|

History > 2011 > USA > Economy > Poverty (I)

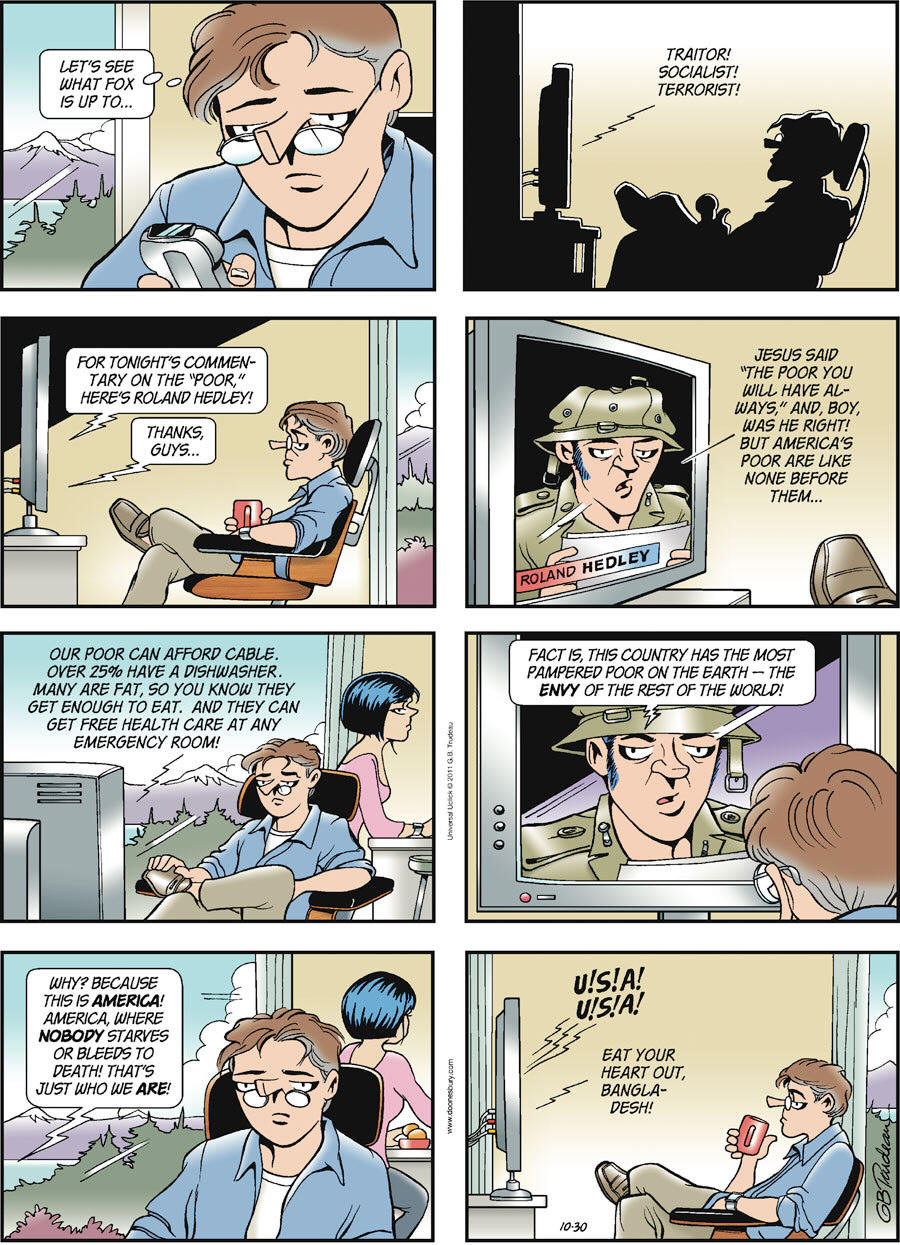

Doonesbury

by Garry Trudeau

Gocomics

October 30, 2011

http://www.gocomics.com/doonesbury/2011/10/30

At Detroit Food Bank,

Founders Are Gone,

but a Mission Endures

December

24, 2011

The New York Times

By DAN BARRY

DETROIT

Trucks sighing under the weight of their cargo pull up, one after another, to

the dock of an old manufacturing plant on the west side of ever-challenged

Detroit. For all the convoluted coding contained in their bills of lading, these

trucks carry freight as basic to life as air.

Food. Thousands of cases of cheap, nutritious food.

And yards away, people bearing the weight of need choose items from some of

these cases that are spilling now with America’s bounty. Blue Diamond enriched

rice from Texas. Mission Pride fruit mix, in extra light syrup, from California.

Land O’ Lakes cheese blocks from Minnesota, in plain white boxes stamped “Not

for Retail.”

An artificial Christmas tree unearthed from storage eases the starkness of the

scene, but this is a year-round affair: tens of thousands of seniors, mothers

and children receive a free monthly parcel of food that would cost $50 at a

brand-name supermarket. That is, if you can still find one in the city.

Providing food to the poor is so routine that we rarely pause to consider its

sad necessity, or even how these harbors of grace come to be. This workhorse

operation in Detroit, for example, traces its roots back many years, to a

charismatic priest, a suburban housewife and the nonprofit organization that

survives them, Focus: HOPE.

The two founders, though dead, still linger. Here is the Rev. William

Cunningham, watching from his Mass card as the food program’s director works the

telephone. Here, too, is Eleanor Josaitis, observing from a photograph as the

warehouse manager prepares another inventory.

The manager, Glenn Stevenson, 65, looks up from his clipboard in a way that

signals he has too much counting to do, and not enough time. A churchgoing man

whose work attire includes a Detroit Tigers cap, he has been with Focus: HOPE

for 21 years. He knew both the priest, who died in 1997 at the age of 67, and

the housewife, who died at 79 in August. And, yes, he confirms, they’re here.

“Their spirit will always be with us,” Mr. Stevenson says, before turning back

to his tallying with the purpose of someone who feels he’s being watched.

The story of Focus: HOPE is part of Detroit lore, beginning with how Father

Cunningham, an English teacher, and Ms. Josaitis, a mother of five, united after

the devastating race riots of 1967 to fight poverty and champion racial harmony.

He gave up teaching to run a poor parish, she and her husband, Don, moved their

family into the city — at a time when other white people were moving out in

haste — and the two of them started to shake things up.

They published a study revealing how inner-city food and drug stores charged

more for goods of poorer quality. They lobbied the Department of Agriculture to

share the country’s stockpiled food with the country’s very poorest. They

broadened their vision to include job-training programs and contract work that

filled up old manufacturing plants along Oakman Boulevard.

Over the years, they became known as the saints of Detroit, which irritated them

and sold them short. They were compassionate, relentless and wonderfully flawed.

In other words, human.

Father Cunningham once rejected a well-intentioned businessman’s offer to donate

secondhand computers because, he said caustically, the people of Focus: HOPE

were not second-class citizens. And Ms. Josaitis could be so hard on employees —

“I know I’m riding my broom, but,” she’d say — that some of them gave her a

broom equipped with a seat and a horn.

The two co-founders could have booming quarrels, then abruptly switch to a

pleasant discussion about where to stop for lunch. They loved each other,

friends say, and knew instinctively that with his never-say-never vision and her

never-say-never managerial skills, anything was possible, including the almost

magical appearance of much-needed food.

Focus: HOPE was in on the ground floor 40 years ago when the federal government

began the Commodity Supplemental Food Program, devised to provide poor women and

children with basic, nutritious food. Before long, the Detroit operation was the

largest of its kind, and leading the fight to include poor people over 60, which

is now this obscure federal program’s central purpose.

These days, the federal program putters along, costing $177 million a year to

serve parts of 39 states, two Indian tribal organizations and the District of

Columbia. Focus: HOPE, meanwhile, is struggling, like the city it serves. The

distressed economy has forced recalibrations and cutbacks. A few weeks ago the

organization laid off dozens of employees and suspended several job-training

classes.

But the supplemental food program grinds on. It is the Focus: HOPE original, the

constant, overseen for the last 20 years by a 57-year-old man who will lunch on

McRib sandwiches five days in a row, no matter that part of his job is to

promote a balanced diet. His name is Frank Kubik, and he is all Detroit.

Mr. Kubik got laid off from Chrysler in 1979, then struggled for more than two

years to find a job. One miserable moment sticks most in his mind: standing in a

line of job seekers outside a building, being covered in snow, and seeing people

inside laughing at him and his fellow unemployed.

He finally took a low-paying job unloading the train cars of food for Focus:

HOPE, figuring he’d stay for six months. It’s been 30 years. Thirty years of

knowing that seniors prefer orange juice to tomato juice for washing down their

pills; that canned tomatoes are less popular than canned beans; that a two-pound

block of cheese can go a long way. Thirty years, all because of the examples set

by a priest and a housewife.

