|

History

>

2014 > USA > Economy > Poverty (I)

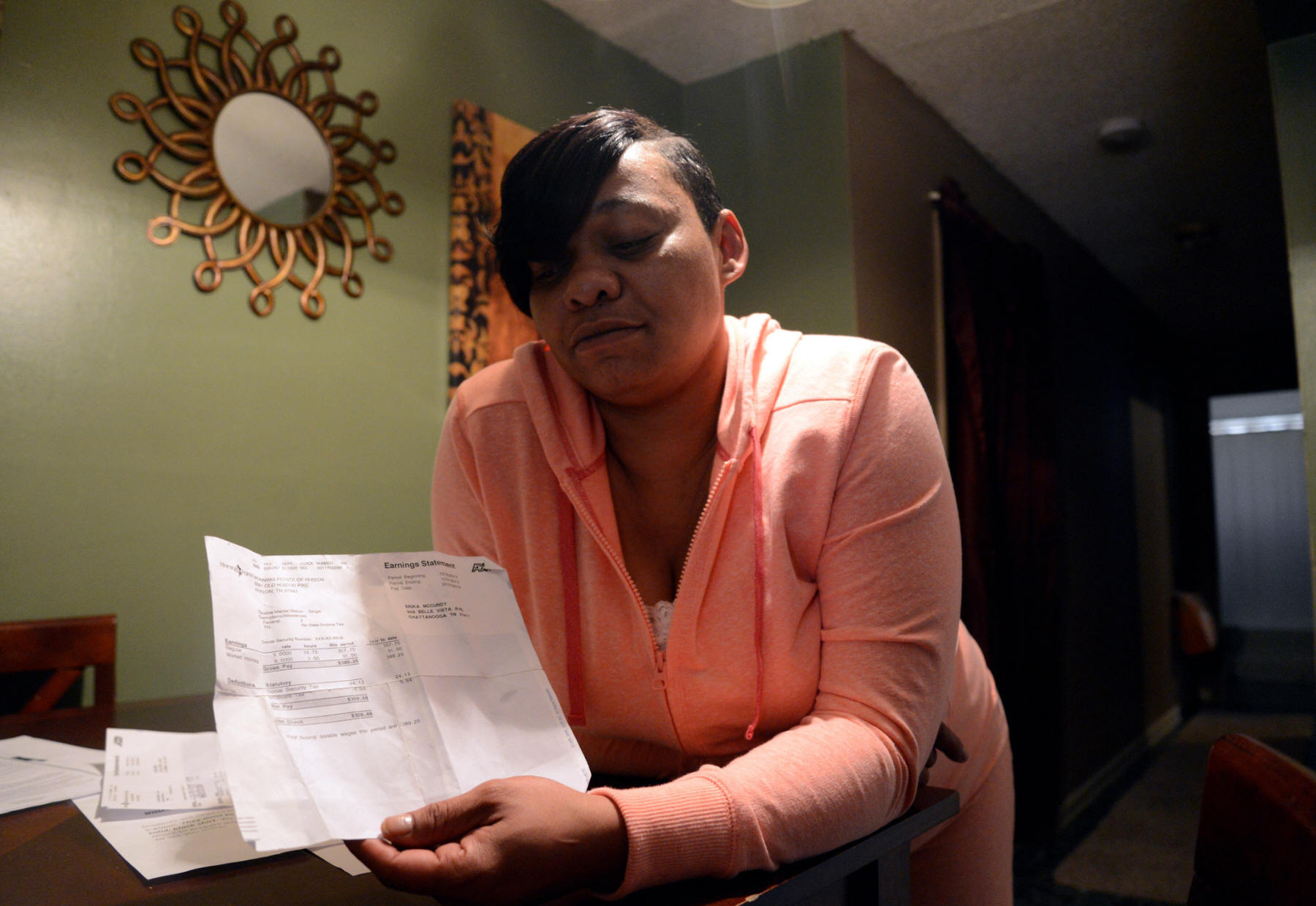

Erika McCurdy, 40, of Chattanooga, Tenn.,

until recently made $9 an hour as a nurse’s aide,

not enough to keep her family above the poverty line.

Photograph:

Billy Weeks for The New York Times

Low-Wage Workers Are Finding Poverty Harder to Escape

NYT

MARCH 16, 2014

https://www.nytimes.com/2014/03/17/

business/economy/low-wage-workers-finding-its-easier-to-fall-into-poverty-and-harder-to-get-out.html

The Expanding World

of Poverty Capitalism

AUG. 26, 2014

The New York Times

The Opinion Pages | Contributing Op-Ed Writer

In Orange County, Calif., the probation department’s “supervised

electronic confinement program,” which monitors the movements of low-risk

offenders, has been outsourced to a private company, Sentinel Offender Services.

The company, by its own account, oversees case management, including breath

alcohol and drug-testing services, “all at no cost to county taxpayers.”

Sentinel makes its money by getting the offenders on probation to pay for the

company’s services. Charges can range from $35 to $100 a month.

The company boasts of having contracts with more than 200 government agencies,

and it takes pride in the “development of offender funded programs where any of

our services can be provided at no cost to the agency.”

Sentinel is a part of the expanding universe of poverty capitalism. In this

unique sector of the economy, costs of essential government services are shifted

to the poor.

In terms of food, housing and other essentials, the cost of being poor has

always been exorbitant. Landlords, grocery stores and other commercial

enterprises have all found ways to profit from those at the bottom of the

ladder.

The recent drive toward privatization of government functions has turned

traditional public services into profit-making enterprises as well.

In addition to probation, municipal court systems are also turning collections

over to a national network of companies like Sentinel that profit from service

charges imposed on the men and women who are under court order to pay fees and

fines, including traffic tickets (with the fees being sums tacked on by the

court to fund administrative services).

When they cannot pay these assessed fees and fines – plus collection charges

imposed by the private companies — offenders can be sent to jail. There are many

documented cases in which courts have imprisoned those who failed to keep up

with their combined fines, fees and service charges.

“These companies are bill collectors, but they are given the authority to say to

someone that if he doesn’t pay, he is going to jail,” John B. Long, a lawyer in

Augusta, Ga. active in defending the poor, told Ethan Bronner of The Times.

A February 2014 report by Human Rights Watch on private offender services found

that “more than 1,000 courts in several US states delegate tremendous coercive

power to companies that are often subject to little meaningful oversight or

regulation. In many cases, the only reason people are put on probation is

because they need time to pay off fines and court costs linked to minor crimes.

In some of these cases, probation companies act more like abusive debt

collectors than probation officers, charging the debtors for their services.”

Human Rights Watch also found that in Georgia in 2012, in “a state of less than

10 million people, 648 courts assigned more than 250,000 cases to private

probation companies.” The report notes that “there is virtually no transparency

about the revenues of private probation companies” since “practically all of the

industry’s firms are privately held and not subject to the disclosure

requirements that bind publicly traded companies. No state requires probation

companies to report their revenues, or by logical extension the amount of money

they collect for themselves from probationers.”

Human Rights Watch goes on to provide an account given by a private probation

officer in Georgia: “I always try and negotiate with the families. Once they

know you are serious they come up with some money. That’s how you have to be.

They have to see that this person is not getting out unless they pay something.

I’m just looking for some good faith money, really. I got one guy I let out of

jail today and I got three or four more sitting there right now.”

Collection companies and the services they offer appeal to politicians and

public officials for a number of reasons: they cut government costs, reducing

the need to raise taxes; they shift the burden onto offenders, who have little

political influence, in part because many of them have lost the right to vote;

and it pleases taxpayers who believe that the enforcement of punishment —

however obtained — is a crucial dimension to the administration of justice.

As N.P.R. reported in May, services that “were once free, including those that

are constitutionally required,” are now frequently billed to offenders: the cost

of a public defender, room and board when jailed, probation and parole

supervision, electronic monitoring devices, arrest warrants, drug and alcohol

testing, and D.N.A. sampling. This can go to extraordinary lengths: in

Washington state, N.P.R. found, offenders even “get charged a fee for a jury

trial — with a 12-person jury costing $250, twice the fee for a six-person

jury.”

