealtyTrac. Credit

Suisse estimates 6.5 million loans will fall into foreclosure over the next five

years, with the peak coming this year.

Families who have already lived through the worst of their financial troubles --

due to inflated monthly mortgage payments, the plunge in U.S. home values, or

layoffs -- have prepared for a low-key holiday.

But even people who have not fallen into dire straits expect to tone it down

this year, frightened by a plunge in financial markets that has wiped out

trillions of dollars of asset values and raised the prospect of a global

recession.

Six times as many people say they will cut back on gift-buying as those who plan

to spend more, according to a recent Reuters/Zogby poll. U.S. retailers are

bracing for their most dismal holiday sales season in nearly two decades.

Virginia Washington, a 64-year-old grandmother to 10, is already planning a more

frugal holiday as she struggles to make payments on the $207,000 loan on her

dream retirement home in Tolleson, Arizona, which is now worth about $150,000.

"The spirit will be there, though many of the things you've gotten used to over

the years may not be," she said.

Counselors who help people through the foreclosure process say that many

families just aren't making holiday plans.

"They're not as concerned about what they're going to do for the holidays, it's

more about what they're going to do to keep the home," said MaryEllen De Los

Santos, a housing counseling coordinator with the Adams County Housing Authority

in Commerce City, Colorado.

One outlier is Ann Neukomm, 57, a receptionist from Cape Coral, Florida, who

filed for bankruptcy in May and now faces foreclosure on a mortgage she took out

about two years ago.

She's thinking about using a small inheritance from her father to take her

17-year-old son on a holiday cruise.

"I'd like to do something with him because it's probably going to be the last

time," Neukommm said, referring to her son's 18th birthday, a time when many

American teenagers stop living with their parents.

De Los Santos, the housing counselor, said that in the past, families in trouble

would pour into her office at the beginning of each year. Many of them could not

make mortgage payments because they spent too much on the holidays.

Now she expects more people won't even make it to the holidays to overspend, and

predicts a flood of cases starting in early December.

One question De Los Santos asks clients is: "Do you want to have this kind of

Christmas, or to you want to spend next Christmas in your home?"

FINANCIAL SPIRAL

Archstone Consulting Chief Executive Todd Lavieri said his biggest concern is

unemployment and job insecurity. The United States has lost more than 700,000

jobs since January and experts are bracing for massive layoffs ahead.

"Saving your money to save your house will have a direct impact on holiday

spending, no question about it," said Lavieri, whose group expects this year's

holiday sales to contract when adjusted for inflation.

The Bertrands' plight began when Mike lost his job in 2007. He has worked since,

but always for lower pay.

"I was working, but I was making less money. I kept fighting and struggling to

catch up," Mike said.

In February, he lost a second job. "That was pretty much the final nail in the

coffin," said Mike.

"The fear was overwhelming," Kristin said of the foreclosure saga, which left

her feeling guilty and helpless.

While the family was not required to make mortgage payments during the year that

the Newbury Park house they bought in 2001 was in foreclosure, Mike and Kristin

said nothing felt as good as making their first payment on their rental.

"It was the best therapy," said Mike.

The couple started a support group called Moving Forward

(http://wearemovingforward.org/) to help others manage the emotional toll of

foreclosure. They worry that the holidays will pile additional stress on

families already struggling to keep their heads above water.

"We need to get through it without any casualties," Kristin said.

(Reporting by Lisa Baertlein; Additional reporting by Tim Gaynor in Phoenix and

Tom Brown in Cape Coral, Florida; Editing by Michele Gershberg and Eddie Evans)

Families brace for

holidays without a home, R, 30.10.2008,

http://www.reuters.com/article/domesticNews/idUSTRE49T01O20081030

Exxon Mobil Posts

Biggest US Quarterly Profit Ever

October 30, 2008

Filed at 9:01 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

HOUSTON (AP) -- Exxon Mobil Corp., the world's largest

publicly traded oil company, reported income Thursday that shattered its own

record for the biggest profit from operations by a U.S. corporation, earning

$14.83 billion in the third quarter.

