|

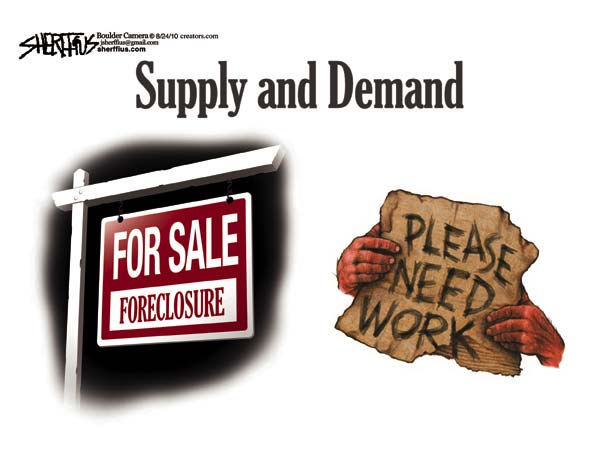

USA > History > 2010 > Economy (IV)

John Sherffius

Boulder Daily Camera

Colorado

Cagle

15 September 2010

More on the Mortgage Mess

October 31, 2010

The New York Times

Ben Bernanke, chairman of the Federal Reserve, said recently that federal

regulators are “looking intensively” at banks’ foreclosure practices. An

investigation is long overdue, though it shouldn’t take a lot of digging.

Consumer advocates, the press, investors and homeowners have already compiled a

compelling list of transgressions: conflicts of interest that have banks pushing

foreclosures, without a good-faith effort to modify troubled loans. Dubious fees

that inflate mortgage balances. The hundreds of thousands of flawed foreclosure

affidavits that violated homeowners’ legal protections. The misplaced documents.

And it goes on.

For years these problems have been the focus of research reports, Congressional

testimony and court cases. Regulators, however, looked the other way, which is

how we got into the mortgage mess.

What makes the latest scandals so outrageous is that even after the financial

meltdown and taxpayer bailout— and all those vows about accountability — the

regulators are still behind the curve. The fundamental problem is that the

banks’ drive to profit from the foreclosure process is all too often at odds

with the interests of mortgage investors, homeowners and the economy’s health.

That is a big reason that the Obama administration’s antiforeclosure effort,

with its voluntary participation by banks, has fallen so short.

Here is the background. The big banks — Bank of America, JPMorgan Chase,

Citibank, Wells Fargo — service most of the nation’s home mortgages for

investors who own the loans. They are paid a fee by the investors and also make

money from fees on delinquent loans.

Servicers are obligated to manage the loans in the best interest of the

investors. That means modifying a troubled loan, if reduced payments would bring

in more money over time than a foreclosure. Or foreclosing if a borrower cannot

make the payments on a modified loan.

If only it worked that way in practice.

Take, for example, underwater borrowers — the millions of Americans who owe more

on their loans than their homes are worth. For them, the best modification is

often to reduce the loan’s principal balance, lowering the monthly payment and

restoring some equity. That could be best for investors too, because even

reduced payments are often better than a foreclosure sale. A bank’s servicing

fee is based on the principal balances of the loan — a strong incentive not to

reduce a troubled borrower’s balance.

Another conflict occurs when the bank that services a primary mortgage is also

the owner of a second lien on the same property. Resolving a troubled first

mortgage generally requires a write-down of the second lien, a step that banks

have been loath to take.

Banks also profit from late fees and other default-related charges assessed on

borrowers. And there is an additional incentive to pile on charges, since the

bigger the loan balance, the higher the fee to manage the loan. A group of

prominent investors — including Freddie Mac, the Federal Reserve Bank of New

York and Pimco, the world’s largest bond fund — recently accused Bank of America

of fee-padding. The bank denies wrongdoing.

High default charges harm homeowners because they make it increasingly difficult

to catch up on late payments and avoid foreclosure. They also disadvantage

investors, because the servicer collects the charges from the foreclosure sale

before the investors see any money. Everyone loses, except the bank.

Mr. Bernanke said that the regulators’ findings would be released in November.

What is also needed is real enforcement — and new rules and possibly new laws —

to make banks change their ways.

More on the Mortgage

Mess, NYT, 31.10.2010,

http://www.nytimes.com/2010/11/01/opinion/01mon1.html

How the Banks

Put the Economy Underwater

October 30, 2010

The New York Times

By YVES SMITH

IN Congressional hearings last week, Obama administration officials

acknowledged that uncertainty over foreclosures could delay the recovery of the

housing market. The implications for the economy are serious. For instance, the

International Monetary Fund found that the persistently high unemployment in the

United States is largely the result of foreclosures and underwater mortgages,

rather than widely cited causes like mismatches between job requirements and

worker skills.

This chapter of the financial crisis is a self-inflicted wound. The major banks

and their agents have for years taken shortcuts with their mortgage

securitization documents — and not due to a momentary lack of attention, but as

part of a systematic approach to save money and increase profits. The result can

be seen in the stream of reports of colossal foreclosure mistakes: multiple

banks foreclosing on the same borrower; banks trying to seize the homes of

people who never had a mortgage or who had already entered into a refinancing

program.

Banks are claiming that these are just accidents. But suppose that while

absent-mindedly paying a bill, you wrote a check from a bank account that you

had already closed. No one would have much sympathy with excuses that you were

in a hurry and didn’t mean to do it, and it really was just a technicality.

The most visible symptoms of cutting corners have come up in the foreclosure

process, but the roots lie much deeper. As has been widely documented in recent

weeks, to speed up foreclosures, some banks hired low-level workers, including

hair stylists and teenagers, to sign or simply stamp documents like affidavits —

a job known as being a “robo-signer.”

Such documents were improper, since the person signing an affidavit is attesting

that he has personal knowledge of the matters at issue, which was clearly

impossible for people simply stamping hundreds of documents a day. As a result,

several major financial firms froze foreclosures in many states, and attorneys

general in all 50 states started an investigation.

However, the problems in the mortgage securitization market run much wider and

deeper than robo-signing, and started much earlier than the foreclosure process.

When mortgage securitization took off in the 1980s, the contracts to govern

these transactions were written carefully to satisfy not just well-settled,

state-based real estate law, but other state and federal considerations. These

included each state’s Uniform Commercial Code, which governed “secured”

transactions that involve property with loans against them, and state trust law,

since the packaged loans are put into a trust to protect investors. On the

federal side, these deals needed to satisfy securities agencies and the Internal

Revenue Service.

This process worked well enough until roughly 2004, when the volume of

transactions exploded. Fee-hungry bankers broke the origination end of the

machine. One problem is well known: many lenders ceased to be concerned about

the quality of the loans they were creating, since if they turned bad, someone

else (the investors in the securities) would suffer.

A second, potentially more significant, failure lay in how the rush to speed up

the securitization process trampled traditional property rights protections for

mortgages.

The procedures stipulated for these securitizations are labor-intensive. Each

loan has to be signed over several times, first by the originator, then by

typically at least two other parties, before it gets to the trust, “endorsed”

the same way you might endorse a check to another party. In general, this

process has to be completed within 90 days after a trust is closed.

Evidence is mounting that these requirements were widely ignored. Judges are

noticing: more are finding that banks cannot prove that they have the standing

to foreclose on the properties that were bundled into securities. If this were a

mere procedural problem, the banks could foreclose once they marshaled their

evidence. But banks who are challenged in many cases do not resume these

foreclosures, indicating that their lapses go well beyond minor paperwork.

Increasingly, homeowners being foreclosed on are correctly demanding that

servicers prove that the trust that is trying to foreclose actually has the

right to do so. Problems with the mishandling of the loans have been compounded

by the Mortgage Electronic Registration System, an electronic lien-registry

service that was set up by the banks. While a standardized, centralized database

was a good idea in theory, MERS has been widely accused of sloppy practices and

is increasingly facing legal challenges.