“They blew me away,” Mr. Kubik says, as rainwater drips from his office’s leaky

ceiling and Father Cunningham watches from a Mass card taped to a bookshelf.

It is a familiar refrain here, echoed by Mr. Stevenson in the warehouse, who

remembers how Ms. Josaitis often teased him about his messy desk (she was

teasing, wasn’t she?). By Jonetta Johnson, 50, the floor manager, who has been

here ever since Father Cunningham told her, more than 30 years ago, “You need

something to do.” By others. It’s Father William this and Eleanor that, still.

On another biting December day, people arrive by car, bus and foot for food.

They enter a storelike setting that carries an air of common dignity once

insisted upon by a priest and a housewife — and, now, by a successor who has not

forgotten the humiliation of standing in line for a job, covered in snow.

Guiding their carts past the glittering Christmas tree, the customers make their

selections down an aisle of opened boxes that overflow like cardboard

cornucopias. Tomato juice. Grape juice. Canned beef chunks. Canned apricots.

Spinach. Pasta. Corn. Rice. Cheese. The things that sustain us.

At Detroit Food Bank, Founders Are Gone, but a Mission Endures, NYT, 24.12.2011,

http://www.nytimes.com/2011/12/25/us/at-detroit-food-bank-founders-are-gone-but-mission-endures.html

Millionaires on Food Stamps and Jobless Pay? G.O.P. Is on It

December

12, 2011

The New York Times

By JENNIFER STEINHAUER

WASHINGTON — It’s an image many Americans would find rather upsetting: a

recently laid-off millionaire, luxuriating next to the pool eating grapes bought

with food stamps while waiting for an unemployment check to roll in.

Under the Republican bill to extend a payroll tax holiday scheduled to be voted

on in the House as early as Tuesday, those Americans with gross adjusted income

over $1 million would no longer be eligible for food stamps or jobless pay,

producing $20 million in savings to help pay for the tax cut for American

workers. The idea is also embraced by many Democrats, who had a similar version

of the savings in a Senate bill to extend the payroll tax cut, as did a failed

Republican Senate bill.

Yet as it turns out, millionaires on food stamps are about as rare as petunias

in January, even if you count a lottery winner in Michigan who managed to

collect the benefit until chagrined officials in the state put an end to it.

But the idea of ending unemployment insurance for very high earners — which

would be achieved essentially through taxing benefits up to 100 percent with a

phase-in beginning for those with gross adjusted income over $750,000 —

demonstrates an increasing desire among members of Congress to find some way to

make sure that the wealthiest Americans contribute more to reducing the deficit

and paying for middle-class tax relief.

Democrats have sought a surtax on income over $1 million to pay for an extension

of a tax break for the middle class, a surtax that Republicans have rejected.

Employees’ share of the payroll tax, now 4.2 percent of wages, is scheduled to

rise to 6.2 percent in January unless Congress takes action. The Senate is

expected to come back this week with another version of its bill to extend the

tax holiday. On Monday night, the majority leader, Senator Harry Reid, Democrat

of Nevada, served notice to Congressional Republicans that he would prevent

final votes on a must-pass bill to finance government operations until the

Democrats get what they want on the payroll tax.

While tycoons on food stamps might be hard to find, some millionaires do indeed

pursue unemployment pay when they find themselves out of job.

From 2005 to 2009, millionaires collected over $74 million in unemployment

benefits, according to an estimate by Senator Tom Coburn, Republican of

Oklahoma, who has paired with Senator Mark Udall, Democrat of Colorado, to push

to end the practice.

According to Mr. Coburn’s office, the Internal Revenue Service reported that

2,362 millionaires collected a total of $20,799,000 in unemployment benefits in

2009; 18 people with an adjusted gross income of $10,000,000 or more received an

average of $12,333 in jobless benefits for a total of $222,000.

“Making Coloradans pay for unemployment insurance for millionaires is frankly

irresponsible, especially at a time when money is tight and our debt is out of

control,” Mr. Udall said in an e-mail.

Unemployment benefits are essentially an insurance program financed through the

state and federal governments. States charge employers taxes dedicated to cover

the first 26 weeks of unemployment benefits paid to those Americans who lose

their jobs, with the federal government paying for extensions.

Currently, unemployment benefits have stretched out to 99 weeks, through a

series of nine extensions that began in 2008, reflecting the high levels of

extended unemployment that have dogged the country, at a cost of roughly $180

billion to the federal government. (While there are also federal taxes charged

to employers, those monies tend to be used for administrative costs and not

benefits.) Roughly 3.5 million people are now receiving extended benefits. Some

states have already begun to reduce the number of extended weeks unemployment

offered.

The Republican legislation seeks to shorten the number of weeks that will be

extended to the jobless, and offer states more flexibility with how they use

their own unemployment taxes, including starting programs that train people for

work while they accept benefits.

“It’s a water drop in a hurricane,” said Wayne Vroman, an economist at the Urban

Institute. “I can see the PR appeal, but unemployment insurance collected by

millionaires is not one of the major problems with the program. This is a way of

trying to put an income test on the unemployment system that has never existed

in the past.”

Food stamps are another matter, as recipients must demonstrate low income levels

to receive them. Household income must not exceed 130 percent of poverty; for a

family of three that would be a gross monthly income of $2,008.

However, of the 53 states and territories, 40 have no asset tests, which means

that in some situations it would be possible for someone with, for instance, a

large house or a luxury car — or in the case of Michigan, current lottery

winnings not yet delivered in full — to receive food stamps.

Department of Agriculture officials dismissed the notion of millionaire food

stamp recipients. “Federal law is clear,” said Aaron Lavallee, a spokesman for

the department. “The program is intended for households with income not

exceeding 130 percent of poverty.”

Among the 46 million Americans who receive the assistance — roughly one in seven

Americans — few seem to be millionaires. As such, the $200 million in savings

from this cut would be largely achieved through the cuts to the unemployment

insurance for high earners.

Jackie

Calmes contributed reporting.

Millionaires on Food Stamps and Jobless Pay? G.O.P. Is on It, NYT, 12.12.2011,

http://www.nytimes.com/2011/12/13/us/gop-bill-would-block-food-stamps-and-jobless-pay-for-millionaires.html

To Fix

Health, Help the Poor

December 8,

2011

The New York Times

By ELIZABETH H. BRADLEY and LAUREN TAYLOR

New Haven

IT’S common knowledge that the United States spends more than any other country

on health care but still ranks in the bottom half of industrialized countries in

outcomes like life expectancy and infant mortality. Why are these other

countries beating us if we spend so much more? The truth is that we may not be

spending more — it all depends on what you count.

In our comparative study of 30 industrialized countries, published earlier this

year in the journal BMJ Quality and Safety, we broadened the scope of

traditional health care industry analyses to include spending on social

services, like rent subsidies, employment-training programs, unemployment

benefits, old-age pensions, family support and other services that can extend

and improve life.

We studied 10 years’ worth of data and found that if you counted the combined

investment in health care and social services, the United States no longer spent

the most money — far from it. In 2005, for example, the United States devoted

only 29 percent of gross domestic product to health and social services

combined, while countries like Sweden, France, the Netherlands, Belgium and

Denmark dedicated 33 percent to 38 percent of their G.D.P. to the combination.

We came in 10th.

What’s more, America is one of only three industrialized countries to spend the

majority of its health and social services budget on health care itself. For

every dollar we spend on health care, we spend an additional 90 cents on social

services. In our peer countries, for every dollar spent on health care, an

additional $2 is spent on social services. So not only are we spending less,

we’re allocating our resources disproportionately on health care.

Our study found that countries with high health care spending relative to social

spending had lower life expectancy and higher infant mortality than countries

that favored social spending. While the stagnating life expectancy in the United

States remains at 78 years, in many European countries it has leapt to well over

80 years, and several countries boast infant mortality rates approximately half

of ours. In a national survey conducted by the Robert Wood Johnson Foundation,

four out of five physicians agreed that unmet social needs led directly to worse

health.

Unfortunately, instead of learning from countries like Sweden and France, we

prefer the frantic scramble to recover money from one part of the health care

system only to reallocate it toward retreads of previously failed reforms. We

pretend that the fresh schemes are innovative, but they are usually long on

promises, short on details and often marked with an annoying acronym: H.M.O.,

F.S.A., A.C.O. and so forth.

It’s time to think more broadly about where to find leverage for achieving a

healthier society. One way would be to invest more heavily in social services.

