|

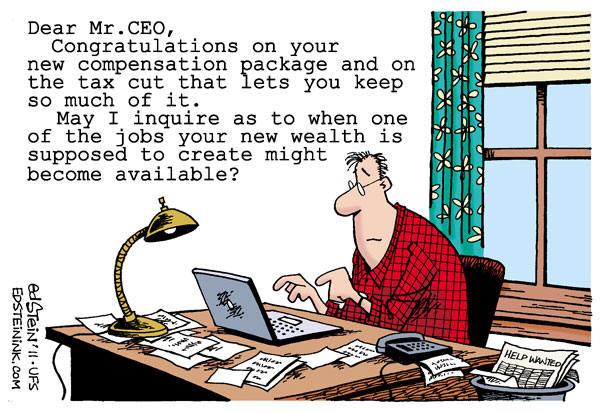

History > 2011 > USA > Economy (II)

Ed Stein

Denver

Colorado

Cagle

13 April 2011

IMF

says Strauss-Kahn

resigns as managing director

SINGAPORE

| Thu May 19, 2011

12:23am EDT

Reuters

SINGAPORE

(Reuters) - Dominique Strauss-Kahn resigned as head of the International

Monetary Fund, the IMF said in a statement dated May 18, as he faces charges of

sexual assault and attempted rape.

"I deny with the greatest possible firmness all of the allegations that have

been made against me," Strauss-Kahn said in his letter of resignation, released

by the IMF.

(Reporting

by Emily Kaiser)

IMF says Strauss-Kahn resigns as managing director, R,

19.5.2011,

http://www.reuters.com/article/2011/05/19/us-strausskahn-arrest-idUSTRE74D29F20110519

I.M.F. Names New Leader

May 15, 2011

The New York Times

By AL BAKER and STEVEN ERLANGER

Hours after its chief, Dominique Strauss-Kahn, was

arrested in connection with the alleged sexual attack of a maid at a Midtown

Manhattan hotel, the International Monetary Fund on Sunday named John Lipsky as

acting managing director.

Mr. Lipsky, the I.M.F.’s first deputy managing director, is a former U.S.

Treasury executive and onetime banker at JP Morgan. William Murray, an I.M.F.

spokesman, said that Mr. Lipsky, who has been overseeing the logistics of the

bailout of the Greek economy, would meet with members of the I.M.F. board in

Washington later in the day, according to Reuters.

“In line with standard I.M.F. procedures, John Lipsky, first deputy managing

director, is acting managing director while the M.D. is not in D.C.,” Mr. Murray

said in a statement. “Mr. Lipsky will chair the informal Board session today.”

Mr. Strauss-Kahn, 62, was awaiting arraignment on Sunday evening in Manhattan.

The New York Police Department formally arrested him at 2:15 that morning “on

charges of criminal sexual act, attempted rape, and an unlawful imprisonment in

connection with a sexual assault on a 32-year-old chambermaid in the luxury

suite of a Midtown Manhattan hotel yesterday” about 1 p.m., Deputy Commissioner

Paul J. Browne, the department’s chief spokesman, said.

Meanwhile, the woman who told the police she was sexually attacked by Mr.

Strauss-Kahn picked him out of a police lineup Sunday. After making the

identification, she left in a police van amid a gaggle of reporters.

Reached by telephone, Benjamin Brafman, a lawyer, said he would be representing

Mr. Strauss-Kahn with William Taylor, a lawyer in Washington.

Early Sunday morning, Mr. Brafman said that his client “will plead not guilty.”

Mr. Strauss-Kahn was widely expected to become the Socialist candidate for the

French presidency, was apprehended by detectives of the Port Authority of New

York and New Jersey in the first-class section of the jetliner, and immediately

turned over to detectives from the Midtown South Precinct, officials said.

Mr. Strauss-Kahn, a former French finance minister, had been expected to declare

his candidacy soon, after three and a half years as the leader of the fund,

which is based in Washington. He was considered by many to have done a good job

in a period of intense global economic strain, when the institution itself had

become vital to the smooth running of the world and the European economy.

His apprehension came at about 4:40 p.m. at Kennedy Airport, when two detectives

of the Port Authority suddenly boarded Air France Flight 23, as the plane idled

at the departure gate, said John P. L. Kelly, a spokesman for the agency.

“It was 10 minutes before its scheduled departure,” Mr. Kelly said. “They were

just about to close the doors.”

Mr. Kelly said that Mr. Strauss-Kahn was traveling alone and that he was not

handcuffed during the apprehension.

“He complied with the detectives’ directions,” Mr. Kelly said.

The Port Authority officers were acting on information from the Police

Department, whose detectives had been investigating the assault of a female

employee of Sofitel New York, at 45 West 44th Street, near Times Square. Working

quickly, the city detectives learned he had boarded a flight at Kennedy Airport

to leave the country.

Though Mr. Strauss-Kahn received generally high marks for his stewardship of the

fund, his reputation was tarnished in 2008 by an affair with a Hungarian

economist who was a subordinate there. The fund decided to stand by him despite

concluding that he had shown poor judgment in the affair. Mr. Strauss-Kahn

issued an apology to I.M.F. employees and to his wife, Anne Sinclair, an

American-born French journalist, who he married in 1991.

In his statement then, Mr. Strauss-Kahn said, “I am grateful that the board has

confirmed that there was no abuse of authority on my part, but I accept that

this incident represents a serious error of judgment.” The economist, Piroska

Nagy, left the fund as part of a buyout of nearly 600 employees instituted by

Mr. Strauss-Kahn to cut costs.

In the New York case, Mr. Browne said that it was about 1 p.m. on Saturday when

the maid, a 32-year-old woman, entered Mr. Strauss-Kahn’s suite — Room 2806 —

believing it was unoccupied. Mr. Browne said that the suite, which cost $3,000 a

night, had a foyer, a conference room, a living room and a bedroom, and that Mr.

Strauss-Khan had checked in on Friday.

As she was in the foyer, “he came out of the bathroom, fully naked, and

attempted to sexually assault her,” Mr. Browne said, adding, “He grabs her,

according to her account, and pulls her into the bedroom and onto the bed.” He

locked the door to the suite, Mr. Browne said.

“She fights him off, and he then drags her down the hallway to the bathroom,

where he sexually assaults her a second time,” Mr. Browne added.

At some point during the assault, the woman broke free, Mr. Browne said, and

“she fled, reported it to other hotel personnel, who called 911.” He added,

“When the police arrived, he was not there.” Mr. Browne said Mr. Strauss-Kahn

appeared to have left in a hurry. In the room, investigators found his

cellphone, which he had left behind, and one law enforcement official said that

the investigation uncovered forensic evidence that would contain DNA.

Mr. Browne added, “We learned that he was on an Air France plane,” and the plane

was held at the gate, where Mr. Strauss-Kahn was taken into custody. Later

Saturday night, Mr. Browne said Mr. Strauss-Kahn was in a police holding cell.

Mr. Browne said the city’s Emergency Medical Service took the maid to Roosevelt

Hospital for what Mr. Browne described as treatment for “minor injuries.”

No matter the outcome of Saturday’s episode, it will most likely throw the

French political world into turmoil and the Socialist Party into an embarrassed

confusion.

Mr. Strauss-Kahn, a leading member of the party, has been considered the

front-runner for the next presidential election in France in May 2012. Opinion

polls have shown him to be the Socialists’ most popular candidate and running

well ahead of the incumbent, Nicolas Sarkozy, who leads the center-right party.

France has been waiting for Mr. Strauss-Kahn to decide whether to run for his

party’s nomination in a series of primaries, which would mean giving up his post

at the fund.

The view in France was that if Mr. Strauss-Kahn wanted to run, he would have to

make his intentions clear early this summer, and most politicians and analysts

have been predicting that he would not be able to resist the chance to run the

country.

