|

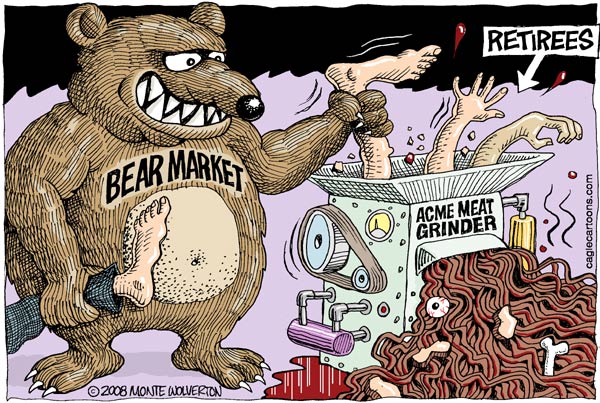

History > 2008 > USA > Economy (XIIa)

Monte Wolverton

The Wolvertoon

Cagle

1 December 2008

Fannie to Help Renters

Stay in Foreclosed Homes

December 15, 2008

Filed at 11:38 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

NEW YORK (AP) -- Fannie Mae said Monday it's finalizing a plan to help

renters stay in their homes even if their landlord enters foreclosure.

The mortgage giant said it's working on a national policy to allow renters

living in foreclosed properties -- and who can make their rental payments -- to

sign new leases with Fannie while the property is up for sale or get cash to

help move into a new home.

Last month, Fannie and sibling company Freddie Mac suspended foreclosure sales

on occupied single-family homes and evictions from those properties through the

holidays until Jan. 9, 2009. Fannie said these actions helped an estimated 7,000

to 10,000 families to remain in their homes.

The company said the new renter policy will go in effect before Jan. 9.

Last week, New Haven Legal Assistance Association Inc. in Connecticut, which

represents several tenants facing eviction on properties held by Fannie Mae,

raised the concerns about renter evictions and discussed the situation with

Fannie on Friday.

''Fannie Mae had the tendency to empty these properties with no attempt before

or after the foreclosure to contact these tenants,'' said Amy Marx, an attorney

at the legal aid group. ''A lot of these renters are low-income and an eviction

wreaks havoc on their lives due to moving costs and the lack of affordable

housing.''

Despite the suspension on foreclosure sales and evictions, some Fannie evictions

were still going forward, Marx said. Fannie said Monday it contacted its lawyer

and broker network to halt those evictions.

Fannie and sibling company Freddie Mac own or guarantee about half of the $11.5

trillion in U.S. outstanding home loan debt. The government seized control of

the pair in September.

Company spokesman Brad German said Monday that Freddie Mac also aims to have a

similar plan in place by early January.

''Clearly, renters are caught in the crossfire,'' German said. ''The goal is to

provide them some stability and not evict them as a result of another's

foreclosure.''

Fannie to Help Renters

Stay in Foreclosed Homes, NYT, 15.12.2008,

http://www.nytimes.com/aponline/2008/12/15/business/AP-Fannie-Mae-Renters.html

Fraud Inquiry Centers

on Investment Firm’s Sanctum

December 15, 2008

The New York Times

By DIANA B. HENRIQUES and ALEX BERENSON

The epicenter of what may be the largest Ponzi scheme in history was the 17th

floor of the Lipstick Building, an oval red-granite building rising 34 floors

above Third Avenue in Midtown Manhattan.

A busy stock-trading operation occupied the 19th floor, and the computers and

paperwork of Bernard L. Madoff Investment Securities filled the 18th floor.

But the 17th floor was Bernie Madoff’s sanctum, occupied by fewer than two dozen

staff members and rarely visited by other employees. It was called the “hedge

fund” floor, but federal prosecutors now say the work Mr. Madoff did there was

actually a fraud scheme whose losses Mr. Madoff himself estimates at $50

billion.

The tally of reported losses climbed through the weekend to nearly $20 billion,

with a giant Spanish bank, Banco Santander, reporting on Sunday that clients of

one of its Swiss subsidiaries have lost $3 billion. Some of the biggest losers

were members of the Palm Beach Country Club, where many of Mr. Madoff’s wealthy

clients were recruited.

The list of prominent fraud victims grew as well. According to a person familiar

with the business of the real estate and publishing magnate Mort Zuckerman, he

is also on a list of victims that already included the owners of the New York

Mets, a former owner of the Philadelphia Eagles and the chairman of GMAC.

And the 17th floor is now an occupied zone, as investigators and forensic

auditors try to piece together what Mr. Madoff did with the billions entrusted

to him by individuals, banks and hedge funds around the world.

So far, only Mr. Madoff, the firm’s 70-year-old founder, has been arrested in

the scandal. He is free on a $10 million bond and cannot travel far outside the

New York area.

According to charges against Mr. Madoff, his firm paid off earlier investors

with money from new investors, fitting the classic definition of a Ponzi scheme.

It unraveled as markets declined and many investors who lost money elsewhere

sought to withdraw money from their investments with Mr. Madoff.

But a question still dominates the investigation: how one person could have

pulled off such a far-reaching, long-running fraud, carrying out all the simple

practical chores the scheme required, like producing monthly statements, annual

tax statements, trade confirmations and bank transfers.

Firms managing money on Mr. Madoff’s scale would typically have hundreds of

people involved in these administrative tasks. Prosecutors say he claims to have

acted entirely alone.

“Our task is to find the records and follow the money,” said Alexander

Vasilescu, a lawyer in the New York office of the Securities and Exchange

Commission. As of Sunday night, he said, investigators could not shed much light

on the fraud or its scale. “We do not dispute his number — we just have not

calculated how he made it,” he said.

Scrutiny is also falling on the many banks and money managers who helped steer

clients to Mr. Madoff and now say they are among his victims.

Mr. Madoff was not running an actual hedge fund, but instead managing accounts

for investors inside his own securities firm.

While many investors were friends or met Mr. Madoff at country clubs or on

charitable boards, even more had entrusted their money to professional advisory

firms that, in turn, handed it to Mr. Madoff — for a fee. Investors are now

questioning whether these paid advisers were diligent enough in investigating

Mr. Madoff to ensure that their money was safe. Where those advisers work for

big institutions like Banco Santander, investors will most likely look to them,

rather than to the remnants of Mr. Madoff’s firm, for restitution.

Santander may face $3.1 billion in losses through its Optimal Investment

Services, a Geneva-based fund of hedge funds that is owned by the bank. At the

end of 2007, Optimal had 6 billion euros, or $8 billion, under management,

according to the bank’s annual report — which would mean that its Madoff

investments were a substantial part of Optimal’s portfolio.

A spokesman for Santander declined to comment on the case.

Other Swiss institutions, including Banque Bénédict Hentsch and Neue Privat

Bank, acknowledged being at risk, with Hentsch confirming about $48 million in

exposure.

BNP Paribas said it had not invested directly in the Madoff funds but had 350

million euros, or about $500 million, at risk through trades and loans to hedge

funds. And the private Swiss bank Reichmuth said it had 385 million Swiss

francs, or $327 million, in potential losses. HSBC, one of the world’s largest

banks, also said it had made loans to institutions that invested in Madoff but

did not disclose the size of its potential losses.

Calls to Mr. Zuckerman and his representatives were not returned on Sunday

night.

Losses of this scale simply do not seem to fit into the intimate business that

Mr. Madoff operated in New York.By the elevated standards of Wall Street, the

Madoff firm did not pay exceptionally well, but it was loyal to employees even

in bad times. Mr. Madoff’s family filled the senior positions, but his was not

the only family at the firm — generations of employees had worked for Madoff and

invested their savings there.

Even before Madoff collapsed, some employees were mystified by the 17th floor.

In recent regulatory filings, Mr. Madoff claimed to manage $17 billion for

clients — a number that would normally occupy far more than the 20 or so people

who worked on 17.

One Madoff employee said he and other workers assumed that Mr. Madoff must have

a separate office elsewhere to oversee his client accounts.