As a result, investors are becoming concerned that the value of their securities

will suffer if it becomes difficult and costly to foreclose; this uncertainty in

turn puts a cloud over the value of mortgage-backed securities, which are the

biggest asset class in the world.

Other serious abuses are coming to light. Consider a company called Lender

Processing Services, which acts as a middleman for mortgage servicers and says

it oversees more than half the foreclosures in the United States. To assist

foreclosure law firms in its network, a subsidiary of the company offered a menu

of services it provided for a fee.

The list showed prices for “creating” — that is, conjuring from thin air —

various documents that the trust owning the loan should already have on hand.

The firm even offered to create a “collateral file,” which contained all the

documents needed to establish ownership of a particular real estate loan.

Equipped with a collateral file, you could likely persuade a court that you were

entitled to foreclose on a house even if you had never owned the loan.

That there was even a market for such fabricated documents among the law firms

involved in foreclosures shows just how hard it is going to be to fix the

problems caused by the lapses of the mortgage boom. No one would resort to such

dubious behavior if there were an easier remedy.

The banks and other players in the securitization industry now seem to be

looking to Congress to snap its fingers to make the whole problem go away,

preferably with a law that relieves them of liability for their bad behavior.

But any such legislative fiat would bulldoze regions of state laws on real

estate and trusts, not to mention the Uniform Commercial Code. A challenge on

constitutional grounds would be inevitable.

Asking for Congress’s help would also require the banks to tacitly admit that

they routinely broke their own contracts and made misrepresentations to

investors in their Securities and Exchange Commission filings. Would Congress

dare shield them from well-deserved litigation when the banks themselves use

every minor customer deviation from incomprehensible contracts as an excuse to

charge a fee?

There are alternatives. One measure that both homeowners and investors in

mortgage-backed securities would probably support is a process for major

principal modifications for viable borrowers; that is, to forgive a portion of

their debt and lower their monthly payments. This could come about through

either coordinated state action or a state-federal effort.

The large banks, no doubt, would resist; they would be forced to write down the

mortgage exposures they carry on their books, which some banking experts contend

would force them back into the Troubled Asset Relief Program. However, allowing

significant principal modifications would stem the flood of foreclosures and

reduce uncertainty about the housing market and mortgage securities, giving the

authorities time to devise approaches to the messy problems of clouded titles

and faulty loan conveyance.

The people who so carefully designed the mortgage securitization process

unwittingly devised a costly trap for people who ran roughshod over their

handiwork. The trap has closed — and unless the mortgage finance industry agrees

to a sensible way out of it, the entire economy will be the victim.

Yves Smith is the author of the blog Naked Capitalism and “Econned: How

Unenlightened Self-Interest Undermined Democracy and Corrupted Capitalism.”

How the Banks Put the

Economy Underwater, NYT, 30.10.2010,

http://www.nytimes.com/2010/10/31/opinion/31smith.html

What It Takes to Buy a House in Foreclosure

October 29, 2010

The New York Times

By RON LIEBER

ATLANTA — As in any economic downturn, the wave of home foreclosures has

attracted voracious opportunists — investors among them who are buying, fixing

and then renting the places out.

In their wake are aspiring owner-occupants. How hard could it be, they ask, to

pick up one of these houses on the cheap and make it livable?

For an answer, consider Jennifer Kuzara, 32, a grants manager for a nonprofit

organization here. From early 2009 to early this year, she spent about 1,000

hours on her foreclosure project. The gang of helpers she assembled included two

real estate agents, a banker, an architect, a contractor and her parents.

To stand a chance of making the project work in the neighborhoods where she was

willing to live, she needed $100,000 in cash. Ultimately, Ms. Kuzara and her

parents were exposed to a fair bit of risk, all in the name of a bungalow in a

middle-class neighborhood.

And while the specifics are particular to Ms. Kuzara, plenty of people in

foreclosure-ridden markets in Florida, Arizona, Nevada and elsewhere are in for

a house hunt that is going to look a lot like hers. The headlines may be raising

all sorts of questions about whether the foreclosures were legitimate. But there

will always be people who want to buy when things are really cheap and are

willing to press ahead when the quest seems most challenging.

So this is the story of what it will take for their search to have a happy

ending.

It began in 2006, when Ms. Kuzara had nearly six figures in student loan debt

and the housing market was at its most heated. She was virtually certain that

she would never be able to afford a home. “I remember thinking that it might

have been the end of my American dream,” Ms. Kuzara said.

Two years later, after she had finished her Ph.D. course work in anthropology at

Emory University, and begun full-time work in the nonprofit field, the housing

market began to turn. Not long after, a friend was considering buying a

foreclosed home as an investment property and encouraged Ms. Kuzara to look at

the listings.

Through another friend, Ms. Kuzara found Lisa Iakovides and her business

partner, Michael Redwine, real estate agents at a company called Atlanta Intown.

They established some price parameters and some items that would be deal

breakers, like mold and crooked rooflines.

Then they shopped for neighborhoods. One, East Atlanta, made the short list,

even though Ms. Kuzara hit the floor of Mr. Redwine’s car one day when she heard

gunshots on the way back from visiting a home there. She and Ms. Iakovides

hadn’t even started up the walkway of a house in another neighborhood,

Peoplestown, when a neighbor loudly made her feelings known about white people

moving in.

Other homes told stories in subtler ways. “Squatters had taken them all over,”

Ms. Kuzara said. “Some moved in furniture and their families. But there was one

where I never would have known until I opened up a closet and saw a little stack

of sleeping bags and blankets. And on the top ledge there was a knife, a fork

and a spoon.”

Ms. Kuzara vowed to leave cookies and a nice note for whomever was living there

if she bought that home, but she didn’t get it or many others. By the time she

entered the fray, investors were already swarming. She bid on at least 10 homes

over six months and lost them all.

The house she finally bought had been divided in half and turned into

apartments, which might have been why she did not have to fight so hard for it.

The 1,100-square-foot bungalow sits high on a small piece of property in the

Edgewood neighborhood. It is one of those places where you can walk a few blocks

to the left and find two stores with a fine malt liquor selection, then stroll

10 minutes to the right to Bed Bath & Beyond for high thread-count sheets to

sleep off the hangover. Ms. Kuzara’s block has a halfway house for former

substance abusers next door and a beautifully renovated home across the street

with an alarm service sign planted prominently out front.

Ms. Iakovides managed to get a preliminary $39,000 offer accepted by the bank on

the home in early August 2009, and she began trying to set a closing date. Ms.

Kuzara drove by the home each day, planning the renovation.

But one day she found the front door wide open and called her real estate agents

in a panic, worried that vandals were casing the place or that squatters would

take up residence. Without really asking the bank’s permission, the agents

called a contractor to padlock the door. “Who would we have asked?” Mr. Redwine

said, incredulously, as if the bank that still owned the house was actually

going to return his calls.

Ms. Kuzara’s next step was to get together the money to pay for the place and

the $60,000 or so in repair work. After trying early on in her hunt to cobble

together various combinations of tax credits, down payment assistance programs

and government loans, it became clear that most banks preferred all-cash offers

for their foreclosed homes.

But Ms. Kuzara had no cash. Her parents, Mark and Jennie, had some savings but

not nearly enough. So her parents borrowed $25,000 at about 8 percent interest

against a life insurance policy and $50,000 more at a lower rate from his 401(k)

and bought the $39,000 home themselves. They used the remaining money for the

renovation, planning all along to sell it to Ms. Kuzara as soon as the repairs

were done.

For that to work, however, Ms. Kuzara would need to qualify for a mortgage to

buy it from her parents. She had no money for a down payment, though. To qualify

for the Federal Housing Administration loan that she needed, the home,

postrenovation, would have to be appraised at a high enough amount that her

parents could give her some of the newly created equity for a down payment while

still getting all their money back.