Mr. Strauss-Kahn contested for the nomination five years ago, losing to Ségolène

Royal, who ultimately lost a second-round runoff to Mr. Sarkozy. Mr. Sarkozy

then arranged for Mr. Strauss-Kahn to get the I.M.F. job, partly to remove a

popular rival from France’s political landscape.

Mr. Strauss-Kahn was the French minister of economy under the Socialist prime

minister Lionel Jospin, from 1997 to 1999, and he has also been a professor of

economics at the Paris Institute of Political Studies.

In 1995, he was elected mayor of Sarcelles, a poor suburb of Paris.

The couple are known to enjoy the finer things in life, and Mr. Strauss-Kahn has

sometimes been attacked for being a “caviar leftist.”

Recently Mr. Strauss-Kahn and his wife were photographed entering an expensive

Porsche in Paris belonging to one of their friends. The image of a Socialist

with Porsche tastes was quickly picked up by the news media, especially the

newspapers that generally support Mr. Sarkozy.

William K. Rashbaum and Colin Moynihan contributed

reporting.

This article has been revised to reflect the

following correction:

Correction: May 15, 2011

An earlier version of this article misstated the year of Dominique

Strauss-Kahn's marriage to Anne Sinclair. It is 1991, not 1995.

I.M.F. Names New Leader, NYT, 15.5.2011,

http://www.nytimes.com/2011/05/16/nyregion/imf-names-replacement-as-chief-awaits-arraignment.html

Murray Handwerker, 89, Dies; Made Nathan’s More Famous

May 15, 2011

The New York Times

By REED ABELSON

Murray Handwerker, who transformed his father’s Brooklyn hot dog business,

Nathan’s Famous, into a celebrated national fast-food chain, died Saturday at

his home in Palm Beach Gardens, Fla. He was 89.

His son William confirmed his death.

Nathan’s Famous, at Surf and Stillwell Avenues in Coney Island, was opened by

Mr. Handwerker’s father and mother in 1916 and soon became an American legend,

its name virtually synonymous with hot dogs. In 1939, President Franklin D.

Roosevelt served Nathan’s hot dogs to the king and queen of England.

Mr. Handwerker spent his childhood at Nathan’s Famous. “I was raised behind the

counter of the Coney store,” he told The New York Times in 1986. “My playpen was

a 3-by-3 crate the hot dog rolls used to come in.”

His father, Nathan, a Jewish immigrant from Poland, and his mother, Ida, had

opened the stand with $300 borrowed from the entertainers Jimmy Durante and

Eddie Cantor, friends of his father’s who had yet to become stars. Nathan’s sold

all-beef hot dogs at a nickel, half of what its Coney Island competitor was

charging.

“We were the original fast-food operation,” Mr. Handwerker recalled in an oral

history, “It Happened in Brooklyn,” by Myrna Katz Frommer and Harvey Frommer,

rereleased in 2009 by SUNY Press. “We called it finger food; you didn’t need a

knife and fork. But it was always quality. My father insisted on that.”

It was Murray Handwerker who turned the family business from a famous hot dog

stand to a famous national chain, which went public in 1968. After returning

from World War II Army service, Mr. Handwerker joined Nathan’s Famous in 1946

and, his son William said, “had many ideas of expanding.”

In “It Happened in Brooklyn,” Mr. Handwerker recalled returning home with other

soldiers in the 1940s and wanting to add other foods to the Nathan’s Famous

menu.

“I realized the American soldier had been exposed to French food, his tastes had

become more sophisticated,” he said. Despite his father’s objections, Mr.

Handwerker successfully introduced shrimp and clams to Nathan’s menu. He later

added a delicatessen line.

There were other disagreements with his father, including one over whether to

let restaurant managers have days off during the summer. At the time, Murray

Handwerker said, the managers were working seven days a week, and he insisted

they be given a day off. The first week, they all got terrible sunburns and

could not come into work the next day. “My father gave me hell,” he recalled in

“It Happened in Brooklyn.”

Mr. Handwerker was born in Brooklyn on July 25, 1921, and graduated from New

York University in 1947 with a degree in French. “I loved languages,” he told

The Times in 1986, “but the only time I used French was during the old World’s

Fair when a lot of French people came to Coney Island for hot dogs.”

By the mid-1960s Nathan’s had three restaurants, and Mr. Handwerker, who became

president of the company in 1968, oversaw its expansion over the next decade by

adding dozens of company-owned restaurants and franchised units. He also

published a cookbook featuring Nathan’s Famous recipes. He became chairman in

1971.

By the early 1980s, Nathan’s was struggling. Its stock, which had reached $42 in

1971, had fallen to $1 by 1981. Mr. Handwerker was forced to close some of the

restaurants and abandon the idea of a franchise that would offer a more limited

menu. “Nathan’s forte is supposed to be variety,” he said at the time. The

company also ran into trouble with some of its franchisees.

The business survived, however, as Mr. Handwerker continued to emphasize its

main menu item. “The hot dog,” his son said, “was the mainstay.”

Mr. Handwerker ran the business until the family sold its stake to the Equicor

Group, a private investment company, in 1987. He then retired to Florida.

Mr. Handwerker’s wife, Dorothy, died in 2009. He is survived by his sons,

Steven, Kenneth and William; his brother, Sol; and several grandchildren.

At the company’s 70th-anniversary celebration near the Times Square Nathan’s in

1986, Mr. Handwerker was being given a hard time by Mayor Edward I. Koch, who

complained about the demise of the five-cent hot dog. Grabbing the microphone,

Mr. Handwerker explained to the crowd that the five-cent frankfurter went out

with the five-cent subway ride.

Murray Handwerker, 89, Dies; Made Nathan’s

More Famous, NYT, 15.5.2011,

http://www.nytimes.com/2011/05/16/nyregion/murray-handwerker-who-made-nathans-more-famous-dies-at-89.html

Obama

warns of worse crisis if no debt ceiling rise

WASHINGTON | Sun May 15, 2011

9:52am EDT

Reuters

By Jeff Mason

WASHINGTON (Reuters) - President Barack Obama warned Congress that failing to

raise the debt limit could lead to a worse financial crisis and economic

recession than 2008-09 if investors began doubting U.S. credit-worthiness.

In remarks recorded last week and broadcast by CBS News on Sunday, Obama

repeated his stance that Republicans should not link the debt ceiling decision

to spending cuts as part of deficit-reducing measures.

"If investors around the world thought that the full faith and credit of the

United States was not being backed up, if they thought that we might renege on

our IOUs, it could unravel the entire financial system," Obama told a CBS News

town-hall meeting.

"We could have a worse recession than we already had, a worse financial crisis

than we already had."

The White House and congressional Republicans are locked in a debate over the

deficit and the debt ceiling.

The Treasury Department is expected to hit its $14.3 trillion borrowing limit on

Monday, making it unable to access bond markets again.

Republican leaders, who have said they agree the limit must be raised, say they

will not approve a further increase in borrowing authority without steps to keep

debt under control.

A deal may not emerge for several months.

The Treasury Department says it can stave off default until August 2 by drawing

on other sources of money to pay its bills.

Obama said he was committed to deficit reduction but discouraged a link between

that and the debt limit.

"Let's not have the kind of linkage where we're even talking about not raising

the debt ceiling. That's going to get done," he said. "But let's get serious

about deficit reduction."

A report from the think tank Third Way to be released on Monday supports Obama's

warnings. It says the United States could plunge back into recession if inaction

in Washington forced a debt default, with some 640,000 U.S. jobs vanishing,

stocks falling and lending activity tightening.

Vice President Joe Biden is leading talks between the White House and lawmakers

over how to reduce massive U.S. budget deficits and raise the credit limit. He

told reporters on Thursday that progress was being made but it was too early to

be optimistic about a deal.

(Additional

reporting by Andy Sullivan; Editing by Peter Cooney)

Obama warns of worse crisis if no debt ceiling rise, R,

15.5.2011,

http://www.reuters.com/article/2011/05/15/us-obama-debt-idUSTRE74E1TN20110515

Factbox: Prison sentences in insider trading cases

NEW YORK

| Wed May 11, 2011

2:22pm EDT

Reuters

NEW YORK

(Reuters) - After a conviction on all counts, Raj Rajaratnam faces the next

step: sentencing.