Nevertheless, Mr. Madoff attracted and held the trust of companies that prided

themselves on their diligent investigation of investment managers.

One of them was Walter M. Noel Jr., who struck up a business relationship with

Mr. Madoff 20 years ago that helped earn his investment firm, the Fairfield

Greenwich Group, millions of dollars in fees. Indeed, over time, one of

Fairfield’s strongest selling points for its largest fund was its access to Mr.

Madoff.

But now, Mr. Noel and Fairfield are the biggest known losers in the scandal,

facing potential losses of $7.5 billion, more than half the firm’s assets.

Jeffrey Tucker, a Fairfield co-founder and former federal regulator, said in a

statement posted on the firm’s Web site: “We have worked with Madoff for nearly

20 years, investing alongside our clients. We had no indication that we and many

other firms and private investors were the victims of such a highly

sophisticated, massive fraudulent scheme.”

The huge loss comes at a time when the hedge fund industry has already been

wounded by the volatile markets. Several weeks ago, Fairfield had halted

investor redemptions at two of its other funds, citing the tough market

conditions as dozens of hedge funds have done. The firm reported a drop of $2

billion in assets between September and November.

Fairfield was founded in 1983 by Mr. Noel, the former head of international

private banking at Chemical Bank, and Mr. Tucker, a former Securities and

Exchange Commission official. It grew sharply over the years, attracting

investors in Europe, Latin America and Asia.

Mr. Noel first met Mr. Madoff in the 1980s, and Fairfield’s fortunes grew along

with the returns Mr. Madoff reported. The two men were very different: Mr.

Madoff hailed from eastern Queens and was tied closely to the Jewish community,

while Mr. Noel, a native of Tennessee, moved in the Greenwich social scene with

his wife, Monica.

“He was a person of superb ethics, and this has to cut him to the quick,” said

George L. Ball, a former executive at E. F. Hutton and Prudential-Bache

Securities who knows Mr. Noel.

Fairfield boasted about its investigative skills. On its Web site, the firm

claimed to investigate hedge fund managers for 6 to 12 months before investing.

As part of the process, a team of examiners conducted personal background

checks, audited brokerage records and trading reports and interviewed hedge fund

executives and compliance officials.

In 2001, Mr. Madoff called Fairfield and invited the firm to inspect his books

after two news reports questioned the validity of his returns, according to a

person close to Fairfield. Outside auditors hired to inspect Mr. Madoff’s

operations concluded that “everything checked out,” this person said.

The Fairfield Greenwich Group “performed comprehensive and conscientious due

diligence and risk monitoring,” Marc Kasowitz, a lawyer for Fairfield, said in a

statement. “FGG, like so many other Madoff clients, was a victim of a highly

sophisticated massive fraud that escaped the detection of top institutional and

private investors, industry organizations, auditors, examiners and regulatory

authorities.”

Now, Fairfield is seeking to recover what it can from Mr. Madoff.

“It is our intention to aggressively pursue the recovery of all assets related

to Bernard L. Madoff Investment Securities,” Mr. Tucker said in a statement. “We

are also committed to the operation of our continuing funds. We hope to have a

better idea of the entire situation as the facts develop.”

Working alongside the federal investigators on Madoff’s 17th floor, staff

workers for Lee S. Richards 3d, the court-appointed receiver for the firm, are

trying to determine what parts of the firm can keep operating to preserve assets

for investors.

“We don’t have anything to report to investors at this time,” he said. “We are

doing everything we can to protect the assets of the Madoff entities that are

subject to the receivership, and to learn what we can about the operations of

those entities.”

Eric Dash, Jennifer 8. Lee, Zachery Kouwe, Michael J. de la Merced and Nelson D.

Schwartz contributed reporting.

Fraud Inquiry Centers on

Investment Firm’s Sanctum, NYT, 15.12.2008,

http://www.nytimes.com/2008/12/15/business/15madoff.html?hp

A Palm Beach Enclave,

Stunned by an Inside Job

December 15, 2008

The New York Times

By IAN URBINA

PALM BEACH, Fla. — The room of somber whispers fell silent when the two men

walked in.

Just days after the collapse of Bernard L. Madoff’s suspected $50 billion Ponzi

scheme, two of his emissaries returned to the epicenter of the financial

disaster to face some of the hardest-hit investors, many of them old friends

whom they had recruited to invest in Mr. Madoff’s firm.

As Carl J. Shapiro and Robert M. Jaffe sat down at the Men’s Grill of the Palm

Beach Country Club they scanned an awkwardly quiet room, seemingly looking for

friendly faces and reassuring nods.

The moment was a stark reversal for two men whom people used to trip over

themselves to meet in hopes of a chance to invest with Mr. Madoff.

“You doing O.K.?” asked one of the several club members who approached the men

in a show of support. “We’re here for you.”

While the fallout from Mr. Madoff’s suspected con game shook investors around

the world, perhaps nowhere was there a higher concentration of victims than in

this room. Investors were said to have paid hundreds of thousands of dollars a

year to remain members of this club in hopes of an introduction to Mr. Madoff,

usually by Mr. Jaffe or Mr. Shapiro. Mr. Madoff has been a member since 1996.

But more than wealth, these people seemed to have lost a sense of trust and

prestige. During a visit to the club on Saturday, many members, asked for their

reactions, requested not to be named because they did not want to ruin their

standing among friends.

In Mr. Madoff’s fall, their world turned upside down, they said. Those who

prided themselves as financially savvy suddenly seemed gullible. The trusted

friend, sage adviser and model philanthropist they thought they knew was now

charged with being a multibillion-dollar swindler.

There is no evidence that either Mr. Shapiro, who is 95 and joined the club in

1974, or his son-in-law, Mr. Jaffe, who is 64 and joined in 1992, knew of the

fraud. Both men, who give millions every year to countless charities, are also

said to have been duped of hundreds of millions of their own money, according to

friends of their families.

But as a steady stream of older men in pastel sweaters and sockless

penny-loafers slowly stood and approached the center table for hushed

conversations and to offer pats on their backs, Mr. Shapiro and Mr. Jaffe looked

ashen.

“All I can say is that this is an awful awful time for us,” Mr. Shapiro’s wife,

Ruth, said in a short phone interview.

This was not the first swindle to hit this country club, which was formed in the

1950s by Jewish residents who had been barred from other island haunts.

Only three years ago, a handful of its members were victims of a similar, albeit

smaller, pyramid scheme. Two men, John and Yung Kim, ran a company called the KL

Group, which was based on the island and bilked investors of more than $190

million.

“But everyone at the club saw this differently,” said Laurence Leamer, an island

resident and author of a forthcoming book, “Madness Under the Royal Palms,”

about the island’s elite.

“Anyone can get robbed,” he said. “Madoff’s scam was so much worse because he

was one of their own.”

Everywhere at the club, it was the topic of conversation.

Upstairs in the women’s dining room, a woman joked that she now knew the proper

way to pronounce his name.

“Made off,” she said. “You know, like he made off with all our money.”

Even off the island, many investors said they were impressed with how careful

Mr. Madoff had seemed.

“He just didn’t make mistakes,” said Richard Spring, 73, from Boca Raton. “He

was just a sound, smart, reasonable guy.”

Mr. Spring recounted meeting Mr. Madoff in the early 1970s when they shared a

helicopter each day commuting from Long Island to Wall Street.

He said he vividly recalled one commute when Mr. Madoff “bawled out” one of his

traders for sloppy work, not protecting against a downturn.

Impressed, he later invested with Mr. Madoff, over time putting more than $11

million into the firm, virtually every cent of his savings, he said.

“I’m taking care of my sick mother-in-law. My wife has cancer. I just can’t deal

with it,” Mr. Spring said, only barely choking back tears. “I’m cooked.”

The shock and sense of betrayal reached far beyond the country club.

Just three hours before the news hit, Tommy Mayes, director of the Palm Beach

office of the wealth management company Calibre, said he was at a conference

meeting with investors who spoke glowingly of Mr. Madoff.

