|

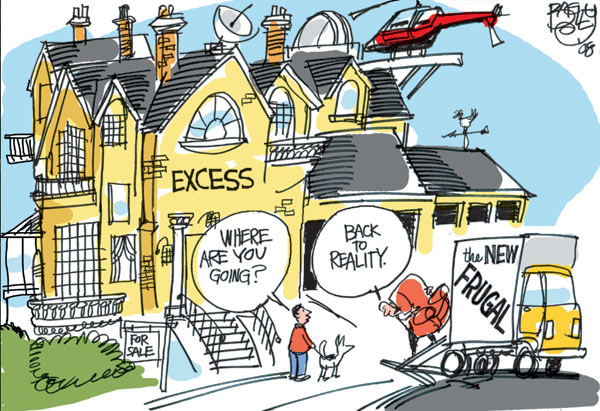

History > 2008 > USA > Economy (XIIb)

Pat Bagley

cartoon

Salt Lake Tribune, Utah

Cagle

18 December 2008

Home Prices Fell

at Sharper Pace in October

December 31, 2008

The New York Times

By JACK HEALY

Home values in America’s 20 largest metropolitan areas dropped at a record

pace in October as the fallout from the financial collapse reverberated through

the housing market, according to data released Tuesday.

The price of single-family homes fell 18 percent in October from a year earlier,

according to the closely watched Standard & Poor’s/Case Shiller Housing Index.

All 20 cities reported annual price declines in October; prices in 14 of the 20

metropolitan areas surveyed fell at a record rate as the financial crisis

reached a critical point.

“October was clearly the free-fall month,” said David M. Blitzer, chairman of

the index committee at Standard & Poor’s. “Everything was going against us in

October, without exception.”

After increasing steadily through the first part of the decade, home prices have

fallen every month since January 2007, their slide accelerating as troubles in

the housing market infected the broader economy and brought down financial

firms.

Prices are falling at their fastest pace on record, a sign that the housing

market is a long way from recovery.

“It is unlikely that we are anywhere near a bottom in nationwide home prices,”

Joshua Shapiro, chief United States economist at MFR, wrote in a note.

The 10-city index dropped 19.1 percent in October, its largest decline in its

21-year history, and the new numbers show that the cities that played host to

the greatest excesses of the housing boom are suffering the deepest drops.

Prices in Las Vegas and Phoenix, where developers built subdivisions stretching

into the desert, fell by nearly a third in October from 2008. Home prices fell

31 percent in San Francisco and 29 percent in Miami. Prices in New York declined

7.5 percent in October over the same month a year ago.

Fourteen of the 20 cities in the Case-Shiller survey posted double-digit

declines for the year. The relative winner was Dallas, which had the smallest

yearly decline, of 3 percent. The value of a single-family house in Detroit,

which has been pummeled by closing plants and the implosion of the auto

industry, was less in October than it was in October 1998.

The Case-Shiller numbers were the latest round of bleak news for the housing

sector, which is at the center of the country’s broader economic troubles.

Foreclosures, bad loans and collapsing housing prices contributed to the

financial crisis earlier this year, and now, the widening recession is dragging

housing down even more.

Last week, the National Association of Realtors reported that sales of

previously owned homes, which dominate the market, fell to the lowest pace in

years. Home values tumbled 13 percent in November from a year earlier, the

sharpest drop in more than 40 years, the industry group reported.

A glut of unsold houses is weighing down the market, and housing is likely to

deteriorate further in 2009 as the jobs picture continues to weaken.

Unemployment is now at 6.7 percent, its highest point in a decade, and

economists predict it will rise to 8 or 10 percent next year.

“People who think they’re going to lose their job don’t buy a home,” Steven

Ricchiuto, chief economist at Mizuho Securities, said.

Home Prices Fell at

Sharper Pace in October, NYT, 31.12.2008,

http://www.nytimes.com/2008/12/31/business/economy/31econ.html

Breaking Up Is Harder to Do

After Housing Fall

December 30, 2008

The New York Times

By JOHN LELAND

When Marci Needle and her husband began to contemplate divorce in June, they

thought they had enough money to go their separate ways. They owned a

million-dollar home near Atlanta and another in Jacksonville, Fla., as well as

investment properties.

Now the market for both houses has crashed, and the couple are left arguing

about whether the homes are worth what they owe on them, and whether there are

any assets left to divide, Ms. Needle said.

“We’re really trying very hard to be amicable, but it puts a strain on us,” said

Ms. Needle, the friction audible in her voice. “I want him to buy me out. It’s

in everybody’s interest to settle quickly. That would be my only income. It’s

been incredibly stressful.”

Chalk up another victim for the crashing real estate market: the easy divorce.

With nearly one in six homes worth less than the mortgage owed on it, according

to Moody’s Economy.com, divorce lawyers and financial advisers around the

country say the logistics of divorce have been turned around. “We used to fight

about who gets to keep the house,” said Gary Nickelson, president of the

American Academy of Matrimonial Lawyers. “Now we fight about who gets stuck with

the dead cow.”

As a result, divorce has become more complicated and often more expensive, with

lower prospects for money on the other side. Some divorce lawyers say that

business has slowed or that clients are deciding to stay together because there

are no assets left to help them start over.

“There’s an old joke,” said Randall M. Kessler, Ms. Needle’s lawyer. “Why is a

divorce so expensive? Because it’s worth it. Now it better really be worth it.”

In a normal economy, couples typically build equity in their homes, then divide

that equity in a divorce, either after selling the house or with one partner

buying out the other’s share. But after the recent boom-and-bust cycle, more

couples own houses that neither spouse can afford to maintain, and that they

cannot sell for what they owe. For couples already under stress, the family home

has become a toxic asset.

“It’s much harder to move on with their lives,” said Alton L. Abramowitz, a

partner in the New York firm Mayerson Stutman Abramowitz Royer.

Mr. Abramowitz said he was in the middle of several cases where the value of the

real estate could not be determined. “All of a sudden,” he said, “prices are all

over the place, people aren’t closing, and it becomes virtually impossible to

judge how far the market has fallen, because nothing is selling.”

For John and Laurel Goerke, in Santa Barbara, Calif., the housing market crashed

in the middle of what Mr. Goerke said had been an orderly legal proceeding. At

the height of the market, Mr. Goerke said, they had their house appraised at

$2.3 million, which would have given them about $1 million to divide after

paying off the mortgage. But by the time they sold last year, the value had

fallen by $600,000, cutting their equity by more than half.

“That changed everything,” said Mr. Goerke, who is now nearly two years into the

divorce process, with legal and other fees of several hundred thousand dollars.

“The prospect of us both being able to buy modest homes was eliminated. The

money’s not there.”

Now, with both spouses living in rental properties, their lawyers still cannot

agree on what their remaining assets are worth. Their wealth is ticking away at

$350 an hour, times two.

“It’s got to end,” Mr. Goerke said, “because at some point there’s nothing left

to argue about.”

For other couples it does not have to end. Lisa Decker, a certified divorce

financial analyst in Atlanta, said she was seeing couples who were determined to

stay together even after divorce because they could not sell their home, a

phenomenon rarely seen before outside Manhattan.

“We’re finding the husband on one floor, the wife on the other,” Ms. Decker

said. “Now one is coming home with a new boyfriend or girlfriend, and it’s

creating a layer to relationships that we haven’t seen before. Unfortunately,

we’re seeing ‘The War of the Roses’ for real, not just in a Hollywood movie.”

In California, James Hennenhoefer, a divorce lawyer, said couples were taking

advantage of the housing crisis to save money by stopping their mortgage

payments but continuing to live together for as long as they can.

“Most of the lenders around here are in complete disarray,” Mr. Hennenhoefer

said. “They’re not as aggressive about evictions. Everyone’s hanging around in

properties hoping the government will buy all that bad paper and then they’ll

negotiate a new deal with the government. They just live in different parts of

the house and say, ‘We’ll stay here for as long as we can, and save our money,

so we have the ability to move when and if the sheriff comes to toss us out.’ ”

Mr. Hennenhoefer said this tactic worked only with first mortgages; on second

and third mortgages, the lenders pursue repayment even after the homeowners have

lost the home.

