|

Vocapedia >

Economy > Currencies >

USA > Dollar

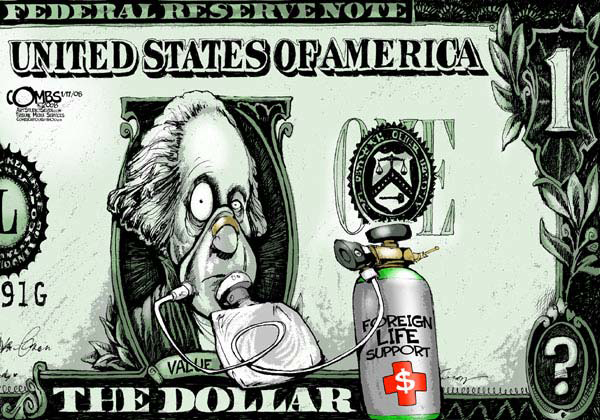

Paul Combs

editorial cartoon

The Tampa

Tribune

Cagle

17 January 2008

http://cagle.com/politicalcartoons/PCcartoons/combs.asp - broken link

Don Wright

editorial cartoon

Palm Beach , FL

Cagle

18 December 2008

Uncle Sam

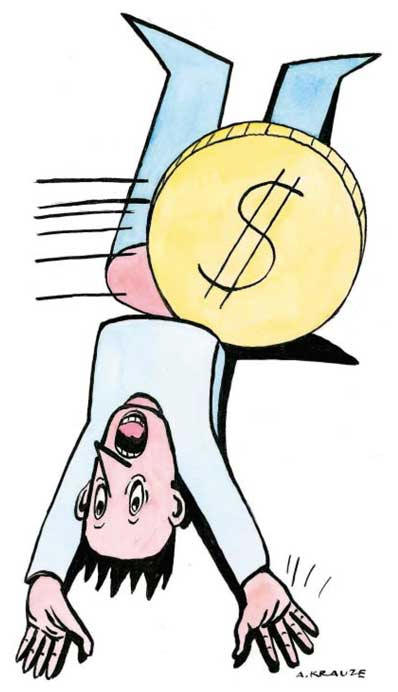

Andrzej Krauze

The Guardian p. 17 18 April 2005

Allure of the blank slate:

Naomi Klein

From

Aceh to Haiti,

a predatory form of disaster capitalism

is reshaping societies to its own design

https://www.theguardian.com/Columnists/Column/0,5673,1462290,00.html

https://www.theguardian.com/culture/2001/oct/17/artsfeatures2

podcasts > 2025

podcasts > before 2025

USA >

American dollar / US dollar / the greenback

UK / USA

https://www.nytimes.com/topic/subject/

dollar

https://www.theguardian.com/business/

dollar

https://en.wikipedia.org/wiki/

United_States_dollar

2025

https://www.npr.org/2025/07/07/

nx-s1-5455867/trump-dollar-value-debt-currency

https://www.npr.org/2025/07/04/

nx-s1-5453739/us-dollar-economy-harvard-university-kenneth-rogoff

2024

https://www.npr.org/2024/06/11/

nx-s1-4990256/strong-dollar-overseas-travel-currency-exchange-rate

2022

https://www.npr.org/2022/09/27/

1124284032/strong-dollar-euro-pound-foreign-exchange-fx-inflation

https://www.nytimes.com/interactive/2022/07/16/

business/strong-dollar.html

https://www.npr.org/2022/02/06/

1072406109/digital-dollar-federal-reserve-apple-pay-venmo-cbdc

2021

https://www.theguardian.com/business/2021/apr/02/

the-us-dollars-hegemony-is-looking-fragile

2019

https://www.npr.org/sections/money/2019/07/30/

746337868/75-years-ago-the-u-s-dollar-became-the-worlds-currency-will-that-last

https://www.nytimes.com/2019/02/22/

business/dollar-currency-value.html

2017

http://www.npr.org/2017/09/19/

551294729/the-dollar-is-weaker-but-that-may-not-be-a-bad-thing

2014

http://dealbook.nytimes.com/2014/09/25/

buoyant-dollar-underlines-resurgence-in-u-s-economy/

http://www.nytimes.com/2014/08/28/

opinion/dethrone-king-dollar.html

2012

http://www.nytimes.com/roomfordebate/2012/04/04/

bringing-dollars-and-cents-into-this-century/

2011

http://www.guardian.co.uk/business/2011/apr/26/dollar-falls-new-lows

2008

https://www.reuters.com/article/hotStocksNews/idUST244803

20080313

https://www.reuters.com/article/idUST271601

20080313

https://www.reuters.com/article/hotStocksNews/idUSL11840897

20080313

https://www.theguardian.com/business/2008/mar/13/

currencies.marketturmoil

https://www.reuters.com/article/hotStocksNews/idUST6905

20080122

2006

https://www.theguardian.com/money/2006/nov/29/

lifeandhealth.business

weak dollar

dollar peg USA

http://www.nytimes.com/reuters/2010/06/20/

business/business-us-china-yuan-forecasts.html

petrodollars UK / USA

http://www.guardian.co.uk/environment/2008/nov/02/

green-energy-oil-saudi-arabia

http://www.nytimes.com/2005/10/16/

business/worldbusiness/16view.html

dollar coin

USA

https://www.npr.org/2019/04/08/

711162059/government-watchdog-flips-on-dollar-coin

the world's reserve

currency > dollar USA

https://www.npr.org/2023/06/12/

1181062016/dollar-reserve-currency-debt-ceiling-sanctions-china

http://www.nytimes.com/2014/08/28/

opinion/dethrone-king-dollar.html

greenback

USA

https://www.nytimes.com/2014/04/02/

nyregion/two-dollar-bill-is-oddity-but-some-love-the-tender.html

$2 bill USA

https://www.nytimes.com/2014/04/02/

nyregion/two-dollar-bill-is-oddity-but-some-love-the-tender.html

dollar bills

USA

https://www.npr.org/2019/04/08/

711162059/government-watchdog-flips-on-dollar-coin

https://www.npr.org/sections/money/2012/04/19/

150976150/should-we-kill-the-dollar-bill

$20 bill

USA

http://www.npr.org/sections/thetwo-way/2016/04/20/

474983292/treasury-decides-to-put-harriet-tubman-on-20-bill

http://www.nytimes.com/2015/07/05/

opinion/sunday/take-jackson-off-the-20-bill-put-a-woman-in-his-place.html

historical figures on

the $5, $10 and $20 bills

http://www.nytimes.com/2016/04/21/

us/mlk-eleanor-roosevelt-susan-anthony.html

$100

bill

https://www.npr.org/sections/money/2020/09/15/

912695985/should-we-kill-the-100-bill

bill

USA

https://www.nytimes.com/2011/07/07/

business/07currency.html

the cent

/ penny, pennies

USA

https://en.wikipedia.org/wiki/

Penny_(United_States_coin)

https://www.npr.org/2025/05/22/

nx-s1-5407493/no-more-pennies-one-cent-treasury-stop-minting

https://www.npr.org/sections/money/2020/07/14/

890435359/is-it-time-to-kill-the-penny

https://www.npr.org/2015/11/26/

457397908/critics-wonder-whether-pennies-make-sense-anymore

buck

USA

https://www.nytimes.com/2012/10/24/

opinion/why-the-fed-should-buy-munis-not-mortgages.html

big bucks

USA

https://www.npr.org/2025/05/22/

nx-s1-5407493/no-more-pennies-one-cent-treasury-stop-minting

Corpus of news articles

Economy > Currencies > USA > Dollar

As Plastic

Reigns,

the Treasury Slows Its Printing Presses

July 6, 2011

The New York Times

By BINYAMIN APPELBAUM

WASHINGTON —

The number of dollar bills rolling off the great government presses here and in

Fort Worth fell to a modern low last year. Production of $5 bills also dropped

to the lowest level in 30 years. And for the first time in that period, the

Treasury Department did not print any $10 bills.

The meaning seems clear. The future is here. Cash is in decline.

You can’t use it for online purchases, nor on many airplanes to buy snacks or

duty-free goods. Last year, 36 percent of taxi fares in New York were paid with

plastic. At Commerce, a restaurant in the West Village in Manhattan, the bar

menus read, “Credit cards only. No cash please. Thank you.”

There is no definitive data on all of this. Cash transactions are notoriously

hard to track, in part because people use cash when they do not want to be

tracked. But a simple ratio is illuminating. In 1970, at the dawn of plastic

payment, the value of United States currency in domestic circulation equaled

about 5 percent of the nation’s economic activity. Last year, the value of

currency in domestic circulation equaled about 2.5 percent of economic activity.

“This morning I bought a gallon of milk for $2.50 at a Mobil station, and I paid

with my credit card,” said Tony Zazula, co-owner of Commerce restaurant, who

spoke with a reporter while traveling in upstate New York. “I do carry a little

cash, but only for gratuities.”

It is easy to look down the slope of this trend and predict the end of paper

currency. Easy, but probably wrong. Most Americans prefer to use cash at least

some of the time, and even those who do not, like Mr. Zazula, grudgingly concede

they cannot live without it.

Currency remains the best available technology for paying baby sitters and

tipping bellhops. Many small businesses — estimates range from one-third to half

— won’t accept plastic. And criminals prefer cash. Whitey Bulger, the Boston

gangster who lived in Santa Monica for 15 years, paid his rent in cash, and

stashed thousands of dollars in his apartment walls.

Indeed, cash remains so pervasive, and the pace of change so slow, that Ron

Shevlin, an analyst with the Boston research firm Aite Group, recently

calculated that Americans would still be using paper currency in 200 years.

“Cash works for us,” Mr. Shevlin said. “The downward trend is clear, but change

advocates always overestimate how quickly these things will happen.”

Production of paper currency is declining much more quickly than actual currency

use because the bills are lasting longer. Thanks to technological advances, the

average dollar bill now circulates for 40 months, up from 18 months two decades

ago, according to Federal Reserve estimates.

Banks regularly send stacks of old notes to the Fed, which replaces the damaged

ones. Until recently, notes were simply stacked facedown and destroyed, as were

dog-eared notes, because the Fed’s scanning equipment could not distinguish

between creases and tears. Now it can. In 1989, the Fed replaced 46 percent of

returned dollar bills. Last year it replaced 21 percent. The rest of the notes

were returned to circulation where they may lead longer lives because they are

being used less often.

The futurists who have long predicted the end of paper money also underestimated

the rise of the $100 bill as one of America’s most popular exports.

For two decades, since the fall of the Soviet Union, demand has exploded for the

$100 bill, which is hoarded like gold in unstable places. Last year Treasury

printed more $100 bills than dollar bills for the first time. There are now more

than seven billion pictures of Benjamin Franklin in circulation — and the

Federal Reserve’s best guess is that two-thirds are held by foreigners. American

soldiers searching one of Saddam Hussein’s palaces in 2003 found about $650

million in fresh $100 bills.