The Galleon Group founder could face up to 25 years in prison when he is

sentenced in July, although prosecutors said on Wednesday that he could get

15-1/2 to 19-1/2 years in prison under federal sentencing guidelines.

Following is a list of punishments meted out to defendants in other high-profile

insider trading cases:

IVAN BOESKY

--Boesky, the famed Wall Street stock speculator of the 1980s, was sentenced to

three years in prison in 1987 after pleading guilty to a criminal charge related

to insider trading. Boesky, who faced a maximum penalty of five years,

cooperated with prosecutors in their probe of trading firms that resulted in

charges against more than a dozen people.

MARK KURLAND, ROBERT MOFFAT AND ALI HARIRI

--All three pleaded guilty in the sweeping Galleon probe. Kurland, a former

senior managing director at New Castle Funds LLC, was sentenced in May 2010 to

two years and three months in prison. Kurland admitted to trading on information

he got from Danielle Chiesi, also a former New Castle employee who became a

central figure in the Galleon investigation. Chiesi has pleaded guilty and is

awaiting sentencing.

Moffat, a former International Business Machines Corp executive, was sentenced

to six months in prison for tipping Chiesi about an impending IBM deal with

Advanced Micro Devices Inc. Hariri, a former executive at chipmaker Atheros

Communications Inc. received an 18-month sentence in November for tipping a

former Galleon employee.

SAM WAKSAL

--The founder of biotechnology company ImClone Systems Inc. was sentenced to

seven years in prison after pleading guilty to insider trading in 2002. The

scandal also ensnared Waksal's father as well as lifestyle entrepreneur Martha

Stewart, who was convicted of lying to federal agents about her sale of ImClone

stock. She served five months in prison.

JOSEPH NACCHIO

--Nacchio, the former CEO of Qwest Communications, was sentenced to six years in

prison, later reduced by two months, after he was convicted in a 2007 trial of

19 counts of insider trading in selling $52 million in Qwest stock. A judge also

ordered Nacchio to forfeit $44.6 million and pay a $19 million fine.

JOSEPH CONTORINIS

--Contorinis, a former hedge fund manager, received a 6-year sentence in

December for his role in providing tips on impending mergers, such as the 2006

buyout of the supermarket chain Albertsons Inc.

HAFIZ NASEEM

--A judge sentenced Naseem, a former Credit Suisse Group investment banker, to

10 years in prison after he was found guilty in February 2008 of participating

in a $7.5 million scheme to leak inside information about pending corporate

deals.

RANDI AND CHRISTOPHER COLLOTTA

--Randi Collotta, a former Morgan Stanley lawyer, received a sentence of 60 days

in prison on nights and weekends for passing along tips to her husband about

impending merger deals. Her husband, Christopher, got a sentence of 6 months'

home confinement.

(Reporting

by Carlyn Kolker, editing by Dave Zimmerman)

Factbox: Prison sentences in insider trading cases, R,

11.5.2011,

http://www.reuters.com/article/2011/05/11/us-galleon-rajaratnam-insidercases-idUSTRE74A6A120110511

Rajaratnam guilty on all insider trading counts

NEW YORK

| Wed May 11, 2011

1:29pm EDT

Reuters

By Grant McCool and Basil Katz

NEW YORK

(Reuters) - Hedge fund founder Raj Rajaratnam was found guilty on all 14 counts

in a sweeping insider trading verdict on Wednesday that vindicated the

government's aggressive use of phone taps to prosecute Wall Street figures.

Rajaratnam, founder of the Galleon Group and the central figure in the broadest

Wall Street insider trading probe in decades, will appeal the use of the secret

recordings, tactics historically deployed in organized crime and drug

trafficking cases, not white-collar probes.

One-time billionaire Rajaratnam, the richest Sri Lankan in the world, faces a

minimum of 15-1/2 years in prison after the verdict in Manhattan federal court

convicting him on all 14 counts of conspiracy and securities fraud. The jury's

decision affirmed the prosecution case that Rajaratnam ran a web of

highly-placed insiders from McKinsey & Co consultancy to Intel Corp to a former

Goldman Sachs Group Inc board member to leak valuable corporate secrets to him.

Rajaratnam, 53, showed little emotion during the two month-long trial and sat

expressionless between his lawyers as the verdict was read in a tense Manhattan

federal courtroom.

"It's an historic verdict. It's a dramatic verdict," said Bill Singer,

securities lawyer with Gusrae, Kaplan, Bruno & Nusbaum.

"It will likely set the stage for a dramatic change not only in the way that the

Wall Street insider-trader activities are investigated and prosecuted, but most

likely this will have a chilling effect on individuals and companies that

trade."

The case was the first Wall Street insider trading trial to draw such public

attention since the mid-1980s scandal involving speculator Ivan Boesky and junk

bond financier Michael Milken.

The jurors filed into the tense courtroom in mid-morning and the verdict was

read by the judge's deputy. The official read from the jury's completed verdict

form, saying "guilty" for each of the five counts of conspiracy and nine counts

of securities fraud. He then asked each individual juror whether that was their

verdict.

After the jury was dismissed, Rajaratnam was released until his July 29

sentencing. He is free under a $100 million bail package that will now include

an electronic monitoring device and house arrest in his Manhattan apartment.

His main lawyer, John Dowd, told dozens of reporters outside the courthouse that

his client would keep fighting.

"We're gonna take an appeal for this conviction," Dowd said. "We started out

with 37 stocks, we're down to 14 so the score I'd say is 23-14 in favor of the

defense. We'll see you in the 2nd circuit" a reference to the appeals court in

New York.

TWO

MONTH-LONG TRIAL

The trial lasted two months and the verdict was read on the 12th day of jury

deliberations in which jurors requested replays of several of the phone

recordings at the heart of the government's case.

Litigation experts said the phone taps strengthened insider trading charges,

which historically have been difficult to prove because they rely on

circumstantial evidence.

Defense lawyers had stuck consistently to their main theme that Rajaratnam's

trades were guided by a trove of research and public information, not secrets

leaked by highly-placed corporate insiders.

Most litigation experts said the prosecution had a strong case using FBI phone

taps and witness stand testimony of three former friends and associates of

Rajaratnam -- former McKinsey & Co partner Anil Kumar, former Intel treasury

group executive Rajiv Goel and former Galleon employee, Adam Smith.

All three pleaded guilty to criminal charges and agreed to cooperate with the

government in the hopes of receiving lighter sentences.

Rajaratnam is the only one out of 26 people charged in the broad Galleon case to

go on trial so far. Twenty-one pleaded guilty and one defendant is at large. A

second trial of three former securities traders, one of them a former Galleon

hedge fund employee, is scheduled to start on Monday with phone tap also key to

the prosecution evidence.

The case is USA v Raj Rajaratnam et al, U.S. District Court for the Southern

District of New York, No. 09-01184.

(Additional

reporting by Jonathan Stempel, Dan Levine, Scot Paltrow),

editing by Dave Zimmerman)

Rajaratnam guilty on all insider trading counts, R,

11.5.2011,

http://www.reuters.com/article/2011/05/11/us-galleon-rajaratnam-idUSTRE74A3XM20110511

China

pushes U.S. on debt ahead of high-level talks

BEIJING |

Fri May 6, 2011

5:28am EDT

Reuters

By Chris Buckley

BEIJING

(Reuters) - China, wielding its huge dollar holdings, on Friday pressed

Washington to tackle its huge fiscal deficit and said it would raise the issue

of discrimination against Chinese investors at high-level talks next week.

Senior Chinese officials also made clear that U.S. demands for Beijing to raise

sharply the value of the yuan currency and to end a crackdown on dissent -- both

irritants in ties between the world's two biggest economies -- would gain little

ground at next week's Strategic and Economic Dialogue in Washington.