Dee Dee Tomasko, a nursing student and mother in suburban Cleveland, expected to

leave her marriage with about $200,000 in starter money, primarily from the

marital home, which was appraised at about $1 million in 2006. By the time of

her divorce last year, however, the house was appraised at $800,000; her share

of the equity came to about $105,000.

Though she is relieved to be out of the marriage, if she had known how little

money she would get “I might have stuck with it a little more; I don’t know,”

Ms. Tomasko said, adding, “Maybe it would’ve made me think a little harder.”

For divorcing spouses with resources, though, there can be opportunities in the

falling housing market.

Josh Kaufman and his wife bought a new 6,500-square-foot house outside Cleveland

on five and a half acres, with four bedrooms and two three-car garages, that was

worth $1.5 million at the height of the market. When they divorced in June, Mr.

Kaufman knew his wife could not afford to carry the home. The longer the divorce

process continued, the more the house depreciated; by the time he assumed the

house, its appraised value was half what the couple had put into it; he did not

pay her anything for her share.

“From a negotiating standpoint we knew that she couldn’t afford to stay in it,”

Mr. Kaufman said. “It appeared as an opportunity to turn the negative situation

around. There was no emotion involved. It was a business decision on what made

most financial sense. It wasn’t an attempt to take advantage of someone.”

Still, his lawyer, Andrew A. Zashin, said, “He bought this house at a bargain

basement price.”

For Nancy R., who spoke on condition of anonymity because her colleagues do not

know her marital status, the impediments to divorce are visible every time she

opens her door.

“There’s three other houses for sale on our same road,” she said. “There’s no

way our house would sell.”

For now the couple are separated, waiting for real estate prices to recover. But

for Ms. R., that means remaining financially dependent on her husband. He moved

out; she remains in the house.

“I still feel kept in certain ways, and I don’t want to rock the boat,” she

said. “And it’s draining. So suddenly, when there’s an economic crunch, we’re

paying for two places. And we’re both eating out more, because it’s no fun to

eat alone.”

The same dynamics that marked their marriage now hang over their separation, she

said: “He has the ultimate control.”

“We can’t sell the house,” she said, “and whatever settlement I get depends on a

good relationship with him, based on his good will. The lines get blurry and

confused quickly, which makes emotions fly easily” — especially if she were to

start dating.

“Any icing on the cake is going to come from his good will,” she said, “and that

means being the peacemaker. I’m the underdog in this situation. We’re basically

forced to remain in a relationship after we’ve decided to end it.”

Breaking Up Is Harder to

Do After Housing Fall, NYT, 30.12.2008,

http://www.nytimes.com/2008/12/30/us/30divorce.html

In Season of Recession,

New Ways to Celebrate

December 26, 2008

The New York Times

By JENNIFER MEDINA and KEN BELSON

No lamb this year; ham, at 89 cents a pound, was a better deal. There were

gifts, yes, but fewer than usual, and only for the children. Maybe clothes this

time around instead of a bag of toys. Somehow, the Long Island chill would have

to be made as alluring a holiday destination as the isles of the Caribbean.

It is unsurprising, perhaps, that this is the Christmas of cutbacks, what with

neighbors facing foreclosures, relatives being laid off and the endless chatter

of a recession like no other. Nearly everyone in New York City, it seemed — from

shoppers in central Brooklyn to churchgoers in the Bronx, people eating (and

volunteering) at a Harlem soup kitchen and those heading out of town from Penn

Station — had something they were doing without.

“It doesn’t feel like Christmas,” said Christine Enniss, who planned to pare her

holiday spread to the essentials: green salad, roast chicken and, maybe, potato

salad.

But as each family tried to make merry amid the misery, what stayed and went was

revealing. Sharon Parker, whose husband recently lost his job as a mechanic,

held Christmas dinner for her immediate family of five, rather than playing host

to the more than a dozen cousins and friends she usually has over. Susan

Strande, an art teacher who lives in the East Village, did her own baking rather

than buying fancy tarts and pies. O’Neil Hutchinson, an engineering consultant,

visited family in England several weeks ago to avoid the more expensive holiday

fares.

Many tried to avoid sacrificing quantity by scaling back on quality. At

Sherry-Lehmann Wine and Spirits on Park Avenue near 59th Street, sales of

Nicolas Feuillatte Brut Champagne, at $27.95 a bottle, more than doubled, to 160

cases this month, from last December. But “all the higher-end stuff is more

likely to stay on the shelves,” said Chris Adams, a partner in the store.

Mr. Adams, for his part, went to Saks Fifth Avenue on Christmas Eve to shop for

a last-minute gift for his wife, as he always does. But he stayed away from the

pricey perfumes, veering instead to the makeup counter to buy creams she might

need and would normally pick up for herself.

Of course, this cutback Christmas can also be seen as the season of the sales.

Some took advantage of bargain trips to Las Vegas resorts; others filled

shopping bags with merchandise at half price. “Everything was really cheap,”

said one woman, a bit defensively, as she boarded a train to see family in New

Jersey, laden with Bloomingdale’s bags that were teeming with red-wrapped gifts.

For the Lombardo family, Christmas Eve has always been about the Feast of the

Seven Fishes, a traditional Italian banquet.

But with business at the family’s pizzeria in Harrison, N.Y., pinched, the

Lombardos scaled back. Each of the 18 adults and seven grandchildren was served

the seven courses, but the grownups survived on one lobster tail instead of two.

The crowd shared a few dozen clams on the half shell instead of 10 dozen or

more, the shrimp cocktails were more modest, the linguini had fewer blue crabs,

and there was a bit less scungilli. There were fewer Alaskan king crab legs,

too.

“We’re not getting a lot of businessmen taking their clients to lunch,” Sofia

Lombardo, a daughter of one of the founders, said of her family’s restaurant,

Sofia’s Pizzeria. “They just have slices instead of chicken parmesan.”

The tug of tough times also led the Lombardos to trim their gift-giving. Last

year, the adults traded “secret Santa” gifts worth about $75 each. This year,

they decided to limit each gift to $30.

Ms. Lombardo’s parents and one of her brothers did away with swapping gifts

entirely. “My family always went to the nines,” she said. “Is it weird not

opening gifts on Christmas Day? Yes. But the catering business is not where it’s

been in the last few years.”

Even with less, there were countless attempts to make Christmas as happy as it

has always been. Parents, in particular, took pains to give their children an

abundance of gifts, even while watching the price tag.

Last year, Veronica Tyms bought 30 presents for cousins, in-laws, friends and

their children. This year, she chopped her list in half and fully expected the

would-be recipients to do the same. “We didn’t have to talk about it,” said Ms.

Tyms’s friend Margaret Gregory, who joined her this week on a bargain-hunting

trip to the Target store in the Atlantic Terminal Mall in Brooklyn. “People just

understood.”

Both women, however, still showered their children with presents. Ms. Gregory

ticked off the list for her 18-year-old daughter: “clothes, movies, perfume,

makeup.” Ms. Tyms bought gifts for her 8-year-old son and more than a dozen

other children of friends and relatives.

“My son still believes in Santa Claus,” she said. “I’m not ready to change that

yet.”

Ed Chin of Greenwich, Conn., who landed at job at China Merchants Bank in

September after being out of work for six months, skipped the usual trip to

North Carolina to visit his in-laws and to golf, and he canceled his family’s

traditional Champagne brunch. Rather than expensive gifts for each of their four

children, ages 9 to 14, Mr. Chin and his wife, Julie, bought an Xbox video game

console for them to share.

“Even people in Greenwich have to tighten up,” Ms. Chin said of her wealthy

hometown. “This is not the time to spend money on this kind of stuff.”

Dominic Giangrasso, who runs the computer systems at ConEdison Solutions, hooked

up a Web camera to his flat-panel television so that his pregnant daughter, who

lives in Massachusetts, could watch Christmas dinner at his home in Westchester

County rather than spend money on traveling there.