And therein lay the risk. Because Ms. Kuzara bought one of the worst homes on a

nice block, her agents were convinced that the renovation could yield an

appraisal at the value that the bank required.

It helped that they had ushered in a contractor they had worked with before,

whom they could count on to stay within the strict budget. Under his

supervision, the renovations were finished in less than two months.

Then came the deciding moment: the appraisals. One came in at $130,000, while

the other was for $145,000. As a result, the bank allowed Ms. Kuzara to borrow

$100,000 to buy the home from her parents and thus make them whole. Then she

used some of the remaining, newly created equity for the required down payment.

Ms. Kuzara moved in a year ago this weekend, and today the cozy house has three

bedrooms, two baths, a front porch for dinner parties and a backyard for her two

dogs. She’s furnished the place with chairs from consignment stores and thrift

shops and has assembled a nice collection of vintage cookware and dishes.

She pays $828 a month on her 30-year fixed-rate mortgage, including taxes and

insurance, and she has a roommate who chips in $500 month.

Including the weeks when she painted every inch of the interior, Ms. Kuzara

spent about 1,000 hours on her foreclosure project — poring over listings,

researching every last one in county databases, visiting houses and making her

eventual home habitable.

So anyone who wants to do what she did needs to be ready to put in that much

time. You may need a source of funds or willing co-conspirators like Ms.

Kuzara’s parents. And you will need a team of people who know the rules of the

foreclosure game cold.

The odds of success are certainly long. But for those with the patience to pull

it off, it sure seems a whole lot of fun to play this game and win.

“It turned out to be a sweet little house,” said Mark Kuzara, Jennifer’s father.

“And I think somewhere down the road, she’ll sell that house and come out pretty

nicely on it.”

What It Takes to Buy a

House in Foreclosure, NYT, 29.10.2010,

http://www.nytimes.com/2010/10/30/your-money/30money.html

U.S. Hears Echo of Japan’s Woes

October 29, 2010

The New York Times

By MARTIN FACKLER and STEVE LOHR

TOKYO — In the annals of economic policy blunders, the one in which Hiroshi

Kato played a hand in early 1997 ranks among the biggest in recent Japanese

history.

Mr. Kato led a government advisory committee that concluded that the economy,

which was then finally starting to rebound from the collapse of its 1980s land

and stock bubbles, was healthy enough to raise the national consumption tax to 5

percent from 3 percent.

Aimed at reducing deficits, the tax increase instead quickly snuffed out the

fragile recovery, pushing Japan to the brink of a financial meltdown and

thrusting the nation deeper into the economic morass from which it has yet to

emerge even today.

“Our sins are large,” Mr. Kato, now president of Kaetsu University in Tokyo,

said ruefully. “I hope the rest of the world can learn from this mistake.”

And indeed, the lessons of Japan’s long stagnation are well known to American

policy makers like the treasury secretary, Timothy F. Geithner, and the chairman

of the Federal Reserve, Ben S. Bernanke, who have studied Japan’s policy

missteps.

In 1999, Mr. Bernanke, then an academic, tartly criticized Japanese officials

for mishandling their 1990s financial crisis, saying Japan’s plight was “self

induced.” Partly because of that expertise, American policy makers have long

been confident, even during the darkest days of the current financial crisis,

that the United States could avoid the fate of Japan and its two lost decades.

But now, with growing signs that the United States might be a lot closer to a

Japan-style slump than previously thought, that confidence is waning.

In the United States, a robust recovery remains stubbornly elusive, and Mr.

Bernanke is said to be ready to take new, unconventional steps to increase the

money supply in order to maintain the uncertain growth of the past year. He is

also said by close associates to favor further fiscal measures to stimulate the

economy. But in the current political climate, with Republicans poised to make

strong gains in the midterm elections while preaching fiscal austerity, the

prospect of more federal stimulus spending seems remote, and it is unclear if

monetary policy alone will be enough to restore healthy growth.

Partly as a result, some economists now predict that it could take years or even

a decade for the American economy to regain the levels of employment and vigor

achieved before the 2008 crisis. The growing political pressure for cuts in

federal spending — along with plunging consumer confidence and companies that

seem more intent on cutting costs and hoarding cash than investing in new growth

— have led economists to talk of the United States’ entering a grim new era of

austerity.

That is very close to what befell Japan two decades ago, when the seemingly

invincible Asian economic juggernaut fell into a deep rut of chronically anemic

demand and corrosive price declines, known as deflation, from which it has never

fully recovered. The parallels are so striking, and unsettling, that economists

are now taking a renewed look at Japan for insights on how the United States can

avoid the deflation trap.

“There has been a political and intellectual arrogance in the United States that

it won’t happen to us,” said Adam S. Posen, a senior fellow at the Peterson

Institute for International Economics in Washington. “We shouldn’t be so smug.

You can get there without being Japan.”

Indeed, the financial crisis that crippled Japan’s once high-flying economy

appears an eerie precursor of the one that struck much of the global economy in

2008. In Japan, a huge expansion in credit created twin price bubbles in the

land and stock markets that, when they burst in the late 1980s and early 1990s,

left banks and other companies drowning in failed real estate investments.

But perhaps the most alarming part is what came next: a collapse in demand that

pushed prices and ultimately wages into a self-reinforcing deflationary spiral,

which made already stingy individuals and businesses even less willing to use

money, because falling prices meant that cash itself gained in value.

Japan has remained trapped in this spiral despite the equivalent of trillions of

dollars in stimulus spending, more than a decade of near-zero interest rates and

even unconventional steps by the central bank similar to those now contemplated

by Mr. Bernanke, like purchasing corporate and government bonds to increase the

money supply.

Despite the strong parallels, there are still reasons to think the United States

can escape what has been called Japanification.

The United States and Japan are very different, culturally and politically, and

Japan faces a host of unique problems that have sapped its vitality, like a

rapidly aging populace that has created generational tensions, and the closing

of its doors to immigration and the youthful labor and fresh ideas that can

bring. Economists say the dynamic United States economy has shaken off seemingly

intractable slumps before, as in the frightening recession of 1980-82, when

conditions and the prospects for recovery seemed, for a while, every bit as

bleak as they do now.

However, some warn that the United States could still get it wrong, especially

if the midterm elections produced a sharply divided political landscape.

“The danger is if the U.S. plunges into policy paralysis just like Japan in the

1990s,” said Shumpei Takemori, an economist at Keio University in Tokyo.

“Ideological divides and political divides can make bold policy action

impossible.”

In fact, some economists warn that the United States may be deeper into

Japan-style stagnation than is widely realized. Simon Johnson, a former chief

economist at the International Monetary Fund, estimates that the total output of

the American economy this year will be no higher by his estimate than it was in

2006.

“We’ve already lost half a decade,” said Mr. Johnson, now a professor at the

Massachusetts Institute of Technology.

In addition, economists say, Japan had one advantage the United States does not.

With its high savings rate, the government could borrow from its own domestic

sources at minuscule rates to finance trillions of dollars in stimulus projects.

By contrast, the United States has to sell its government bonds to foreign

investors, who are likely to demand higher interest rates as its national debt

grows.

Leading Japanese economists also said their nation’s many failures — like the

1997 tax increase — yielded one crucial lesson on combating the aftereffects of

a financial panic: the need to avoid policy flip-flops.

“The lesson is that there is a proper sequence for pulling a nation out of a

financial crisis,” said Heizo Takenaka, an economist who was the architect of

the successful cleanup of Japan’s banking system in the early 2000s. “First, you

restore growth before worrying about deficits.”

However, Mr. Takenaka acknowledged that while the banking problems have been

largely fixed, Japan has yet to come up with a strategy for restoring growth,

which he says is the only way to end deflation.