This new system of offender-funded law enforcement creates a vicious circle: The

poorer the defendants are, the longer it will take them to pay off the fines,

fees and charges; the more debt they accumulate, the longer they will remain on

probation or in jail; and the more likely they are to be unemployable and to

become recidivists.

And that’s not all. The more commercialized fee collection and probation

services get, the more the costs of these services are inflicted on the poor,

and the more resentful of the police specifically and of law enforcement

generally the poor become. At the same time, judicial systems are themselves in

a vise. Judges, who in many locales must run for re-election, are under intense

pressure from taxpayers to cut administrative costs while maintaining the

efficacy of the judiciary.

The National Center for State Courts recently issued a guide noting that while

the collection of fines and costs is “important for reasons of revenue,” even

more important is the maintenance of “the integrity of the courts.”

In dealing with more serious crimes involving substantial sentences, the rising

costs of maintaining and building new prison facilities has prompted many state

governments, and even the federal government, to turn to the private prison

industry.

This industry, which began to grow in the early 1980s, now faces significant

problems. As incarceration rates drop, and as some states adopt more lenient

sentencing practices, the industry is struggling to find new ways to fill vacant

cells.

Take the Corrections Corporation of America, which is listed on the New York

Stock Exchange and reported revenues of $1.69 billion in 2013. The firm

describes itself as “the nation’s largest owner of privatized correctional and

detention facilities and one of the largest prison operators in the United

States behind only the federal government and three states.”

In its 2013 annual report, C.C.A. was clear about the problems facing the

company: “under a per diem rate structure, a decrease in our occupancy rates

could cause a decrease in revenue and profitability. For the past three years,

occupancy rates have been steadily declining in C.C.A. facilities, from 90

percent in 2011, to 88 percent in 2012 and 85 percent in 2013.”

These numbers reflect the brutal math underlying profit margins in private

prisons. The “revenue per compensated man-day” for each inmate rose by 35 cents

from $60.22 in 2012 to $60.57 in 2013. But expenses “per compensated man-day”

rose by 70 cents from $42.04 to $42.74, for a net decline in operating income

for each inmate from $18.18 a day to $17.83.

In combination with declining occupancy rates, the result was a dip in total

revenue from $1.72 billion in 2012 to $1.69 billion in 2013.

The founders of C.C.A. include Tom Beasley, a former chairman of the Tennessee

Republican Party. One of its early investors was Honey Alexander, who is married

to Senator Lamar Alexander, Republican of Tennessee. Alexander, according to the

Sunlight Foundation, has received in excess of $63,000 from C.C.A. employees and

the company PAC since his election to the Senate in 2002.

Poverty capitalism and government policy are now working on their own and in

tandem to shift costs to those least equipped to pay and in particular to the

least politically influential segment of the poor: criminal defendants and those

delinquent in paying fines.

Last year, Ferguson, Mo., the site of recent protests over the shooting of

Michael Brown, used escalating municipal court fines to pay 20.2 percent of the

city’s $12.75 million budget. Just two years earlier, municipal court fines had

accounted for only 12.3 percent of the city’s revenues.

What should be done to interrupt the dangerous feedback loop between low-level

crime and extortionate punishment? First, local governments should bring private

sector collection charges, court-imposed administrative fees and the dollar

amount of traffic fines (which often double and triple when they go unpaid) into

line with the economic resources of poor offenders. But larger reforms are

needed and those will not come about unless the poor begin to exercise their

latent political power. In many ways, everything is working against them. But

the public outpouring spurred by the shooting of Michael Brown provides an

indication of a possible path to the future. It was, after all, just 50 years

ago — not too distant in historical terms — that collective action and social

solidarity produced tangible results.

The Expanding World of Poverty Capitalism,

NYT, 26.8.2014,

http://www.nytimes.com/2014/08/27/opinion/

thomas-edsall-the-expanding-world-of-poverty-capitalism.html

How to Get Kids to Class

To Keep Poor Students in School,

Provide Social Services

AUG. 25, 2014

The New York Times

The Opinion Pages | Op-Ed Contributor

By DANIEL J. CARDINALI

ARLINGTON, Va. — FOR the 16 million American children living

below the federal poverty line, the start of a new school year should be reason

to celebrate. Summer is no vacation when your parents are working multiple jobs

or looking for one. Many kids are left to fend for themselves in neighborhoods

full of gangs, drugs and despair. Given the hardships at home, poor kids might

be expected to have the best attendance records, if only for the promise of a

hot meal and an orderly classroom.

But it doesn’t usually work out that way. According to the education researchers

Robert Balfanz and Vaughan Byrnes at Johns Hopkins, children living in poverty

are by far the most likely to be chronically absent from school (which is

generally defined as missing at least 10 percent of class days each year).

Amazingly, the federal government does not track absenteeism, but the state

numbers are alarming. In Maryland, for example, 31 percent of high school

students eligible for the federal lunch program had been chronically absent; for

students above the income threshold, the figure was 12 percent.

Thanks to groundbreaking research compiled by Hedy Nai-Lin Chang, the director

at Attendance Works, we have ample proof that everything else being equal,

chronically absent students have lower G.P.A.s, lower test scores and lower

graduation rates than their peers who attend class regularly.

The pattern often starts early. Last year in New Mexico, a third-grade teacher

contacted the local affiliate of Communities in Schools, the national

organization that I run, for help with a student who had 25 absences in just the

first semester. After several home visits, we found that 10 people were living

in her two-bedroom apartment, including the student’s mother, who had untreated

mental health issues. The little girl often got lost in the shuffle, with no

clean clothes to wear and no one to track her progress. Nor was there anything

like a quiet place to do homework.

Embarrassment and peer pressure turned out to be the most immediate problem. By

buying new clothes to replace the girl’s smelly old ones, we were able to help

her fit in and get her to school more often. We found additional community

resources for both the third grader and her family, including a mentorship

group, a housing charity and mental health experts for her mother. As her home

life stabilized over the second semester, the absences all but stopped, and at

the end of the year she moved up with her class.

Her situation is common, but there are nowhere near enough happy endings. That’s

because policy makers usually treat dropout rates and chronic absenteeism as

“school” problems, while issues like housing and mental health are “social”

problems with a different set of solutions.

To bridge this divide, our community school model seeks to bring a site

coordinator, with training in education or social work, onto the administrative

team of every school with a large number of poor kids. That person would be

charged with identifying at-risk students and matching them up with services

that are available both in the school and the community.

This approach is effective and affordable: at Communities in Schools, which

operates in 26 states and the District of Columbia, 75 percent of the students

whose cases we manage show improved attendance. We provide our services at an

average cost of $189 per student per year, a cost that is shared among

government agencies and community partners to minimize the impact on school

budgets.

It’s relatively easy to find these at-risk students. That’s because poverty is

not evenly distributed; it is increasingly concentrated in specific

neighborhoods. According to 2012 census estimates, 7.9 million children live in

neighborhoods where at least 30 percent of residents are poor.

Chronic absenteeism tends to follow the same pattern. In Florida, for instance,

15 percent of public schools are home (or not home) to 52 percent of chronically

absent students. This grotesque fact paradoxically makes it easier for us to

focus our resources: We can effectively reach the most at-risk students with

minimal waste or overlap. Politicians of all stripes are beginning to recognize

the potential of this approach. Mayor Bill de Blasio of New York City, a

Democrat, plans to open 40 community schools at a cost of $52 million, while in

Michigan, Gov. Rick Snyder, a Republican, has announced a major expansion of a

program that puts workers from the state’s Department of Human Services inside

struggling public schools.

We do not need to reinvent the wheel to solve this problem. Child Trends, an

independent research institute, recently conducted a nationwide study to

identify the most effective strategies for school-based provision of social

services. Just 1.5 million kids are receiving these services. The number should

be much higher.

The key is to put dedicated social-service specialists in every low-performing,

high-poverty school, whether they are employed by the school district or another

organization. This specialist must be trained in the delivery of community

services, with continued funding contingent on improvement in indicators like

attendance and dropout rates.

Putting social workers in schools is a low-cost way of avoiding bigger problems

down the road, analogous to having a social worker in a hospital emergency room.

It’s a common-sense solution that will still require a measure of political

courage, something that all too often has itself been chronically absent.

Daniel J. Cardinali is the president of Communities in Schools.

