|

History > 2008 > UK > Economy (IV)

Dave Brown

cartoon

The Independent

Tuesday

28 October 2008

http://www.independent.co.uk/opinion/the-daily-cartoon-760940.html?ino=32

British Prime Minister Gordon Brown

Barclays turns to Middle East

in £7bn fundraising

Friday October 31 2008 10.15 GMT

Graeme Wearden and Jill Treanor

Guardian.co.uk

This article was first published on guardian.co.uk

on Friday October 31 2008.

It was last updated at 10.20 on October 31 2008.

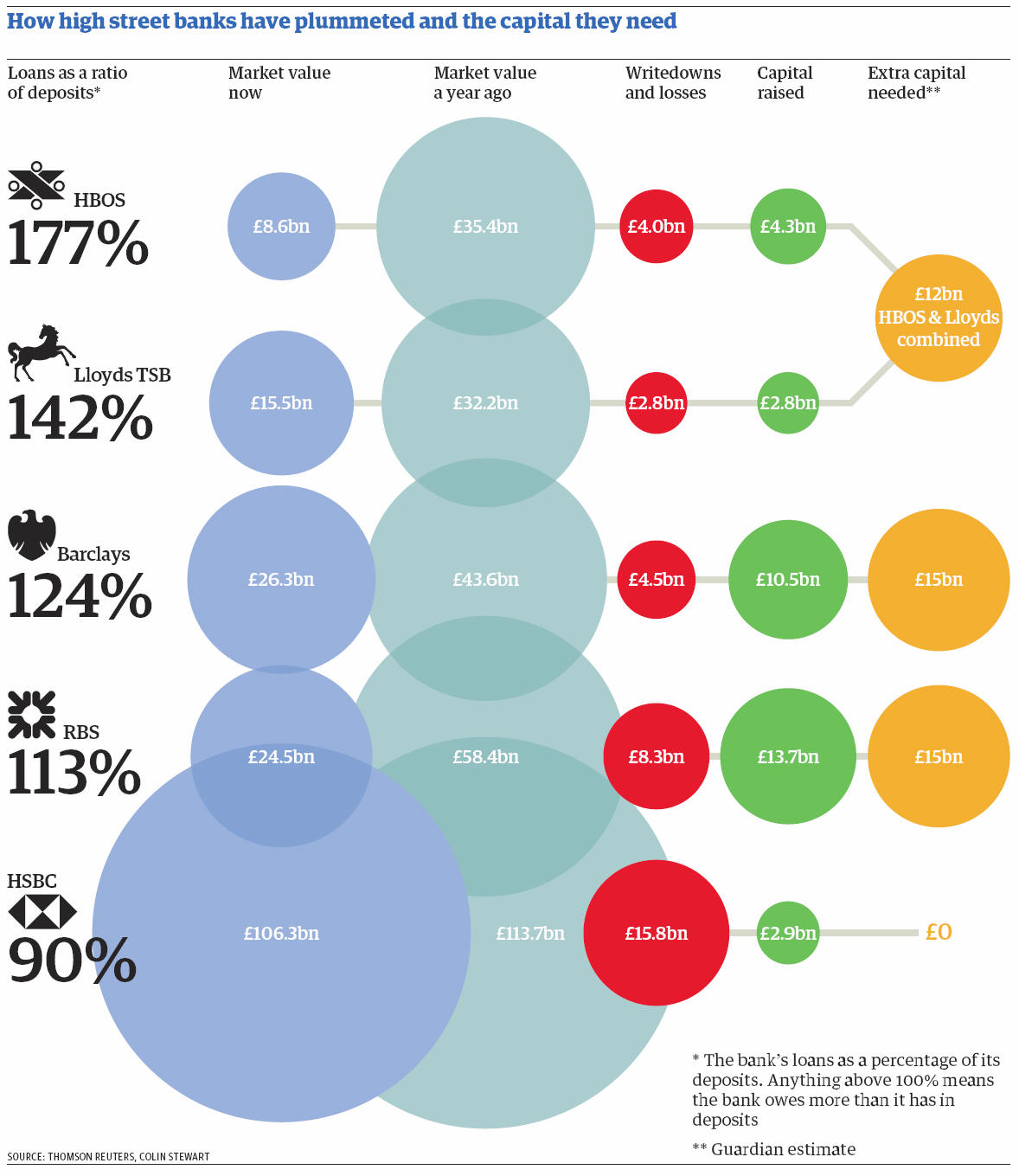

Barclays is raising up to £7.3bn, mainly from Middle East

investors who could end up owning nearly a third of the UK's second largest

bank. The move announced today allows the bank to strengthen its balance sheet

to ride out the financial crisis without getting help from the taxpayer.

Most of the cash injection is coming from the royal families of Abu Dhabi and

Qatar, who have both agreed to pump billions into Barclays to bolster its

capital ratios. The Qataris, who already own a significant shareholding in

Barclays through two different investment funds, are providing up to £2.3bn.

Once the deal goes through they will own up to 15.5% of the bank.

Sheikh Mansour Bin Zayed Al Nahyan, a member of the Abu Dhabi royal family, will

provide up to £3.5bn and will become Barclays' largest shareholder with a 16.3%

stake. A further £1.5bn is being raised from institutional investors.

The deal means that Barclays has avoided selling a stake to the UK government -

the partial nationalisation option taken by Royal Bank of Scotland, Lloyds TSB

and HBOS.

This means it will avoid restrictions on executive pay, bonuses and shareholder

dividends.

The two Middle Eastern royal families appear to be getting generous terms in

return for injecting capital into Barclays.

A large chunk of the £5.8bn investment will buy "reserve capital instruments",

similar to the preference shares which the UK government is taking in RBS and

Lloyds TSB-HBOS. They will pay a dividend of 14% a year, compared with the UK

government's 12% a year. The new shareholders will also own warrants allowing

them to buy shares in Barclays at 197.775p, any time in the next five years.

Shares in Barclays jumped by 10% this morning in early trading, but had soon

fallen by almost 10% to 185.5p as the City digested the deal.

Chairman Marcus Agius brushed aside the suggestion that Barclays was now too

reliant on overseas investors. "This is a forward-looking and progressive

approach to managing the share register," said Aguis, insisting that these deals

create new commercial opportunities around the globe.

"When these strategic investors increase the exposure they have to Barclays they

naturally leads to new business," Aguis added. Last year Barclays sold stakes to

the goverments of China and Singapore, and in June this year it raised £4.5bn

from new and existing shareholders - including Qatar.

Keith Bowman, equity analyst at Hargreaves Lansdown stockbrokers, said Barclays

had "proved the doubters wrong again".

"Barclays continues to underline management's strength in outflanking its

rivals. RBS has been sunk through its desire to win Dutch Bank ABN from the

hands of Barclays, whilst the group's knowledge of the wholesale markets and

experience of the property downturn of the early 1990s has left it better

positioned than the likes of HBOS," said Bowman.

Satisfying the government

Barclays has been forced to raise more capital as part of the bail-out scheme

which seven banks and one building society have signed up to in the government's

attempt to shore up confidence in the banking system.

The chief executive, John Varley, said the deal would enables Barclays to meet

the capital issuance plan agreed with the UK authorities earlier this month,

following the decision by the Financial Services Authority to increase the

capital ratio requirements for all UK banks.

"Today's capital raising provides certainty and speed of execution, and combined

with the strong third-quarter performance in a volatile operating environment

enables us to continue to implement our strategy and build our business by

serving clients and customers around the world," said Varley.

When the UK banking bail-out was being agreed with the Treasury earlier this

month, Varley had convinced government officials and the Financial Services

Authority, that it had one backer prepared to stump up £1bn. Roger Jenkins, a

colleague of Barclays executive Bob Diamond, is believed to have led the

negotiations to find backers prepared to put more cash into the bank.

The government is due to announce later today that it has approved the takeover

of HBOS by Lloyds TSB. Based on today's share prices, Barclays will still be the

UK's second largest bank by market capitalisation, worth almost £19bn, behind

HSBC which is today worth some £89bn. Lloyds TSB and HBOS are today worth

slightly over £17bn.