Bolstered by this summer's record crude prices, the Irving, Texas-based company

said net income jumped nearly 58 percent to $2.86 a share in the July-September

period. That compares with $9.41 billion, or $1.70 a share, a year ago.

The previous record for U.S. corporate profit was set in the last quarter, when

Exxon Mobil earned $11.68 billion.

Revenue rose 35 percent to $137.7 billion.

On average, analysts expected the company to earn $2.39 per share in the latest

quarter on revenue of $131.4 billion.

Exxon Mobil's results got a boost of $1.62 billion in the most-recent quarter

from the sale of a natural gas transportation business in Germany. It also took

a special, after-tax charge of $170 million related to a punitive damages award

related to the 1989 Exxon Valdez oil spill.

Excluding those items, third-quarter earnings amounted to $13.38 billion --

nearly 15 percent above its previous profit record from the second quarter.

As expected, Exxon Mobil posted massive earnings at its exploration and

production, or upstream, arm, where net income rose 48 percent to $9.35 billion.

Higher oil and natural gas prices propelled results, even though production was

down from the third quarter a year ago.

Oil producers are coming off a quarter during which crude prices reached an

all-time high of $147.27 -- and their profits have reflected it. Crude prices,

however, have quickly fallen 50 percent from the summer's highs, and the global

economic malaise has raised questions about energy demand at least into 2009.

Some companies, especially smaller producers, are scaling back spending on new

exploration and production projects because of the uncertainty, though analysts

say that its less likely to happen at the well-heeled giants like Exxon Mobil.

Company shares rose 96 cents to $75.61 in premarket trading.

Exxon Mobil Posts

Biggest US Quarterly Profit Ever, NYT, 30.10.2008,

http://www.nytimes.com/aponline/business/AP-Earns-Exxon-Mobil.html

Economy Shrank In Third Quarter

as Consumers Retreat

October 30, 2008

Filed at 9:02 a.m. ET

The New York Times

By REUTERS

WASHINGTON (Reuters) - The U.S. economy shrank at a 0.3

percent annual rate in the third quarter, its sharpest contraction in seven

years as consumers cut spending and businesses reduced investment in the face of

rising fears that recession was setting in.

The Commerce Department said the third-quarter contraction in gross domestic

product was the steepest since the corresponding quarter in 2001 though it was

slightly less than the 0.5 percent rate of reduction that Wall Street economists

surveyed by Reuters had forecast.

The third-quarter contraction was a striking turnaround from the second

quarter's relatively brisk 2.8 percent rate of growth. It occurred when

financial market turmoil that has heightened concerns about a potentially

lengthy U.S. recession.

Consumer spending, which fuels two-thirds of U.S. economic growth, fell at a 3.1

percent rate in the third quarter - the first cut in quarterly spending since

the closing quarter of 1991 and the biggest since the second quarter of 1980.

Spending on nondurable goods - items like food and paper products - dropped at

the sharpest rate since late 1950.

Continuing job losses coupled with declining gains from stocks and other

investments have put consumers under severe stress. The GDP report showed that

disposable personal income dropped at an 8.7 percent rate in the third quarter -

the steepest since quarterly records on this component were started in 1947 --

after rising 11.9 percent in the second quarter when most of economic stimulus

payments still were flowing.

Consumers cut spending on durable goods like cars and furniture at a 14.1

percent annual rate in the third quarter, the biggest cut in this category of

spending since the beginning of 1987. Car dealers have said that sales have

virtually stalled, in part because tight credit makes it hard for even

creditworthy buyers to get loans.

Businesses also were clearly wary about the future, cutting investments at a 1

percent rate after boosting them 2.5 percent in the second quarter. It was the

first reduction in business investment since the end of 2006. Inventories of

unsold goods backed up at a $38.5-billion rate in the third quarter after rising

$50.6 billion in the second quarter.