"We are paying a lot of attention to this (the fiscal deficit)," Chinese Vice

Finance Minister Zhu Guangyao told reporters at a briefing about the talks.

The White House is in tense negotiations with Republican lawmakers over rival

proposals to tackle the budget deficit, expected to reach $1.4 trillion this

year and a serious worry for governments like China that buy heavily in U.S.

Treasury bonds and other dollar assets.

China's has the world's biggest foreign exchange reserves, with about two-thirds

estimated to be held in dollars, and any sign it was alarmed by policy

uncertainty could ripple through global markets.

"We hope that the United States in its fiscal clean-up will be able to adopt

effective measures based on President Obama's proposal," Zhu said, giving

unusually forthright backing to the Obama plan.

"For the present stage, we believe that the most crucial thing is that the U.S.

economy maintains a vigorous impetus toward recovery and that this developing

trend is maintained," Zhu said.

Zhu and Chinese Vice Foreign Minister Cui Tiankai, speaking to reporters ahead

of the start on Monday of the two-day talks, laid out Beijing's positions on

other economic and foreign policy disputes, stressing their desire for

cooperation.

That included the yuan exchange rate, which Washington has repeatedly said is

held too low, making Chinese exports unfairly cheap and deterring bigger Chinese

purchases of U.S. goods.

The two agree on the direction of yuan reform, but differ on the pace of

appreciation, said Zhu.

"On these specific issues, I frankly acknowledge that China and the United

States have different views. Therefore, we need to have discussion."

China loosened its currency from a nearly two-year peg to the dollar last June,

and this year has guided the yuan to record highs. It has appreciated about 5

percent since June.

Zhu said Vice-Premier Wang Qishan told U.S. Treasury Secretary Timothy Geithner

that yuan exchange rate reform was in China's interest.

Wang and Geithner will lead the economic side of the dialogue next week, while

U.S. Secretary of State Hillary Clinton and Chinese State Councilor Dai Bingguo,

who advises top leaders on foreign policy, will lead the strategic discussions.

CHINA'S

CONCERNS

Zhu said China had concerns of its own that would likely be aired in the

discussions.

Beijing complains that Washington, while pushing for greater access for U.S.

firms in the Chinese market, imposes unwarranted restrictions on Chinese

investment in the United States, often citing national security concerns.

"We hope that the United States will provide a healthy legal and institutional

setting for investment. In particular, we hope that the United States will not

discriminate against Chinese state-owned companies." Zhu said.

The Obama administration has said it will use the strategic dialogue to press

China about human rights -- a sensitive topic for Beijing, which fears potential

unrest inspired by uprisings across the Arab world and which has taken an

increasingly harsh line against dissidents in recent months.

China's response to questions about that on Friday suggested that it does not

want a feud over the issue to spread.

Vice Foreign Minister Cui said that at the summit between President Obama and

his Chinese counterpart Hu Jintao in January both sides had agreed to respect

the paths of development that each country chooses, and that discussion of human

rights would be "on a basis of equality and mutual respect."

"We hope that both sides will continue abiding by this spirit," Cui said.

"We hope that in observing the development of human rights in China, the outside

world will stick to the facts, or to use a popular Chinese phrase, that it will

adopt a sunnier disposition."

(Reporting

by Chris Buckley, Writing by Sui-Lee Wee; Editing by Ken Wills)

China pushes U.S. on debt ahead of high-level talks, R, 6.5.2011,

http://www.reuters.com/article/2011/05/06/us-china-usa-trade-idUSTRE7450D620110506

Special report: Does corporate America kowtow to China?

SHEBOYGAN, Wisc. | Wed Apr 27, 2011

9:32am EDT

By Nick Carey and James B. Kelleher

SHEBOYGAN, Wisc. (Reuters) - China's rise as a manufacturing power has benefited

American factory owners in at least one way.

The Middle Kingdom's insatiable appetite for second-hand machinery means that

small U.S. businesses can make a quick buck by selling old equipment there.

For some American manufacturers, however, the idea of shipping even used stuff

with no book value to their chief overseas rival is anathema.

Many of the machines at Bob Chesebro's factory in this Wisconsin city on the

shores of Lake Michigan do something seemingly mundane: they sew the toes of the

socks he makes closed. In China that is still often done by hand -- a

labor-intensive task that other developing countries will eventually do more

cheaply as Chinese wages rise.

Chesebro, chief executive and third-generation owner of Wigwam Mills Inc, one of

America's few remaining sock makers, refuses to surrender his edge. His

equipment ends its days as scrap metal in a dumpster behind his plant.

"We have taken the view that if we sell these machines we're just going to put

them in the hands of people who will compete against us," he said.

In several ways, Wigwam defies the conventional wisdom of today's global market.

It has managed to succeed making a relatively high-volume, low-cost commodity

product, employing hundreds of workers right here in the United States. It has

done so by boosting its productivity and developing niche products like hiking

and medical socks in-house.

Given the savage nature of the competition you might expect Chesebro to vent

mainly against Chinese-style capitalism. But like dozens of manufacturers and

others across America interviewed for this story, his anger isn't directed at

China, which he and others say is doing what it deems as necessary to boost its

own people's prosperity. Instead, their ire is aimed at the U.S. government and

American multinationals for not stepping up to the plate and defending long-term

U.S. interests.

"I don't blame the Chinese, they're just pursuing their national interest," said

Patrick Mulloy, a member of the Congressional U.S.-China Economic and Security

Review Commission. "I blame us for not realizing what's happening to us and for

doing nothing about it."

Prior to China's accession to the World Trade Organization almost a decade ago,

free trade proponents argued that the move would create American jobs and

eliminate the country's trade deficit. Neither prediction has proven accurate.

The U.S. trade shortfall with China hit a record high $273 billion last year and

government data shows some 40 percent of factories with more than 250 employees

closed down from 2001 to 2010.

While it can't all be laid at China's door, it is not a coincidence that after

decades of more gradual decline, U.S. manufacturing took a nose dive after

China's entry into the WTO.

Cheap labor is one huge advantage for China, of course. But numerous academics,

former trade officials and labor union officials say predatory trade practices,

subsidized exports and other controversial economic policies also make Chinese

companies tough to compete against.

And they warn that unless the U.S. works out a way to bolster and promote the

sector, future prosperity and America's superpower status will eventually be at

risk. This is only underlined by the U.S. economy's fragile state, with the

jobless rate at 8.8 percent, growth tepid, and a huge government budget deficit

and debt burden.

Even China's rising production costs may present an increasing threat, they

argue. It means that China will be less able to rely on being the cheap maker of

textiles, toys, furniture and plastics to create jobs -- some of that production

is increasingly going to go to places like Bangladesh and Vietnam.

Instead, Beijing is increasingly focused on moving up the chain to higher valued

technology-based goods -- which puts it in direct competition with the remaining

power base of the U.S. manufacturing sector. And the technology-transfer terms

that many big American companies are agreeing to when they do deals in China,

and the research centers they are opening up there, means they could in some

cases be signing their own death warrants.

Peter Navarro, a professor of economics and public policy at the University of

California, who correctly predicted the U.S. housing bust, predicts that the

crash America faces if it neglects manufacturing for too long is "going to be

far worse."

"Over time the problems Americans are seeing with their economy are only going

to get worse as China rises," he said. "We're heading for a collision and the

longer that collision is delayed the harder it's going to be."

CHINA INC

VERSUS JAPAN INC

Still, free trade proponents have warned repeatedly that any protectionist

measures would result in a costly trade war that neither side can win. They also

argue that the United States has only itself to blame for its economic problems.

In an interview at the Hilton Chicago during Chinese President Hu Jintao's visit

to the city earlier this year, Doug Oberhelman, CEO of heavy equipment maker

Caterpillar Inc, which has 11 Caterpillar plants and R&D centers and some 15

percent of its workforce in China, acknowledged there would always be

"frictions" between the two countries.

"But the fact is ... we need each other desperately," he said. "We need peace."