This is very profitable for the United States. Currency is printed by the

Treasury and issued by the Federal Reserve. The central bank pays the Treasury

for the cost of production — about 10 cents a note — then exchanges the notes at

face value for securities that pay interest. The more money it issues, the more

interest it earns. And each year the Fed returns to the Treasury a windfall

called a seigniorage payment, which last year exceeded $20 billion.

To meet foreign demand, the Fed has licensed banks to operate currency

distribution warehouses in London, Frankfurt, Singapore and other financial

centers.

In March, largely because of the boom in $100 notes, the value of all American

notes in circulation topped $1 trillion for the first time.

In the United States, research suggests that the spread of electronic payment

technologies is steadily reducing the share of payments made in cash. Drivers

use E-Z Pass at toll plazas for roads and bridges. Commuters swipe stored-value

cards at turnstiles. Christmas stockings are stuffed with gift cards.

Mr. Zazula, the restaurateur, made his decision in 2009, inspired by a flight on

American Airlines, which had just introduced a no-cash policy. He said that 85

percent of his customers already paid with credit cards, and taking cash to and

from the bank was a nuisance and security risk.

Two years later, Mr. Zazula said he had no regrets.

“You still have some people that are outraged that we won’t accept cash,” he

said, “but most of it is a show because they end up having a credit card.”

But Commerce remains a rarity. Experts on payments cannot name another no-cash

restaurant. Snap, a cafe in the Georgetown neighborhood of Washington, rejected

cash in 2006, then reversed the policy a few years later.

Businesses are not required to take cash. The famous phrase “legal tender for

all debts” means that lenders — and only lenders — are required to accept the

bills. But most merchants don’t see the point in frustrating customers.

“It’s a rarity for a retailer of any size to go cash only, and it’s a rarity to

decline to accept cash at all,” said Brian Dodge of the Retail Industry Leaders

Association, a trade group.

Even the financial industry, which has promoted the spread of electronic

payments, has moved away from grand predictions.

“There’s always going to be some people, for good or nefarious reasons, who want

to use cash,” said Doug Johnson, vice president for risk management policy at

the American Bankers Association. “I’m glad I had it yesterday,” Mr. Johnson

said. “I blew out a fan belt on my car, and it’s nice to be able to give the tow

driver a twenty.”

As Plastic Reigns, the Treasury Slows Its Printing Presses,

NYT,

6.7.2011,

https://www.nytimes.com/2011/07/07/

business/07currency.html

Where Cash Registers Go

to Get Their ‘Ka-Ching’ Back

March 10, 2009

The New York Times

By JAMES BARRON

The hair dryer whines. Brian Faerman aims. Hot air blasts into a cash

register that is about as old as he is, which is 46.

That is old enough for the cash register to have black-and-white numbers that go

up and down, not a green, glowing electronic display. That is old enough to have

rows of buttons — 10 for cents, 10 for dimes, 10 for dollars and 10 beyond that.

So to ring up a $29.95 special, you have to press four separate buttons, one by

one. This is the kind of machine that is slow. It is thoughtful. It is

onomatopoeic. Ka-ching. But it is not ka-chinging the way it is supposed to. It

is not ka-chinging at all. Hence the hair dryer.

“Steel holds cold,” he says. “Machines, they need to be warm to work.”

This machine resides on a dusty shelf in a store on the Bowery, between Broome

and Delancey Streets, that still sells and repairs cash registers. Once the

Bowery was cash register heaven. Beneath the old Third Avenue el, among the

restaurant supply stores and the flophouses and the down-and-outers who lived in

them, stores trafficked in cash registers.

Now Mr. Faerman’s father, Bernard Faerman, an old man whose hair turned white in

this store, is remembering, and counting. “There were five within a radius of

five blocks,” says the father, who is 86 and still comes in most days.

The son remembers another store. The father, busy poking a screwdriver in a cash

register, remembers another, and another. Hit the total button, check the

receipt: a grand total of eight, gone now.

The father says the Bowery has always been a barometer. The son says, “The

Bowery told what was going on — what happened here happened later everywhere

else.”

It is tempting to say, glibly, that what happened is that the others cashed in,

that they made a big profit from the real estate boom that remade skid row when

there was mortgage money to be borrowed. Maybe they did, maybe they did not.

The Faermans’ neighbors now include a bank turned catering hall, the scene of

benefits running $500 a person and up. Or, walk a few blocks to a Whole Foods

store. It’s a pricey neighborhood these days. Bernard Faerman says stores rent

for $15,000 a month. Brian Faerman says it is more than that. They own their

building, and the son says it is not for sale.

Their shelves are filled with “tombstones” in different colors: orange, gold,

copper, blue, black, silver. Tombstones are what bartenders call the tallish,

slender machines that ring up beers and martinis and the occasional burger. The

Faermans sell new electronic machines, too, but it is these old ones that are

prized by restaurateurs who want that old-fashioned look behind the bar.

A walk down the aisle at their store is like a little archaeological expedition.

The cash registers show the last total they rang up: 00.55 on that one, who

knows how long ago; 50.76 on this one. That one over there still packs a mean

stomach punch when the drawer flies open.

One machine, the kind that a lot of barber shops used to have, has a bumper

sticker: “1986 N.F.C. Champions — Giants.” They won the Super Bowl that season,

too, defeating Denver, 39-20, in January 1987.

That was nine months before a stock market collapse. Bernard Faerman says

recessions are good for business. “We make more money in recession times than in

good times,” he says. “When people get laid off, they go into any kind of

business, starting up, and they need a cash register.”

The son says, “That’s what I’ve always been told.”