A version of this op-ed appears in print on August 26, 2014,

on page A23 of the New York edition with the headline:

How to Get Kids to Class.

How to Get Kids to Class, NYT, 25.8.2014,

http://www.nytimes.com/2014/08/26/opinion/

to-keep-poor-kids-in-school-provide-social-services.html

Philadelphia’s Success

in Helping the Homeless

Gets a Philanthropic Boost

MAY 7, 2014

The New York Times

By JON HURDLE

PHILADELPHIA — There’s a straight line that goes from David

Drap to David Brown, but you cannot find it in most other cities.

Mr. Drap, 43, could be seen recently assembling pieces of plywood around a twin

mattress under a highway overpass, trying to build a shelter amid detritus left

by a half dozen other homeless people. Mr. Brown, 57, lived on the streets for

25 years until he finally found housing through Project HOME, a local nonprofit

organization. He now lives in a building with a computer lab, a library and a

fitness room.

What the two men have in common is a city that has had conspicuous success in

providing housing for the homeless and where some well-heeled donors have

stepped up to contribute to a cause that has often been off the radar for many

wealthy philanthropists.

On Wednesday, two such philanthropists, John and Leigh Middleton, who sold their

family cigar business for $2.9 billion in 2007, were awarded the prestigious

Philadelphia Award, whose previous recipients have included the city planner

Edmund Bacon and the conductor Leopold Stokowski. The Middletons were recognized

for their support for a variety of local causes, including giving $30 million to

Project HOME, this city’s leading advocacy organization for the homeless.

The size of the donation — one of the largest in homeless philanthropy — will

help Project HOME double the number of its apartments for homeless people, open

a new medical center and leverage additional public and private funds that the

organization hopes will eventually total $300 million.

“The best philanthropy is clearheaded and hard-nosed,” Mr. Middleton, 59, said

in an interview. “This is about results, not about good intentions.”

Mr. Middleton said that Project HOME, which celebrates its 25th anniversary this

year, has already shown results by helping some 8,500 people get off the streets

in a city that has the highest poverty rate, 26 percent, among the 10 largest

cities in the country.

Potential donors of millions or even tens of millions of dollars are put off

because they think homelessness is an overwhelming problem that is the

responsibility of government to solve, he said.

“They think this is an impossible venture, almost like Don Quixote jousting with

windmills,” Mr. Middleton said. “It’s so daunting to people that they get

discouraged and don’t try. They might give half a million or a million but not

the 10 million that they are capable of giving.”

Despite the high poverty rate, Philadelphia has the lowest number of homeless

people per capita among seven large American cities with similar poverty and

housing problems, according to data from Project HOME.

In 2013, Philadelphia’s homeless population declined by 2.3 percent from 2012,

while it rose 27 percent in Los Angeles and 13 percent in New York, according to

the data.

“They are an influential organization,” Nan Roman, president of the National

Alliance to End Homelessness, said of Project HOME. “If you have a stronger

community with better education opportunities, health care and housing that’s

affordable, you’re not going to have many homeless people.”

Mr. Brown is one success. He now lives in his own 450-square-foot apartment in a

renovated building in North Philadelphia where 58 other formerly homeless people

also live on their own.

“This home is very important to me,” Mr. Brown said. “When you get something

like this, you want to hold on to it.”

The organization’s success, Mr. Middleton said, is attributable in part to the

effectiveness of its management, led by Sister Mary Scullion, a Roman Catholic

nun who is known for her ability to cajole politicians and business leaders into

supporting her clients.

“When Mary asks you to do something, it’s only really a question of how fast you

say yes,” Mr. Middleton said.

Last month, 1,250 people, including business and government leaders, attended

the organization’s anniversary celebration at a Philadelphia hotel, raising

about $2.1 million. Guests included Jim Yong Kim, president of the World Bank,

and the singer Jon Bon Jovi, who earlier that day opened JBJ Soul Homes, Project

HOME’s latest housing center, whose $16.6 million construction cost was paid

for, in part, by Mr. Bon Jovi’s foundation.

Mr. Middleton said his donation was driven in part by his confidence that the

organization had the potential to inspire solutions to homelessness beyond

Philadelphia.

“We have somebody who is truly a national leader in the field — not only a

national practitioner but also a national thought leader,” he said, referring to

Sister Mary, a member of the Sisters of Mercy.

Listing “scalability” among his philanthropic goals, Mr. Middleton said he would

like to see other cities use Project HOME’s methods. “We put the stake in the

ground in Philadelphia,” he said.

Abandoning previous attempts to keep their donations anonymous, the Middletons

are now trying to change wealthy donors’ attitude toward homelessness.

“We think we need to be more public to try to get it to be more of a top-of-mind

issue and to try to convince people that you can in fact solve this problem,” he

said.

And by taking a holistic approach to homelessness, Mr. Middleton said he hoped

that more big donors could be persuaded to support the cause.

“It’s not just about putting a shelter over people’s heads,” he said. “It’s

about dealing with each of these discrete problems. You have to educate people,

you have to provide medical treatment, you have to provide employment

opportunities.”

A version of this article appears in print on May 8, 2014,

on page A17 of the New York edition with the headline:

Philadelphia’s Success in Helping the Homeless

Gets a Philanthropic Boost.

Philadelphia’s Success in Helping the

Homeless

Gets a Philanthropic Boost,

NYT, 7.5.2014,

http://www.nytimes.com/2014/05/08/us/

philadelphias-success-in-helping-the-homeless-gets-a-philanthropic-boost.html

50 Years Into the War on Poverty,

Hardship Hits Back

The New York Times

APRIL 20, 2014

By TRIP GABRIEL

TWIN BRANCH, W.Va. — When people visit with friends and

neighbors in southern West Virginia, where paved roads give way to dirt before

winding steeply up wooded hollows, the talk is often of lives that never got off

the ground.

“How’s John boy?” Sabrina Shrader, 30, a former neighbor, asked Marie Bolden one

cold winter day at what Ms. Bolden calls her “little shanty by the tracks.”

“He had another seizure the other night,” Ms. Bolden, 50, said of her son, John

McCall, a former classmate of Ms. Shrader’s. John got caught up in the dark

undertow of drugs that defines life for so many here in McDowell County, almost

died of an overdose in 2007, and now lives on disability payments. His brother,

Donald, recently released from prison, is unemployed and essentially homeless.

“It’s like he’s in a hole with no way out,” Ms. Bolden said of Donald as she

drizzled honey on a homemade biscuit in her tidy kitchen. “The other day he came

in and said, ‘Ain’t that a shame: I’m 30 years old and carrying my life around

in a backpack.’ It broke my heart.”

McDowell County, the poorest in West Virginia, has been emblematic of entrenched

American poverty for more than a half-century. John F. Kennedy campaigned here

in 1960 and was so appalled that he promised to send help if elected president.

His first executive order created the modern food stamp program, whose first

recipients were McDowell County residents. When President Lyndon B. Johnson

declared “unconditional war on poverty” in 1964, it was the squalor of

Appalachia he had in mind. The federal programs that followed — Medicare,

Medicaid, free school lunches and others — lifted tens of thousands above a

subsistence standard of living.

But a half-century later, with the poverty rate again on the rise, hardship

seems merely to have taken on a new face in McDowell County. The economy is

declining along with the coal industry, towns are hollowed out as people flee,

and communities are scarred by family dissolution, prescription drug abuse and a

high rate of imprisonment.

Fifty years after the war on poverty began, its anniversary is being observed

with academic conferences and ideological sparring — often focused, explicitly

or implicitly, on the “culture” of poor urban residents. Almost forgotten is how

many ways poverty plays out in America, and how much long-term poverty is a

rural problem.

Of the 353 most persistently poor counties in the United States — defined by

Washington as having had a poverty rate above 20 percent in each of the past

three decades — 85 percent are rural. They are clustered in distinct regions:

Indian reservations in the West; Hispanic communities in the Rio Grande Valley

of Texas; a band across the Deep South and along the Mississippi Delta with a

majority black population; and Appalachia, largely white, which has supplied

some of America’s iconic imagery of rural poverty since the Depression-era

photos of Walker Evans.