Barclays turns to

Middle East in £7bn fundraising, G, 31.10.2008,

http://www.guardian.co.uk/business/2008/oct/31/barclay-banking1

Chancellor demands cheaper petrol

as Shell posts record

profits

Trace the rise and fall in crude prices in the last decade

Thursday October 30 2008

12.15 GMT

Guardian.co.uk

Graeme Wearden

Alistair Darling today called on oil companies to pass on

lower costs to consumers by cutting petrol prices as Royal Dutch Shell posted a

71% rise in profits.

The chancellor said that he wanted the recent drop in the oil price, which has

halved in recent months, to be passed on to the pumps as soon as possible.

"People are entitled to see the benefit of that falling price reflected in what

they actually pay when they fill up the car," Darling told GMTV.

Shell defied the economic gloom this morning and smashed analyst forecasts when

it reported a profit of $10.9bn (£6.6bn) for the third quarter of 2008, up from

$6.4bn the previous year, thanks to the earlier surge in the price of oil.

The company benefited from the record oil price, which hit $147 a barrel in July

before falling sharply in recent weeks. This more than made up for a 6.5% drop

in the amount of oil and gas it produced, due to hurricane damage in the Gulf of

Mexico.

Its chief executive, Jeroen van der Veer, called the results "satisfactory" and

insisted that Shell was "robust across a wide range of oil prices".

"We are watching the world economic situation closely," he added.

The figures come just two days after rival BP sparked a row by posting a 148%

jump in profits. Unions and MPs called for a windfall tax on the oil giants, who

they said had profited from speculation on the oil price.

Oil was trading at around $70 a barrel today, less than half its price in July,

and motoring groups have complained that this is not yet reflected in the cost

of petrol. Last weekend the average price of a litre of petrol dropped back

through the £1 a litre mark, down from a high of 119.7p a litre in July,

following price cutting by supermarkets.

But as around 70% of the cost of a litre of petrol goes to the government as

duty and VAT, the drop in crude oil prices can only have a limited effect on the

cost of filling up at the pump.

The AA said it was important to keep pressure on suppliers and retailers, but

warned that further price falls may be unlikely.

"We think the supermarkets have pared their costs to the bone and are now

engaged in cut-throat competition over petrol. We can't necessarily expect the

rest of the industry to move as dramatically, but it will catch up," said an AA

spokesman.

"I do wonder if we've reached a bit of a trough for the moment, unless the

supermarkets fight for Christmas trade by cutting petrol prices to try and fill

the aisles."

The fall in the value of sterling, which has dropped by around 25% against the

dollar since July, is also undermining the benefit of lower oil prices as both

crude oil and petrol are traded in dollars.

Darling himself is under pressure to help motorists by scrapping the planned

rise of 2p a litre in fuel duty, which has been postponed until March 2009, but

the AA does not believe this is likely to happen.

"The government needs all revenue it can get, so they have no option but to

bring in the 2p rise next year," the AA spokesman predicted.

Shell itself struck an upbeat tone today. Van der Veer said world markets were

experiencing "unprecedented volatility", adding: "We are steering the Shell ship

through rough waters and so far, OK."

"Yes, we are generating large profits. Yes, we have the largest investment

programme in Shell's history to create value for shareholders and to play our

part in providing safe and cost competitive energy for consumers," he added.

The high oil price has also proved profitable for Exxon Mobil, the world's

biggest oil company. It posted record quarterly profits today of $14.8bn (£9bn),

up 58% on last year, beating analyst expectations.

Chancellor demands

cheaper petrol as Shell posts record profits, G, 30.10.2008,

http://www.guardian.co.uk/business/2008/oct/30/oil-royaldutchshell

Cost of crash: $2,800,000,000,000

• Bank of England calls for reform

• Markets jittery after Asian losses

• Brown defends borrowing

Tuesday October 28 2008

The Guardian

Larry Elliott, Phillip Inman and Nicholas Watt

This article appeared in the Guardian

on Tuesday October 28 2008 on p1 of the

Top stories section.

It was last updated at 08.17 on October 28 2008.

A worker walks past a screen displaying stock market movements

at a window of the London Stock Exchange in the City of London, October 27,

2008. Photograph: Alessia Pierdomenico/Reuters

Autumn's market mayhem has left the world's financial institutions nursing

losses of $2.8tn, the Bank of England said today, as it called for fundamental

reform of the global banking system to prevent a repeat of turmoil "arguably"

unprecedented since the outbreak of the first world war.

In its half-yearly health check of the City, the Bank said tougher regulation

and constraints on lending would be needed as policymakers sought to learn

lessons from the mistakes that have led to a systemic crisis unfolding over the

past 15 months.

The Bank's Financial Stability Report, which will be sent to every bank director

in Britain, more than doubled the previous estimate of the potential losses

faced by all financial institutions since the spring, but said that given time

the actual losses could be pared by between a third and a half.

The £50bn pledged by the government had helped underpin the system, the Bank

said, and would provide a breathing space for UK banks so that they did not have

to sell assets at cut-price values immediately. The report also expressed

cautious optimism about the effectiveness of the recent global bail-out plan.

The Bank's estimate exceeds that made by the International Monetary Fund

recently. The IMF concentrated on US institutions and did not include losses

from the turmoil of recent weeks. Estimated paper losses from UK banks on

mortgage-backed securities and corporate bonds are currently £122.6bn, the Bank

report said.

Gordon Brown insisted yesterday that it was right for the government to increase

borrowing in order to fund investment to help the economy through tough times.

But he moved to reassure markets that he would not preside over a reckless

increase in borrowing during the recession and said he would reduce it as a

proportion of GDP once the economy picks up.

Paving the way for an expected abandonment of the tight fiscal rules he

established as chancellor, Brown said: "The responsible course of government is

to invest at this time to speed up the economic activity. As economic activity

rises, as tax revenues recover, then you would want borrowing to be a lower

share of your national income. But the responsible course at the moment is to

use the investments that are necessary, and to continue them, and to help people

through very difficult times.

"I think that's a very fundamental part of what we are doing."

In another turbulent day yesterday on global markets, there were hefty falls in

Asian stockmarkets and a fresh fall in the pound. Japan's Nikkei index closed

down more than 6% at a 26-year-low of 7162.9. London's FTSE 100 recovered from

an early fall of more than 200 points to close 30 points lower at 3852.6, while

the Dow Jones closed down 2.42% at 8,175.77.

Brown and Peter Mandelson, the business secretary, served notice that Britain

should brace itself for a downturn when they both warned about rising

unemployment. Brown said: "I can't promise people that we will keep them in

their last job if it becomes economically redundant. But we can promise people

that we will help them into their next job."

Mandelson was more blunt as he warned of the impact of the recession. "We are

facing an unparalleled financial crisis," he said during a visit to Moscow. "I

don't think yet people have realised what the impact is going to be on our real

economy."

The Tories intensified their attacks on the government by depicting Brown as not

a man with a plan but a man with an overdraft.

Responding to Brown's remarks, George Osborne, shadow chancellor, said: "What

they are talking about is borrowing out of necessity, not out of virtue. Gordon

Brown is a man with an overdraft, not a man with a plan. He is being forced into

this borrowing. He presents it as a strategy but it is actually a consequence of

his great failure that borrowing is already out of control before we even get

into the worst of the economic circumstances that we are in."

Brown was speaking as the Treasury finalised plans to rewrite the fiscal rules

which have governed his approach to the economy over the past decade. Alistair

Darling will use his pre-budget report next month to say that it is time for a

more flexible approach in the new economic cycle, which started in 2006-07.

The previous FSR in April envisaged a gradual recovery in global markets and the

Bank was careful today not to sound the all-clear despite the coordinated action

in Britain, the US and the eurozone this month to recapitalise banks and provide

extra liquidity to markets. "In recent weeks, the global banking system has

arguably undergone its biggest episode of instability since the start of the

first world war," it said.

Sir John Gieve, the Bank's deputy governor for financial stability, added: "With

a global economic downturn under way, the financial system remains under strain.

But it is better placed as a result of the exceptional package of capital,

guaranteed funding and liquidity support. That is helping to underpin the

banking system both directly and by demonstrating the authorities' determination

to do whatever is needed to restore confidence.