The Rev. Jos Kandathikudy, the priest at St. Thomas Syro Malabar Catholic Church

in the Bronx, said that last year he walked from the rectory through the

neighborhood to admire the fanciful decorations. This year, he said, the streets

were mostly dark.

“Businesses and residences both; I think people just want to and need to save

money — everything is reduced,” he said. “But this is not the meaning of

Christmas. It is not about lights and presents.”

Father Kandathikudy was one of many ministers to preach about how the tough

economic times could help people focus on the religious meaning of Christmas.

One parishioner at the Church of the Ascension on West 107th Street simply

handed over $500 to the Rev. John Duffell last week, saying only that someone

needed it more than he did.

And at the Church of Saint Raymond on Castle Hill Avenue in the Bronx, one altar

girl had trimmed her wish list.

“My daughter understood that things were difficult this year,” said Maria

Gonzalez, 40, as she walked into the noon Mass at the church, beaming as her

daughter, Jessica Garcia, led the processional. “She loves music and has worked

so hard to practice, so all she wanted was a keyboard. She wants to play music

to serve God, and I want to help her in that.”

Ralph Blumenthal and Kareem Fahim contributed reporting.

In Season of Recession,

New Ways to Celebrate, NYT, 26.12.2008,

http://www.nytimes.com/2008/12/26/nyregion/26xmas.html?hp

In Madoff Scandal,

Jews Feel an Acute Betrayal

December 24, 2008

The New York Times

By ROBIN POGREBIN

There is a teaching in the Talmud that says an individual who comes before

God after death will be asked a series of questions, the first one of which is,

“Were you honest in your business dealings?” But it is the Ten Commandments that

have weighed most heavily on the mind of Rabbi David Wolpe of Sinai Temple in

Los Angeles in light of the sins for which Bernard L. Madoff stands accused.

“You shouldn’t steal,” Rabbi Wolpe said. “And this is theft on a global scale.”

The full scope of the misdeeds to which Mr. Madoff has confessed in swindling

individuals and charitable groups has yet to be calculated, and he is far from

being convicted. But Jews all over the country are already sending up something

of a communal cry over a cost they say goes beyond the financial to the

theological and the personal.

Here is a Jew accused of cheating Jewish organizations trying to help other

Jews, they say, and of betraying the trust of Jews and violating the basic

tenets of Jewish law. A Jew, they say, who seemed to exemplify the worst

anti-Semitic stereotypes of the thieving Jewish banker.

So in synagogues and community centers, on blogs and in countless conversations,

many Jews are beating their chests — not out of contrition, as they do on Yom

Kippur, the Day of Atonement, but because they say Mr. Madoff has brought shame

on their people in addition to financial ruin and shaken the bonds of trust that

bind Jewish communities.

“Jews have these familial ties,” Rabbi Wolpe said. “It’s not solely a shared

belief; it’s a sense of close communal bonds, and in the same way that your

family can embarrass you as no one else can, when a Jew does this, Jews feel

ashamed by proxy. I’d like to believe someone raised in our community, imbued

with Jewish values, would be better than this.”

Among the apparent victims of Mr. Madoff were many Jewish educational

institutions and charitable causes that lost fortunes in his investments; they

include Yeshiva University, Hadassah, the Jewish Community Centers Association

of North America and the Elie Wiesel Foundation for Humanity. The Chais Family

Foundation, which worked on educational projects in Israel, was recently forced

to shut down because of losses in Madoff investments. Many of Mr. Madoff’s

individual investors were Jewish and supported Jewish causes, apparently drawn

to him precisely because of his own communal involvement and because he radiated

the comfortable sense of being one of them.

“The Jewish world is not going to be the same for a while,” said Rabbi Jeremy

Kalmanofsky of Congregation Ansche Chesed in New York.

Jews are also grappling with the implications of Mr. Madoff’s deeds for their

public image, what one rabbi referred to as the “shanda factor,” using the

Yiddish term for an embarrassing shame or disgrace. As Bradley Burston, a

columnist for haaretz.com, the English-language Web site of the Israeli

newspaper Haaretz, wrote on Dec. 17: “The anti-Semite’s new Santa is Bernard

Madoff. The answer to every Jew-hater’s wish list. The Aryan Nation at its most

delusional couldn’t have come up with anything to rival this.”

The Anti-Defamation League said in a statement that Mr. Madoff’s arrest had

prompted an outpouring of anti-Semitic comments on Web sites around the world,

most repeating familiar tropes about Jews and money. Abraham H. Foxman, the

group’s national director, said that canard went back hundreds of years, but he

noted that anti-Semites did not need facts to be anti-Semitic.

“We’re not immune from having thieves and people who engage in fraud,” Mr.

Foxman said in an interview, disputing any notion that Mr. Madoff should be seen

as emblematic. “Why, because he happens to be Jewish, he should have a

conscience?”

He added that Mr. Madoff’s victims extended well beyond the Jewish community.

In addition to theft, the Torah discusses another kind of stealing, geneivat

da’at, the Hebrew term for deception or stealing someone’s mind. “In the

rabbinic mind-set, he’s guilty of two sins: one is theft, and the other is

deception,” said Burton L. Visotzky, a professor at the Jewish Theological

Seminary.

“The fact that he stole from Jewish charities puts him in a special circle of

hell,” Rabbi Visotzky added. “He really undermined the fabric of the Jewish

community, because it’s built on trust. There is a wonderful rabbinic saying —

often misapplied — that all Jews are sureties for one another, which means, for

instance, that if a Jew takes a loan out, in some ways the whole Jewish

community guarantees it.”

Several rabbis said they were reminded of Esau, a figure of mistrust in the

Bible. According to a rabbinic interpretation, Esau, upon embracing his brother

Jacob after 20 years apart, was actually frisking him to see what he could

steal. “The saying goes that, when Esau kisses you,” Rabbi Visotzky said, “check

to make sure your teeth are still there.”

Rabbi Kalmanofsky said he was struck by reports that Mr. Madoff had tried to

give bonus payments to his employees just before he was arrested, that he was

moved to do something right even as he was about to be charged with doing so

much wrong. “The small-scale thought for people who work for him amidst this

large-scale fraud — what is the dissonance between that sense of responsibility

and the gross sense of irresponsibility?” he said.

In a recent sermon, Rabbi Kalmanofsky described Mr. Madoff as the antithesis of

true piety.

“I said, what it means to be a religious person is to be terrified of the

possibility that you’re going to harm someone else,” he said.

Rabbi Kalmanofsky said Judaism had highly developed mechanisms for not letting

people control money without ample checks and balances. When tzedakah, or

charity, is collected, it must be done so in pairs. “These things are supposed

to be done in the public eye,” Rabbi Kalmanofsky said, “so there is a high

degree of confidence that people are behaving in honorable ways.”

While the Madoff affair has resonated powerfully among Jews, some say it

actually stands for a broader dysfunction in the business world. “The Bernie

Madoff story has become a Jewish story,” said Rabbi Jennifer Krause, the author

of “The Answer: Making Sense of Life, One Question at a Time,” “but I do see it

in the much greater context of a human drama that is playing out in

sensationally terrible ways in America right now.”

“The Talmud teaches that a person who only looks out for himself and his own

interests will eventually be brought to poverty,” Rabbi Krause added.

“Unfortunately, this is the metadrama of what’s happening in our country right

now. When you have too many people who are only looking out for themselves and

they forget the other piece, which is to look out for others, we’re brought to

poverty.”

According to Jewish tradition, the last question people are asked when they meet

God after dying is, “Did you hope for redemption?”

Rabbi Wolpe said he did not believe Mr. Madoff could ever make amends.

“It is not possible for him to atone for all the damage he did,” the rabbi said,

“and I don’t even think that there is a punishment that is commensurate with the

crime, for the wreckage of lives that he’s left behind. The only thing he could

do, for the rest of his life, is work for redemption that he would never

achieve.”

In Madoff Scandal, Jews

Feel an Acute Betrayal, NYT, 24.12.2008,

http://www.nytimes.com/2008/12/24/us/24jews.html

As Economy Dips,

Arrests for Shoplifting Soar

December 23, 2008

The New York Times

By IAN URBINA and SEAN D. HAMILL

Richard R. Johnson is the first to admit it was a bad idea.

