|

History

>

2008 > USA > Economy (IXa)

Christopher Crotty

worked on the floor of the New York Stock Exchange

on

Wednesday.

Photograph:

Richard Drew

Associated Press

September 17, 2008

As Fears Grow, Wall St. Titans See Shares Fall

NYT

18.9.2008

https://www.nytimes.com/2008/09/18/business/18wall.html

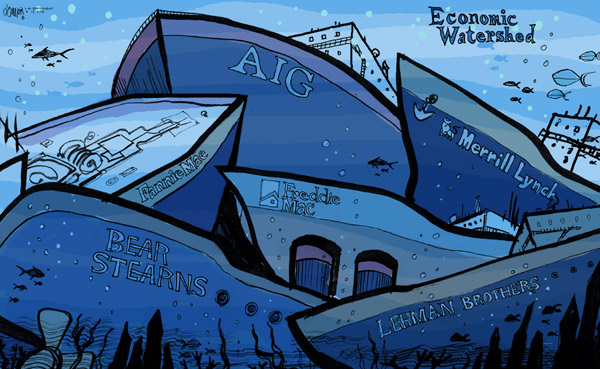

Wesley Bedrosian

Editorial cartoon

Present at the Crash

NYT 18.9.2008

http://www.nytimes.com/2008/09/19/opinion/19baris.html

Op-Ed Contributor

Present at the Crash

September 19, 2008

The New York Times

By SAM G. BARIS

ON the subway, a stranger in a suit knowingly eyed my Lehman Brothers ID

badge in its Bear Stearns holster. With a look of detached curiosity, he

expressed his condolences. This is not the way I thought my Wall Street career

would begin.

During college, I was an intern at Bear Stearns. There, I toiled at the lowest

levels of Wall Street, fetching coffee, moving boxes, filing papers.

In my final summer at Bear, I was promoted to intern in the marketing department

of the asset management division. There, I worked on some hedge funds that

invested in stuff called “mortgage-backed securities.”

Several months later, the hedge funds went down the tubes, dragging Bear Stearns

behind them.

After I graduated from college, Lehman Brothers hired me to help settle trades

in complex derivatives, the very derivatives that led to the company’s demise. I

helped resolve trading issues involving tens — hundreds — of millions of

dollars.

And now? Now from my desk here in the trenches, my colleagues and I watch CNBC

reports on the collapse of Wall Street. Over the months, we have watched our

stock price plummet 99.8 percent, from $65 per share to 15 cents.

The news provides grist for the rumor mill. I trade notes with my colleagues

here. Though some more senior people have lost their entire life savings, the

steady stream of bad news and uncertainty are also difficult for those of us at

the bottom of the Wall Street food chain. It is dizzying.

Most of the time, in the office and out, I feel like I am on display, an object

of pity or fascination. Friends and family send frequent expressions of concern

and empathy by phone, e-mail and text message.

Even though I had little — nothing, actually — to do with the real estate losses

that led to Lehman’s problems, or the hedge funds that precipitated Bear’s

demise, the only conclusion I can draw is that I’m a jinx. Prospective employers

will take one look at my résumé and call security to escort me out the door lest

my mere presence infect their otherwise healthy businesses.

Meanwhile, I sit at my desk. “Your password will expire in nine days,” my

computer informs me. “Would you like to change it?” Each time, I click “No.”

Sam G. Baris is an analyst at Lehman Brothers.

Present at the Crash,

NYT, 18.9.2008,

http://www.nytimes.com/2008/09/19/opinion/19baris.html

Eric Devericks

Editorial cartoon

Seattle,

WA, The Seattle Times

Cagle

18.9.2008

Pain Spreads

as Credit Vise Grows Tighter

September 19, 2008

The New York Times

By LOUIS UCHITELLE

The latest outgrowth of the housing crisis, the breakdown on Wall Street,

threatens to gradually corrode economic activity on Main Street, mainly by

disabling the credit on which so many everyday transactions depend — but also by

frightening people.

Lenders of all types had already been raising the bar for borrowers, turning

away all but the best customers. This week, they became even less willing to

part with their money, further crimping budgets and family spending.

An economy propelled by easy credit for more than a decade is fraying as credit

disappears. American Express, to take one striking example, is reducing the

maximum credit limit for half of its tens of millions of cardholders.

The credit shock is in some ways reminiscent of the 1973 oil embargo, which

“came into people’s lives right away,” said Andrew Kohut, director of the Pew

Research Center, the public opinion pollster. Then, Americans were forced to

line up for gasoline and turn down their thermostats in winter. Though less

visible, the credit squeeze, if it persists, will force businesses and consumers

to cut spending more than they already have.

“We have moved into a decline in consumer spending, which normally happens only

in a major recession,” said Ethan Harris, chief domestic economist at Lehman

Brothers. He calls the experience “a slow-motion recession in which economic

growth will be near zero for an extended period of time.”

Consumer spending accounts for two-thirds of American economic activity and has

been slowing as the value of homes falls. Although the economy is not yet in a

formal recession, consumer spending in June and July grew only because consumers

paid more for the same goods. After factoring in higher prices, they actually

bought less.

Borrowers are finding that the nation’s lenders are tightening up in numerous

ways. American Express is hardly alone. After several banks said they would not

lend the asking price, a tractor-trailer dealer in North Carolina had to cut the

$20,000 he was seeking for a second-hand tractor to $14,000. And a commercial

real estate agent, trying to raise $4 million by refinancing an apartment

building, got only half that amount from the Bank of Smithtown on Long Island,

even though the building was appraised for $10 million.

“With marginal lenders in trouble, we have more people than ever coming to us

for loans,” said Brad Rock, chairman of the Smithtown bank. “So all of a sudden,

we can be much pickier in deciding what loans to make and how much to lend.”

Being pickier means that an American Express cardholder whose maximum has been

reduced to $1,000 from $1,200 has that much less to spend on clothing or meals

out, purchases that lift the economy.

At $14,000 for a used tractor, a trucker, caught in the same squeeze as the

dealer, would lack a sufficient down payment for a new tractor, which costs more

than $100,000. Indeed, many truckers in this situation find themselves looking

for other work, even as job seekers across the nation outnumber job openings by

more than 2 to 1, the biggest mismatch since 2004, the Bureau of Labor

Statistics reports.

And the commercial real estate agent is shy $2 million that would have been

invested in a new venture to generate economic growth.

Mr. Rock, also chairman of the American Bankers Association, with 8,400

affiliates, does not see a problem in this turn of events.

“Now people are going to actually have to have a job to get a loan and they are

going to have to make installment payments that are already higher per dollar

borrowed than they used to be,” he said, arguing that the debt-fueled prosperity

of the bubble years was unsustainable.

But there is not, for the moment, an adequate replacement.

Henry Kaufman, a Wall Street economist, ticks off the alternatives and discounts

them. Exports could carry some of the load, but the surge in the first half of

the year is fading as European and Asian economies weaken. Here at home, capital

spending by business on new buildings and equipment could provide a lift, but

that, too, is beginning to fade as corporate profits — and demand — weaken. Just

Wednesday, FedEx announced that profits had shrunk in the latest quarter as

freight traffic declined.

Home construction is off the table, of course, as a means of lifting the

economy. That leaves government, which could inject money into the economy

through aid to the states or infrastructure spending or another round of tax

rebates. There is even talk of a bigger bailout for the housing market, akin to

Resolution Trust Corporation’s role in the savings and loan crisis. But Congress

seems unlikely to authorize any of these measures in its current, brief

pre-election session.

“Sometime in 2009, after the new president takes office, we will address these

issues,” Mr. Kaufman said, lamenting the delay.

Meanwhile, the barriers to borrowing go up. By late summer, a majority of the

nation’s lenders had tightened standards for every type of credit, the Federal

Reserve’s bank surveys show. Home equity lines of credit have been canceled or

reduced as home prices have fallen. Credit card companies are imposing higher

delinquency fees, stepping up collection efforts and checking on repayment

histories.

“More and more, they don’t give the card if you don’t have a good credit

record,” Mr. Harris, of Lehman Brothers, said.

Michael O’Neill, an American Express vice president, agrees. He adds that the

company is offering fewer new cards than in the past in Florida, California and

parts of the Southwest, all areas where home prices have fallen the most. And

quietly, American Express is skinning back credit limits. The company is always

reviewing its millions of accounts, normally increasing the limit on three out

of four, and decreasing the fourth. Since July, “the tilt is 50-50,” Mr. O’Neill

said.