McDowell County is in some ways a place truly left behind, from which the

educated few have fled, leaving almost no shreds of prosperity. But in a nation

with more than 46 million people living below the poverty line — 15 percent of

the population — it is also a sobering reminder of how much remains broken, in

drearily familiar ways and utterly unexpected ones, 50 years on.

A Scarred Landscape

Much of McDowell County looks like a rural Detroit, with broken windows on

shuttered businesses and homes crumbling from neglect. In many places, little

seems to have been built or maintained in decades.

Continue reading the main story

Numbers tell the tale as vividly as the scarred landscape. Forty-six percent of

children in the county do not live with a biological parent, according to the

school district. Their mothers and fathers are in jail, are dead or have left

them to be raised by relatives, said Gordon Lambert, president of the McDowell

County Commission.

Beginning in the 19th century, the rugged region produced more coal than any

other county in West Virginia, but it got almost none of the wealth back as

local investment. Of West Virginia’s 55 counties, McDowell has the lowest median

household income, $22,000; the worst childhood obesity rate; and the highest

teenage birthrate.

It is also reeling from prescription drug abuse. The death rate from overdoses

is more than eight times the national average. Of the 115 babies born in 2011 at

Welch Community Hospital, over 40 had been exposed to drugs.

Largely as a consequence of the drug scourge, a problem widespread in rural

America, the incarceration rate in West Virginia is one of the highest in the

country.

“Whole families have been wiped out in this county: mother, father, children,”

said Sheriff Martin B. West.

“These are good people, good families,” Sheriff West, an evangelical pastor,

said of his lifelong neighbors. “But they get involved with drugs, and the next

thing you know they’re getting arrested.”

The sheriff’s wife, Georgia Muncy West, has a historical link to the war on

poverty. Her parents, Alderson and Chloe Muncy, were the first beneficiaries of

the modern food stamp program, traveling to Welch to collect $95 in coupons. Ms.

West, one of 15 children, said that unlike many current families, hers remained

intact even through the leanest times. She went to work the Monday after she

graduated from high school, sent her two children to college and served on the

county school board.

As coal mining jobs have declined over half a century, there has been a steady

migration away from the mountains. McDowell County’s population is just 21,300,

down from 100,000 in the 1950s. Those who stayed did not have the education or

skills to leave, or remained fiercely attached to the hollows and homes their

families had known for generations.

Alma and Randy McNeely, both 50, tried life in Tennessee. But they returned to

McDowell County to be close to their large extended family.

The couple married when they were 16. In a family photo album, Ms. McNeely

appears in her white wedding dress as if headed to the junior prom. Turning the

album’s pages for a visitor, she apologized for its lack of captions. “Mama

couldn’t write, so, you know, there ain’t no names in it,” she said.

Ms. McNeely, whose long, dark hair is gathered behind, is known as Maw for being

a surrogate mother to many in Hensley, a dot of a community. Her home is a few

small rooms under a metal roof, clinging to a hillside.

Her husband worked in sawmills before a back injury in 1990. His disability

payments, some $1,700 a month, are the family’s only income.

After marrying, the couple had two children. Their daughter, Angela, gave birth

at 14 and was expelled from a Christian school, her mother said. Now, Ms.

McNeely is raising Angela’s daughter, Emalee Short, who is 15.

A high school sophomore, Emalee dreams of being a veterinarian or maybe a marine

biologist. The house and yard ring with the yelps of a dozen Chihuahuas and

other small dogs, some of them strays dropped off by neighbors.

A confident teenager in a “Twilight” T-shirt, Emalee is enrolled in Upward

Bound, the federal program that offers Saturday classes and summer school for

bright students aspiring to college. “I want to be one of the ones who gets out

of here,” she said. “I don’t want people to talk about me” — meaning the

recitation of damaged young lives that is a regular part of catching up.

Photo

John F. Kennedy, then a senator running for president, with miners near Mullens,

W.Va., in 1960. Credit Hank Walker/Time Life Pictures, via Getty Images

Continue reading the main story

Another photo in the album shows Randy Jr., the McNeelys’ son, known as Little

Man. Little Man dropped out of high school six months shy of graduation, “with

me sitting here crying,” Ms. McNeely said. He has been in and out of jail but is

one of the lucky ones who have found work, at a junkyard run by a family friend.

Although Ms. McNeely encourages her granddaughter to aim for college, which

would mean leaving McDowell County, she said that “her other mommy and daddy” —

meaning Emalee’s biological parents — “and all her aunts and uncles, they don’t

want her to go.”

“They’re scared she’s going to get hurt,” Ms. McNeely said.

Food Stamps and Coal

Many in McDowell County acknowledge that depending on government benefits has

become a way of life, passed from generation to generation. Nearly 47 percent of

personal income in the county is from Social Security, disability insurance,

food stamps and other federal programs.

But residents also identify a more insidious cause of the current social

unraveling: the disappearance of the only good jobs they ever knew, in coal

mining. The county was always poor. Yet family breakup did not become a calamity

until the 1990s, after southern West Virginia lost its major mines in the

downturn of the American steel industry. The poverty rate, 50 percent in 1960,

declined — partly as a result of federal benefits — to 36 percent in 1970 and to

23.5 percent in 1980. But it soared to nearly 38 percent in 1990. For families

with children, it now nears 41 percent.

Today, fewer than one in three McDowell County residents are in the labor force.

The chief effort to diversify the economy has been building prisons. The most

impressive structure on Route 52, the twisting highway into Welch, is a state

prison that occupies a former hospital. There is also a new federal prison on a

mountaintop. But many residents have been skipped over for the well-paying jobs

in corrections: They can’t pass a drug test.

Sheriff West, a former coal miner who presided over a magistrate court before he

was elected sheriff in 2012, said the region’s ills traced back to many failures

by elected officials, including local politicians who governed by patronage and

state leaders in Charleston, the capital, who took the county’s solidly

Democratic voters for granted and never courted them with aid.

The sheriff and other members of McDowell County’s small elite are not inclined

to debate national poverty policy. They draw conclusions from what is in front

of them.

“Our politicians never really did look ahead in this county for when coal

wouldn’t be king,” Sheriff West said. “Therefore, we’ve fallen flat on our

face.”

Returning for Neighbors

Not everyone with an education and prospects has moved away. McDowell County has

a small professional class of people fighting long odds to better a place they

love. Florisha McGuire, who grew up in War, which calls itself West Virginia’s

southernmost city, returned to become principal of Southside K-8 School.

For Ms. McGuire, 34, the turning point in the town’s recent history was the year

she left for college, 1997, when many of the 17-year-olds who stayed behind

graduated from beer and marijuana to prescription pill abuse.

Many of the parents of the children in her school today are her former

classmates. In some, emaciated bodies and sunken eyes show the ravages of

addiction. “I had a boy in here the other day I went to high school with,” she

said. “He had lost weight. Teeth missing. You can look at them and go, ‘He’s

going to be the next to die.’ ”

Ms. McGuire, who grew up in poverty — her father did not work and died of lung

cancer at 49; her mother had married at 16 — was the first in her family to

attend college. On her first morning at Concord University in Athens, W.Va.,

about 50 miles from War, her roommate called her to breakfast. Ms. McGuire

replied that she didn’t have the money. She hadn’t realized her scholarship

included meals in a dining hall.

“I was as backward as these kids are,” she said in the office of her school, one

of few modern buildings in town. “We’re isolated. Part of our culture here is we

tend to stick with our own.” In her leaving for college, she said, “you’d think

I’d committed a crime.”

As the mother of a 3-year-old girl, she frets that the closest ballet lesson or

soccer team is nearly two hours away, over the state line in Bluefield, Va. But

she is committed to living and working here. “As God calls preachers to preach,

he calls teachers to certain jobs,” she said. “I really believe it is my mission

to do this and give these kids a chance.”

Ms. McGuire described War as almost biblically divided between forces of dark

and light: between the working blue- and white-collar residents who anchor

churches, schools and the city government, and the “pill head” community. As she

drove down the main street, past municipal offices with the Ten Commandments

painted in front, she pointed out the signs of a once-thriving town sunk into

hopelessness. The abandoned American Legion hall. A pharmacy with gates to

prevent break-ins. The decrepit War Hotel, its filthy awning calling it “Miner’s

City,” where the sheriff’s department has made drug arrests.