Prices were still rising relatively strongly in the third quarter, with the

personal consumption expenditures index up at a 5.4 percent annual rate, the

sharpest since early 1990. Even excluding volatile food and energy items, core

prices grew at a 2.9 percent rate, up from the second quarter's 2.2 percent

rise.

However, many commodity prices in October have begun to ease and the Federal

Reserve indicated on Wednesday when it slashed interest rates again that its

concern for the future was focused more heavily on weak growth than on

inflation.

(Reporting by Glenn Somerville, editing by Neil Stempleman)

Economy Shrank In

Third Quarter as Consumers Retreat, NYT, 30.10.2008,

http://www.nytimes.com/reuters/business/business-us-usa-economy.html

Concerned Fed Trims Key Rate

by a Half Point

October 30, 2008

The New York Times

By EDMUND L. ANDREWS

WASHINGTON — The Federal Reserve lowered its benchmark

interest rate by half a percentage point on Wednesday, its second big rate cut

this month, as policy makers tried to fend off what could be the worst economic

downturn in decades.

The move brought the target rate for federal funds — the interest rate at which

banks lend to each other overnight — to 1 percent, down to the near-record lows

reached in 2003 and 2004, when the Fed was trying to encourage an economic

recovery after the bursting of the Internet bubble. The central bank left open

the possibility of going still lower, warning “downside risks to growth remain.”

As the crisis that began in the mortgage market spreads through the economy,

policy makers are redoubling their efforts to contain the damage. Even as the

Fed reduced rates on Wednesday, the Bush administration was weighing a plan to

slow the foreclosure epidemic in the nation’s housing market. Details of the

initiative were in flux, but the plan could involve the government guaranteeing

the mortgages of as many as three million at-risk homeowners, a step that could

cost taxpayers tens of billions of dollars, people briefed on the plan said.

But neither the Fed’s move nor word of the possible mortgage rescue were enough

to allay concern in the financial markets that the economy was in deep trouble.

The stock market, which had rallied briefly after the rate cut was announced

shortly after 2 p.m., tumbled in the final minutes of trading.

In a statement, the Fed acknowledged that the economy had lost steam on almost

every front — consumer spending, business investment, financial markets and even

exports, which had been the one bright spot recently. For the time being,

infla-tion is of little concern.

“The pace of economic activity appears to have slowed markedly, owing

importantly to a decline in consumer expenditures,” the central bank said.

Industrial production and investment in new equipment have also slowed, it said,

and slumping growth around the world has reduced demand for American exports.

The government has taken a series of extraordinary steps in recent weeks to get

credit flowing again, but while the strains in the credit markets have eased

somewhat in response, confidence remains fragile. The central bank left room for

itself to drive short-term rates even lower, saying that it would “act as

needed” to promote both sustainable growth and stable prices.

But analysts said lower interest rates were not likely to accomplish much at

this point, because the economy’s biggest problem is the fear among banks and

financial institutions about lending money.

“The difference between 1.5 percent and 1 percent is really pretty

insignificant, particularly when the banking system is as weak as it is,” said

Ethan Harris, a senior economist at Barclay’s Capital. “You have a big

uncertainty shock. It’s not just that the markets have declined. People are

uncertain about where the world is going.”

Indeed, the stock markets reacted chaotically, even though the rate cut was in

line with what investors had been expecting. The Dow Jones industrial average

plunged nearly 200 points in the first few minutes after the announcement at

2:15 p.m., then zigzagged before closing down 74.16 points at 8,990.96.

The Federal Reserve is within striking range of reducing the overnight lending

rate to zero, a point that Japan reached in the 1990s and where it remained for

years while struggling to revive its economy.

If the federal funds rate were to reach zero, the Fed would not be out of tools

for stimulating the economy. But it would have to resort to unconventional

approaches that it has never used before. Instead of trying to reduce rates on

overnight loans between banks, for example, it might start buying longer-term

Treasury securities.