The North Carolina truck dealer originally listed a 2001 Freightliner for

$20,000 on truckertotrucker.com, an online marketplace for tractors and

trailers, and this week, he dropped the price to $14,000 because of the growing

resistance from bankers, said James McCormack, who operates the site.

“The banks were giving loans for the full value of these trucks and the value

was falling, and the truckers found themselves owing more than the trucks were

worth,” Mr. McCormack said. “They found themselves forced to keep driving or let

the banks repossess, and many have elected repossession.”

Debt traps and loan famines, in one form or another, can prove costly to

companies. Harley-Davidson, for example, which finances purchases of its

motorcycles, is issuing bonds and notes at slightly higher rates to support its

financing arm.

Restaurants in the casual-dining sector are in a severe slump, according to

industry analysts, and will most likely come under further pressure. The pancake

house IHOP bought Applebee’s last year with a strategy of selling off

company-owned stores to franchisees. Now known as DineEquity, the company may

have problems finding prospective franchisees who can obtain financing, industry

analysts said.

The winners so far are the Brad Rocks of America, the bankers who have emerged

unscathed, their capital intact and with enough retained earnings to support

lending, on their terms. A residential mortgage from Bank of Smithtown requires

20 percent down and clear evidence of adequate income to repay the loan, as well

as a good record of paying down debt.

Bank of Smithtown specializes in small businesses — the stationery stores, pizza

parlors and pharmacies of eastern Long Island with annual revenue of $2 million

or less, regularly in need of bridge loans, for example. During the credit boom,

Mr. Rock said, many of these business owners went to lenders who required, as he

put it, nothing more than a tax ID number to qualify for a loan.

“Now many of these lenders are gone,” Mr. Rock said, “and the small-business

borrowers are coming to us, and we are doing good old-fashioned underwriting,

and the result is that fewer people are getting loans.”

Pain Spreads as Credit

Vise Grows Tighter, NYT, 19.9.2008,

http://www.nytimes.com/2008/09/19/business/economy/19econ.html

Chris Britt

Editorial cartoon

Springfield, IL -- The State Journal-Register

Cagle

18.9.2008

Downturn Drives Up

New York’s Jobless Rates

September 19, 2008

The New York Times

By PATRICK McGEEHAN

The unemployment rates for New York City and State shot up in August as the

rapidly spiraling economic downturn left more people without jobs, the state’s

Department of Labor said on Thursday.

The city’s unemployment rate rose to 5.8 percent from 5 percent in July — the

largest monthly increase in more than 30 years — as about 5,200 private-sector

jobs were eliminated, the department reported. Many of the layoffs came in the

tumbling financial sector, which is one of the city’s biggest employers and the

provider of nearly one-fourth of its annual wages and salaries.

In the last 12 months, employment in the financial realm has declined by 5,300

jobs, according to James Brown, an analyst with the Labor Department. Some of

those losses resulted from the collapse of the Bear Stearns investment bank in

March. But many of the cutbacks at that firm and others on Wall Street still

have not shown up in the official statistics.

For example, the August totals do not include the 1,500 layoffs that Lehman

Brothers had planned to make before it was forced into a bankruptcy filing on

Monday. Lehman, which employed more than 25,000 people, has sold its main

trading operations to Barclays Capital, a London-based firm, but it is not known

how many of the 10,000 employees of those operations will keep their jobs.

American International Group, the Manhattan-based insurance giant, was on the

brink of failure before receiving an $85 billion lifeline from the federal

government this week.

“Although the crises at Lehman Brothers and A.I.G. appear to be working out so

as to avoid immediate large-scale layoffs, the continued financial-sector

turmoil guarantees that job losses on Wall Street will climb rapidly over the

next few months,” Mr. Brown said.

Despite the current deterioration in the job market, the city still had about

31,000 more jobs last month than it had in August 2007, when the unemployment

rate was 5.3 percent, according to the report. Most of that job growth has come

in the fields of education, health care, trade and transportation, and leisure

and hospitality.

“Most of the professional business industries such as law firms lost a small

number of jobs in August, but all in all, New York City has still yet to see any

significant impact from the turmoil on Wall Street,” said Barbara Denham, chief

economist for Eastern Consolidated, a real estate investment firm.

“This will undoubtedly change in the next few months, but the job losses from

Lehman Brothers’ bankruptcy and Bank of America’s purchase of Merrill Lynch may

not hit the job numbers until November or later,” Ms. Denham said. “While New

York City’s economy remains well diversified in health care and private

education, the problems on Wall Street will likely spill over into the business

travel industry, which would affect hotels, restaurants and entertainment.”

The jobless rates for the city and the state were lower than the national

unemployment rate, which jumped to 6.1 percent last month, according to the

Labor Department.

Statewide, the jobless rate also rose to 5.8 percent, from 5.2 percent in July.

That was the largest monthly increase in the state’s rate since January 1991,

said Peter A. Neenan, director of the department’s division of research. Still,

the department reported that the state added 3,000 private-sector jobs in

August.

“New York State’s labor market indicators reported mixed signals in August,” Mr.

Neenan said.

Downturn Drives Up New

York’s Jobless Rates, NYT, 19.9.2008,

http://www.nytimes.com/2008/09/19/nyregion/19unemployed.html

Oil rises above $100 a barrel

September 19, 2008

Filed at 9:10 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

LONDON (AP) -- Oil prices rose above $100 a barrel Friday as

investors waited for details of a U.S. government plan that could help ease the

credit crisis that has roiled global markets.

Light, sweet crude for October delivery rose $3.98 to $101.86 a barrel in

electronic trading on the New York Mercantile Exchange after word of the plan

eased concerns that demand for energy would fall sharply amid a weakening world

economy.

After discussions Thursday night with congressional leaders, Treasury Secretary

Henry Paulson said the goal was to come up with a ''comprehensive approach that

will require legislation'' to deal with the bad debts on banks' balance sheets.

He did not provide any details, but the plan taking shape called for Congress to

give the Bush administration the power to buy distressed bank assets.

''The market is taking guidance from some mild restoration of confidence in the

U.S., but the market still remains cautious,'' said Mark Pervan, senior

commodity strategist with ANZ Bank in Melbourne. ''For the moment they have

calmed some fears, but there will be a lot of fence-sitting before the plan

comes out.''

Oil prices have fallen about $50 since reaching a record $147.27 a barrel on

July 11 on concern that slowing economic growth in developed countries will

undermine crude demand.

Those fears deepened this week as turmoil in the U.S. financial system led to

the bankruptcy of investment bank Lehman Brothers Holding Inc. and an $85

billion government rescue of insurer American International Group Inc.

''Oil demand is coming off in the U.S. regardless of what Paulson does, but we

may not see the sharp falloff that the market was increasingly worried about,''

Pervan said.

Nigeria's main militant group said Thursday it bombed another oil pipeline,

marking a sixth straight day of stepped-up violence in Africa's oil giant.

The Movement for the Emancipation of the Niger Delta said in a statement it used

high explosives to destroy the conduit run by a unit of Royal Dutch Shell PLC.

Shell officials could not immediately be reached for comment.

The militants have declared an ''oil war'' in the Niger Delta, where militants

demanding more oil-industry funds from the federal government have increased

attacks. About 40 percent of Nigeria's normal daily oil production is now

offline, severely curtailing exports.

''The focus of the market right now has switched from supply to demand,'' Pervan

said. ''So these stories will have some impact, but not as much as they had

during the last six months when the market was supply-driven.''

In other Nymex trading, heating oil futures rose 2.31 cents to $2.806 a gallon,

while gasoline prices gained 2.30 cents to $2.505 a gallon. Natural gas for

October delivery fell 1.0 cent to $7.611 per 1,000 cubic feet.

In London, October Brent crude rose $2.23 to $97.42 a barrel on the ICE Futures

exchange.

----

Associated Press writer Alex Kennedy contributed to this report from Singapore.

Oil rises above $100 a barrel, NYT, 19.9.2008,

http://www.nytimes.com/aponline/business/AP-Oil-Prices.html

Investors, Hungry for Hope,

Send Dow Up 410

September 19, 2008

The New York Times

By VIKAS BAJAJ

and MICHAEL M. GRYNBAUM

A seesaw day on Wall Street ended with a rush of euphoria Thursday as

investors raced back into beaten-down banking shares, heartened by signs that

the government is taking more drastic steps to tamp down problems plaguing the

financial markets.