Local manufacturers, though, say the first shots have been fired, and they

question whether the g multinationals are wrongly pursuing a policy of

appeasement.

They complain that Chinese companies benefit from a raft of subsidies -- from

what they see as an undervalued yuan currency, to artificially cheap or even

free land in some cases, low-interest loans and even subsidized energy bills --

and the U.S. government and major companies say or do little in response.

"We're in the middle of an economic war with China," said Milton Magnus,

president of Leeds, Alabama-based M&B Hangers, America's last maker of metal

coat hangers, who also destroys his old machines, which are designed and built

in-house. "The Chinese want what we have and we're just sitting back and giving

it to them."

But it isn't just a war over cheaper products like coat hangers and socks.

Mounting evidence also suggests China is appropriating proprietary technology

from Western firms and then using it to compete directly in ever more advanced

fields.

The Chinese government has also been accused by foreign businessmen of changing

the rules at home to favor local manufacturers for government contracts over

foreign competitors.

Small manufacturers say they have increased productivity to compete. Wigwam's

Chesebro says he has not replaced staff who retired or moved on over the years,

reducing headcount to about 260 from 500 over the past two decades and his

machines are now far more efficient. But small manufacturers insist labor costs

are not relevant when in many cases heavily-subsidized goods from China have

been sold in America for below what the local manufacturers pay for raw

materials.

"Labor costs have nothing to do with it," said Bill Upton, president of Pelham,

Alabama-based Vulcan Threaded Products Inc. Vulcan makes steel bars and rods for

everything from air conditioning units to sprinkler systems, is the last

American firm of its kind, and won a trade case against Chinese competitors in

2008.

"We have a lean, efficient operation and we can compete against anyone in the

world on a level playing field. But there's no way we can compete against

finished goods that cost less than the raw materials," Upton said.

Even when American manufacturers do successfully pursue cases alleging unfair

competition they may not come out on top. A case can cost around $1 million in

legal fees, and often takes more than a year plus a lot of management time that

could be spent more productively. And they claim even after penalties have been

imposed, Chinese competitors often merely circumvent customs duties and other

barriers by trans-shipping goods through third countries.

Still, free trade proponents point to the example of "Japan Inc" in the 1980s --

when there were fears that Japan's rise as a manufacturer threatened future

American prosperity -- as evidence that concerns over foreign competition can be

overblown.

Yet a key difference between "Japan Inc" in the 1980s and "China Inc" is that

Japan discouraged foreign investment, whereas China has embraced it.

Back then, some key U.S. multinationals made a great deal of noise in public,

and in the U.S. Congress, about unfair Japanese trading practices. Their

interests were aligned with the smaller domestic manufacturers.

But today, multinationals profit hugely from China and have less incentive to

rock the boat. Only last week, Yum Brands Inc, the owner of the KFC, Pizza Hut

and Taco Bell fast food restaurants, reported its operating profit was 75

percent greater in China than in the U.S. in the first quarter.

"The big difference is that no one made any money off Japan Inc," said Diane

Swonk, chief economist at Mesirow Financial. "But some people are making a lot

of money off China Inc."

SILENCE

OF THE CEOS

Big American companies with investments in China are afraid to criticize Beijing

because of the controls it has over just about any access to the Chinese market.

They fear too strident a stance could mean they will lose contracts or even be

ostracized as Google Inc was after a dispute with China over censorship and

hacking.

"The Chinese government controls all the levers of the economy, from import and

export licenses on up," said Victor Shih, an assistant professor of politics at

Northwestern University. "There are so many ways for the Chinese government to

retaliate it is no surprise businesses are so reluctant to criticize it."

But multinationals and their CEOs have a great deal of influence on debate in

Washington and more widely in the country. They have often lobbied aggressively

against any measures they deem protectionist, so their relative silence is seen

by many smaller manufacturers and others as weakening the U.S. in its trade

relationship with China.

"The issue today is that the firms hurting the most are not as politically

connected as the firms that are benefiting the most," Mesirow's Swonk said.

There are no easy answers to America's predicament, for either the

administration of U.S. President Barack Obama or the businesses that have bet

heavily on China.

The WTO, for instance, ruled on March 11 that the United States could not levy

extra duties on Chinese goods that the American government had described as

subsidized and unfairly priced.

But such difficulties are not a reason for multinationals to roll over easily in

the face of Chinese demands, say critics of their behavior.

Critics and academics warn that multinationals trading technology for market

access have frequently found themselves a few years later losing out in export

markets to Chinese competitors who were formerly their partners.

"The companies that hand over proprietary technology do so in the hope that

they'll be the ones to get the better end of the bargain," said Eswar Prasad, a

trade policy professor at Cornell University and a senior fellow at the

Brookings Institution. "But so far the Chinese have come out ahead in most

cases. Hope springs eternal, but it's a very dangerous bargain to make."

The handing over of proprietary technology also raises questions about the

impact on U.S. national security, especially in trying to keep the Chinese

military from being belligerent toward American allies in the Asia-Pacific

region.

In a recent RAND Corp report "Ready for Takeoff: China's Advancing Aerospace

Industry," the authors stated there is "no question... that foreign involvement

in China's aviation manufacturing industry is contributing to the development of

China's military aerospace capabilities."

This contribution, the report later states is "increasing China's ability and

possibly its propensity to use force in ways that negatively affect U.S.

interests and would increase the costs of resisting attempts to use such force."

Another risk to not talking more openly and directly about America's China

problem is that it leaves the field open to extreme rhetoric and populist

politics.

A solid majority of Americans in opinion polls say they view China as an

economic threat and if America's dysfunctional relationship with the country is

not addressed more openly, some fear it could prompt a marked protectionist

swing in American politics.

"It would be better to deal with issues like the undervalued renminbi more

directly and openly," said Menzie Chinn, a professor of public affairs and

economics at the University of Wisconsin. "I am concerned that if these problems

are allowed to fester for too long, voters will force Congress into an open

trade war. And that would be bad for everybody."

For instance, real estate tycoon Donald Trump has been playing the China card as

he considers whether to seek nomination as the 2012 Republican presidential

candidate, and his support in polls has been rising.

In recent months the garrulous star of NBC's reality show "The Apprentice" has

referred to the Chinese in various national television interviews as "enemies"

and "abusers" and says that he "would love a trade war with China." He told

Reuters he would put a 25 percent tax on all goods from China.

"Saying China is the enemy may sound like an extreme opinion, but it can become

a mainstream opinion if uttered in public often enough," said Steven Schier, a

politics professor at Carleton College in Minnesota.

GREAT

EXPECTATIONS

It is all a far cry from where things were back in 2000. The debate in the U.S.

Congress on normalizing trade relations with China -- a step that would help

China join the WTO -- saw lawmakers, lobby groups and businesses line up to

stress that increased trade with China would be a win-win situation for

Americans.

"Opening China's markets to U.S. products and services... is the biggest single

step we can take to reduce America's growing trade deficit with China," said

Robert Kapp, then president of the U.S.-China Business Council and now a

consultant for companies seeking to do business with China, at the time. "We're

not talking about a 'gift' for China ... we're talking about bringing home the

bacon."

The bacon may have arrived in the form of the profits American companies have

been able to make in China but it certainly hasn't for the American workforce.

According to the U.S. Bureau of Labor Statistics (BLS), the number of U.S.

manufacturing jobs fell by a third to 8.1 million from 12.2 million during the

past decade -- more jobs lost than in the previous two decades combined. BLS

data also show that from the first quarter of 2001 to the first quarter of 2010,

a full 39 percent of U.S. manufacturing plants with more than 250 employees

closed.

Chinese membership of the WTO has been a disaster for local manufacturers, says

Charles Blum, president of trade consulting firm International Advisory Services

Group Ltd and an official at the Office of the U.S. Trade Representative under

President Ronald Reagan.

"It doesn't really matter how small your manufacturing operation is, the sector

is systematically being hollowed out," he said. "We figured the global market

would take care of itself and that as a result the United States would turn out

to be the winner. But it hasn't quite worked out that way."