This month, Japan’s central bank pushed its benchmark rate back down to zero.

However, central bankers here argue that it is not enough just to loosen

monetary policy when a lack of borrowers and new investment means there is no

demand for money to start with. And this points to another feature of Japan’s

experience that may already be visible in the United States: the paradox of a

stagnant economy that is awash in cash.

This occurs when companies and individuals stop spending and banks stop lending

for fear that anemic growth and rising bankruptcies will result in defaults.

This is particularly apparent in regional economies outside Tokyo, which remains

relatively vibrant.

In a healthy economy, banks typically lend out more money than they have on

deposit. But in Osaka, Japan’s third largest city and commercial hub, nearly two

decades of hoarding of cash created the unusual situation in 2002 of deposits at

all the city’s banks surpassing their outstanding volume of loans. Since 1997,

the total amount of loans by the city’s banks has fallen by a third, to $530

billion, while deposits have risen by 20 percent, to $767 billion.

“Deflation has made everyone very conservative and eager to hold cash,” said

Hiroshi Tanaka, a senior director at Osaka Shinkin Bank. “We have too much cash

and nowhere to invest it all.”

This has created distortions in Japan’s economy. One is a sharp drop in the

number of times cash changes hands in normal business and spending transactions.

This so-called velocity of money has dropped to about a third the level of the

United States, according to figures from the Mizuho Research Institute in Tokyo.

Another distortion is Japan’s so-called dresser savings — the piles of cash that

individuals keep at home for fear that their banks may also go bankrupt. These

stashes are estimated to total about $370 billion, according to Akira Otani, a

researcher at the Bank of Japan.

Economists see early signs that the United States is heading down the same path.

Recent data shows a surge in savings rates to 6.4 percent in June from less than

1 percent in 2005, reflecting consumers’ reluctance to spend, and continued

disinflation.

The picture is not entirely bleak for the United States, where the constant

drive to innovate can produce bursts of growth that few economists or anyone

else can see coming. While Japan was seen once as an unstoppable powerhouse, the

picture was altered by wave after wave of technological innovation in the United

States — the personal computer industry, then the Internet and Web businesses,

smart phones, and mobile software. That dynamism, economists note, is often

wrenching. But it also means that investment dollars and people shift more

rapidly to new opportunities. In Japan, though, such painful payroll cuts and

corporate deaths were postponed for years.

The American approach to economic adjustment is “shock treatment,” said Edward

J. Lincoln, director of the Center for Japan-U.S. Business and Economic Studies

at New York University, while “Japan favors stability and the corporate

socialization of the pain.”

“Deep down inside, as an American,” Mr. Lincoln said, “I tend to think that the

United States’ approach makes for a healthier economy in the long run.”

Martin Fackler reported from Tokyo, and Steve Lohr from New York.

U.S. Hears Echo of

Japan’s Woes, NYT, 29.10.2010,

http://www.nytimes.com/2010/10/30/world/asia/30japan.html

Bernanke’s Reluctance to Speak Out Rankles Some

October 28, 2010

The New York Times

By SEWELL CHAN

WASHINGTON — The Federal Reserve is all but certain next week to begin a

multibillion-dollar effort to coax the recovery along, but privately, Ben S.

Bernanke, the chairman, worries that more is needed to turn the sluggish economy

around and revive employment.

He believes that without the Obama administration’s $787 billion stimulus

program, the nation would have been worse off, and that Congress needs to

continue to prop up the economy in the short run. He agrees that fiscal measures

to support the recovery would probably make the Fed’s unconventional monetary

policy more potent.

But Mr. Bernanke has been reluctant to prominently voice those views, which were

gleaned from testimony, speeches and interviews with people close to him over

the last several months. His predecessor, Alan Greenspan, did not display such

hesitation, advocating for the Bush tax cuts of 2001 and 2003.

Mr. Bernanke is uncomfortable in that role, which he believes to be outside his

purview, even — or especially — in an election season dominated by economic

anxiety. He has not ruled out weighing in when a bipartisan budget commission

named by President Obama delivers its report in December, but it seems unlikely

that he will intervene in the battle over the Bush tax cuts.

The hesitance of Mr. Bernanke, who was President George W. Bush’s chief economic

adviser for six months before becoming Fed chairman in 2006, has sharply divided

economists.

Some say he could guide the debate, and give a lift to the White House, by

speaking out against the aggressive budget-cutting proposed by many Republican

candidates, particularly those backed by the Tea Party movement.

Others assert that Mr. Bernanke needs to be more outspoken in warning of the

dangers posed by the country’s unsustainable debt burden. Still others say the

Fed should stay out of the way, given its failure to prevent the financial

crisis and the longest recession since the 1930s.

What is clear is that Mr. Bernanke is intent on not embroiling the Fed in a

partisan brawl, and that he believes the central bank should weigh in on fiscal

policy in only the broadest terms — even if past chairmen like Marriner S.

Eccles in the 1930s, Arthur F. Burns in the ’70s and Paul A. Volcker in the ’70s

and ’80s at times broke that mold.

“The chairman’s relative reticence is unusual, but it reflects the difficult

circumstances in which the Fed now operates,” said Iwan W. Morgan, a University

of London historian who studies American fiscal policy. “Its credibility, which

was so high in the Volcker and early Greenspan years owing to its success in

constraining inflation, is now at its lowest ebb since the inflationary 1970s.”

Mark W. Olson, who served with Mr. Bernanke on the Fed’s board of governors and

is now co-chairman of Treliant Risk Advisors in Washington, acknowledged that

“fiscal policy decisions could either exacerbate or negate monetary policy

decisions,” but said that Mr. Bernanke wanted to avoid the “oracle trap” into

which Mr. Greenspan sometimes fell.

Mr. Greenspan’s reputation as a sage, developed over 18 years as chairman, has

lost its luster, owing not only to his aversion to regulation and his decision

to keep interest rates low after the 2001 recession, but also to his support for

the tax cuts, which he has since renounced, saying the cuts should be allowed to

expire.

“For a long time, Alan Greenspan’s pronouncements were viewed in Congress and

elsewhere as if orchestrated on Mount Sinai, and there seems a consensus now is

that this was a mistake,” said Bernard Shull of Hunter College in New York.

As a scholar of the Depression, Mr. Bernanke chastised Japan for being too timid

in combating deflation and advocated overwhelming force as a response to

financial crises — advice he has followed at the Fed.

But Mr. Bernanke, who was confirmed to a second term in January by an

uncomfortably narrow margin, has been adroit in avoiding fiscal controversy.

At a pair of Congressional hearings in September, for example, he gave each

party a message it wanted to hear. He told Democrats that the government should

maintain short-term fiscal support for the recovery. He assured Republicans of

the need to rein in deficits and stabilize debt levels. And when pressed, he

declined to be precise.

“I’m reluctant to take positions on specific tax and spending measures,” he told

Representative Spencer T. Bachus of Alabama, the top Republican on the House

committee that oversees the Fed. “I’m sure you can understand my position on

that.”

However, Mr. Bernanke has spoken of the budgetary challenges posed by an aging

population. And he came the closest he has in a while to advocating fiscal

measures in an Oct. 4 speech in Providence, R.I., when he suggested that the

government adopt fiscal rules — in essence surrendering some of Congress’s and

the president’s discretion.

Congress already uses so-called pay-go rules, which require that spending

increases or tax cuts be offset within a 10-year horizon, but there are

significant exemptions. Moreover, the rules are intended only to prevent

projected deficits from getting worse and do not require Congress “to reduce the

ever-increasing deficits that are already built into current law,” Mr. Bernanke

noted.

Of the dozen economists interviewed for this article, those who favored

additional stimulus tended to want Mr. Bernanke to speak out.