In a rally that came in the final hour of trading, the Dow Jones industrials

surged to a 410-point gain, nearly erasing the 449-point loss sustained on

Wednesday.

But it was by no means a sign that the crisis on Wall Street had turned a

corner.

Fear and stress still abounded in the credit markets, where investors flocked to

the safety of Treasury bills and banks charged each other higher loan rates, a

reflection of lingering anxiety about the health of the financial industry.

As investors grapple with the once-unthinkable developments that have rocked the

world of finance in the last week, lending to consumers and some businesses has

tightened, drying up an important lubricant of the economy even as growth

continues to contract.

“We are still in a flight-to-quality mode,” said Jane Caron, chief economic

strategist at Dwight Asset Management, a bond investment firm in Burlington, Vt.

“When I assess the mood on my trading desk, people are still very concerned that

we have not seen the end of this crisis.”

The Standard & Poor’s 500-stock index closed up 4.33 percent, to 1,206.51, and

the Dow Jones industrial average rose 3.86 percent, to 11,019.69 The Nasdaq

composite jumped 4.78 percent.

Analysts attributed the stock market rally not to a fundamental improvement in

the financial environment, but rather to reports that the government might be

planning to quarantine some of the worst assets held by major banks.

Sentiment was also buoyed when regulators announced actions intended to blunt

the impact of short sellers, investors who bet that a stock’s price will drop.

Some banks and government officials have blamed short sellers for the

precipitous drops in shares of big banks over the last few months, including the

decline that played a role in the downfall of Lehman Brothers this week.

Shares of the last two independent investment banks standing, Morgan Stanley and

Goldman Sachs, seesawed a day after suffering steep losses. Investors worried

that the banks could face fates similar to those of Lehman and Merrill Lynch,

which sold itself Sunday to Bank of America to avert a deepening financial

crisis.

Morgan Stanley stock ended up 3.7 percent, but Goldman Sachs closed down, one of

the few major financial companies to end the day in the red. Goldman shares lost

5.7 percent; earlier they were down as much as 25 percent, reflecting the

uncertainty over the bank’s future.

Wachovia, the banking giant that is considering a possible merger with Morgan

Stanley, jumped nearly 60 percent; Washington Mutual, the troubled savings and

loan that has also been working on efforts to save itself, gained 49 percent.

For the first time since Lehman collapsed and the American International Group

was rescued, President Bush made a brief statement in Washington, saying the

government would “act to strengthen and stabilize our financial markets and

improve investor confidence.”

Earlier, the Federal Reserve said it would extend an effort that allows central

banks around the world to lend dollars in foreign economies. The Fed will

provide an extra $180 billion under the program to grease the wheels of finance.

Despite the surge in stocks, investors remained wary about lending to businesses

and to one another. The cost to insure companies’ debt, a measure of investors’

confidence in the firms, remained at historically high levels, analysts said,

although the cost declined slightly from Wednesday.

Investors displayed a strong preference for safer and more tradable government

securities than other short-term, private debt. The cost of several types of

corporate and bank borrowing remained high and, in some cases, increased further.

A gauge of fear — the Libor rate, which measures how much banks charge one

another for overnight loans — remained elevated on Thursday.

Treasury notes and bonds sold off in the afternoon but the price of short-term

government debt remained elevated. The yield on the three-month Treasury bill,

which falls when the price rises, was 0.076 percent, little changed from 0.061

percent on Wednesday. A week ago, the yield was 1.644 percent.

The sharp move in the last few days suggests that some investors are willing to

receive virtually no return to hold a Treasury bill, thought to be among the

safest of all investments. By contrast, interest rates on three-month commercial

paper, a competing form of private borrowing used by banks and corporations,

jumped to 3.32 percent, from 3.17 percent on Wednesday and 2.86 percent a week

earlier, according to Bloomberg data.

If the tight conditions in the money market persist, economists and analysts say

it could severely limit the availability of credit to businesses and consumers.

Federal Reserve data released on Thursday showed that consumer and business

borrowing slowed significantly, though it continued to grow, in the second

quarter.

Commercial paper outstanding fell by 2.87 percent for the seven days that ended

Wednesday, according to the Federal Reserve, its biggest one-week decline since

the summer of 2007. Back then, investors became concerned about certain kinds of

commercial paper that was used to buy securities backed by mortgages and other

consumer debts.

“This is a breakdown in the system of trading bonds and a breakdown of extending

credit,” said James T. Swanson, chief investment officer at MFS Investments, a

mutual fund company based in Boston.

Mr. Swanson said that so far, the stress had not affected most nonfinancial

corporations, many of which have large holdings of cash and do not have a

pressing need to borrow money. But he said companies that his analysts talk to

have said the credit squeeze could start to hurt if the commercial paper market

remains shut down and bank lending remains as tight as it is now.

Sectors like energy, pharmaceuticals and technology are more flush with cash and

less vulnerable to troubles in the credit markets. But others, like retail

stores, restaurants and airlines, could be hurt if tight conditions persist.

Kurt von Emster, portfolio manager of the MPM BioEquities Fund, said he had

advised companies to draw down on their bridge loans from banks, because of the

turmoil in the credit market. “Those will be not only hard to come by, but

impossible to come by,” he said about bridge loans.

The benchmark 10-year Treasury note was down 1 3/32, at 103 25/32, and the yield,

which moves in the opposite direction from the price, was at 3.54 percent, up

from 3.41 percent late Wednesday.

Following are the results of Thursday’s Treasury auction of 20-day and 76-day

cash management bills:

Matthew Saltmarsh and Heather Timmons contributed reporting.

Investors, Hungry for

Hope, Send Dow Up 410, NYT, 19.9.2008,

http://www.nytimes.com/2008/09/19/business/19markets.html

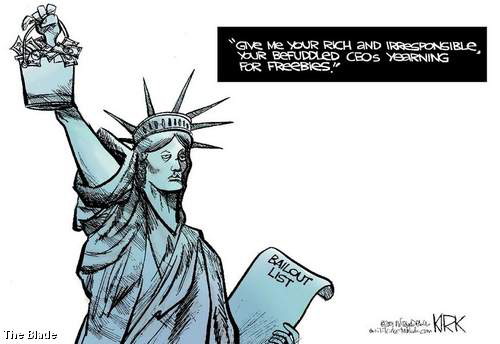

Kirk Walters

Editorial cartoon

Ohio -- The Toledo Blade

Cagle

18.9.2008

Paulson outlines

bold approach to end crisis

September 19, 2008

Filed at 10:52 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- Treasury Secretary Henry Paulson on Friday sketched out a

multi-faceted effort to confront the worst U.S. financial crisis in decades,

outlining a program that could cost taxpayers ''hundreds of billions'' of

dollars to buy up bad mortgages and other toxic debt that has unhinged Wall

Street.

''This needs to be big enough to make a real difference and get to the heart of

the problem,'' he told reporters as the administration asked Congress to give it

sweeping powers.

He gave few details but said he would work through the weekend with leaders of

Congress from both parties to flesh out the program, the biggest proposed

government intervention in financial markets since the Great Depression.

The government steps were clearly welcomed by financial markets. As Paulson

spoke, the Dow Jones industrials were up over 300 points and at one point had

soared by 450 points.

Before the markets opened, the government announced plans to temporarily insure

money-market deposits and to block short-selling in financial securities. Short

selling is a trading method that bets the stocks will go down.

Speaking to reporters at the Treasury Department, Paulson said that the new

troubled-asset relief program that he wants Congress to enact must be large

enough to have the necessary impact while protecting taxpayers as much as

possible.

''I am convinced that this bold approach will cost American families far less

than the alternative -- a continuing series of financial institution failures

and frozen credit markets unable to fund economic expansion,'' Paulson said in a

prepared statement.

''The financial security of all Americans ... depends on our ability to restore

our financial institutions to a sound footing,'' Paulson said.

Paulson said mortgage giants Fannie Mae and Freddie Mac will step up their

purchases of mortgage-backed securities to help provide support to the crippled

housing market.

He also said Friday that the Treasury Department will expand a program,

announced earlier this month, to buy mortgage-backed securities, which have been

badly hurt by the housing and credit crisis.

''As we all know, lax lending practices earlier this decade led to irresponsible

lending and irresponsible borrowing. This simply put too many families into

mortgages they could not afford,'' Paulson said.