Recently laid off from a job building trailers in Elkhart, Ind., Mr. Johnson

came up a dollar short at Martin’s Supermarket last month when he went to buy a

$4.99 bottle of sleep medication. So, “for some stupid reason,” he tried to

shoplift it and was immediately arrested.

“I was desperate, I guess,” said Mr. Johnson, 25, who said he had never been

arrested before. As the economy has weakened, shoplifting has increased, and

retail security experts say the problem has grown worse this holiday season.

Shoplifters are taking everything from compact discs and baby formula to gift

cards and designer clothing.

Police departments across the country say that shoplifting arrests are 10

percent to 20 percent higher this year than last. The problem is probably even

greater than arrest records indicate since shoplifters are often banned from

stores rather than arrested.

Much of the increase has come from first-time offenders like Mr. Johnson making

rash decisions in a pinch, the authorities say. But the ease with which stolen

goods can be sold on the Internet has meant a bigger role for organized crime

rings, which also engage in receipt fraud, fake price tagging and gift card

schemes, the police and security experts say.

And as temptation has grown for potential thieves, so too has stores’

vulnerability.

“More people are desperate economically, retailers are operating with leaner

staffs and police forces are cutting back or being told to deprioritize

shoplifting calls,” said Paul Jones, the vice president of asset protection for

the Retail Industry Leaders Association.

The problem, he said, could be particularly acute this December, “the month of

the year when shoplifting always goes way up.”

Two of the largest retail associations say that more than 80 percent of their

members are reporting sharp increases in shoplifting, according to surveys

conducted in the last two months.

Compounding the problem, stores are more reluctant to stop suspicious customers

because they fear scaring away much-needed business. And retailers are

increasingly trying to save money by hiring seasonal workers who, security

experts say, are themselves more likely to commit fraud or theft and are less

practiced at catching shoplifters than full-time employees are.

More than $35 million in merchandise is stolen each day nationwide, and about

one in 11 people in America have shoplifted, according to the nonprofit National

Association for Shoplifting Prevention.

“We used to see more repeat offenders doing it because of drug addiction,” said

Samyah Jubran, an assistant district attorney in Knoxville who for 13 years has

handled the bulk of the shoplifting cases there. “But many of these new

offenders may be doing it because of the economic situation. Maybe they’re

hurting at home, and they’re taking a risk they may not take otherwise.”

Much of the stolen merchandise is sold online.

Dave Finley, the president of Leadsonline.com, which offers software that helps

store owners track stolen goods being sold online and at pawn shops, said his

company had seen a 50 percent increase over the last year in the number of

shoplifting investigations handled by the company.

Security experts say retail theft is also being facilitated by Web sites that

sell fake receipts that thieves can use to obtain cash refunds for stolen

merchandise.

Andreas Carthy, the creator of one such site, denied that he was assisting with

fraud.

“We provide a no-questions-asked service,” he said in an e-mail message, adding

that his site was intended for people looking for prank gifts or students

seeking to inflate spending to get more generous allowances from their parents.

At about $40 each, the Web site — which insists they are “for novelty use only”

— sells about 80 fake receipts a month, Mr. Carthy said.

Local law enforcement and retailers have been trying new tactics to battle

shoplifting and other forms of retail crime.

In Savannah, Ga., a local convenience store chain has linked its video

surveillance to a police station so officers can help monitor the store for

shoplifting and other crimes. In Louisiana, the police have been requiring

shoplifters, even first-time offenders, to post $1,000 bail or stay in jail

until their court date. On Staten Island, malls have started posting the mug

shots of repeat shoplifters on video screens.

“There are more of them, and they seem more desperate,” said a store manager

about shoplifters at the nation’s largest shopping center, the Mall of America

in Bloomington, Minn., which has seen a 19 percent increase in shoplifting this

year over last.

The manager, who asked not to be identified because she was not permitted to

speak to reporters, said stealing gift cards was especially popular during the

holidays.

Shoplifters also seem to be getting bolder, according to industry surveys.

Thieves often put stolen items in bags lined with aluminum foil to avoid

detection by the storefront alarms. Others work in teams, with a decoy who tries

to look suspicious to draw out undercover security agents and attract the

attention of security cameras, the police said.

“We’re definitely seeing more sprinters,” said an undercover security guard at

Macy’s in Oakland, Calif., referring to shoplifters who make a run for the door.

The guard said that most large department stores instructed guards not to chase

shoplifters more than 100 feet outside the store, because research showed that

confrontations tended to become more serious beyond that point.

The holidays are a particularly popular time for pilfering.

About 20 percent of annual retail sales occur in November and December, and even

with precautions, the increased customer traffic makes it tougher to track

thieves. Moreover, cashiers are rushed by long lines, making them less vigilant

about checking for stolen credit cards.

Mr. Johnson, who was arrested last month, said that after being laid off from

his $20-an-hour job at a trailer factory a year ago, he took a job for $6.55 an

hour at McDonald’s. Six months later, he was laid off and has not been able to

find a job since.

He and his two small children rely on his wife’s minimum-wage job at Wal-Mart,

groceries from a food bank and help from his mother, he said.

“I just know things are going to get a lot rougher,” said Mr. Johnson, who is

awaiting trial. He added that no matter how tough it became, he had no intention

of shoplifting again.

Mr. Martin said he was shocked that the store had decided to prosecute him for

stealing such a small amount. A manager at Martin’s Supermarket said the store

had a policy of prosecuting all shoplifting.

Retail security experts, however, say that people like Mr. Johnson do not pose

the biggest threat to stores. People like Tommy Joe Tidwell do.

Mr. Tidwell, 35, pleaded guilty last month to running a shoplifting ring out of

Dayton, Ohio, that netted more than $1 million, according to court papers.

After Mr. Tidwell would print fraudulent UPC bar code labels on his home

computer, he and several conspirators would place them on items at Wal-Mart and

other stores, then buy the merchandise for a fraction of the real price. They

would resell the goods on the Internet, according to court papers.

Joe LaRocca, vice president of loss prevention for the National Retail

Federation, said that as the holidays approached, retail security workers were

keeping a close eye on receipt fraud.

But to entice shoppers, three times as many stores as last year have loosened

their return policies, extending the return period and being more lenient with

shoppers who lack receipts, according to the federation.

“Retailers are trying to find a balance,” Mr. LaRocca said. “They want to

provide good customer service at a time when it’s crucial for customers to be

able to shop comfortably or to return unwanted or duplicate gifts.

“But they also want to prevent criminals from taking advantage of them.”

Bob Driehaus contributed reporting.

As Economy Dips, Arrests

for Shoplifting Soar, NYT, 23.12.2008,

http://www.nytimes.com/2008/12/23/us/23shoplift.html?hp

As Outlook Dims,

Obama Expands Recovery Plans

December 21, 2008

The New York Times

By JACKIE CALMES

WASHINGTON — Faced with worsening forecasts for the economy, President-elect

Barack Obama is expanding his economic recovery plan and will seek to create or

save 3 million jobs in the next two years, up from a goal of 2.5 million jobs

set just last month, several advisers to Mr. Obama said Saturday.

Even Mr. Obama’s more ambitious goal would not fully offset as many as 4 million

jobs that some economists are projecting might be lost in the coming year,

according to the information he received from advisers in the past week. That

job loss would be double the total this year and could push the nation’s

unemployment rate past 9 percent if nothing is done.

The new job target was set after a meeting last Tuesday in which Christina D.

Romer, who is Mr. Obama’s choice to lead his Council of Economic Advisers,

presented information about previous recessions to establish that the current

downturn was likely to be “more severe than anything we’ve experienced in the

past half-century,” according to an Obama official familiar with the meeting.

Officials said they were working on a plan big enough to stimulate the economy

but not so big to provoke major opposition in Congress.

Mr. Obama’s advisers have projected that the multifaceted economic plan would

cost $675 billion to $775 billion. It would be the largest stimulus package in

memory and would most likely grow as it made its way through Congress, although

Mr. Obama has secured Democratic leaders’ agreement to ban spending on

pork-barrel projects.