“Further short-run fiscal expansion paired with credible measures to deal with

longer-term deficits would be a good idea,” said Alan J. Auerbach, a professor

of economics and law at the University of California, Berkeley. “The political

difficulty of accomplishing this puts pressure not only on the Fed but also on

our trade policy, where we are forced to lean more heavily on China.”

William G. Gale, of the Brookings Institution, said additional federal spending

would be more effective than new debt purchases by the Fed — a strategy known as

quantitative easing — and that Mr. Bernanke should at least explain the

connection between the two.

“By pursuing quantitative easing, he is committing to monetary expansion,” Mr.

Gale said. “He has the right to say that he has made the commitment, and now it

is time for Congress to make a similar commitment.”

Other economists say the Fed has already gotten dangerously close to the

Treasury Department, given their collaboration under Mr. Bush in bailing out

Wall Street, and in propping up the housing market.

“The distinction and separation of monetary and fiscal policy has almost

disappeared,” said Alberto F. Alesina, an economics professor at Harvard. “This

is, I believe, dangerous.”

Another Harvard professor, Martin S. Feldstein, who like Mr. Bernanke is a

former chairman of the White House Council of Economic Advisers, said, "There

have been times when the Fed has in effect said: If fiscal policy is tightened,

the Fed will be able to lower interest rates. That does not apply now."

Bernanke’s Reluctance to

Speak Out Rankles Some, NYT, 28.10.2010,

http://www.nytimes.com/2010/10/29/business/economy/29fed.html

The Mortgage Morass

October 26, 2010

The New York Times

The mortgage mess just keeps getting messier. Last week, Bank of America

announced that it had performed a “thorough review” of its processes, found

nothing amiss and would soon restart 102,000 pending foreclosures. On Sunday,

the bank acknowledged that it had in fact found errors in its filings, and would

resume foreclosures only in a deliberate manner as new and corrected paperwork

was submitted to the courts.

The repeated recalibration cast further doubt on Bank of America’s procedures

and the ability of the entire industry to clean up this mess.

The immediate issue is robo-signing, in which employees at Bank of America,

JPMorgan Chase and other banks falsely attested to having verified the facts in

what may turn out to be hundreds of thousands, or more, court foreclosure

filings. That has brought to light other problems, including crucial documents

that have been lost or improperly transferred — raising questions about the

banks’ legal standing to foreclose as well as the value of securities backed by

these mortgages.

The state courts will have to resolve the question of whether banks can

foreclose with defective or substitute documents. Courts will also have to rule

on any disputes between banks and investors over mortgage securities, a complex

and contentious process if it comes to that. The Obama administration needs to

do a lot more to get hold of this crisis, before it gets any worse.

Last week, Bank of America also acknowledged receiving a letter from mortgage

investors — including Freddie Mac and the Federal Reserve Bank of New York —

demanding that it repurchase tens of billions of dollars in problem loans that

were bundled into securities.

Investors can demand that banks repurchase loans that did not meet underwriting

guidelines or were inadequately vetted or processed. The repurchases are

important to taxpayers, because — through Fannie, Freddie and the Fed — the

government now owns or backs a large number of problem loans and related

securities. If the banks do not take the hit, the taxpayers will.

Fannie and Freddie have increased their repurchase demands on lenders over the

past year, but banks are sure to resist large repurchases, setting up more

clashes and disruption.

Bank of America has said it does not believe it is at fault for the loans’ poor

performance. Freddie Mac and the Fed should push their claims hard.

The Obama administration needs to ensure that the taxpayers’ interests come

first. Until now, the White House has focused far more energy on shoring up the

banks — a stance that may have made sense in the thick of the financial crisis

but is increasingly suspect now.

The administration has called on banks to correct the problems in their

foreclosure paperwork. More is needed, including a plan to impose coherence on

the increasingly chaotic mortgage system.

The White House needs to work with Congress to ensure that no foreclosures

proceed — not just those with questionable paperwork — without homeowners’ first

being offered fair and timely loan modifications. The Housing and Urban

Development secretary, Shaun Donovan, has promised tougher action, but has been

short on details and even refrained from naming the banks that have been

laggards in loan workouts.

The administration and federal regulators should also acknowledge the potential

hit to banks’ finances from the coming wave of litigation and repurchases. They

should be taking precautions right now, say, by initiating more robust

monitoring or new stress tests to gauge whether banks need to raise more capital

to absorb the costs of any court fights and buying back bad loans.

The markets are relatively calm for now. That is the time to get ahead of

problems that are not going away.

The Mortgage Morass,

NYT, 26.10.2010,

http://www.nytimes.com/2010/10/26/opinion/26tue1.html

Divide on U.S. Deficit Likely to Grow After Election

October 25, 2010

The New York Times

By JACKIE CALMES

WASHINGTON — A midterm campaign that has turned heavily on the issue of the

mounting federal debt is likely to yield a government even more split over what

to do about it, people in both parties say, with diminished Democrats and

reinforced Republicans confronting internal divisions even as they dig in

against the other side.

In the weeks after next Tuesday’s elections, the White House and a lame-duck

Congress will face immediate decisions testing the balance of power — on

extending the Bush-era tax rates, approving overdue spending bills to keep the

government operating and, possibly, debating the recommendations that President

Obama has directed a bipartisan debt-reduction commission to offer by December.

The report of the 18-member commission, which includes a dozen senior members of

Congress, six from each party, will help determine whether a bipartisan

consensus exists to deal with the unsustainable combination of fast-growing

entitlement programs like Social Security and Medicare and inadequate tax

revenues.

The group has delayed making decisions until after the election, to avoid leaks

that would become campaign fodder, but even some of its members doubt they can

muster the 14 votes needed to send a package to Congress for a vote; at best

they hope options left on the table, or agreed to by the chairmen — Erskine B.

Bowles, a White House chief of staff to President Bill Clinton, and Alan K.

Simpson, the former Republican Senate leader from Wyoming — will find support in

the spending-and-tax debates.

In interviews, a number of Democrats and Republicans agreed on one thing: For

all the pre-election talk that a divided government could force the parties to

work together, especially on cutting annual deficits, the opposite could just as

well be true.

David Cote, the chief executive of Honeywell International and a member of the

debt commission, said in an interview that “the thing that shocked me” was that

the debt crisis had been predicted for decades because of the costs of federal

benefits for the baby boom generation. “We need to have a more thoughtful,

nuanced discussion about what we’re going to do and what exactly does this

mean,” Mr. Cote said. “And I don’t see that happening. It seems like everybody

wants to just argue.”

Democrats are all but certain to lose a number of seats and perhaps their

majorities. Most of the casualties will be fiscally conservative Democrats from

Republican-leaning areas, leaving a smaller, more solidly liberal caucus less

inclined to support cost-saving changes in future Social Security benefits, for

example.

Republicans’ ranks will almost certainly be strengthened by a wave of

conservatives, including Tea Party loyalists, who are opposed to raising any

taxes and to compromising with Democrats generally — a stand Congressional

Republican leaders have adopted. And incumbents otherwise inclined to make deals

are now wary, Republicans say privately, mindful of colleagues who lost primary

challenges from Tea Party candidates.

Both parties also face internal rifts that could hinder any grand bargain to

reduce the annual deficits adding to the accumulated debt, which by decade’s end

will reach economically dangerous levels as more retirees claim Medicare and

Social Security.

Most Republicans, especially those likely to be in Congress or running for

president, are taking a hard line against tax increases, eager to court the Tea

Party and antitax conservatives generally. But a growing minority is arguing

that the projected debt is too great to shrink with spending cuts alone unless

popular benefits and military programs are put under the knife.

“Everything has got to be on the table for discussion,” said Senator Saxby

Chambliss, Republican of Georgia, who with Senator Mark Warner, Democrat of

Virginia, has formed a group of anti-deficit senators to promote the

recommendations from the debt-reduction commission.