At a news conference in which he only took three questions, Paulson was asked

the approximate dollar size of the government intervention. ''We're talking

hundreds of billions,'' he said.

Paulson did not address specifics about the plan to buy back bad debt or whether

the government would take a direct stake in troubled banks in exchange for its

help.

''These illiquid assets are clogging up our financial system, and undermining

the strength of our otherwise sound financial institutions. As a result,

Americans' personal savings are threatened, and the ability of consumers and

businesses to borrow and finance spending, investment, and job creation has been

disrupted,'' Paulson said.

He said that the administration would present Congress with a proposed

legislative package and then work with lawmakers ''to flesh out the details

through the weekend. And we're going to be asking them to take action on

legislation next week.''

''This is what we need to do. Because for some time we've been saying that the

root cause of the problems in our economy and our financial system is housing,

and until we get stability in the housing market we are not going to get

stability in our financial markets,'' he said.

Earlier, President Bush authorized Treasury to tap up to $50 billion from a

Depression-era fund to insure the holdings of eligible money market mutual

funds. And the Federal Reserve announced it will expand its emergency lending

program to help support the $2 trillion in assets of the funds.

Both moves are designed to bolster the huge money market mutual fund industry,

which has come under stress in recent days.

The Fed said it is expanding its emergency lending efforts to allow commercial

banks to finance purchases of asset-backed paper from money market funds. The

central bank's move should help the funds meet demands for redemptions.

The Securities and Exchange Commission early Friday imposed a temporary

emergency ban on short-selling of financial company stocks. As the financial

crisis widened, entreaties had come from all quarters to stem a swarm of

short-selling contributing to the collapse of stock values in investment and

commercial banks.

Congressional leaders said they expected to get the rescue plan Friday and act

on it before Congress recesses for the election.

The government's actions could help alleviate the uncertainty that has been

sending the markets into tumult over the past week. Lending has grinded to a

virtual standstill in the wake of the bankruptcy of Lehman Brothers Holdings

Inc.

Global stock markets roared higher, too.

And European Central Bank, Swiss National Bank and Bank of England offered up

more cash Friday. The three banks put a combined $90 billion into money markets

in a lockstep move.

The chairman of the Senate Banking Committee, Chris Dodd, D-Conn., warned the

United States could be ''days away from a complete meltdown of our financial

system'' and said Congress is working quickly to prevent that.

Dodd told ABC's ''Good Morning America'' on Friday that the nation's credit is

seizing up and people can't get loans.

The ranking Republican on the Banking Committee, Sen. Richard Shelby, said the

U.S. has ''been lurching from one crisis to another'' and predicted the new

bailout plan would cost at least half a trillion dollars.

''We hope to move very quickly. Time is of the essence,'' House Speaker Nancy

Pelosi, D-Calif., said after Paulson and Bernanke briefed congressional leaders

Thursday night.

The federal government already has pledged more than $600 billion in the past

year to bail out, or help bail out, some of the biggest names in American

finance.

------

Associated Press writers Martin Crutsinger, Andrew Taylor and Marcy Gordon in

Washington and Joe Bel Bruno in New York contributed to this report.

Paulson outlines bold

approach to end crisis, NYT, 19.9.2008,

http://www.nytimes.com/aponline/business/AP-Financial-Meltdown.html

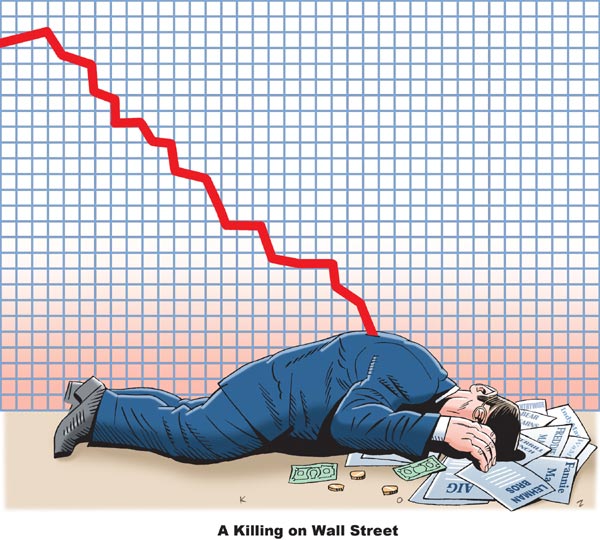

Martin Kozlowski

inxart.com Cagle

18.9.2008

Bush says economy stable

despite financial crisis

September 19, 2008

Filed at 10:51 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- President Bush has told the nation his administration is

taking ''unprecedented action'' to deal with the ailing financial markets.

Bush said he appreciates the willingness of Congress to work with the

administration to address the crisis ''head on.''

The president spoke publicly for the third time this week about convulsive

developments in the business world. He was joined on the White House steps

outside the Oval Office by Federal Reserve Chairman Ben Bernanke, Treasury

Secretary Henry Paulson and Securities and Exchange Commission Chairman

Christopher Cox.

THIS IS A BREAKING NEWS UPDATE. Check back soon for further information. AP's

earlier story is below.

WASHINGTON (AP) -- For the third time this week, President Bush will work to

reassure nervous consumers and stabilize markets, delivering a short speech

Friday about federal actions to halt the worst financial crisis in decades.

Bush will speak for about nine minutes in the Rose Garden alongside Treasury

Secretary Henry Paulson and Christopher Cox, chairman of the Securities and

Exchange Commission. White House press secretary Dana Perino said Bush will

discuss the causes of the crisis and outline urgent actions being taken by the

Federal Reserve, the Treasury Department and the SEC to stabilize markets and

restore confidence.

The president will pledge to work in a bipartisan way with the

Democratic-controlled Congress on a systemwide proposal to improve the health of

U.S. financial institutions, Perino said.

The Bush administration said Friday it would safeguard assets in money market

mutual funds and temporarily banned short-selling of financial company stocks.

The Treasury Department has asked Congress to give it sweeping power to buy up

toxic debt that has unhinged Wall Street.

Bush also has authorized Treasury to tap up to $50 billion from a Depression-era

fund to insure the holdings of eligible money market mutual funds. And the

Federal Reserve announced it will expand its emergency lending program to help

support the $2 trillion in assets of the funds.

Bush says economy stable

despite financial crisis, NYT, 19.9.2008,

http://www.nytimes.com/aponline/washington/AP-Bush-Markets.html

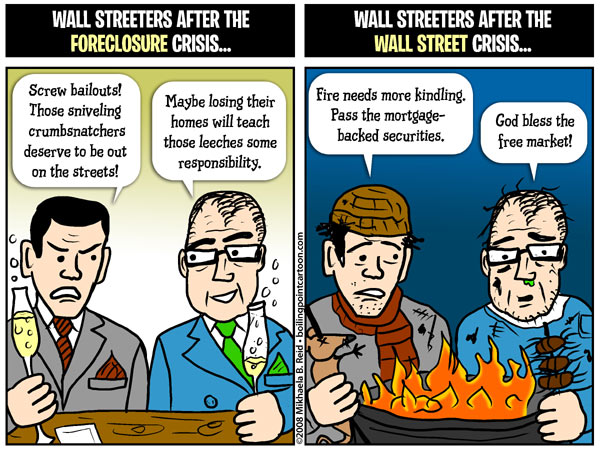

Mikhaela Reid Cagle

18.9.2008

U.S. Drafts Sweeping Plan to Fight Crisis

Treasury Shores Up Money Markets in First Salvo;

Paulson Set to Hold Press

Conference

SEPTEMBER 19, 2008

9:18 A.M. ET

The Wall Street Journal

By DEBORAH SOLOMON and DAMIAN PALETTA

WASHINGTON -- The federal government is working on a sweeping series of

programs that would represent perhaps the biggest intervention in financial

markets since the 1930s, embracing the need for a comprehensive approach to the

financial crisis after a series of ad hoc rescues.

At the center of the potential plan is a mechanism that would take bad assets

off the balance sheets of financial companies, said people familiar with the

matter, a device that echoes similar moves taken in past financial crises. The

size of the entity could reach hundreds of billions of dollars, one person said.

U.S. Treasury Secretary Henry Paulson will hold a 10 a.m. EDT press conference

Friday to discuss a "comprehensive approach to market developments."