The message from Mr. Obama was that “there was not going to be any spending

money for the sake of spending money,” said Lawrence H. Summers, who will be the

senior economic adviser in the White House.

Mark Zandi, chief economist of Moody’s Economy.com, who was an adviser to

Senator John McCain’s presidential campaign, said, “My advice is, err on the

side of too big a package rather than too little.” In an interview, Mr. Zandi,

who lately has advised Democratic leaders in Congress, also said he would

probably soon raise his own recommendation of a $600 billion stimulus.

Besides new spending, the Obama plan would provide tax relief for low-wage and

middle-income workers of roughly $150 billion, Democrats familiar with the

proposal said. The government would probably reduce the withholding of income or

payroll taxes so that most workers received larger paychecks as soon as possible

in 2009, an Obama adviser said.

The sorts of jobs Mr. Obama would propose to create involve construction work on

roads, mass transit projects, weatherization of government buildings and

installation of information technology in medical facilities, among others.

The outlines for Mr. Obama’s emerging plan, which he is developing in

consultation with Congress, including some Republicans, were mostly settled last

Tuesday when he met for four hours with economic and policy advisers. Mr. Obama

and his family left Saturday for a two-week vacation in Hawaii, his native

state, but the advisers will take his guidance — including instructions to be

“bolder,” according to one — and complete a draft in time for his return on Jan.

2.

The new Congress convenes on Jan. 6. The House and Senate, with larger

Democratic majorities, will work to pass a bill for Mr. Obama to sign shortly

after his inauguration, on Jan. 20.

The Obama blueprint covers five main areas of spending and tax breaks: health,

education, infrastructure, energy, and support for the poor and the unemployed.

Mr. Summers said the president-elect set short- and long-term themes in choosing

the plan’s components: “Creating jobs for people who need them, and doing things

that need to be done to lay the foundation for an economy that works for

middle-class families.”

At the meeting on Tuesday, Ms. Romer also laid out recommendations from private

sector analysts and liberal to conservative economists for a government stimulus

that ranged from $800 billion to $1.3 trillion over two years. Those consulted

included Martin Feldstein, a conservative economist and longtime Republican

presidential adviser, who is at the low end, and Lawrence B. Lindsey, a Federal

Reserve governor and Bush administration economist, who has recommended up to $1

trillion.

Even before the election, Mr. Feldstein was publicly arguing that whoever was

elected should immediately begin working with Congress on a big spending

package. Since then, Mr. Feldstein has also been revising his assessment upward

as the economy weakened further. “Without action,” he wrote in an e-mail

exchange, “the economy will continue to decline rapidly.”

Many decisions about the details have not been made, or are tentative pending

consultations with Congress. Several hundred billion dollars could go to states

and cities to finance public works and subsidize their health and education

programs so that local governments do not have to raise taxes and cut essential

programs, steps that would be counterproductive economically.

The Obama team has a list of $136 billion in infrastructure projects from the

National Governors Association that consists mostly of transit construction but

also includes port expansions and renewable energy programs. For education,

besides money to build and renovate schools, Mr. Obama will call for money to

train more teachers, expand early childhood education and provide more college

tuition aid.

Federal money to local governments would come with a “use it or lose it” clause

under Mr. Obama’s plans, advisers say. The president-elect will also propose to

direct some money to public and private partnerships for major projects like a

national energy grid intended to harness alternative energy sources such as wind

power.

For those “most vulnerable” because of the recession, as the Obama team

describes the needy and jobless population, the president-elect will propose

expanding the length of unemployment compensation, as well as food aid and

additional support.

With millions more Americans losing their health care coverage, either through

job losses or because they can no longer afford to pay for insurance, Mr. Obama

will propose major new spending to subsidize states’ share of Medicaid and their

children’s health programs, and to expand health care coverage for those who

lose insurance from their employers.

Mr. Obama plans a down payment on his campaign promise to help pay for hospitals

and other medical providers to computerize their health records to save billions

in paperwork and administrative costs. He might also propose subsidies to train

more nurses, both to create jobs now and address a looming shortage in the

health professions.

Mr. Obama has spoken in recent days with the Senate majority leader, Harry Reid,

and the House speaker, Nancy Pelosi. Last week, Mr. Reid’s office sent an e-mail

message to senators saying that in conversations with the Obama transition team,

“we have communicated our willingness to work within these parameters as closely

as possible and urge all offices to do the same.”

As Outlook Dims, Obama

Expands Recovery Plans, NYT, 21.12.2008,

http://www.nytimes.com/2008/12/21/us/21stimulus.html

The Reckoning

White House Philosophy

Stoked Mortgage Bonfire

December 21, 2008

The New York Times

By JO BECKER, SHERYL GAY STOLBERG

and STEPHEN LABATON

“We can put light where there’s darkness, and hope where there’s despondency

in this country. And part of it is working together as a nation to encourage

folks to own their own home.” — President Bush, Oct. 15, 2002

WASHINGTON — The global financial system was teetering on the edge of collapse

when President Bush and his economics team huddled in the Roosevelt Room of the

White House for a briefing that, in the words of one participant, “scared the

hell out of everybody.”

It was Sept. 18. Lehman Brothers had just gone belly-up, overwhelmed by toxic

mortgages. Bank of America had swallowed Merrill Lynch in a hastily arranged

sale. Two days earlier, Mr. Bush had agreed to pump $85 billion into the failing

insurance giant American International Group.

The president listened as Ben S. Bernanke, chairman of the Federal Reserve, laid

out the latest terrifying news: The credit markets, gripped by panic, had frozen

overnight, and banks were refusing to lend money.

Then his Treasury secretary, Henry M. Paulson Jr., told him that to stave off

disaster, he would have to sign off on the biggest government bailout in

history.

Mr. Bush, according to several people in the room, paused for a single, stunned

moment to take it all in.

“How,” he wondered aloud, “did we get here?”

Eight years after arriving in Washington vowing to spread the dream of

homeownership, Mr. Bush is leaving office, as he himself said recently, “faced

with the prospect of a global meltdown” with roots in the housing sector he so

ardently championed.

There are plenty of culprits, like lenders who peddled easy credit, consumers

who took on mortgages they could not afford and Wall Street chieftains who

loaded up on mortgage-backed securities without regard to the risk.

But the story of how we got here is partly one of Mr. Bush’s own making,

according to a review of his tenure that included interviews with dozens of

current and former administration officials.

From his earliest days in office, Mr. Bush paired his belief that Americans do

best when they own their own home with his conviction that markets do best when

let alone.

He pushed hard to expand homeownership, especially among minorities, an

initiative that dovetailed with his ambition to expand the Republican tent — and

with the business interests of some of his biggest donors. But his housing

policies and hands-off approach to regulation encouraged lax lending standards.

Mr. Bush did foresee the danger posed by Fannie Mae and Freddie Mac, the

government-sponsored mortgage finance giants. The president spent years pushing

a recalcitrant Congress to toughen regulation of the companies, but was

unwilling to compromise when his former Treasury secretary wanted to cut a deal.

And the regulator Mr. Bush chose to oversee them — an old prep school buddy —

pronounced the companies sound even as they headed toward insolvency.

As early as 2006, top advisers to Mr. Bush dismissed warnings from people inside

and outside the White House that housing prices were inflated and that a

foreclosure crisis was looming. And when the economy deteriorated, Mr. Bush and

his team misdiagnosed the reasons and scope of the downturn; as recently as

February, for example, Mr. Bush was still calling it a “rough patch.”

The result was a series of piecemeal policy prescriptions that lagged behind the

escalating crisis.

“There is no question we did not recognize the severity of the problems,” said

Al Hubbard, Mr. Bush’s former chief economics adviser, who left the White House

in December 2007. “Had we, we would have attacked them.”

Looking back, Keith B. Hennessey, Mr. Bush’s current chief economics adviser,

says he and his colleagues did the best they could “with the information we had

at the time.” But Mr. Hennessey did say he regretted that the administration did

not pay more heed to the dangers of easy lending practices. And both Mr. Paulson

and his predecessor, John W. Snow, say the housing push went too far.