If the Fed bought, for example, two-year Treasury notes, that demand would push

prices up and yields down, and presumably would also push down the interest

rates for consumer credit that tracks those Treasury securities.

The Fed’s biggest weakness at the moment is that the economy’s problems have

less to do with interest rates than the reluctance of banks and financial

institutions to lend money. Even though the Fed has lent almost $600 billion to

financial institutions in the last month alone, banks are still reluctant to

lend to businesses or consumers.

Since the credit crisis began in August 2007, the Fed has slashed the overnight

lending rate from 5.25 percent. But interest rates for 30-year fixed-rate

mortgages are about 6.3 percent, roughly where they were when the credit crisis

began.

Many economists contend that the United States economy has already slipped into

a recession that could well last longer and be more severe than any downturn

since the early 1970s.

Macroeconomic Advisers, a forecasting firm in St. Louis, said the spate of

discouraging economic data over the last four weeks has prompted it to mark down

its estimate of third-quarter growth from a slight increase of 0.1 percent to a

contraction of 0.7 percent.

“It’s unbelievable what has happened to all aspects of financial conditions in

the past several weeks,” said Laurence H. Meyer, a former Fed governor and now

vice chairman of Macroeconomic Advisers. “Everything has changed in such a

dramatic way.”

Both consumers and businesses have ratcheted back spending. Major corporations

from General Electric to Coca-Cola have announced layoffs, and Detroit’s

automakers are struggling to survive.

Private forecasters expect that the Commerce Department, which will release its

initial estimate of third-quarter growth on Thursday, will report that the

economy contracted about one-half of 1 percent. But most forecasters expect the

fourth quarter to be down by 2 percent or more.

The United States has shed more than 700,000 jobs so far this year, and the

unemployment rate has climbed to 6.1 percent, from 5 percent in January. What

makes that alarming to many analysts is that the job losses usually have come so

early in the downturn.

Traditionally, companies have been cautious about laying off workers at the

start of a downturn and equally cautious about adding workers after a recovery

begins.

“The ground is moving from underneath us,” said Diane Swonk, chief economist at

Mesirow Financial, an investment firm in Chicago.

Details of the administration’s plan to stem foreclosures were still under

discussion on Wednesday, but people briefed on the effort said the government

might guarantee $500 billion to $600 billion of home loans, or about 5 percent

of all loans, for up to five years. The ultimate cost to taxpayers is uncertain

and would ultimately depend on the course of the housing market and the economy.

The government is expected to allocate up to $50 billion to the program, which

assumes only a small portion of the homeowners will default on their loans and

losses will be limited.

Officials from the White House, the Treasury Department and the Federal Deposit

Insurance Corporation are working on the plan and an announcement could come in

the next few days or weeks. Sheila C. Bair, the chairman of the Federal Deposit

Insurance Corporation, has been the leading proponent of the plan and first

discussed the idea publicly a week ago.

A spokeswoman for the Treasury, Jennifer Zuccarelli, said it would be premature

to discuss a plan that policy makers are still working on. “As we said last

week, the administration is going through the White House policy process too

look at ways to reduce foreclosures, and that process is ongoing,” she said. “We

have not decided on a particular approach."

The plan was authorized by Congress earlier this month as part of the $700

billion financial rescue package. Though the government would only allocate

about $50 billion to the program, because the money serves as a reserve for

losses, it could be used to back loans totaling between $500 billion to $600

billion.

Like with any other insurance company, the government would spend money when

something bad happens. In this case, the Treasury or the F.D.I.C. would make a

payment to investors or banks if borrowers with loans that have been modified

fall behind on their new, lower payments. The government would only cover half

of the losses on defaulted loans.

The program is intended to entice servicing companies that handle billing and

collections to reduce payments for homeowners by lowering interest rates and

writing down loan balances. At the end of June, nearly 1 in 10 mortgages was

delinquent or in foreclosure.

Edmund L. Andrews reported from Washington and Vikas Bajaj from New York. Eric

Dash contributed reporting from New York.