Given the coming influx of novice lawmakers, Mr. Chambliss said in an interview,

“there are a lot of things people are going to have to be educated about, on the

spending side as well as the revenue side.” He added: “They’re thinking we can

come in and eliminate earmarks and everybody’s going to be happy on the spending

side. Gee, that just scratches the surface.”

Yet the conservative blowback was fierce this month after Gov. Mitch Daniels of

Indiana, a budget director for President George W. Bush and a potential 2012

Republican presidential candidate, suggested keeping an open mind about a

consumption tax like the value-added tax used in Europe and a tariff on imported

oil.

That kind of reaction cannot be lost on others. Two Republicans on the fiscal

commission are Representatives Dave Camp of Michigan and Paul D. Ryan of

Wisconsin, who are in line to lead the tax-writing Ways and Means Committee and

the Budget Committee, respectively, if Republicans win a House majority. But

they must be elected by other House Republicans in December and, Republicans

say, a deal with Democrats on deficit-reduction measures could threaten that.

Democrats differ among themselves on whether to extend all the Bush tax cuts as

Republicans demand, or just those for households with annual incomes below

$250,000 as Mr. Obama wants. Over 10 years, an extension for the middle class

would cost more than $3 trillion while extending rates for the rich, too, would

cost $700 billion more; together the nearly $4 trillion is more than half the

debt projected in the decade to 2020.

Many Democrats, backed by a wide range of economists, say that with unemployment

stuck at nearly 10 percent, more stimulus spending is needed — for the

unemployed, struggling states and cities and job-creating public works projects

— before focusing on deficits. The fiscal commission is considering delaying any

deficit-reduction proposals until perhaps 2012.

Democrats are also split on fixing Social Security’s long-term solvency. Mr.

Obama had wanted to tackle the issue early, and he created the debt commission

by executive order — after Senate Republicans blocked legislation — partly in

the hope that it would propose future benefit and payroll tax changes he could

embrace. Some Democrats say he will have all the more reason to lead that charge

after the elections, to signal a more centrist, fiscally conservative course.

Yet liberal groups have already formed a big coalition to lobby against any such

move.

What could result is “deficit reduction by gridlock,” said John Podesta, the

president of the progressive Center for American Progress and a chief of staff

in the Clinton White House.

That would be the outcome if Republicans, as expected, block additional

unemployment aid and if the parties deadlock in the lame-duck session over

pending appropriations and the Bush tax cuts that expire Dec. 31. That would

leave lower spending levels in place for the fiscal year 2011 and force Mr.

Obama and Republicans to try to reach a tax compromise next year.

But that sort of immediate deficit reduction, said Robert Greenstein, the

founder of the left-leaning Center on Budget and Policy Priorities, “will hurt

the economy more than help it without doing very much to deal with the long-term

problem, which is where the real issue is.”

Divide on U.S. Deficit

Likely to Grow After Election, NYT, 25.10.2010,

http://www.nytimes.com/2010/10/26/us/politics/26fiscal.html

Bank of America Reports $7.3 Billion Loss, Citing Charges

October 19, 2010

The

New York Times

By NELSON D. SCHWARTZ

Bank of America, the nation’s biggest bank, announced Tuesday that operating

profit rebounded in the third quarter, helped by improved credit conditions

among consumers and businesses.

On a noncash basis for the quarter, the bank reported a loss of $7.3 billion

because of a $10.4 billion write-down in the value of its credit card unit,

attributed to federal regulations that limit debit fees and other charges.

Without the one-time charge, the bank earned $3.1 billion, or 27 cents a share.

Wall Street had been expecting earnings of 16 cents a share, according to

Thomson Reuters.

Analysts said the improving credit environment was a healthy sign, both for the

bank and the broader economy. The bank set aside $5.4 billion in the quarter for

credit losses, $2.7 billion less than the previous quarter and $6.3 billion less

than the period a year ago.

“The biggest thing is that credit quality improved way more than anybody

thought,” said Chris Kotowski, an analyst with Oppenheimer & Company. “That is

the holy grail — anything else you can deal with. The one thing that kills value

for banking institutions is when credit quality spirals out of control, so this

should be the key to the stock doing well for the next year or two.”

Indeed, a substantial portion of the profit gain came from the expectation of

lower losses among credit card and mortgage borrowers, rather than new business,

as the bank was able to recapture money it had earlier set aside. It released

$1.8 billion from reserves, compared with a release of $1.45 billion in the

second quarter.

In recent days, Bank of America shares have been hammered as investors worried

about the impact of legal challenges to home foreclosures. After halting

foreclosures across the country, Bank of America said Monday it was resuming the

process in 23 states where court approval is required for a foreclosure to

proceed.

One critical worry over the last week was that investors would force the bank to

repurchase now-toxic mortgage backed securities, arguing that they were put

together improperly.

These so-called “put-backs,” some analysts warned, could total tens of billions

of dollars, undermining earnings for years to come. But the $872 million charge

recorded for put-backs in the quarter indicates the threat is manageable, Mr.

Kotowski said.

In the same quarter a year ago, Bank of America reported a loss of $2.2 billion,

or 26 cents a share.

“We are adapting to the regulatory environment, credit quality continues to

improve, and we are managing risk and building capital,” the chief executive,

Brian T. Moynihan, said in a statement. “We are realistic about the near-term

challenges, and optimistic about the long-term opportunity.”

Bank of America became the third major bank to report third-quarter earnings.

JPMorgan Chase reported a $4.4 billion profit for the third quarter while

Citigroup reported earnings of $2.2 billion, its third profitable quarter in a

row.

Bank of America Reports

$7.3 Billion Loss, Citing Charges, NYT, 19.10.2010,

http://www.nytimes.com/2010/10/20/business/20bank.html

Income Inequality: Too Big to Ignore

October 16, 2010

The

New York Times

By ROBERT H. FRANK

PEOPLE often remember the past with exaggerated fondness. Sometimes, however,

important aspects of life really were better in the old days.

During the three decades after World War II, for example, incomes in the United

States rose rapidly and at about the same rate — almost 3 percent a year — for

people at all income levels. America had an economically vibrant middle class.

Roads and bridges were well maintained, and impressive new infrastructure was

being built. People were optimistic.

By contrast, during the last three decades the economy has grown much more

slowly, and our infrastructure has fallen into grave disrepair. Most troubling,

all significant income growth has been concentrated at the top of the scale. The

share of total income going to the top 1 percent of earners, which stood at 8.9

percent in 1976, rose to 23.5 percent by 2007, but during the same period, the

average inflation-adjusted hourly wage declined by more than 7 percent.

Yet many economists are reluctant to confront rising income inequality directly,

saying that whether this trend is good or bad requires a value judgment that is

best left to philosophers. But that disclaimer rings hollow. Economics, after

all, was founded by moral philosophers, and links between the disciplines remain

strong. So economists are well positioned to address this question, and the

answer is very clear.

Adam Smith, the father of modern economics, was a professor of moral philosophy

at the University of Glasgow. His first book, “A Theory of Moral Sentiments,”

was published more than 25 years before his celebrated “Wealth of Nations,”

which was itself peppered with trenchant moral analysis.

Some moral philosophers address inequality by invoking principles of justice and

fairness. But because they have been unable to forge broad agreement about what

these abstract principles mean in practice, they’ve made little progress. The

more pragmatic cost-benefit approach favored by Smith has proved more fruitful,

for it turns out that rising inequality has created enormous losses and few

gains, even for its ostensible beneficiaries.

Recent research on psychological well-being has taught us that beyond a certain

point, across-the-board spending increases often do little more than raise the

bar for what is considered enough. A C.E.O. may think he needs a

30,000-square-foot mansion, for example, just because each of his peers has one.

Although they might all be just as happy in more modest dwellings, few would be

willing to downsize on their own.