Meanwhile, the Treasury announced a massive program Friday to shore up the

nation's money-market mutual-fund sector, responding to concerns that the global

financial crisis is starting to affect those historically safe assets. The move

is designed to stem an outflow of funds as consumers start to worry about even

the safest of investments, a sign of how the crisis is spreading to Main Street.

There is $3.4 trillion in money-market funds outstanding.

In addition, the Federal Reserve is expanding its liquidity programs, which

should help money funds meet redemption demand. The initiative includes

purchasing certain short-term debt obligations issued by Fannie Mae, Freddie

Mac, and the Federal Home Loan Banks. The Fed said it will also extend so-called

non-recourse loans at the primary credit rate to U.S. banks to finance their

purchases of high-quality asset-backed commercial paper from money-market mutual

funds.

Meanwhile, the Securities and Exchange Commission proposed a temporary ban on

short-selling on 799 financial stocks. The ban, which is effective immediately,

is set to last for 10 days, but could be extended for up to 30 days. (See

related article.)

Under the Treasury program, the government will insure the holdings of any

eligible publicly offered money-market fund. The funds must pay a fee to

participate in the program.

"The program provides support to investors in funds that participate in the

program and those funds will not 'break the buck,'" Treasury said in a

statement, referring to the concern that arises when the net asset value of

money-market funds falls below $1 per share.

The insurance program will be financed with up to $50 billion from the

Treasury's Exchange Stabilization Fund, which was created in 1934. President

George W. Bush had to sign off on Treasury's use of the fund.

"Concerns about the net asset value of money-market funds falling below $1 have

exacerbated global financial market turmoil and caused severe liquidity strains

in world markets," Treasury said in a statement.

The administration had been taking a patchwork approach to the financial crisis,

putting out fires as they ignited. The new moves represent an effort to take a

more systematic approach, after a spiral of bad debts, credit downgrades and

tumbling stocks brought down venerable names from investment bank Lehman

Brothers Holdings Inc. to insurance giant American International Group Inc.

Banks have grown unwilling to lend to one another, a sign of extreme stress,

because financial markets work only when institutions have faith in each other's

ability to meet their obligations.

Word of a coordinated government plan came first came Thursday, a day when the

Federal Reserve and other major central banks offered hundreds of billions of

dollars in loans to commercial banks to alleviate a deepening freeze in the

world's credit markets. That step appeared to have moderate impact on lending

among banks. Meanwhile, a wave of redemptions continued hitting money-market

funds, causing a second large fund to shut to investors.

In Russia, officials suspended stock-market trading for the second-straight day

as the Russian government promised to inject $20 billion to halt a collapse in

share prices. In China, government officials directed purchases of bank shares

and encouraged companies to buy their own shares in efforts to prop up a falling

market.

Stocks Rallied Thursday, Early Friday

Still, word of a possible U.S. plan to address the crisis sent the stock

market soaring on Thursday, in one of its sharpest reversals in recent memory.

The Dow Jones Industrial Average ended up 3.9%, the index's biggest percentage

gain in nearly six years, on record New York Stock Exchange volume. The

blue-chip index finished more than 560 points above its intraday low and

reclaimed about 90% of its Wednesday losses. Nasdaq composite trading also saw

trading volume set a new single-day high at 3.89 billion shares. All 30 Dow

component stocks closed higher, but financial companies were the biggest

winners, racking up double-digit percentage gains after weeks of selling off.

Early Friday, stock futures roared higher as investors welcomed government

efforts to shore up markets and clamp down on short selling. Dow futures climbed

more than 300 points before the opening bell.

The flurry of moves under discussion may bring the markets some breathing room,

but it isn't clear whether they will amount to a long-term solution to the

complex financial problems sweeping the market.

"The market wants to see a more systemic solution that doesn't leave us

wondering day after day about the next institution that's the weakest link in

the chain," said former Fed Board member Laurence Meyer, vice chairman of

Macroeconomic Advisers, an economic research firm.

Treasury Department officials have studied a structure to buy up distressed

assets for weeks, but have been reluctant to ask Congress for such authority

unless they were certain it could get approved. The intensified market turmoil

may have changed that political calculus, even with less than two months left

until the November elections.

A big question still to be answered is how the government will value the assets

it takes onto its books. One possible avenue could be some sort of auction

facility, so that the government would not have to be involved in negotiating

asset values with companies. Financial companies would likely take big losses.

President Bush met with Treasury Secretary Paulson, Securities and Exchange

Commission Chairman Christopher Cox and Federal Reserve Chairman Ben Bernanke

for 45 minutes Thursday to discuss "the serious conditions in our financial

markets," said White House spokesman Tony Fratto.

Messrs. Paulson, Cox and Bernanke later addressed congressional leaders Thursday

evening on their proposals. At the meeting, Mr. Bernanke began by laying out the

severity of the crisis. Mr. Paulson "made the sale," said a top congressional

aide.

House Financial Services Committee Chairman Barney Frank, the Massachusetts

Democrat, said his panel could hold a vote on the package as soon as Wednesday.

"They said they would like legislation to do it, and there was virtually

unanimous agreement that there would be legislation to do it," said Mr. Frank.

In a news conference after the meeting, Mr. Paulson described his effort as "an

approach to deal with the systemic risk and the stresses in our capital

markets." The "comprehensive" solution would deal with the souring real-estate

and other illiquid assets at the heart of the financial crisis, he said.

Exactly how such an entity might be structured isn't yet clear. The possible

plan isn't expected to mirror the Resolution Trust Corp., which was used from

1989 to 1995 during the savings and loan crisis to hold and sell off the assets

of failed banks. Rather, a new entity might purchase assets at a steep discount

from solvent financial institutions and eventually sell them back into the

market.

The program may look more like the Reconstruction Finance Corporation, a

Depression-era relief program formed in 1932 by President Hoover that tried to

inject liquidity into the market by giving loans to banks and other businesses.

According to a top congressional aide, the Treasury department wants authority

to either control the program or have it be a separate division of the

government.

A series of veteran policy makers, including former Treasury Secretary Lawrence

Summers and former Fed Chief Paul Volcker, has pushed in recent weeks for such a

government agency that would attempt a comprehensive solution to the markets

crisis.

The idea would be to steady the market so that investors regain confidence in

financial institutions and resume conducting business normally with them.

"By stepping in here and getting the markets to function again, the government

could deliver the Sunday punch to this financial turmoil," said former

Comptroller of the Currency Eugene Ludwig, who is now chief executive of

Promontory Financial Group, and a big proponent for the idea. "By taking the

first step and making a market the new government entity could take fear out of

marketplace," he added.

Thursday, Republican nominee Sen. John McCain sought a broad expansion of

government regulation over financial institutions, including the formation of a

body to both assume distressed mortgages and help failing investment banks.

Saying the government cannot "wait until the system fails," Sen. McCain called

for the creation of an entity that would essentially help companies sell off bad

loans and other impaired assets. It is unclear how the body, dubbed the Mortgage

and Financial Institutions trust, would operate, including whether or not

institutions would seek help or whether the government would intervene on its

own behalf.

His rival, Democratic Sen. Barack Obama of Illinois was less specific about what

steps he would take, offering broader outlines of policy proposals that included

a "Homeowner and Financial Support Act." The measure, which would inject capital

and liquidity in the financial system, is designed to provide a more coordinated

response than "the daily improvisations that have characterized policy-making

over the last year."

—Brian Blackstone, Maya Jackson Randall, Joellen Perry, Laura Meckler, Nick

Timiraos, Elizabeth Holmes, Michael M. Phillips and Craig Karmin contributed to

this article.

U.S. Drafts Sweeping Plan to Fight Crisis,

NYT, 19.9.2008,

http://online.wsj.com/article/SB122182746619856569.html

Don Wright Palm Beach ,

FL Cagle

18.9.2008

Vast Bailout by U.S. Proposed

in Bid to Stem Financial Crisis

September 19, 2008

The New York Times

By EDMUND L. ANDREWS

WASHINGTON — The head of the Treasury and the Federal Reserve began

discussions on Thursday with Congressional leaders on what could become the

biggest bailout in United States history.

While details remain to be worked out, the plan is likely to authorize the

government to buy distressed mortgages at deep discounts from banks and other

institutions. The proposal could result in the most direct commitment of

taxpayer funds so far in the financial crisis that Fed and Treasury officials

say is the worst they have ever seen.

Senior aides and lawmakers said the goal was to complete the legislation by the

end of next week, when Congress is scheduled to adjourn. The legislation would

grant new authority to the administration and require what several officials

said would be a substantial appropriation of federal dollars, though no figures

were disclosed in the meeting.