Small businesses have traditionally been the backbone of America's economy,

providing at least half the jobs, hiring more quickly when a recovery begins

after a recession, and accounting for many more patents per employee than large

firms.

Henry "Hank" Nothhaft, a serial entrepreneur and currently CEO of Tessera

Technologies Inc, which specializes in miniaturization technologies for

electronic devices, says most innovation occurs on the factory floor, so he

worries that American innovation will slide with the erosion of the country's

manufacturing base.

"If the manufacturing ecosystem goes, then innovation and engineering go with

it," he said. "This means that future innovation is going to occur over in China

and not here in the United States."

CHINA

CHANGES COURSE

Meanwhile, the Chinese, if anything, have been getting more demanding.

Some business leaders and academics have noticed that the Chinese government's

industrial strategy became more aggressive from 2006 onwards.

New rules "seek to appropriate technology from foreign multinationals" in key

industries like avionics, power generation and high-speed rail, according to a

December 2010 article for the Harvard Business Review called "China vs the

World," by academics Thomas Hout and Pankaj Ghemawat.

"These rules limit investment by foreign companies as well as their access to

China's markets, stipulate a high degree of local content in equipment produced

in the country, and force the transfer of proprietary technologies from foreign

companies to their joint ventures with China's state-owned enterprises. The new

regulations are complex and ever changing."

Distracted by the financial crisis in 2008 and 2009, governments and

multinationals have only really become aware of this shift in Chinese policy

over the past year or so, Hout, a former partner at the Boston Consulting Group,

said in a telephone interview.

"The Chinese have managed to time this beautifully," he said. "Even people like

myself who have really been paying attention were caught out and it's only been

clear for the past year or so what's going on."

A growing number of Western firms who thought they were getting a good deal by

trading technology for access to China's market have also belatedly found out

that they were mistaken.

In 2004 and 2005, China set up partnerships with Kawasaki Heavy Industries,

France's Alstom, Germany's Siemens and Canada's Bombardier to build high-speed

trains for China.

At first Kawasaki exported finished trains, then the group of foreign companies

subcontracted the production of basic components to Chinese train manufacturer

Sifang and then assembled them in China.

Then in 2009 the government began requiring that prospective bidders for Chinese

high-speed rail projects form minority joint ventures with state-run

manufacturers and hand over their latest designs and that 70 percent of the

equipment had to be produced locally.

While aware of the flow of technology to the Chinese side, Kawasaki saw its

joint venture as an opportunity to gain access to China, which was rapidly

expanding its high-speed rail network. China has been by a long way the world's

largest market for new rail lines in recent years.

Now, Chinese companies build faster, cheaper trains than their former mentors

make and compete against them in global markets. Kawasaki has complained that

trains built by Sifang are based on its own technology. Similarly, Siemens was

elbowed aside by its erstwhile partner, the China National Railway Signal and

Communication Corp, when it came to constructing the high-profile

Beijing-Shanghai high-speed link.

Other times, technology is pilfered. Glen Tellock, CEO of crane maker Manitowoc,

says that while American companies find intellectual property theft a major

problem, "the answer from the Chinese is always 'what's the harm?'"

In "China vs the World," Hout and Ghemawat write that Chinese firms have "come

to dominate the global silicon-wafer-panel business, aided by low-cost financing

and inexpensive land sales."

Local governments provide companies with land cheaply or even free. Chinese

firms are provided land grants in excess of what they need, so they build

apartment buildings on the land, which then pays for research costs and offsets

start-up losses. State-owned banks provide Chinese firms with loans at below

prevailing interest rates and sometimes local governments pay the interest on

their behalf.

Hout and Ghemawat also examine the solar panel industry, an area that the Obama

administration has championed as a way to create "green" jobs for the future.

But Chinese competition pushed solar panel prices down 50 percent in 2010 from

2009, hurting Western manufacturers. China now exports most of its solar panels

and Chinese firms control half of the German market and a third of the U.S.

market.

China's Suntech Power Holdings Co Ltd is the world's largest solar panel maker.

while Yingli Green Energy and JA Solar Holdings Co Ltd are also major

competitors in the industry.

Hout says China is now seeking to catch up with Western firms in the aviation

and power generation industries.

"NOT

NAIVE OR STUPID"

In January, General Electric Co. announced a joint venture with Aviation

Industry Corporation of China (AVIC) to develop electronics for the C919, a

single-aisle commercial jetliner. That raised concerns that GE runs the risk of

creating Chinese competitors through the proprietary technology it will provide

as part of that joint venture.

"Multinationals are a little too optimistic about how much they can control the

technology transfer process," the Brookings Institution's Prasad said. "The

Chinese are very keen to build up their aviation industry and they've made it

very clear what they want from GE to make that happen."

In a January 19 interview with Reuters, CEO Jeff Immelt, who also heads Obama's

jobs council, insisted the company was "not naive or stupid" about doing

business in China. "We really do think a lot about it," he said. "There is a

multitude of ways to succeed in China. It's going to be the biggest economy in

the world. The only question is when."

This tone differed markedly from comments Immelt made in July last year at a

private dinner in Rome -- remarks that caused him no little trouble. "I really

worry about China," he told a group of executives, as reported by the Financial

Times. "I am not sure that in the end they want any of us to win, or any of us

to be successful."

GE initially contested the FT report then changed tack when a spokesman said

Immelt's remarks "do not represent our views."

Behind the scenes there does appear to be mounting worry among U.S.

multinationals over Chinese policy. A report commissioned by the U.S. Chamber of

Commerce ("China's Drive for 'Indigenous Innovation': A Web of Industrial

Policies") examines a Chinese plan for science and technology from 2006 to 2020

that is "considered by many international technology companies to be a blueprint

for technology theft on a scale the world has never seen before."

"Indigenous innovation" refers to a Chinese government policy designed, among

other things, to favor Chinese firms for state contracts and require technology

transfer if Western companies want to participate.

"With these indigenous innovation industrial policies, it is very clear that

China has switched from defense to offense," the chamber report said.

During his state visit here in January, China's Hu said the country would ease

up on the program. The U.S. government has since publicly stated China needs to

make good on that promise, though so far it is not clear that anything has yet

changed.

What has also not changed is how keen American multinationals are to get into

China, even if there are long-term concerns over the conditions attached to

doing business there. And their willingness to keep silent about things they do

not like.

Ralph Gomory, a research professor at New York University's Stern School of

Business who worked for IBM for three decades, said the problem for U.S.

multinationals is that the focus on short-term profit easily outweighs long-term

worries.

"The Chinese are exploiting our weaknesses," he said. "They see the strength of

America as the strength of our corporations and that the driver is profit. So

they have merely said bring your plant over here and we'll make sure you make a

big profit."

It means that shareholders of the American multinationals like Caterpillar may

be doing well in the short term -- after all its share price has doubled in less

than a year largely on demand from China and other emerging markets. However,

middle class Americans have not seen the benefits in terms of jobs created or

wages increased.

When asked about GE's recently announced Chinese avionics joint venture and how

he would look at it if he held GE shares, the Brookings Institution's Prasad

said, "If I had GE shares in my 401(k) that I intended to hold for the next 20

years, I would be very worried," he said. "But if I was just holding them for

short-term gain I wouldn't be concerned. And I suspect that's also how people

inside GE look at it."

CHINESE

EXCEPTIONALISM

For their part, the Chinese tend to view technology transfer as being fair trade

for access to its growing manufacturing base and its potential as a consumer

market of 1.3 billion people.

"The Chinese response is typically that multinationals have come to China

because it has a huge market," Northwestern's Shih said. "The Chinese say that

in doing so 'you have implicitly signed up for technology transfer as the price

of entry to that market.'"

Criticism of subsidies also tends to fall flat as the Chinese point to subsidies

for key industries and the farming sector in Europe and the U.S. as proof that

they are not alone in supporting their own interests.