“The Bush administration took a lot of pride that homeownership had reached

historic highs,” Mr. Snow said in an interview. “But what we forgot in the

process was that it has to be done in the context of people being able to afford

their house. We now realize there was a high cost.”

For much of the Bush presidency, the White House was preoccupied by terrorism

and war; on the economic front, its pressing concerns were cutting taxes and

privatizing Social Security. The housing market was a bright spot: ever-rising

home values kept the economy humming, as owners drew down on their equity to buy

consumer goods and pack their children off to college.

Lawrence B. Lindsay, Mr. Bush’s first chief economics adviser, said there was

little impetus to raise alarms about the proliferation of easy credit that was

helping Mr. Bush meet housing goals.

“No one wanted to stop that bubble,” Mr. Lindsay said. “It would have conflicted

with the president’s own policies.”

Today, millions of Americans are facing foreclosure, homeownership rates are

virtually no higher than when Mr. Bush took office, Fannie and Freddie are in a

government conservatorship, and the bailout cost to taxpayers could run in the

trillions.

As the economy has shed jobs — 533,000 last month alone — and his party has been

punished by irate voters, the weakened president has granted his Treasury

secretary extraordinary leeway in managing the crisis.

Never once, Mr. Paulson said in a recent interview, has Mr. Bush overruled him.

“I’ve got a boss,” he explained, who “understands that when you’re dealing with

something as unprecedented and fast-moving as this we need to have a different

operating style.”

Mr. Paulson and other senior advisers to Mr. Bush say the administration has

responded well to the turmoil, demonstrating flexibility under difficult

circumstances. “There is not any playbook,” Mr. Paulson said.

The president declined to be interviewed for this article. But in recent weeks

Mr. Bush has shared his views of how the nation came to the brink of economic

disaster. He cites corporate greed and market excesses fueled by a flood of

foreign cash — “Wall Street got drunk,” he has said — and the policies of past

administrations. He blames Congress for failing to reform Fannie and Freddie.

Last week, Fox News asked Mr. Bush if he was worried about being the Herbert

Hoover of the 21st century.

“No,” Mr. Bush replied. “I will be known as somebody who saw a problem and put

the chips on the table to prevent the economy from collapsing.”

But in private moments, aides say, the president is looking inward. During a

recent ride aboard Marine One, the presidential helicopter, Mr. Bush sounded a

reflective note.

“We absolutely wanted to increase homeownership,” Tony Fratto, his deputy press

secretary, recalled him saying. “But we never wanted lenders to make bad

decisions.”

A Policy Gone Awry

Darrin West could not believe it. The president of the United States was

standing in his living room.

It was June 17, 2002, a day Mr. West recalls as “the highlight of my life.” Mr.

Bush, in Atlanta to unveil a plan to increase the number of minority homeowners

by 5.5 million, was touring Park Place South, a development of starter homes in

a neighborhood once marked by blight and crime.

Mr. West had patrolled there as a police officer, and now he was the proud owner

of a $130,000 town house, bought with an adjustable-rate mortgage and a $20,000

government loan as his down payment — just the sort of creative public-private

financing Mr. Bush was promoting.

“Part of economic security,” Mr. Bush declared that day, “is owning your own

home.”

A lot has changed since then. Mr. West, beset by personal problems, left

Atlanta. Unable to sell his home for what he owed, he said, he gave it back to

the bank last year. Like other communities across America, Park Place South has

been hit with a foreclosure crisis affecting at least 10 percent of its 232

homes, according to Masharn Wilson, a developer who led Mr. Bush’s tour.

“I just don’t think what he envisioned was actually carried out,” she said.

Park Place South is, in microcosm, the story of a well-intentioned policy gone

awry. Advocating homeownership is hardly novel; the Clinton administration did

it, too. For Mr. Bush, it was part of his vision of an “ownership society,” in

which Americans would rely less on the government for health care, retirement

and shelter. It was also good politics, a way to court black and Hispanic

voters.

But for much of Mr. Bush’s tenure, government statistics show, incomes for most

families remained relatively stagnant while housing prices skyrocketed. That put

homeownership increasingly out of reach for first-time buyers like Mr. West.

So Mr. Bush had to, in his words, “use the mighty muscle of the federal

government” to meet his goal. He proposed affordable housing tax incentives. He

insisted that Fannie Mae and Freddie Mac meet ambitious new goals for low-income

lending.

Concerned that down payments were a barrier, Mr. Bush persuaded Congress to

spend up to $200 million a year to help first-time buyers with down payments and

closing costs.

And he pushed to allow first-time buyers to qualify for federally insured

mortgages with no money down. Republican Congressional leaders and some housing

advocates balked, arguing that homeowners with no stake in their investments

would be more prone to walk away, as Mr. West did. Many economic experts,

including some in the White House, now share that view.

The president also leaned on mortgage brokers and lenders to devise their own

innovations. “Corporate America,” he said, “has a responsibility to work to make

America a compassionate place.”

And corporate America, eyeing a lucrative market, delivered in ways Mr. Bush

might not have expected, with a proliferation of too-good-to-be-true teaser

rates and interest-only loans that were sold to investors in a loosely regulated

environment.

“This administration made decisions that allowed the free market to operate as a

barroom brawl instead of a prize fight,” said L. William Seidman, who advised

Republican presidents and led the savings and loan bailout in the 1990s. “To

make the market work well, you have to have a lot of rules.”

But Mr. Bush populated the financial system’s alphabet soup of oversight

agencies with people who, like him, wanted fewer rules, not more.

Like Minds on Laissez-Faire

The president’s first chairman of the Securities and Exchange Commission

promised a “kinder, gentler” agency. The second was pushed out amid industry

complaints that he was too aggressive. Under its current leader, the agency

failed to police the catastrophic decisions that toppled the investment bank

Bear Stearns and contributed to the current crisis, according to a recent

inspector general’s report.

As for Mr. Bush’s banking regulators, they once brandished a chain saw over a

9,000-page pile of regulations as they promised to ease burdens on the industry.

When states tried to use consumer protection laws to crack down on predatory

lending, the comptroller of the currency blocked the effort, asserting that

states had no authority over national banks.

The administration won that fight at the Supreme Court. But Roy Cooper, North

Carolina’s attorney general, said, “They took 50 sheriffs off the beat at a time

when lending was becoming the Wild West.”

The president did push rules aimed at forcing lenders to more clearly explain

loan terms. But the White House shelved them in 2004, after industry-friendly

members of Congress threatened to block confirmation of his new housing

secretary.

In the 2004 election cycle, mortgage bankers and brokers poured nearly $847,000

into Mr. Bush’s re-election campaign, more than triple their contributions in

2000, according to the nonpartisan Center for Responsive Politics. The

administration did not finalize the new rules until last month.

Among the Republican Party’s top 10 donors in 2004 was Roland Arnall. He founded

Ameriquest, then the nation’s largest lender in the subprime market, which

focuses on less creditworthy borrowers. In July 2005, the company agreed to set

aside $325 million to settle allegations in 30 states that it had preyed on

borrowers with hidden fees and ballooning payments. It was an early signal that

deceptive lending practices, which would later set off a wave of foreclosures,

were widespread.

Andrew H. Card Jr., Mr. Bush’s former chief of staff, said White House aides

discussed Ameriquest’s troubles, though not what they might portend for the

economy. Mr. Bush had just nominated Mr. Arnall as his ambassador to the

Netherlands, and the White House was primarily concerned with making sure he

would be confirmed.

“Maybe I was asleep at the switch,” Mr. Card said in an interview.

Brian Montgomery, the Federal Housing Administration commissioner, understood

the significance. His agency insures home loans, traditionally for the same

low-income minority borrowers Mr. Bush wanted to help. When he arrived in June

2005, he was shocked to find those customers had been lured away by the “fool’s

gold” of subprime loans. The Ameriquest settlement, he said, reinforced his

concern that the industry was exploiting borrowers.