“They were attributing their success to their access to a guy like Bernard

Madoff,” he said. “I cannot imagine that all of us have been duped like this.”

For Morse Life, a nonprofit residence for the elderly in West Palm Beach, news

of Mr. Madoff’s arrest came on Thursday night as the organization held its

Silver Anniversary Ball at The Breakers, the prominent oceanfront hotel in Palm

Beach.

“Nobody wanted to be the one to make a general announcement or alarm anyone who

might not be involved,” said Marjorie Agran, the chairwoman of the Friends of

Morse Life, a volunteer fund-raising group.

But the mood was gloomiest at the country club where, people here said, at least

a third of the 300 or so members had money invested with Mr. Madoff.

The shame of the Madoff scandal seemed especially bitter here in part because

the club is known for its noblesse oblige in requiring members to give tens of

thousands of dollars each year to charity.

The attention was also particularly unwelcome for a community whose grand homes

sit hidden behind 20-foot-tall ficus hedges and steel gates.

In cultivating an aloof mystique, Mr. Madoff had fooled those who fancied

themselves the wiser.

Typically, investors needed at least $1 million to approach Mr. Madoff. Being a

member of this club also helped.

But even with those prerequisites, there was little guarantee that Mr. Madoff

would take the client.

Looking out on the stunning beauty of the country club’s driving range, wedged

between the Intracoastal Waterway and the Atlantic Ocean, one club member

commented that the outsiders of Mr. Madoff’s clique turned out to be the lucky

ones.

“It’s funny how these things work out,” the member said, adding that he had

never tried to invest with the firm because he did not like Mr. Madoff’s

unwillingness to explain his methods.

Ross B. Intelisano, a lawyer representing a collection of its members, said he

thought relations at the country club and on the island generally might never be

the same again.

“He had this reputation that he’s one of these guys, that he’s what Wall

Street’s all about,” he said about Mr. Madoff. “It’s all about a handshake, and

people trusted him.”

That sort of trust may be gone now, Mr. Intelisano said.

“People may not really trust the guys they play golf with,” he said.

Even before Mr. Madoff’s scandal, a way of life was coming under strain here.

In a world where worrying publicly about money was verboten, a worker at the

country club said he was surprised recently that some patrons were asking about

the prices of certain things on the menu or for certain golf course services.

Along the island’s extravagant shopping district on Worth Avenue, an attendant

at Jimmy Choo complained that it was bad enough that customers had stopped

buying. But in recent months, some even came in his store to complain to him

about their finances.

“And I looked out front and there is a Bentley when I saw they were driving a

Lexus just two months ago,” he said.

“Palm Beach is a place of fantasy,” Mr. Leamer said. “There are no hospitals,

funeral homes, people don’t talk about the negative.”

But in recent months, the overall financial crisis has been causing worry.

Mr. Leamer told of several friends who were aghast when a friend offered to take

them out to dinner and he took them to a pizza parlor rather than the swanky

spot they were used to going.

“Even though they still had millions, people were getting panicked about money,”

he said. “They were angry that they were seeing such losses.”

For some on the island, the news of Mr. Madoff’s demise inspired soul-searching.

At Green’s Pharmacy, a popular lunch counter in downtown Palm Beach, a man who

said two of his relatives were founding members of the country club wondered

aloud whether the club’s unusually exclusive nature, especially among the

wealthiest investors, is what enabled the suspected scheme to go on so long.

“There was such insularity of this inner circle of an already pretty exclusive

club,” he said. But then he observed that lots of investors who were not members

of the club had been duped, too.

“I don’t know,” he said. “The whole thing just makes you question your

assumptions.”

Thomas R. Collins contributed reporting.

A Palm Beach Enclave,

Stunned by an Inside Job, NYT, 15.12.2008,

http://www.nytimes.com/2008/12/15/business/15palm.html

States’ Funds for Jobless Are Drying Up

December 15, 2008

The New Tork Times

By JENNIFER STEINHAUER

With unemployment claims reaching their highest levels in decades, states are

running out of money to pay benefits, and some are turning to the federal

government for loans or increasing taxes on businesses to make the payments.

Thirty states are at risk of having the funds that pay out unemployment benefits

become insolvent over the next few months, according to the National Association

of State Workforce Agencies. Funds in two states, Indiana and Michigan, have

already dried up, and both states are borrowing from the federal government to

make payments to the unemployed.

Unemployment taxes are collected by states from employers, but the rate varies

from state to state per employee. In good times states build up trust funds so

that when unemployment is high there is enough money to cover the requests for

benefits, which are guaranteed by the federal government.

“You don’t expect the loans to happen this early in a jobs slump,” said Andrew

Stettner, the deputy director of the National Employment Law Project, an

advocacy organization for low-wage workers. “You would expect that the states

should, even when they are not well prepared, to have savings.”

The Labor Department said last week that initial applications for jobless

benefits rose to 573,000, the highest reading since November 1982. It is

recommended that states keep at least one year of peak-level benefits in their

trusts, but many have not, and already some states are far worse off than

others.

Indiana’s unemployment trust fund went insolvent last month, and has borrowed

twice from Washington since then — the first such loans to the state since 1983.

It also expects to request an additional $330 million early next year.

Michigan, which has been borrowing money from the federal government for the

past few years to replenish its fund, is now $508.8 million in the hole and

unable to repay it. Next month the state, where the unemployment rate is more

than 9 percent, will begin levying a special “solvency tax” against some

employers to replenish its trust fund.

California, New York, Ohio, Rhode Island and other states are inching toward

insolvency as well, and may have to borrow from the federal government to get

through at least the first quarter of 2009.

In South Carolina, officials recently requested a $15 million line of credit.

“Right now we have $40 million in our trust fund, and we are paying out around

$11 million a week,” said Allen Larson, deputy executive director for the

unemployment insurance program at the South Carolina Employment Security

Commission. “So we think it is going to be very close as to whether or not we

can get through this year. We have never experienced anything like this.”

Officials in New York said the state’s trust fund has about $314 million,

compared with $595 million last year, and will most likely have to borrow from

the federal government in January.

The situation puts states, many of them facing huge deficits, in an even tighter

vise. As more people lose their jobs, the revenue base that the benefits are

drawn from shrinks, making it harder to pay claims. Adding to that burden is

that states will eventually have to pay back what they borrow.

Some states are worried about next year because the lion’s share of unemployment

taxes are collected early in each year, and they are not sure the money will

stretch through the end of the next year. The maximum amount of income the

federal government can tax employers for each worker is $7,000. (The amount

ranges from about $7,000 to about $25,000 for state taxes.)

“It is something that we are concerned about,” said Kim Brannock, a spokeswoman

for the Office of Employment and Training in Kentucky, where the unemployment

trust fund balance now sits at $133 million, compared with $250 million a year

ago. The fund has not borrowed money from the federal government since the

1980s. “At this point we are solvent,” she said, “but we are monitoring the

situation.”

States that come up short have the option of borrowing from the federal

government, but if the loan is not paid back within the federal fiscal year, 4.7

percent interest is accrued, which cuts into states’ general funds.

“With longer term solvency issues due to the sharp increase in unemployment,

federal borrowing quickly becomes expensive,” said Loree Levy, a spokeswoman for

the Employment Development Department in California, which is already facing a

multibillion dollar budget gap. “We are anticipating interest payments of $20

million in 2009-10 and if nothing is done to revise the revenue generation model

the interest would be $150 million in 2010-11.”

As such, they are then forced to raise taxes or cut services, or both.

Robert Vincent, a spokesman for the Gtech Corporation, a technology company for

the lottery industry based in Rhode Island, said, “Unemployment taxes are one of

a number of taxes that make it difficult to do business here.”

In many cases, states that have kept unemployment tax rates artificially low —

or in some instances decreased them — find themselves in the worst pickle now.

Indiana legislators, for example, reduced the tax rates to businesses by 25

percent in 2001.

“So, frankly, they created the perfect storm,” said John Ruckelshaus, the deputy

commissioner for the Indiana Department of Workforce Development. “The

Legislature will have to go in and look at the whole unemployment trust find

first thing when they begin their session.”