What about now? Are they seeing customers who are starting out on their own?

“Not yet,” he says. He talks about banks that do not lend and a nation that does

not save the stuff that goes into the drawers of the machines they deal in. If

only the economy could be fixed in a day or two, with a handful of tools and a

hair dryer.

“There’s a way certain things were made,” Brian Faerman says. “National Cash

Register was probably the greatest manufacturing company in the world. Not only

did they make their own machines; they made their own tools. They made things

the best, and that’s why these old things still work. It’s a sad thing. Things

are made cheap now.”

Where Cash Registers Go

to Get Their ‘Ka-Ching’ Back,

NYT, 10.3.2009,

http://www.nytimes.com/2009/03/10/nyregion/10cash.html

Op-Ed Columnist

Where the Money Is

January 13, 2009

The New York Times

By BOB HERBERT

A trillion here, a trillion there ...

President-elect Barack Obama is warning us to expect trillion-dollar budget

deficits “for years to come.”

The economy is in a precipitous downturn and no one, on the left or right, is

advocating tax increases that would jeopardize a recovery.

In the meantime, we’re spending money as fast as we can: the Troubled Asset

Relief Program ($700 billion and counting); Mr. Obama’s proposed stimulus

program ($800 billion and counting); and important initiatives still to come,

like an overhaul of the way we pay for health care.

China, which has purchased more than $1 trillion of American debt, is getting

antsy. As Keith Bradsher of The Times has reported, the global downturn has

prompted Beijing “to keep more of its money at home, a move that could have

painful effects for U.S. borrowers.”

Mr. Obama has tried to assure the public that his administration will be as

careful as possible with its monumental spending, promising to invest wisely and

manage the expenditures well. And he has made it clear that he is aware of the

minefields that accompany mammoth long-term deficits.

At some point, however, someone is going to have to talk about raising revenue.

The dreaded T-word is going to come up: taxes.

Well, there’s a good idea floating around that takes its cue from the legendary

Willie Sutton. Why not go where the money is?

The economist Dean Baker is a strong advocate of a financial transactions tax.

This would impose a small fee — ranging up to, say, 0.25 percent — on the sale

or transfer of stocks, bonds and other financial assets, including the seemingly

endless variety of exotic financial instruments that have been in the news so

much lately.

According to Mr. Baker, the co-director of the Center for Economic and Policy

Research in Washington, the fees would raise a ton of money, perhaps $100

billion or more annually — money that the government sorely needs.

But there’s another intriguing element to the proposal. While the fees would be

a trivial expense for what the general public tends to think of as ordinary

traders — people investing in stocks, bonds or other assets for some reasonable

period of time — they would amount to a much heavier lift for speculators, the

folks who bring a manic quality to the markets, who treat it like a casino.

“It raises money in a way that comes primarily at the expense of speculation,”

said Mr. Baker. “The fees would be a considerable expense for someone who is

buying futures, or a stock, or any asset at 2 o’clock and then selling it at 3.

The more you trade, the more you pay.

“For the typical person holding stock, who is planning to hold it for a long

period of time, paying the quarter of one percent on a trade is just not that

big a deal.”

The fees, though small, could amount to a big deal for speculators because in

addition to the volume of their trades they often make their money on very small

margins. Someone who buys an asset and then sells it an hour later at a one

percent appreciation might feel quite pleased. He or she would be less pleased

at having to pay a quarter-percent fee to purchase the asset in the first place

and then another quarter percent to sell it.

This, according to Mr. Baker, is part of the beauty of the transfer tax; it

tends to curb at least some speculation. “It’s a very progressive tax,” he said,

“that discourages nonproductive activity.”

A hallmark of the Bush years has been the rampant irresponsibility — by the

White House, Congress and the general public — when it comes to matters of

finance. The costs of the wars in Iraq and Afghanistan were placed on credit

cards and off the books. Their ultimate overall costs will be in the trillions.

Incredibly, President Bush and Congress cut taxes in wartime, which is insane.

Budget deficits and the national debt are streaking toward the moon. And the

only remedy anyone has come up with for fending off Great Depression II has been

deficit spending on a scale reminiscent of World War II.

Excuse me, but did somebody say the baby boomers are about to start retiring?

Maybe the piper will never have to be paid. Maybe the deficits will someday

magically right themselves. Maybe some prosperous future generation will be more

than happy to clean up the mess we left behind.

If none of that is true, we should start looking now for some real money

somewhere. A stock transfer tax is not a bad place to start.

Where the Money Is, NYT,

13.1.2009,

http://www.nytimes.com/2009/01/13/opinion/13herbert.html

Money

Makes the Political World

Go Around

November 2,

2008

Filed at 11:49 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON

(AP) -- What's your vote worth? Because Barack Obama and John McCain can spend

about $8 to get it.

Together, the two presidential candidates have amassed nearly $1 billion -- a

stratospheric number in a campaign of record-shattering money numbers. Depending

on turnout, $1 billion means nearly $8 for every presidential vote, compared

with $5.50 in 2004.

And that's just McCain and Obama. All the presidential candidates in the

2007-2008 contest took in $1.55 billion, nearly twice the amount collected by

candidates in 2004 and three times the amount from 2000. The total includes

fundraising for the primaries as well as the general election.

Using all that cash, the candidates have traveled more miles, employed more

workers and advertised more than ever.

But it has been Obama, with his $641 million and 3.2 million donors, who has

rewritten the rules for financing campaigns.