"Looking further ahead, we need a fundamental rethink of how to manage systemic

risk internationally. We need to establish stronger restraints on the build-up

of risks in the financial system over the cycle with the dangers they bring to

the wider economy.

"That means not just increasing capital and liquidity requirements for

individual institutions but relating them to the cyclical growth of risk in the

system more broadly. Counter-cyclical policy of that sort should complement

regulation of companies and broader macroeconomic policy."

The Bank believes that the capital injection from the taxpayer will also prevent

banks from slashing their lending too aggressively over the coming months,

relieving the recessionary pressure on the economy.

Figures released yesterday, however, from financial data provider Moneyfacts

showed banks were failing to pass on interest rate cuts to mortgage borrowers

despite making severe cuts in savings rates. It said most institutions had

already passed on the last half-point base rate cut to savers while holding back

on cuts in home loan interest rates.

"Some providers are using the base rate cut as a way of increasing their margin

for risk, by not passing on the full cut to mortgage customers but passing the

cut on in full to savings customers," it said.

A separate study last week marked a new low in the number of mortgage products

available.

Concerns at widespread job losses across the finance sector prompted unions to

demand a "social contract" to protect jobs. Derek Simpson, Unite's joint general

secretary, said: "Workers in the financial services are facing insecurity as the

world is gripped by economic turmoil. The Unite 'social contract' sets out the

principles which employees expect the government and finance companies to now

sign up to.

"Unite is calling for the protection of jobs, pensions, the end to short-term

remuneration policies and an overhaul of the regulatory structures in the

financial services sector. There must be a recognition of the importance of

employment in the financial services sector, as many communities now depend on

the sector since being decimated by the collapse of the manufacturing industry.

"Workers in the financial services industry are not the culprits of the credit

crunch and we are not prepared to allow them to become the victims. The taxpayer

must now get firm assurances that the financial lifeline extended to these large

organisations will be used to protect jobs and the public. It is not acceptable

for the government to socialise the risk without allowing the wider society to

capitalise on the rewards in the finance industry."

How much is that?

The Bank of England may have put the paper cost of the global

crisis at a staggering $2.8 trillion, but how does one come to grips with such a

sum? Think of it like this: it could pay for 46 bail-outs of the kind the

Treasury handed to the banks RBS, HBOS group and Lloyds TSB; or pay off the last

quarter's public debt 45 times. It is more than three times the sum of UK annual

public spending, and also equivalent to the wealth of 100 Oleg Deripaskas -

before the credit crunch anyway. It's equal to 138m bottles of 1947 Petrus

Pomerol, the bankers' favourite vintage; or, if it's your turn in the coffee

round, 773bn lattes - nearly 13,000 each for every UK citizen.

Cost of crash:

$2,800,000,000,000, G, 28.10.2008,

http://www.guardian.co.uk/business/2008/oct/28/economics-credit-crunch-bank-england

BP smashes forecasts

as profits soar 148%

Tuesday October 28 2008

09.52 GMT

Guardian.co.uk

Julia Kollewe

This article was first published on guardian.co.uk

on Tuesday October 28 2008.

It was last updated at 11.30 on October 28 2008.

Oil giant BP has reaped the benefits of this summer's record

oil prices, smashing all forecasts with a 148% rise in third-quarter profits.

The figures are likely to spark fresh protests from motorists and businesses

that have been hit hard by higher petrol prices.

The shares rose 19.5p to 457.5p this morning, a gain of 4.5%. BP said it would

pay a dividend of 14 cents a share in December, up some 30% in dollar terms from

a year ago and 60% higher in sterling terms.

"Although it has since fallen away sharply, the high oil price of the third

quarter obviously helped our absolute result," said BP's chief executive, Tony

Hayward.

Oil surged to a record high of $147 a barrel in July, but the price has since

more than halved amid mounting fears of a global recession. Today the price of

crude rose to $64 a barrel.

BP, Europe's second-biggest oil producer behind Royal Dutch Shell, posted

replacement cost profits of $10bn (£6bn) for the quarter from July to September,

up from $4bn a year earlier. Replacement cost profit is a measure often used by

oil companies and is calculated using the cost of replacing supplies at current

prices, rather than the prices at which they were bought.

Revenues climbed 45% from $71bn to $103bn over the quarter.

"We are well-placed to weather the prevailing financial storm and to benefit

from the business opportunities that may well arise from a downturn," Hayward

said. "Our balance sheet is strong and we have committed less of our portfolio

to high-cost options like tar sands and gas conversion than some of our peers."

Analysts were worried about the impact of the recent fall in oil prices on BP,

but noted that the company had made good progress on restructuring its

crude-processing division, which has underperformed rivals in recent years.

"In refining and marketing they have a restructuring plan under way and that

looks as if it has helped the results there," said oil analyst Tony Shepard at

brokerage Charles Stanley.

The oil firm, which expects to spend up to $22bn on capital investment this

year, counts pension funds among its major shareholders.

BP smashes forecasts

as profits soar 148%, G, 28.10.2008,

http://www.guardian.co.uk/business/2008/oct/28/oil-oilandgascompanies

Home repossessions and arrears rise

as borrowers struggle

Tuesday October 28 2008

10.53 GMT

Guardian.co.uk

Hilary Osborne

This article was first published on guardian.co.uk

on Tuesday October 28 2008.

It was last updated at 11.31 on October 28 2008.

The number of properties repossessed by lenders in the second

quarter of this year was up 71% on the same period last year, figures showed

today.

Rising household bills and increasing mortgage costs resulted in 11,054 new

possessions cases in the three months between April and June this year, compared

with just 6,476 in the same quarter of 2007.

The figures, from the Financial Services Authority, also showed an increase in

the number of homeowners who had fallen behind on mortgage repayments.

The City watchdog said while the number of new arrears cases had stayed

constant, at around 54,000 each quarter since early 2007, consumers were

increasingly struggling to clear their arrears. Consequently the total number of

accounts in arrears was rising.

At the end of June there were 312,000 loan accounts in arrears, an increase of

3% on the first three months of this year and 16% up on a year earlier.

Over the past year borrowers have been hit by a double whammy of rising mortgage

costs and inflation.

Borrowers coming to the end of cheap fixed-rate deals have seen repayments jump,

with the credit crunch forcing lenders to reprice deals upwards.

Some have stopped lending to borrowers with big mortgages, leaving those who

took out large loans with lenders like Northern Rock unable to move away from

high standard variable rate (SVR) mortgages.

The figures still represent a small fraction of the mortgage market, with just

over 2% of outstanding mortgages in arrears or possession. However the rising

number of people unable to catch up with repayments they have missed suggests

repossession rates will continue to rise.

Last year, the Council of Mortgage Lenders predicted the number of homes

repossessed this year would rise by 50%, to 45,000, and the FSA's figures for

the first half of the year are broadly in line with that, showing just over

20,000 properties were repossessed.

However recent economic news has been more gloomy than anticipated, and rising

job losses could push many more homeowners than expected into difficulties.

Home repossessions

and arrears rise as borrowers struggle, G, 28.10.2008,

http://www.guardian.co.uk/money/2008/oct/28/repossessions-debt

Commodities slide

amid demand fears

Published: October 27 2008 10:35

Last updated: October 27 2008 10:35

The Financial Times

By Javier Blas in London

Commodities prices continued to fall sharply on Monday, with oil prices falling

to a fresh 17-month low just above $60 a barrel, on growing concern that a

potential global recession was unavoidable, raising further fears for raw

materials demand.

The fall in oil prices came in spite of last week’s Opec oil cartel agreement to

cut its production official limit by 1.5m barrels a day in an effort to put a

floor on dropping oil prices. Opec officials said they were monitoring the fall

in prices.

Iran said Opec was ready to cut further its production if last week’s reduction

does not stop the slide, the country’s Opec governor was quoted as saying in the

local media.

“In case the reduction in production does not stabilise the oil market, Opec

will again reduce its production ceiling,” Mohammad Ali Khatibi Khatibi was

quoted as saying by Farhang-e Ashti newspaper.