At the same time payments have gone up in some states.

To recalibrate the balance, several states are raising taxes on businesses —

often through an automatic increase that is triggered when fund levels are

endangered — to keep the unemployment checks flowing. An example is the Michigan

solvency tax, which will be levied against employers whose workers have received

more in benefits than the companies have contributed in unemployment insurance

taxes, to the tune of $67.50 per employee.

In Rhode Island, where the unemployment rate is 9.3 percent, the taxable wage

base will go to $18,000 from $14,000 in 2009, the highest rate in a decade.

“There is a possibility that we might be slightly under the funds we need come

the end of the first quarter,” said Raymond Filippone, the assistant director of

income support at the Rhode Island Department of Labor and Training. The state

has not borrowed from the federal government since 1980, he said.

“Many states have not raised that tax in years,” said Scott Pattison, executive

director of the National Association of State Budget Officers in Washington.

“Some states have automatic triggers. But then of course you have businesses

saying, ‘Whoa, you are raising taxes on me when we are having a tough time and

it is a recession, too.’ ”

Still, some said they were thinking beyond the dollars.

“In these times of financial stress every extra cost is a concern,” said Linda

Shelton, the spokeswoman for Lifespan, a large health care system in Rhode

Island. “However there are many things that worry us even more. We are much more

concerned about Rhode Island’s budget crisis, about rising unemployment, the

rising number of uninsured and the continuing cuts to health care.”

States’ Funds for Jobless Are Drying Up, NYT,

15.12.2008,

http://www.nytimes.com/2008/12/15/us/15funds.html

Bad Times

Draw Bigger Crowds to Churches

December 14, 2008

The New York Times

By PAUL VITELLO

The sudden crush of worshipers packing the small evangelical Shelter Rock

Church in Manhasset, N.Y. — a Long Island hamlet of yacht clubs and hedge fund

managers — forced the pastor to set up an overflow room with closed-circuit TV

and 100 folding chairs, which have been filled for six Sundays straight.

In Seattle, the Mars Hill Church, one of the fastest-growing evangelical

churches in the country, grew to 7,000 members this fall, up 1,000 in a year. At

the Life Christian Church in West Orange, N.J., prayer requests have doubled —

almost all of them aimed at getting or keeping jobs.

Like evangelical churches around the country, the three churches have enjoyed

steady growth over the last decade. But since September, pastors nationwide say

they have seen such a burst of new interest that they find themselves contending

with powerful conflicting emotions — deep empathy and quiet excitement — as they

re-encounter an old piece of religious lore:

Bad times are good for evangelical churches.

“It’s a wonderful time, a great evangelistic opportunity for us,” said the Rev.

A. R. Bernard, founder and senior pastor of the Christian Cultural Center in

Brooklyn, New York’s largest evangelical congregation, where regulars are

arriving earlier to get a seat. “When people are shaken to the core, it can open

doors.”

Nationwide, congregations large and small are presenting programs of practical

advice for people in fiscal straits — from a homegrown series on “Financial

Peace” at a Midtown Manhattan church called the Journey, to the “Good Sense”

program developed at the 20,000-member Willow Creek Community Church in South

Barrington, Ill., and now offered at churches all over the country.

Many ministers have for the moment jettisoned standard sermons on marriage and

the Beatitudes to preach instead about the theological meaning of the downturn.

The Jehovah’s Witnesses, who moved much of their door-to-door evangelizing to

the night shift 10 years ago because so few people were home during the day,

returned to daylight witnessing this year. “People are out of work, and they are

answering the door,” said a spokesman, J. R. Brown.

Mr. Bernard plans to start 100 prayer groups next year, using a model conceived

by the megachurch pastor Rick Warren, to “foster spiritual dialogue in these

times” in small gatherings around the city.

A recent spot check of some large Roman Catholic parishes and mainline

Protestant churches around the nation indicated attendance increases there, too.

But they were nowhere near as striking as those reported by congregations

describing themselves as evangelical, a term generally applied to churches that

stress the literal authority of Scripture and the importance of personal

conversion, or being “born again.”

Part of the evangelicals’ new excitement is rooted in a communal belief that the

big Christian revivals of the 19th century, known as the second and third Great

Awakenings, were touched off by economic panics. Historians of religion do not

buy it, but the notion “has always lived in the lore of evangelism,” said Tony

Carnes, a sociologist who studies religion.

A study last year may lend some credence to the legend. In “Praying for

Recession: The Business Cycle and Protestant Religiosity in the United States,”

David Beckworth, an assistant professor of economics at Texas State University,

looked at long-established trend lines showing the growth of evangelical

congregations and the decline of mainline churches and found a more telling

detail: During each recession cycle between 1968 and 2004, the rate of growth in

evangelical churches jumped by 50 percent. By comparison, mainline Protestant

churches continued their decline during recessions, though a bit more slowly.

The little-noticed study began receiving attention from some preachers in

September, when the stock market began its free fall. With the swelling

attendance they were seeing, and a sense that worldwide calamities come along

only once in an evangelist’s lifetime, the study has encouraged some to think

big.

“I found it very exciting, and I called up that fellow to tell him so,” said the

Rev. Don MacKintosh, a Seventh Day Adventist televangelist in California who

contacted Dr. Beckworth a few weeks ago after hearing word of his paper from

another preacher. “We need to leverage this moment, because every Christian

revival in this country’s history has come off a period of rampant greed and

fear. That’s what we’re in today — the time of fear and greed.”

Frank O’Neill, 54, a manager who lost his job at Morgan Stanley this year, said

the “humbling experience” of unemployment made him cast about for a more

personal relationship with God than he was able to find in the Catholicism of

his youth. In joining the Shelter Rock Church on Long Island, he said, he found

a deeper sense of “God’s authority over everything — I feel him walking with

me.”

The sense of historic moment is underscored especially for evangelicals in New

York who celebrated the 150th anniversary last year of the Fulton Street Prayer

Revival, one of the major religious resurgences in America. Also known as the

Businessmen’s Revival, it started during the Panic of 1857 with a noon prayer

meeting among traders and financiers in Manhattan’s financial district.

Over the next few years, it led to tens of thousands of conversions in the

United States, and inspired the volunteerism movement behind the founding of the

Salvation Army, said the Rev. McKenzie Pier, president of the New York City

Leadership Center, an evangelical pastors’ group that marked the anniversary

with a three-day conference at the Hilton New York. “The conditions of the

Businessmen’s Revival bear great similarities to what’s going on today,” he

said. “People are losing a lot of money.”

But why the evangelical churches seem to thrive especially in hard times is a

Rorschach test of perspective.

For some evangelicals, the answer is obvious. ”We have the greatest product on

earth,” said the Rev. Steve Tomlinson, senior pastor of the Shelter Rock Church.

Dr. Beckworth, a macroeconomist, posited another theory: though expanding

demographically since becoming the nation’s largest religious group in the

1990s, evangelicals as a whole still tend to be less affluent than members of

mainline churches, and therefore depend on their church communities more during

tough times, for material as well as spiritual support. In good times, he said,

they are more likely to work on Sundays, which may explain a slower rate of

growth among evangelical churches in nonrecession years.

Msgr. Thomas McSweeney, who writes columns for Catholic publications and appears

on MSNBC as a religion consultant, said the growth is fed by evangelicals’

flexibility: “Their tradition allows them to do things from the pulpit we don’t

do — like ‘Hey! I need somebody to take Mrs. McSweeney to the doctor on

Tuesday,’ or ‘We need volunteers at the soup kitchen tomorrow.’ ”

In a cascading financial crisis, he said, a pastor can discard a sermon

prescribed by the liturgical calendar and directly address the anxiety in the

air. “I know a lot of you are feeling pain today,” he said, as if speaking from

the pulpit. “And we’re going to do something about that.”

But a recession also means fewer dollars in the collection basket.

Few evangelical churches have endowments to compare with the older mainline

Protestant congregations.