When coal was king, there were two movie theaters and a high school, now closed.

“Everybody worked,” Ms. McGuire said.

She turned up Shaft Hollow, where many people live in poorly built houses once

owned by a coal company, their roofs sagging and the porches without railings.

At the foot of Shop Hollow, a homemade sign advertised Hillbilly Fried Chicken.

Another pointed the way to the True Light Church of God in Jesus Name. “This is

one of the most country places, but I love these people,” Ms. McGuire said. She

said it was a bastion of Pentecostal faith, where families are strict and their

children well behaved.

She and others who seek to lift McDowell County have attracted some outside

allies. Reconnecting McDowell, led by the American Federation of Teachers union,

is working to turn schools into community centers offering health care, adult

literacy classes and other services. Its leaders hope to convert an abandoned

furniture store in Welch to apartments in order to attract teachers.

“Someone from Indiana or Pennsylvania, they’re not going to come to McDowell

County and live in a house trailer on top of a mountain,” said Bob Brown, a

union official.

Another group, the West Virginia Healthy Kids and Families Coalition, is working

to create a home visitation service to teach new parents the skills of

child-rearing.

Sabrina Shrader, the former neighbor of Marie Bolden in Twin Branch, has spoken

on behalf of the group to the State Legislature and appeared before a United

States Senate committee last year. Ms. Shrader, who spent part of her youth in a

battered women’s shelter with her mother, earned a college degree in social

work.

“It’s important we care about places like this,” she said. “There are kids and

families who want to succeed. They want life to be better, but they don’t know

how.”

A version of this article appears in print on April 21, 2014,

on page A1 of the New York edition with the headline:

50 Years Later, Hardship Hits Back.

50 Years Into the War on Poverty, Hardship

Hits Back,

NYT, 20.4.2014,

http://www.nytimes.com/2014/04/21/us/

50-years-into-the-war-on-poverty-hardship-hits-back.html

Low-Wage Workers

Are Finding Poverty

Harder to Escape

MARCH 16, 2014

The New York Times

By STEVEN GREENHOUSE

CHATTANOOGA, Tenn. — At 7 in the morning, they are already

lined up — poultry plant workers, housekeepers, discount store clerks — to ask

for help paying their heating bills or feeding their families.

And once Metropolitan Ministries opens at 8 a.m., these workers fill the

charity’s 40 chairs, with a bawling infant adding to the commotion. From pockets

and handbags they pull out utility bills or rent statements and hand them over

to caseworkers, who often write checks — $80, $110, $150 — to patch over gaps in

meeting this month’s expenses or filling the gas tank to get to work.

Just off her 10 p.m. to 6 a.m. shift, Erika McCurdy needed help last month with

her electricity and heating bill, which jumped to $280 in January from the usual

$120 — a result of one of the coldest winters in memory. A nurse’s aide at an

assisted living facility, Ms. McCurdy said there were many weeks when she

couldn’t make ends meet raising her 19-year-old son and 7-year-old daughter.

“There’s just no way, making $9 an hour as a single parent with two children,

that I can live without assistance,” said Ms. McCurdy, 40, a strong-voiced,

solidly built Chattanooga native.

She was so financially stretched, she said, that she and her daughter often

sneaked into her son’s high school football games free during halftime because

she couldn’t afford the $6 tickets. (She proudly noted that her son, Charles,

had made the All State football team.) As for her daughter Jer’Maya, who mimics

Beyoncé’s every move on her mother’s iPhone, Ms. McCurdy said, “She’d love to

take ballet and piano lessons, but there’s no way I can afford that.”

Having worked as a nurse’s aide for 15 years, Ms. McCurdy has been among the

nearly 25 million workers in the United States who make less than $10.10 an hour

— the amount to which President Obama supports increasing the minimum wage. Of

those workers, 3.5 million make the $7.25 federal minimum wage or less.

And like many of them, Ms. McCurdy hasn’t been able to rely on steady full-time

hours — she has often been assigned just 20 hours a week. Even if she worked

full time year-round, her $9 hourly wage would put her below the poverty

threshold of $19,530 for a family of three.

Climbing above the poverty line has become more daunting in recent years, as the

composition of the nation’s low-wage work force has been transformed by the

Great Recession, shifting demographics and other factors. More than half of

those who make $9 or less an hour are 25 or older, while the proportion who are

teenagers has declined to just 17 percent from 28 percent in 2000, after

adjusting for inflation, according to Janelle Jones and John Schmitt of the

Center for Economic Policy Research.

Today’s low-wage workers are also more educated, with 41 percent having at least

some college, up from 29 percent in 2000. “Minimum-wage and low-wage workers are

older and more educated than 10 or 20 years ago, yet they’re making wages below

where they were 10 or 20 years ago after inflation,” said Mr. Schmitt, senior

economist at the research center. “If you look back several decades, workers

near the minimum wage were more likely to be teenagers — that’s the stereotype

people had. It’s definitely not accurate anymore.”

Continue reading the main story

In Chattanooga, the prevalence of low-wage jobs has contributed to the high

poverty rate: 27 percent of the city’s residents live below the poverty line,

compared with 15 percent nationwide. Women head about two-thirds of the city’s

poor households, and 42 percent of its children are poor, nearly double the rate

statewide.

“The face of poverty in this community is women, especially women of color,”

said Valerie L. Radu, a professor of social work at the University of Tennessee,

Chattanooga.

This city was not always a magnet for low-wage jobs. For much of the last

century, the city, which hugs the Tennessee River, was a manufacturing hub with

dozens of apparel factories, textile mills and metal foundries.

During the last quarter of the 20th century, almost all the factories and

foundries were shuttered, and with them disappeared thousands of manufacturing

jobs that had once lifted workers, even ones without high school degrees, into

the middle class or to the cusp of it. In their place have come thousands of

service-sector jobs: at the aquarium and Imax theater built to lure tourists and

at hotels, nursing homes, big-box stores, brew pubs, fast-food restaurants,

beauty salons and hospitals.

Discount stores dot the landscape, including a Family Dollar downtown near the

upscale Bluewater Grille, reflecting how much American cities have experienced a

hollowing-out of the middle class.

“Chattanooga has a twofold problem: the low level of educational attainment and

the traditional jobs that these people move into have largely disappeared,” said

Matthew N. Murray, an economist at the University of Tennessee. Just 23 percent

of Tennessee adults have a bachelor’s degree.

JeraLee Kincaid, 23, is an $8.50-an-hour cashier who works at the checkout booth

at a parking garage next to the Marriott Courtyard hotel downtown. A solid

student in high school, Ms. Kincaid, who lives with her mother, planned to study

computer programming in college, but instead her family decided that she needed

to help pay the medical bills of a 5-year-old niece who has leukemia.

“She can’t eat, talk or walk by herself,” said Ms. Kincaid. She says she feels

stuck, but also grateful that her boss is trying to help find her a scholarship

to attend college.

When Volkswagen opened a $1 billion assembly plant in 2011, 80,000 people

applied for 2,000 jobs paying an average of $19.50 an hour. Many low-wage

workers, like Ms. McCurdy — a high school dropout who later obtained her high

school equivalency diploma — would have loved to work there, but they faced

difficulty mastering the math tests given for jobs that involve advanced

machinery.

“We understand that more individuals have to get some kind of higher education

degree or certificate to have a chance in this world,” said Chattanooga’s mayor,

Andy Berke. “We don’t want the South to be a place where businesses go to find

low-wage, low-education jobs. That’s a long-term problem that midsized cities in

the South face.”

Here as well as elsewhere, a college degree cannot guarantee a good job.

Landon Howard graduated from the University of Tennessee campus here four years

ago with a bachelor’s degree in social work, but has been unable to find a job

in that field. Instead he is a prep cook at the trendy Tupelo Honey Cafe. Often

scheduled for just 15 to 20 hours a week at $9.50 an hour, he usually takes home

less than $200 a week.

“I’ve had to move back in with my parents,” Mr. Howard said. His most urgent

concern is his lack of dental insurance. “One of my teeth is cracked,” he said.

“There’s a big gaping hole. I don’t know if I’m going to lose it.”

Ms. McCurdy, as a parent in a modest income bracket, would not usually be

eligible for the state’s Medicaid program, although her children would, but she

was accepted because of a heart condition requiring costly medications.