This may be difficult for many Americans to swallow as it suggests a potentially

expanded role for government. Out of respect for individuals’ rights, our

current social programs are mostly opt-in, leaving holes for the undocumented,

uneducated and unemployed to slip through cracks and become acutely ill.

Emergency rooms, though, are not allowed to opt out of providing these people

extraordinarily expensive medical treatment before discharging them back to

wretched conditions and their inevitable return to the E.R.

The impact of sub-par social conditions on health has been well documented.

Homelessness isn’t typically thought of as a medical problem, but it often

precludes good nutrition, personal hygiene and basic first aid, and it increases

the risks of frostbite, leg ulcers, upper respiratory infections and trauma from

muggings, beatings and rape. The Boston Health Care for the Homeless Program

tracked the medical expenses of 119 chronically homeless people for several

years. In one five-year period, the group accounted for 18,834 emergency room

visits estimated to cost $12.7 million.

We can learn from the star pupils in our analysis. Other countries have created

government ministries that marry health and social care. Earlier this year, the

Department of Health in Britain released plans to create health and well-being

boards comprising local government representatives, primary care physicians,

hospital administrators, children and adult-services specialists and public

health directors, who will coordinate care for their constituencies across the

health and social care spectrum. We should think expansively about how to

construct similar programs that enable much needed integration of these mutually

dependent sectors. The Department of Veterans Affairs is leading the way, with

programs called “stand downs” that simultaneously address the health and social

needs of retired service members.

It is Americans’ prerogative to continually vote down the encroachment of

government programs on our free-market ideology, but recognizing the health

effects of our disdain for comprehensive safety nets may well be the key to

unraveling the “spend more, get less” paradox. Before we spend even more money,

we should consider allocating it differently.

Elizabeth H.

Bradley is professor of public health at Yale

and faculty

director of its Global Health Leadership Institute,

where Lauren

Taylor is a program manager.

To Fix Health, Help the Poor, NYT, 8.12.2011,

http://www.nytimes.com/2011/12/09/opinion/to-fix-health-care-help-the-poor.html

Newt’s

War on Poor Children

December

2, 2011

The New York Times

By CHARLES M. BLOW

Newt

Gingrich has reached a new low, and that is hard for him to do.

Nearly two weeks after claiming that child labor laws are “truly stupid” and

implying that poor children should be put to work as janitors in their schools,

he now claims that poor children don’t understand work unless they’re doing

something illegal.

On Thursday, at a campaign stop in Iowa, the former House speaker said, “Start

with the following two facts: Really poor children in really poor neighborhoods

have no habits of working and have nobody around them who works. So they

literally have no habit of showing up on Monday. They have no habit of staying

all day. They have no habit of ‘I do this and you give me cash’ unless it’s

illegal.” (His second “fact” was that every first generational person he knew

started work early.)

This statement isn’t only cruel and, broadly speaking, incorrect, it’s

mind-numbingly tone-deaf at a time when poverty is rising in this country. He

comes across as a callous Dickensian character in his attitude toward America’s

most vulnerable — our poor children. This is the kind of statement that shines

light on the soul of a man and shows how dark it is.

Gingrich wants to start with the facts? O.K.

First, as I’ve pointed out before, three out of four poor working-aged adults —

ages 18 to 64 — work. Half of them have full-time jobs and a quarter work part

time.

Furthermore, according to an analysis of census data by Andrew A. Beveridge, a

sociologist at Queens College, most poor children live in a household where at

least one parent is employed. And even among children who live in extreme

poverty — defined here as a household with income less than 50 percent of the

poverty level — a third have at least one working parent. And even among

extremely poor children who live in extremely poor areas — those in which 30

percent or more of the population is poor — nearly a third live with at least

one working parent.

For this analysis, the most granular national data available — census areas with

100,000 or more people — were compared. For reference, New York City has 55 of

these areas. You’d have to slice the definition of neighborhoods rather thinly

to find a few areas that support Gingrich’s position.

Lastly, Gingrich vastly overreaches by suggesting that a lack of money

universally correlates to a lack of morals. Yes, poverty presents increased risk

factors for crime. But, encouragingly, data show that even as more Americans

have fallen into poverty in recent years, the crime rate over all — and,

specifically, among juveniles — has dropped.

“Facts” are not Gingrich’s forte. Yet he is now the Republican front-runner. It

just goes to show how bankrupt of compassion and allergic to accuracy that party

is becoming.

Newt’s War on Poor Children, NYT, 2.12.2011,

http://www.nytimes.com/2011/12/03/opinion/blow-newts-war-on-poor-children.html

Lines

Grow Long for Free School Meals, Thanks to Economy

November

29, 2011

The New York Times

By SAM DILLON

Millions of

American schoolchildren are receiving free or low-cost meals for the first time

as their parents, many once solidly middle class, have lost jobs or homes during

the economic crisis, qualifying their families for the decades-old safety-net

program.

The number of students receiving subsidized lunches rose to 21 million last

school year from 18 million in 2006-7, a 17 percent increase, according to an

analysis by The New York Times of data from the Department of Agriculture, which

administers the meals program. Eleven states, including Florida, Nevada, New

Jersey and Tennessee, had four-year increases of 25 percent or more, huge shifts

in a vast program long characterized by incremental growth.

The Agriculture Department has not yet released data for September and October.

“These are very large increases and a direct reflection of the hardships

American families are facing,” said Benjamin Senauer, a University of Minnesota

economist who studies the meals program, adding that the surge had happened so

quickly “that people like myself who do research are struggling to keep up with

it.”

In Sylva, N.C., layoffs at lumber and paper mills have driven hundreds of new

students into the free lunch program. In Las Vegas, where the collapse of the

construction industry has caused hardship, 15,000 additional students joined the

subsidized lunch program this fall. In Rochester, unemployed engineers and

technicians have signed up their children after the downsizing of Kodak and

other companies forced them from their jobs. Many of these formerly

middle-income parents have pleaded with school officials to keep their

enrollment a secret.

Students in families with incomes up to 130 percent of the poverty level — or

$29,055 for a family of four — are eligible for free school meals. Children in a

four-member household with income up to $41,348 qualify for a subsidized lunch

priced at 40 cents.

Among the first to call attention to the increases were Department of Education

officials who use subsidized lunch rates as a poverty indicator in federal

testing. This month, in releasing results of the National Assessment of

Educational Progress, they noted that the proportion of the nation’s fourth

graders enrolled in the lunch program had climbed to 52 percent from 49 percent

in 2009, crossing a symbolic watershed.

In the Rockdale County Schools in Conyers, Ga., east of Atlanta, the percentage

of students receiving subsidized lunches increased to 63 percent this year from

46 percent in 2006.

“We’re seeing people who were never eligible before, never had a need,” said

Peggy Lawrence, director of school nutrition.

One of those is Sheila Dawson, a Wal-Mart saleswoman whose husband lost his job

as the manager of a Waffle House last year, reducing their income by $45,000.

“We’re doing whatever we can to save money,” said Ms. Dawson, who has a

15-year-old daughter. “We buy clothes at the thrift store, we see fewer movies

and this year my daughter qualifies for reduced-price lunch.”

She added, “I feel like: ‘Hey, we were paying taxes all these years. This is

what they were for.’ ”

Although the troubled economy is the main factor in the increases, experts said,

some growth at the margins has resulted from a new way of qualifying students

for the subsidized meals, known as direct certification. In 2004, Congress

required the nation’s 17,000 school districts to match student enrollment lists

against records of local food-stamp agencies, directly enrolling those who

receive food stamps for the meals program. The number of districts doing so has

been rising — as have the number of school-age children in families eligible for

food stamps, to 14 million in 2010-11 from 12 million in 2009-10.

“The concern of those of us involved in the direct certification effort is how

to help all these districts deal with the exploding caseload of kids eligible

for the meals,” said Kevin Conway, a project director at Mathematica Policy

Research, a co-author of an October report to Congress on direct certification.

Congress passed the National School Lunch Act in 1946 to support commodity

prices after World War II by reducing farm surpluses while providing food to

schoolchildren. By 1970, the program was providing 22 million lunches on an

average day, about a fifth of them subsidized. Since then, the subsidized

portion has grown while paid lunches have declined, but not since 1972 have so

many additional children become eligible for free lunches as in fiscal year

2010, 1.3 million. Today it is a $10.8 billion program providing 32 million

lunches, 21 million of which are free or at reduced price.

All 50 states have shown increases, according to Agriculture Department data. In

Florida, which has 2.6 million public school students, an additional 265,000

students have become eligible for subsidies since 2007, with increases in

virtually every district.

“Growth has been across the board,” said Mark Eggers, the Florida Department of

Education official who oversees the lunch program.