He abandoned the public financing system -- after pledging to participate if

McCain did -- and became the first major party candidate to raise private funds

to pay for a general election since the campaign money reforms of the Watergate

era. McCain did take public funds, but Obama's success left little doubt that

taxpayer-supported presidential campaigns, as currently configured, are 20th

century relics.

Neither Obama nor McCain participated in public financing during the primaries.

McCain's acceptance of $84 million in general election public financing also

came with limitations on spending. He continued to raise money for the

Republican Party, though, which so far has spent about $100 million on his

behalf to supplement his public funds.

Obama mastered new technology, turning the Internet into an incredible political

networking tool and attracting record numbers of donors giving less than $200.

While that flood of money raised new questions about the safeguards of Internet

fundraising, it also helped dilute the role of big money donors and fundraisers.

''When you have that many contributors, I think it does, in a weird way, cleanse

the system even though it seems like that much more money,'' the Federal

Election Commission chairman, Republican Donald F. McGahn II, said recently.

''That many more contributors disperse the influence of any one contributor.''

Some of the financial highlights from the presidential campaign:

The total is almost the same as what the Federal Trade Commission says food and

beverage companies spend in a year marketing their products to children.

--Selling politics like burgers: With all that money, Obama has blanketed the

country with his message. As of mid-October, he had spent $240 million on

broadcast ads to penetrate old battlegrounds and to help create new ones. He

spent $77 million in the first two weeks of October, more than McDonald's spends

on ads in a month. He pinpointed audiences with ads on such video games as

''Guitar Hero'' and ''Madden NFL 09.''

He also went global, with national network advertising that culminated with a $4

million-plus half hour buy on prime time six days before the election. His

spending stretched McCain's resources; the Republican had spent about $116

million as of mid-October.

--Bad apple, bad money: Some fundraisers put campaigns in awkward situations.

Barack Obama donated to charity tens of thousands of dollars in donations to his

past campaigns that were linked to convicted Chicago developer Antoin ''Tony''

Rezko. Democratic Sen. Hillary Rodham Clinton returned more than $800,000 to

donors whose contributions were linked to Norman Hsu, a fundraiser who was

wanted in California on charges of bilking investors. Hsu was subsequently

indicted in New York on federal charges of fraud and violating campaign finance

laws.

--Bundle up some cold hard cash: Perfecting a fundraising practice initially

mastered by George W. Bush, presidential candidates enlisted fundraisers to

raise thousands upon thousands of dollars for them. These are the well-connected

money people to whom a campaign is ultimately indebted. Both McCain and Obama

list their fundraisers -- or bundlers, as they are known -- on their Web sites.

McCain's are easier to find than Obama's. But unlike McCain, Obama lists the

fundraisers' home towns.

--Who are those small donors, anyway: Obama has raised about half of his money

in increments of $200 or less. The average contribution is $86, the campaign

says. But the success of the Internet fundraising effort has also led to some

puzzling donors. Individuals have been credited with giving tens of thousands of

dollars to the Obama campaign, far more than the $2,300 limit. Obama has

reported more than $17,000 in contributions from a donor identified as ''Doodad

Pro'' and more than $11,000 from one identified as ''Good Will.''

''I wouldn't be surprised if the FEC doesn't address this in the next couple of

years -- what you have to put on your Web site for soliciting contributions,''

said Bradley A. Smith, a former FEC chairman and a law professor at Capital

University Law School in Columbus, Ohio.

--I show mine, you don't show yours: Federal law requires candidates to identify

only those donors who contribute, in the aggregate, more than $200. But McCain

has made his entire donor database available through his Web site. Obama has

not, drawing criticism.

------

On the Net:

Federal campaign finance law:

http://www.fec.gov/law/feca/feca.shtml

Money Makes the Political World Go Around, NYT, 2.11.2008,

http://www.nytimes.com/aponline/washington/

AP-What-It-Takes.html

A Shortage at the Pump:

Not of Gas, but of 4s

July 15, 2008

The New York Times

By KEN BELSON

If one is the loneliest number, then four is the hottest — at

least when it comes to gasoline.

With regular gas in New York City at a near-record $4.40 a gallon, station

managers are rummaging through their storage closets in search of extra 4s to

display on their pumps. Many are coming up short.

That’s why Vishal Nair, who runs the Lukoil station at Eighth Avenue and 13th

Street in Greenwich Village, took another plastic number last week, turned it

over and scribbled “4” on it with a black magic marker. The result was an

obviously homemade “$4.47,” but it would have to do until he received the extra

4s he ordered months ago.

“Typically, we have a lot of 9s and 1s, and we had a shortage of 3s before we

got a lot of 3s in,” Mr. Nair said.

The missing digits are an unanticipated barometer of how frequently prices are

changing. The average price of regular gasoline in New York City has risen by 35

percent this year, forcing station managers to change their price displays

almost every time they get a delivery, which can be daily at some stations.

Franchises often order numbers from their parent companies, though like

independent station owners, they can buy directly from sign companies. Sets of

40 include equal numbers of each digit, which are magnetic or slip into plastic

holders. Digits, which are often in a Helvetica font, are sold individually for

as little as a $1.50. In New York, numbers must be 4.5 or 9 inches tall.

When prices passed $4, many stations ran out of 4s, and managers improvised by

photocopying signs or stenciling numbers by hand.

The makeshift digits are legal as long as they are similar to the neighboring

numbers, said John Browne, the assistant director of enforcement for the city’s

Department of Consumer Affairs’ petroleum unit.

“As long as the color and size are correct and it is apparent what the number

is, they are fine,” said Mr. Browne, who inspected Mr. Nair’s handiwork last

Friday at the Lukoil station.