Her family has had to make many sacrifices since she was laid off in 2012 from

her job as a full-time nurse’s assistant in the emergency room of Memorial

Hospital.

Her fall to $9 an hour at the assisted living facility from $13.75 at the

hospital forced her to give up a 2,000-square-foot home in Harrison, a local

suburb, “which is beautiful, and you have better schools,” she said.

“It was a good life,” she added. “You didn’t have to worry about violence or

anyone breaking in.”

After being laid off, “I realized I couldn’t afford to stay in a house where the

rent was $625 a month,” she said. So she found a $400-a-month, 1,100-square foot

house in Brainerd, known for its gangs and violence. “I stay in at night,” she

said. “I put bars on the windows.”

The new house has two modest bedrooms, a largely unfurnished living room, a

bathroom and a small shotgun kitchen “where I got to move the table when my son

gets up from dinner,” she said. “Imagine being in a two-bedroom place with a

6-2, 280-pound boy and a little girl. Me and my little girl share a room.”

They also share a bed, but Jer’Maya keeps her dolls, books and clothes in

Charles’s room, among his footballs and athletic gear. Ms. McCurdy receives $400

a month in food stamps. Without it, she said, “we wouldn’t be eating.”

Still, Ms. McCurdy worries about her children’s future.

“I have a son that’s graduating in May,” she said. “He’s looking at college. My

heart is pounding 99 miles per hour. If he goes on full scholarship, I’ll still

need to support him — how to pay his cellphone bill, how to pay for

transportation and food during vacations.”

Her February utility bill just arrived and it stunned her: $320. She may again

turn to Metropolitan Ministries for help, although she says she hopes the $3,000

or so she expects to receive from the earned-income tax credit will help her pay

that bill — and also buy a new living room couch.

Rebecca Whelchel says she has seen big changes in the clientele since she became

the executive director of Metropolitan Ministries eight years ago.

“It used to be that folks came in with a single issue — it was like, ‘I have to

buy a new tire because my tire blew out,’ or, ‘I’m short on my electrical bill,’

” Ms. Whelchel said. “Now they come in with a rubber band around a bunch of

bills and problems. Everything is wrong. Everything is tangled with everything

else.”

At age 34, Nick Mason earns $9 an hour as an assistant manager for a Domino’s,

overseeing a crew of six. “I don’t think $9 is fair — I’ve been working in the

pizza business for 19 years, since I was 15,” he said.

He attended the University of Tennessee, Chattanooga, studying to become a

registered nurse, but he dropped out as a sophomore when his marriage fell

apart. He returned to work full time, and he and his children moved in with his

parents in the suburb of Hixson.

“I just wish we could have our home, but I can’t afford to,” said Mr. Mason,

father of 7-year-old Halle and 5-year-old Eli. “That’s what the kids keep asking

for.”

“We’ve had to sacrifice a lot of things,” he continued. “I’d love nothing more

than to give them what they deserve. As a single father, it’s impossible. I put

my kids in karate about a year ago. They loved it, but I got to the point where

it was a choice between paying for a cellphone or karate, and as a manager, I

need a cellphone for people to keep in touch with me.”

Mr. Mason has heard the criticisms: Stop complaining about your pay; just go

back to school and that way you’ll find a better-paying job.

“I would love to go back to school,” he said. “It’s easy for people to say that

because they haven’t been in my shoes. I’m already busy every minute of the day.

I already don’t get to see my kids enough. I doubt I’ll be able to afford

school, and I don’t know where I would find the time.”

His big hope is to be promoted to run a Domino’s, which might mean earning $15

an hour.

Ms. McCurdy, who applied for two dozen jobs this winter, delivered good news

with a big smile. She was offered a job as a full-time nurse’s aide on the

transition medical floor at Erlanger Health System, a hospital.

“They’re paying me $10.64,” she said, an improvement over the $9 an hour she had

been earning. “That gives me a little room to breathe.”

A version of this article appears in print on March 17, 2014,

on page B1 of the New York edition with the headline:

The Walls Close In.

Low-Wage Workers Are Finding Poverty Harder

to Escape,

NYT, 16.3.2014,

http://www.nytimes.com/2014/03/17/business/economy/

low-wage-workers-finding-its-easier-to-fall-into-poverty-and-harder-to-get-out.html

Richard Boone,

Johnson Aide on Poverty,

Dies at 86

MARCH 7, 2014

The New York Times

By ADAM CLYMER

Richard W. Boone, who played a central role in President

Lyndon B. Johnson’s war on poverty in the 1960s and led private organizations

pursuing political and social change, died on Feb. 26 at his home in Santa

Barbara, Calif. He was 86.

His son Wade said the cause was complications of non-Hodgkin’s lymphoma and

Parkinson’s disease.

Mr. Boone went to Washington in 1962 to work at the Justice Department on

juvenile delinquency, an issue he had dealt with as a police captain in Cook

County, Ill. He was close to Attorney General Robert F. Kennedy and worked with

him when, as a senator from New York, Kennedy became deeply involved in

antipoverty efforts.

“He was one of four or five people who had the senator’s ear, always,” Frank

Mankiewicz, press secretary for Kennedy as senator, said in a recent interview.

Mr. Boone went from the Justice Department to the White House staff, and from

there to the Office of Economic Opportunity, headed by R. Sargent Shriver,

brother-in-law to Robert and President John F. Kennedy.

As an important aide in Johnson’s antipoverty program, Mr. Boone was most

closely involved with Head Start and Upward Bound, educational initiatives for

preschoolers and high school students, respectively, and Foster Grandparents, a

mentoring program for children with exceptional needs. He was also integral in

nationwide efforts to establish community health centers and legal services for

the poor and in promoting the administration’s goal of “maximum feasible

participation” by the poor in efforts to lift their own circumstances.

Mr. Boone spent most of his career in the private philanthropic sphere. He

directed the Citizens Crusade Against Poverty, an umbrella group founded by the

United Automobile Workers to work alongside government efforts but also to

scrutinize them. A major effort by the group was a 1968 report, “Hunger USA,”

which found that the Agriculture Department was failing in its efforts to combat

hunger among 29 million poor Americans.

As director of the Field Foundation from 1977 to 1989, Mr. Boone used grants to

establish nonprofit groups to help refugees who had escaped Vietnam by boat

during the war there, to promote voting by minorities and young people and to

campaign against the buildup of nuclear weapons.

Two organizations he helped create and guide remain active and influential in

Washington: the Communications Consortium Media Center, which has aided liberal

groups in communications strategies since 1988, and the Center on Budget and

Policy Priorities, a liberal research institute that examines the impact of

federal spending and taxation.

Mr. Boone created the budget center when he became dismayed at President Ronald

Reagan’s success in cutting spending on programs for the poor, said Robert

Greenstein, its director since its founding in 1981.

Besides his son Wade, Mr. Boone is survived by his wife of 62 years, Chloris

Robinson Boone; three other sons, Steven, Brent and Jed; a daughter, Laurel

Boone Nelson; and six grandchildren.

Mr. Boone was born in Louisville, Ky., on March 29, 1927, the son of Cassius

Aurelius Boone, a doctor, and Leah Wolf Boone. Before graduating from high

school, he entered the University of Chicago at 16. After Navy service in the

Pacific, he returned and earned a bachelor’s degree in 1948 and a master’s in

1949. When a professor of his was brought in as a reform police chief in Cook

County, he recruited Mr. Boone and made him a captain.

Wade Boone recalled his father telling him that he first became acquainted with

poverty by going with his own father by horse and carriage to make house calls

in Appalachia. The charge, during the Depression, was 25 cents a visit.

A version of this article appears in print on March 8, 2014,

on page D6 of the New York edition with the headline:

Richard Boone, 86, Johnson Aide on Poverty.

Richard Boone, Johnson Aide on Poverty,

Dies at 86, NYT, 7.3.2014,

http://www.nytimes.com/2014/03/08/us/politics/

richard-boone-johnson-aide-on-poverty-dies-at-86.html

New York Is Removing Over 400 Children

From 2 Homeless Shelters

FEB. 21, 2014

The New York Times

By ANDREA ELLIOTT

and REBECCA R. RUIZ

In the face of New York’s mounting homeless crisis, Mayor Bill

de Blasio will announce on Friday that his administration is removing hundreds

of children from two city-owned homeless shelters that inspectors have

repeatedly cited for deplorable conditions over the last decade, officials said.