In Tennessee, the number of students receiving subsidized meals has grown 37

percent since 2007.

“When a factory closes, our school districts see a big increase,” said Sarah

White, the state director of school nutrition.

In Las Vegas, with 13.6 percent unemployment, the enrollment of thousands of new

students in the subsidized lunch program forced the Clark County district to add

an extra shift at the football field-size central kitchen, said Virginia Beck,

an assistant director at the school food service.

In Roseville, Minn., an inner-ring St. Paul suburb, the proportion of subsidized

lunch students rose to 44 percent this fall from 29 percent in 2006-7, according

to Dr. Senauer, the economist. “There’s a lot of hurt in the suburbs,” he said.

“It’s the new face of poverty.”

In New York, the Gates Chili school district west of Rochester has lost 700

students since 2007-8, as many families have fled the area after mass layoffs.

But over those same four years, the subsidized lunch program has added 125

mouths, many of them belonging to the children of Kodak and Xerox managers and

technicians who once assumed they had a lifetime job, said Debbi Beauvais,

district supervisor of the meals program.

“Parents signing up children say, ‘I never thought a program like this would

apply to me and my kids,’ ” Ms. Beauvais said.

Many large urban school districts have for years been dominated by students poor

enough to qualify for subsidized lunches. In Dallas, Newark and Chicago, for

instance, about 85 percent of students are eligible, and most schools also offer

free breakfasts. Now, some places have added free supper programs, fearing that

needy students otherwise will go to bed hungry.

One is the Hickman Mills C-1 district in a threadbare Kansas City, Mo.,

neighborhood where a Home Depot, a shopping mall and a string of grocery stores

have closed.

Ten years ago, 48 percent of its students qualified for subsidized lunches. By

2007, that proportion had increased to 73 percent, said Leah Schmidt, the

district’s nutrition director. Last year, when it hit 80 percent, the district

started feeding 700 students a third meal, paid for by the state, each afternoon

when classes end.

“This is the neediest period I’ve seen in my 20-year career,” Ms. Schmidt said.

Robbie Brown

and Kimberley McGee contributed reporting.

Lines Grow Long for Free School Meals, Thanks to Economy, NYT, 29.11.2011,

http://www.nytimes.com/2011/11/30/education/surge-in-free-school-lunches-reflects-economic-crisis.html

The

Poor, the Near Poor and You

November

23, 2011

The New York Times

What is

it like to be poor? Thankfully, most Americans do not know, at least not

firsthand. And times are tough for the middle class. But everyone needs to

recognize a chilling reality: One in three Americans — 100 million people — is

either poor or perilously close to it.

The Times’s Jason DeParle, Robert Gebeloff and Sabrina Tavernise reported

recently on Census data showing that 49.1 million Americans are below the

poverty line — in general, $24,343 for a family of four. An additional 51

million are in the next category, which they termed “near poor” — with incomes

less than 50 percent above the poverty line.

As for all of that inspirational, up-by-their-bootstrap talk you hear on the

Republican campaign trail, over half of the near poor in the new tally actually

fell into that group from higher income levels as their resources were sapped by

medical expenses, taxes, work-related costs and other unavoidable outlays.

The worst downturn since the Great Depression is only part of the problem.

Before that, living standards were already being eroded by stagnating wages and

tax and economic policies that favored the wealthy.

Conservative politicians and analysts are spouting their usual denial. Gov. Rick

Perry and Representative Michele Bachmann have called for taxing the poor and

near poor more heavily, on the false grounds that they have been getting a free

ride. In fact, low-income workers do pay up, if not in federal income taxes,

then in payroll taxes and state and local taxes.

Asked about the new census data, Robert Rector, an analyst at the conservative

Heritage Foundation told The Times that the “emotionally charged terms ‘poor’ or

‘near poor’ clearly suggest to most people a level of material hardship that

doesn’t exist.” Heritage has its own, very different ranking system, based on

households’ “amenities.” According to that, the typical poor household has

roughly 14 of 30 amenities. In other words, how hard can things be if you have a

refrigerator, air-conditioner, coffee maker, cellphone, and other stuff?

The rankings ignore the fact that many of these are requisites of modern life

and that things increasingly out of reach for the poor and near poor —

education, health care, child care, housing and utilities — are the true

determinants of a good, upwardly mobile life.

Government surveys analyzed by the Center on Budget and Policy Priorities

indicate that in 2010, just over half of the country’s nearly 17 million poor

children, lived in households that reported at least one of four major

hardships: hunger, overcrowding, failure to pay the rent or mortgage on time or

failure to seek needed medical care. A good education is also increasingly out

of reach. A study by Martha Bailey, an economics professor at the University of

Michigan, showed that the difference in college-graduation rates between the

rich and poor has widened by more than 50 percent since the 1990s.

There is also a growing out-of-sight-out-of-mind problem. A study, by Sean

Reardon, a sociologist at Stanford, shows that Americans are increasingly living

in areas that are either poor or affluent. The isolation of the prosperous, he

said, threatens their support for public schools, parks, mass transit and other

investments that benefit broader society.

The poor do without and the near poor, at best, live from paycheck to paycheck.

Most Americans don’t know what that is like, but unless the nation reverses

direction, more are going to find out.

The Poor, the Near Poor and You, NYT, 23.11.2011,

http://www.nytimes.com/2011/11/24/opinion/the-poor-the-near-poor-and-you.html

Older,

Suburban and Struggling,

‘Near

Poor’ Startle the Census

November

18, 2011

The New York Times

By JASON DePARLE, ROBERT GEBELOFF and SABRINA TAVERNISE

WASHINGTON

— They drive cars, but seldom new ones. They earn paychecks, but not big ones.

Many own homes. Most pay taxes. Half are married, and nearly half live in the

suburbs. None are poor, but many describe themselves as barely scraping by.

Down but not quite out, these Americans form a diverse group sometimes called

“near poor” and sometimes simply overlooked — and a new count suggests they are

far more numerous than previously understood.

When the Census Bureau this month released a new measure of poverty, meant to

better count disposable income, it began altering the portrait of national need.

Perhaps the most startling differences between the old measure and the new

involves data the government has not yet published, showing 51 million people

with incomes less than 50 percent above the poverty line. That number of

Americans is 76 percent higher than the official account, published in

September. All told, that places 100 million people — one in three Americans —

either in poverty or in the fretful zone just above it.

After a lost decade of flat wages and the worst downturn since the Great

Depression, the findings can be thought of as putting numbers to the bleak

national mood — quantifying the expressions of unease erupting in protests and

political swings. They convey levels of economic stress sharply felt but until

now hard to measure.

The Census Bureau, which published the poverty data two weeks ago, produced the

analysis of those with somewhat higher income at the request of The New York

Times. The size of the near-poor population took even the bureau’s number

crunchers by surprise.

“These numbers are higher than we anticipated,” said Trudi J. Renwick, the

bureau’s chief poverty statistician. “There are more people struggling than the

official numbers show.”

Outside the bureau, skeptics of the new measure warned that the phrase “near

poor” — a common term, but not one the government officially uses — may suggest

more hardship than most families in this income level experience. A family of

four can fall into this range, adjusted for regional living costs, with an

income of up to $25,500 in rural North Dakota or $51,000 in Silicon Valley.

But most economists called the new measure better than the old, and many said

the findings, while disturbing, comported with what was previously known about

stagnant wages.

“It’s very consistent with everything we’ve been hearing in the last few years

about families’ struggle, earnings not keeping up for the bottom half,” said

Sheila Zedlewski, a researcher at the Urban Institute, a nonpartisan economic

and social research group.

Patched together a half-century ago, the official poverty measure has long been

seen as flawed. It ignores hundreds of billions the needy receive in food

stamps, tax credits and other programs, and the similarly large sums paid in

taxes, medical care and work expenses. The new method, called the Supplemental

Poverty Measure, counts all those factors and adjusts for differences in the

cost of living, which the official measure ignores.

The results scrambled the picture of poverty in many surprising ways. The

measure shows less severe destitution, but a bit more overall poverty; fewer

poor children, but more poor people over 65.

Of the 51 million who appear near poor under the fuller measure, nearly 20

percent were lifted up from poverty by benefits the official count overlooks.

But more than half were pushed down from higher income levels: more than eight

million by taxes, six million by medical expenses, and four million by work

expenses like transportation and child care.

Demographically, they look more like “The Brady Bunch” than “The Wire.” Half

live in households headed by a married couple; 49 percent live in the suburbs.

Nearly half are non-Hispanic white, 18 percent are black and 26 percent are

Latino.

Perhaps the most surprising finding is that 28 percent work full-time, year

round. “These estimates defy the stereotypes of low-income families,” Ms.