Rejection of Chinese bids for a number of American companies on national

security grounds, including California oil company Unocal, have also allowed

Beijing to allege that Washington has protectionist policies. (For a special

report on a U.S.-China M&A Cold War, click here: link.reuters.com/tub98r )

Certainly there is a sense that after many years of humiliation at the hands of

foreign nations -- in particular in the 19th century when China was forced, in

the words of the late British economist Angus Maddison, to cede a "welter of

colonial enclaves" -- that the Chinese are merely returning to their place as a

top power.

Just as many in the United States believe in "American exceptionalism," or the

idea that the country is inherently superior to the rest of the world, the

Chinese see a return to the top as their destiny.

"The Chinese feel they are returning to the level they were at 500 years ago and

that it's where they belong," said Eamonn Fingleton, a writer who has been

following China since the 1980s. "China sees no reason why it should not be the

world's number one power."

And there are those in the United States who say that rather than fear

competition from China, America should embrace and welcome it because the

country's rise has been accompanied by cheap consumer goods that have kept a lid

on inflation.

"The Chinese are going to move up the supply chain but they are not a threat to

us," said Dan Griswold, who specializes in trade at the Cato Institute, a

conservative think tank. "China merely wants to regain its rightful place among

the leading economies of the world."

FEW EASY

PATHS

But there are a growing number of groups that seek to address what they say is

America's China problem, and they are bringing together manufacturers,

agricultural groups, labor unions and even the occasional local chamber of

commerce.

"We believe in free but fair trade," said Tony Paglia, vice president for

government affairs at the Youngstown/Warren Regional Chamber of Commerce in

northeastern Ohio, of the chamber's backing for proposed legislation that would

impose duties on goods from countries that manipulated their currencies. "All we

want is a level playing field for our members."

As well as handing over technology, multinationals like GE and Caterpillar have

increasingly moved research and development to China, and experts like Hout

worry that will cause America to lose its innovative edge.

"I'm afraid that they've managed to lure us into a bit of a trap," Hout said.

"The Chinese are merely using a much older playbook and are holding our

multinationals hostage."

Although American spending on R&D ($402 billion in 2010) is quadruple China's

($103 billion), Hout and Ghemawat estimate that at current growth levels China

will catch up with U.S. spending by 2020. Factoring in what they estimate could

be a 40 percent undervaluation for the yuan, they estimate that spending parity

will come by 2016.

The real problem for America is that it has few easy alternatives when it comes

to solving its Chinese puzzle and leveling that field.

Pressuring the Chinese government to allow the yuan to revalue seems a

straightforward solution, for example, and is one that U.S. administrations have

been suggesting for some time. Economists say a substantial revaluation would

make a sizable dent in the U.S. trade and current account deficits.

But there would be a downside as well as positive consequences for Corporate

America.

The large number of U.S. multinationals producing goods in China for export

means that any significant appreciation would hurt their profits, said Sunil

Chopra, a professor at Northwestern University's Kellogg School of Management.

One politically sensitive consequence of an appreciation of the yuan could also

come in the form of higher prices for consumers at retail stores, which would

hurt poorer people hardest. "We get a major rise in import prices from China,

who does it hurt the most?" Mesirow's Swonk asked. "People who shop at Walmart

and Target."

Hout said that although the Obama administration has been more vocal about

problem issues with China than his predecessor George W. Bush, America needs to

take far bolder action.

"The United States is so wedded to the multinational processes of the WTO, which

take forever and provide only rifle shot results," he said. "We've got all this

stuff fleeing the United States and we've been very inactive when it comes to

playing hardball."

"The obvious reaction would be to rely on reciprocity," he added. "If the

Chinese insist that American firms have to form joint ventures in China and have

to adhere to local content requirements, then the U.S. government should enact

requirements for Chinese firms wishing to ship goods here that they must do

likewise. But we've seen nothing from the U.S. government."

GETTING

TOUGH

Others recommend getting tougher with China in the same way President Reagan got

tough with Japan at times, by being willing to impose more customs duties or

file more cases through bodies like the WTO.

Reagan, with the backing of his Commerce Secretary Malcolm Baldrige and a number

of CEOs angry over Japanese trade policy, was unafraid to impose duties on

Japanese goods. Reagan also brokered a semiconductor trade agreement with Japan

that prevented the dumping of Japanese semiconductors on the U.S. market.

"They (Reagan and Baldrige) were the most activist leaders for a long time in

defending U.S. manufacturing and took action necessary to do so," said Gil

Kaplan, an international trade lawyer who worked in the Reagan administration.

"They realized that we need a manufacturing sector in the United States."

Kaplan said that although proponents of free trade fear a trade war with China

would be inevitable if the U.S. government took a tougher line on unfair

subsidies, "we need to demonstrate that we are not afraid to take action."

"We do have to act now," he said. "At some point in time we're going to reach a

tipping point where we won't be able to come back. In some industries so much of

the supply chain has gone that it's going to be difficult to come back."

Kaplan and others say the government's actions do not necessarily have to be

limited to taking action against the Chinese, but could take the form of greater

support for American manufacturers.

A common practice in developed nations, for instance, is to have a Value Added

Tax that provides manufacturers with tax rebates as an added incentive to export

goods.

"We don't just have to focus on the negative," said Tessera's Nothhaft. "We can

find ways to support our own companies and make the playing field a little more

level."

For many local manufacturers, the lack of a real public debate is discouraging

to say the least. They feel disenfranchised, outgunned and outmaneuvered by the

influential U.S. multinationals who argue for more free trade while small

manufacturers want fair trade as well.

"The politicians in Washington don't represent you and me, they represent the

special interests who pay their bills," said Richard Gill, president of Polyfab

Corp, a plastic molding company in Sheboygan County, Wisconsin. "Our decline is

not inevitable. We can still turn this around. But things are going to get a lot

worse if we don't do the right things to stop it."

Carleton College's Schier said "increased middle-class radicalism" shown by the

power of the conservative Tea Party movement will likely be followed by

increased radicalism in general as more voters are hurt by the decline of

manufacturing and the lack of jobs more than two years after the height of the

financial crisis.

"America's political elite would rather not give the debate much oxygen because

they haven't come up with any real solutions," Schier said. "But the majority of

the public has a sense there's something very wrong with our relations with

China."

"It's a prescription for chronic instability," he said. "You can't build a

long-term working majority in a situation like this. Voters are going to zig and

zag and we'll likely see backlash after backlash."

(Additional reporting by Terril Jones in Beijing; Editing by Jim Impoco, Martin

Howell and Claudia Parsons)

Special report: Does corporate America kowtow to China?,

R, 27.4.2011,

http://www.reuters.com/article/2011/04/27/us-special-report-china-idUSTRE73Q10X20110427

Obama sees no magic bullet to push down gas prices

WASHINGTON | Sat Apr 23, 2011

6:10am EDT

Reuters

By Steve Holland

WASHINGTON (Reuters) - Barack Obama told Americans on Saturday there is no

"magic bullet" to bring down high gasoline prices and said he wants to end what

he called $4 billion in taxpayer subsidies to oil and gas companies.

Obama is feeling the heat from gasoline prices that are about $4 a gallon and

may surge higher. A New York Times-CBS News poll found that 70 percent of

Americans believe the country is on the wrong track and analysts believe gas

prices are a main reason.

The president devoted his weekly radio and Internet address to outlining his

views on the U.S. energy predicament, saying clean energy is ultimately the way

forward for a country long addicted to gas-guzzling vehicles.

"Now, whenever gas prices shoot up, like clockwork, you see politicians racing

to the cameras, waving three-point plans for $2 gas. You see people trying to

grab headlines or score a few points. The truth is, there's no silver bullet

that can bring down gas prices right away," he said.

Obama, in the early stages of his 2012 re-election campaign, has been seeing

steady improvement in the U.S. economy. But rising gasoline prices are forcing

Americans to pay more out of their income, which some fear could harm the

fragile economic recovery.

Obama said it is time to eliminate what he called $4 billion in annual "taxpayer

subsidies" to oil and gas companies.