Democrats, having their own desire for a second round of economic aid for

struggling Americans, see the administration’s request as a way to win White

House approval of new spending to help stimulate the economy in exchange for

support for the Treasury request. Democrats also say they will push for relief

for homeowners faced with foreclosure in return for supporting any broad bailout

of struggling financial institutions.

“What we are working on now is an approach to deal with systemic risks and

stresses in our capital markets,” said Henry M. Paulson Jr., the Treasury

secretary. “And we talked about a comprehensive approach that would require

legislation to deal with the illiquid assets on financial institutions’ balance

sheets,” he added.

One model for the proposal could be the Resolution Trust Corporation, which

bought up and eventually sold hundreds of billions of dollars’ worth of real

estate in the 1990s from failed savings-and-loan companies. In this case,

however, the government is expected to take over only distressed assets, not

entire institutions. And it is not clear that a new agency would be created to

manage and dispose of the assets, or whether the Federal Reserve or Treasury

Department would do so.

The bailout discussions came on a day when the Federal Reserve poured almost

$300 billion into global credit markets and barely put a dent in the level of

alarm.

Hoping to shore up confidence with a show of financial shock and awe, the

Federal Reserve stunned investors before dawn on Thursday by announcing a plan

to provide $180 billion to financial markets through lending programs operated

by the European Central Bank and the central banks of Canada, Japan, Britain and

Switzerland.

But after an initial sense of relief swept markets in Asia and Europe, the fear

quickly returned. Tensions remained so high that the Federal Reserve had to

inject an extra $100 billion, in two waves of $50 billion each, just to keep the

benchmark federal funds rate at the Fed’s target of 2 percent.

None of those actions, however, brought much catharsis or relief, with banks

around the world remaining too frightened to lend to each other, much less to

their customers. This forced Mr. Paulson and Ben S. Bernanke, the Fed chairman,

to think the unthinkable: committing taxpayer money to buy hundreds of billions

of dollars in distressed assets from struggling institutions.

Rumors about the Bush administration’s new stance swept through the stock

markets Thursday afternoon. By the end of trading, the Dow Jones industrial

average shot up 617 points from its low point in midafternoon, the biggest surge

in six years, and ended the day with a gain of 410 points or 3.9 percent.

The rally continued in early trading in Asia. The Australian market was up 3.5

percent by mid-day there and the Nikkei 225 Index was up 2.9 percent in Tokyo.

“The markets voted, and they liked the proposal,” said Laurence H. Meyer, vice

chairman of Macroeconomic Advisers.

The stock surge began after Senator Charles E. Schumer, Democrat of New York,

announced his own proposal for a government rescue on the Senate floor and

declared that both the Treasury and the Federal Reserve were open to all ideas.

“The Federal Reserve and the Treasury are realizing that we need a more

comprehensive solution,” Mr. Schumer said. “I’ve been talking to them about it.”

Still, the evening discussions took most of Washington by surprise, especially

since Congress had been trying to finish up its business and head home to

campaign for re-election.

The scale and complexity of the project are almost certain to create huge

philosophical differences among the parties, which could make negotiations

difficult to say the least. Still, lawmakers said the goal was to work through

the coming weekend and to have both the House and Senate vote on a measure by

the end of next week.

As they exited the session, grim-faced lawmakers said they would await proposals

from the Treasury Department. The Senate majority leader, Harry Reid, said he

expected to see a proposal within hours, not days.

“What we agreed to do is sit down together on a bipartisan basis and work

together to solve the problem,” said Senator Mitch McConnell of Kentucky, the

Republican leader, who said no specific approach was advocated by the

administration officials.

President Bush and his top advisers have adamantly opposed bailouts, but the

mortgage crisis has already forced the Treasury and the Fed to bail out four of

the country’s most prominent financial institutions — Bear Stearns in March;

Fannie Mae and Freddie Mac earlier this month; and American International Group,

the insurance conglomerate, just this week.

Created in 1989, the Resolution Trust Corporation disposed of bad assets held by

hundreds of crippled savings institutions. The agency closed or reorganized 747

institutions holding assets of nearly $400 billion. It did so by seizing the

assets of troubled savings and loans, then reselling them to bargain-seeking

investors.

By 1995, the S.& L. crisis had abated and the agency was folded into the Federal

Deposit Insurance Corporation, which Congress created during the Great

Depression to regulate banks and protect the accounts of customers when they

fail.

By any reckoning, Mr. Paulson and Mr. Bernanke were desperate for a way to stem

the crisis once and for all by Thursday evening. Over the previous 10 days, they

had allowed one Wall Street firm, Lehman Brothers, to collapse; and an even

bigger Wall Street firm, Merrill Lynch, to be sold to Bank of America. Then, on

Tuesday, the Federal Reserve abruptly took over the nation’s biggest insurance

conglomerate, the American International Group, and began bailing it out with an

$85 billion loan.

The meeting in the Capitol, which began around 7 p.m., came after Congressional

leaders had initially appeared unclear about what role they would play in the

rapid-fire decisions being made. Leaders of both parties had complained about a

lack of hard information flowing from the administration. House Republicans even

canceled a closed-door party session Thursday morning after the administration

refused to provide an official to brief them on the administration’s emerging

policies.

But as Thursday progressed, Congressional leaders sought to reassert themselves

on the crisis, scheduling oversight hearings, calling for a legislative response

to the market turmoil and offering to put off an adjournment scheduled to start

at the end of next week if the administration and Congress could find common

ground on a solution.

Nancy Pelosi, the House speaker, in a letter sent Thursday evening to President

Bush, reiterated that view. “We stand ready beyond the targeted adjournment date

of September 26 to permit Congress to consider legislative proposals and conduct

necessary investigations,” Ms. Pelosi said in the letter, which said “the

worsening crisis in our financial markets demands strong solutions and decisive

leadership.”

But whether a legislative consensus could be found remained an open question,

and members of Mr. Bush’s own party were among those who were most critical of

the increasing federal intervention in private markets.

At the meeting Thursday night, where officials said the atmosphere was tense,

Senator Richard Shelby of Alabama, the senior Republican on the banking

committee, was notably skeptical.

A spokesman for the senator, Jonathan Graffeo, said later: “Senator Shelby

believes it’s his responsibility to be skeptical on behalf of taxpayers. He

believes our goal must be to minimize taxpayer exposure while maximizing the

benefit to the economy. ”

Earlier in the day, Representative John A. Boehner of Ohio, the House Republican

leader, had expressed similar wariness about the risk to taxpayers’ funds. And

Representative Jeb Hensarling, a Texas Republican who heads a coalition of House

conservatives, was circulating a letter to the administration demanding that it

not engage in any further bailouts.

Even before the Thursday night session with Mr. Paulson — the second for top

Congressional leaders this week — the House had scheduled new oversight hearings.

The Financial Services Committee set a session for next week, with Mr. Paulson

and Mr. Bernanke as witnesses. The Oversight and Government Reform Committee set

hearings for early October to examine developments that led to the collapse of

Lehman Brothers and the bailout of A.I.G., even though Congress is to be in

recess.

Ms. Pelosi, suggesting the public was probably not of a mind to wait until 2009

for a Congressional fix, said lawmakers first had to explore the causes of the

problems and potential solutions in hearings.

“Let’s hear from the Bernankes and the Paulsons and the rest what their view of

it is,” she said. “Let’s hear from the private sector. How these captains of the

financial world could make millions of dollars in salary, and yet their

companies fail and then we have to step in to bail them out.”

Mr. Paulson and Mr. Bernanke have been studying an array of new and sometimes

radical approaches to fight what current and former Fed officials describe as

the worst financial crisis they have ever seen.

The Fed has already stretched itself very thin by introducing new emergency

lending programs for banks, Wall Street firms and, this week, a giant insurance

company.

With the Fed running short of unencumbered reserves, the Treasury Department had

begun raising fresh cash for the central bank by selling new Treasury bills at

an unprecedented pace — $200 billion this week alone — and parking it at the Fed

for whatever use it wanted.

Carl Hulse and David M. Herszenhorn contributed reporting.

Vast Bailout by U.S.

Proposed in Bid to Stem Financial Crisis, NYT, 19.9.2008,

http://www.nytimes.com/2008/09/19/business/19fed.html

Dan Wasserman

The

Boston Globe Cagle

18.9.2008

L: U.S. President George W. Bush.