Renwick said.

Among them is Phyllis Pendleton, a social worker with Catholic Charities in

Washington, who proudly displays the signs of a hard-won middle-class life. She

has one BlackBerry and two cars (both Buicks from the 1990s), and a $230,000

house that she, her husband and two daughters will move into next week.

Combined, she and her husband, a janitor, make about $51,000 a year, more than

200 percent of the official poverty line. But they lose about a fifth to taxes,

medical care and transportation to work — giving them a disposable income of

about $40,000 a year.

Adjust the poverty threshold, as the new measure does, to $31,000 for the

region’s high cost of living, and Ms. Pendleton’s income is 29 percent above the

poverty line. That is to say, she is near poor.

While the phrase is new to her, the struggle it evokes is not.

“Living paycheck to paycheck,” is how she describes her survival strategy. “One

bad bill will wipe you out.”

It took her three years to save $3,000 for the down payment on her house, which

she got with subsidies from a nonprofit group, Capital Area Asset Builders. But

even after cutting out meals at Red Lobster, movie nights and new clothes, she

had to rely on government aid to get health insurance for her daughters, 11 and

13, and she is already worried about college tuition.

“I’m turning over every rock looking for scholarships,” she said. “The money’s

out there, you just have to find it.”

The findings, which the Census Bureau plans to release on Monday, have already

set off a contentious debate about how to describe such families: struggling,

straitened, economically insecure?

Robert Rector, an analyst at the conservative Heritage Foundation, rejects the

phrase “near poverty,” arguing that it conjures levels of dire need like hunger

and homelessness experienced by a minority even among those actually poor.

“I don’t have any objection to this measure if you use the term ‘low-income,’ ”

he said. “But the emotionally charged terms ‘poor’ or ‘near poor’ clearly

suggest to most people a level of material hardship that doesn’t exist. It is

deliberately used to mislead people.”

Bruce Meyer, an economist at the University of Chicago, warned that the numbers

are likely to mask considerable diversity. Some households, especially the

elderly, may have considerable savings. (Indeed, nearly one in five of the near

poor own their homes mortgage-free.) But others may be getting help with public

housing and food stamps.

“I do think this is a better measure, but I wouldn’t say that 100 million people

are on the edge of starvation or anything close to that,” Mr. Meyer said.

But Ms. Zedlewski said the seeming ordinariness of these families is part of the

point. “There are a lot of low-income Americans struggling to make ends meet,

and we don’t pay enough attention to them,” she said.

One group likely to gain attention is older Americans. By the official count,

only 22 percent of the elderly are either poor or near poor. By the alternate

count, the figure rises to 34 percent.

That is still less than the share among children, 39 percent, but it erases

about half the gap between the economic fortunes of the young and old recorded

in the official count. The likeliest explanation is high medical costs.

Another surprising finding is that only a quarter of the near poor are insured,

and 42 percent have private insurance. Indeed, the cost of paying the premiums

is part of the previously uncounted expenses they bear.

Belinda Sheppard’s finances have been so battered in the past year, she finds

herself wondering what storm will come next. Her adult daughter lost her job and

moved in. Her adult son does not have one and cannot move out.

That leaves three adults getting by on $46,000 from her daughter’s unemployment

check and the money Ms. Sheppard makes for a marketing firm, placing products in

grocery stores. Take out $7,000 for taxes, transportation and medical care, and

they have an income of about 130 percent of the poverty line — not poor, but

close.

Ms. Sheppard pays $2,000 in rent and says her employer classifies her as part

time to avoid offering her health insurance, even though she works 40 hours a

week. Unable to buy it on her own, she crosses her fingers and tries to stay

healthy.

“I try to work as many hours as I can, but my salary, it’s not enough for

everything,” she said. “I pay my bills with very small wiggle room. Or none.”

Older, Suburban and Struggling, ‘Near Poor’ Startle the

Census, NYT, 18.11.2011,

http://www.nytimes.com/2011/11/19/us/census-measures-those-not-quite-in-poverty-but-struggling.html

Bleak

Portrait of Poverty Is Off the Mark, Experts Say

November

3, 2011

The New York Times

By JASON DePARLE, ROBERT GEBELOFF and SABRINA TAVERNISE

WASHINGTON — When the Census Bureau said in September that the number of poor

Americans had soared by 10 million to rates rarely seen in four decades,

commentators called the report “shocking” and “bleak.” Most poverty experts

would add another description: “flawed.”

Concocted on the fly a half-century ago, the official poverty measure ignores

ever more of what is happening to the poor person’s wallet — good and bad. It

overlooks hundreds of billions of dollars the needy receive in food stamps and

other benefits and the similarly formidable amounts they lose to taxes and

medical care. It even fails to note that rents are higher in places like

Manhattan than they are in Mississippi.

On Monday, that may start to change when the Census Bureau releases a

long-promised alternate measure meant to do a better job of counting the

resources the needy have and the bills they have to pay. Similar measures,

quietly published in the past, suggest among other things that safety-net

programs have played a large and mostly overlooked role in restraining hardship:

as much as half of the reported rise in poverty since 2006 disappears.

The fuller measures have also shown less poverty among children but more among

older Americans, who are plagued by high medical costs. They have shown less

poverty among blacks but more among Asians; less poverty in rural areas and more

in cities and suburbs, where the cost of living is high. And they have found

fewer people in abject destitution, but a great many more crowding the hard-luck

ranks of the near poor, who do not qualify for many benefit programs and lose

income to taxes, child care and medical costs.

“The official measure no longer corresponds to reality,” said Jane Waldfogel, a

professor of social work at Columbia University. “It doesn’t get either side of

the equation right — how much the poor have or how much they need. No one really

trusts the data.”

Coming amid soaring need and bitter debt debates, the findings in Monday’s

release are likely to offer fodder both to defenders of safety-net programs and

fiscal conservatives who say the government already does much to temper hardship

and needs to do no more.

Experts expect the new report to be consistent with a decade of research about

the ways in which the official poverty rate distorts the realities of American

poverty.

The numbers in this article are based on that research — by the census, the

National Academy of Sciences and others — and include not just cash income but

also government benefits, work expenses, taxes and cost of living. Many experts

expect Monday’s census report, based on similar methods, to add a bit to the

official poverty count of 46.2 million, while most experts also expect the

recent growth will ap-pear less steep.

One alternate census data set quietly published last week said the number of

poor people has grown by 4.6 million since 2006, not by 9.7 million as the

bureau reported in September. At least 39 states showed no statistically

significant poverty growth despite surging unemployment, according to an

analysis by The New York Times, including Michigan, New York, New Jersey, Ohio,

Tennessee and Texas.

In North Carolina, poverty has risen by more than 250,000 people by official

count, but stayed flat under the alternate measure despite soaring unemployment.

One explanation can be found in programs the official count ignores: food stamps

and tax credits. Combined the two programs delivered $221 billion across the

country last year, according to the Center on Budget and Policy Priorities, more

than doubling since 2006.

In Charlotte, Angelique Melton was among the beneficiaries. A divorced mother of

two, Ms. Melton, 42, had worked her way up to a $39,000 a year position at a

construction management firm. But as building halted in 2009, Ms. Melton lost

her job.

Struggling to pay the rent and keep the family adequately fed, she took the only

job she could find: a part-time position at Wal-Mart that paid less than half

her former salary. With an annual income of about $7,500 — well below the

poverty line of $17,400 for a family of three — Ms. Melton was officially poor.

Unofficially she was not.

After trying to stretch her shrunken income, Ms. Melton signed up for $3,600 a

year in food stamps and received $1,800 in nutritional supplements from the

Women, Infants and Children program. And her small salary qualified her for

large tax credits, which arrive in the form of an annual check — in her case for

about $4,000.

Along with housing aid, those subsidies gave her an annual income of nearly

$18,800 — no one’s idea of rich, but by the new count not poor.

“They help you, my God,” Ms. Melton said. “I would not have made it otherwise.”

The official way of counting poverty — beloved not even by many of the people

who run the count — is a historical artifact. A federal official named Mollie

Orshansky created it as a placeholder in 1963 until something more sophisticated

came along.

It takes a limited view of income by counting cash alone. It ignores expenses,

like taxes and medical costs. And it set the poverty threshold in an outmoded

way — as a multiple of food costs, which have dwindled as a share of most

budgets, as is typical as a country becomes richer over time.

All three elements need updating, experts say. Yet other than to adjust the

poverty line for inflation, the government has not changed it since Ms.

Orshansky’s day. Efforts to do so have been slowed by both technical and

political concerns. Conservatives worry liberals will inflate the number to

justify more spending; liberals worry conservatives will define poverty away.