"That's $4 billion of your money going to these companies when they're making

record profits and you're paying near record prices at the pump. It has to

stop," he said.

The Obama administration on Thursday unveiled a working group of federal

agencies to probe potential fraud in the energy markets that affects pump

prices, including actions by speculators.

RENEWABLE

ENERGY

Obama accused Republicans of seeking to cut 70 percent in government spending to

encourage development of clean energy projects.

"Instead of subsidizing yesterday's energy sources, we need to invest in

tomorrow's. We need to invest in clean, renewable energy," he said.

"Yes, we have to get rid of wasteful spending -- and make no mistake, we're

going through every line of the budget scouring for savings. But we can do that

without sacrificing our future," he added.

Senate Republican leader Mitch McConnell said in response to the president that

the Obama administration over the past two years has "declared what can only be

described as a war on American energy."

"It's canceled dozens of drilling leases, imposed a moratorium on drilling off

the Gulf Coast and increased permit fees. It's done just about everything it can

to keep our own energy sector from growing," McConnell said.

McConnell said more must be done to increase domestic oil production.

The comments by Obama and McConnell came three days after the anniversary of the

giant BP Plc oil spill off the coast of Louisiana that caused economic and

environmental harm to the U.S. Gulf Coast.

(Editing by

Will Dunham)

Obama sees no magic bullet to push down gas prices, R,

23.4.2011,

http://www.reuters.com/article/2011/04/23/us-obama-energy-idUSTRE73M10820110423

FACTBOX-Key points of friction in U.S.-China trade

Thu May

5, 2011

3:42pm EDT

Reuters

May 5

(Reuters) - Senior U.S. and Chinese officials will grapple with the vast and

sometimes contentious relationship between the world's two biggest economies in

two days of talks in Washington on Monday and Tuesday.

Here is an explanation of the issues that may be discussed at the latest annual

Strategic and Economic Dialogue.

U.S.

TRADE DEFICIT, CHINA'S SURPLUS

A key cause of trade friction between Beijing and Washington is the U.S. trade

deficit with China. Despite a pledge by both countries to work together on

overcoming global imbalances, the U.S. trade deficit with China in 2010 rose to

$273.1 billion, a 20.4 percent increase from the shortfall in 2009. That

surpassed the record of $268 billion set in 2008, illustrating how heavily China

still relies on exports to the United States to fuel economic growth. China's

own figures showed its overall trade surplus narrowed in 2010 for the second

straight year. The 2010 surplus was $183.1 billion, down from $196.1 billion in

2009 and nearly $300 billion in 2008.

CURRENCY

China's currency policies have been a major irritant in ties for several years

and a focus of U.S. congressional anger at China since at least 2005. Contention

over the yuan exchange rate has cooled a bit this year, but remains strong. Many

U.S. lawmakers believe the yuan is undervalued by 15 percent to 40 percent,

giving Chinese companies an unfair price advantage in international trade.

China loosened its currency from a nearly two-year peg to the dollar in June,

and this year the People's Bank of China has guided the yuan to record highs. It

has now appreciated about 5 percent since June 2010.

Policymakers in Beijing have made it clear they will deploy the currency as a

weapon to fight inflation, which hit a 32-month high of 5.4 percent in March.

With prices moving up much more rapidly in China than the United States, the

yuan's real exchange rate has risen about 10 percent since last June. U.S.

Treasury Secretary Timothy Geithner said on May 3 that China would be better off

allowing for a faster nominal appreciation that would help temper inflation.

The U.S. Treasury was scheduled to issue a semi-annual report on April 15 on the

currency practices of U.S. trade partners that, in theory, could have labeled

China a foreign exchange manipulator. That report has been delayed indefinitely

and it is likely the Obama administration will opt for continued

behind-the-scenes persuasion rather than roiling the diplomatic waters by

calling Beijing a manipulator looking for a trade edge.

The Obama administration faces continued calls from Congress to do more to

pressure China. The U.S. House of Representatives approved a bill last September

pushing the Commerce Department to treat currency undervaluation as a subsidy

under U.S. trade law. That would allow U.S companies, on a case-by-case basis,

to ask for steeper countervailing duties against Chinese imports than they

currently can. The bill died when the Senate did not hold a vote before its term

expired at year end.

After a trip to China in late April, however, Senator Charles Schumer, a

prominent Democrat from New York, said he was "more convinced than ever" of the

need to pass legislation to force China to raise the value of the yuan. However,

Republican leaders in the control of the House have said they have other

priorities.

U.S. DEBT

LEVELS

China has the world's biggest foreign exchange reserves. They rose by nearly

$200 billion in the first quarter to $3.05 trillion, with about two-thirds

estimated to be invested in dollars.

Beijing has a big interest in protecting the value of those dollar-denominated

assets and has repeatedly nudged Washington to give public assurances about

government debt levels and the strength of the dollar.

After ratings agency Standard & Poor's slapped a negative outlook on the United

States' top-notch AAA credit rating in April, China urged Washington to protect

investors in its debt. But China has little choice but to keep its

dollar-denominated debt for now, and that deters the government from voicing any

worries about U.S. fiscal policy more loudly.

China has repeatedly warned that loose U.S. monetary policy risks undercutting

the dollar, but it has continued to accumulate dollar assets. It bought about

$260 billion of U.S. Treasury securities last year, according to U.S. data. With

the Chinese government determined to limit yuan strength, it must buy a large

amount of the dollars streaming into the country from its trade surplus, and it

recycles those into U.S. investments.

The state of talks in Washington over cutting the U.S. budget deficit, on course

to hit $1.4 trillion this year, will no doubt be a subject of discussion, as

will the Obama administration's related effort to convince lawmakers to raise

the $14.294 trillion limit on the U.S. government's debt.

Geithner has said China has confidence Congress would ultimately vote to raise

the debt ceiling. If it fails to, it would ultimately lead to a first-ever U.S.

debt default.

PIRACY

AND COUNTERFEITING

China has long faced American companies' ire about widespread unauthorized

copying of software, music, films and other products -- from luxury goods to

industrial machinery. The International Intellectual Property Alliance, which

represents U.S. copyright industry groups, has estimated U.S. trade losses in

China due to piracy at $3.5 billion in 2009. Meanwhile, U.S. customs officials

say 80 percent of the fake tennis shoes, clothing, luxury bags and other goods

they seize each year at the border come from China.

China says it is making progress against intellectual property piracy and

launched many enforcement campaigns to stamp out bootlegged books, music, DVDs

and software. Still, all are still openly available in Chinese shops and street

stalls. China remains on the U.S. "priority watch list" of countries deemed to

have serious copyright and trademark theft.

Microsoft (MSFT.O: Quote, Profile, Research, Stock Buzz) and other members of

the Business Software Alliance in the United States complain nearly 80 percent

of the software installed on personal computers in China is pirated. They have

called for a "results-based" deal to boost U.S. software sales and exports to

China by 50 percent in two years. China has said it is making progress in its

campaign to ensure government offices do not use pirated software. Two-fifths of

central government offices were using legal software and another two fifths were

buying it, an official from China's National Copyright Administration said.

INDIGENOUS INNOVATION, STATE-OWNED ENTERPRISES

Big U.S. companies like General Electric (GE.N: Quote, Profile, Research, Stock

Buzz) are worried that China's industry-supporting "indigenous innovation"

policies could make it more difficult for them to compete in China. The

"indigenous innovation" regulations are intended to promote innovation within

China and reduce its dependence on foreign technology and companies.

U.S. industry fears China is using discriminatory policies in areas from

government procurement to technical standards and tax policy to promote its

state-owned enterprises at the expense of foreign firms.

U.S. companies are also worried that under indigenous innovation, they may be

forced to transfer development and ownership of intellectual property to China

to participate in the country's huge government procurement market.

President Hu Jintao and other Chinese leaders have indicated goods produced by

Chinese affiliates of U.S. and other foreign firms would be considered

indigenous innovation products. But the Obama administration and U.S. businesses