Jessica Chittenden, a spokeswoman for the state’s Department of Agriculture and

Markets, which regulates gas stations, said inspectors were being lenient

because prices were changing so rapidly and because few manufacturers made the

signs.

“People are running out of 4s and 5s, so we’re allowing them to post makeshift

numbers as long as they are the right size,” she said.

Sanjay Thakker, president of Gasoline Advertising in Clifton, N.J., said that

sales of his magnetic digits had risen as much as 20 percent this year, though

because it costs only about $10 to outfit the signs above the pumps with enough

numbers, the product is not a huge money maker.

Until extra digits arrive, improvising can be tricky. Alex Kubotki, 27, who runs

the Exxon on Coney Island Avenue at Caton Avenue in Brooklyn, ran out of 4s for

his large sign on the corner. So on Sunday, he painted a fresh “4” that was

roughly the same as the manufactured digit, and avoided using a paper number

because it might bleed in the rain.

“Everybody’s doing the same thing,” he said.

Even stations in New Jersey, where gasoline prices have only recently breached

the $4 barrier, are getting ready. At the Getty station on Tonnelle Avenue in

North Bergen, Jatinder Sarin, the manager, said he will order a bunch of new

magnetic numbers next month. He was selling a gallon of regular gasoline for

$3.85, but assumed that $4 a gallon was inevitable.

“We know it’s going to go up,” he said. “Usually it goes a digit up, and it

stays there five or six months. Let’s hope they stay at 4.”

But back in New York, stations are already grappling with the next problem.

“Now that we seem to be going to go to $5 a gallon,” Mr. Nair said, “we might

order more 5s, too.”

In fact, diesel prices are already over $5 a gallon.

On Monday, at a BP station on Coney Island Avenue and Lancaster Avenue in

Gravesend, Brooklyn, a “2” had been turned upside down to make a 5 for the large

sign on the corner.

“I don’t have enough 5s,” said Serdal Ozumer, 51, a clerk. “I got to talk to the

manager.”

Ann Farmer, Daryl Khan and Nate Schweber

contributed reporting.

A Shortage at the

Pump: Not of Gas, but of 4s, NYT, 15.7.2008,

http://www.nytimes.com/2008/07/15/nyregion/15four.html

Bush

says

strong dollar in U.S. interest

Mon Jun 9,

2008

9:43am EDT

Reuters

By Tabassum Zakaria

WASHINGTON

(Reuters) - U.S. President George W. Bush acknowledged economic concerns as he

left for Europe on Monday, saying the United States was committed to a strong

dollar and that energy prices were high.

"I'll talk about our nation's commitment to a strong dollar. A strong dollar is

in our nation's interests. It is in the interests of the global economy," Bush

said at the White House before departing for a U.S.-European Union summit in

Slovenia.

The dollar tumbled on Friday after a jump in the unemployment rate underscored

the U.S. economy's weakness and was a factor that contributed to the biggest

one-day price gain in the history of the oil market. Oil surged by nearly $11 a

barrel to a record above $139.

Europeans are concerned about the dollar's weakness and have urged the Bush

administration to speak up more forcefully in defense of the U.S. currency.

Since oil is priced in dollars, Europeans blame some of their inflation

pressures on the dollar's weakening value and fear the cheap dollar will make

their products more expensive in U.S. consumer markets.

Bush will discuss the economy with European leaders during his June 9-16 trip,

which will include stops in Germany, Italy, France and Britain.

"Our economy is large and it's open and flexible," Bush said. "Our capital

markets are some of the deepest and most liquid. And the long-term health and

strong foundation of our economy will shine through and be reflected in currency

values."

He said he recognized the public was concerned about the U.S. economy in the

face of rising energy prices.

"A lot of Americans are concerned about our economy," Bush said. "I can

understand why. Gasoline prices are high, energy prices are high."

He said he would discuss with European allies the need to advance technologies

to become less dependent on hydrocarbons. Bush reiterated his stance that the

United States should increase domestic oil production and that Congress should

allow drilling in Alaska's Arctic National Wildlife Refuge.

Record-high oil prices have raised concerns about the impact on the U.S.

economy, which is barely growing. The U.S. unemployment rate jumped to 5.5

percent in May, its highest in more than 3-1/2 years, contributing to renewed

fears that the U.S. economy was at risk of sliding into recession.

"The U.S. economy has continued to grow in the face of unprecedented

challenges," Bush said.

"We got to keep our economies flexible. Both the U.S. economy and European

economies need to be flexible in order to deal with today's challenges," he

said.

Bush said he also would discuss with European allies the need to do more to help

Afghanistan. His wife, Laura, visited Afghanistan during the weekend and

reported that she saw progress but also "there's a lot of work to be done," Bush

said.

(Editing by Bill Trott)

Bush says strong dollar in U.S. interest, R, 9.6.2008,

http://www.reuters.com/article/politicsNews/

idUSN0944596220080609

Dollar Falls Against Euro, Yen

March 17, 2008

Filed at 12:09 p.m. ET

The New York Times

By THE ASSOCIATED PRESS

BERLIN (AP) -- The dollar fell to record low against the euro

on Monday, and sank to its lowest level in more than 12 years against the

Japanese yen as investors reacted to the latest emergency rate cut by the U.S.

Federal Reserve and to news that JPMorgan Chase is buying rival investment bank

Bear Stearns for a fraction of what it was worth last week.

In European trading, the euro rose as high as $1.5904 but soon fell back to

$1.5746. That was still above the $1.5687 it bought late Friday in New York

trading.