Virtually every effort to take a fuller view — counting more income and more

expenses — shows poverty rising more slowly in the recession than the official

data suggests. That is true of localized studies in New York City and Wisconsin

and at least four different national data sets that the Census Bureau publishes.

While the official national measure shows a rise of 9.8 million people, the

fuller census measures show a range from 4.5 million to 4.8 million.

“That’s a big difference,” said Timothy Smeeding, an economist at the University

of Wisconsin who oversaw the study in that state. “It’s about time we started

counting the programs we use to fight poverty.”

Arloc Sherman, a senior researcher at the Center on Budget and Policy

Priorities, said the new measure “is showing that government help is keeping

millions of families above the poverty line right now.”

While most scholars have called the fuller measure a step forward, Robert

Rector, an analyst at the Heritage Foundation, argues that both census counts —

old and new — sharply overstate the amount of deprivation in the United States.

In a recent study, he cited government data showing many poor families had game

systems like Xbox.

“When the American public hears the word poverty, they are thinking about

material hardship — bad housing, homelessness and hunger,” he said. “Most of the

people that are defined as poor by the government are not poor in that sense.”

One consistent finding in the alternate measures is that poverty falls among

children, the target of many government programs. And it rises among Americans

65 or older, who often have high out-of-pocket medical costs, despite being

covered by Medicare.

Such is the case for John William Springs, 69, a retired city worker in

Charlotte who gets nearly $12,000 a year in Social Security and disability

checks. That leaves him about $1,300 above the poverty threshold for a single

adult his age — officially not poor. Then again, Mr. Springs had a heart attack

last summer and struggles with lung disease. Factor in the $2,500 a year that he

estimates he spends on medicine, and Mr. Springs crosses the statistical line

into poverty.

An upbeat survivor of a lifetime of need, Mr. Springs fills his prescriptions in

partial amounts and argues the poverty counters got him right the first time.

“I ain’t poor,” he said. “I eat. I got a roof over my head.”

Some experts say cases like that of Mr. Springs may point to a hidden need among

the elderly, whose official poverty rates have sharply declined over the past

generation. Others have cautioned that the new measure still has flaws — failing

to capture, for instance, that many elderly can draw from savings and are less

reliant on annual income and benefits than younger people.

One concern in recent years is the sharp rise in “deep” poverty, defined as

living on less than half the money it would take to no longer be poor. That is

partly because of changes that make cash welfare harder to get. Yet many of the

very poor do receive food stamps, a program whose rapid expansion has made it a

safety net of last resort.

In part by counting food stamps, the fuller Census measure analyzed by The Times

shows deep poverty falling by nearly 25 percent.

At the same time, all the new measures show many more people in “near poverty” —

living on incomes between 100 percent and 150 percent of the poverty line. The

alternate census data show a 50 percent rise in their numbers, with 44 million

Americans in that economic band, where benefits dwindle in sums lost to taxes

and child care, and medical expenses mount. “That’s where your safety net

benefits phase out,” said Sheila Zedlewski, a researcher at the Urban Institute.

Even with assistance, life is a series of hard choices. Ashley Bolton was lifted

above the poverty line under the new measure by about $10,000 in federal

programs that cushioned her earnings as a hostess at the Original Pancake House

in Charlotte. Still, sometimes she lets her car insurance lapse. She juggles two

part-time jobs with classes to become a pharmacy technician, and relies on her

mother, who works nights, to put her children to bed.

“I live the recession,” Ms. Bolton said. “All that stuff that happened to people

— that’s my life every day.”

Bleak Portrait of Poverty Is Off the Mark, Experts Say, NYT, 3.11.2011,

http://www.nytimes.com/2011/11/04/us/experts-say-bleak-account-of-poverty-missed-the-mark.html

Extreme Poverty Spikes in U.S., Study Finds

November

3, 2011

The New York Times

By SABRINA TAVERNISE

WASHINGTON — The number of people living in neighborhoods of extreme poverty

grew substantially, by one third, over the past decade, according to a new

report, erasing most of the gains from the 1990’s when concentrated poverty

declined.

More than 10 percent of America’s poor now live in such neighborhoods, up from

9.1 percent in the beginning of the decade, an addition of more than 2 million

people, according to the report by the Brookings Institution, an independent

research group.

Extreme poverty — defined as areas where at least 40 percent of the population

lives below the federal poverty line, which in 2010, was $22,300 for a family of

four — is still below its 1990 level, when 14 percent of poor people lived in

such areas.

The report analyzed Census Bureau income data from 2000 to 2009, the most recent

year for which there is comprehensive data.

The data captures the first part of the decade most clearly, when growth in

concentrated poverty was highest in metropolitan areas in the Midwest. Of the

neighborhoods where poverty became most acute, three were Midwestern: Toledo,

Youngstown and Detroit.

The report estimated that in metropolitan areas, worsening economic conditions

in 2010 may have bumped up the portion of those living in concentrated poverty

metro areas to 15 percent, a notch below the 1990 level, 16.5 percent. The

biggest rises were in Sun Belt areas like Cape Coral, Fla., and Fresno, Calif.,

where the housing bust was biggest.

The Census Bureau’s traditional measure of poverty tends to overstate poverty

for some groups, because it does not take into account noncash government

assistance for the poor, like food stamps and the earned income tax credit.

Those programs lift millions of people above the poverty line.

The measure of concentrated poverty came into broad public use among academics

in the 1960’s, when civil unrest, the decline of blue-collar jobs and the flight

to the suburbs, left swaths of American cities stranded in deep poverty.

Academics argued that residents of such areas were stuck in a cycle of

joblessness, poor schools, broken families and high crime that led to worse

outcomes

“It’s the toughest, most malignant poverty that we have in the United States,”

said Peter Edelman, the director of the Center on Poverty, Inequality and Public

Policy at Georgetown University. “It’s bad outcomes reinforcing each other.”

Extreme Poverty Spikes in U.S., Study Finds, NYT,

3.11.2011,

http://www.nytimes.com/2011/11/04/us/extreme-poverty-is-up-brookings-report-finds.html

Outside Cleveland,

Snapshots of Poverty’s Surge in the Suburbs

October

24, 2011

The New York Times

By SABRINA TAVERNISE

PARMA

HEIGHTS, Ohio — The poor population in America’s suburbs — long a symbol of a

stable and prosperous American middle class — rose by more than half after 2000,

forcing suburban communities across the country to re-evaluate their identities

and how they serve their populations.

The increase in the suburbs was 53 percent, compared with 26 percent in cities.

The recession accelerated the pace: two-thirds of the new suburban poor were

added from 2007 to 2010.

“The growth has been stunning,” said Elizabeth Kneebone, a senior researcher at

the Brookings Institution, who conducted the analysis of census data. “For the

first time, more than half of the metropolitan poor live in suburban areas.”

As a result, suburban municipalities — once concerned with policing, putting out

fires and repairing roads — are confronting a new set of issues, namely how to

help poor residents without the array of social programs that cities have, and

how to get those residents to services without public transportation. Many

suburbs are facing these challenges with the tightest budgets in years.

“The whole political class is just getting the memo that Ozzie and Harriet don’t

live here anymore,” said Edward Hill, dean of the Levin College of Urban Affairs

at Cleveland State University.

This shift has helped redefine the image of the suburbs. “The suburbs were

always a place of opportunity — a better school, a bigger house, a better job,”

said Scott Allard, an associate professor at the University of Chicago who

focuses on social welfare policy and poverty. “Today, that’s not as true as the

popular mythology would have us believe.”

Since 2000, the poverty roll has increased by five million in the suburbs, with

large rises in metropolitan areas as different as Colorado Springs and

Greensboro, N.C. Over the decade, Midwestern suburbs ranked high; recently, the

rise has been sharpest in communities the housing collapse hit the hardest, like

Cape Coral, Fla., and Riverside, Calif., according to the Brookings analysis.

Nearly 60 percent of Cleveland’s poor, once concentrated in its urban core, now

live in its suburbs, up from 46 percent in 2000. Nationwide, 55 percent of the

poor population in metropolitan areas is now in the suburbs, up from 49 percent.

Poverty is new in Parma Heights, a quiet suburb of cul-de-sacs and clipped

lawns, and asking for help can be hard. The Parma Heights Food Pantry, which

began serving several dozen families a month in 2006, and now helps 260, draws a

stream of casualties from the moribund economy. Many never needed food relief

before.

Like Mary W., 59, who has worked all her life, most recently at a tire company

in Cleveland, and was always the one to remind colleagues to donate to charity.

Now she is the one who receives it.