“We are at the front end of a $10 million building program,” said the Rev. Terry

Smith, pastor of the Life Christian Church in West Orange, N.J. “Am I worried

about that? Yes. But right now, I’m more worried about my congregation.” A

husband and wife, he said, were both fired the same day from Goldman Sachs;

another man inherited the workload of four co-workers who were let go, and

expects to be the next to leave. “Having the conversations I’m having,” Mr.

Smith said, “it’s hard to think about anything else.”

At the Shelter Rock Church, many newcomers have been invited by members who knew

they had recently lost jobs. On a recent Sunday, new faces included a hedge fund

manager and an investment banker, both laid off, who were friends of Steve

Leondis, a cheerful business executive who has been a church member for four

years. The two newcomers, both Catholics, declined to be interviewed, but Mr.

Leondis said they agreed to attend Shelter Rock to hear Mr. Tomlinson’s sermon

series, “Faith in Unstable Times.”

“They wanted something that pertained to them,” he said, “some comfort that

pertained to their situations.”

Mr. Tomlinson and his staff in Manhasset and at a satellite church in nearby

Syosset have recently discussed hiring an executive pastor to take over

administrative work, so they can spend more time pastoring.

“There are a lot of walking wounded in this town,” he said.

Bad Times Draw Bigger

Crowds to Churches, NYT, 14.12.2008,

http://www.nytimes.com/2008/12/14/nyregion/14churches.html

Even Workers

Surprised by Success of Factory Sit-In

December 13, 2008

The New York Times

By MICHAEL LUO and KAREN ANN CULLOTTA

CHICAGO — The word came just after lunch on Dec. 2 in the cafeteria of

Republic Windows and Doors. A company official told assembled workers that their

plant on this city’s North Side, which had operated for more than four decades,

would be closed in just three days.

There was a murmur of shock, then anger, in the drab room lined with snack

machines. Some women cried. But a few of the factory’s union leaders had been

anticipating this moment. Several weeks before, they had noticed that equipment

had disappeared from the plant, and they began tracing it to a nearby rail yard.

And so, in secret, they had been discussing a bold but potentially dangerous

plan: occupying the factory if it closed.

By the time their six-day sit-in ended on Wednesday night, the 240 laid-off

workers at this previously anonymous 125,000-square-foot plant had become

national symbols of worker discontent amid the layoffs sweeping the country.

Civil rights workers compared them to Rosa Parks. But all the workers wanted,

they said, was what they deserved under the law: 60 days of severance pay and

earned vacation time.

And to their surprise, their drastic action worked. Late Wednesday, two major

banks agreed to lend the company enough money to give the workers what they

asked for.

“In the environment of this economic crisis, we felt we were obligated to fight

for our money,” Armando Robles, a maintenance worker and president of Local 1110

of the United Electrical, Radio and Machine Workers of America, which

represented the workers, said in Spanish.

The reverberations of the workers’ victory are likely to be felt for months as

plants continue to close. Bob Bruno, director of the labor studies program at

the University of Illinois at Chicago, predicted organized labor would be

emboldened by the workers’ success. “If you combine some palpable street anger

with organizational resources in a changing political mood,” he said, “you can

begin to see more of these sort of riskier, militant adventures, and they’re

more likely to succeed.”

The tale of how this small band of workers came to embody the welter of emotions

in the country’s economic downturn is flecked with plot turns from the deepening

recession, growing anger over the Wall Street bailout and difficult business

calculations. The workers were not aware, for example, that Republic’s owners

had quietly set up a new company, Echo Windows LLC, incorporated on Nov. 18,

according to records with the Illinois secretary of state’s office. And Echo had

bought a window and door manufacturing plant in Red Oak, Iowa.

Company officials in Iowa declined to comment, but Mary Lou Friedman, the human

resources manager at Echo, said in a telephone interview that the factory had

102 employees, all nonunion.

And at the last minute of negotiations, according to Representative Luis V.

Gutierrez, Democrat of Illinois, who helped moderate talks to resolve the

standoff, and union officials, Republic’s chief executive, Richard Gillman,

demanded that any new bank loan to help the employees also cover the lease of

several of his cars — a 2007 BMW 350xi and a 2002 Mercedes S500 are among those

registered to company addresses — as well as eight weeks of his salary, at

$225,000 a year.

The demand held up the settlement, which was reached only after Mr. Gillman

agreed to back down. (Mr. Gillman said Friday that he had sought the money to

offset a large bonus in 2007 that he had chosen not to accept.)

In many ways, however, Republic was an unlikely setting for a worker uprising.

Many workers interviewed, including some who had been at the plant for more than

three decades, said they considered it a decent place to work. It was a mostly

Hispanic work force, with some blacks. Some earned over $40,000 a year,

including overtime, pulling them into the middle class and enabling them to set

up 401(k) retirement accounts and buy modest homes.

But after Mr. Gillman took over as owner in 2006, there were several rounds of

layoffs, and the number of employees fell to about 240, from more than 500.

The company had been affected by the declining housing market, and Mr. Gillman

said it had also been affected by Chicago’s higher production costs. He said he

had hoped to salvage the business by buying another manufacturer in Ohio, but

was turned down by Bank of America.

“This has been the worst week of my life,” he said. “I know many of those

workers at Republic personally, and I put 34 years of my life into that

business, and all my money, too. No stone was left unturned in our effort to

save Republic.”

By mid-October, the company had exhausted its $5 million line of credit with

Bank of America, and the bank was refusing to lend the company any more money.

“We declined to provide an additional loan because of the company’s dire

financial conditions,” said Julie Westermann, a bank spokeswoman.

Bank officials said Republic filed for bankruptcy on Friday.

In mid-November, during a late-night vigil to see where the missing equipment

was going, Mark Meinster, 35, one of the factory’s union organizers, broached

the possibility of a sit-in with Mr. Robles, the president of the local, if the

plant should be closed.

Mr. Robles, 38, who had worked at the factory for eight years, said he was

excited by the idea but also mulled the potential repercussions. “We’d basically

be trespassing on private property,” he said. “We might get arrested.”

Nevertheless, Mr. Robles told Mr. Meinster that he believed most workers would

participate. In the coming days, the idea would take root among other union

leaders.

On Tuesday, Dec. 2, Barry Dubin, the company’s chief operating officer,

delivered the final verdict to workers, telling them they would probably not be

getting severance pay or be paid for accrued vacation days. Union leaders

quickly moved to hash out details of an occupation.

“We knew keeping the windows in the warehouse was a bargaining chip,” said

Melvin Maclin, a groove cutter and vice president of the local.

While some workers picketed Bank of America, others began attending to their own

financial worries, with many liquidating their 401(k)’s. Others cast worried

eyes on their meager savings accounts.

On Friday, union officials met with company officers and learned the workers’

health insurance was being cut off.

Later, with employees gathered in the cafeteria, Mr. Robles asked for a show of

hands of how many would be willing to stay at the factory. All hands went up,

with shouts of, “Sí, se puede!” — or “Yes, we can!”

“I ain’t got no other choice,” Alexis McCoy, 32, a driver’s assistant, said

later. “I have a newborn. I have to take care of my family.”

Local politicians discouraged the police from arresting the workers. Exasperated

company officials decided not to press the matter as the news media began

arriving in droves.

The workers organized themselves into three shifts and set up committees in

charge of cleanup, security and safety. A sign was taped to a cafeteria wall

banning alcohol, drugs and smoking.

Negotiations involving the company, Bank of America and union officials began

late Monday afternoon at the bank’s offices downtown.

At the root of much of the discussions was the federal law requiring employees

to be given 60 days’ notice, or that amount of severance, when plants close.

Bank officials said it was not their responsibility as lenders to ensure that

the company made these payments. They said later that they had been discussing

closing the plant with the company as far back as July, giving it plenty of time

to fulfill its obligations to its workers.

Nevertheless, union officials argued that Bank of America had received billions

of taxpayer dollars in the recent federal bailout, meant to free up credit to

companies like Republic.