In London morning trading, Nymex December West Texas Intermediate fell by a

further $1.45 a barrel to $62.82 a barrel having earlier hit a fresh 17-month

low of $61.30 a barrel. Heating oil and gasoline in New York also fall sharply.

In London, ICE December Brent crude futures lost $3 to hit an intraday low of

$59.05 a barrel, its lowest level since February 2007.

Opec’s decision to cut production sparked criticism from the US and UK

governments but the continuing fall for oil prices led to talk that the cartel

would try to reduce output further before the end of the year.

Robert Laughlin at MF Global in London said whilst many will not shed a tear for

oil producers at present it should be noted that several countries may well be

running into a ” nil-margin ” production scenario with oil prices sub $ 60 a

barrel

The key signal for prices in the medium term will be Opec’s adherence to its

agreement. Many traders doubt that it will fully implement the cuts, noting that

historically the group has managed about a 60 per cent adherence rate.

But Chakib Khelil, Algeria’s energy minister and Opec’s president, insisted that

the group had “no other choice” and it was having trouble selling its oil as

buyers stayed away or were unable to secure letters of credit.

Other commodity prices also fell sharply on Monday as investors continued to

unwind positions in what now is seen as a risky asset class.

Oliver Jakob, of Swiss-based Petromatrix consutants, said that financial flows

were overall dominated by the closing of bets of raising prices in commodity

indices.

“With volatility indices at levels of systemic breakdowns it should be expected

that more risk is still to be taken off the table, meaning that the waves of

indiscriminate selling across asset classes are not yet necessarily over and

will dominate in the near term over fundamental considerations,” he said in a

note to clients.

Gold prices also came under pressure, as the strengthening dollar reduced the

metal’s appeal as a currency hedge. Spot gold slipped nearly 3 per cent to

$717.80 a troy ounce, having hit a low of $712 an ounce.

Base metals were also hampered by the spectre of a global recession and its

likely implications for demand. Copper continued its fall under the $4,000 mark,

losing almost 5 per cent to $3,645 a tonne on the London Metal Exchange.

Agriculture commodities were also down, with CBOT December corn falling 7 cents

to $3.65 ¾ a bushel, its lowest in 11 months.

Commodities slide

amid demand fears, FT, 27.10.2008,

http://www.ft.com/cms/s/0/aefd7198-a402-11dd-8104-000077b07658.html

Economy shrinks

as Britain enters recession

October 25, 2008

From The Times

Gary Duncan, Economics Editor

Britain’s economy is shrinking for the first time in 16 years,

official figures showed yesterday, confirming that the country is in recession.

The toll from the credit crisis and housing crash has ended Britain’s longest

unbroken run of growth since quarterly records began in 1955. City analysts gave

a warning that the economy could shrink at an even faster pace in coming months.

Figures for gross domestic product revealed a worse-than-expected fall of 0.5

per cent over the past three months. A recession is defined as two consecutive

quarters of negative growth, but a further contraction is inevitable.

The response on the financial markets was swift and brutal. The pound plummeted

against the dollar and nearly £49 billion was wiped off the value of Britain’s

leading companies. Alistair Darling, the Chancellor, sought to shore up

confidence among fearful families and businesses. “It’s obvious now that our

economy, other economies across the world, are moving into recession,” he said.

“Yes, it’s going to be difficult, yes it’s going to be tough, but we can get

through it.”

Charlie Bean, the deputy governor of the Bank of England, said

that Britain was only “in the early days” of the fallout from unprecedented

global financial convulsions. “This is a once-in-a-lifetime crisis, and possibly

the largest crisis of its kind in human history,” Professor Bean said.

Shares in London slumped in response. The FTSE 100 closed down a further 204.5

points, or 5 per cent.The pound suffered one of its worst batterings since it

was floated in 1971. At one point it was down by 8 cents against the dollar,

before closing a little over 3.5 cents down on the day at $1.5837. In Europe,

leading shares also fell by 5 per cent, while US blue-chips fell almost 4 per

cent in a day of wild swings in financial markets.

Currencies and commodity prices also suffered. Oil prices continued to fall

despite a decision by Opec to cut production by 1.5 million barrels a day.

Benchmark Brent crude fell $3.94 to $61.98 per barrel – from a high of $146 in

July.

Even gold, the traditional safe haven in times of panic, fell sharply, although

it later rcovered. Pressure is growing on the Bank to deliver drastic cuts in

interest rates. Its rate-setting committee is expected to order a half-point cut

at the start of next month.

Economy shrinks as

Britain enters recession, Ts, 25.10.2008,

http://business.timesonline.co.uk/tol/business/economics/article5010581.ece

Mega-mall:

Is this the future of shopping?

He's built a global empire of malls.

Now, in London, Frank Lowy

is about to unveil his boldest project yet

– just as

recession hits.

Does he know something we don't?

Rob Sharp reports on a £1.7bn gamble

Thursday, 23 October 2008

The Independent

On a building site in west London, 8,000 contractors are

crawling across a gargantuan, soon-to-be-finished shopping centre. Lifts raise

builders in hi-vis jackets as they finish painting restaurant exteriors. Droves

of stone masons hurriedly shift huge granite slabs into their final resting

places. Sparks from welding torches cascade to the floor. Rivers of polythene

wrapping snake as far as the eye can see.

When Boris Johnson opens its doors on Thursday next week, Westfield London will

be Britain's largest urban shopping centre. Sprawling across 43 acres just north

of Shepherd's Bush Green, it will house 265 shops, with Tiffany & Co, Louis

Vuitton, Gucci, Prada and De Beers offering glitz alongside Waitrose, Russell &

Bromley, Marks & Spencer and other familiar high-street names. There will be

dozens of restaurants, a library, and two new London Underground stations to

bring in the masses. Those who drive will have the option of employing the

services of a 70-strong team of valets. Needless to say, this is no ordinary

shopping centre. Its makers are marketing it as the cutting edge of "retail

experiences".

Costing £1.7bn, it is also the biggest venture – in monetary terms – that the

development company, Westfield, has ever undertaken. Back in 2004, when

Westfield bought the site, it must have seemed an irresistible way to ride the

consumer boom. Given the current economic climate, it feels like an even more

audacious move than the company may have intended. Household budgets are under

pressure; consumer confidence is far from buoyant. Earlier this week, The Ernst

& Young Item Club, an influential forecasting agency, predicted that consumer

expenditure on everything from food, clothes, holidays, household bills, home

improvements and entertainment will fall by 1.2 per cent in 2009. This compares

with an average annual growth of 3.5 per cent over the past decade.

One would think such statistics would send a shiver down the spine of even the

most hardened of businessmen. But Westfield's chairman Frank Lowy, who turned 78

yesterday, is no ordinary corporate suit. According to Australian media reports,

he boasts a fortune of £2.4bn, making him the richest man in Australia. Born in

Slovakia, he arrived in Australia in 1953 after spending a period shortly after

the Second World War in a refugee camp in Cyprus. After founding Westfield in

1959 with business partner John Saunders (who died in 1997 aged 75), Lowy has

grown his company into the biggest publically listed retail property group in

the world. It is valued at more than £26bn, and leases 10 million square metres

of retail space to 23,000 retailers in 119 centres around the world. In the

company's homeland, as many people speak of "going to Westfield" as they do of

"going shopping".

But pulling off this audacious development is more than just a question of

battling economic forces. Local residents are far from pleased about the effects

of bus routes imposed by Hammersmith and Fulham council to serve the new centre.

Writing in the London Evening Standard this week, the novelist Sebastian Faulks

slammed the new routes planned for areas close to the development for running

through some of the capital's historic conservation areas. He also described how

the council's consultation over the new routes was radically under-resourced,

and how new buses will add unnecessary pollution and congestion to already busy

and dirty streets. In addition, the scheme – located just three miles from

London's West End – will draw customers away from already cash-strapped Oxford

Street shops. For years, Westfield London has been spoken of as the nail in the

coffin of Oxford Street.

Meanwhile, tax authorities in Australia are investigating Lowy amid claims by

the US Senate that he hid £42m from the Australian Taxation Office. But this is

all in a day's work for a man who obtained a shrapnel scar on his forehead when

fighting for the Israeli army. Westfield London, experts say, will still manage

to bring a smile to his lips.