Concerned Fed Trims

Key Rate by a Half Point, NYT, 30.10.2008,

http://www.nytimes.com/2008/10/30/business/economy/30fed.html

Op-Ed Contributor

Mortgage Justice Is Blind

October 30, 2008

The New York Times

By JOHN D. GEANAKOPLOS and SUSAN P. KONIAK

THE current American economic crisis, which began with a

housing collapse that had devastating consequences for our financial system, now

threatens the global economy. But while we are rushing around trying to pick up

all the other falling dominos, the housing crisis continues, and must be

addressed.

We start with this simple fact: Too many families are being thrown out of their

homes when it makes more sense to let them stay by “reworking” their mortgages —

adjusting terms to make it possible for the homeowners to meet their

responsibilities. In many cases, adjusting loans would help the homeowners and

the lenders: the new mortgages would have lower monthly payments that homeowners

could afford to pay, and would end up giving the lenders more money than the 50

cents on the dollar that many foreclosure sales are bringing these days.

The presidential candidates have proposed plans to help some homeowners and

mortgage-security holders by buying out loans or putting a moratorium on

foreclosures. We have a plan that would be much less costly than buyouts and

more comprehensive than a moratorium.

In the old days, a mortgage loan involved only two parties, a borrower and a

bank. If the borrower ran into difficulty, it was in the bank’s interest to ease

the homeowner’s burden and adjust the terms of the loan. When housing prices

fell drastically, bankers renegotiated, helping to stabilize the market.

The world of securitization changed that, especially for subprime mortgages.

There is no longer any equivalent of “the bank” that has an incentive to rework

failing loans. The loans are pooled together, and the pooled mortgage payments

are divided up among many securities according to complicated rules. A party

called a “master servicer” manages the pools of loans. The security holders are

effectively the lenders, but legally they are prohibited from contacting the

homeowners.

In place of the bank lender, the master servicer now holds the power to rework

the loans. And, as we have seen in the current crisis, these servicers aren’t

doing that, as house after house goes into foreclosure.

Why are the master servicers not doing what an old-fashioned banker would do?

Because a servicer has very different incentives. Most anything a master

servicer does to rework a loan will create big winners but also some big losers

among the security holders to whom the servicer holds equal duties. So the

servicers feel safer doing nothing. By allowing foreclosures to proceed without

much intervention, they avoid potentially huge lawsuits by injured security

holders.

On top of the legal risks, reworking loans can be costly for master servicers.

They need to document what new monthly payment a homeowner can afford and assess

fluctuating property values to determine whether foreclosing would yield more or

less than reworking. It’s costly just to track down the distressed homeowners,

who are understandably inclined to ignore calls from master servicers that they

sense may be all too eager to foreclose.

Yes, the master servicer is paid to oversee the mortgages, but those fees were

agreed on during the housing boom, and were based on the notion that reworking

mortgages would be a relatively small part of the job and would carry little

litigation risk.

Last, some big master servicers are part of, or have now been bought out by, the

very companies that own the securities that can be affected by the reworking or

foreclosure decisions the master servicer makes. This conflict further increases

the chances of litigation and contributes to inaction.

Thus it is no surprise that so few mortgages have been reworked, with

devastating consequences for the economy. It is also no surprise that trading in

the securities tied to the mortgage pools has drastically declined, because

potential buyers cannot be sure what the servicers are going to do with the

underlying loans.

To solve this problem, we propose legislation that moves the reworking function

from the paralyzed master servicers and transfers it to community-based,

government-appointed trustees. These trustees would be given no information

about which securities are derived from which mortgages, or how those securities

would be affected by the reworking and foreclosure decisions they make.

Instead of worrying about which securities might be harmed, the blind trustees

would consider, loan by loan, whether a reworking would bring in more money than

a foreclosure. The government expense would be limited to paying for the

trustees — no small amount of money, but much cheaper than first paying off the

security holders by buying out the loans, which would then have to be reworked

anyway. Our plan would also be far more efficient than having judges attempt

this role. The trustees would be hired from the ranks of community bankers, and

thus have the expertise the judiciary lacks.