People do not exist in a social vacuum. Community norms define clear

expectations about what people should spend on interview suits and birthday

parties. Rising inequality has thus spawned a multitude of “expenditure

cascades,” whose first step is increased spending by top earners.

The rich have been spending more simply because they have so much extra money.

Their spending shifts the frame of reference that shapes the demands of those

just below them, who travel in overlapping social circles. So this second group,

too, spends more, which shifts the frame of reference for the group just below

it, and so on, all the way down the income ladder. These cascades have made it

substantially more expensive for middle-class families to achieve basic

financial goals.

In a recent working paper based on census data for the 100 most populous

counties in the United States, Adam Seth Levine (a postdoctoral researcher in

political science at Vanderbilt University), Oege Dijk (an economics Ph.D.

student at the European University Institute) and I found that the counties

where income inequality grew fastest also showed the biggest increases in

symptoms of financial distress.

For example, even after controlling for other factors, these counties had the

largest increases in bankruptcy filings.

Divorce rates are another reliable indicator of financial distress, as marriage

counselors report that a high proportion of couples they see are experiencing

significant financial problems. The counties with the biggest increases in

inequality also reported the largest increases in divorce rates.

Another footprint of financial distress is long commute times, because families

who are short on cash often try to make ends meet by moving to where housing is

cheaper — in many cases, farther from work. The counties where long commute

times had grown the most were again those with the largest increases in

inequality.

The middle-class squeeze has also reduced voters’ willingness to support even

basic public services. Rich and poor alike endure crumbling roads, weak bridges,

an unreliable rail system, and cargo containers that enter our ports without

scrutiny. And many Americans live in the shadow of poorly maintained dams that

could collapse at any moment.

ECONOMISTS who say we should relegate questions about inequality to

philosophers often advocate policies, like tax cuts for the wealthy, that

increase inequality substantially. That greater inequality causes real harm is

beyond doubt.

But are there offsetting benefits?

There is no persuasive evidence that greater inequality bolsters economic growth

or enhances anyone’s well-being. Yes, the rich can now buy bigger mansions and

host more expensive parties. But this appears to have made them no happier. And

in our winner-take-all economy, one effect of the growing inequality has been to

lure our most talented graduates to the largely unproductive chase for financial

bonanzas on Wall Street.

In short, the economist’s cost-benefit approach — itself long an important arrow

in the moral philosopher’s quiver — has much to say about the effects of rising

inequality. We need not reach agreement on all philosophical principles of

fairness to recognize that it has imposed considerable harm across the income

scale without generating significant offsetting benefits.

No one dares to argue that rising inequality is required in the name of

fairness. So maybe we should just agree that it’s a bad thing — and try to do

something about it.

Robert H. Frank is an economics professor at the Johnson Graduate School of

Management at Cornell University.

Income Inequality: Too

Big to Ignore, NYT, 16.10.2010,

http://www.nytimes.com/2010/10/17/business/17view.html

How Countrywide Covered the Cracks

October 16, 2010

The

New York Times

By GRETCHEN MORGENSON

ON June 27, 2006, Countrywide Financial, the nation’s largest mortgage

lender, was about to close its books on a record-breaking six-month run. The

housing market was on fire and Countrywide’s earnings were soaring. Despite all

the euphoria inside the company, some executives noticed that Angelo R. Mozilo,

the company’s brash and imperious chief executive, seemed subdued.

At a town hall meeting that day with 110 of the company’s highest-ranking

executives in Calabasas, Calif., Mr. Mozilo sat alone on a stage, fielding

questions and offering rosy predictions about his company’s prospects. But then

he struck a sober note in response to a question from one of his colleagues.

The questioner wanted to know what, if anything, worried Mr. Mozilo, according

to a participant.

“I wake up every day frightened that something is going to happen to

Countrywide,” Mr. Mozilo said.

A year and a half later, that day arrived. In January 2008, Countrywide, the

company he had built from a two-man mortgage operation into a lending behemoth,

had to sell itself to Bank of America at a bargain price because it was being

smothered by losses tied to a mountain of sketchy loans.

Yet almost until the moment Countrywide was taken over, Mr. Mozilo was publicly

buoyant about its ability to ride out the mortgage crisis. Privately, however,

he occasionally offered a gloomier assessment of Countrywide’s prospects and

practices, according to e-mail and interviews.

What Mr. Mozilo, now 71, knew about Countrywide’s problems, and precisely when

he knew it, was what eventually led the Securities and Exchange Commission to

file civil securities fraud charges against him last year. And on Friday, in the

Los Angeles courtroom of John F. Walter, a federal District Court judge,

representatives for Mr. Mozilo and for two of his top lieutenants — David

Sambol, Countrywide’s former president, and Eric Sieracki, the company’s former

chief financial officer — settled those charges.

As part of the settlement, Mr. Mozilo and his co-defendants didn’t admit to any

wrongdoing. But Mr. Mozilo agreed to pay $67.5 million in a penalty and

reparations to investors and is permanently banned from serving as an officer or

a director of a public company. Mr. Sambol is paying $5.52 million in a penalty

and reparations and agreed to a three-year ban from serving as an officer or

director of a public company. Mr. Sieracki agreed to pay a $130,000 penalty.

The settlement is a signal event in the credit crisis and its aftermath,

including the foreclosure debacle that is now rattling the mortgage market and

upending the lives of average homeowners. Although Goldman Sachs settled

securities fraud charges earlier this year, Mr. Mozilo is the first prominent

chief executive to be held personally accountable for questionable business

practices that contributed to the housing bubble, the dizzying financial

machinations that surrounded it, and a ruinous lending spree that ultimately

threatened to undermine the nation’s economy.

Mr. Mozilo and his two former colleagues were accused of misrepresenting the

company’s declining lending standards during 2006 and 2007 and portraying

themselves publicly as underwriters of high-quality mortgages even as they

learned that the company’s loans were becoming increasingly risky.

The government also contended that Mr. Mozilo and Mr. Sambol improperly profited

on inside information about the company’s problematic loans when they sold

Countrywide shares. From May 2005 to the end of 2007, Mr. Mozilo generated $260

million from his stock sales, while Mr. Sambol’s sales produced $40 million, the

government says.

Lawyers for Mr. Mozilo declined to comment. Mr. Sambol’s lawyer said his client

had “put the matter behind him for the benefit of his family and loved ones.”

Mr. Sieracki’s lawyer noted that the S.E.C. had decided not to pursue fraud

charges against his client and that his client had not been barred from serving

at a public company. Bank of America is paying Mr. Mozilo’s legal bills.

Countrywide is paying $5 million toward Mr. Sambol’s repayment to investors and

$20 million of Mr. Mozilo’s reparations.

The S.E.C.’s legal team, led by John M. McCoy III, associate regional director

of the enforcement division, said the settlement amounted to a hard-won victory.

In a statement on Friday, Mr. McCoy said: “This settlement will provide affected

shareholders significant financial relief, and reinforces the message that

corporate officers have a personal responsibility to provide investors with an

accurate and complete picture of known risks and uncertainties facing a

company.”

Battered by widespread criticism that it failed to corral scam artists like

Bernard L. Madoff and to effectively police Wall Street as a whole during the

years leading up to the credit crisis, the S.E.C. may now regain some stature as

a successful litigator and investor advocate from its settlement with Mr.

Mozilo.

“As is the case with most settlements, this is a compromise where nobody comes

out a complete winner,” said Lewis D. Lowenfels, an authority on securities law

at Tolins & Lowenfels. “The S.E.C. gets a substantial monetary settlement and a

bar with respect to Mozilo serving as an officer or director. On Mozilo’s side,

he is probably satisfied to have this behind him. He suffers a considerable

stain on his reputation, has to pay a substantial amount of money but retains

significant wealth and at the age of 71 may find the possibility of being an

officer or director of another public company less enticing.”