The city has begun transferring over 400 children and their families out of the

Auburn Family Residence in Fort Greene, Brooklyn, and from the Catherine Street

shelter in Lower Manhattan, while vowing to improve services for the swelling

population of 22,000 homeless children, Mr. de Blasio and other officials said

in interviews this week.

The administration is trying to find either subsidized permanent housing or

suitable temporary shelter for the families and will be converting the Auburn

and Catherine Street facilities into adult family shelters, the officials said.

State and city inspectors have cited Auburn for over 400 violations — many of

them repeated — for a range of hazards, including vermin, mold, lead exposure,

an inoperable fire safety system, insufficient child care and the presence of

sexual predators, among them, a caseworker.

“We just weren’t going to allow this to happen on our watch,” the mayor said.

The conditions at Auburn, which were detailed in a recent series in The New York

Times, prompted the City Council to schedule hearings next week on family

shelters. Records and interviews show that similar lapses have dogged Catherine

Street, which, like Auburn, is an aging residence with communal bathrooms that

children share with strangers. Families live in rooms without kitchens or

running water, preventing them from cooking their own meals or washing baby

bottles.

Since 2006, the state agency responsible for overseeing homeless shelters has

routinely ordered the city to remove all infants and toddlers from Catherine

Street, citing at least 150 violations in that time.

That agency, the Office of Temporary and Disability Assistance, could have

sanctioned Auburn and Catherine Street by withholding state funding, but chose

not to because that “would have meant defunding services that help tens of

thousands of New Yorkers in need at a time when New York City had the highest

number of homeless residents in its history,” the office’s commissioner, Kristin

M. Proud, said in an email.

In the fall, a resident at Catherine Street took five children and two

caseworkers hostage, barricading them in a room on the second floor, according

to police records. In August 2012, a group of teenage boys took “over the

building,” threatening children in bathrooms and assaulting others on the

street, according to state records.

“This is no place for kids,” said Dawn Hazel, 38, a single mother studying to be

a nurse who has lived at Catherine Street with her five children for just over a

year.

Ms. Hazel said her youngest son, now 6, was cornered in the men’s bathroom last

year by a group of residents who exposed themselves to him. A security guard was

present during the encounter but did not intervene, said Ms. Hazel, who filed a

complaint at the shelter.

While security has more than doubled at Auburn in recent weeks, with security

guards stationed outside every bathroom, Catherine Street’s transition will take

longer, officials said. The city’s Department of Homeless Services will first

move families out of Auburn. Forty-two families have already left, mostly to

other shelters, and another 64 will move by late June to allow for minimal

disruption of school, officials said.

As Auburn’s families depart, security guards from that shelter will be

transferred to Catherine Street, where 211 children currently reside, a

spokeswoman for the department said. Since January, a dozen families have been

placed in other shelters or in permanent housing, and the rest will be moved by

the fall, officials said.

The transition plan for both shelters will cost the city more than $13 million,

between allocations for enhanced security and upgrades to both facilities, which

will feature closed-circuit security cameras, renovated bathrooms and

refurbished rooms.

In a somewhat surreal twist, the city is exploring a plan to convert part of

Auburn’s ground floor — the site of a cafeteria notorious for its mice and

rancid food — into a “culinary arts” training program for adult residents. In

the meantime, the city has added six more microwaves to the cafeteria, where

people used to wait in lines to heat food that was sometimes served cold.

Both Auburn and Catherine Street were converted into family shelters in 1985

and, in the intervening decades, have remained a thorn in the side of homeless

advocates.

“Until today, no mayor was willing to say no children should be treated this

way, and that’s a historic breakthrough,” said Steven Banks, the attorney in

chief at the Legal Aid Society, which has battled the city in court over shelter

conditions.

Yet only a small fraction of the city’s homeless children live at Auburn and

Catherine Street. Its temporary housing system includes 151 family facilities of

varying quality, and it remains to be seen whether the administration will

address complaints about conditions at other shelters.

Advocates for the homeless have pressed Mr. de Blasio to reinstate several

policies that ended under Mayor Michael R. Bloomberg. From 1990 until 2005, the

city placed more than 53,000 homeless families in permanent housing by giving

them priority referrals to federal subsidy programs, according to an analysis of

city data by Patrick Markee of the Coalition for the Homeless.

The Bloomberg administration canceled that policy and in its place created a

short-term rent subsidy program that ended in 2011 when the state withdrew its

portion of the funding. By the time Mr. Bloomberg left office at the end of last

year, the homeless population had peaked at more than 52,000 — the highest

number on record since the Great Depression.

That tally reflects only the shelter population, which fluctuates daily and does

not include families that live doubled up with friends or relatives. According

to data compiled by the State Education Department, more than 80,000 school-age

children in the city were identified as homeless during the last academic year.

“There are major American cities that have the same population as we have people

in shelter,” Mr. de Blasio said. “We have to look this in the face. This is

literally an unacceptable dynamic, and we have to reverse it.”

In interviews, Mr. de Blasio, his deputy mayor for health and human services,

Lilliam Barrios-Paoli, and the newly appointed homeless services commissioner,

Gilbert Taylor, laid out the broad outlines of a still-evolving plan to address

homelessness.

They will focus on prevention efforts, and said the administration was committed

to renewing a version of the former rent subsidy program, which will require

money from the state. A spokesman for Gov. Andrew M. Cuomo said the proposal was

under discussion.

The de Blasio administration is also exploring a plan to enhance anti-eviction

legal services for families, and an “aftercare” support program intended to

prevent newly housed families from becoming homeless again.

The city is less likely to depend on federal housing programs as a solution

because of the dwindling supply, Mr. de Blasio said. “It will be a tool we use

as needed, but I think the central thrust has to be getting at the root causes,”

he said. “Greater supply of affordable housing. Pushing up wages and benefits.

More preventative efforts.”

The subject of the series in The Times, Dasani Coates, 12, spent three years at

Auburn, sharing one room with her parents and seven siblings before the family

was transferred to a shelter in Harlem, where they have remained since October.

The Department of Homeless Services is trying to place the family in one of the

city’s few supportive housing programs, which provide affordable apartments with

on-site services for vulnerable families.

“It takes all of this for something to happen?” Dasani’s mother, Chanel, said in

response to the announced changes at Auburn, and the city’s recent effort to

house her family. “Why was it so hard to do this three years ago?”

A version of this article appears in print on February 21, 2014, on page A1 of

the New York edition with the headline: 400 Children to Be Removed From 2

Shelters.

New York Is Removing Over 400 Children From

2 Homeless Shelters,

NYT, 21.2.2014,

http://www.nytimes.com/2014/02/21/nyregion/

new-york-is-removing-over-400-children-from-2-homeless-shelters.html

The Post Office Banks on the Poor

FEB. 7, 2014

The New York Times

By MEHRSA BARADARAN

ATHENS, Ga. — PEOPLE like to complain about banks popping up

like Starbucks on every corner these days. But in poor neighborhoods, the

phenomenon is quite the opposite: Over the past couple of decades, the banks

have pulled out.

Approximately 88 million people in the United States, or 28 percent of the

population, have no bank account at all, or do have a bank account, but

primarily rely on check-cashing storefronts, payday lenders, title lenders, or

even pawnshops to meet their financial needs. And these lenders charge much more

for their services than traditional banks. The average annual income for an

“unbanked” family is $25,500, and about 10 percent of that income, or $2,412,

goes to fees and interest for gaining access to credit or other financial

services.

But a possible solution has appeared, in the unlikely guise of the United States

Postal Service. The unwieldy institution, which has essentially been self-funded

since 1971, and has maxed out its $15 billion line of credit from the federal

government, is in financial straits itself. But what it does have is

infrastructure, with a post office in most ZIP codes, and a relationship with

residents in every kind of neighborhood, from richest to poorest.

Last week, the office of the U.S.P.S. inspector general released a white paper

noting the “huge market” represented by the population that is underserved by

traditional banks, and proposing that the post office get into the business of

providing financial services to “those whose needs are not being met.” (I wrote

a paper years ago suggesting just such an idea.) Postal banking has a powerful

advocate in Senator Elizabeth Warren, Democrat of Massachusetts, who has

publicly supported the plan.