When she first came to the pantry, “I cried my eyes out,” said Mary, who asked

that her last name not be used because she did not want her children to know

about her financial troubles.

At Vineyard Community Church in Wickliffe, another Cleveland suburb, Brent

Paulson, the pastor, said he had to post an employee in the driveway the day the

church’s food bank was open to coax people inside, they were so ashamed to ask

for help.

In a sign of just how far the economic distress had spread, one volunteer saw

his former boss come to the pantry, Mr. Paulson said.

The Cleveland Food Bank, which serves six counties, doubled its distribution

between 2005 and 2010. “There’s this sense of surprise,” said Anne Goodman, the

director, “this feeling that this has got to be a mistake. It has got to be a

bad dream.”

Calls to the United Way social services hot line from suburban areas in

northeast Ohio more than doubled from 2005 to 2010, outstripping the increase in

cities. “We are seeing a rise in need in places we never expected it,” said

Stephen Wertheim, director of the hotline, First Call for Help.

Poverty has been growing in the suburbs for years — along with the population.

But the 53 percent increase in poverty far outstripped the 14 percent population

increase in the past decade, speeding the change in their status as

upper-middle-class enclaves. They have been attracting immigrants following

construction jobs and families from cities seeking inexpensive housing as

suburbs aged.

Federal vouchers to get poor people into private housing also contributed, Ms.

Kneebone said. Cleveland was No. 15 among the country’s top 100 metropolitan

areas for increase in suburban share of vouchers.

Urban problems have appeared. In Penn Hills, a suburb of Pittsburgh where people

have always driven, poor residents walking near yards and bus stops have created

trouble with litter, said Alexandra Murphy, a Princeton doctoral student

studying suburban poverty.

Warrensville Heights, a suburb southeast of Cleveland, was pristine when Fran

Matthews moved there in 1987, with good schools, manicured lawns and

middle-class neighbors, she said. Now for-sale signs dot overgrown yards.

Break-ins are on the rise, though crime is still far lower than in the city.

Over all, the suburban poverty rate — 11.4 percent in 2010 — is still far below

the city rate of 20.9 percent, according to Ms. Kneebone.

“Now when you come home, you have to look around before you get out of the car,”

Ms. Matthews said.

The changes have affected the school system, she said, and her grandson now

attends a charter school in Cleveland.

The double punch of the recession and the foreclosure crisis — which hit

Cleveland and its suburbs particularly hard — has dragged middle-class people

down the income ladder. As defined by the Census Bureau, the poverty line for a

family of four was $22,314 last year.

“This community is middle class, but right on the line,” said Brad Sellers, a

retired professional basketball player who grew up in Warrensville Heights and

is running for mayor. “Any dramatic downturn can send you over the edge.”

The unemployment rate among black Americans was 16 percent in September,

according to the Bureau of Labor Statistics — nearly double the national rate, a

painful statistic in a suburb that is majority black.

“Where’s that 9 percent?” Mr. Sellers asked. “Not here.”

Some communities resist the idea that poverty exists. When Ann George, who runs

the Parma Heights pantry with stalwart volunteers, speaks at churches and

community gatherings, “I see the skepticism on people’s faces,” she said. “They

say, ‘This is Parma Heights, not Cleveland.’ ”

Other suburbs are adapting. In Maple Heights, Mayor Jeffrey Lansky embraced the

idea of a food bank, setting aside a space for it in 2008 and having the Fire

Department help renovate it. The Cuyahoga County Public Library now runs

after-school homework centers with snacks from the food bank, aimed at the

growing population of poor children.

Edward FitzGerald, the executive of Cuyahoga County, argued that the increase in

the suburban poor population could help lead to a fundamental change in local

government. For years Cleveland had most of the population — and resources — but

policy should reflect the flip in favor of the county, he said.

And with the state slashing funds, counties and the suburbs they contain will

have to ramp up social services and economic development on their own, many for

the first time.

“You’re talking about governing systems that have never really done this

before,” Mr. FitzGerald said.

Outside Cleveland, Snapshots of Poverty’s Surge in the

Suburbs; NYT, 24.10.2011,

http://www.nytimes.com/2011/10/25/us/suburban-poverty-surge-challenges-communities.html

For

Jobs, It’s War

September

16, 2011

The New York Times

By CHARLES M. BLOW

The

American political discussion has finally turned to the right target: jobs.

Even so, the president’s jobs bill is already being nickeled and dimed from the

right — and the left — even though it is only throwing nickels and dimes at the

problem to begin with. But at least it’s a start, even if a long-overdue one.

To understand just how overdue it is, one need look no further than the

absolutely dreadful data issued this week by the Census Bureau about the

increasing numbers of people falling into poverty. No matter how you slice it,

it’s bloody.

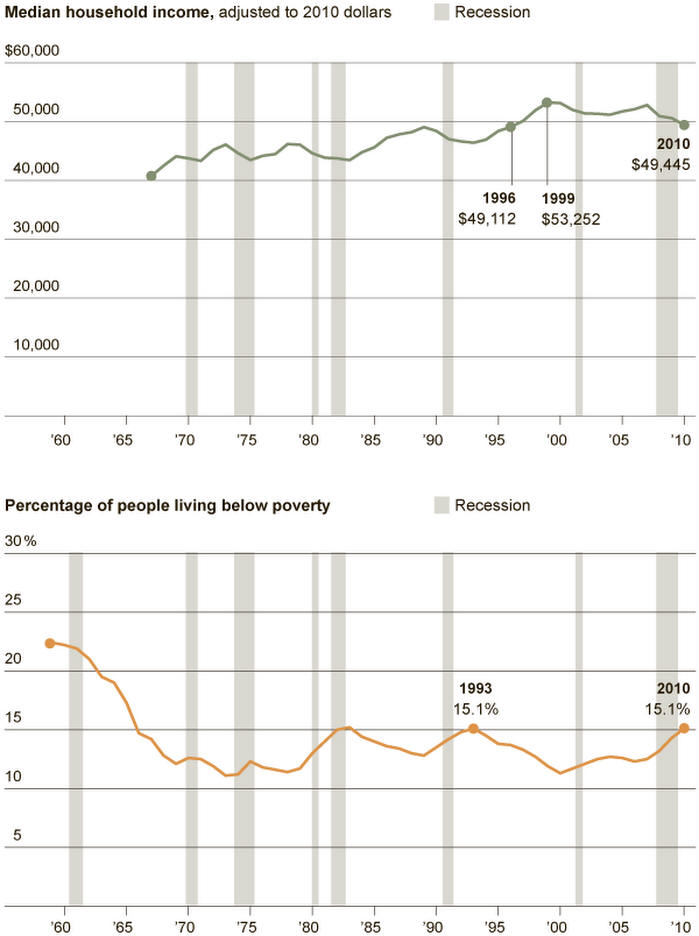

There are now 46.2 million poor Americans.

Of those, 2.6 million fell into poverty last year.

At 15.1 percent, the poverty rate is at its highest since 1993.

Bloody, bloody, bloody.

But even those numbers somewhat obscure the true historic nature of the crisis

and the effect that the recession, falling wages and chronic joblessness have

had on those living in poverty. If you remove children and the elderly and just

look at working-age adults — those 18 to 64 — the picture is even more bleak.

The percentage of that group that is in poverty is the highest recorded since

President Lyndon B. Johnson declared a “war on poverty” during his first State

of the Union address in January 1964.

And it’s not that most of these people don’t have jobs. It’s that they don’t

have good jobs that pay enough to push them out of poverty. Three out of four of

those below the poverty line work: half have full-time jobs, a quarter work part

time. Only a quarter do not work at all.

This raises an important distinction — not only do we need to create more jobs,

we need to increase the number of good jobs. And we can’t see that quest for

good jobs as an internal skirmish between warring political ideologies. It’s an

international war. At least that is the way Jim Clifton, chairman of Gallup,

frames it in his fascinating — and frightening — new book, “The Coming Jobs

War.”

According to Clifton, “the coming world war is an all-out global war for good

jobs.”

(He defines a good job, also known as a formal job, as one with a “paycheck from

an employer and steady work that averages 30-plus hours per week.”)

In the book he makes this striking statement, drawing from all of Gallup’s data:

“The primary will of the world is no longer about peace or freedom or even

democracy; it is not about having a family, and it is neither about God nor

about owning a home or land. The will of the world is first and foremost to have

a good job. Everything else comes after that.” The only problem is that there

are not enough good jobs to go around.

Clifton explains that of the world’s five billion people over 15 years old,

three billion said they worked or wanted to work, but there are only 1.2 billion

full-time, formal jobs. Therefore his conclusion “from reviewing Gallup’s

polling on what the world is thinking on pretty much everything is that the next

30 years won’t be led by U.S. political or military force.”