Lowy was born into a Jewish family in 1930 in Fil'akovo, a rural town in what

was then Czechoslovakia. According to the official biography on the Westfield

website, at an early age he helped his mother to run the family grocery shop.

When the Second World War broke out, his family sold their shop and fled to

Budapest. Here, Lowy helped his older brother, John, run a metalware business,

but the family was soon hit by tragedy. When the Nazis invaded Hungary in March

1944, Lowy's father was captured and sent to Auschwitz, where he eventually

died. Without the family's main breadwinner, Lowy supported his mother by

foraging for food.

When the war ended, Lowy left Europe for Israel. On his way, he was picked up by

the British Army and spent several months in a refugee camp in Cyprus. After his

release, he reached Israel, aged 17, to join the nation's Golani Brigade, an

army unit fighting in the 1948 Arab-Israeli war.

When the war finished the same year, Lowy spent a brief time working in a bank,

and studying to become an accountant at night school. Eventually, he decided to

go to Australia, to where many members of his family had already moved. He

arrived there on 26 January 1952, carrying a small suitcase, and possessing only

a basic knowledge of English. "All those events shaped my life," Lowy said in an

interview earlier this month. "It's a requirement to have some sort of paranoia.

You have to think of what can go wrong even when times are good. So you can

never enjoy your success fully."

In Sydney, the man who would become a property magnate managed to scrape

together enough cash to buy a van. He began work as a deliveryman, and it was

then that he met Saunders, another Holocaust survivor, who had set up a small

shop in the outskirts of Sydney. The pair's first business venture together was

running a delicatessen. They soon realised that along with salami and rye bread,

newcomers from Europe needed a wider array of goods. They borrowed from a local

bank manager and used profits from the deli to buy farmland out of town. The

pair read about the popularity of American shopping malls, and in 1959 built

their first shopping centre on that land. Westfield Investments was listed on

the Australian stock exchange in 1960. Over the next two decades, the pair built

up their company to become one of the best-known shopping centre providers in

Australia, where Lowy now owns 44 malls.

In 1977, the company bought its first US shopping centre, in Connecticut, but it

was not until 2000 that the company gained its first foothold in the UK market.

In March of that year it bought the Broadmarsh centre in Nottingham, in

partnership with the investment house Hermes. The same year it also acquired

shopping centres in Tunbridge Wells, Guildford, Derby and Northern Ireland.

Now, Lowy runs his worldwide empire – across Australia, New Zealand, the United

States and Britain – with his two sons, group managing directors Steven and

Peter. Frank Lowy is based on the top floor of the 24-storey Westfield Towers in

Sydney, which his company built in 1974. The company founder's own floor has

uninterrupted views of Sydney's Opera House and Harbour Bridge, near to which

Lowy's 74-metre yacht, named Ilona IV after his mother, is berthed. It was here

that the Australian executive worked on his plan to enter the UK market – a plan

that took his three decades to perfect.

The company developed its first UK shopping centre, after demolishing an

existing mall in Derby. The £340m Westfield Derby project opened in October of

last year. It was the biggest shopping centre to open in Britain that year. Now,

Westfield hopes its west London development – located in an area known as White

City – will move shopping centre development in the UK to the "next level".

"All our projects are about evolution," says Westfield UK and Europe managing

director Michael Gutman. "In the White City project we are trying to bring

together all the knowledge we have gathered from our 118 centres in four

countries around the world. This will be our 119th. It is a unique trading area

and demographic in terms of the power and disposable income of the people who

live nearby. It is unparalleled in terms of connectivity. It contains some

phenomenal public spaces both inside and out."

The story of how Westfield created Westfield London goes back four years. It

involves a complicated series of acquisitions and joint ventures, but

essentially involved Westfield taking control of an existing scheme being

developed by fellow property firm Chelsfield in 2004.

Westfield bought out its partners in that acquisition, the Reuben brothers,

billionaire private investors, and Multiplex, the Australian construction firm.

In 2006 Westfield also took control of the project's construction from the

Australian construction firm Multiplex, which at the time was dealing with

negative press surrounding the late delivery of Wembley Stadium, which it was

also contracted to build. Westfield currently owns a half stake in Westfield

London, with the other half being owned by the property arm of the German

financier Commerzbank.

Before Westfield's acquisition of the development, the acclaimed British

architect Ian Ritchie had designed a concept for the shopping centre. He had

suggested a number of features, which included the interior of the centre being

covered by a fabric roof. When Westfield took control, it decided not to

continue its relationship with Ritchie and brought its own in-house designers on

board, who collaborated with out-of-house architects on specific elements of the

scheme. These external designers included a young firm of London architects,

Softroom, who designed a futuristic-looking café court called "The Balcony".

Acclaimed New York designer Michael Gabellini took charge of blueprints for "The

Village" – the separate area of the centre where the luxury brands such as

Tiffany & Co are housed.

Westfield's own architects scrapped the fabric roof in favour of a glass version

that would allow more light to enter the centre's interior. They also introduced

a street of bars and restaurants that will be open around the clock – the

"Southern Terrace" – at the centre's south-east corner, at the suggestion of

superstar architect Richard Rogers, who at that point was acting as an adviser

to former London mayor Ken Livingstone. Rogers felt the street would improve the

area's public space.

"Normally we design all of our own buildings. But when we acquired the property,

its design had already won planning permission from the council and it was under

construction," says Gutman. "On a major retail development, the planning and

circulation requires knowledge and experience. So we needed to bring on board

some specialists, which we got through Softroom and Michael Gabellini."

On a private tour with the developer late last week, two weeks before the

completion of construction, things appeared to be in impressive shape.

Approaching Westfield London from the south-east, where a new bus terminal and

specially designed, sleek-looking Shepherd's Bush Tube station sit, shoppers

ascend the shallow granite ramp or "shopping street" of "Southern Terrace". This

street is already lined with finished restaurants, outside which diners will sit

on terraces overlooking the thoroughfare. The façades of the restaurant are of

various sizes and designs to give each its own character. Overhead, various

canopies, each again of unique size and material, offer protection from the

elements. The red Westfield logo is affixed at key points to the street's

façade.

Entering through a huge glass entrance, customers encounter a massive central

space. Above this, one gets a look at the distinctive, undulating glass roof,

through which daylight streams to cast triangular patterns on perfectly white

walls.

This central space contains a large central "well" surrounded by the centre's

three floors. On the uppermost of these, a 14-screen cinema, due to open next

autumn, will allow film-goers to take a beer, wine or cocktail to the newest

film releases as well as to reserve special "VIP" areas.

On the floor beneath this, the clothing store Timberland has turned the front of

its shop into what appears to be a large wooden box, in line with the company's

"rugged and outdoor" branding. A short distance away, Apple has finished its

unit with typical white minimalism. To one side, Softroom's "Balcony" stretches

for some 50 metres. Its futuristic, capsule-like appearance is contained within

a façade that appears to be divided into a series of wooden slats. Here, an

array of dedicated restaurants such Crocque Gascon – who will serve modern

French cuisine like "duck burger classique" – and Vietnamese street food

restaurant Pho, will serve to customers who will then sit at a shared seating

area.

On the lowest floor, DKNY and Russell & Bromley have leased units. Gabellini's

"Village" lies to the north-east of this central space. Here, the ceiling is

shaped into soft ovals of plastic from which chandeliers hang.

Such features seem to have gone down well with retailers. At the time of

opening, Westfield says the centre will be more than 96 per cent leased. Around

90 per cent of the tenants locked into 10 to 15-year contracts before the full

extent of the current economic crisis was known. Unless the shops go out of

business, Westfield will get their money.

It may sound worrying for the retailers concerned, but signing on Lowy's dotted

line may well prove to suit them as much as Westfield. It's impossible to know

the details of each deal, but industry experts believe that they may not have to

part with any cash for the first year or two. So they can take their places in

this glittering cathedral to the future of shopping, and pay for it when (they

hope) the economy, and consumer confidence, is in an altogether better place.

And many believe that Lowy will prosper despite the current economic gloom.