“We never made the argument you have a legal responsibility,” said Mr.

Gutierrez, who described bank officials as willing to be helpful almost

immediately. “We said, ‘Will you make a corporate responsibility decision?’ ”

Bank of America’s offer to lend the company roughly $1.35 million came on

Tuesday, and additional help came from William M. Daley, the brother of Mayor

Richard M. Daley of Chicago and the Midwest chairman of JPMorgan Chase, which

owned 40 percent of the window company and agreed to lend an additional

$400,000.

Mr. Gillman’s demands, however, became a major sticking point. “I’m not going to

describe to you the words that were used when those issues were brought up,” Mr.

Gutierrez said.

Eventually, the parties agreed that the workers would be the only ones to

benefit. They would be paid severance and for vacation, and receive two months’

health coverage. The company owners also agreed to come up with $114,000 to

cover the payroll for their last week of work.

When union negotiators returned to the factory on Wednesday evening with the

agreement, the workers approved it unanimously. They emerged from the factory

chanting, “Yes, we did!”

Karen Ann Cullotta contributed reporting.

Even Workers Surprised

by Success of Factory Sit-In, NYT, 13.12.2008,

http://www.nytimes.com/2008/12/13/us/13factory.html

Store Brands Lift Grocers

in Troubled Times

December 13, 2008

The New York Times

By ANDREW MARTIN

LOVELAND, Ohio — Linda Severin, a Kroger vice president, has spent the last

two years dreaming up new products to sell under the chain’s store-brand labels.

Her creations, while inexpensive compared to national brands, are often fancier

than the store brands of old. They include Mediterranean-style pizzas and cake

mix with edible images of princesses.

Her timing could not have been better.

As the economy plunges into a deep recession, grocery stores are one of the few

sectors doing well. That is because cash-short consumers are eating out less and

stocking up at the supermarket. And store brand products, which tend to be

cheaper than national brands and more profitable for grocers, are doing

especially well.

Led by chains like Trader Joe’s, Kroger, Wegmans and Safeway, grocers have

expanded their store brands beyond cheap generics and simple knockoffs of

Cheerios, Oreos and Coca-Cola. Now, retailers are increasingly adding premium

store-brand items like organics, or creating products without direct

competition.

For instance, the team led by Ms. Severin, Kroger’s vice president for corporate

brands, developed three-minute microwaveable pizzas as an easy snack for

children when they return home from school.

“This is designed for moms,” Ms. Severin said. “This is a good example where we

didn’t knock off the national brand, but we thought, ‘How can we deliver what

our customers are looking for?’ ”

Dollar sales of store brands increased 10 percent during the 52 weeks before

Nov. 1, compared with a 3 percent gain for branded products, according to the

Nielsen market research company.

Store brands now account for nearly 22 percent of products sold at the grocery,

up from 20 percent a year ago, Nielsen found. At Kroger, store brands account

for 26 percent of grocery sales.

In this economic climate, the numbers suggest, many shoppers are willing to try

the newly developed store brands. They also say it is hard to resist the low

prices of store brands for staple goods like milk, sugar and cheese.

“They are less expensive and they taste just as good,” said Kim Dittelberger,

49, whose shopping cart at a Kroger store here on a recent day included

store-brand “toaster treats,” aluminum foil, coffee filters and coffee. “Now

even more so because the economy stinks.”

Jan-Benedict E. M. Steenkamp, marketing professor at the University of North

Carolina, Chapel Hill, said past recessions had given consumers a reason to

trade down from national brands. This time, he said, the gains may stick because

the quality and consistency of store brands have improved.

“Sometimes, it will be disappointing,” said Mr. Steenkamp, co-author of a book

on private-label strategy. “More often, it will be better than expected.”

Besides the weak economy, the growth of store brands reflects a historic shift

in the balance of power between packaged food manufacturers and grocery

retailers. As grocery chains have consolidated and grown bigger, they are

increasingly able to stock their shelves with their own products, which bring

higher profits and drive customer loyalty — all to the detriment of major food

brands.

“The brands aren’t as dominating,” said Alex Miller, president of Daymon

Worldwide, a broker for store-brand products. “The retailer is much more in the

driver seat about what goes on in their stores.”

The increase in store-brand sales has been a boon for some manufacturers, too.

Some store brands are made by major food companies like ConAgra Foods and Sara

Lee, but many of the goods are made by companies that few customers have heard

of, like Ralcorp Holdings (cereal, cookies and crackers), Johanna Foods (yogurt

and fruit juice) and Treehouse Foods (soups, salad dressings and salsa).

“Those who are winning at retail are those who have decided that rather than be

a warehouse for national brands, they have to establish their own brand,” said

Sam K. Reed, the chairman and chief executive of Treehouse Foods. A former chief

executive at Keebler, Mr. Reed said he started Treehouse in 2005 because

“private label was consistently growing at a faster rate than branded foods

across many categories.”

Of course, major branded food companies dispute the idea that store brands are

just as good as their products. They argue that branded products offer better

taste, consistency and innovation, justifying a premium price.

“We’re committed to providing our consumers with great-tasting products that are

a good value against any competitor,” said Michael Mitchell, a spokesman for

Kraft Foods.

Others argue that store-brand manufacturers have not been able to replicate some

of America’s best-known brands, like Cheerios, Budweiser and Brawny paper

towels. Grocers certainly sell store brands that look like Cheerios or like

Heinz ketchup, but to many palates, the knockoffs do not taste the same.

“A lot of it depends on what product it is,” said Sharon Frey, 42, a Kroger

shopper who was trying Kroger premium ice cream for the first time because it

was on sale. “If it’s eggs, it doesn’t matter. I would buy Heinz. I prefer Heinz

ketchup.”

Store brands have evolved over the years from homemade items like the sauerkraut

that Kroger’s founder, Barney Kroger, stocked on his shelves to the plainly

labeled generics that were sold in the 1970s.

In the 1980s, a Canadian grocery executive, Dave Nichol, borrowed from a British

grocer the idea of introducing premium store-brand products, like a

chocolate-chip cookie with more chips than national brands. Mr. Nichol, then an

executive and pitchman for the Loblaws chain, sold the cookies under the

President’s Choice label. Within two years, the brand was the best-selling

cookie in Canada.

“That’s when the alarm bells went on and that’s when I realized this was the

whole answer,” Mr. Nichol said.

In the United States, a growing number of grocery retailers are embracing Mr.

Nichol’s philosophy, including Kroger.

The Cincinnati-based chain, the nation’s second-largest grocer after Wal-Mart,

hired Ms. Severin two years ago to expand Kroger’s store brands, which include a

value brand, a medium tier that competes directly against national brands, and a

premium category.

A veteran of major food brands, Ms. Severin said her model was not competitors

in the United States, but grocers in Canada and Europe, where store brands

account for as much as 40 percent of the items sold. She said her focus had been

on developing products that offered something other than simply low prices, like

premium ingredients or innovative packaging.

During a tour of the Loveland store, she pointed to store-brand packages of cut

vegetables that were microwave-ready, compact fluorescent light bulbs that were

environmentally friendly and dog food made with natural ingredients.

She said she was particularly proud of a curved, 12-ounce bottle of hand soap

with scents like cherry blossom and coconut lime. The Kroger logo was barely

visible.

A typical shopper wants hand soap that “looks good and smells pretty,” Ms.

Severin explained, but does not want a “big Kroger logo staring out at her.” The

Kroger product was also cheaper, per ounce, than nearby Softsoap, a popular

national brand.

Even as it develops fancier products, Kroger is being careful to keep unadorned

store brands on its shelves, too, recognizing that they appeal to many shoppers

for the sole reason that they are cheap. One top seller in Kroger’s value line

is four rolls of toilet paper in plain packaging for 77 cents.

“It’s really a price that isn’t going to be beat,” Ms. Severin said.