In December 2005, Mr. Montgomery drafted a memo and brought it to the White

House. “I don’t think this is what the president had in mind here,” he recalled

telling Ryan Streeter, then the president’s chief housing policy analyst.

It was an opportunity to address the risky subprime lending practices head on.

But that was never seriously discussed. More senior aides, like Karl Rove, Mr.

Bush’s chief political strategist, were wary of overly regulating an industry

that, Mr. Rove said in an interview, provided “a valuable service to people who

could not otherwise get credit.” While he had some concerns about the industry’s

practices, he said, “it did provide an opportunity for people, a lot of whom are

still in their houses today.”

The White House pursued a narrower plan offered by Mr. Montgomery that would

have allowed the F.H.A. to loosen standards so it could lure back subprime

borrowers by insuring similar, but safer, loans. It passed the House but died in

the Senate, where Republican senators feared that the agency would merely be

mimicking the private sector’s risky practices — a view Mr. Rove said he shared.

Looking back at the episode, Mr. Montgomery broke down in tears. While he

acknowledged that the bill did not get to the root of the problem, he said he

would “go to my grave believing” that at least some homeowners might have been

spared foreclosure.

Today, administration officials say it is fair to ask whether Mr. Bush’s

ownership push backfired. Mr. Paulson said the administration, like others

before it, “over-incented housing.” Mr. Hennessey put it this way: “I would not

say too much emphasis on expanding homeownership. I would say not enough early

focus on easy lending practices.”

‘We Told You So’

Armando Falcon Jr. was preparing to take on a couple of giants.

A soft-spoken Texan, Mr. Falcon ran the Office of Federal Housing Enterprise

Oversight, a tiny government agency that oversaw Fannie Mae and Freddie Mac, two

pillars of the American housing industry. In February 2003, he was finishing a

blockbuster report that warned the pillars could crumble.

Created by Congress, Fannie and Freddie — called G.S.E.’s, for

government-sponsored entities — bought trillions of dollars’ worth of mortgages

to hold or sell to investors as guaranteed securities. The companies were also

Washington powerhouses, stuffing lawmakers’ campaign coffers and hiring

bare-knuckled lobbyists.

Mr. Falcon’s report outlined a worst-case situation in which Fannie and Freddie

could default on debt, setting off “contagious illiquidity in the market” — in

other words, a financial meltdown. He also raised red flags about the companies’

soaring use of derivatives, the complex financial instruments that economic

experts now blame for spreading the housing collapse.

Today, the White House cites that report — and its subsequent effort to better

regulate Fannie and Freddie — as evidence that it foresaw the crisis and tried

to avert it. Bush officials recently wrote up a talking points memo headlined

“G.S.E.’s — We Told You So.”

But the back story is more complicated. To begin with, on the day Mr. Falcon

issued his report, the White House tried to fire him.

At the time, Fannie and Freddie were allies in the president’s quest to drive up

homeownership rates; Franklin D. Raines, then Fannie’s chief executive, has fond

memories of visiting Mr. Bush in the Oval Office and flying aboard Air Force One

to a housing event. “They loved us,” he said.

So when Mr. Falcon refused to deep-six his report, Mr. Raines took his

complaints to top Treasury officials and the White House. “I’m going to do what

I need to do to defend my company and my position,” Mr. Raines told Mr. Falcon.

Days later, as Mr. Falcon was in New York preparing to deliver a speech about

his findings, his cellphone rang. It was the White House personnel office, he

said, telling him he was about to be unemployed.

His warnings were buried in the next day’s news coverage, trumped by the White

House announcement that Mr. Bush would replace Mr. Falcon, a Democrat appointed

by Bill Clinton, with Mark C. Brickell, a leader in the derivatives industry

that Mr. Falcon’s report had flagged.

It was not until 2003, when Freddie became embroiled in an accounting scandal,

that the White House took on the companies in earnest. Mr. Bush decided to quit

the long-standing practice of rewarding supporters with high-paying appointments

to the companies’ boards — “political plums,” in Mr. Rove’s words. He also

withdrew Mr. Brickell’s nomination and threw his support behind Mr. Falcon,

beginning an intense effort to give his little regulatory agency more power.

Mr. Falcon lacked explicit authority to limit the size of the companies’ mammoth

investment portfolios, or tell them how much capital they needed to guard

against losses. White House officials wanted that to change. They also wanted

the power to put the companies into receivership, hoping that would end what Mr.

Card, the former chief of staff, called “the myth of government backing,” which

gave the companies a competitive edge because investors assumed the government

would not let them fail.

By the spring of 2005 a deal with Congress seemed within reach, Mr. Snow, the

former Treasury secretary, said in an interview.

Michael G. Oxley, an Ohio Republican and then-chairman of the House Financial

Services Committee, had produced what Mr. Snow viewed as “a pretty darned good

bill,” a watered-down version of what the president sought. But at the urging of

Mr. Card and the White House economics team, the president decided to hold out

for a tougher bill in the Senate.

Mr. Card said he feared that Mr. Snow was “more interested in the deal than the

result.” When the bill passed the House, the president issued a statement

opposing it, effectively killing any chance of compromise. Mr. Oxley was

furious.

“The problem with those guys at the White House, they had all the answers and

they didn’t think they had to listen to anyone, including the Treasury

secretary,” Mr. Oxley said in a recent interview. “They were driving the

ideological train. He was in the caboose, and they were in the engine room.”

Mr. Card and Mr. Hennessey said they had no regrets. They are convinced, Mr.

Hennessey said, that the Oxley bill would have produced “the worst of all

possible outcomes,” the illusion of reform without the substance.

Still, some former White House and Treasury officials continue to debate whether

Mr. Bush’s all-or-nothing approach scuttled a measure that, while imperfect,

might have given an aggressive regulator enough power to keep the companies from

failing.

Mr. Snow, for one, calls Mr. Oxley “a hero,” adding, “He saw the need to move.

It didn’t get done. And it’s too bad, because I think if it had, I think we

could well have avoided a big contributor to the current crisis.”

Unheeded Warnings

Jason Thomas had a nagging feeling.

The New Century Financial Corporation, a huge subprime lender whose mortgages

were bundled into securities sold around the world, was headed for bankruptcy in

March 2007. Mr. Thomas, an economic analyst for President Bush, was responsible

for determining whether it was a hint of things to come.

At 29, Mr. Thomas had followed a fast-track career path that took him from a

Buffalo meatpacking plant, where he worked as a statistician, to the White

House. He was seen as a whiz kid, “a brilliant guy,” his former boss, Mr.

Hubbard, says.

As Mr. Thomas began digging into New Century’s failure that spring, he became

fixated on a particular statistic, the rent-to-own ratio.

Typically, as home prices increase, rental costs rise proportionally. But Mr.

Thomas sent charts to top White House and Treasury officials showing that the

monthly cost of owning far outpaced the cost to rent. To Mr. Thomas, it was a

sign that housing prices were wildly inflated and bound to plunge, a condition

that could set off a foreclosure crisis as conventional and subprime borrowers

with little equity found they owed more than their houses were worth.

It was not the Bush team’s first warning. The previous year, Mr. Lindsay, the

former chief economics adviser, returned to the White House to tell his old

colleagues that housing prices were headed for a crash. But housing values are

hard to evaluate, and Mr. Lindsay had a reputation as a market pessimist, said

Mr. Hubbard, adding, “I thought, ‘He’s always a bear.’ ”

In retrospect, Mr. Hubbard said, Mr. Lindsay was “absolutely right,” and Mr.

Thomas’s charts “should have been a signal.”

Instead, the prevailing view at the White House was that the problems in the

housing market were limited to subprime borrowers unable to make their payments

as their adjustable mortgages reset to higher rates. That belief was shared by

Mr. Bush’s new Treasury secretary, Mr. Paulson.

Mr. Paulson, a former chairman of the Wall Street firm Goldman Sachs, had been

given unusual power; he had accepted the job only after the president guaranteed

him that Treasury, not the White House, would have the dominant role in shaping

economic policy. That shift merely continued an imbalance of power that stifled

robust policy debate, several former Bush aides say.