"Rather than being troubled by the financial crisis, Westfield has almost landed

on its feet," says Retail Week editor Tim Danaher. "In fact, far from being

unenthusiastic about the development, retailers don't want to be left out. While

the details of the deals they have struck are mired in secrecy, Westfield, like

all developers of new shopping centres, will have made concessions – such as

rent-free periods and contributions to the shops' fit-outs, which have helped to

persuade people to come on board. While some of the smaller retailers might go

bust, the big guys won't come unstuck. Westfield has got the stomach to cope."

It has not all been plain sailing for Lowy and his empire, however. The business

news agency Bloomberg reports that the billionaire is embroiled in a bout with

tax authorities. The Australian Taxation Office is investigating claims that he

hid £42m from tax officials. A US Senate panel had alleged in July that the Lowy

family and LGT Group, a bank owned by Liechtenstein's royal family, had used a

foundation and companies registered in Delaware and the British Virgin Islands

to conceal the fact that the Lowys owned the money in question. This is

something Frank Lowy has vehemently denied.

On a more local level, the White City scheme has encountered a degree of

opposition. Nigel Kersey, director of the London branch of the Campaign to

Protect Rural England, tried unsuccessfully to take the local council to court

in 2000 for failing to ask for an environmental damage assessment over the

initial Chelsfield scheme. "Had the planning authority played by the rules, it

would have shown that the impact would be substantial," he said at the time.

Since then, Westfield says it has conducted broad consultations and that local

groups now welcome the project. Indeed, the company is so confident that it is

pressing on with plans to build a £1.45bn, 175,000sq m centre in Stratford, east

London, to be completed in time for the 2012 Olympics. "The current slowdown is

only likely to be relatively short-term compared with the planning process and

the active life of a shopping centre," says Richard Dodd, a spokesperson for the

British Retail Consortium, which represents British shopping centres. "Now, when

retailers are competing more fiercely for customers' every pound, investing in

your premises can be a good thing to do. Shopping centres offer great access and

investment in retail."

Certainly, Michael Gutman feels the company has done enough to make sure that it

is not hit by any forthcoming economic crash. "Most definitely we are in this

for the long haul," he concludes. "We have a history of being long-term owners.

We are beginning our relationship with Londoners and we hope to be embraced as a

new icon on the landscape, like Covent Garden or the O2.

"We have opened projects in recessions before and in booms before. These

buildings are built for long-term and they take several years to settle. The

retailers who have taken stores are our customers and we are in a partnership

with them to maximise their performance. The ability to effectively come in the

morning to do grocery shopping and have a coffee and maybe go to the gym and go

back home as well as doing fashion shopping surpasses anything you currently see

in the high street."

In an interview last month, Frank Lowy, Gutman's ultimate boss, divulged that a

few times a month, he plays poker. The billionaire says he gambles for stakes

high enough to be painful if he doesn't win. "It has to hurt you a little bit

when you lose," he said, declining to say how much someone with his finances

might actually bet. "And I don't like to lose, period."

This time, with the ante at £1.7bn, you can bet that losing would cause Lowy

considerable pain.

Mega-mall: Is this

the future of shopping?, I, 23.10.2008,

http://www.independent.co.uk/news/uk/this-britain/megamall-is-this-the-future-of-shopping-969624.html

Financial crisis

Pound falls to five-year low

as Bank head admits recession

is here

• Sterling drops 4% against the US dollar

• King says banking turmoil 'almost unimaginable'

• FTSE 100 drops 2% in early trading

Wednesday October 22 2008

10.15 BST

Guardian.co.uk

Graeme Wearden and Ashley Seager

This article was first published on guardian.co.uk

on Wednesday October 22 2008.

It was last updated at 10.18 on October 22 2008.

Sterling was hammered down to a five-year low against the

dollar this morning after Mervyn King admitted for the first time that the UK is

entering a recession.

The pound began tumbling last night as the Bank of England governor told

business leaders in Leeds that the economy is shrinking and hinted at fresh

interest rate cuts.

By this morning it had fallen by seven cents to $1.6209, a drop of more than 4%.

Traders reported frantic selling as investors rushed to cut their losses by

selling the UK currency.

Sterling also fell against the euro, losing around 2% to a low of €1.2636 this

morning. The euro itself fell sharply against other currencies, hitting a

four-and-a-half-year low against the yen, and its lowest value against the

dollar since November 2006.

Shares fell sharply in London this morning, with the FTSE 100 shedding over 100

points, or 2.3%, in early trading to 4127.29.

The pound had already been hit yesterday by unexpectedly gloomy manufacturing

data showing that confidence has collapsed, and King's comments appear to have

added to concern over quite how weak the British economy now is.

Describing the banking system turmoil of recent weeks as "extraordinary, almost

unimaginable," he said the financial system had come closer to collapse two

weeks ago than at any time in the past 90 years.

"The combination of a squeeze on real take-home pay and a decline in the

availability of credit poses the risk of a sharp and prolonged slowdown in

domestic demand. Indeed, it now seems likely that the UK economy is entering a

recession," King said.

"It is surely probable that the drama of the banking crisis, which is

unprecedented in the lifetime of almost all of us, will damage business and

consumer confidence more generally."

His fears were confirmed yesterday as the CBI reported that confidence among

British manufacturers had tumbled to its lowest since July 1980, with output and

orders also collapsing.

The thinktank the National Institute for Economic and Social Research said today

that Britain entered a recession in the third quarter of the year and warns the

slump will probably last for a year or more, making it every bit as painful as

the recessions of the early 1990s or early 1980s.

City commentator David Buik said that King's speech has "put sterling to the

sword for the time being".

The Bank of England cut the cost of borrowing by half a point to 4.5% earlier

this month, as part of coordinated global action, and King hinted that rates may

come down again soon.

"During the past month, the balance of risks to inflation in the medium-term

shifted decisively to the downside," he said.

CMC Markets analyst James Hughes said that the possibility of interest rate cuts

across Europe have made the greenback more attractive - after months in which

traders bet against the dollar.

"Investors continue to flock to the dollar as speculation mounts that central

banks elsewhere will continue with aggressive rate cuts in an attempt to

stimulate growth in the near term," said Hughes.

Official data out on Friday will almost certainly show that the economy

contracted in the July to September period, having not grown at all in the

second quarter. A "technical" recession is defined as two consecutive quarters

of contraction, which experts say is the least Britain can expect this time

round.

Pound falls to

five-year low as Bank head admits recession is here, G, 22.10.2008,

http://www.guardian.co.uk/business/2008/oct/22/pound-recession-interest-rates

Economics:

Public finances slump to record deficit

Analysts described the figures

as 'dreadful' and predict worse

to come

as the economy deteriorates

Monday October 20 2008

10.36 BST

Ashley Seager, economics correspondent

Guardian.co.uk

This article was first published on guardian.co.uk

on Monday October 20 2008.

It was last updated at 11.03 on October 20 2008.

The public finances lurched to a record deficit last month

driven by a weakening economy and overspending by the government, and analysts

say much worse is yet to come as the economy tips into recession.

The Office for National Statistics said that public sector net borrowing came in

higher than expected at £8.1bn, a record for a September and way above the

£4.8bn shortfall seen in September last year.

That left the cumulative PSNB for the first half of the 2008/09 fiscal year at

£37.6bn versus £21.5bn in the same period a year ago and the highest since

records began in 1946.

"The September public finances were dreadful, deteriorating even more than

expected. This highlight the extremely poor state of the public finances as they

are hit by past largesse, the marked economic slowdown, markedly weak housing

market activity and prices, rising unemployment and government policy

concessions since the March budget," said Howard Archer, economist at

consultancy Global Insight.

The cash-based measure known as the public sector net cash requirement also hit

a record high for the month of September, of £12.6bn compared with a deficit of

£8.7bn in the same month last year.

"It confirms what we pretty much all know now, that borrowing is set to surge

and rise dramatically in the current financial year," said Paul Dales, an

economist at Capital Economics.

In his budget in March, the chancellor, Alistair Darling, forecast a shortfall

for the full 2008/09 year to next March of £43bn. But today's figures show that

figure has nearly been reached at the half-way stage of the year, meaning he

will have to revise that figure sharply higher in next month's pre-budget

report.