The U.S.P.S. — which already handles money orders for customers — envisions

offering reloadable prepaid debit cards, mobile transactions, domestic and

international money transfers, a Bitcoin exchange, and most significantly, small

loans. It could offer credit at lower rates than fringe lenders do by taking

advantage of economies of scale.

The post office has branches in many low-income neighborhoods that have long

been deserted by commercial banks. And people at every level of society have a

certain familiarity and comfort in the post office that they do not have in more

formal banking institutions — a problem that, as a 2011 study by the Federal

Deposit Insurance Corporation demonstrated, can keep the poor from using even

the banks that are willing to offer them services.

Many will oppose the idea of a governmental agency providing financial services.

Camden R. Fine, chief executive of the Independent Community Bankers of America,

has already called the post office proposal “the worst idea since the Ford

Edsel.” But the federal government already provides interest-free “financial

services” to the largest banks (not to mention the recent bailout funds). And

this is done under an implicit social contract: The state supports and insures

the banking system, and in return, banks are to provide the general population

with access to credit, loans and savings. But in reality, too many are left out.

It wasn’t always this way. In 1910, President William Howard Taft established

the government-backed postal savings system for recent immigrants and the poor.

It lasted until 1967. The government also supported and insured credit unions

and savings-and-loans specifically created to provide credit to low-income

earners.

But by the 1990s, there were essentially two forms of banking:

regulated and insured mainstream banks to serve the needs of the wealthy and

middle class, and a Wild West of unregulated payday lenders and check-cashing

joints that answer the needs of the poor — at a price.

People need credit to increase their financial prospects — that’s the theory

behind government backing of student loans and mortgages. The Latin root of the

word “credit” is credere — to believe. But belief is something that mainstream

lenders lack when it comes to assessing the creditworthiness of the poor. And

yet establishing credit not only allows individual families and communities to

grow wealth, but also allows our economy to do so. Everyone benefits.

There is, of course, a certain irony in the post office, cash-strapped and maxed

out on credit, looking to elbow in on the business of check-cashing and

payday-loan storefronts. And while the U.S.P.S. white paper stresses that its

own offerings, rates and fees would be “more affordable,” a note of alarm is

raised when it highlights the potential bonanza that providing financial

services to the financially underserved could yield, stating that the result

could be “major new revenue for the Postal Service” estimated at $8.9 billion a

year. It’s a plan that could indeed save the post office, which last year

recorded a $1 billion operating loss.

In this potential transaction between an institution and a population that are

both in need, it would be wise to look back a century ago, at the last time a

similar experiment was conducted. In 1913, the chief post office inspector,

Carter Keene, declared that the postal savings system was not meant to yield a

profit: “Its aim is infinitely higher and more important. Its mission is to

encourage thrift and economy among all classes of citizens.” Any benefit to the

post office’s bottom line should not come at the expense of those who can least

afford it.

Mehrsa Baradaran is an assistant professor of law

at the University of Georgia, specializing in banking regulation.

A version of this op-ed appears in print on February 8, 2014,

on page A19 of the New York edition with the headline:

The Post Office Banks on the Poor.

The Post Office Banks on the Poor, NYT,

7.2.2014,

http://www.nytimes.com/2014/02/08/opinion/the-post-office-banks-on-the-poor.html

Enemies of the Poor

JAN. 12, 2014

The New York Times

The Opinion Pages|Op-Ed Columnist

Suddenly it’s O.K., even mandatory, for politicians with

national ambitions to talk about helping the poor. This is easy for Democrats,

who can go back to being the party of F.D.R. and L.B.J. It’s much more difficult

for Republicans, who are having a hard time shaking their reputation for reverse

Robin-Hoodism, for being the party that takes from the poor and gives to the

rich.

And the reason that reputation is so hard to shake is that it’s justified. It’s

not much of an exaggeration to say that right now Republicans are doing all they

can to hurt the poor, and they would have inflicted vast additional harm if they

had won the 2012 election. Moreover, G.O.P. harshness toward the less fortunate

isn’t just a matter of spite (although that’s part of it); it’s deeply rooted in

the party’s ideology, which is why recent speeches by leading Republicans

declaring that they do too care about the poor have been almost completely

devoid of policy specifics.

Let’s start with the recent Republican track record.

The most important current policy development in America is the rollout of the

Affordable Care Act, a k a Obamacare. Most Republican-controlled states are,

however, refusing to implement a key part of the act, the expansion of Medicaid,

thereby denying health coverage to almost five million low-income Americans. And

the amazing thing is that they’re going to great lengths to block aid to the

poor even though letting the aid through would cost almost nothing; nearly all

the costs of Medicaid expansion would be paid by Washington.

Meanwhile, those Republican-controlled states are slashing unemployment

benefits, education financing and more. As I said, it’s not much of an

exaggeration to say that the G.O.P. is hurting the poor as much as it can.

What would Republicans have done if they had won the White House in 2012? Much

more of the same. Bear in mind that every budget the G.O.P. has offered since it

took over the House in 2010 involves savage cuts in Medicaid, food stamps and

other antipoverty programs.

Still, can’t Republicans change their approach? The answer, I’m sorry to say, is

almost surely no.

First of all, they’re deeply committed to the view that efforts to aid the poor

are actually perpetuating poverty, by reducing incentives to work. And to be

fair, this view isn’t completely wrong.

True, it’s total nonsense when applied to unemployment insurance. The notion

that unemployment is high because we’re “paying people not to work” is a fallacy

(no matter how desperate you make the unemployed, their desperation does nothing

to create more jobs) wrapped in a falsehood (very few people are choosing to

remain unemployed and keep collecting benefit checks).

But our patchwork, uncoordinated system of antipoverty programs does have the

effect of penalizing efforts by lower-income households to improve their

position: the more they earn, the fewer benefits they can collect. In effect,

these households face very high marginal tax rates. A large fraction, in some

cases 80 cents or more, of each additional dollar they earn is clawed back by

the government.

The question is what we could do to reduce these high

effective tax rates. We could simply slash benefits; this would reduce the

disincentive to work, but only by intensifying the misery of the poor. And the

poor would become less productive as well as more miserable; it’s hard to take

advantage of a low marginal tax rate when you’re suffering from poor nutrition

and inadequate health care.

Alternatively, we could reduce the rate at which benefits phase out. In fact,

one of the unheralded virtues of Obamacare is that it does just that. That is,

it doesn’t just improve the lot of the poor; it improves their incentives,

because the subsidies families receive for health care fade out gradually with

higher income, instead of simply disappearing for anyone too affluent to receive

Medicaid. But improving incentives this way means spending more, not less, on

the safety net, and taxes on the affluent have to rise to pay for that spending.

And it’s hard to imagine any leading Republican being willing to go down that

road — or surviving the inevitable primary challenge if he did.

The point is that a party committed to small government and low taxes on the

rich is, more or less necessarily, a party committed to hurting, not helping,

the poor.

Will this ever change? Well, Republicans weren’t always like this. In fact, all

of our major antipoverty programs — Medicaid, food stamps, the earned-income tax

credit — used to have bipartisan support. And maybe someday moderation will

return to the G.O.P.

For now, however, Republicans are in a deep sense enemies of America’s poor. And

that will remain true no matter how hard the likes of Paul Ryan and Marco Rubio

try to convince us otherwise.

A version of

this op-ed appears in print on January 13, 2014,

on page A21 of the New York edition with the headline:

Enemies Of The Poor.

Enemies of the Poor, NYT, 12.1.2014,

http://www.nytimes.com/2014/01/13/opinion/krugman-enemies-of-the-poor.html

In the Long War on Poverty,

Small Victories That Matter

January 8, 2014

11:00 am

The New York Times

By DAVID BORNSTEIN

It was 50 years ago that President Lyndon B. Johnson started

the “war on poverty,” railing against the “lack of jobs, bad housing [and] poor

schools” that perpetuated an array of social crises, struggle and suffering amid

a sea of plenty. Given the state of poverty today, it’s tempting to believe that

the effort was a failure, and that perhaps we may never prevail against these