The U.S. Commerce Department said that the deficit in the current account

dropped by 9 percent last year to $738.6 billion. Later, the Fed said U.S.

industrial output fell half a percent in February, the biggest amount in four

months.

The dollar fell as low as 95.72 Japanese yen, its lowest since August 1995,

before recovering to 97.03 yen but still below the 99.21 yen it bought in New

York on Friday. The dollar broke below 100 yen just last Thursday.

The lows came a day after the Fed approved a cut in its emergency lending rate

to financial institutions to 3.25 percent from 3.5 percent.

Also on Sunday, JPMorgan Chase & Co. said it would acquire Bear Stearns for

$236.2 million in a deal backed by the Fed. JP Morgan will pay $2 per share,

down from Bear Stearns closing price of $30 per share on Friday.

''It has certainly been something of an historic weekend, with an emergency Fed

rate cut and news that J.P. Morgan intends to acquire Bear Stearns marking the

next chapter in the credit crisis,'' said James Hughes of CMC Markets in London.

''Unsurprisingly this has been broadly bad news for the dollar with (the)

euro-dollar managing a short-lived breach above 1.5900 -- yet another all-time

record high -- although this has been short lived with profit takers stepping

in,'' Hughes said.

The Fed is scheduled to meet Tuesday, and analysts are predicting that the

central bank could reduce its 3 percent benchmark rate on overnight loans

between commercial banks by as much as another percent.

The European Central Bank, by comparison, has left its own rate at 4 percent as

inflation in the 15-nation euro zone hit yet another record high last month.

Lower interest rates can jump-start a nation's economy, but can also weigh on

its currency as traders transfer funds to countries where they can earn higher

returns.

So far the ECB has remained steadfast in keeping its rates unchanged because

inflation has been so high, but politicians and some companies have bemoaned the

strong euro because it makes goods produced in the euro zone far more expensive

elsewhere and undermines exports.

However, at the same time, the higher euro can increase domestic purchasing

power.

The Bank of England said Monday it will offer an extra 5 billion pounds --

around $10.1 billion -- of reserves into the short-term money market because of

conditions in the market.

The dollar rose against the British pound, which fell to $2.0059 from $2.0218 on

Friday.

Dollar Falls Against

Euro, Yen, NYT, 17.3.2008,

http://www.nytimes.com/aponline/business/AP-Dollar.html

Dollar Weakens to $1.50 to the Euro

February 27, 2008

The New York Times

By CARTER DOUGHERTY

The dollar breached the level of $1.50 to the euro on Wednesday for the first

time as fears of weakness in the United States economy mixed with evidence of

resilience in Europe.

In Asian trading, the euro hit $1.5047 after flirting with the $1.50 level in

New York Tuesday. That was the dollar’s weakest position since the euro, now the

currency of 15 countries, was introduced in 1999. In New York, the dollar

continued to weaken and was trading at $1.5126 at 12:30 p.m.

“Psychologically and symbolically, this is a significant move,” said Tony

Morriss, senior currency strategist with Australia & New Zealand Banking Group

in Sydney. “The economic numbers out of the U.S. have been uniformly terrible,

and we are entering a new phase of dollar weakness.”

The dollar has weakened steadily in recent weeks after recovering from similar

levels in November on the emerging realization that the Federal Reserve, despite

worries about inflation in the United States, will keep cutting interest rates

to protect economic growth at the same time that the European Central Bank is

holding rates steady.

Interest rate differentials drive currency movements by decreasing the appeal of

dollar-denominated assets. Donald L. Kohn, vice chairman of the Fed, played down

the risks of inflation in the United States on Tuesday, focusing instead on the

risks to economic growth — a clear sign the Fed has not finished the

rate-cutting cycle it began after the start of financial market turmoil late

last summer.

“The Fed’s stance is really aggressive,” said Stephen Jen, chief currency

economist at Morgan Stanley in London. “Every time we think the Fed is eyeing

inflation, they turn around and cut rates.”

Another round of weakness has the potential to increase political tensions in

Europe, though so far France is the only country that has consistently

complained about the strong euro. Though it has acknowledged the potential costs

of a stronger euro, Germany has remained upbeat, saying it is not worried.

Volker Trier, the chief economist of the German Chambers of Industry and

Commerce, largely echoed this view on Wednesday.

“The euro’s strength is hurting here and there,” Mr. Trier said, according to

Reuters. “Over all, though, the economy can still cope with it well.”

Asian currencies have also risen against the dollar, but exporters there can

take comfort in the fact that any pain is being broadly shared.

“Asian currencies are uniformly appreciating against the U.S. currency due to

dollar weakness, rather than any single Asian currency rapidly firming against

the others,” said Cem Karacadag, director in the emerging markets economics

group at Credit Suisse in Singapore. “So, no single country is going to lose

export share to its competitors in the region.”

Dollar Weakens to $1.50

to the Euro, NYT, 27.2.2008,

http://www.nytimes.com/2008/02/27/business/27cnd-dollar.html

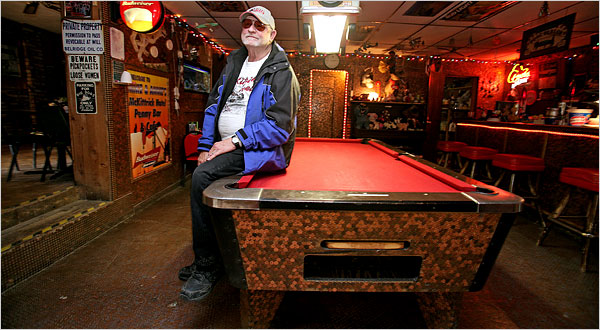

Over six years, Mike Moore

affixed nearly one million pennies

to

the bar he owns with his wife, Annie.