Throughout the spring of 2007, Mr. Paulson declared that “the housing market is

at or near the bottom,” with the problem “largely contained.” That position

underscored nearly every action the Bush administration took in the ensuing

months as it offered one limited response after another.

By that August, the problems had spread beyond New Century. Credit was

tightening, amid questions about how heavily banks were invested in securities

linked to mortgages. Still, Mr. Bush predicted that the turmoil would resolve

itself with a “soft landing.”

The plan Mr. Bush announced on Aug. 31 reflected that belief. Called “F.H.A.

Secure,” it aimed to help about 80,000 homeowners refinance their loans. Mr.

Montgomery, the housing commissioner, said that he knew the modest program was

not enough — the White House later expanded the agency’s rescue role — and that

he would be “flying the plane and fixing it at the same time.”

That fall, Representative Rahm Emanuel, a leading Democrat, former investment

banker and now the incoming chief of staff to President-elect Barack Obama,

warned the White House it was not doing enough. He said he told Joshua B.

Bolten, Mr. Bush’s chief of staff, and Mr. Paulson in a series of phone calls

that the credit crisis would get “deep and serious” and that the only answer was

big, internationally coordinated government intervention.

“You got to strangle this thing and suffocate it,” he recalled saying.

Instead, Mr. Bush developed Hope Now, a voluntary public-private partnership to

help struggling homeowners refinance loans. And he worked with Congress to pass

a stimulus package that sent taxpayers $150 billion in tax rebates.

In a speech to the Economic Club of New York in March 2008, he cautioned against

Washington’s temptation “to say that anything short of a massive government

intervention in the housing market amounts to inaction,” adding that government

action could make it harder for the markets to recover.

Dominoes Start to Fall

Within days, Bear Sterns collapsed, prompting the Federal Reserve to engineer a

hasty sale. Some economic experts, including Timothy F. Geithner, the president

of the New York Federal Reserve Bank (and Mr. Obama’s choice for Treasury

secretary) feared that Fannie Mae and Freddie Mac could be the next to fall.

Mr. Bush was still leaning on Congress to revamp the tiny agency that oversaw

the two companies, and had acceded to Mr. Paulson’s request for the negotiating

room that he had denied Mr. Snow. Still, there was no deal.

Over the previous two years, the White House had effectively set the agency

adrift. Mr. Falcon left in 2005 and was replaced by a temporary director, who

was in turn replaced by James B. Lockhart, a friend of Mr. Bush from their days

at Andover, and a former deputy commissioner of the Social Security

Administration who had once run a software company.

On Mr. Lockhart’s watch, both Freddie and Fannie had plunged into the riskiest

part of the market, gobbling up more than $400 billion in subprime and other

alternative mortgages. With the companies on precarious footing, Mr. Geithner

had been advocating that the administration seize them or take other steps to

reassure the market that the government would back their debt, according to two

people with direct knowledge of his views.

In an Oval Office meeting on March 17, however, Mr. Paulson barely mentioned the

idea, according to several people present. He wanted to use the troubled

companies to unlock the frozen credit market by allowing Fannie and Freddie to

buy more mortgage-backed securities from overburdened banks. To that end, Mr.

Lockhart’s office planned to lift restraints on the companies’ huge portfolios —

a decision derided by former White House and Treasury officials who had worked

so hard to limit them.

But Mr. Paulson told Mr. Bush the companies would shore themselves up later by

raising more capital.

“Can they?” Mr. Bush asked.

“We’re hoping so,” the Treasury secretary replied.

That turned out to be incorrect, and did not surprise Mr. Thomas, the Bush

economic adviser. Throughout that spring and summer, he warned the White House

and Treasury that, in the stark words of one e-mail message, “Freddie Mac is in

trouble.” And Mr. Lockhart, he charged, was allowing the company to cover up its

insolvency with dubious accounting maneuvers.

But Mr. Lockhart continued to offer reassurances. In a July appearance on CNBC,

he declared that the companies were well managed and “worsts were not coming to

worst.” An infuriated Mr. Thomas sent a fresh round of e-mail messages accusing

Mr. Lockhart of “pimping for the stock prices of the undercapitalized firms he

regulates.”

Mr. Lockhart defended himself, insisting in an interview that he was aware of

the companies’ vulnerabilities, but did not want to rattle markets.

“A regulator,” he said, “does not air dirty laundry in public.”

Soon afterward, the companies’ stocks lost half their value in a single day,

prompting Congress to quickly give Mr. Paulson the power to spend $200 billion

to prop them up and to finally pass Mr. Bush’s long-sought reform bill, but it

was too late. In September, the government seized control of Freddie Mac and

Fannie Mae.

In an interview, Mr. Paulson said the administration had no justification to

take over the companies any sooner. But Mr. Falcon disagreed: “They absolutely

could have if they had thought there was a real danger.”

By Sept. 18, when Mr. Bush and his team had their fateful meeting in the

Roosevelt Room after the failure of Lehman Brothers and the emergency rescue of

A.I.G., Mr. Paulson was warning of an economic calamity greater than the Great

Depression. Suddenly, historic government intervention seemed the only option.

When Mr. Paulson spelled out what would become a $700 billion plan to rescue the

nation’s banking system, the president did not hesitate.

“Is that enough?” Mr. Bush asked.

“It’s a lot,” the Treasury secretary recalled replying. “It will make a

difference.” And in any event, he told Mr. Bush, “I don’t think we can get

more.”

As the meeting wrapped up, a handful of aides retreated to the White House

Situation Room to call Vice President Dick Cheney in Florida, where he was

attending a fund-raiser. Mr. Cheney had long played a leading role in economic

policy, though housing was not a primary interest, and like Mr. Bush he had a

deep aversion to government intervention in the market. Nonetheless, he backed

the bailout, convinced that too many Americans would suffer if Washington did

nothing.

Mr. Bush typically darts out of such meetings quickly. But this time, he

lingered, patting people on the back and trying to soothe his downcast staff.

“During times of adversity, he bucks everybody up,” Mr. Paulson said.

It was not the end of the failures or government interventions; the

administration has since stepped in to rescue Citigroup and, just last week, the

Detroit automakers. With 31 days left in office, Mr. Bush says he will leave it

to historians to analyze “what went right and what went wrong,” as he put it in

a speech last week to the American Enterprise Institute.

Mr. Bush said he was too focused on the present to do much looking back.

“It turns out,” he said, “this isn’t one of the presidencies where you ride off

into the sunset, you know, kind of waving goodbye.”

Kitty Bennett contributed reporting.

White House Philosophy

Stoked Mortgage Bonfire, NYT, 21.12.2008,

http://www.nytimes.com/2008/12/21/business/21admin.html

Extended Benefits

Are a Lifeline for Many Unemployed

December 21, 2008

The New York Times

By MICHAEL LUO

HUDSON, Fla. — Rick E. Rockwell plopped his large frame down in front of his

laptop on Thursday morning, next to a foot-wide sheaf of unpaid bills still in

their envelopes, lined up like an accordion on his desk. He logged into his bank

account to see if his unemployment check had been deposited yet.

His balance, however, remained stuck at $57.17.

“That’s amazing to me,” Mr. Rockwell said. “It still hasn’t posted yet.”

So Mr. Rockwell began another day as a man of the middle class who is now living

on an economic precipice.

Mr. Rockwell, 56, who estimates he has sent out more than 400 job applications

over the last year and gone to just four interviews, is one of the more than 5.4

million people across the country receiving unemployment benefits. And Mr.

Rockwell is part of arguably the hardest-luck group of all — those who have been

out of work for so long that they are depending on a second emergency extension

of unemployment insurance that Congress passed and President Bush signed last

month.

In the 21 states and the District of Columbia currently with three-month average

unemployment rates above 6 percent that means 20 more weeks of what has become

an economic lifeline for many in the midst of one of the deepest recessions in

the past century. Florida’s rate for November was 7.3 percent. (The other states

get seven additional weeks.)

For Mr. Rockwell, who lost his job in January as a sales manager at a computer

store that he and his brother owned, the weekly checks of $275 — the maximum