COUNTRYWIDE FINANCIAL began operations in 1969, when Mr. Mozilo and his

mentor, David Loeb, refugees from an established mortgage lender, decided to

start their own loan originator. The company grew slowly at first, but by 2004,

Countrywide was the nation’s largest home lender, generating annual revenue of

$8.6 billion. Mr. Mozilo ran the company alone after Mr. Loeb retired in 2000.

(Mr. Loeb died in 2003.)

An up-by-the-bootstraps entrepreneur — his father was a butcher in the Bronx —

Mr. Mozilo was obsessed with wresting market share away from his buttoned-down

rivals in the staid world of banking.

“I run into these guys on Wall Street all the time who think they’re something

special because they went to Ivy League schools,” he told The New York Times in

2005. “We’re always underestimated. And we still are. I am. I must say, it

bothered me when I was younger — their snobbery and their looking down on us.”

In an industry that favored low-key behavior and conservative dress, Mr. Mozilo

stood apart. He offered blunt opinions about banking and was open about his

corporate aspirations. To complement his ever-present tan, he wore flashy

clothes and drove expensive cars like Rolls-Royces that were often painted in a

shade of gold.

Still, he managed his business for most of its history with a tight focus on the

bottom line and on vigilant lending practices.

For years, Countrywide specialized in plain-vanilla, fixed-rate loans. As

recently as 2003, such mortgages accounted for 95 percent of the company’s

loans, according to regulatory filings. Countrywide was the biggest supplier of

mortgage loans to Fannie Mae, the federally backed mortgage finance giant that

was also hobbled in the credit crisis.

In 2004, Countrywide’s sober-minded lending style changed significantly. It

began aggressively offering loans to first-time home buyers and to borrowers

with modest incomes. These mortgages were known in the industry as

“affordability products,” but that ho-hum designation belied the potential

financial dangers embedded in the loans if borrowers — particularly low-income

borrowers — wound up unable to pay their debts.

Even so, Countrywide embraced such loans with gusto. For example,

adjustable-rate mortgages — those with a low introductory rate that could

ratchet up in later years — accounted for about 18 percent of Countrywide’s

business in 2003. But a year later, they made up 49 percent of its loans.

Subprime loans also grew in 2004, to 11 percent of its originations, up from 4.6

percent in 2003. These loans often required no down payments and very little

documentation of borrowers’ incomes, assets or employment; they generated

immense profits to Countrywide but, again, presented a bevy of risks. And even

when the going got rough for some homeowners, Countrywide didn’t hesitate to

take a hard line with borrowers who fell behind.

A born salesman, Mr. Mozilo promoted his company’s prospects wherever he went.

In front of a crowd of investors or analysts, he would predict what Countrywide

would generate in profits five years down the road and how many of its

competitors the company would vanquish. No matter what, Countrywide would

survive, he vowed.

“Over the entire history of this country, housing prices have never gone down

nationally. They have gone down in some local areas, but never nationally,” he

told an interviewer for CNBC in early 2005. “Secondly, any homeownership over

the 10 years has proved to be the best investment that you could ever make. Over

any 10-year period, housing prices go up.”

Later that year, he was equally optimistic when he again visited CNBC’s studios.

“From our perspective — and we’ve been doing this for 38 years — we’re still in

a terrific mortgage market,” he said. “So the road ahead to us appears to be

extremely vibrant, very sound.”

Even as the wheels were coming off of the Countrywide cart in 2007, Mr. Mozilo’s

upbeat public pronouncements continued.

“I think you have to keep things in perspective. You know, there’s an old saying

that you don’t know who’s swimming naked until the tide goes out, and obviously

the tide’s gone out,” he told CNBC in March 2007, when a number of

once-successful subprime lenders were plunging toward bankruptcy. “I think it’s

a mistake to apply what’s happening to them to the more diversified financial

services companies such as Countrywide.”

When Bank of America invested $2 billion in Countrywide in August 2007 — a move

that caused many analysts to question Countrywide’s financial wherewithal and

its ability to remain independent — Mr. Mozilo again struck an optimistic note.

“Countrywide’s future’s going to be great. You know, it’s always been great,” he

told CNBC at the time. “So I think, down the line, this is going to be a better

company, a more profitable company and a company that’s going to be a great

investment for shareholders as we continue down the line. Because the market

ultimately will come to us. This is America. People want to own homes.”

PRIVATELY, however, Mr. Mozilo had long been worried about some of the loans

his company favored, as indicated by e-mails he sent to his deputies. And this

gulf between Mr. Mozilo’s private views and his public proclamations went to the

heart of the S.E.C.’s case against him.

Beginning in 2005, for example, he fretted about lending practices at

Countrywide, e-mail messages show. One target of his ire was the “pay-option

adjustable-rate mortgage,” a loan that let borrowers pay a fraction of the

interest owed and none of the principal during an introductory period. These

loans put homes within many borrowers’ financial grasp — at least initially.

When a borrower made only modest payments, the shortfall was added to the

principal balance on the loan, meaning that the mortgage would grow in size.

Given this arithmetic, borrowers could wind up owing more than their homes were

worth.

In 2004, pay-option A.R.M.’s accounted for 6 percent of Countrywide’s

originations. Two years later, they accounted for 21 percent of its loans. The

loans were moneymakers for Countrywide; internal company documents show that the

company made gross profit margins of more than 4 percent on such loans, double

the 2 percent generated on standard loans backed by the Federal Housing

Administration.

Countrywide pushed the lucrative loans hard. A sales document called “Pay Option

A.R.M.’s Made Simple” asked rhetorically what kinds of customers would be

interested in these loans. “Anyone who wants the lowest possible payment!” was

one of the answers.

But these loans unnerved Mr. Mozilo, as his e-mails indicate. In April 2006, for

example, he learned that almost three-quarters of the company’s pay-option

customers had chosen to make the minimum payment the prior February, up from 60

percent the previous August, according to the S.E.C.’s complaint. In an e-mail

to Mr. Sambol, Mr. Mozilo wrote: “Since over 70 percent have opted to make the

lower payment it appears that it is just a matter of time that we will be faced

with much higher resets and therefore much higher delinquencies.”

Two months later, and just one day after he talked up his company’s pay-option

A.R.M.’s to investors at a Wall Street conference, Mr. Mozilo wrote an e-mail to

Mr. Sambol predicting trouble ahead for many borrowers in these mortgages. They

“are going to experience a payment shock which is going to be difficult if not

impossible for them to manage,” he said.

And in September 2006, Mr. Mozilo wrote an e-mail saying the company had no way

to assess the risks of holding pay-option A.R.M.’s on its balance sheet. “The

bottom line is that we are flying blind on how these loans will perform in a

stressed environment of higher unemployment, reduced values and slowing home

sales,” he wrote.

Another Countrywide product that concerned Mr. Mozilo was its so-called 80/20

loan, named for the fact that the combination allowed a borrower to receive

money covering 100 percent of a home’s purchase price.

Mr. Mozilo had become worried about these loans in the first quarter of 2006,

when HSBC Bank, a buyer of Countrywide’s 80-20 loans, began forcing the lender

to repurchase some that HSBC contended were defective.

“In all my years in the business, I have never seen a more toxic product,” he

wrote to Mr. Sambol in an April 17, 2006, e-mail cited by the S.E.C. “With real

estate values coming down ... the product will become increasingly worse.”

Such e-mails suggest that by mid-2006, Mr. Mozilo had recognized how reckless

some of his company’s lending had become. And just three months later, according

to the S.E.C. complaint, he met with his financial adviser to increase the

amount of Countrywide shares he could cash in under a planned executive

stock-sale program.

Mr. Mozilo had always been a big seller, and rarely a buyer, of the Countrywide