Darling said over the weekend that the government would bring forward some

infrastructure projects intended for future years to give a boost to the economy

during the downturn. Treasury officials denied that this meant extra spending

would result, however.

The Ernst & Young Item Club thinktank today became the latest in a line of

forecasters to predict a savage widening of the deficit over the next couple of

years as recession crimps tax receipts and boosts government spending on welfare

payments.

Item's chief economist Peter Spencer has pencilled in a deficit of £60bn this

year - a record - and £92bn in 2009/10 - equivalent to 6% of gross domestic

product.

Separately, the Council of Mortgage Lenders (CML) today reported that gross

mortgage lending fell by a further 10.0% to just £17.7bn in September from

£19.7bn in August and £24.7bn in July. Gross lending was down 41.7% year on year

from £30.4bn in September 2007.

Economics: Public

finances slump to record deficit, G, 20.10.2008,

http://www.guardian.co.uk/business/2008/oct/20/governmentborrowing-economics

Still confused by the credit crisis?

Then, read on ...

Bemused by the banking crisis

and the stock market madness of recent weeks?

Business Editor Margareta Pagano

answers the key questions

Sunday, 19 October 2008

The Independent

Is the worst of the worldwide crisis in banking now over?

Governments have committed a total of $2 trillion to be injected into the

banking system. Here in the UK, for example, the Government is pumping £39bn

into three of the our biggest banks – Royal Bank of Scotland, Lloyds TSB and

HBOS – by buying shares in them to provide new capital.

The aim is to strengthen the banks' balance sheets so that they can start

lending to each other again, and to their customers. But the most important

objective is restoring confidence in the financial markets. It's too early to

tell whether this has been achieved. But the way the world's leaders took such

committed action last weekend to put together this co-ordinated action appears

to have gone far to prevent a systemic collapse. Don't take too much notice of

the volatile reaction of the stock markets last week after the news was

announced. The markets are now looking forward to the next crises – the

unwinding of the derivatives market and recession.

Who is to blame?

We all are, to some extent. Over the past decade the US and UK governments

allowed people and companies to borrow too much and too cheaply. In the US,

mortgage companies were offering "teaser" mortgages at only 1 per cent, so when

interest rates were raised, many could not afford to meet the new mortgage

payments – leading to the so-called sub-prime market. In the UK, banks were

lending money to people to buy mortgages at 100 per cent. They were also

encouraged to take on more credit. With house prices rising, everyone felt

wealthy and so they replaced equity in their house for debt to fund the next

holiday. Savings ratios crashed. But then last year Northern Rock collapsed,

sending shivers through the financial system because it could not raise enough

money to meet the demands of its depositors. So you could say governments were

to blame for allowing the debt mountain to grow, the financial regulators for

not keeping a tighter control over the banks who lent beyond their means too,

and the public for indulging in their debt addiction.

Why won't the banks lend to each other?

They have been too scared. They have been nervous about lending because none of

them had confidence in each other. This was because none of them knew exactly

what sort of exposures they had to the US sub-prime market and other securitised

loans.

Who controls the half-nationalised banks? Their shareholders or taxpayers?

Details of the UK bailout are still being worked on. At the moment it looks as

though the Government may end up owning some 60 per cent of the shares in Royal

Bank of Scotland because it is investing about £20bn in the bank. The Government

will put directors on the board and will take part in the bank's everyday

decision-making; just as it is doing with Northern Rock and Bradford & Bingley.

But in reality this means the taxpayer indirectly owns those shares because the

Government is raising the money going into the banks by raising new gilt-edged

bonds – in other words, the public debt which we all own as citizens. The case

of Lloyds and HBOS, which are merging, is different because the Government will

be a minority shareholder. But it will still put a representative on the board.

The rest of the shares in the banks are owned by the City's big investors, the

pension funds, and insurance companies. They are angry at the Treasury's

decision not to pay out dividends for at least a year until the Government's

preference shares are paid. But the Government's plan is to return the banks to

the private sector as soon as it can.

What is moving the markets up and down at the moment?

Stock markets move with events, but they also try to take account and predict

the future. So the equity markets are volatile and fragile at the moment because

now that they have been assured that the banking system is not going to

collapse, they are looking ahead to what will happen to companies' profits as we

head into recession. That's why the UK FTSE 100 index and the US Dow Jones index

saw hairy trading last week: the big institutional investors, the hedge funds

and retail investors were busy selling shares in companies which they think will

suffer from the economic downturn. On the commodity markets investors were also

selling natural resources such as metals and oil, because if the world goes into

recession there will be less demand for these products. Only gold shot up again

last week because it is seen as the safest commodity of all.

If the markets are going down, what has that got to do with me?

Everything. The markets work together like a great big machine and we are all

connected. If you have a pension, then this is invested in the companies that

are listed on the market and your pension comes from the dividends earned by

those companies. For example, the big pension funds and insurance companies such

as the Prudential or Standard Life are some of the biggest investors in the UK

stock market as well as in those overseas. They also own government bonds. So if

those prices fall, the value of your pension falls along with them. Those people

who are retiring this year or next will have been severely hit by this bear

market.

Why are some people predicting the FTSE will be at record levels in 18 months ?

Some economists reckon that's when we will be coming out of recession. It's

based on forecasts that the world's big economies – the US, China, India, Russia

and the growing markets of the Middle East – will by then be recovering and

trade gets going again. That means British companies, particularly those with

big overseas exposure, will do well and so will their share prices.

How will we know when the worst of this banking crisis is over?

If only we knew. If the banks can recapitalise smoothly and start lending again,

then this will be an enormous boost of confidence to the "real economy". It

means they will start lending money for mortgages again and to the corporate

sector. When we hear that companies are having no problems in raising money for

new investment, that will be a good sign.

How bad is the global economy looking ?

Touch and go. China, the powerhouse of the world, is slowing down, but it's

economy is still expect to grow at 9 per cent next year. But it won't prevent us

from tipping into recession. Other trouble spots in the world are Ukraine,

Hungary, the Baltic states and Turkey – even Switzerland had to save its banks

last week. Then, of course, there are fears over the $513bn ticking time bomb of

the derivatives market, which may go off at any time.

How much worse is it going to get?

Next year will be tough. Economists reckon we have now officially hit recession

in the UK. Unemployment will exceed two million by the end of this year; house

repossessions are rising, and investment in business is falling. Retailers are

getting ready for the worst Christmas since the late 1980s. But interest rates

will be slashed and inflation will come down as oil and food prices drop. And

the recession will last only a year.

The downturn in numbers

4.8%

Annual sales fall announced by the John Lewis Group last week

2m

Projected unemployment figure for December. About 1.79 million out of work now

11.5

Average number of sales per estate agent last quarter – a 30-year low

£467

Extra public borrowing per citizen required compared to March forecast

Still confused by the

credit crisis? Then, read on ..., I, 19.10.2008,

http://www.independent.co.uk/news/business/analysis-and-features/still-confused-by-the-credit-crisis-then-read-on-966247.html

http://digital.guardian.co.uk/guardian/2008/10/16/pdfs/gdn_081016_ber_1_20951401.pdf

Financial crisis

FTSE 100 hits five-year low

as world stockmarkets slump

again

• US manufacturing spark selling

• Oil price slips

• Japan's Nikkei down 11%

in worst performance since 1987

Thursday October 16 2008

17.15 BST

Guardian.co.uk

Graeme Wearden and Dan Milmo

The FTSE hit its lowest point in more than five years today as

fears of a global recession sent world stockmarkets falling across Asia, Europe

and the US.

Shares in the UK's leading companies closed down 5.35% at 3861, the FTSE 100's

lowest point since April 2003, following another wave of selling by investors.

A batch of poor manufacturing figures from the US saw the Dow Jones index fall

2% this evening, as the Federal Reserve reported US industrial production in

September suffered its biggest drop since 1974.

The Dow Jones had fallen by 172 points to 8405 by 5pm BST, giving up modest

early gains.

An influential regional factory output survey, from the Philadelphia Federal

Reserve Bank, compounded the gloom by reporting an 18-year low in factory

activity.