Multiple quick fixes tried

for US financial crisis

September 19, 2008

Filed at 9:15 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

WASHINGTON (AP) -- Urgently moving on multiple fronts to stem the worst

financial crisis in decades, the government on Friday said it would safeguard

assets in money market mutual funds and temporarily banned short-selling of

financial company stocks. The Treasury Department has asked Congress to give it

sweeping power to buy up toxic debt that has unhinged Wall Street.

President Bush authorized Treasury to tap up to $50 billion from a

Depression-era fund to insure the holdings of eligible money market mutual

funds. And the Federal Reserve announced it will expand its emergency lending

program to help support the $2 trillion in assets of the funds.

Both moves are designed to bolster the huge money market mutual fund industry,

which has come under stress in recent days.

The Fed said it expanding its emergency lending efforts to allow commercial

banks to finance purchases of asset-backed paper from money market funds. The

central bank should help the funds to meet demands for redemptions.

The Securities and Exchange Commission early Friday imposed a temporary

emergency ban on short-selling of financial company stocks, a trading method

that bets the stocks will go down.As the financial crisis widened, entreaties

had come from all quarters to stem a swarm of short-selling contributing to the

collapse of stock values in investment and commercial banks.

Bush planned to discuss the swirl of emergency actions in a Rose Garden

statement later Friday.

Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke are

crafting a massive rescue plan to buy up dodgy assets held by troubled banks and

other financial institutions at the heart of the nation's financial crisis.

Congressional leaders said they expected to get the plan Friday and act on it

before Congress recesses for the election.

Wall Street headed for a huge rally Friday. The government's moves could help

alleviate the uncertainty that has been sending the markets into tumult over the

past week. Lending has grinded to a virtual standstill in the wake of the

bankruptcy of Lehman Brothers Holdings Inc.

Global stock markets roared higher, too.

And European Central Bank, Swiss National Bank and Bank of England offered up

more cash Friday. The three banks put a combined $90 billion into money markets

in a lockstep move.

The chairman of the Senate Banking Committee, Chris Dodd, D-Conn., warned the

United States could be ''days away from a complete meltdown of our financial

system'' and said Congress is working quickly to prevent that.

Dodd told ABC's ''Good Morning America'' on Friday that the nation's credit is

seizing up and people can't get loans.

The ranking Republican on the Banking Committee, Sen. Richard Shelby, said the

U.S. has ''been lurching from one crisis to another'' and predicted the new

bailout plan would cost at least half a trillion dollars.

''We hope to move very quickly. Time is of the essence,'' House Speaker Nancy

Pelosi, D-Calif., said after Paulson and Bernanke briefed congressional leaders

Thursday night.

Stocks on Wall Street shot up more than 400 points late Thursday on word that a

plan was in the works. Fallout from the housing and credit debacles have badly

bruised the economy and pushed unemployment to a five-year high.

''I don't say any prudent money manager would say we're out of the woods, but

right in this moment it all seems positive and leading toward an upward move for

the market going into Friday session,'' said Scott Fullman, director of

derivative investment strategy for New York-based institutional broker WJB

Capital Group.

Fullman said the biggest bonus of any potential government plan is that it is

being put together to help the banking industry as a whole. Until now, the

Treasury and Fed have selectively bailed out institutions that were the most

vulnerable.

''This staves off Judgment Day,'' said Anthony Sabino, professor of law and

business at St. John's University. ''This is a detox for banks, and will help

cleanse themselves of the bad mortgage securities, loans and everything else

that has hurt them.''

The roots of the current crisis can be traced to lax lending for home mortgages

-- especially subprime loans given to borrowers with tarnished credit -- during

the housing boom. Lenders and borrowers were counting on home prices to keep

zooming upward. But when the housing market went bust, home prices plummeted.

Foreclosures spiked as people were left owing more on their mortgage than their

home was worth. Rising mortgage rates also clobbered some homeowners.

As financial companies racked up multibillion-dollar losses on soured mortgage

investments, and credit problems spread globally, firms hoarded cash and clamped

down on lending. That crimped consumer and business spending, dragging down the

national economy -- a vicious cycle policymakers have been trying to break.

''The root cause of the stress in the capital markets is the real estate

correction,'' Paulson said, adding he hopes to have a solution ''aimed right at

the heart of this problem.''

Bernanke said a resolution would help ''get our economy moving again.''

Rep. Barney Frank, D-Mass., chairman of the House Financial Services Committee,

discounted the idea of setting up a new agency -- similar to the Resolution

Trust Corp. -- established in 1989 to help resolve a savings and loan crisis at

a cost to taxpayers of $125 billion.

''It will be the power -- it may not be a new entity. It will be the power to

buy up illiquid assets,'' Frank said. ''There is this concern that if you had to

wait to set up an entity, it could take too long.''

The federal government already has pledged more than $600 billion in the past

year to bail out, or help bail out, some of the biggest names in American

finance. There was no immediate word on how much the new rescue plan might cost.

The SEC on Friday said it was acting in concert with the U.K. Financial Services

Authority in taking emergency action to prohibit short selling in financial

companies to protect the integrity of the securities market and boost investor

confidence.

''The commission is committed to using every weapon in its arsenal to combat

market manipulation that threatens investors and capital markets,'' SEC Chairman

Christopher Cox said in a statement. ''The emergency order temporarily banning

short-selling of financial stocks will restore equilibrium to markets.''

------

Associated Press writers Martin Crutsinger, Andrew Taylor and Marcy Gordon in

Washington and Joe Bel Bruno in New York contributed

to this report.

Multiple quick fixes

tried for US financial crisis, NYT, 19.9.2008,

http://www.nytimes.com/aponline/business/AP-Financial-Meltdown.html

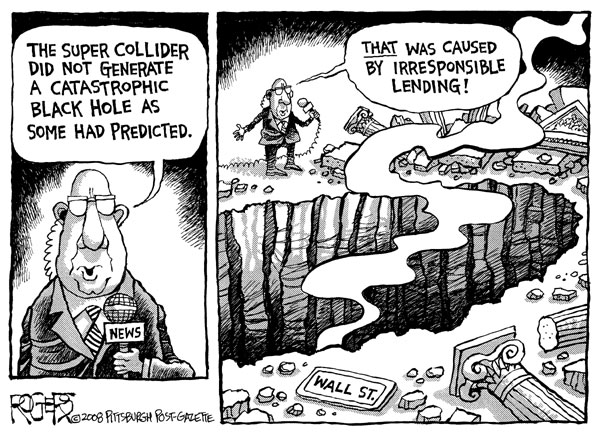

Rob Rogers

cartoon

The

Pittsburgh Post-Gazette, Pennsylvania

Cagle

18.9.2008

A Modest Proposal

to Help to Save the World

September 18, 2008

5:44 pm

The Wall Street Journal

Posted by Dennis K. Berman

It is about trust. Banks don’t trust one another to lend. Individuals are

increasingly fearful of trusting, too, scared of putting their cash in

money-market funds that lubricate the entire economy.

The root of all this panic lies, of course, in the deflating prices of mortgage

assets and their gruesomely-twisted derivatives such as collateralized debt

obligations, and synthetic-CDO-squareds.

The problem is that banks, hedge funds, and insurers aren’t too inclined to talk

about the prices of these securities–what is known as their marks, in part

because they don’t want anyone to know what they are. And that makes them just

as suspicious about their own counterparties. If I’m fibbing, then everyone else

must be fibbing.

The mistrust and misinformation feeds on itself, and before long the system

grinds to a halt.

But what if there were a simple way to make everyone honest? And wouldn’t that

honesty help clean up the markets, as everyone could see the prevailing market

prices–for better or for worse–and get to the business of buying and selling?

That step would be to strongly ask (or perhaps even require) that banks,

insurers and maybe even some hedge funds contribute their market prices to a

fully transparent, searchable database of pricing data. This could be easily

organized, because each security has a separate identifying number–called its

CUSIP number–that makes for easy tracking.

In other words, everyone shows their hand, for better or for worse.

The markets rallied this afternoon on the expectation that the government would

go one step further–and collect all these bad assets into a central

clearinghouse. Taxpayers would, of course, pay a monumental price to absorb all

the losses. And there could be lots of objections from market players who would

be fearful of where their marks would stack up against competitors.