Americans have repeatedly been told that the distressed loans cannot be reworked

because these mortgages can no longer be “put back together.” But that is not

true. Our plan does not require that the loans be reassembled from the

securities in which they are now divided, nor does it require the buying up of

any loans or securities. It does require the transfer of the servicers’ duty to

rework loans to government trustees. It requires that restrictions in some

servicing contracts, like those on how many loans can be reworked in each pool,

be eliminated when the duty to rework is transferred to the trustees.

Under our plan, servicers would provide the homeowner’s name and other relevant

information on each loan to a central government clearing house, which would in

turn give trustees the data on homes in their local area. Once the trustees have

examined the loans — leaving some unchanged, reworking others and recommending

foreclosure on the rest — they would pass those decisions to the government

clearing house for transmittal back to the appropriate servicers.

The servicers would then do exactly the same work they do now, passing on the

payments they collect from the reworked mortgages to the securities’ owners in

each pool. The servicers would also foreclose on those properties the trustees

had decided did not qualify for reworking. For performing those tasks, the

servicers would continue to receive the fees due under their existing contracts.

The rules governing the trustees must ensure that only homeowners in true

financial distress qualify to have their mortgages reworked, so that homeowners

do not see the program as a free ride to a cheaper mortgage. Luckily, there is

already a rough set of guidelines in place for making these sorts of

loan-modification decisions, thanks to the Hope Now Alliance, a joint effort of

the Treasury, the Department of Housing and Urban Development and private

lenders.

Our plan would keep many more Americans in their homes, and put government money

into local communities where it would make a difference. By clarifying the true

value of each loan, it would also help clarify the value of securities

associated with those mortgages, enabling investors to trade them again. Most

important, our plan would help stabilize housing prices.

We need an innovative approach to overcome the gridlock that plagues our housing

markets. Otherwise, we imperil millions of homeowners and — through the alchemy

of derivatives — the American and global economy.

John D. Geanakoplos is a professor of economics at Yale and a partner in a hedge

fund that trades in mortgage securities. Susan P. Koniak is a former law

professor at Boston University.

Mortgage Justice Is

Blind, NYT, 30.10.2008,

http://www.nytimes.com/2008/10/30/opinion/30geanakoplos.html

Manufacturing Orders Rebound in September

October 30, 2008

The New York Times

By MICHAEL M. GRYNBAUM

A report on Wednesday presented a mixed picture of business

investment in September, with a surge in orders for aircraft and transportation

equipment offsetting declines in the communications industry.

Over all, orders for durable goods — considered a useful, if volatile, gauge for

longer-term business spending — were 0.8 percent higher in September than

August, the fourth increase in five months. Orders for August were revised

lower, to minus 5.5 percent, the Commerce Department said Wednesday.

The biggest gains came in a 30 percent surge in orders for civilian aircraft, a

figure that is highly volatile from month to month. But businesses also invested

in transportation equipment, including motor vehicle-related parts; capital

goods; electronic equipment; and heavy machinery.

The gain is an encouraging sign for the manufacturing industry, which has

suffered from a decline in export orders as the dollar strengthens against

foreign currencies.

Still, a benchmark gauge for business spending declined 1.4 percent, adding to a

2.2 percent decline in August. This gauge measures orders of civilian capital

goods outside of aircraft.

Orders for metal products fell, along with demand for computers, communications

equipment and miscellaneous electronic products.

Outside of transportation, durable goods orders fell 1.1 percent. And excluding

military equipment, orders dropped 0.6 percent.

“The trend in core capital goods orders is still broadly flat, but we are very

nervous about the next few months,” Ian Shepherdson, an economist at High

Frequency Economics, wrote in a note.

Manufacturing Orders

Rebound in September, NYT, 30.10.2008,