"The Philly Fed data provides the first reliable lead into the October numbers

and confirms that the meltdown in financial markets is being closely followed by

a dramatic slide in real economic activity," said Alan Ruskin, the chief

international strategist at RBS Global Banking.

Earlier today, the panic selling that began on Wall Street yesterday evening

spread around the globe as investors lost faith that Europe and America's bank

rescue packages would stave off an economic downturn.

In London, the FTSE 100 fell by almost 6% in the first few minutes of trading to

just 3840.6, its lowest level during the recent crisis. Although it later

bounced back, attempts at a more solid rally faltered after the Dow Jones

maintained its downward trajectory this afternoon.

The FTSE's performance followed an 11% plunge on Japan's Nikkei, its worst daily

fall since 1987.

There was little sign of optimism in the City this morning.

Antonio Borges, a former vice-president of Goldman Sachs, warned that investors

are panicking, selling shares in favour of cash. "The markets are very, very

volatile because we do have a crisis of confidence, so the slightest piece of

bad news throws the markets into disarray," he said.

One analyst warned that shares may have much further to fall. "Unless something

remarkable happens, it looks like the FTSE 100 will test the low of 3287 that it

hit in March 2003," warned David Buik of BGC Partners.

"Regarding a recession – we are in it."

Earlier today, Jaguar Land Rover cut almost 200 jobs, and Corus slashed steel

production for the rest of the year by 20%.

This follows a raft of evidence on Wednesday that the wider economy has been

damaged by the financial crisis.

In the UK, the jobless total hit 1.79 million, and is expected to break through

2 million by Christmas.

Across the Atlantic, yesterday's 733 point plunge on the Dow Jones index was

prompted by a shock drop in retail sales and a grim warning from Ben Bernanke.

The Federal Reserve chairman said that the frozen credit markets posed a big

risk to the wider economy.

"By restricting flows of credit to households, businesses, and state and local

governments, the turmoil in financial markets and the funding pressures on

financial firms pose a significant threat to economic growth," Bernanke told the

Economic Club of New York.

The price of oil slipped again today, with a barrel of US crude oil falling

another $3 to $71.73 on expectations of lower demand.

Markets had rallied on Monday as the world's governments began taking action to

pump capital into their struggling banks.

But in Japan, where the Nikkei fell 11.4% to 8458, the prime minister, Taro Aso,

said America's $250bn (£145bn) injection into the banks did not go far enough.

"It was insufficient, and so the market is falling rapidly again," Aso said.

Borges agreed that the optimism over the bail-out may have been misplaced.

"After the government guarantees, it is fair to expect that the banking sector

will go back to a more normal state. The problem is, however, that this may have

come a bit too late and, meanwhile, the consequences of the credit crunch are

beginning to be felt across the economy," Borges told BBC Radio 4's Today

programme.

Hong Kong's Hang Seng index fell by 8.5%, with China's Shanghai Composite down

almost 4% in late trading.

FTSE 100 hits

five-year low as world stockmarkets slump again, G, 17.10.2008,

http://www.guardian.co.uk/business/2008/oct/16/market-turmoil-recession

Sharp rise in unemployment

as financial crisis hits jobs

market

• ILO measure posts largest increase since 1991

• Claimant count up too - but less than City expected

• PM says government will do all it can to help people

Wednesday October 15 2008

12.30 BST

Guardian.co.uk

Julia Kollewe and Ashley Seager

This article was first published on guardian.co.uk on Wednesday October 15 2008.

It was last updated at 12.50 on October 15 2008.

British unemployment today posted its biggest rise since the

country's last recession 17 years ago as the financial crisis filtered through

to the jobs market.

Official figures showed unemployment measured by International Labour

Organisation (ILO) standards rose by 164,000 in the three months to August from

the previous quarter to stand at 1.79million. The rise took the jobless rate up

half a percentage point to 5.7%, also the biggest jump since July 1991.

"These numbers are truly horrendous and much worse than I had feared," said

David Blanchflower, a labour market expert and member of the Bank of England's

monetary policy committee.

He told the Guardian his earlier prediction that unemployment would rise to two

million by Christmas now looked conservative. "Unemployment will be above two

million by Christmas. I am particularly worried at the 56,000 rise in the number

of young unemployed people. These are school leavers who are unable to get a job

or claim benefits, which is why the claimant count has not risen even faster

than it has," he said.

The number of Britons out of work and claiming jobless benefits rose by 31,800

last month to 939,000, the eighth monthly increase in a row, and August's rise

was revised higher to 35,700. The City had expected a 35,000 increase for

September.

This so-called claimant count measure is always lower than the broader,

internationally recognised ILO measure which includes people not claiming

benefits, because some unemployed people are not entitled to claim benefits, or

choose not to do so.

The rise took the claimant count jobless rate up to 2.9%, its highest level

since January 2007.

The prime minister, Gordon Brown, responded to the figures this morning by

pledging the government would do everything it could to create jobs in the UK

economy, which is teetering on the brink of recession.

The government also announced today it was making an extra £100m available to

retrain workers who lose their jobs.

The employment minister, Tony McNulty, said the jobs data painted a "bad

picture" of the UK economy: "But the job is to look forward and see how we can

deal with any dip in employment rather than talking about the causes."

The number of employed people dropped 122,000 to 29.4million over the

three-month period.

The FTSE 100 fell more than 3% this morning, wiping out all of yesterday's

gains. The mood darkened after the unemployment figures, and the index of

leading shares fell more than 150 points to 4235.6.

The Liberal Democrats' work and pensions spokeswoman, Jenny Willott, urged the

government to turn its attention to unemployment and inflation, now the banking

rescue package had beeen agreed.

"Real families across Britain are suffering, not just those working in the

Square Mile. As the number of vacancies shrink, it will be harder and harder to

get people back into work. It will not simply be a case of retraining the

unemployed if there are no jobs for them to return to," she said.

The number of job vacancies dropped by 62,000 from a year ago to 608,000 in the

three months to September. And 147,000 people faced redundancy in the three

months to August, up by 28,000.

For many people, a bleak Christmas lies ahead as the fallout from stockmarket

turmoil spreads to the rest of the economy.

Brendan Barber, the general secretary of the TUC, said: "We are now seeing the

effect of the credit crunch on the rest of the economy. I fear that the whole

economy will soon feel the impact of the problems in the banking sector."

He urged the Bank of England to cut interest rates again to avoid a severe

recession.

Derek Simpson, the joint general secretary of the Unite union, said: "Government

intervention should not just stop with the banks. Action across the wider

economy is necessary to protect jobs and the economy in a recession."

Alan Clarke, UK economist at BNP Paribas, said: "If you look at the claimant

count number, it wasn't as bad as expected, but if you look at the ILO, it was

simply awful. These numbers are falling off a cliff."

In a sign that consumer price inflation - now at a 16-year high of 5.2% - is not

feeding into wages, annual average earnings growth slowed to 3.4% in the three

months to August, its weakest in five years.

"As for pay pressures, the average earnings numbers remain very subdued," said

Philip Shaw, the chief economist at Investec. "The labour market appears yet

again not to be an inflationary threat to the economy which helps to justify the

cut in interest rates last week."

Economists believe it is going to get worse. Thousands of jobs are being lost in

the City, where banks have merged or collapsed, and on the high street, where

growing numbers of retailers are going bust.

Manufacturers laid off 46,000 workers in the three months to August, taking the

total number of manufacturing jobs to 2.87million, today's figures from the

Office for National Statistics showed.

Job losses are spread across the economy, with Cadbury announcing 580 job cuts

this week and ITV cutting about 1,000 jobs. The Centre for Economics and

Business Research estimates 62,000 financial jobs will be lost by the end of

next year.

Nigel Meager, the director of the Institute for Employment Studies, said: "No

part of the country is spared. Much attention has focused on high-end jobs in

the City. In an economic downturn, however, the real human cost is likely to hit

lower-skilled workers who find it harder to move into another job and have less

of a financial cushion to see them through difficult times.

"As vacancies continue to evaporate, competition for any job available will

become fierce and the existing long-term unemployed, as well as young people

entering the labour market will be particularly disadvantaged."

Sharp rise in

unemployment as financial crisis hits jobs market, G, 15.10.2008,