Store Brands Lift Grocers in Troubled Times,

NYT, 13.12.2008,

http://www.nytimes.com/2008/12/13/business/13private.html

After 15 Years,

North Carolina Plant Unionizes

December 13, 2008

The New York Times

By STEVEN GREENHOUSE

After an expensive and emotional 15-year organizing battle, workers at the

world’s largest hog-killing plant, the Smithfield Packing slaughterhouse in Tar

Heel, N.C., have voted to unionize.

The United Food and Commercial Workers, which had lost unionization elections at

the 5,000-worker plant in 1994 and 1997, announced late Thursday that it had

finally won. The victory was significant in a region known for hostility toward

organized labor.

The vote was one of the biggest private-sector union successes in years, and

officials from the United Food and Commercial Workers said it was the largest in

that union’s history.

The union won by 2,041 votes to 1,879 after two years of turmoil at the plant.

As a result of a federal crackdown on illegal immigrants, more than 1,500

Hispanic workers have left the plant. Its work force is now 60 percent black, up

from around 20 percent two years ago.

After the results were announced, Wanda Blue, a hog counter, was among the many

workers who were celebrating.

“It feels great,” said Ms. Blue, who makes $11.90 an hour and has worked at

Smithfield for five years. “It’s like how Obama felt when he won. We made

history.”

“I favored the union because of respect,” said Ms. Blue, who is black. “We

deserve more respect than we’re getting. When we were hurt or sick, we weren’t

getting treated like we should.”

“The union didn’t win by a big margin, but it’s an important positive sign for

labor,” said Richard Hurd, a professor of labor relations at Cornell University.

“They may be able to use it as leverage to organize other meatpacking plants in

the South. The victory may be tied to the political environment. The election of

Barack Obama may have eased people’s concerns about speaking out and standing up

for a union.”

The United Food and Commercial Workers maintained that it lost the 1997 election

because Smithfield broke the law by intimidating and firing union supporters. In

2006, after seven years of litigation, the United States Court of Appeals for

the District of Columbia Circuit ruled that Smithfield had engaged in “intense

and widespread” coercion.

The court ordered Smithfield to reinstate four union supporters it found were

illegally fired, one of whom was beaten by the plant’s police on the day of the

1997 election. The court also said Smithfield had engaged in other illegal

activities: spying on workers’ union activities, confiscating union materials,

threatening to fire workers who voted for the union and threatening to freeze

wages and shut the plant.

The unionization campaign this year was conducted under unusual conditions and

rules, intended to reduce the vitriol.

In October, the company and the union reached a settlement under court

supervision in which the union agreed to drop its nationwide campaign intended

to denounce and embarrass Smithfield and the company agreed to drop a lawsuit

asserting that the union’s denunciations and calls for a boycott violated

racketeering laws.

The union’s pressure campaign had been intended to persuade the company to let

the workers decide on unionizing not through secret balloting but through having

a majority of workers sign pro-union cards.

Under the settlement, the two sides could campaign in a limited fashion, and

they could not denounce each other. The agreement also allowed union organizers

on the plant’s property; union organizers are generally barred from setting foot

on company property, even a parking lot, unless management consents.

“We won because that gave us more of a level playing field,” said Joseph Hansen,

the union’s president. “That was probably the major thing.”

Dennis Pittman, a Smithfield spokesman, said: “It was close, and the people had

a chance to do what we wanted all along, to speak their voice in a secret

ballot, and they spoke. As we said all along, we will respect their decision.”

Mr. Pittman said he expected that the two sides would begin negotiations early

next year.

Many unions are pushing Congress to pass legislation that would enable unions to

organize workers by having them sign pro-union cards. “I would say in this case,

it shows that the union can win without a card check,” Mr. Pittman said.

But Mr. Hansen said the 15-year unionization fight showed how hard it was to win

under the normal system.

To win the election, union organizers pushed for the cooperation of the plant’s

black and Hispanic workers. At lunchtime, outspoken workers sometimes wore

T-shirts saying “Smithfield Justice” and gave speeches to hundreds of workers.

Several workers said that in the days leading up to the vote, some 2,000 workers

had “Union Time” written on their hard hats.

Professor Hurd said one factor that helped the union was the growing percentage

of black workers at the plant. “African-Americans are the strongest supporters

of unions,” he said.

Lydia Victoria, who helps cut off hog tails at the plant, acknowledged that many

Hispanic workers were afraid of being seen as union supporters. Illegal

immigrant workers are especially worried because they fear deportation.

“A lot of Hispanic people,” Ms. Victoria said, “were scared to support the

union, sometimes because of the language, and sometimes because they feel they

don’t get the same treatment like the people who speak English.”

“But people came together,” she said. “People wanted fair treatment. We fought

so long to get this, and it finally happened.”

After 15 Years, North

Carolina Plant Unionizes, NYT, 13.12.2008,

http://www.nytimes.com/2008/12/13/us/13smithfield.html?hp

For Investors, Trust Lost, and Money Too

December 13, 2008

The New York Times

By DIANA B. HENRIQUES and ALEX BERENSON

The zoning lawyer in Miami trusted him because his father had dealt

profitably with him for decades. The officers of a little charity in

Massachusetts respected him and relied on his advice.

Wealthy men like J. Ezra Merkin, the chairman of GMAC; Fred Wilpon, the

principal owner of the New York Mets; and Norman Braman, who owned the

Philadelphia Eagles, simply appreciated the steady returns he produced,

regardless of market conditions.

But these clients of Bernard L. Madoff had this in common: They chose him to

oversee much of their personal wealth.

And now, they fear, they have lost it.

While Mr. Madoff is facing federal criminal charges, accused by federal

prosecutors of operating a vast $50 billion Ponzi scheme, many of his clients

are facing an abrupt reversal of fortune that is the stuff of nightmares.

“There are people who were very, very well off a few days ago who are now

virtually destitute,” said Brad Friedman, a lawyer with the Milberg firm in

Manhattan. “They have nothing left but their apartments or homes — which they

are going to have to sell to get money to live on.”

From New York to Palm Beach, business associates of Mr. Madoff spent Friday

assessing the damage, the extent of which will not be known for some time. Many

invested with Mr. Madoff through other funds and may not know that their money

is at risk.

Emergency meetings were being held at country clubs, schools and charities to

assess the potential losses on their investments and to look for options.

There is not much guidance available yet from regulators. On Friday, a federal

judge appointed a receiver to oversee the Madoff firm’s assets and customer

accounts. A Web site is being set up to keep customers informed, but no one is

sure yet whether any sort of safety net will catch the most vulnerable

investors.

For Stephen J. Helfman, a lawyer in Miami whose father had opened an account

with Mr. Madoff more than 30 years ago, the news on Thursday came as a hammer

blow.

“The name ‘Madoff’ has overnight gone from being revered to reviled in the

Helfman family,” Mr. Helfman said on Friday. His grandmother, at 98, relied on

her Madoff money to pay for round-the-clock care, he said, and his two

children’s college funds were wiped out.

“Thirty-six years of loyalty, through two generations, and this is what we get,”

he said.

The news was equally devastating for the Robert I. Lappin Charitable Foundation

in Salem, Mass., which works to reverse the dilution of Jewish identity through

intermarriage and assimilation by sending teenagers to Israel and supporting

other Jewish education efforts.

The foundation was forced on Friday to dismiss its small staff and shut down its

programs to cope with its losses in the Madoff funds, according to Deborah

Coltin, its executive director.

“We’ve canceled everything as of today, everything,” she said tearfully.

Ms. Coltin said she did not know how the little foundation came to be so exposed

to the Madoff firm. Its most recent tax filings show that it had $7 million at

the end of 2006, with $143,344 in stocks and the rest in “government

securities.”

It reported the sale that year of “Bernie Madoff” securities, but did not

explain what those securities were.

Sam Englebardt, a media investor in Los Angeles, said several relatives had

entrusted virtually all of their assets to Mr. Madoff — and he understood why.

“It seems like a huge over-allocation, I know,” Mr. Englebardt said. “But

remember, they had started out small and invested over 5 years, 15 years, 30

years — and every year they got a great return, and they could always take money

out without ever having a problem.”