With the markets pleading for some sort of federal bailout, such a simple step

may get trampled underfoot. But the interim step of price discovery may go a

long way to establishing a market without immediately spending taxpayer money.

A Modest Proposal to

Help to Save the World, NYT, 18.9.2008,

http://blogs.wsj.com/deals/2008/09/18/a-modest-proposal-to-help-to-save-the-world/

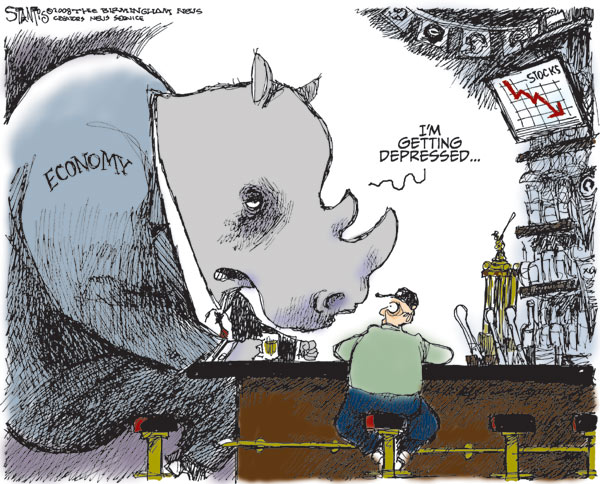

Scott Stantis

Alabama,

The Birmingham News Cagle

18.9.2008

As

Fears Grow,

Wall St. Titans See Shares Fall

September 18, 2008

The New York Times

By BEN WHITE and ERIC DASH

Even Morgan Stanley and Goldman Sachs, the two last titans left standing on

Wall Street, are no longer immune.

To the surprise of executives within those firms, and their rivals, the stocks

of these powerful companies were drawn into the crisis of investor confidence on

Wednesday. Morgan Stanley, whose stock fell almost 25 percent, was considering a

merger with Wachovia or another bank to help shore up its finances. Goldman

Sachs’s stock fell almost 14 percent, and it had to rebuff rumors that it was

seeking a capital infusion.

The assault on these two companies underscored how quickly a sense of fear is

spreading through Wall Street. Both firms just reported respectable profits on

Tuesday, and were considered in a separate class from weaker banks like Bear

Stearns and Lehman Brothers that saw the value of their businesses evaporate.

“Stop the Insanity,” wrote Glenn Schorr, a brokerage analyst at UBS, in an

e-mail message to clients on Wednesday.

A tie-up with a bank would restore Morgan Stanley to its structure during the

Depression, when the firm split from the Morgan banking empire. It would also

leave Goldman Sachs as the last major American investment bank after a global

financial crisis that has gripped markets for more than a year snowballed last

week, forcing the most risk-taking industry in the world to get back to basics.

Only a day earlier, Morgan Stanley defended itself from growing doubts about its

future, issuing a fairly positive earnings report to ward off concerns about its

health. But the fear that gripped markets after Lehman Brothers failed also

enveloped the firm.

Seeking to avoid the kind of fate that led Lehman and Bear Stearns to collapse,

John J. Mack, Morgan Stanley’s chief executive, made an unsuccessful effort on

Tuesday evening to persuade Citigroup’s chief executive, Vikram S. Pandit, to

enter into a combination, according to people briefed on the talks.

“We need a merger partner or we’re not going to make it,” Mr. Mack told Mr.

Pandit, according to two people briefed on the talks. Mr. Pandit, a former

senior investment banker at Morgan Stanley, said Citigroup was not interested.

It is thinking of deals it can strike with consumer banks, like buying the

struggling Washington Mutual out of bankruptcy if its reported efforts to

auction itself should fail, that would provide it with cheaper deposit funding.

A Citigroup spokeswoman declined to comment.

Having failed at that, Mr. Mack entered into discussions on Wednesday with

Wachovia and several other banks, people briefed on those discussions said. The

talks with Wachovia are preliminary and a deal may not emerge. The banks

declined to comment.

Goldman Sachs may be under less pressure given its recent history of

outperforming its peers. The bank made $11.6 billion last year and has not

posted a loss during the credit crisis. Morgan Stanley has also performed well,

but has suffered more write-downs and had a loss of $3.6 billion in the fourth

quarter of last year.

Still, many specialists say they believe that the monumental events of the last

four days herald a new period of painful change for the American financial

industry — one that speculators are rushing to pounce on. While Wall Street has

gone through tough times before, only to emerge bigger and stronger, some

financial specialists question whether the industry can rebound quickly after

using high levels of leverage, or borrowed money, to binge on risky investments.

Those investments have proved to be disastrous. Worldwide, financial companies

have reported more than $500 billion in charges and losses stemming from the

credit crisis — a figure some specialists say could eventually exceed $1

trillion.

Merrill Lynch rushed into the arms of Bank of America this week in a deal that

in some ways harked back to the past. During the Depression, Congress separated

commercial banks, which take deposits and make loans, from investment banks,

which underwrite and trade securities. The investment banks were allowed to do

business with less oversight, while commercial banks operated with tighter

supervision.

But after Congress repealed those Depression-era laws in 1999, commercial banks

began muscling in on Wall Street’s turf. As the new competition whittled down

profit margins, investment banks used more of their capital to trade securities

and also began developing financial derivatives to fuel profits.

Now, executives like John A. Thain, the chief executive of Merrill and a former

Goldman executive, say investment banks will need large bases of deposits to

shore up their capital.

Investors appeared to be questioning whether either Morgan Stanley or Goldman

Sachs would be able to survive alone as panic spread through the markets. The

cost of protecting against defaults on the debt of both have shot up, a signal

that some investors believe one or both of the banks could be next in the

growing list of financial companies to either go bust, get sold or require a

government bailout. Any institution without a big, stable balance sheet is seen

as vulnerable to the kind of rapid collapse in confidence that led to the demise

of Bear Stearns and Lehman Brothers.

As Morgan Stanley considered its options on Wednesday, the struggling savings

and loanWashington Mutual also put itself up for auction, people briefed on the

matter said. Shares of Washington Mutual fell 31 cents, or 13.36 percent, to

$2.01; Wachovia shares fell $2.39, or 20.76 percent, to $9.12.

Normally, a declining share price alone should not force a stalwart like Morgan

Stanley into a sale. But those declines, which executives blamed on aggressive

hedge funds that profit when stocks drop, can increase the firm’s cost of

borrowing by forcing it to post more collateral to lenders when its credit

default protection prices rise.

Such an event often leads credit rating agencies to downgrade a company’s debt.

That, in turn, can quickly deplete even a well-financed bank’s capital and force

into sale or bankruptcy. The real end for Lehman Brothers, for example, came

when Moody’s, the ratings agency, downgraded the company’s debt last week,

forcing it into a corner.

Indeed, with healthy earnings, Wednesday’s relentless downward spiral in shares

of both Morgan Stanley and Goldman Sachs made little sense to some.

Mr. Schorr, the analyst at UBS, said the increase in the risk premiums investors

are demanding on debt have become self-fulfilling prophecies that now operate

almost entirely detached from underlying fact, a thought echoed by people inside

both banks and by several investors.

“It’s all confidence, it’s not reality,” Mr. Schorr said.

Morgan and Goldman have some problems, including a parcel of troubled mortgage

assets and trading and advisory businesses that are vulnerable to a slowing

economy.

“But that is not what is going on here,” Mr. Schorr said. “It is just a flat-out

squeeze that should not be able to happen. The negative feedback loop has to be

somehow suspended,” he added, “but I don’t know exactly how you do that.”

Goldman Sachs declined to comment.

On Wednesday, the Securities and Exchange Commission reinstated a rule curbing

the ability of investors to drive the share price of firms down to make a

profit. Nearly five days ago, Wall Street chieftans who were gathered for

emergency meetings at the New York Federal Reserve bank pleaded for the agency

to revive the rule, which expired in the summer.

Mr. Mack has been in contact with regulators about what he views as abusive

short-selling of the company’s shares. On Wednesday, he sent a memo to employees

assuring them of the bank’s strong capital position and blaming short-sellers

for driving the stock down “in the midst of a market controlled by fear and

rumors.” He plans to hold a town hall meeting with Morgan employees Thursday

morning.

Andrew Ross Sorkin contributed reporting.

As Fears Grow, Wall St.

Titans See Shares Fall, NYT, 18.9.2008,

http://www.nytimes.com/2008/09/18/business/18wall.html