“Instead,” he says, “the world will be led with economic force — a force that is

primarily driven by job creation and quality G.D.P. growth.” And guess who is

vying for the lead? That’s right: China.

And I must say, we don’t appear to be poised to fight this war. In education

we’ve gone from leading to lagging, our infrastructure is literally crumbling

around us, ever-expanding health care costs threaten to suffocate us and our

politics have succumbed to paralysis.

A widely-cited 2009 study by the consulting firm McKinsey & Company, “The

Economic Impact of the Achievement Gap in America’s Schools,” found that the

recent American educational achievement gaps — between black and Latino students

and white ones; between low-income students and the rest; between low-performing

states and the rest; and between the United States as a whole and

better-performing countries — not only cost the economy trillions of dollars,

they also “impose on the United States the economic equivalent of a permanent

national recession.”

According to a recent report by the Urban Land Institute and Ernst & Young,

China has “about 9 percent of G.D.P. devoted to infrastructure, compared with

less than 3 percent in the United States.” And the Report Card for America’s

Infrastructure graded by the American Society of Civil Engineers in 2009 was so

full of C’s and D’s that it looked like Rick Perry’s college transcript. The

group estimated that $2.2 trillion of investment over five years was needed to

bring conditions up to par. We’re not even close to that.

Furthermore, Clifton points out that 30 percent of America’s students drop out

or do not graduate on time. He concludes, “If this problem isn’t fixed fast, the

United States will lose the next worldwide, economic, jobs-based war because its

players can’t read, write or think as well as their competitors in a game for

keeps.”

And, a Rand Corporation study released last week found that “between 1999 and

2009, total spending on health care in the United States nearly doubled, from

$1.3 trillion to $2.5 trillion. During the same period, the percentage of the

nation’s gross domestic product devoted to health care climbed from 13.8 percent

to 17.6 percent. Per person health care spending grew from $4,600 to just over

$8,000 annually.”

We simply can’t sustain that sort of growth.

Clifton enumerates 10 “demands” that America will have to master to “lead the

new will of the world” — from drastically increasing exports, to having

investments follow “rare entrepreneurs versus the worldwide oversupply of

innovation,” to something as basic as doing a better job of identifying where

likely customers are. But at the top of the list is understanding that the world

has a shortage of good jobs and every decision of every leader must be informed

by increasing the share of those jobs.

He puts it this way:

“The war for global jobs is like World War II: a war for all the marbles. The

global war for jobs determines the leader of the free world. If the United

States allows China or any country or region to out-enterprise, out-job-create,

out-grow its G.D.P., everything changes. This is America’s next war for

everything.”

For Jobs, It’s War, NYT, 16.9.2011,

http://www.nytimes.com/2011/09/17/opinion/blow-for-jobs-its-war.html

Ex-Basketball Prodigy Dies on Streets Where He Lived

September

15, 2011

The New York Times

By ADAM NAGOURNEY

LOS

ANGELES — Lewis Brown, a high school and college basketball prodigy who spent

the past 10 years living on a sidewalk in Hollywood, seemed on the verge of a

second chance. He had scraped enough money together to get a California

identification card so he could fly to visit a sister in New York who had

thought him dead. Friends said that he would finally get off the street.

That was on Tuesday. But Wednesday, around 6 a.m., Mr. Brown, breathless and

frantic, was pleading for someone to call an ambulance. By the time help

arrived, Mr. Brown — 300 pounds, 6 feet 11 inches — was lying on the ground. A

half-hour of efforts by four paramedics — as his neighborhood friends shouted:

“Come on, Big Lew! You can make it” — could not save him.

For Mr. Brown — a star high school center who once seemed destined for a spot in

the N.B.A. — all that was left on Thursday was a Staples shopping cart carrying

a few of his possessions: a pair of sneakers, a blanket, a laminated copy of a

New York Times article from this year that detailed his sad story of decline,

bitterness, drug arrests and missed opportunities. The remainder of his

belongings — a mattress, some tattered clothes — had been put into a Dumpster.

Throughout the day, people who had known Mr. Brown, 56, from the neighborhood,

where he would wash windows and talk about his lost basketball past in Compton

and at the University of Nevada, Las Vegas, stopped as they learned of his

death. Tony Chauncey, a Time Warner Cable worker, said he had seen him last

month and told him that he was going to a hospital to be checked for a

reappearance of cancer.

“We hugged,” Mr. Chauncey said. “He said: ‘I’m giving you my healing prayer. You

are going to be O.K.” Two weeks later, Mr. Chauncey said, he learned that he was

free of cancer. “His last words to me were: ‘See. I told you I’m a spiritual

man. Now give me $3!’ ”

Michael Kaiping, who works at a special effects rental company on the block

where Mr. Brown lived, said Mr. Brown told him two weeks ago that he had raised

most of the money toward his ID card so he could visit his sister, Anita, and

asked to borrow $11.

“Lewis said his sister told him she needs him,” Mr. Kaiping said. “I always

thought it would be very good for him to get off the streets.”

“I didn’t mind throwing him a few bucks,” he said. “He had every intention of

giving me back that $11.”

Stephen Turner, who played basketball with Mr. Brown in Compton and recognized

him washing windows at a gas station last year, said he would try to organize a

memorial service.

Mr. Brown was long estranged from his family, though his mother had said, upon

learning from a Times reporter that he was alive, that she wanted to see him

before she died. Mr. Turner said the two had spoken by phone but she had not had

a chance to see him in person before his sudden death.

A second sister, Jeri, who lives in Compton, had not had seen him after he

resurfaced. “I pray for the best outcome for my brother,” she said after

learning of his death. “God’s will is done.”

Ex-Basketball Prodigy Dies on Streets Where He Lived, NYT,

15.9.2011,

http://www.nytimes.com/2011/09/16/us/lewis-brown-faded-basketball-prodigy-dies-homeless.html

Poor

Are Still Getting Poorer,

but

Downturn’s Punch Varies, Census Data Show

September

15, 2011

The New York Times

By JASON DePARLEand SABRINA TAVERNISE

WASHINGTON — The discouraging numbers spilling from the Census Bureau’s poverty

report this week were a disquieting reminder that a weak economy continues to

spread broad and deep pain.

And so it does. But not evenly.

The Midwest is battered, but the Northeast escaped with a lighter knock. The

incomes of young adults have plunged — but those of older Americans have

actually risen. On the whole, immigrants have weathered the storm a bit better

than people born here. In rural areas, poverty remained unchanged last year,

while in suburbs it reached the highest level since 1967, when the Census Bureau

first tracked it.

Yet one old problem has not changed: the poor have rapidly gotten poorer.

The report, an annual gauge of prosperity and pain, is sure to be cited in

coming months as lawmakers make difficult decisions about how to balance the

competing goals of cutting deficits and preserving safety nets.

Its overall findings — income down, poverty up — are hardly surprising in the

worst economic downturn since the Great Depression. Of equal interest, with

fiscal knives in the air, are the looks at who has suffered the most and who has

largely escaped.

“Certainly in a recession we want to put resources where they’re most needed,”

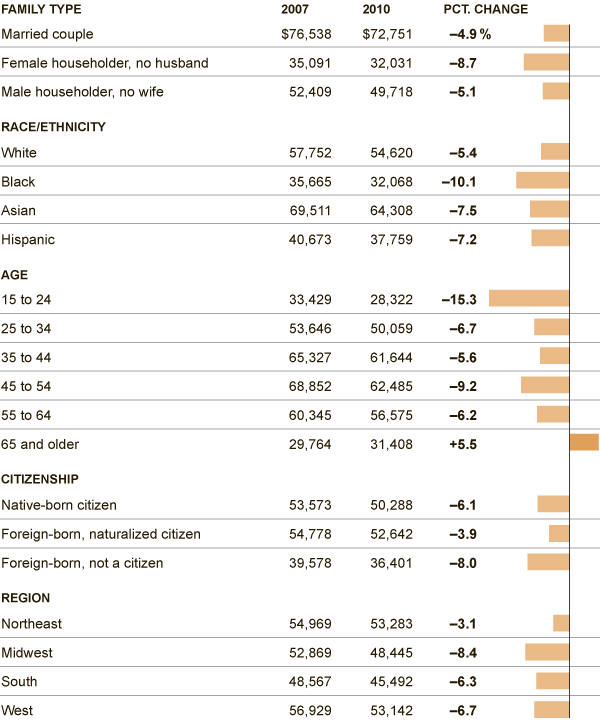

said Eugene Steuerle of the Urban Institute, who served as a Treasury official