As that track record lengthened, his relatives gradually entrusted more of their

savings to Mr. Madoff, he said. “I suspect that is what has happened across the

board,” he added. “People came to trust him so much that, eventually, they

trusted him with everything.”

Such stories were repeated in e-mail messages and telephone calls throughout the

day on Friday. A woman in Brooklyn whose father died just weeks ago found that

his entire estate and a substantial portion of her stepmother’s money was

invested with Mr. Madoff. A law school official in Massachusetts fears he has

lost millions in the collapse of the Madoff operation.

Some wealthy victims, of course, can afford to seek redress on their own. But

for them, litigation seems the only certainty.

Throughout the rumor-fueled hedge fund world on Friday, money managers were

comparing notes and assessing losses. By all accounts, they run broad and deep —

in the billions.

Mr. Merkin, a prominent philanthropist and the founder of several hedge funds,

including one called Ascot Partners, jolted his clients on Thursday with a

letter announcing that “substantially all” of that fund’s $1.8 billion in assets

were invested with Mr. Madoff.

“As one of the largest investors in our fund, I have also suffered major losses

from this catastrophe,” Mr. Merkin said in the letter. “We have retained counsel

to determine what our next steps should be.”

Some of Mr. Merkin’s investors have also “retained counsel.” Harry Susman, a

lawyer in the Houston office of Susman Godfrey, said he was talking with several

clients about legal options.

“These investors were never aware that all of their money was invested with

Madoff,” Mr. Susman said. “They are obviously shocked.”

Sterling Equities and the Wilpon family acknowledged on Friday that they had

money at risk in the Madoff scandal.

“We are shocked by recent events and, like all investors, will continue to

monitor the situation,” said Richard C. Auletta, a spokesman for Sterling and

the Wilpons.

The Mets organization issued a statement saying that the scandal would not

derail its new Citi Field stadium project in Queens or “affect the day-to-day

operations and long-term plans of the Mets organization.”

A lawyer for Norman Braman of Miami, a wealthy retired retailer and the former

owner of the Philadelphia Eagles football team, confirmed that Mr. Braman, too,

had money locked up and perhaps lost in the Madoff mess.

And Bramdean Alternatives, a London asset manager run by Nicola Horlick, saw its

share price plummet nearly 36 percent on Friday after it announced that nearly

10 percent of its holdings were caught in the Madoff scandal.

Mr. Madoff has resigned from his positions at Yeshiva University, where he was

treasurer for the university’s board and deeply involved in the business school.

“Our lawyers and accountants are investigating all aspects of his relationship

to Yeshiva University,” said Hedy Shulman, a spokeswoman for the university.

The most recent tax filings for the university show that its endowment fund, a

separate charity, was heavily invested in hedge funds and other nontraditional

alternatives at the end of its fiscal year in 2006.

The school paper, the Yeshiva Commentator, recently reported that its

endowment’s value had dropped to $1.4 billion from $1.8 billion — before the

scandal broke.

Reporting was contributed by Stephanie Strom, Julie Creswell, Eric Konigsberg,

Zachery Kouwe and Charles Bagli.

For Investors, Trust

Lost, and Money Too, NYT, 13.12.2008,

http://www.nytimes.com/2008/12/13/business/13investors.html?hp

Hedge Funds Are Victims, Raising Further Questions

December 13, 2008

The New York Times

By MICHAEL J. de la MERCED

Frauds on Wall Street aren’t unheard of. But a $50 billion Ponzi scheme, one

that prosecutors say struck at boldface names on several continents, is a

bombshell by any standard.

The case against Bernard L. Madoff, the respected longtime trader accused of

running one of the biggest frauds in Wall Street history, has been Topic A in

the investor community. But close behind is a heated discussion of how the

sordid drama will affect the already-battered community of hedge funds and other

investment firms — many of which invested with Mr. Madoff.

Mr. Madoff’s case could hardly have come at a worse time for hedge funds. The

whipsawing markets and suddenly unfriendly lenders have already taken their toll

on high financiers, and many have already suffered what amounts to runs on the

bank by investors clamoring to withdraw their investments.

“It can’t help but have the effect of further chipping away at the confidence

that the investor community has in the hedge fund industry,” said Ralph L.

Schlosstein, the chief executive of Highview Investment Group, a money

management firm and a former president of BlackRock. “But like many things that

come at moments of fragility, its impact is magnified.”

The collapse of Mr. Madoff’s firm took the vast majority of investors by

surprise. Mr. Madoff, once the largest market maker on the Nasdaq stock market,

was known for his modest demeanor and, perhaps more important, his steady and

overwhelmingly positive returns. That in turn appears to have attracted scores

of investors, from Palm Beach country clubs to Manhattan social circles.

It is difficult to map out the swath of damage that the Madoff firm’s collapse

is likely to cut through the hedge fund industry, not to mention a wide range of

other investors. But among its biggest investors were funds of funds, firms that

invest in several hedge funds and are nominally among the most sophisticated

judges of character in the industry. Because Mr. Madoff reported consistently

positive returns for more than a decade — some say impossibly so — he drew vast

amounts of business from them.

Now, the collateral damage is likely to add to the chaos that has already been

ravaging hedge funds. Spooked by losses and forced to raise cash quickly as the

financial crisis ballooned, investors have sought to pull out their money from

hedge funds, causing serious pain, and even some forced closures. A growing list

of large, well-known firms have sought to block redemption requests in an effort

to stem a mass exodus of investors who now desperately want to get into cash.

In a letter sent Friday, the Citadel Investment Group said it was halting

redemptions at its two largest hedge funds through March 31.

Confidence will only weaken further with the Madoff firm scandal, intensifying

pain for the industry.

“If you couple this with the deleveraging already, this means one thing: more

redemptions,” said Campbell R. Harvey, a professor at the Fuqua School of

Business at Duke University.

The losses from the Madoff firm will also raise more questions about how well

funds of funds perform due diligence, a concern already magnified by losses in

the hedge fund industry.

“Funds of funds that invested in Madoff will get a double whammy,” said Whitney

Tilson, who runs the T2 Partners hedge fund. “Not only will they have to take a

loss, but they are going to have to do an awful lot of explaining for how they

ever got fooled here.”

Indeed, while many investors are asking how regulators could have missed a

towering Ponzi scheme, some are beginning to question the whole process of due

diligence. Several potential investors had raised questions about Mr. Madoff’s

claims of steady returns over the years, but regulators apparently took few

steps to investigate.

“Where were the auditors?” asked Bill Grayson, the president of Falcon Point

Capital, a hedge fund based in San Francisco. “Where was his chief compliance

officer? Where was the S.E.C.?”

Already under heightened scrutiny, the collapse of the Madoff firm is likely to

propel calls for greater regulation of the hedge fund industry, beyond the

current optional registration with the Securities and Exchange Commission.

What’s more, many investors in hedge funds are likely to ask tougher questions

of the managers of these firms. Executives who are loath to disclose their

investment strategies — instead running a “black box” model, as Mr. Madoff

infamously did — will probably come under increased pressure to open the lid on

their operations, at least a little bit.

“I suspect that many investors are going to start asking many more questions of

their managers,” Mr. Tilson said. “They will be much less tolerant of black box

managers.”

Still, some disagree that Mr. Madoff’s arrest will lead to widespread contagion

throughout the industry. Mr. Tilson argued that most investors would see the

case as an unusual circumstance whose breadth and brazenness is unlikely to be

duplicated. “This is not a Lehman Brothers,” he said.

Hedge Funds Are Victims, Raising Further

Questions, NYT, 13.12.2008,

http://www.nytimes.com/2008/12/13/business/13damage.html?ref=business

Questions Are Raised in Trader’s Massive Fraud

December 13, 2008

The New York Times

By ALEX BERENSON and DIANA B. HENRIQUES

For years, investors, rivals and regulators all wondered how Bernard L.

Madoff worked his magic.

But on Friday, less than 24 hours after this prominent Wall Street figure was

arrested on charges connected with what authorities portrayed as the biggest