Now the place is up for sale, pennies and all.

Photograph: Monica Almeida

The New York Times

See a Penny,

Pick It Up and ‘Honey, Get the Glue!’

NYT

January 7, 2007

https://www.nytimes.com/2007/01/07/

us/07penny.html

McKittrick

Journal

See a Penny, Pick It Up

and ‘Honey, Get the Glue!’

January 7,

2007

The New York Times

By RANDAL C. ARCHIBOLD

McKITTRICK,

Calif., Jan. 4 — It began innocently enough, like most casual obsessions. Annie

Moore dropped a penny into an empty coffee can. Clink.

And then another. Clink. And soon enough, many, many more. Mrs. Moore began

scouring parking lots for lost pennies. Clink, clink, clink. She filled several

cans.

Like many penny hoarders, she was never sure what to do with all of them — until

she and her husband bought a roadside bar and cafe in this speck of a town in

California oil country near Bakersfield. Why not, she asked her husband, Mike,

festoon the bar with the pennies? And he dutifully obliged the crazy idea, using

regular Elmer’s glue to affix them from one end of the bar to another.

Job well done. Well, almost.

“I said that was a nice start, but I meant the whole bar, everything,” Mrs.

Moore said with a laugh. She is the laughing one of the pair. Mr. Moore is the

grumbler, and it is no wonder.

It was his task to complete the job, penny by painstaking penny, six years of

gluing, gluing and gluing.

Now, one million pennies later — from Annie’s cans, customers with loose change

and not a few trips to the bank for exchanges — Mike & Annie’s Penny Bar is a

sight to behold. The pennies, like a swarm of copper ants, cover nearly every

surface: the floor, the walls, even the sides of the pool table.

Mr. Moore did not exactly count out one million pennies, but after calculating

304 pennies per square foot of surface area, he figures it is pretty close.

“It’s 200,000 on the floor alone,” he said proudly.

There are surprises. Mr. Moore used different shadings of pennies, old and new,

to spell out a few messages that the sober may miss without squinting: “No

Fishing,” under a fish tank. “I was a TV,” over an old television set. “Mike

(heart) Annie,” on the back wall behind a row of liquor bottles. (These compete

with an assortment of bumper stickers with messages like “Don’t suffer from

insanity, enjoy every minute of it.”)

Mr. Moore did not enjoy every minute of this job, especially when pennies kept

loosening from the ceiling railings. And it was not done entirely out of love.

Mrs. Moore paid him a bribe of a Harley-Davidson motorcycle a couple of years

ago.

Of course, they do appreciate the tourists.

“It is kind of a regional attraction,” said Kial Gunter, an oil field worker,

whose beer one afternoon sat close to the bar’s prize possession, an 1883 Indian

head penny. The oldest of the lot, it sits unheralded among its contemporary

brethren beneath the hard plastic that covers the bar top.

“I didn’t even know it was there until a customer pointed it out to me one day,”

Mr. Moore said. After a while, a penny is a penny.

The bar and cafe are what is left of the McKittrick Hotel, which has not

operated as one for decades and is one of just a few businesses downtown, such

as it is. A road sign off Highway 33, the main drag, gives the population as

190, but Jan Heim, a local rancher, said, “I think they were counting cats and

dogs.”

Still, the Moores are preparing to give it all up. They have put the place up

for sale, asking $899,999.98, “as is,” pennies included.

It is time to retire, they said, exhausted from the crush of business.

Illness sidelined Mr. Moore from much of the cafe work and penny-laying a couple

of years ago. Mrs. Moore, working seven days a week, is ready for some fishing.

For lunch each day she cooks about 80 steak specials on two outdoor grills, and

she often does many more for the dinner crowd.

The establishment’s pennies surely lure some, but it is also the only restaurant

to speak of for the growing number of energy workers in this part of Kern

County, which locals have nicknamed West Texas for all the oil derricks and

natural-gas plants.

Attractions are few.

“Who the heck would live in a godforsaken place like this?” Mr. Moore recalled

asking when he first passed through in the early 1970s, on the way to visit one

of Mrs. Moore’s aunts, who lived in town.

But the Moores were interested in getting out of the termite-extermination

business they had operated in Eureka, Calif., and so they rented and operated

the cafe for several months then. They went back to crawling under houses for a

few more decades before quitting eight years ago and buying the McKittrick Hotel

outright, moving in to some of the rooms upstairs.

From their travels they had grown fond of greasy spoons, and they dreamed of

owning one in a quiet, simple place. But every little cafe needs a quirk, and

that is where the pennies came in. Those, coupled with Mrs. Moore’s secret steak

marinade, have drawn the masses ever since.

Television stations and magazines have visited over the years, and usually

donations of pennies have followed. One customer left a five-gallon bucket full

of them.

The Moores are leaving it up to the next owner to decide the pennies’ fate, but

they hope they will remain. At the very least, someone has to keep up the penny

puns, which have been difficult to avoid to this point — but it is time for a

change.

“I guess,” Mrs. Moore said, “the buyer needs to be penny-wise.”

See a Penny, Pick It Up and ‘Honey, Get the Glue!’,

NYT,

7.1.2007,

https://www.nytimes.com/2007/01/07/

us/07penny.html

Explore more on these topics

Anglonautes > Vocapedia

economy, money,

shopping, bills, taxes,

housing market,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

America, USA, Americana >

iconic words

Related > Anglonautes >

Arts >

Cartoons

the poor / the rich

|